Market

5 DePin Altcoins to Add to Your Portfolio in June 2024

Decentralized Physical Infrastructure Networks (DePIN) have emerged as a groundbreaking sector. With several projects taking clear strides to be the best within the category.

These projects aim to decentralize and democratize the internet’s infrastructure layer, creating immense potential for growth and innovation. Here are five DePIN projects that show promising technical setups and could be valuable additions to your portfolio.

Render (RNDR)

Render coin (RNDR) is the lifeblood of the Render Network, a special DePIN platform that utilizes blockchain tech to connect artists with unused processing power from other people’s computers.

Imagine you’re an artist working on a project that requires intense 3D rendering, like creating special effects for a movie. Traditionally, this would necessitate a powerful computer, which can be expensive. The Render Network lets you tap into the unused graphics processing unit (GPU) power of other computers on the network. Folks lending out their GPU power earn RNDR tokens in return.

Render’s market cap fluctuates around $3.8 billion, ranking it the 31st largest cryptocurrency by market capitalization.

RNDR Technical Outlook:

Render’s price has shown strength over the past two months, rebounding from a major correction to the $6 level and now trading at $10. The key support level is the 1D Ichimoku cloud, as shown in the chart.

If the price breaks below the cloud, it could present a good buying opportunity for RNDR.

Read More: Render Token (RNDR): A Guide to What It Is and How It Works

Render (RNDR) is currently trading at $10.01. The key resistance levels are $10.78, $11.30, and $13.99. These levels mark significant points where the price has previously struggled to break through. On the support side, the immediate support level is at $9.03, indicated by the EMA line.

Other crucial support levels are $8.26 and $5.28, the latter offering a major buying opportunity if the price dips this far. The 1D Ichimoku cloud shown in the chart acts as a key support zone, and a break below this cloud could present a good buying opportunity for RNDR.

Phala (PHA)

Phala Network is a DePIN blockchain-based cloud computing service that focuses on privacy. Unlike traditional cloud services, where your data resides on someone else’s servers, Phala offers a way to perform computations on your data without ever revealing the data itself.

This is achieved through a combination of advanced cryptography and specialized hardware.

Phala’s market cap fluctuates around $134.8 million, making it the 398th largest cryptocurrency by market capitalization. This is a highly significant low-cap cryptocurrency to consider investing in, though it also carries higher risk.

PHA Technical Outlook:

Phala’s price has sharply declined from $0.37 to $0.16 and is now trading at $0.1857. Currently, the price is below the daily Ichimoku cloud. If it manages to break above the cloud, it could present significant upside potential for investors.

Additionally, if the price breaks below the 200 EMA in green, this could lead to a further price correction, as the price is currently consolidating and finding the 200 EMA as an important support level. Monitoring these levels will be crucial for making informed investment decisions.

Nosana (NOS)

Nosana is a DePIN crowd-computing platform built on the Solana blockchain. It functions by connecting individuals with spare CPU power on their devices to projects that require a computational boost.

In return, people contributing their CPU power earn NOS tokens, the platform’s native cryptocurrency.

Why is Nosana Important?

Nosana offers a unique take on cloud computing with a couple of key advantages:

- Democratized Access to Processing Power: Projects requiring intensive computational resources can access them through a distributed network, making powerful computing more affordable and accessible.

- Monetization of Unused Resources: Individuals with idle CPU capacity on their devices can generate additional income by renting it out to the network.

- Eco-Friendly Alternative: Nosana leverages underutilized personal devices, reducing reliance on large data centers that consume significant energy.

NOS Technical Outlook:

Nosana (NOS) is currently trading inside the 1D Ichimoku cloud. The price has tested the lower boundary of the cloud, which is a bullish sign, highlighting the importance of monitoring this technical indicator.

Read More: Is DePIN the Dark Horse of the Next Crypto Bull Run?

The EMA 100 D, shown in blue, is acting as a major support level. A breakout below the 200 EMA could signal further price depreciation. Despite recent fluctuations, NOS remains an attractive coin within the Solana ecosystem.

