Market

3 Crypto That Reached All-Time Highs Today — December 4

With the altcoin season underway, most of the top crypto tokens other than Bitcoin are noting gains. Two of the top 15 cryptocurrencies even made it to new all-time highs (ATHs) today amid strong bullish momentum.

BeInCrypto has analyzed these three crypto tokens, which formed new all-time highs, and what to expect from them going forward.

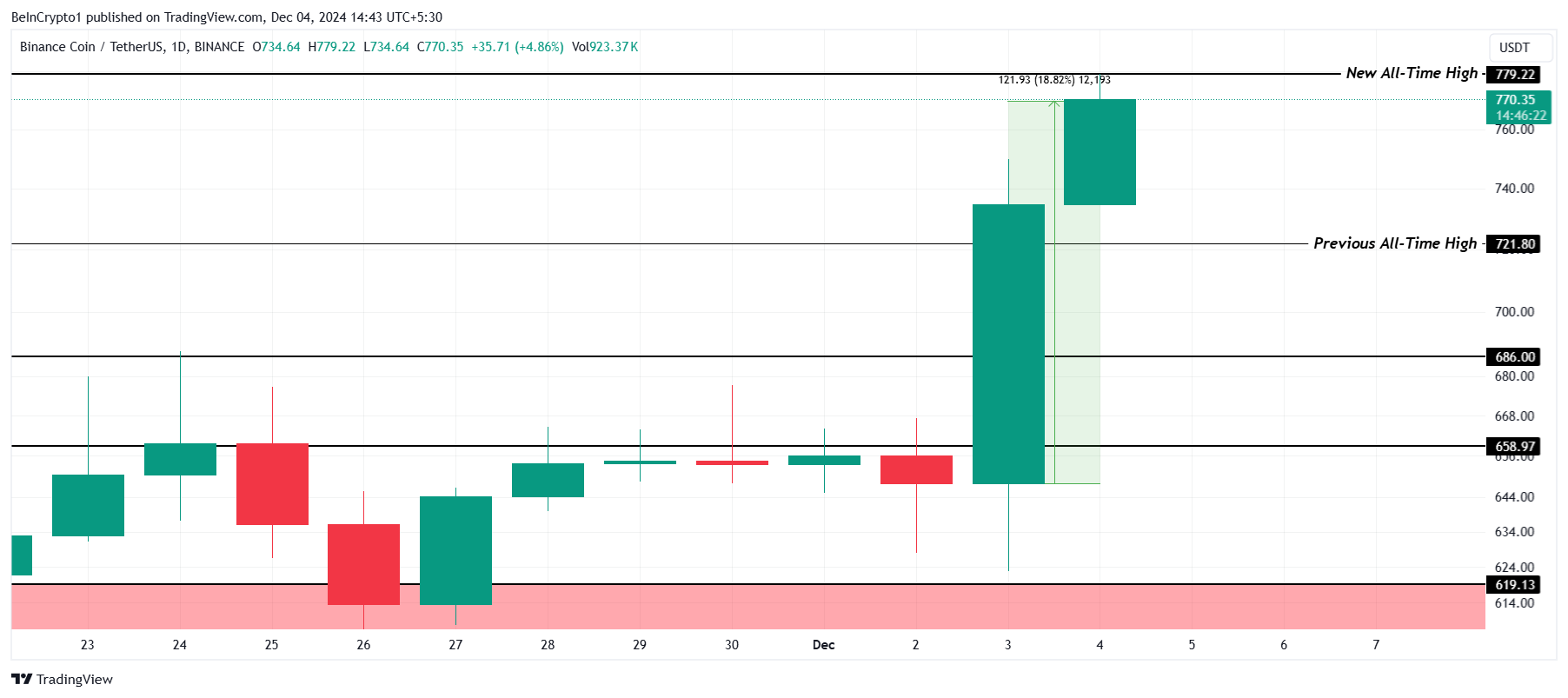

BNB

BNB price surged by 18% in the past 24 hours, reaching $770 at the time of writing. The intra-day high of $779 set a new all-time high (ATH) for the altcoin. This price movement highlights strong bullish momentum and increasing market confidence in BNB’s future performance.

