Market

AI Agents Thrive Without Crypto: Tokenization Not Required

The artificial intelligence sector is witnessing a rapid surge in the development and deployment of AI agents, but for crypto and Web 3, not all is as it seems.

Most of these AI agents are free and open-source, challenging the notion that tokenized models are necessary for AI evolution.

Non-Tokenized AI Agents Outpace Crypto Solutions in Popularity

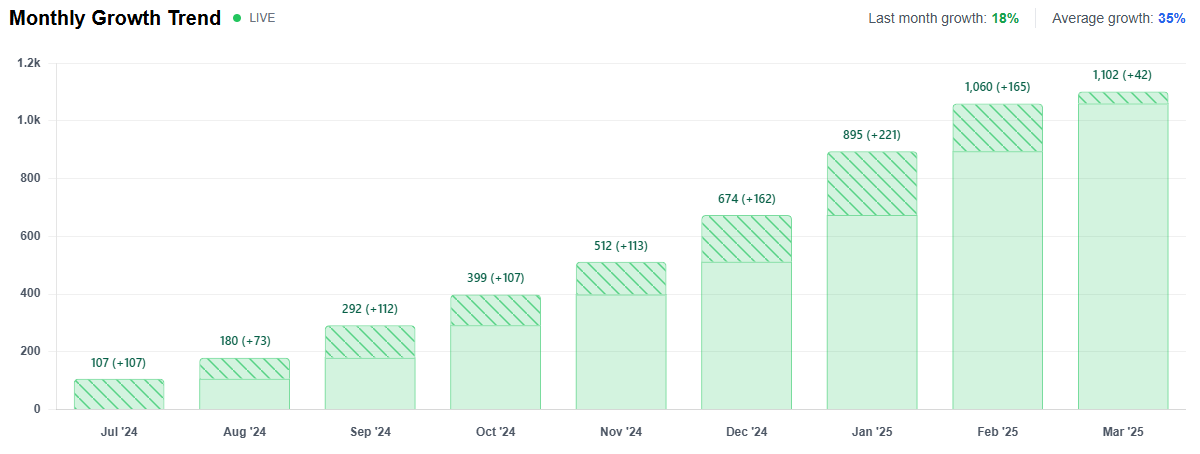

Data from the AI Agents Directory indicates an average monthly increase of 35% in the number of AI agents. However, despite the growing interest, Web3-based artificial intelligence solutions still account for a minimal fraction (3%) of the overall AI agent ecosystem.

Further, data shows that users and developers’ most sought-after AI agents do not include any from the Web3 sector. This highlights the lack of mainstream traction for crypto-integrated AI solutions.

Hitesh Malviya, an analyst and popular figure on X, echoed this sentiment in a post.

“If you look outside the crypto echo chamber, you’ll find that we do have a solid ecosystem of free and better AI agents—and they don’t have tokens, nor might they ever need one. So, what we’re trading in the name of agents is nothing but memes—a value we created out of thin air, like we always do,” Hitesh observed.

The emergence of tools like Manus, ChatGPT Operator, and n8n has made it easier than ever for individuals and businesses to develop and deploy their own tailored AI agents. These platforms allow users to create AI-powered solutions without needing a native token.

This reinforces the idea that tokenization on blockchain is not an essential component of AI agent functionality. Meanwhile, the debate surrounding AI agent tokens has also drawn criticism from industry insiders. On-chain detective ZachXBT recently slammed AI agent tokens, saying 99% are scams.

The blockchain sleuth’s concerns align with broader skepticism regarding tokenized AI projects. Many have been accused of leveraging AI hype without delivering substantive technological advancements.

Similarly, a recent survey of Solana (SOL) ecosystem founders revealed widespread skepticism about the utility of AI agents. As BeInCrypto reported, most Solana developers see AI agents as overhyped.

“The focus on AI agents distracts from core blockchain innovation. They’re more of a gimmick than a necessity in the space,” one respondent noted.

However, the crypto AI agent sector is not entirely stagnant. Recent reports suggest that new launches within the Web3 space are on the rise again. Despite the criticisms, some developers and investors still see potential in blockchain-integrated AI solutions.