JasmyCoin (JASMY)

Jasmy coin (JASMY) is the native cryptocurrency that fuels the DePIN Jasmy ecosystem. This project centers around the Internet of Things (IoT) and aims to empower users with control over their data.

JASMY Technical Outlook

Jasmy has gained 100% from May 26 to the present, leading to an overbought condition. We anticipate a correction to the $0.027 – $0.030 range, with the 4H Ichimoku cloud being a key level to watch. Although the uptrend may continue, investing at current prices presents a risk.

Waiting for the 4H Ichimoku cloud correction could be a wise move for prudent investors.

Jasmy coin has flipped many cryptos in the market cap ranking, making it the 68th largest crypto by market capitalization, currently fluctuating around $1.7 billion.

Golem (GLM)

Golem Network is a decentralized platform that disrupts the traditional way we access and share computing resources. In essence, it acts as a giant online marketplace for computational power.

How Does Golem Network Work?

Golem Network functions through a peer-to-peer (P2P) system connecting two types of users:

- Requestors: Individuals or projects need extra computing power for tasks like scientific simulations, 3D rendering, or artificial intelligence (AI) training.

- Providers: People with unused processing power on their computers (CPUs or GPUs) can contribute that power to the network and earn Golem’s native token, GLM.

GLM Technical Outlook:

GLM is trading in a descending pattern, continuing its price correction from $0.66 to $0.47. The current price is $0.49, which could be a good point to invest in GLM long-term. If the price falls below the $0.47 support level, it could be very bearish and potentially send the price down to $0.45 or $0.40.

Read More: Decentralized Physical Infrastructure Network (DePIN) Projects to Watch in 2024

This could present a very good opportunity to invest in GLM. If the price of GLM tests the daily Ichimoku cloud, it could be very bullish and increase volatility. Key resistance levels to watch are $0.60 and $1.

The $1 mark has never been reached, corresponding to a $1 billion market cap in the current circulating supply.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is Ethereum Falling to $1,000 This April?

Ethereum (ETH) is down almost 6% in the last 24 hours, intensifying a week of sharp declines. With the price below $1,500, market watchers are increasingly questioning whether ETH could fall to $1,000 in April.

Mounting concerns around liquidations, declining network activity, and bearish technicals are fueling the debate. As investor sentiment wavers, the next few days could prove critical for Ethereum’s short-term trajectory.

If ETH Falls Below $1200, Nearly $342 Million Will Be Liquidated

Ethereum is currently hovering just above the $1,500 mark, down more than 15% over the past week as bearish pressure intensifies across the crypto market.

The recent downturn has sparked concern among traders, especially with ETH struggling to hold key support levels. Standard Chartered recently stated that XRP could overtake Ethereum by 2028.

The decline reflects broader risk-off sentiment and uncertainty surrounding altcoins, with Ethereum now teetering dangerously close to levels that could trigger a major wave of liquidations.