The previous ATH for BNB was set in June at $721, which has now become a crucial support level. If BNB manages to maintain this level, it could continue its upward trend, further solidifying its position in the market. The $721 support is vital for sustaining investor confidence in the token.

Given the current momentum, BNB is expected to continue its rise and potentially form new ATHs. However, if profit-taking occurs and the price falls below the $721 support level, the bullish thesis would be invalidated. A drop below this level would signal a shift in market sentiment, leading to possible corrections.

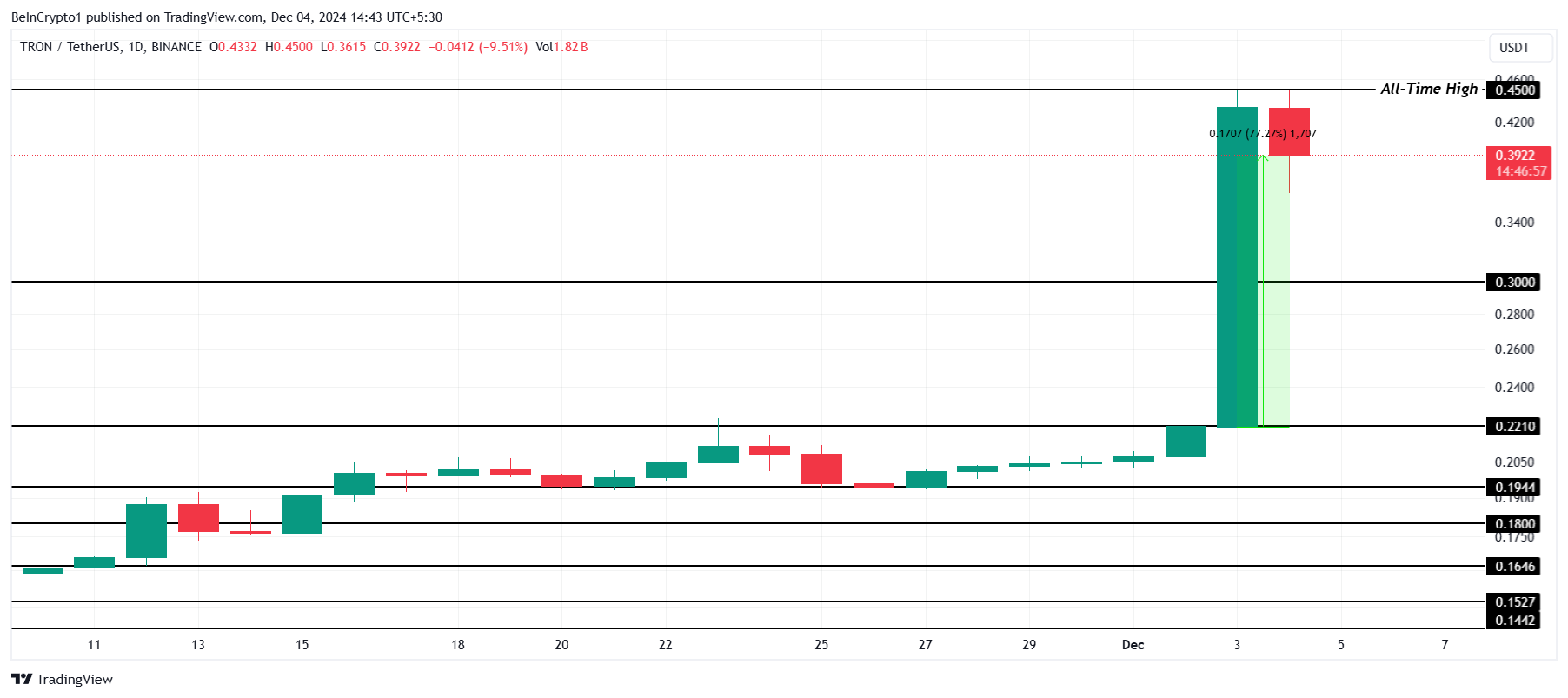

Tron (TRX)

Tron’s price surged by 77% in the past 24 hours, reaching $0.39. Despite a 9.5% intra-day dip, the altcoin is expected to maintain support above $0.30.

