Market

Alkimi Exchange CEO on Decentralized Ads and Data Ownership

In recent years, the advertising industry has faced growing criticism due to concerns around data privacy, fraud, and inefficiencies. Traditional digital advertising, particularly through intermediaries like Google and Facebook, has led to a lack of transparency for advertisers and publishers alike.

Ben Putley, CEO and Co-Founder of Alkimi Exchange, believes the digital advertising industry is long overdue for a change. Here, he breaks down how blockchain technology is reshaping advertising and why it’s time for the industry to evolve.

Alkimi Exchange is a blockchain-based decentralized advertising platform aimed at solving inefficiencies in the digital ad ecosystem. The platform leverages blockchain technology to eliminate intermediaries, reduce costs, and provide transparency in transactions between advertisers and publishers. It uses tokenized ad inventory and smart contracts to automate payments, ensuring efficiency and fraud prevention. Alkimi also empowers users with control over their data, allowing them to choose between sharing it for rewards or maintaining their privacy.

The Broken State of Advertising

At its core, digital advertising operates through intermediaries who profit by managing transactions between advertisers and publishers. These intermediaries — ad exchanges, supply-side platforms (SSPs), and demand-side platforms (DSPs) — not only inflate costs but also introduce vulnerabilities to fraud. Advertisers face an alarming $65 billion in global losses annually due to fraudulent activity, including bot-generated traffic and manipulated metrics.

“Advertisers are essentially pouring money into a system they can’t see or control. Fraud thrives in environments where transparency is missing. The lack of accountability also undermines trust, with advertisers unsure whether their spending translates into meaningful engagement or results,” Ben Putley explained.

Publishers are financially constrained under this system. Although they are responsible for creating the content that draws audiences and fuels the advertising ecosystem, they often see only a small portion of the ad revenue, as intermediaries claim a significant share. This leaves publishers with decreasing profits despite their critical role in the process.

Users fare no better. Most digital advertising platforms treat them as commodities, harvesting their data without consent and inundating them with poorly targeted or intrusive ads. This has led to a rise in ad blockers, with many users opting to avoid ads altogether rather than engage with an ecosystem they don’t trust.

“Users feel exploited, and they’re not wrong. They’re excluded from the value chain while their personal data fuels it,” he added.

Blockchain technology offers an elegant solution to many of these issues by introducing a transparent and decentralized framework for advertising. Unlike the current system, where transactions occur in a black-box environment, blockchain creates a public ledger where every impression, click, and transaction can be verified.

For advertisers, this transparency means real-time visibility into how budgets are being spent and assurance that their investments are reaching actual users rather than bots. For publishers, blockchain ensures they receive fair compensation, as payments are automated and verifiable. Every transaction is logged on a decentralized network, making it auditable and resistant to manipulation.

“Through the Ads Explorer, our proprietary tool, Alkimi provides complete transparency over every ad transaction. Every transaction on Alkimi is validated by a decentralized network of validators and stored on the Ethereum blockchain, ensuring that all spending is fully auditable and eliminating any ambiguity that is common in traditional systems,” Putley said.

The inefficiencies of the current advertising model stem largely from the reliance on intermediaries. These entities take significant cuts of the ad spend, leaving advertisers with higher costs and publishers with lower earnings. Research suggests that nearly half of an advertiser’s budget — around 47% — is absorbed by these fees.

“Decentralized platforms change the economics of advertising. By eliminating intermediaries, we’ve reduced fees to just 3-8%. That’s not just a marginal improvement — it’s transformative,” Putley shared.

This cost-saving benefits both advertisers and publishers. Advertisers can allocate more of their budgets to meaningful engagement, while publishers retain a larger share of the revenue, enabling them to invest in higher-quality content.

Smart contracts are a critical component of this system. These self-executing agreements automate payments between advertisers and publishers based on predefined conditions. For example, a smart contract might trigger payment only when a user interacts with an ad or makes a purchase.

“Smart contracts ensure fairness by removing the need for intermediaries. They execute transactions instantly and without bias, based entirely on the terms agreed upon. Smart contracts also add a layer of security, as they cannot be altered once deployed, providing an immutable and trustworthy system for all parties,” he noted.

But decentralization isn’t just about improving transparency and reducing costs — it’s also about empowering users. In the current model, users are passive participants, with no control over how their data is collected or used.

