Market

82% of Investors Believe Crypto Bull Market Is Not Over

Bitcoin’s recent price struggles have not dampened market sentiment, with over half of crypto investors still bullish.

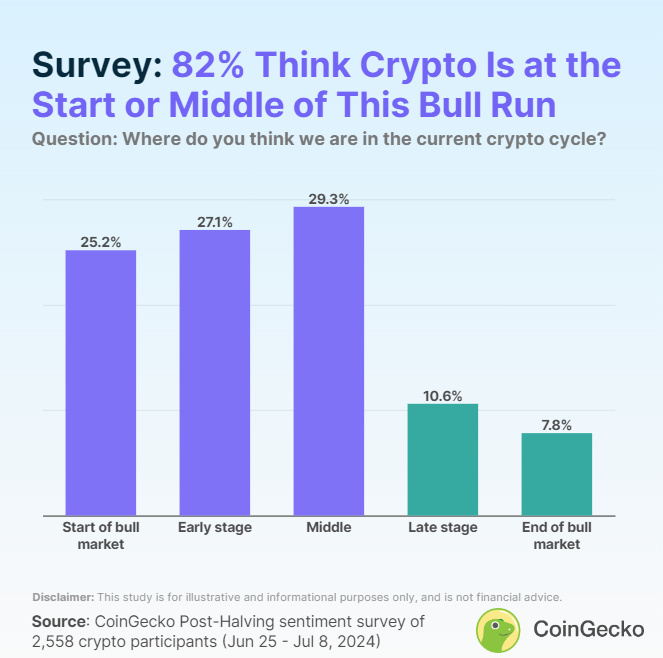

According to a CoinGecko survey of 2,588 respondents, 82% believe the crypto bull run isn’t over, with more than 50% suggesting it’s still in its early stages.

Crypto Bull Run is Not Yet Over

The survey revealed distinct sentiments across different roles in the crypto community. About 55.5% of investors see the bull run in its early stages, while 28.8% believe it’s in the middle. Overall, 84.3% of investors think the market green run is ongoing.

However, traders and builders are more cautious. According to the survey, 78.6% of traders and 74.9% of builders believe that the crypto bull run was not over. Unsurprisingly, market participants tagged as spectators showed the most pessimism, with only 69% believing that the bull run could continue.

Read more: Bitcoin Price Prediction 2024/2025/2030

Meanwhile, the bullish optimism appears evenly distributed among market participants regardless of their experience levels in crypto. Per the survey, around 52.7% of those with 0-3 years of experience, 52.2% with 4-7 years, and 51.8% with 8 or more years believe the market is in the early stages of a bull run.

“In other words, having different years of crypto experience did not seem to significantly influence how participants viewed the current cycle’s bull run. Instead, there was a similar distribution of optimistic and pessimistic opinions,” CoinGecko stated.

CoinGecko pointed out that 60.4% of participants think the market hasn’t peaked and will rise again, while 21.3% anticipate a supercycle with continued gains. This suggests that Bitcoin’s over $73,000 all-time high in March could be easily surpassed in the current market cycle.

“In other words, a combined 81.7% of participants believed that the market would see a bullish continuation, either because crypto had yet to peak or had entered a supercycle state. This further reinforces the above consensus view that the current crypto bull run is not over yet and still has upside potential,” CoinGecko added.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

The survey results align with those of market experts, who believe the crypto market is in the midst of a bull run. Matt Hougan, the Chief Investment Officer for asset management firm Bitwise, explained that key tailwinds could drive Bitcoin to $100,000 by year-end.

“The crypto market is facing a weird dynamic right now: All the short-term news is bad, and all the long-term news is good. The dichotomy is creating an incredible potential opportunity for long-term investors,” he commented.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance and the SEC File for Pause in Lawsuit

The SEC and Binance filed a joint motion to pause their lawsuit for 60 days. They requested a prior pause 60 days ago and have “been in productive discussions” since then.

Both parties have asked for more time to finalize an agreement and consider all the relevant policy implications. In the main, however, it’s a substantially similar agreement to the one between the SEC and Ripple yesterday.

Binance and SEC Discussing a Settlement

The SEC has been dropping a lot of its most prominent enforcement actions lately, such as its lawsuit against Ripple. Still, despite this progress, a few outstanding cases remain.