This level is critical for sustaining the bullish momentum. If Tron holds above $0.30, it could continue its upward trend.

During the price surge, Tron reached a new all-time high (ATH) of $0.45. The next key target for the altcoin is to establish $0.50 as support. If Tron can hold above this level, it will signal further growth, with the potential for more gains in the coming days or weeks.

However, if the downward trend persists and TRX drops below the psychological support of $0.30, panic selling could follow. This scenario would invalidate the current bullish outlook, leading to a potential shift in market sentiment. Traders should monitor support levels closely.

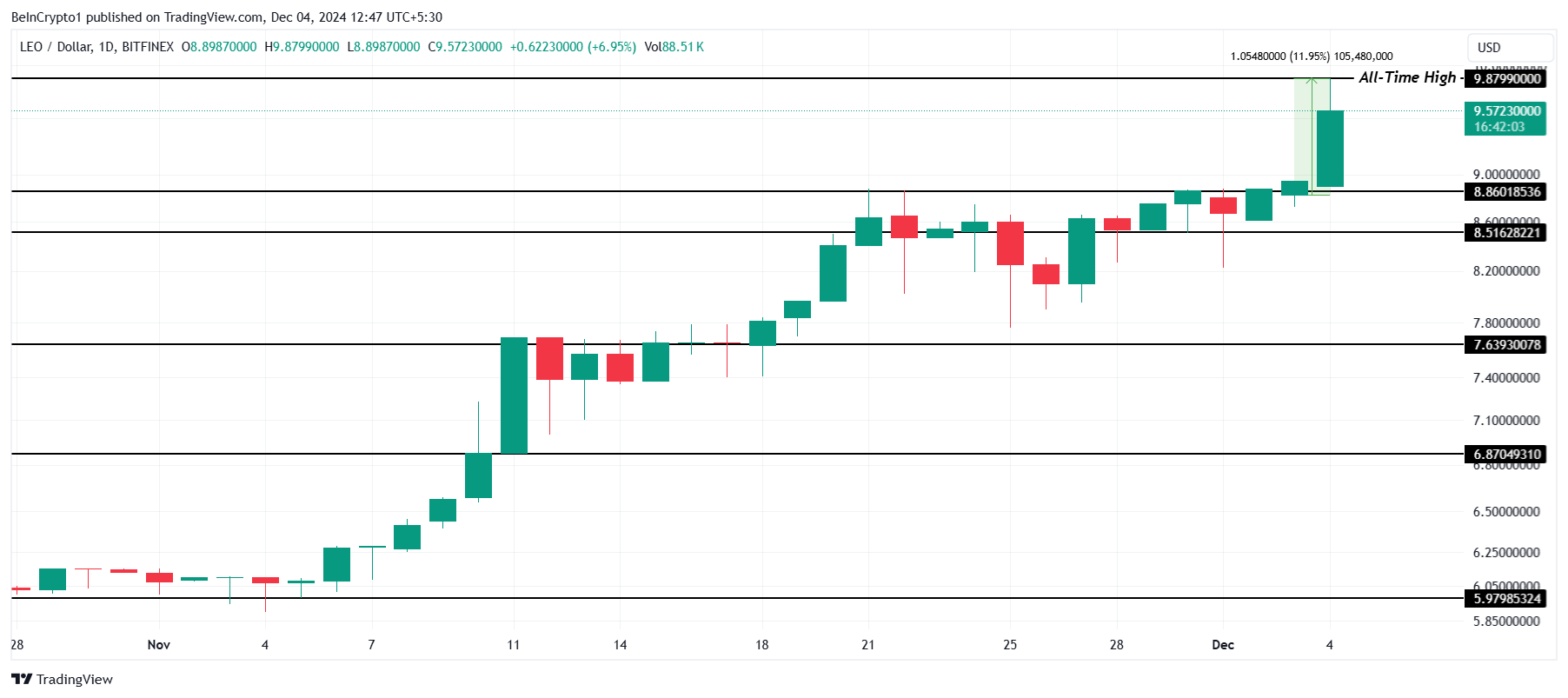

Leo Token (LEO)

LEO token recently reached a new all-time high (ATH) of $9.87 after a near 12% rise in the last 24 hours. This marks the second ATH for LEO in the past month, indicating strong market demand and bullish momentum. The token’s performance has attracted significant attention from investors.