Blockchain flips this narrative, giving users the ability to decide how their data is shared and even rewarding them for their participation.

“Users should have the final say over their data. With decentralization, they can opt-in to share their information in exchange for rewards or keep their data private if they prefer,” Putley asserted.

This user-first approach not only respects privacy but also creates a more ethical and mutually beneficial system. Users who choose to share their data do so transparently and receive compensation, while advertisers gain access to more accurate and engaged audiences. According to Putley, it’s about building trust and creating a system where everyone feels like they’re benefiting.

Challenges to Adoption

Despite its potential, decentralized advertising faces several hurdles. One of the most significant barriers is the steep learning curve associated with blockchain technology.

Many advertisers and publishers are familiar with traditional systems and may hesitate to adopt a model they perceive as complex or unproven.

“The biggest challenge is overcoming inertia. People are naturally resistant to change, even when the benefits are obvious. At Alkimi, we’re addressing this by ensuring our platform is interoperable with existing ad technologies, making the transition as seamless as possible,” Putley said.

To address this, platforms must prioritize education and interoperability. Decentralized systems need to integrate seamlessly with existing workflows, reducing friction for advertisers and publishers making the transition.

Offline events, where Ben and his team showcased their approach, play an important role in driving adoption by demonstrating the practical applications of blockchain technology.

“It’s about making the abstract tangible. We’re showing people that decentralized advertising isn’t just an idea — it’s a working reality,” he noted.

Critics of blockchain often point to its energy consumption and scalability as potential drawbacks. However, advancements in technology have addressed many of these concerns.\

Utilizing Layer-2 scaling solutions helps decentralized platforms process high transaction volumes without the environmental costs associated with earlier blockchain models.

“Advertising is a high-volume industry. We’ve designed our platform to handle that scale efficiently while minimizing energy usage,” Ben acknowledged.

These improvements make decentralized systems more practical and position them as a greener alternative to traditional advertising, which accounts for a significant portion of global greenhouse gas emissions.

Alkimi’s Vision for the Future

As the advertising industry continues to evolve, the case for decentralization grows stronger. The current model is unsustainable, plagued by inefficiencies, distrust, and ethical shortcomings. Blockchain offers a path forward by addressing these challenges and creating a system built on transparency, efficiency, and fairness.

“We’re still in the early stages, but the momentum is there. Decentralization isn’t just a trend — it’s where the industry is heading,” Putley said.

The success of this shift will depend on continued innovation, particularly in making blockchain systems more accessible and scalable. Platforms must also focus on delivering measurable benefits to advertisers, publishers, and users alike.

For advertisers, this means better ROI and reduced costs. For publishers, it’s about fair compensation and sustainable revenue. And for users, it’s about choice, privacy, and respect.

“Ultimately, it’s about creating a system where everyone wins. That’s what decentralized advertising promises, and it’s what we’re working to deliver,” Ben concluded.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

Larry Fink, CEO of BlackRock, claimed in a recent letter that Bitcoin and crypto could damage the dollar’s international standing. If investors treat Bitcoin as an inflation hedge to the dollar, it could precipitate serious trouble.

However, he was also adamant that the industry offers a lot of advantages, particularly through tokenization.

Larry Fink Sees Opportunity in Crypto

BlackRock is the leading Bitcoin ETF issuer in the US, and its CEO Larry Fink has long been bullish on Bitcoin. However, as Fink described in his most recent Annual Chairman’s Letter to investors, crypto’s best interest doesn’t always align with TradFi or the dollar.

“The US has benefited from the dollar serving as the world’s reserve currency for decades. But that’s not guaranteed to last forever. By 2030, mandatory government spending and debt service will consume all federal revenue, creating a permanent deficit. If the US doesn’t get its debt under control… America risks losing that position to digital assets like Bitcoin,” he said.

To be clear, Fink insisted that he supports crypto and listed some practical problems that he believes it can solve. He expressed a particular interest in asset tokenization, claiming that a digital-native infrastructure would improve and democratize the TradFi ecosystem.

Despite these advantages, Fink recognizes the danger that crypto can present to the US economy if not properly managed. He addressed the longstanding practice of using crypto to hedge against inflation, a wise practice for many assets.

