Market

$20 Million Bribe Claims Are False: Uniswap CEO Hayden Adams

Uniswap Protocol CEO Hayden Adams challenged allegations that the decentralized cryptocurrency exchange takes bribes to allow deployments on its platform.

As an open-source protocol, Uniswap provides liquidity and trading for ERC20 tokens on the Ethereum blockchain.

Uniswap CEO Denies Taking Bribes

Adams dismissed the allegations, stating they were made to bait engagement. He clarified that neither Uniswap Labs nor the Uniswap Foundation charges protocols for deploying on its platform. He further explained that governance votes determine whether a protocol is deployed or not.

“I rarely engage with forks trying to bait engagement, but for the record, this is completely false. Neither Uniswap Labs nor Uniswap Foundation have ever charged for a protocol deployment,” Adams explained.

Uniswap Labs is responsible for developing both the Uniswap protocol and the Uniswap interface. For the interface, the ecosystem focuses on the activity and effort required for chain-specific deployment.

Adams’ comments were in response to accusations made by a user named Alexander on X (formerly Twitter), who claimed that Uniswap bribed some protocols with amounts as high as $20 million.

“If you, or someone you love, has been asked to pony up $20 million for an ineffective Uniswap deployment just know that you are not alone and we’re here to help,” Alexandar wrote.

Read More: How To Buy Uniswap (UNI) and Everything You Need To Know

Alexander’s remarks followed claims by Millicent Labs cofounder Kene Ezeji-Okoye, who alleged that Uniswap charges $10 million for protocol deployments and an additional $10 million for user incentives aimed at trading carbon credits.

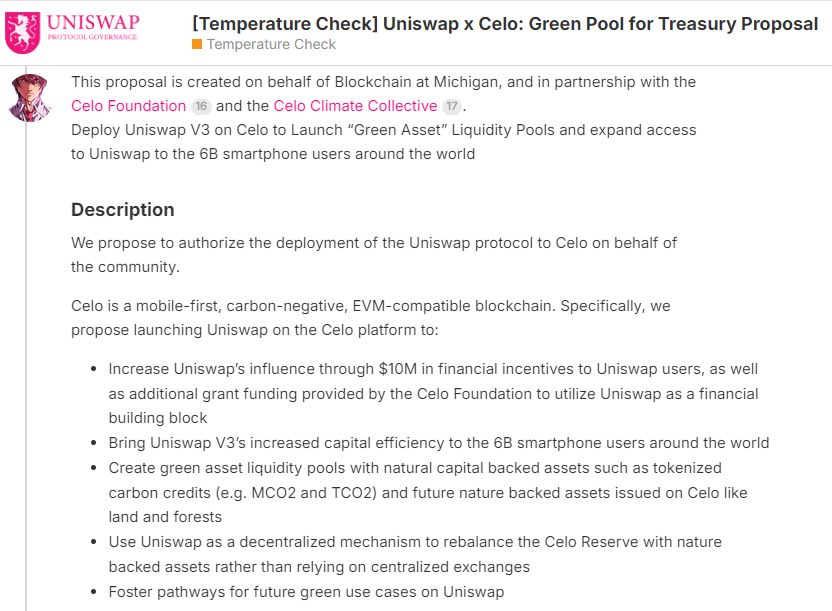

In 2022, the Celo Foundation, which oversees the Celo blockchain — a carbon-negative, mobile-first platform for Web3 and environmental impact — approached Uniswap to promote green use cases. As part of this initiative, the Celo Foundation sought to restructure its treasury using green asset-backed tokens.

A proposal submitted to Uniswap on behalf of the Celo Foundation and other parties outlined that Celo would commit $10 million in CELO tokens for Uniswap-specific user incentives and grants, along with an additional $10 million in financial incentives.

According to a snapshot of the governance proposal vote, users approved it with 12 million ‘ayes’ against only 603 ‘nays’. BeInCrypto reached out for comment, but neither Hayden Adams nor Alexander immediately responded.

Meanwhile, the decentralized exchange recently settled its case against the US Commodities Futures Commission (CFTC). Amid allegations of illegal retail commodity transactions using digital assets, the exchange paid $175,000 in fines, a slap on the wrist following Uniswap’s cooperation with the authorities.