As the AI agent industry grows, experts also examine its impact on the workplace. Discussions among industry leaders suggest that AI agents will play a transformative role in automating tasks, streamlining workflows, and enhancing productivity across various sectors.

The AI agent revolution is moving forward, with or without tokenization. As open-source and non-tokenized AI solutions continue gaining traction, AI-driven automation’s future may depend more on accessibility and practical application rather than speculative token economies.

The market will ultimately decide whether blockchain-based AI agents can carve out a lasting niche or if they will remain overshadowed by their non-tokenized counterparts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FOMC Refuses to Cut Interest Rates, Disappointment Priced In

The FOMC concluded its latest meeting by announcing that it will not cut US interest rates. This decision was largely priced in, and the crypto market hasn’t seriously suffered.

Rate cuts would’ve provided a bullish narrative to juice fresh investment, which the market desperately needs. Bearish signals are growing alongside fears of a US recession.

Federal Reserve Says No to Rate Cuts

The Federal Reserve just finished its Federal Open Market Committee (FOMC), which determines much of US financial policy. The crypto industry was waiting with bated breath to see if the FOMC would decide to cut interest rates.

However, the FOMC made its report to the public and claimed that no rate cuts would be taking place.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty around the economic outlook has increased. The Committee is attentive to the risks to both sides of its dual mandate. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4.25% to 4.5%,” it said.

This news more or less fits with the industry’s expectations. Fed Chair Jerome Powell already clearly stated that the FOMC doesn’t plan to cut interest rates.

The industry hoped that rate cuts could provide a bullish narrative, especially while the markets are afraid. For now, it seems like it’ll need to find an optimistic signal somewhere else.

Rate cuts would be bullish for investors, especially for risk-on assets like cryptoassets. However, this isn’t the Federal Reserve’s only concern. The FOMC alluded to its “dual mandate” when denying rate cuts. In other words, it needs to juggle investor concerns with consumer inflation fears, uncertainty around Trump’s tariffs, and a possible US recession.

If the FOMC were to slash interest rates, it would likely boost US inflation. The most recent CPI report was better than expected, and some in the industry hoped that this would build confidence. Ultimately, the main hopes rested with President Trump, who personally advocated for rate cuts. However, he didn’t make a major intervention.

It’s not all bad, though. The FOMC also announced would slow Quantitative tightening (QT) by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion.

Some members of the community were pleased by this news, as slower QT can increase market liquidity. This announcement is at least some consolation for investors.