However, if a wide swath of investors think Bitcoin is more stable than the dollar, it would threaten USD’s status as the world reserve currency. A scenario like that would be very dangerous to all of TradFi, and Fink has a particular interest in protecting BlackRock. Such an event would doubtlessly impact crypto as well.

“Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America’s economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar,” Fink added.

He didn’t offer too many specific solutions to this growing problem, but Fink isn’t the only person concerned with the issue. President Trump recently suggested that stablecoins could promote dollar dominance worldwide. Even if the dollar is seen as unstable, its adoption within a rapidly growing global industry like stablecoins could help reinforce its strength and relevance.

Of course, there are also drawbacks to Trump’s plan. Larry Fink acknowledged a possible threat from crypto, but continues to espouse its utility. Its benefits are too good to ignore.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Bears Lead, But Bulls Protect Key Price Zone

XRP has experienced a significant downturn in recent price action, with its value dropping nearly 15% over the past seven days as bears maintain control of the market. The coin’s technical indicators are showing mixed signals, with the RSI rebounding from oversold territory while Ichimoku Cloud patterns continue to paint a predominantly bearish picture.

Despite yesterday’s test of the critical $2.06 support level resulting in a temporary bounce, the momentum remains negative, with short-term EMAs positioned below long-term averages. The move from extreme oversold conditions suggests XRP might be entering a consolidation phase before its next significant price movement.

XRP RSI Is Up From Oversold Levels

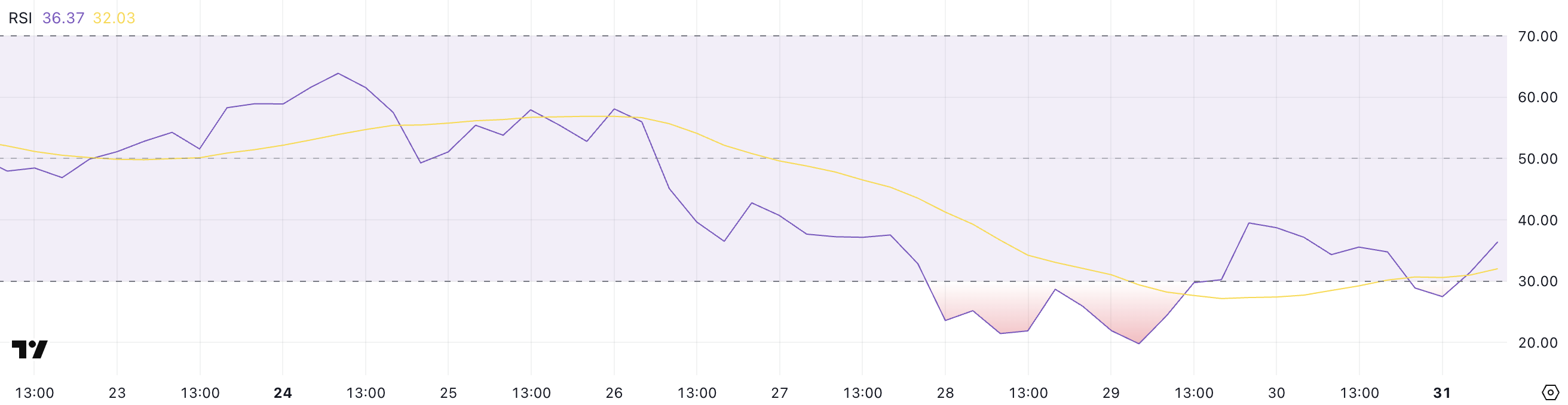

XRP’s Relative Strength Index (RSI) is currently at 36.37, showing a notable rebound from a low of 27.49 just a few hours ago. This upward shift indicates a shift in momentum, as buying interest has started to pick up after a period of heavy selling pressure.

Although still in the lower range, this recovery suggests that traders may be stepping back in. That could mean they are potentially viewing the recent dip as an opportunity.

RSI is a widely used momentum indicator that measures the speed and change of price movements on a scale from 0 to 100. Readings below 30 typically indicate that an asset is oversold and may be undervalued, while readings above 70 suggest it is overbought and could be due for a correction.

XRP’s bounce from 27.49 to 36.37 signals that it may have just exited oversold conditions. This could mean that the recent selling phase is easing. If the buying momentum continues to build, XRP might be entering the early stages of a potential recovery.