Read more: Uniswap (UNI) Price Prediction 2023/2025/2030

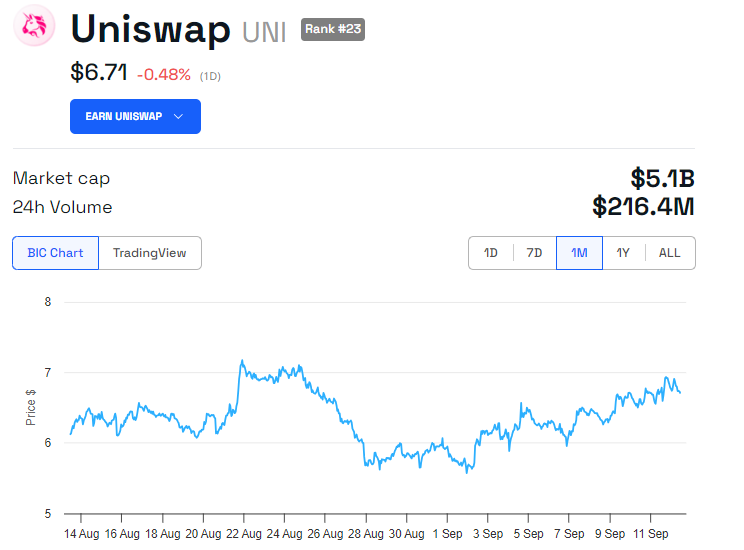

Amidst the latest controversy, the Uniswap token (UNI) is down by 0.48% since the Thursday session opened. As of this writing, it is trading for $6.71.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Price Rally Faces Risk as Bearish Momentum Builds

Solana has posted a 7% increase in the past 24 hours, aligning with the broader market’s recovery. While this surge may appear promising, technical and on-chain data suggest that the coin could face significant resistance.

Despite the recent rally, SOL risks shedding these gains and could fall below the $100 mark if bearish pressures dominate.

