Ethereum

Traders Pulling From ETH Derivative Exchanges: What’s Next For Ethereum?

Ethereum remains under pressure at press time, looking at the formation in the daily chart. In summary, ETH is stable on the last day but down 9% in the last week of trading. Of note, there has been a drastic drop in trading volume over the past few days.

Overall, traders are upbeat, expecting prices to turn around and rip higher, clearing immediate local resistances. Even as this develops, on-chain data points to other developments that leverage traders should closely monitor.

Over 40,000 ETH Moved From Derivatives Exchanges

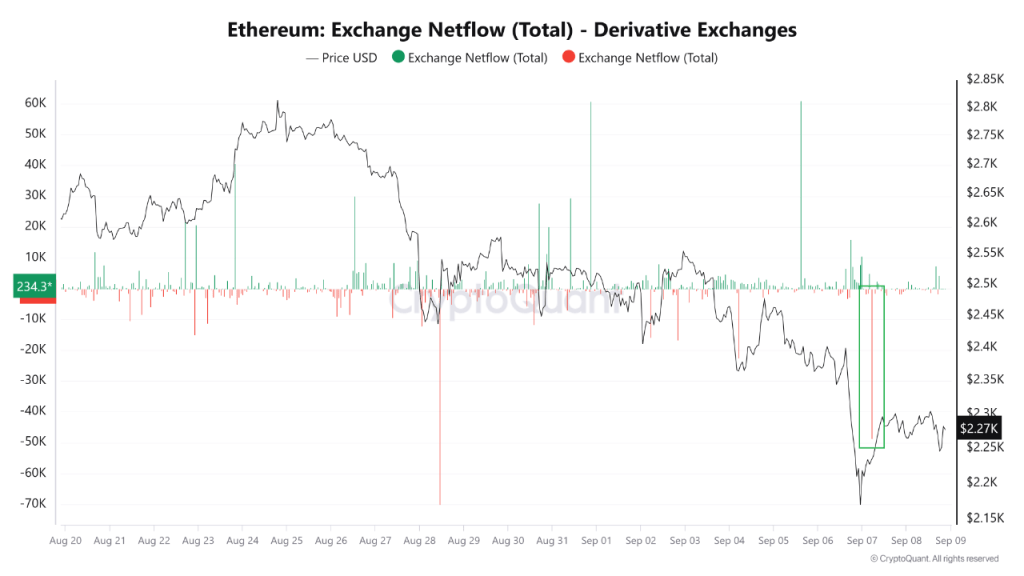

According to one analyst, citing CryptoQuant data, there have been more outflows from derivative exchanges over the past few trading weeks. Specifically, the analyst observes that over 40,000 ETH have been moved from derivatives trading platforms like Binance and OKX.

From a trading standpoint, whenever there is a spike in outflows from derivatives to spot exchanges, it could suggest that traders are cautious and waiting for clearer definitions before committing. However, this is also positive, especially considering that outflows from derivatives mean increasing inflows to spot exchanges.

When there is a spike in deposits to spot exchanges, especially from derivatives exchanges, not external non-custodial wallets, decreasing speculative pressure can support prices. As outflows increase from derivatives exchanges, it signals that fewer traders are willing to punt on crypto prices, placing leveraged short or long positions.

Reading from this development, how prices evolve in the next few trading sessions will be critical. Technically, a drop below $2,100 and August lows may spark a sell-off, forcing even more leveraged traders to shift to preservation mode and move coins to spot and, from there, possibly to stablecoins.

Conversely, a reversal above $2,800 could lift spirits and sentiment, forming a base for another leg up to $3,000 and $3,500. In turn, confidence will rise, forcing more traders to borrow ETH from exchanges as they place leveraged positions.

Ethereum Gas Fees And Institutional Demand Fading

Amid this development, Ethereum continues to face headwinds. For example, some analysts argue declining gas fees could negatively impact demand, questioning the network’s long-term sustainability.

As of September 9, Ethereum gas fees stood at 2.862 gwei, down from 14.21 gwei registered one year ago, according to YCharts.

Additionally, institutional demand for Ethereum via spot ETFs continues to decline. So far, net outflows from all spot Ethereum ETFs in the United States exceed $568 million, according to SosoValue.

Feature image from Canva, chart from TradingView

Ethereum

Ethereum Founder Buterin Funds Swiss Project With 274 ETH—What’s The Agenda?