XRP Ichimoku Cloud Shows A Bearish Scenario

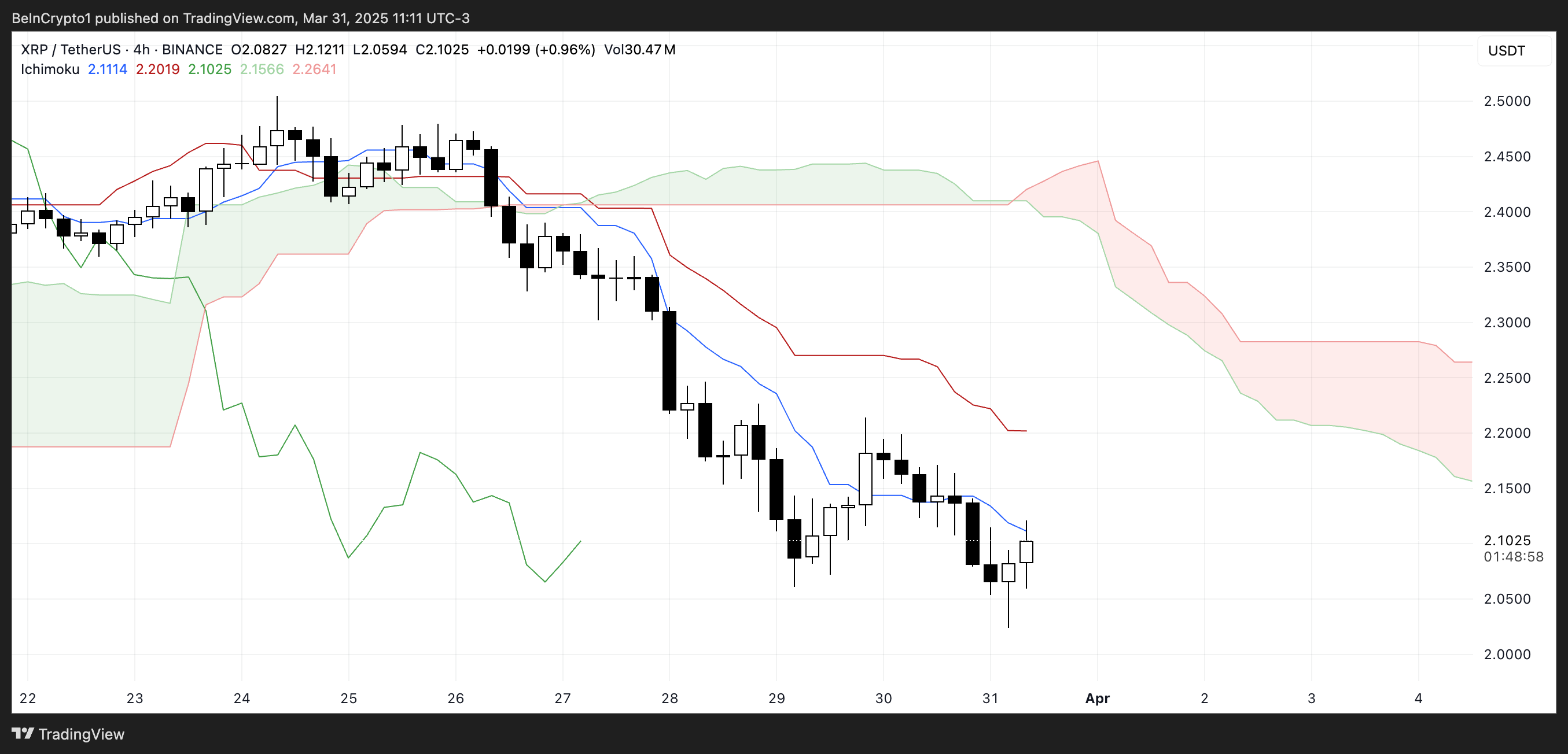

XRP’s Ichimoku Cloud chart shows that the price action remains below both the red baseline (Kijun-sen) and the blue conversion line (Tenkan-sen). That indicates the prevailing momentum is still bearish.

The candles are also forming well beneath the cloud, which reflects a broader downtrend.

When the price is under all major Ichimoku components like this, it typically signals continued downward pressure unless a strong reversal breaks those resistance levels.