LEO is expected to continue benefiting from the ongoing altcoin season, with its price likely to rise further. The altcoin has managed to maintain the critical support level at $8.86, which is crucial for sustaining upward momentum. As long as this support holds, LEO could see additional gains in the coming weeks.

However, if LEO fails to hold the $8.86 support level, the current bullish outlook could be jeopardized. A break below this key level would likely lead to a sharp decline, erasing the recent gains and potentially signaling a shift in market sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

China Raises Tariffs on US to 125%, Crypto Markets Steady

On April 11, 2025, China’s State Council Tariff Commission issued an official notice announcing an increase in additional tariffs on imported US goods—from 84% to 125%. The new rate takes effect on April 12.

This move directly responds to the United States’ decision, announced on April 10, to impose a “reciprocal” 125% tariff on Chinese exports to the US.

Crypto Market Stays Calm Amid Escalating US-China Trade War

Despite escalating tensions between the world’s two largest economies, the cryptocurrency market has shown remarkable stability. Investors appear unfazed by the intensifying trade conflict.

Crypto market capitalization remains around $2.5 trillion. Bitcoin’s price holds above $81,000 after recovering 10% since April 9, when Trump announced a 90-day tariff pause, excluding tariffs on China.

According to the Chinese statement, the tariff hike follows China’s Customs Law, Tariff Law, and Foreign Trade Law. The government reaffirmed its commitment to international rules. It accused the US of violating global trade norms and called Washington’s policy “unilateral bullying.”

Notably, China warned that it would not respond to further tariff increases from the US, arguing that American goods have already lost their competitiveness in the Chinese market at the current tariff level.

“Given that US exports to China are no longer market-viable under the current tariff rate, China will not respond further if the US continues to raise tariffs on Chinese goods,” the statement said.

The tariff dispute is not new. Since 2018, the US and China have imposed retaliatory tariffs on each other. Key sectors affected include agriculture, tech, and energy.

The latest hike pushes tariffs to a record 125%. Economists warn this could disrupt global supply chains, raise prices, and add pressure to inflation in both nations.

Bitcoin miners also feel the impact as mining machine prices surge.

China’s tariff hike sends a strong message about its tough stance in trade negotiations. While the crypto market remains stable for now, analysts urge investors to monitor upcoming developments—especially any potential response from the US.

If no resolution is reached, the ongoing standoff could trigger a broader economic fallout. The world is now watching to see whether the trade war will de-escalate or further entrench the divide between the two economic superpowers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Buyers Fuel Surge with Golden Cross, Suggesting Upside

Hedera’s HBAR has bucked the broader market dip to record a slight 1% rally over the past 24 hours. As of this writing, the altcoin trades at $0.17.

This upward movement comes amidst signs of a resurgence in new demand for the altcoin, as highlighted by key technical indicators on the daily chart.