The SEC has been ending lawsuits against prominent exchanges like Coinbase and Kraken, and now it’s preparing to drop one against Binance:

“Pursuant to the Court’s February 13, 2025 Minute Order, Plaintiff Securities and Exchange Commission and Defendants Binance Holdings Limited… and Changpeng Zhao submit this joint status report and jointly move to continue to stay this case for a period of 60 additional days,” a motion filed today read.

Binance is the world’s largest crypto exchange, and it has been engaged in this fight since 2023. The SEC sued Binance in June of that year, alleging that it committed a few serious crimes.

In addition to violating securities laws, the Commission also claims that Binance deliberately lied to regulators. This caused serious problems for its business, prompting a lengthy battle.

The SEC, however, is under new management now. Paul Atkins is the Commission’s new Chair, and he’s prioritized friendly crypto regulation.

Before his confirmation, the SEC, under Acting Chair Mark Uyeda, filed a joint request with Binance to pause the lawsuit 60 days ago, and they’re asking for another extension.

Today’s filing is slightly shorter than the previous one, but it suggests that real progress has been made. It claims that Binance and the SEC “have been in productive discussions” concerning the Crypto Task Force and broader policy implications of a settlement. However, they still need more time to fully consider a resolution.

This agreement is similar to the one filed yesterday. Specifically, the Commission also requested a 60-day pause in a cross-appeal from Ripple, attempting to tie up loose ends without wasting the court’s resources.

There are a few subtle differences, but Binance’s filing with the SEC attempts to meet the same basic goals.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Are Buying These Altcoins Post Tariffs Pause

Crypto whales are making bold moves following Donald Trump’s 90-day tariff pause, with Ethereum (ETH), Mantra (OM), and Onyxcoin (XCN) drawing significant accumulation.

ETH whales pushed holdings to their highest level since September 2023, while OM holders are quietly increasing exposure amid the growing real-world asset narrative. XCN, meanwhile, saw a sharp spike in whale activity alongside a 50% price surge in just 24 hours.

Ethereum (ETH)

The broader crypto market rallied after Donald Trump announced a 90-day pause on tariffs—excluding China—boosting investor sentiment across risk assets.