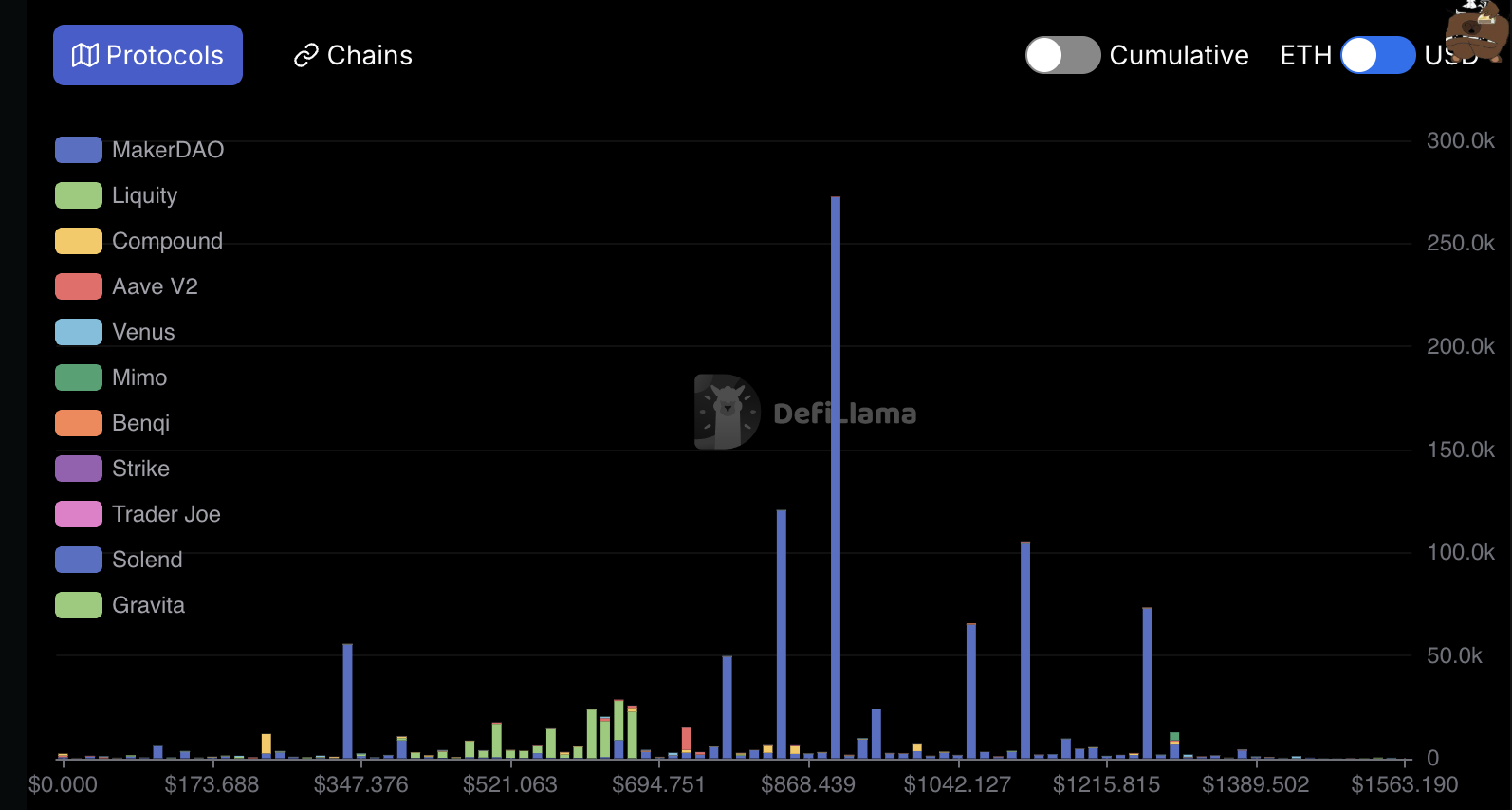

According to on-chain data, if ETH falls below $1,200, it could trigger liquidations totaling approximately $342 million across leveraged positions.

Liquidation occurs when traders who borrowed capital to go long on Ethereum are forced to sell their holdings due to falling prices. This effectively amplifies the downside and adds more selling pressure.

Weighing in on the situation, investor Peter Schiff took to X, warning that he doesn’t think it will take long before Ethereum crashes below $1,000 — a level not seen since January 2021.

Ethereum TVL Is Down 43% Since December

Ethereum’s total value locked (TVL) has been in sharp decline since peaking at $86.6 billion in December — its highest level since mid-2022.

As of now, Ethereum’s TVL has dropped to $49.34 billion, marking a steep 43% decrease in just a few months.

This decline highlights waning user activity and capital outflows from Ethereum-based protocols, raising fresh concerns about the network’s short-term momentum.

TVL measures the total capital deposited into decentralized finance (DeFi) protocols on a blockchain and serves as a key indicator of ecosystem health and investor confidence.

A rising TVL generally signals growing trust and usage of DeFi applications, while a falling TVL suggests declining demand and reduced engagement.