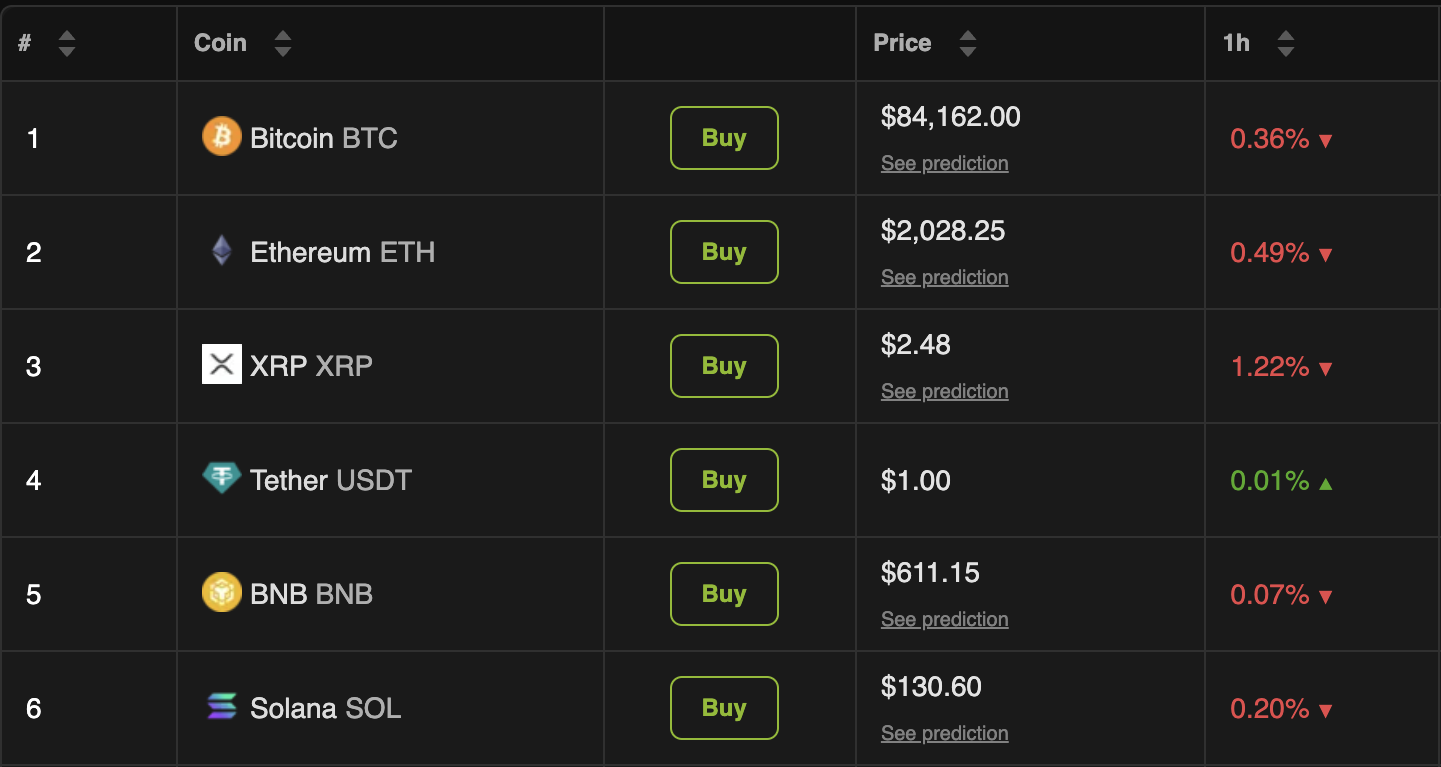

In any event, this lack of rate cuts was expected and priced in. The FOMC didn’t shock anybody by refusing to cut interest rates, and the market hasn’t been chaotic. A few of the top-performing cryptoassets suffered minor losses, but no substantial drops have materialized.

The crypto industry has been desperate for a bullish narrative, and some major players are visibly cracking at the seams.

The FOMC, however, did not provide this narrative via rate cuts. Hopefully, crypto will find something else to be optimistic about before a full-blown market correction takes hold.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XCN Traders Shift Focus as Active Addresses Plunge

Onyxcoin (XCN) has maintained its downward trajectory, plummeting by 10% over the past week as bearish sentiment grips the market.

With more traders turning away from the altcoin, its active address count has seen a sharp fall, signaling a loss of interest in the asset and low network participation.