Additionally, the cloud ahead is red and spans horizontally with a downward slope, reinforcing the bearish outlook in the near term. The thickness of the cloud suggests moderate resistance if the price attempts to move upward.

However, some consolidation is evident in the recent candles, showing that sellers may be losing some control.

For any potential trend reversal, XRP would need to break above the Tenkan-sen and Kijun-sen, and eventually challenge the cloud itself — a move that would require a clear uptick in momentum.

XRP Could Rise After Testing An Important Support Yesterday

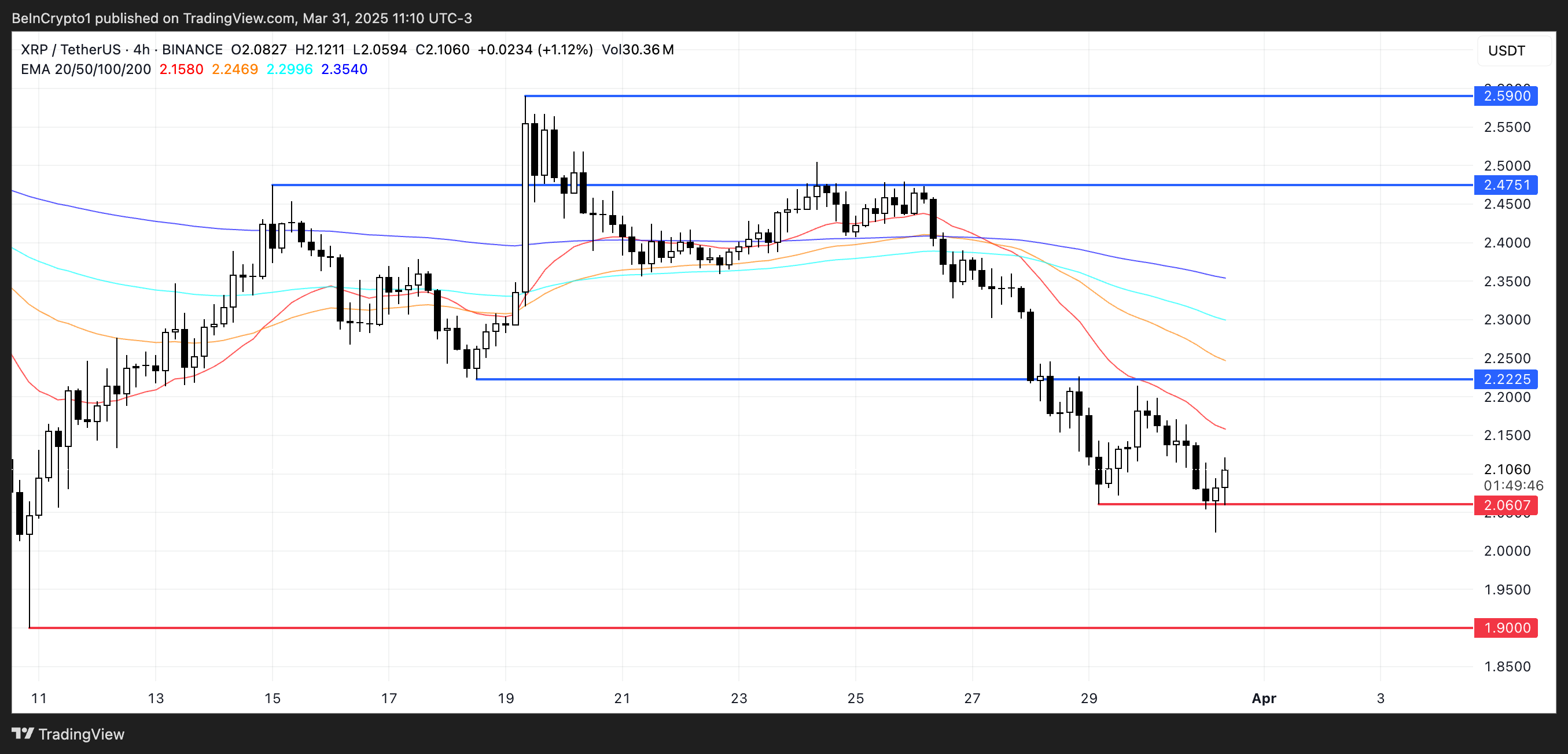

XRP’s EMA lines are clearly aligned in a bearish formation, with the short-term averages sitting well below the long-term ones and a noticeable gap between them—highlighting strong downward momentum.