Ethereum’s TVL is now hovering at multi-month lows, which could be a bearish signal for ETH’s price. This reflects reduced utility and less capital circulating through the network, both of which could put further downward pressure on the asset if the trend continues.

Ethereum Is Currently 70% Down From Its All-Time High

Ethereum’s price has been trading below $2,000 since March 26, and its technical indicators don’t look promising.

The current setup of its Exponential Moving Averages (EMAs) shows a bearish formation, with short-term EMAs positioned below the longer-term ones — a classic signal of ongoing downside momentum.

This suggests that sellers are still in control, and the market could be bracing for further correction.

If bearish momentum continues, Ethereum may retest support near $1,400. A breakdown below that level could trigger a deeper sell-off, with Ethereum price potentially sliding toward $1,000 in April — a key psychological and historical level.

However, if bulls regain control and reverse the trend, ETH could first challenge resistance at $1,749.

A breakout above that would open the door for a test of $1,954, and if momentum stays strong, Ethereum could push past the $2,000 barrier and aim for $2,104.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Price Rally Faces Risk as Bearish Momentum Builds

Solana has posted a 7% increase in the past 24 hours, aligning with the broader market’s recovery. While this surge may appear promising, technical and on-chain data suggest that the coin could face significant resistance.

Despite the recent rally, SOL risks shedding these gains and could fall below the $100 mark if bearish pressures dominate.