HBAR Bullish Trend Gains Strength

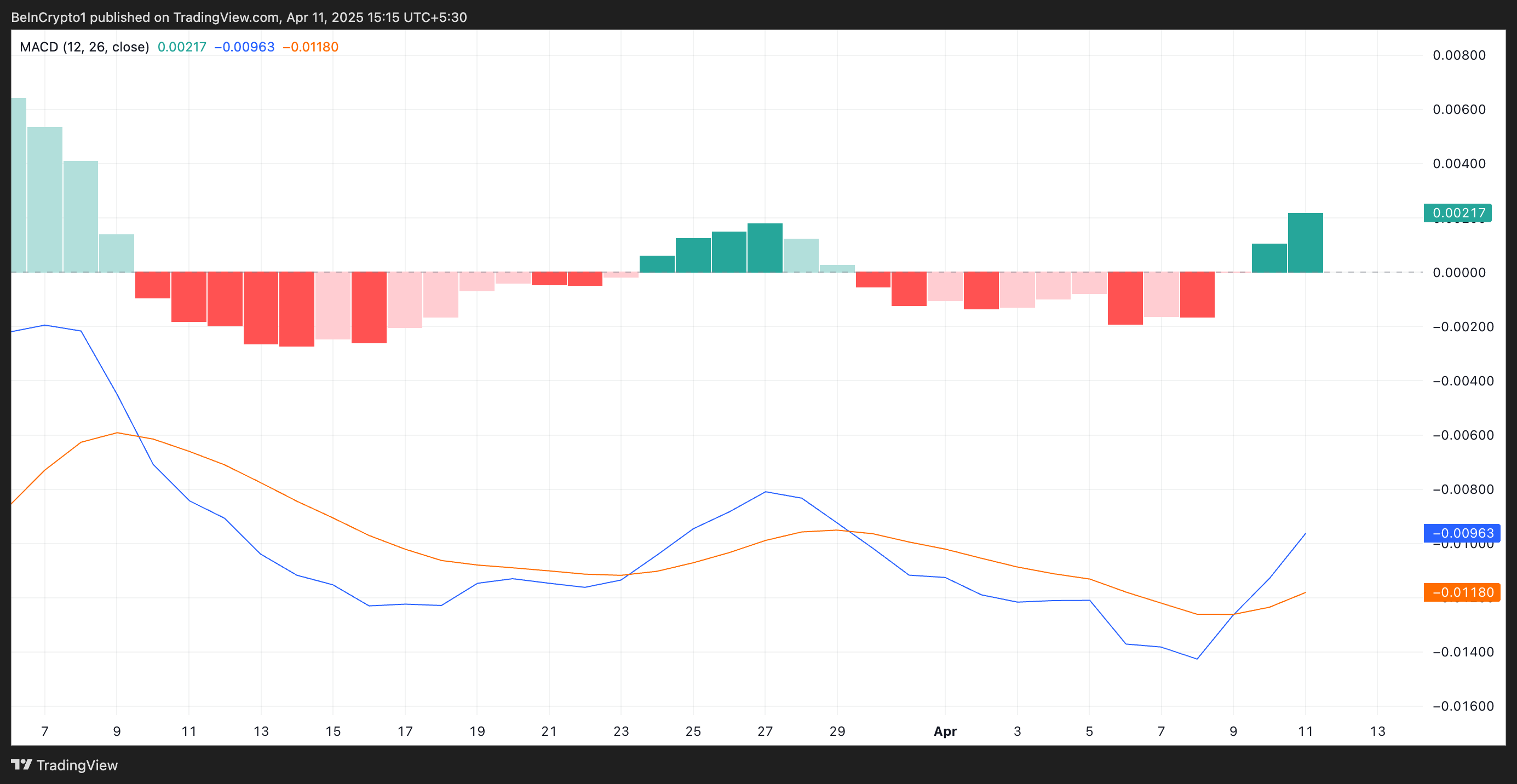

Readings from HBAR’s Moving Average Convergence Divergence (MACD) reveal that on April 9, the token’s MACD line (blue) climbed above its signal line (orange), forming a “golden cross.”

A golden cross occurs when the MACD line crosses above the signal line, signaling a potential bullish trend and increased buying pressure. This confirms that HBAR’s upward momentum is gaining strength, especially as investors commonly view this pattern as a buy signal.