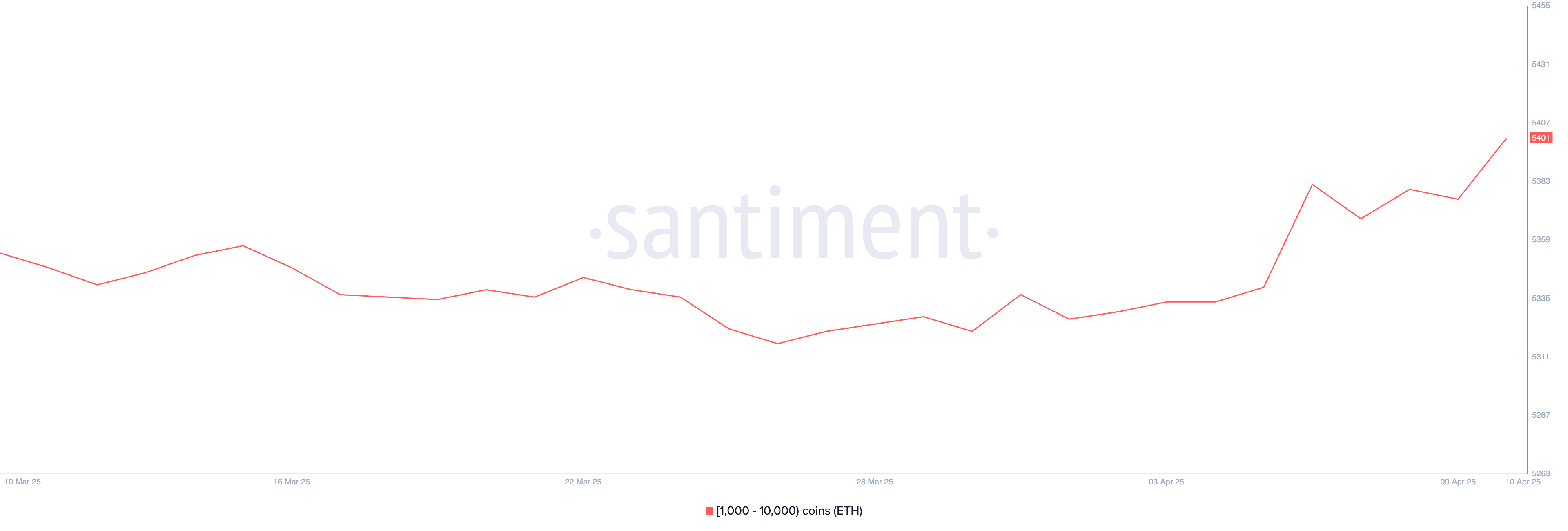

Ethereum followed suit, with on-chain data showing a rise in crypto whales activity; the number of addresses holding between 1,000 and 10,000 ETH climbed from 5,376 to 5,417 between April 9 and 10, reaching its highest level since September 2023.

If Ethereum can maintain this renewed momentum, it may test key resistance levels at $1,749 and potentially rally further toward $1,954 and $2,104. However, macroeconomic uncertainty still looms.

A sentiment reversal could see Ethereum price retesting the $1,412 support zone. If that level fails, a deeper decline toward $1,200—or even $1,000—is possible.

Some analysts have gone as far as comparing Ethereum’s decline to Nokia’s historical collapse, warning of long-term structural weakness.

Mantra (OM)

Real-world assets (RWAs) on the blockchain have hit a new all-time high, surpassing $20 billion in total value, reinforcing their growing importance as a crypto narrative and sector.

Binance Research also highlighted that RWA tokens have shown more resilience than Bitcoin during tariff-related volatility, further boosting confidence in the sector.

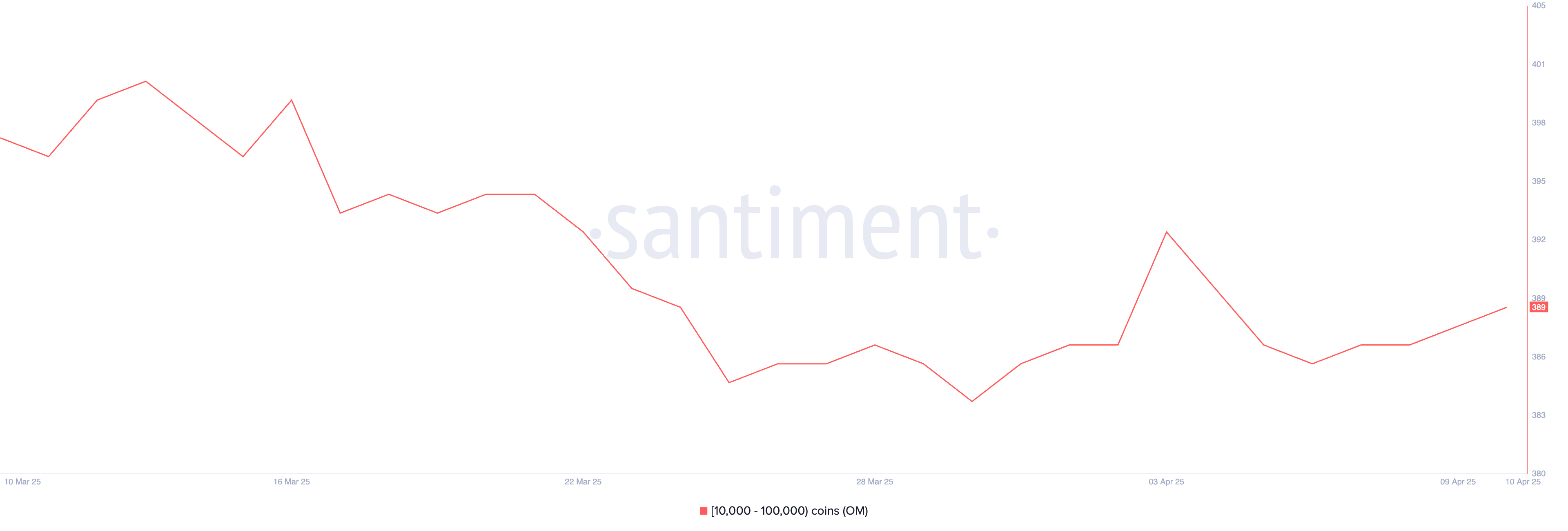

With the RWA narrative gaining traction, OM could see significant upside. Between April 6 and April 10, the number of OM whale addresses holding between 10,000 and 100,000 tokens rose from 386 to 389, signaling quiet accumulation.