Solana’s Price Surge Lacks Momentum

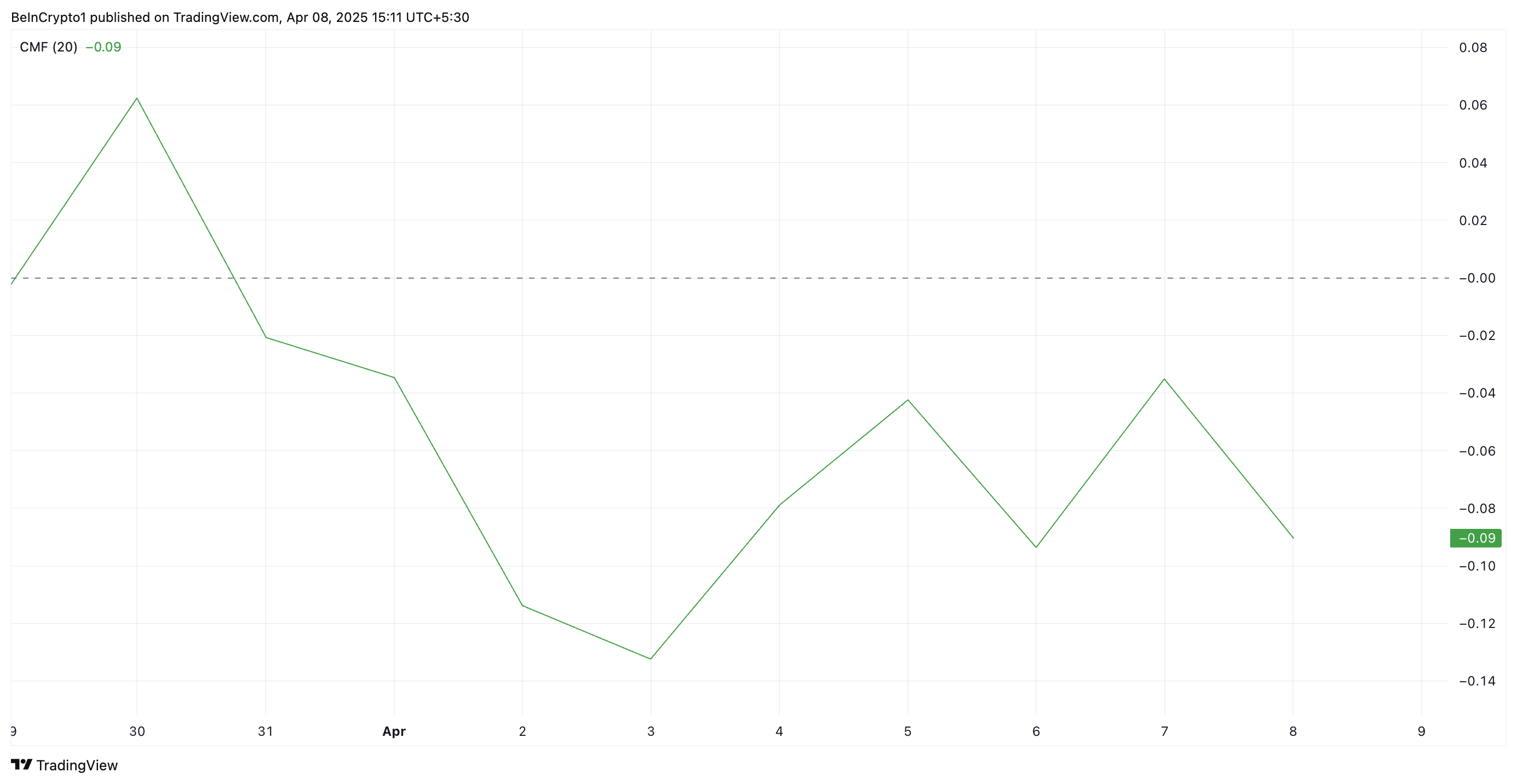

While impressive, SOL’s current rally largely reflects the broader market trend rather than demand for the altcoin. The bearish divergence formed by its Chaikin Money Flow (CMF) shows this.

At press time, SOL’s CMF is below the zero line at -0.09, indicating a lack of buying momentum among SOL market participants.

The CMF indicator measures money flow into and out of an asset. A bearish divergence emerges when the CMF is negative while the price is climbing. The divergence signals that despite the upward movement, there is more selling pressure than buying interest, suggesting weak bullish momentum.

This indicates that SOL’s current price rally may lack sustainability and could be at risk of reversing or stalling as new demand remains scarce.

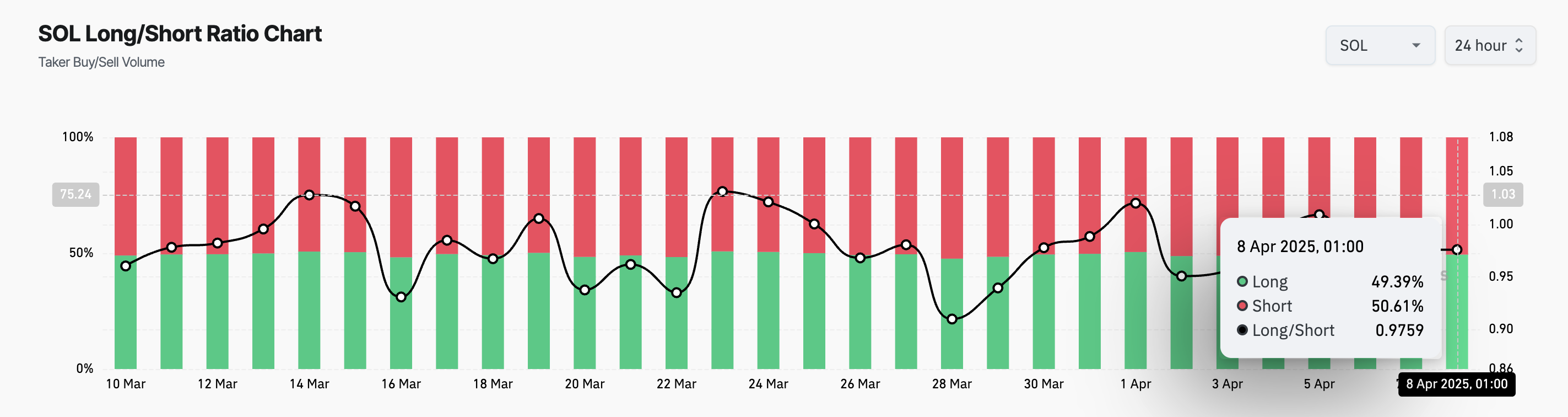

Further, the coin’s long/short ratio highlights that its market participants lean more heavily toward the short side. At press time, this stands at 0.97.