Ethereum co-founder Vitalik Buterin has again made the news with a big donation to a Swiss project called Zuitzerland. Isla, a Web3 researcher developing the project, received the 274 ETH, equivalent to around $500,000, from Buterin, according to reports. The donation was identified by Onchain Lens, a blockchain monitoring site that tracks fund transfers.

This step is not surprising to anyone who has known about Buterin’s charitable activities and experimental associations. Zuitzerland is said to be a product of Buterin’s previous Zuzalu experiment, whose purpose was to unite like-minded people and engage into proposals on technology, longevity, and decentralized regimes.

Ethereum Donation: What Is Zuitzerland?

The Zuitzerland initiative is based on the ideas launched in the Zuzalu experiment, a short-term community project initiated by Buterin between March and May 2023, in Montenegro. Zuzalu assembled about 200 participants who worked and lived together for two months. They exchanged ideas and teamed up on projects together in workshops, discussions, and social gatherings.

Just in: Vitalik (@VitalikButerin) has sent 274.1 $ETH ($500k), as a grant or donation to a contract deployed by @0xisla, who is building @zuitzerland.

Vitalik’s Address: 0xd8da6bf26964af9d7eed9e03e53415d37aa96045

Contract Address: 0x69649512c97c630c4f06a21e09e71f0362ca74ec… pic.twitter.com/NusZDSp7tn

— Onchain Lens (@OnchainLens) April 1, 2025

Zuitzerland pushes this concept further by hosting residencies, hackathons, and citywide events for those with common interests. The platform emphasizes the development of collaboration between “thinkers and builders.” Although Buterin is not among the founders of the project, he is mentioned as a speaker and curator on its official site, indicating his support and engagement.

Funding Through Token Sales

Buterin’s contribution was partly financed by selling tokens he had earlier received as gifts from other crypto projects. According to on-chain statistics, Buterin sold 5,000 Dohrnii (DHN) tokens for $93,882 and 2 trillion LEDOG (DOG) tokens for $16,569 on March 31, 2025. The proceeds from these sales were aggregated and then sent as 274 ETH to Isla.

ETHUSD trading at $1,873 on the daily chart: TradingView.com

This is not the first time that Buterin has sold tokens gifted to him for a cause. In 2022, he sold some Shiba Inu (SHIB) tokens gifted to him in order to donate to an Indian COVID-19 relief fund. Buterin has also publicly urged token issuers to give directly to charities instead of donating tokens to him.

A History Of Token Donations

Dohrnii Labs, the developers of the DHN token, had sent 10,000 tokens to Buterin in January 2025. Likewise, LEDOG’s developers sent 10 trillion DOG tokens to him in August 2024. Although these tokens are usually given as a token of appreciation, they are also a marketing strategy for visibility. Buterin has been selling these tokens gradually over time, using the funds for donations and other things.

As of now, Buterin still retains 2 trillion DOG tokens, as per data on the blockchain. Nevertheless, his actions reveal a distinct orientation towards leveraging such assets to help initiatives such as Zuitzerland, which align with his belief in decentralized governance and innovation led by community.

Featured image from Gemini Imagen, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

$2,300 Emerges As The Most Crucial Resistance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Ethereum (ETH) continues to experience a significant price downturn, recording a 17% drop over the past month, key resistance levels have emerged as critical points for the second-largest cryptocurrency. Analysts suggest that these levels could ignite a potential trend reversal if reclaimed.

Ethereum Faces Potential Decline To $1,155

In a recent update shared on social media platform X (formerly Twitter), crypto analyst Ali Martinez highlighted two pivotal price points for Ethereum’s immediate future.

The first, set at $2,100, is seen as a necessary threshold for initiating a new upward trend. However, the $2,300 mark is regarded as a “more decisive” level that Ethereum must breach to confirm a bullish reversal.

Related Reading

Martinez’s analysis, based on the one-day chart seen below, indicates that if Ethereum fails to reclaim these levels, it may lead to a further decline.

The next target points to watch would be $1,600 and $1,155, levels that could indicate a new downtrend. Such a decline would represent additional losses of 12% and over 37%, respectively, marking a troubling continuation of Ethereum’s worst first quarter in its history.

In another post, the analyst also pointed out that the Ethereum price is facing a significant resistance wall between $2,200 and $2,580. On-chain data from the analytics firm IntoTheBlock reveals that approximately 12.43 million investors have bought about 66.18 million ETH within this price range.