If OM breaks past the resistance levels at $6.51 and $6.85, it could climb above $7. However, if the momentum fades, a correction could push the token down to $6.11, with further downside risk toward $5.68.

Onyxcoin (XCN)

Onyxcoin (XCN) has surged over 50% in the past 24 hours, breaking above the $0.02 mark as whale accumulation intensifies.

Between April 7 and April 10, the number of addresses holding between 1 million and 10 million XCN rose from 503 to 532, signaling renewed interest from large holders.

If this strong bullish momentum continues, XCN could rally toward resistance levels at $0.026, $0.033, and even $0.040. However, given the rapid price increase in a short timeframe, a correction may follow.

In that case, XCN could retest support at $0.020, with potential downside extending to $0.014 if selling pressure accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price may be gearing up for a historic breakout as a long-term Symmetric Triangle pattern from 2017 resurfaces on the charts. If history repeats and a similar explosive move follows, a crypto analyst predicts XRP could skyrocket to an eye-popping $30.

XRP Price Triangle Pattern Signals Breakout Above $30

A new technical analysis by Egrag Crypto, a crypto analyst on X (formerly Twitter), has stirred excitement among XRP supporters, suggesting that the digital asset may be on the brink of a historic price surge and that XRP could jump from its current market value of $2 to reach $30 soon.

Related Reading

While this figure may seem rather ambitious, Egrag Crypto has identified a massive Symmetrical Triangle formation on XRP’s monthly chart. Interestingly, the analyst has revealed that this pattern is strikingly similar to one that preceded XRP’s legendary 2,600% rally in the 2017 bull market.

In the 2017-2018 bull market, XRP had surged to an all-time high of $3.84 in just months. Now, after years of tightening price action within a giant Symmetrical Triangle, the altcoin appears to be breaking out once again, and this time, the analyst predicts that the upside could be even more explosive.

According to Egrag Crypto’s chart, if the asset mirrors its previous 2,600% triangle breakout, it could soar from the breakout zone around $1.20 to as high as $32.36. Notably, XRP’s Symmetrical Triangle formation is a classic consolidation pattern that usually results in a bullish surge in the direction of the prevailing trend.

Currently, XRP’s all-time high is $3.84. A potential surge to $32.36 would represent a whopping 741.6% increase, propelling its price to a level far exceeding its historical peak.

Bullish Pennants Strengthen Symmetrical Triangle Forecast

Egrag Crypto’s bullish forecast for XRP is supported by a textbook diagram comparing bullish pennants and symmetrical triangles, both of which point to double target zones once a breakout occurs. The pattern suggests that once the altcoin escapes its multi-year consolidation, the analyst’s projected rally may play out in three stages: an initial pump, followed by a retracement, and a second explosive move.

Related Reading

The XRP price chart shows a lower target, around $3.52, which aligns with the 1.0 Fibonacci retracement level. This indicates that the token could see a temporary rebound to 3.52, followed by a short-term pullback to the triangle breakout point at $1.20, before ultimately bouncing toward the projected $32.36 target.

Notably, this movement aligns with XRP’s current market structure, where it has maintained long-term support and is now showing signs of upward momentum. While historical price patterns offer insights into potential moves, the predicted rise to $32.36 is uncertain, given the magnitude of such a rise.

Featured image from Adobe Stock, chart from Tradingview.com

-

Altcoin20 hours ago

Altcoin20 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market19 hours ago

Market19 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Market18 hours ago

Market18 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Market20 hours ago

Market20 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Altcoin18 hours ago

Altcoin18 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Market24 hours ago

Market24 hours agoHow SEC Chair Paul Atkins Will Reset US Crypto Policy

-

Market12 hours ago

Market12 hours agoChina Raises Tariffs on US to 125%, Crypto Markets Steady

-

Market17 hours ago

Market17 hours agoBTC ETF Outflows Continue Amid Institutional Caution,