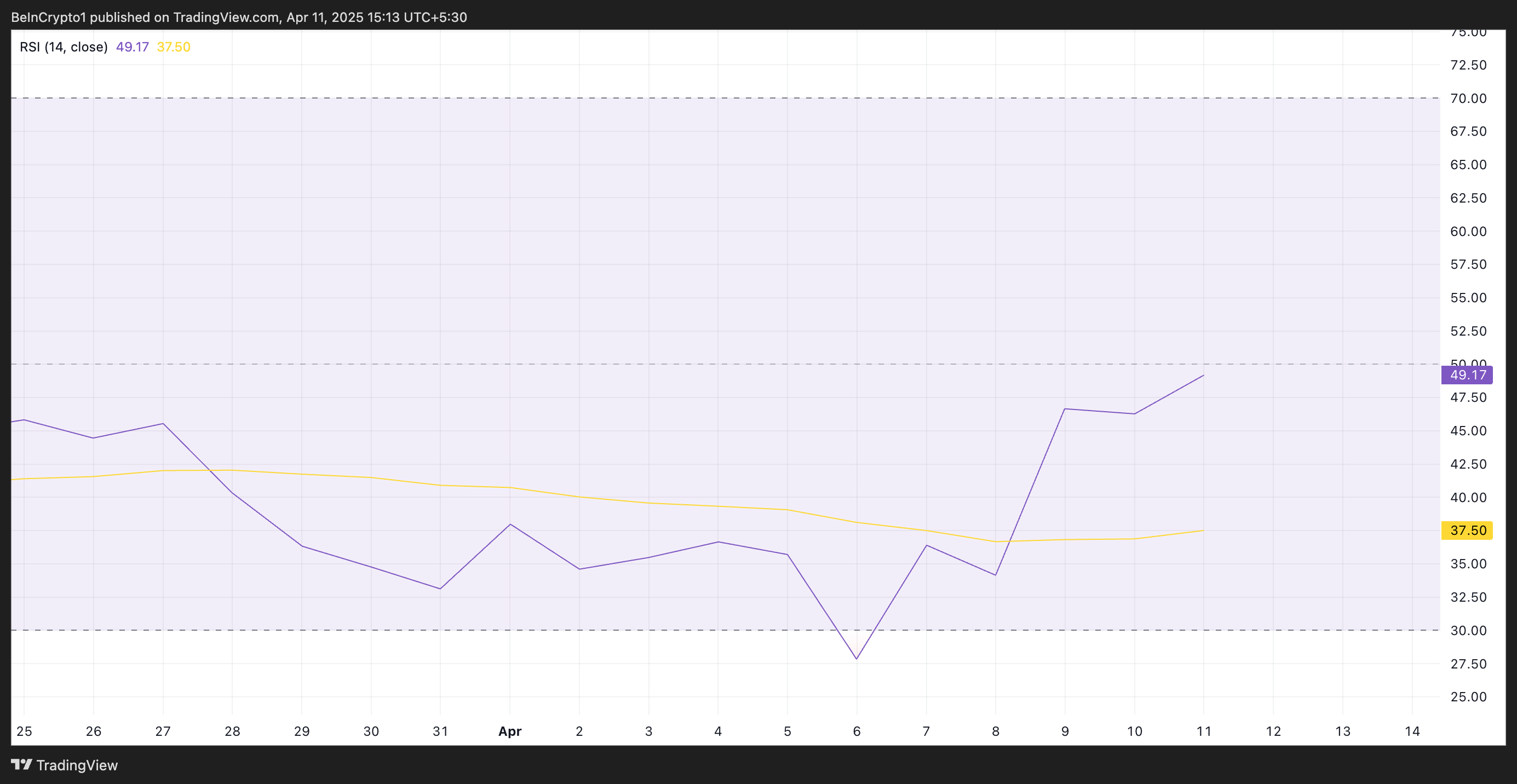

Moreover, as of this writing, HBAR’s Relative Strength Index (RSI) is poised to break above the 50-neutral line, highlighting the spike in fresh demand for the altcoin. It is currently at 49.17 and remains in an uptrend.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 49.17 and climbing, HBAR’s RSI signals a gradual shift from bearish territory into a more neutral zone. If the altcoin’s RSI continues to rise above 50, it would signal increasing bullish sentiment, driving up HBAR’s value.

HBAR Eyes $0.19 Amid Strong Buying Pressure

HBAR’s surge over the past day has pushed its price above the key resistance formed at $0.16, which has kept the token in a downtrend since March 30.

With growing buying pressure, the token could flip this zone into a support floor. If successful, it could propel HBAR’s price to $0.19.