Yesterday, XRP price tested the support level at $2.06 and rebounded, showing that buyers are still active at that zone. However, this support remains critical. If it is tested again and fails to hold, XRP could fall further. Its next major support sitting around $1.90.

If the trend begins to shift and XRP breaks above the short-term EMAs, the first key resistance to watch is at $2.22. A successful move above this level could trigger a stronger recovery, potentially pushing the price toward $2.47.

If bullish momentum continues, the next upside target would be $2.59. For now, though, the EMA structure still leans bearish. XRP would need sustained buying pressure to flip the trend and aim for those higher resistance levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Market Cap Now Approaching $300 Million

SAFE has emerged as the best-performing altcoin of the day, with its price surging 5% in the last 24 hours and its market capitalization now close to $300 million. The coin is showing strong technical indicators despite some mixed signals from momentum oscillators that suggest consolidation may be on the horizon.

Technical analysis of the EMA lines remains bullish, with short-term averages positioned favorably above long-term ones, pointing to continued strength in the immediate term. However, recent RSI and BBTrend readings indicate a potential cooling-off period could be approaching as the asset digests its recent gains.

SAFE RSI Is Back To Neutral Levels After Reaching Overbought Levels

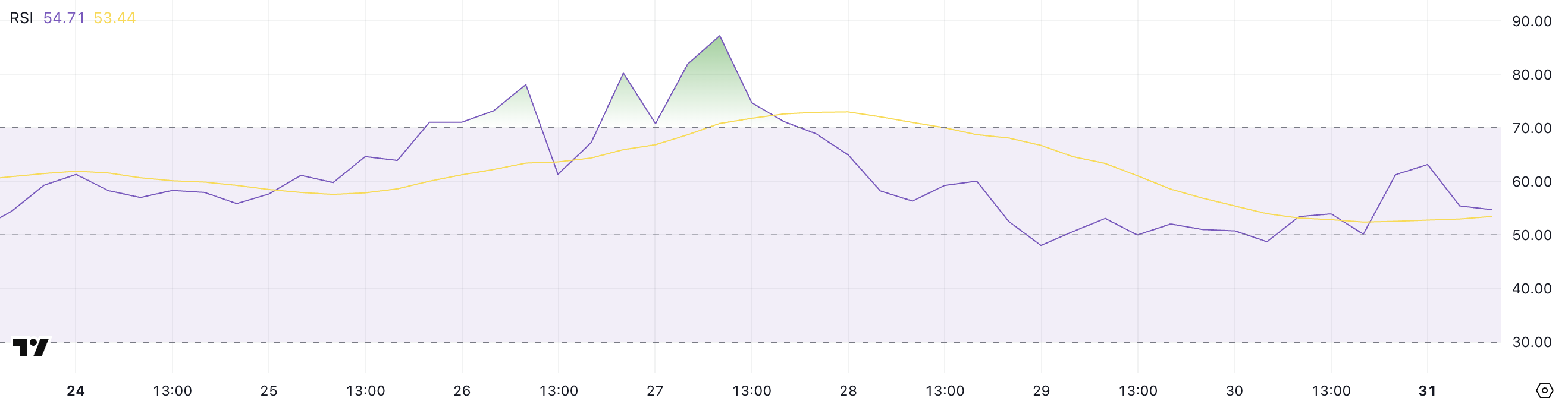

The SAFE RSI is currently at 54.71, maintaining a neutral position for the past three days after experiencing significant momentum earlier in the week.

This moderation in the indicator suggests that the previous buying pressure has subsided somewhat, allowing the asset to consolidate following recent price movements.

The current neutral reading indicates a balanced market where neither buyers nor sellers have a decisive advantage.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100. Generally, an RSI reading above 70 is considered overbought, suggesting a potential reversal or pullback, while readings below 30 indicate oversold conditions that might precede a bounce.

With SAFE’s RSI recently peaking at 87 just four days ago, the asset was in strongly overbought territory, signaling excessive buying enthusiasm. The current value of 54.71 represents a significant cooling off from those extreme levels, suggesting that SAFE’s price could be entering a period of stabilization.