XCN Struggles as Short Sellers Take Control

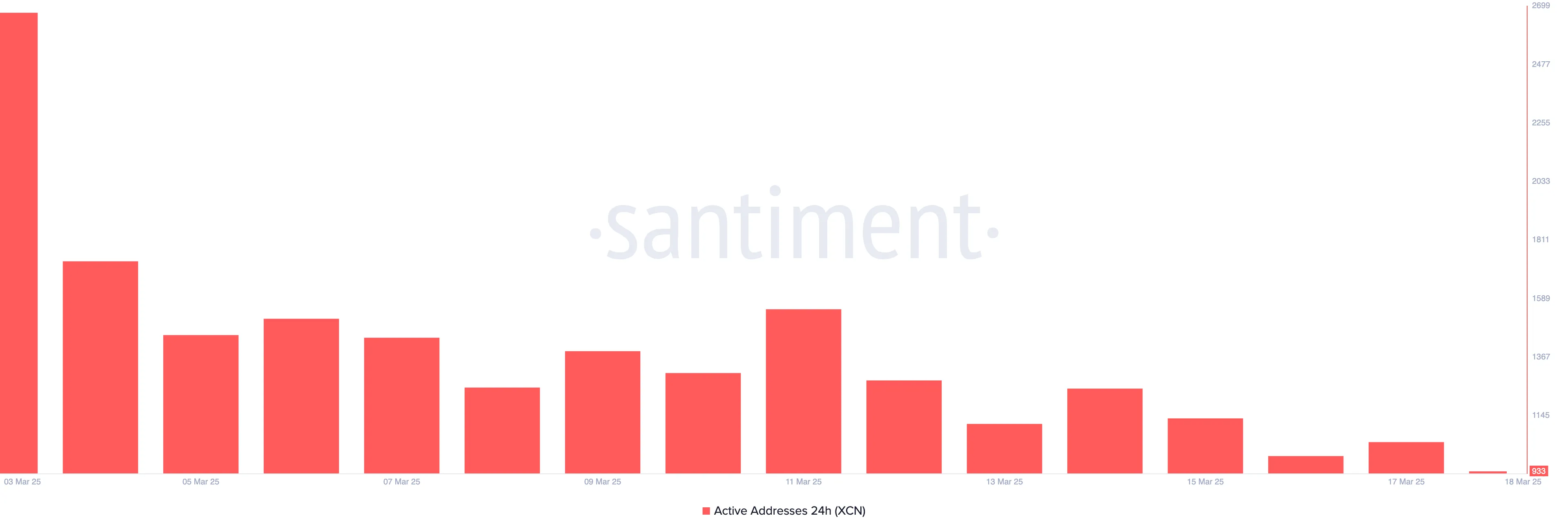

Since early March, Santiment’s data has revealed an aggressive fall in XCN’s daily active address count.

According to the on-chain data provider, on March 3, 2,673 unique addresses completed at least one transaction involving XCN. Since then, this figure has steadily declined, hitting a low of 1,044 on March 18.

This decline highlights waning network activity on Onyxcoin and the reduced demand for its altcoin, reinforcing the bearish sentiment surrounding XCN.

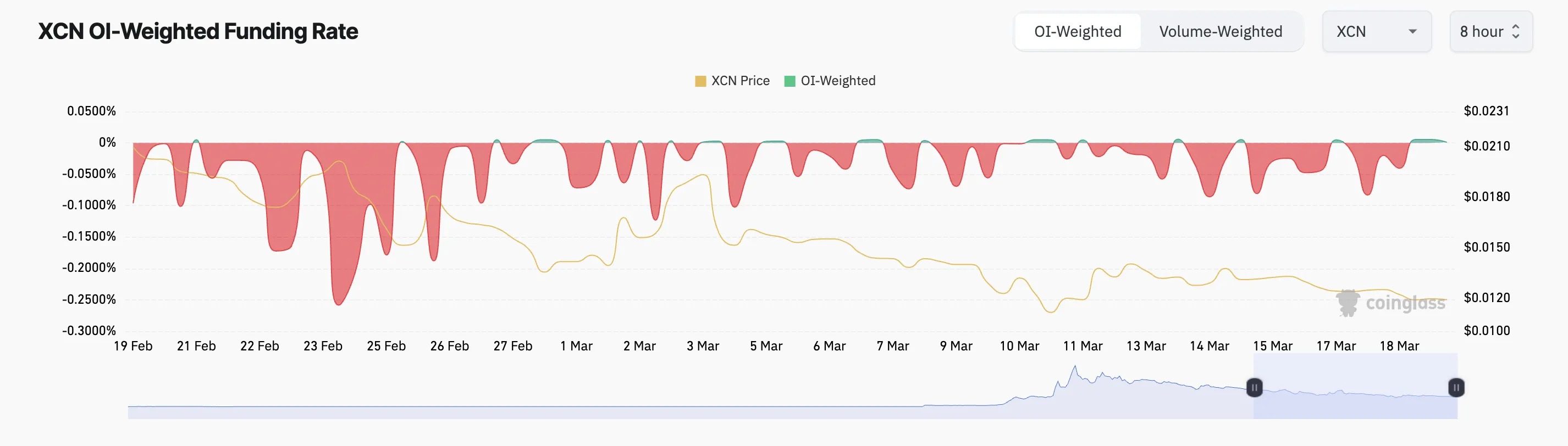

Moreover, the month has been marked by a significant rise in the demand for short positions, as reflected by the altcoin’s predominantly negative funding rate.