However, if traders resume profit-taking, HBAR’s current rally would halt, and the token’s price could fall below $0.16 and decline toward $0.12.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MiCA Boosts Gemini’s Expansion Plans Across Europe

During the 2025 edition of the Paris Blockchain Week (PBS), BeInCrypto sat with Mark Jennings, Head of Europe at crypto exchange Gemini, for an in-depth conversation about the exchange’s regulatory-first strategy and its expanding European footprint. Gemini—founded by the Winklevoss twins—has spent the last decade cementing its reputation as a secure and compliant platform for digital assets.

With the implementation of MiCA in Europe and the company’s pending IPO, Jennings emphasized how regulatory clarity is paving the way for broader crypto adoption and Gemini’s next growth phase across the continent.

How Gemini Sets Itself Apart in a Crowded Exchange Market

If you look at it as a whole, Gemini was born in 2015 from the founders who saw the future around Bitcoin and were early investors there. The key that Gemini has looked at is “how do we secure longevity here?”. For our position, it’s always been “ask for permission”. So, we’ve always taken the regulatory route first in terms of establishing ourselves. If you look at the US, we were registered as a New York Trust and then you move into Europe, registered as a VASP in Ireland. We were the first to get that in Ireland.

I think the key for us has been what is happening in Europe this year when we see MiCA being implemented. It gives us a secure platform to grow into Europe, certainty in the regulatory environment, and how we grow. That’s been at the core of what Gemini has done for the last 10 years, and we see that’s a key way for us to continue to build and grow. One is that we’re a trusted, safe, and secure platform for you to unwrap your fear, trade, and provide secure custody. For us, it’s key for our customers to be able to go on that journey with them and understand if there’s a secure regulatory infrastructure to do that. And now that there’s clarity in Europe, we’re going to continue to build and grow our businesses.

Crypto Regulation in Europe vs. the US

In my role as head of Europe, I’m focused on what the European regulators are looking at and it’s a positive move to see MiCA come into effect at the end of last year.

What I do see as positive if you look to the US, a cryptocurrency stablecoin regulation is on the table for discussion; you know, we can’t manage different regulatory environments but we do see that there is a positive sentiment towards it. They’re looking to put a framework in place, and we see that as a positive for crypto as a whole. From my perspective, we can see that each regulator is now starting to address that.

Also, we’re serving different customers, and so we work under the regulation here in Europe, but each ecosystem has a regulator that should provide positive mechanisms.

User Experience on Gemini

If you see our user experience within the app and within our ActiveTrader desktop functionality, we’re looking at a simple and secure UI ; so being able to see your assets, being able to fund your account very easily, being able to trade easily and knowing that you’ve got the security of Gemini’s customer platform behind it.

For us, it’s a very clear UI and very clear action points for someone to be able to access the platform and Cryptopedia and other educational resources that we have because understanding the different tokens that are available and the different features is part of the journey. That’s also what Gemini wants to do: help with education.

Gemini’s Approach to Platform Security

We’re talking about security from an insurance perspective, and understanding that our insurance infrastructure was built on a proprietary technology that was built at Gemini. I think that’s important for us to own that. We know how important that is for the ecosystem as a whole. For us, it’s been developed on our original New York Trust infrastructure.

We’ve built and replicated that as part of our MiCA licensing. So, we see that this really robust framework is what is underpinning the security there. If you look at the AML frameworks as part of our European regulation, it’s an important part for us to make sure that we know who our customers are, that we’re able to onboard them, and give them a really secure place to trade crypto.

Emerging Market Trends

I think there will be more mainstream adoption, understanding that crypto assets are now an accepted asset as part of somebody’s investment decision, and they’re looking at that. So, I think as that developed, the regulatory infrastructure has given people confidence. And from some of the statistics we’ve seen, that’s one of the biggest barriers to entry.

People have been uncertain about the regulatory infrastructure and where people sit. So now that we see that barrier being clearly set in the sand, people can start to engage more with crypto assets in general.

Is Crypto Losing Its Edge or Gaining Maturity?