A breakout above these levels could potentially generate bullish momentum for the cryptocurrency. However, bullish catalysts that could trigger a move above these levels remain scarce among experts.

ETH’s Largest Accumulation Zone Under Threat

Market intelligence firm Glassnode has indicated that ETH’s Cost Basis Distribution shows limited support near current prices. Weekly data suggests that addresses with a cost basis around $1,800 have not re-engaged. Many investors are reportedly selling at a loss, further adding to the current price uncertainty.

On March 28, several clusters of approximately 250,000 ETH with cost bases between $2,000 and $2,050 effectively vanished, indicating that some higher-cost holders are attempting to average down their positions.

However, Glassnode asserts that the overall Ethereum accumulation zone appears limited at current price levels, raising questions about future stabilization for the second largest cryptocurrency.

Related Reading

The largest accumulation zone below the current market price now sits at $1,537, where nearly 994,000 ETH was acquired. If the downtrend continues, this level is expected to serve as structural support in the near term, potentially providing a buffer against further declines.

ETH is currently trading at $1,830, down 12% for the week.

Featured image from DALL-E, chart from TradingView.com

Ethereum

Ethereum May Have To Undo This Death Cross For Bull’s Return

A quant has revealed how Ethereum (ETH) saw a death cross in this indicator shortly before bearish momentum took the asset in full force.

Ethereum Formed A Death Cross In Funding Rates Earlier

In a CryptoQuant Quicktake post, an analyst has shared a chart for the Funding Rates of Ethereum. The “Funding Rates” refers to a metric that keeps track of the amount of periodic fee that traders on the derivatives market are exchanging between each other right now.

When the value of this indicator is positive, it means the long contract holders are paying a premium to the short investors in order to hold onto their positions. Such a trend suggests a bullish sentiment is shared by the majority of the derivatives traders.

On the other hand, the metric being under the zero mark implies a bearish mentality is dominant in the sector, as short holders are overwhelming the long ones.

Now, here is the chart for the Ethereum Funding Rates posted by the quant, which shows the trend in the 50-day and 200-day simple moving averages (SMAs) of the indicator over the last couple of years:

Looks like these two lines saw a crossover earlier in the year | Source: CryptoQuant

As displayed in the above graph, the 50-day SMA of the Ethereum Funding Rates crossed under the 200-day SMA in January of this year. This suggests that the optimism in the market witnessed a shift.

From the graph, it’s visible that since the crossover in the two SMAs of the indicator has emerged, the ETH price has been sharply moving down. The trend isn’t unique to the asset, as the wider cryptocurrency sector has also seen a similar pattern, with investors becoming risk-averse.

In the first half of last year, the Funding Rates observed the same type of crossover, and then, the Ethereum price followed up with a period of bearish action.

It wasn’t until the reverse crossover happened, with the 50-day SMA finding a break above the 200-day SMA, that bullish momentum returned in the cryptocurrency market. The same pattern was also seen back in 2023.

It’s possible that for constructive price action to return for Ethereum and other assets, a bullish crossover in the Funding Rates may once again have to take place. “When the speculators return and start using their greedy leverage, the crypto bull market will begin,” notes the analyst.

When this would happen, however, is anyone’s guess, as the 50-day and 200-day SMAs of the indicator are currently quite far apart. In 2024, the lines took many months before they crossed back, so it’s possible that it will take some time for the crossover to occur now as well.

ETH Price

Ethereum is moving to end the month of March on a red note as its price has fallen to the $1,800 level, after seeing a decline of almost 14% in the past week.

The trend in the ETH price over the last five days | Source: ETHUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market23 hours ago

Market23 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin21 hours ago

Bitcoin21 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Altcoin19 hours ago

Altcoin19 hours agoWill XRP, SOL, ADA Make the List?

-

Bitcoin22 hours ago

Bitcoin22 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market20 hours ago

Market20 hours agoCoinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

-

Market19 hours ago

Market19 hours agoEthereum Reclaims Top DeFi Spot As Solana DEX Volume Drops

-

Market13 hours ago

Market13 hours agoHow Did UPCX Lose $70 Million in a UPC Hack?

-

Market18 hours ago

Market18 hours agoTrump’s USD1 Stablecoin Eyes Trust Recovery in Crypto