An asset’s funding rate is a periodic fee exchanged between its long and short traders in perpetual futures contracts. When the funding rate is mostly negative, short sellers dominate the coin’s futures markets.

The rising demand for XCN shorts highlights the market’s bearish outlook. Sellers are maintaining control and limiting any potential short-term recovery.

XCN Faces Strong Selling Pressure

The token’s Chaikin Money Flow (CMF) supports this bearish outlook. At press time, the momentum indicator is below zero at -0.19.

The CMF indicator measures fund flows into and out of an asset. When its value is negative, selling pressure outpaces buying activity. This indicates the likelihood of a further price decline as demand remains weak. In this scenario, XCN’s price could slip to $0.0075.

Conversely, the token’s price could rocket toward $0.022 if buyers regain market control.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Russian Crypto Exchange Garantex Is Back Under a New Name

A comprehensive report from Global Ledger claims that Garantex’s founders created a new exchange, Grinex, just a week after the previous exchange was shut down by US and EU authorities. The new platform, Grinex, has already processed $36 million in incoming transactions.

Global Ledger shared this report exclusively with BeInCrypto.

Is Garantex Back Under a New Name?

Garantex, a Russian crypto exchange, was shut down last week, but apparently, it isn’t out. Earlier this month, Tether froze some of its wallets containing USDT worth $28 million, and the US Department of Justice seized its domains, as its co-founder was arrested.

However, a new report shows that Garantex’s team has already launched a similar exchange, Grinex.