The long/short ratio measures the balance between long positions (betting on price increases) and short positions (betting on price decreases) in the market. When the ratio is below zero like this, it indicates that there are more short positions than long positions.

This suggests that bearish sentiment remains dominant in the SOL market, and its futures traders are anticipating a decline in the asset’s price.

Solana in Crucial Zone: Will $95 Hold or Lead to a Steeper Decline?

During Monday’s intraday trading session, SOL plummeted to a 12-month low of $95.26. Although it has since rebounded to trade at $108.77 at press time, the lingering bearish bias leaves the coin at risk of shedding these gains.

If SOL witnesses a pullback, it could break below the support at $107.88. If it falls back below $100, the coin’s price could fall toward $79.

On the other hand, if the uptrend continues, backed by a surge in new demand, SOL’s price could breach the resistance at $111.06 and climb toward $130.82.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Briefly Recovers 5% Due To US-China Tariff Deal Optimism

Crypto and TradFi markets had a strong opening today, as Bitcoin briefly jumped 5% due to optimism about a tariff deal. China and institutional investors in the US wish to avoid a trade war if possible.

Despite these encouraging signs, no deal has actually been reached, and Bitcoin also suffered subsequent losses. The whole market is in a state of flux until the situation becomes more clear.

How Will Bitcoin Perform Under Tariffs?

The crypto markets are full of fear right now, and it’s difficult to determine a safe bet moving forward. Since the market suffered huge liquidations yesterday, it opened with cautious optimism today.

This trend was particularly influenced by Bitcoin, which briefly jumped around 5% due to hopes about a potential deal on Trump’s tariffs.

The price of Bitcoin has fluctuated wildly due to the tariffs as speculation about a sell-off increases. However, the whole market is in a chaotic state right now.

Today, the Dow Jones Industrial Average surged 1,285 points, or 3.4%, while the S&P 500 and Nasdaq Composite both jumped 3.4% and 3.3%, respectively. Nonetheless, hundreds of stocks have fallen 20% or more.

Meanwhile, Bitcoin has a few advantages that can protect it from tariff volatility. For example, a recent report from Binance Research claims that the least risky cryptoassets are the most insulated from drops.

This includes RWAs and centralized exchanges, but Bitcoin is a close third.

Furthermore, the markets are very optimistic about a deal to avoid the tariffs. Yesterday, rumors of a pause triggered a trillion-dollar rally, highlighting traders’ desperation for good news.

Despite the retaliatory tariffs, China is similarly eager to avoid a full-blown trade war with the US. Trump claimed that he is making progress with China and South Korea, fueling optimism.

Nonetheless, it’s important not to overstate Bitcoin’s chances of success under tariffs. Despite the hopes on both sides of the Pacific, China confirmed that it’s prepared to fight a trade war if Trump forces its hand.

This might explain Bitcoin’s price drops despite its strong performance since yesterday. Ultimately, all we can do is wait and hope.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoCrypto Whales Are Buying These Altcoins Post Market Crash

-

Market22 hours ago

Market22 hours agoXRP Targets Rebound After Hitting Oversold Territory

-

Market21 hours ago

Market21 hours ago3 Altcoins to Watch in the Second Week of April 2025

-

Market23 hours ago

Market23 hours agoCan the Fed Rescue Crypto Markets With Interest Rate Cuts?

-

Market20 hours ago

Market20 hours agoWEEX Lists AB (AB) under the RWA and Blockchain Infrastructure Category

-

Altcoin19 hours ago

Altcoin19 hours agoProgrammer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

-

Market15 hours ago

Market15 hours agoEthereum Price Rebound Stalls—Can It Reclaim the Lost Support?

-

Bitcoin20 hours ago

Bitcoin20 hours agoWhy Did MicroStrategy Pause Its Bitcoin Acquisitions Last Week?