This moderation may provide a healthier foundation for sustainable price action moving forward, as the previous overbought conditions have been worked through without dropping into oversold territory. This potentially indicates underlying strength in the asset despite the retreat from recent highs.

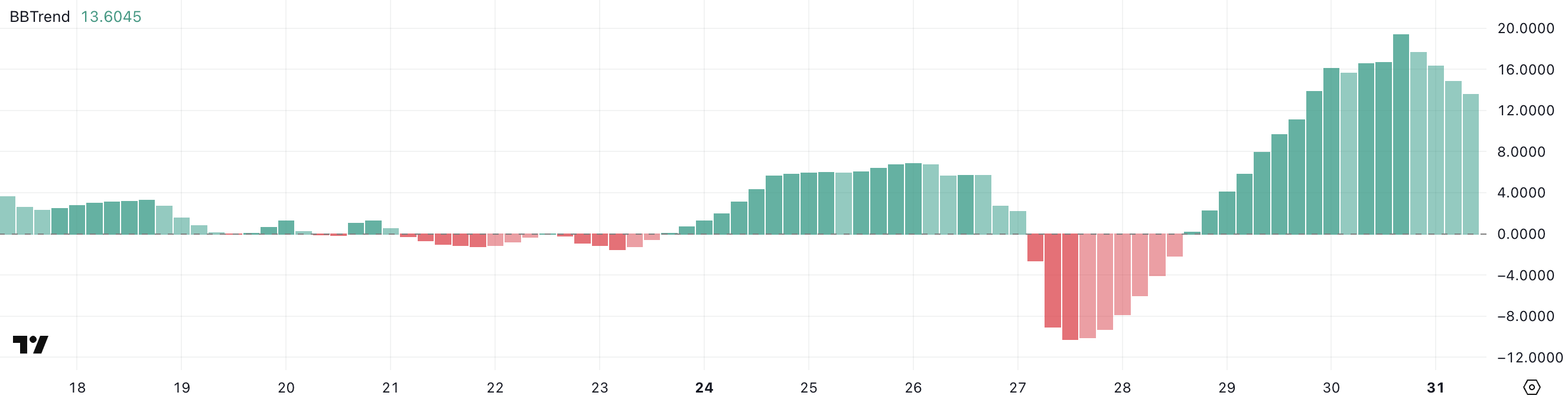

SAFE BBTrend Is Still High, But Down From Yesterday

The SAFE BBTrend is currently at 13.6, maintaining a positive position for the last two days after reaching a peak of 19.39 yesterday.

This recent positive trend suggests that the price movement has been gaining momentum, though there appears to be some moderation from yesterday’s higher reading.

The continued positive BBTrend indicates that the asset is still showing strength, despite the slight pullback from yesterday’s peak value.

BBTrend (Bollinger Bands Trend) is a technical indicator that measures the strength and direction of a trend by analyzing the relationship between price and Bollinger Bands.

The indicator typically ranges from negative to positive values, with readings above 0 indicating a bullish trend and readings below 0 suggesting a bearish trend. With SAFE’s BBTrend at 13.6, this suggests a moderately strong bullish trend that could indicate potential for continued upward price movement in the near term for the altcoin.

However, the decrease from yesterday’s 19.39 peak might signal some slowing in momentum, potentially leading to consolidation before the next significant move higher.

Will SAFE Uptrend Revert Soon?

SAFE EMA lines are still bullish, with short-term lines positioned above long-term ones. This positive alignment of exponential moving averages indicates continued upward momentum in the price action.

If this uptrend momentum maintains its strength, SAFE could potentially climb to test the resistance level at $0.72.

Should this resistance be successfully broken, the next target would be $0.879. The altcoin could exceed $0.90 for the first time since January 19, sustaining its momentum as one of the most trending altcoins.

On the other hand, as indicated by the RSI and BBTrend indicators, the uptrend appears to be losing some momentum. This could signal a potential reversal in the near future.

If the trend does reverse, SAFE might test the nearby support level at $0.54, which sits precariously close to the current price.

Should this support level fail to hold, further downside could see SAFE decline to test subsequent support levels at $0.48 and $0.40. In a worst-case scenario, a drop all the way to $0.35 could potentially occur.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.