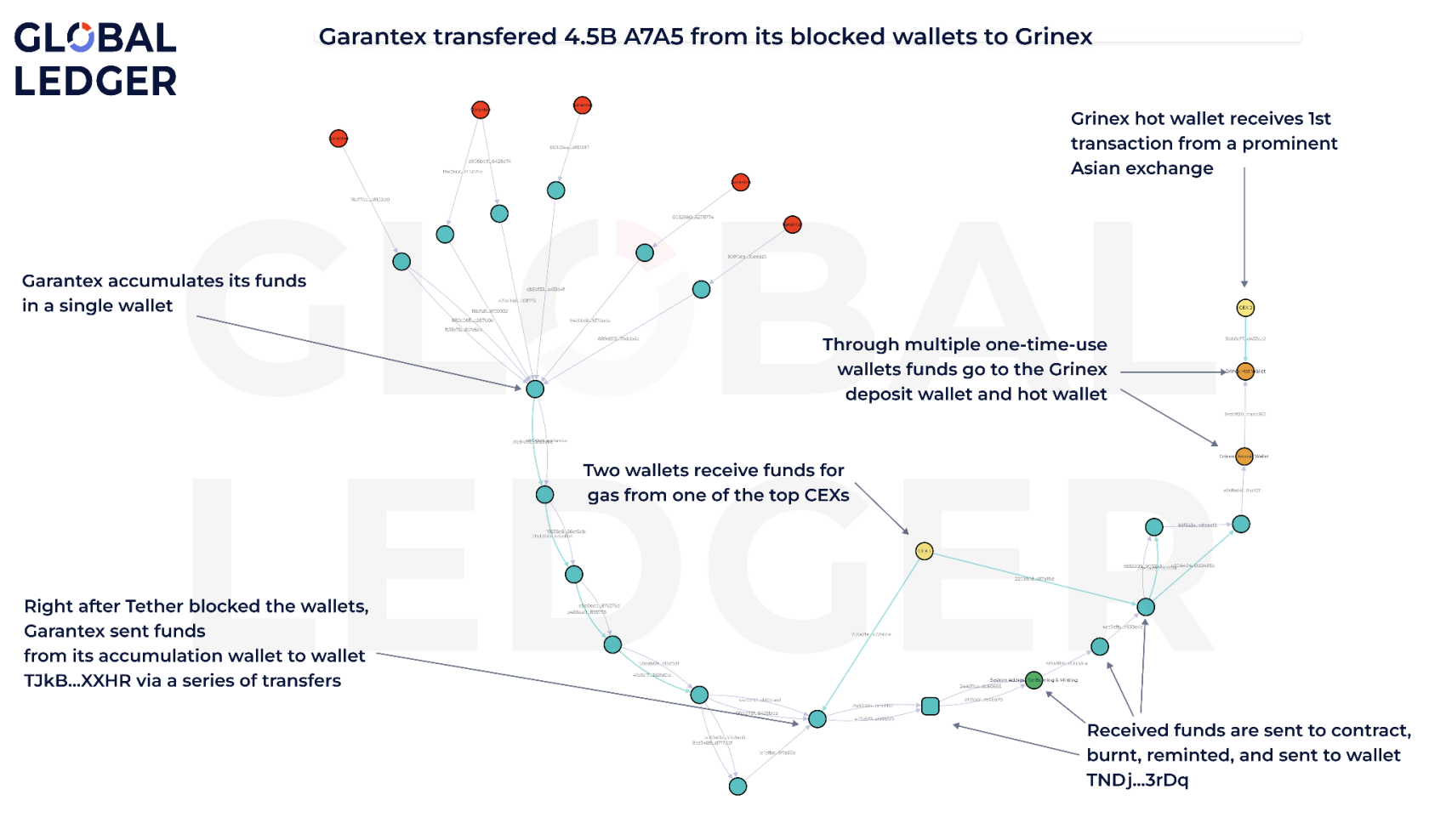

“Swiss blockchain analytics company Global Ledger has completed its investigation and gathered conclusive evidence that Grinex, the exchange that emerged shortly after the dramatic collapse of Garantex, is, in fact, a direct continuation of Garantex itself,” Global Ledger claimed in an exclusive press release shared with BeInCrypto.

The center of this claim comes from on-chain analysis. A7A5, a ruble-backed stablecoin, was listed on Garantex less than a month before its shutdown.

Soon after, its creators confirmed via Telegram that the asset was listed on Grinex. Global Ledger tracked a massive A7A5 liquidity transfer from Garantex to Grinex, proving a connection.

Garantex Users Are Receiving Lost Funds On Grinex

According to Global Ledger’s research, these exchanges have incredibly similar interfaces. Also, a marketing statement on the Russian crypto tracking site ‘CoinMarketRating’ claims that the owners of Garantex created Grinex.

Most notably, some users who lost funds on Garantex have reported receiving reimbursements on Grinex.

Sources also claim that Grinex customers are visiting the Garantex office in person, and many users are moving assets to the new exchange.

Overall, all facts reflect that Grinex has found a way to remain operational, despite the earlier crackdown. The US Department of Justice sanctioned Garantex in 2023.

The case of Grinex is another example of how Russia has been using crypto to actively evade international sanctions. Even if law enforcement acts quickly against Grinex, it could resurface.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoJustin Sun Reveals Plan To Integrate TRX On Solana

-

Regulation23 hours ago

Regulation23 hours agoCoinbase CLO Slams US Treasury for Defying Court Ruling In Tornado Cash Case

-

Market23 hours ago

Market23 hours agoTop 3 Base Meme Coins to Watch Closely This Week

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Predicts XRP Price To Reach $20 With 18 XRP ETFs On The Horizon

-

Market22 hours ago

Market22 hours agoBitcoin ETF Issuers Purchase Over $40 Million in BTC

-

Altcoin21 hours ago

Altcoin21 hours agoADA Bulls Target $1 as Cardano Price Double Bottom Pattern Hints at Reversal

-

Market21 hours ago

Market21 hours ago3 Crypto Smart Money Wallets Are Dumping Fast This March

-

Market24 hours ago

Market24 hours agoNigeria Turns to Crypto to Combat Inflation and Naira Devaluation