Solana’s Price Surge Lacks Momentum

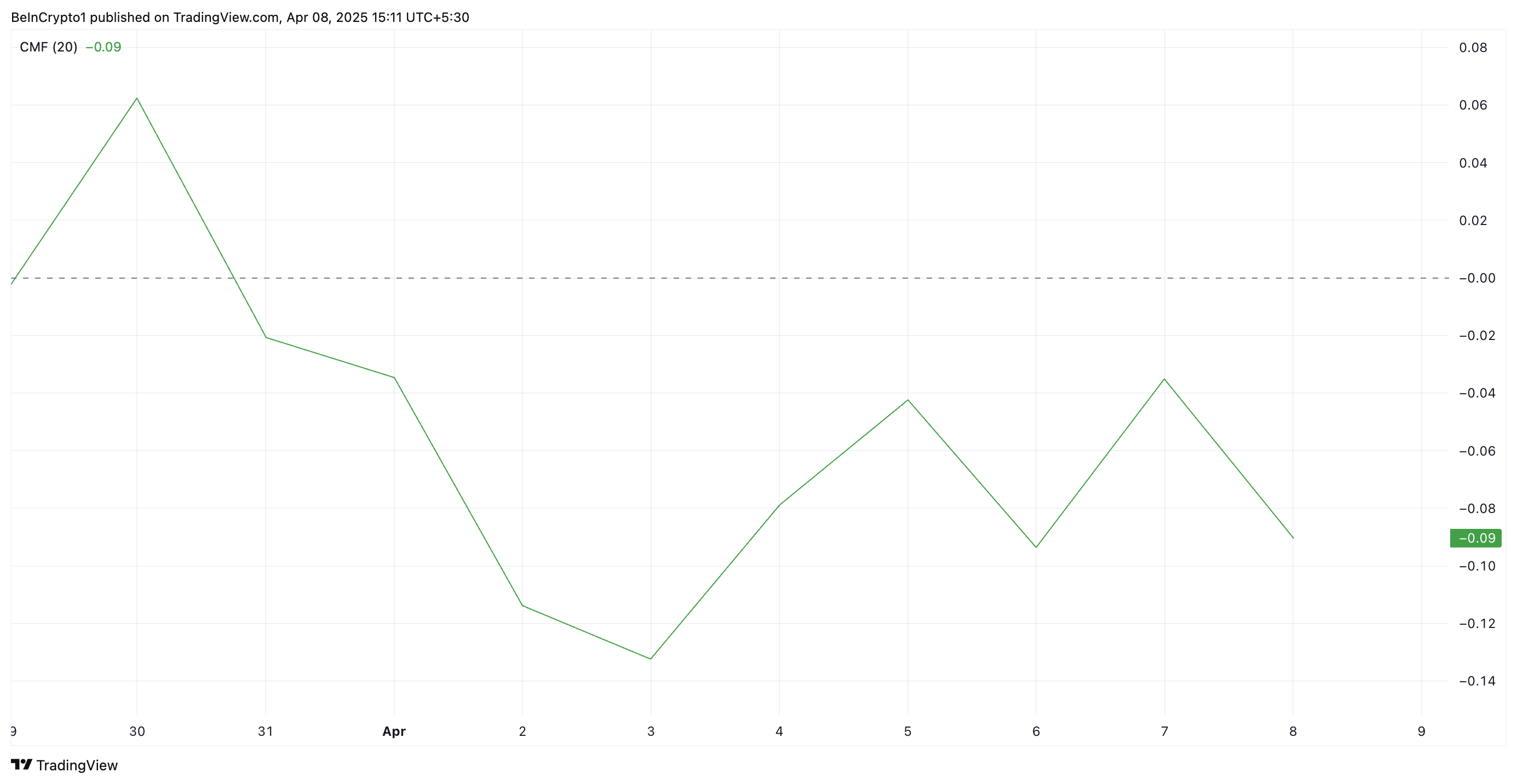

While impressive, SOL’s current rally largely reflects the broader market trend rather than demand for the altcoin. The bearish divergence formed by its Chaikin Money Flow (CMF) shows this.

At press time, SOL’s CMF is below the zero line at -0.09, indicating a lack of buying momentum among SOL market participants.

The CMF indicator measures money flow into and out of an asset. A bearish divergence emerges when the CMF is negative while the price is climbing. The divergence signals that despite the upward movement, there is more selling pressure than buying interest, suggesting weak bullish momentum.

This indicates that SOL’s current price rally may lack sustainability and could be at risk of reversing or stalling as new demand remains scarce.

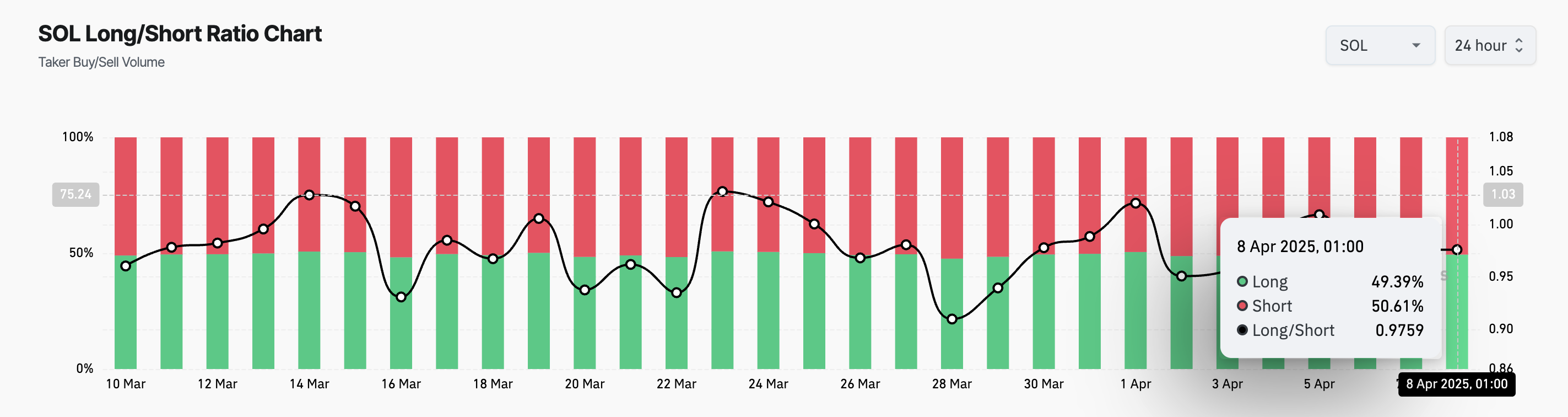

Further, the coin’s long/short ratio highlights that its market participants lean more heavily toward the short side. At press time, this stands at 0.97.

The long/short ratio measures the balance between long positions (betting on price increases) and short positions (betting on price decreases) in the market. When the ratio is below zero like this, it indicates that there are more short positions than long positions.

This suggests that bearish sentiment remains dominant in the SOL market, and its futures traders are anticipating a decline in the asset’s price.

Solana in Crucial Zone: Will $95 Hold or Lead to a Steeper Decline?

During Monday’s intraday trading session, SOL plummeted to a 12-month low of $95.26. Although it has since rebounded to trade at $108.77 at press time, the lingering bearish bias leaves the coin at risk of shedding these gains.

If SOL witnesses a pullback, it could break below the support at $107.88. If it falls back below $100, the coin’s price could fall toward $79.

On the other hand, if the uptrend continues, backed by a surge in new demand, SOL’s price could breach the resistance at $111.06 and climb toward $130.82.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Briefly Recovers 5% Due To US-China Tariff Deal Optimism

Crypto and TradFi markets had a strong opening today, as Bitcoin briefly jumped 5% due to optimism about a tariff deal. China and institutional investors in the US wish to avoid a trade war if possible.

Despite these encouraging signs, no deal has actually been reached, and Bitcoin also suffered subsequent losses. The whole market is in a state of flux until the situation becomes more clear.

How Will Bitcoin Perform Under Tariffs?