I wouldn’t say cryptos are becoming boring [laughs]. What we’re seeing is that there’s a maturation of the market, and the market goes in that direction. And then people are making investment decisions. Institutions are also involved there; if you look at the synergies between markets, where there are more players within that market, it changes the market’s characteristics as a whole. I don’t think cryptos are ever going to be boring.

If you see what’s happening—the underlying technologies being built, the different networks that are there, the increasing pass-through, the increase in the transaction process—I don’t find any of that boring. I think it’s really exciting.

Gemini and DeFi

We’re not really in the DeFi space. We’re continuing to build our on-chain products, but at the moment there’s nothing in the DeFi space specifically. I think it’s an area of innovation that we’re continuing to see grow. Gemini, at its core, is an exchange and a custodian, and I think that’s what we’ll play going forward. But the on-chain team is definitely building and growing. We’ll see if anything comes to that.

I think we’re focused on our core strengths. I think that’s the area where we continue to build and grow. If you look at it, every player in the market is looking to build in a different fashion and solve a different problem. For us, we’re there as one of the largest exchanges. We want to continue to facilitate that. So I wouldn’t say that.

The Profile of Gemini’s Clientele

I think we’ve got a broad client base. We serve retail customers and institutional customers the same. I think we’re engaged with people who value the safety and security aspects of what we do. The fact that we took that regulatory viewpoint very early on resonates with a lot of customers.

I think we’ve built a product that we feel is fit for the environment, and we see customers come to us for that. I don’t know if we’ve targeted customers directly. We’ve built what we think is the best product for customers who want it.

Strategy to Recruit New Customers

Education is one thing. Giving people an understanding of what we can bring to them, whether it’s safety and security of custody, the ability to trade, the ability to fund. I think education is key.

The second piece is the simplification of the process. How do we help them along that journey, from onboarding with us, to being able to fund their account, to being able to use these assets ? That’s key. We want to make sure it’s simple and straightforward and that they understand what’s there.

And the third piece would be to continue to innovate. The crypto space moves very quickly. We want to leverage those technologies to help improve the process and be able to allow people to engage with the crypto ecosystem using the Gemini platform.

These are the three pillars I see.

Gemini’s Vision for Growth

In my role as Head of Europe, the regular landscape has been key. We’re really looking to build our business in Europe. We want to provide a product that can engage all 32 countries that are under the EEA umbrella.

For us, it’s about a very simple and clean UI, getting people very clear access to the platform, and being able to cater to their needs, whether it’s from a funding perspective or from a trading perspective. Keep evolving our products. We get feedback from our customers; we want to continue to evolve on that.

Expectations from Paris Blockchain Week

There are a number of our partners and competitors here. Being involved in the ecosystem, you understand what people are working on, what startups are doing, and how they’re trying to solve some of our problems. I’m here to meet as many people as I can and learn. In this space as a whole, learning is the number one tool.

The second thing is to make people aware of Gemini and our plans in Europe to continue to grow the business. There are so many great businesses I want to know more about. If I get time throughout the day, I will certainly do. But I also want to make sure people see the Gemini team and that you get to speak to us face to face. We want to learn more, we love getting feedback, and we want to be able to adapt on that.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation21 hours ago

Regulation21 hours agoCash App’s Block Inc Settles for $40 Million Over AML Failures For Crypto Platform

-

Market24 hours ago

Market24 hours agoOnyxcoin Buyers Drive Strong Demand as XCN Surges Past $0.01

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Lists BABY As Bitcoin Protocol Babylon Goes Live

-

Bitcoin20 hours ago

Bitcoin20 hours agoFlorida Bitcoin Reserve Bill Passes House With Zero Votes Against

-

Market23 hours ago

Market23 hours agoXRP Price Eyes $2.0 Breakout—Can It Hold and Ignite a Bullish Surge?

-

Market22 hours ago

Market22 hours agoSolana Price Attempts Recovery, Nears $120, But Needs A Push

-

Altcoin22 hours ago

Altcoin22 hours agoEthereum’s Controversial Developer Freed Before Full Sentence

-

Market16 hours ago

Market16 hours agoEthereum Price Climbs, But Key Indicators Still Flash Bearish