The crypto markets are full of fear right now, and it’s difficult to determine a safe bet moving forward. Since the market suffered huge liquidations yesterday, it opened with cautious optimism today.

This trend was particularly influenced by Bitcoin, which briefly jumped around 5% due to hopes about a potential deal on Trump’s tariffs.

The price of Bitcoin has fluctuated wildly due to the tariffs as speculation about a sell-off increases. However, the whole market is in a chaotic state right now.

Today, the Dow Jones Industrial Average surged 1,285 points, or 3.4%, while the S&P 500 and Nasdaq Composite both jumped 3.4% and 3.3%, respectively. Nonetheless, hundreds of stocks have fallen 20% or more.

Meanwhile, Bitcoin has a few advantages that can protect it from tariff volatility. For example, a recent report from Binance Research claims that the least risky cryptoassets are the most insulated from drops.

This includes RWAs and centralized exchanges, but Bitcoin is a close third.

Furthermore, the markets are very optimistic about a deal to avoid the tariffs. Yesterday, rumors of a pause triggered a trillion-dollar rally, highlighting traders’ desperation for good news.

Despite the retaliatory tariffs, China is similarly eager to avoid a full-blown trade war with the US. Trump claimed that he is making progress with China and South Korea, fueling optimism.

Nonetheless, it’s important not to overstate Bitcoin’s chances of success under tariffs. Despite the hopes on both sides of the Pacific, China confirmed that it’s prepared to fight a trade war if Trump forces its hand.

This might explain Bitcoin’s price drops despite its strong performance since yesterday. Ultimately, all we can do is wait and hope.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Announces $1.25B Acquisition Of Hidden Road To Set Major Milestone

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ripple Labs has announced a major acquisition to shock the market out of an otherwise dreadful week. Taking to X (formerly Twitter), the crypto firm announced that it has acquired Hidden Road, a brokerage, clearing, and financing firm as it moves forward in its mission to become the leader for institutional investors moving into the digital assets space.

Ripple Acquires Hidden Road For $1.25 Billion

The Tuesday announcement by Ripple has further solidified the mission that the crypto firm has long put forward, and that is to provide instant and quick transfer of value for traditional and institutional investors coming into the digital assets space.

Related Reading

As CEO Brad Garlinghouse explained in a separate X post, the decision to acquire Hidden Road for $1.25 billion comes after a long-standing customer relationship with the company. Garlinghouse revealed that Ripple understands the breadth of Hidden Road’s expertise, making it a prime candidate for the acquisition.

The integration of the XRP Ledger by Hidden Road will allow for cheap and fast movement of value to the brokerage’s customers, which moves over $3 trillion annually. A portion of this massive value is expected to move through the ledger, as well as using the RLUSD stablecoin as collateral for brokerage services.

Additionally, Hidden Road will be able to expand its capacity for value transfer, allowing Ripple to process even more volume. “With this deal and the backing of Ripple’s significant balance sheet, Hidden Road will exponentially expand its capacity to service its pipeline and become the largest non-bank prime broker globally,” Garlinghouse’s post read.

This acquisition comes after Ripple acquired Standard Custody back in February 2024. Standard Custody provided an online platform offering clients digital asset custody solutions, enabling Ripple to move into the custody market as well.

XRP Price Responds

Despite the Ripple announcement, the XRP price has remained muted as it continues to struggle below $2, which has since turned to resistance. At the time of writing, XRP is still holding at $1.96, despite its almost 10% in the last 24 hours.

Related Reading

According to data from Coinmarketcap, the XRP daily trading volume has seen a notable decline, dropping approximately 24% in the last day. This suggests a decline in participation from investors, due to the bearish headwinds that continue to blow through the crypto market.

A recovery from here is highly dependent on Bitcoin, which continues to dominate the market and lead the charge.

Chart from Tradingview.com

-

Market24 hours ago

Market24 hours agoMANTRA Launches $108 Million RWA Fund As OM Price Surges

-

Market23 hours ago

Market23 hours agoCrypto Whales Are Buying These Altcoins Post Market Crash

-

Market21 hours ago

Market21 hours agoXRP Targets Rebound After Hitting Oversold Territory

-

Market22 hours ago

Market22 hours agoCan the Fed Rescue Crypto Markets With Interest Rate Cuts?

-

Market20 hours ago

Market20 hours ago3 Altcoins to Watch in the Second Week of April 2025

-

Market19 hours ago

Market19 hours agoWEEX Lists AB (AB) under the RWA and Blockchain Infrastructure Category

-

Altcoin18 hours ago

Altcoin18 hours agoProgrammer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

-

Altcoin17 hours ago

Altcoin17 hours agoSolana’s Fartcoin Jumps 20% Despite Market Selloff