Ethereum

Lower Ethereum Fees And Key Factor Could Revive DeFi Summer, Steno Research Says

A report by Steno Research states that the decentralized finance (DeFi) summer on Ethereum and the crypto market could return as early as 2025. Four years after the fondly remembered DeFi summer of 2020, the total value locked (TVL) in protocols can hit an all-time high by early next year.

However, the return of DeFi summer rests on two key factors.

Lower Ethereum Fees Crucial To Attract Investors

Ethereum (ETH) has historically led the DeFi wave, boasting the highest TVL locked into its protocols among all other smart-contract blockchains. According to DeFiLlama, the TVL locked in Ethereum-based protocols currently stands at approximately $50.11 billion.

Ethereum is followed by Tron (TRX) and Solana (SOL), with a TVL of $8.27 billion and $4.99 billion, respectively. The enormous difference between TVL locked in Ethereum and all its competitors gives a fair idea about the significance of the Ethereum blockchain in the nascent space.

Unsurprisingly, it’s evident that for any meaningful DeFi wave to rise, Ethereum-based protocols must be accessible to all industry enthusiasts, big and small alike. Steno Research posits that lower Ethereum network fees are important to make its ecosystem more accessible.

Interest Rate Cuts Could Pave The Way For DeFi Summer

The report by Steno Research posits that the change in U.S. interest rates will play a crucial role in determining DeFi’s comeback. Since the emerging market is largely denominated in USD, a series of rate cuts could increase investor’s risk appetite, leading them to invest in more risk-on assets, including digital assets.

Mads Eberhardt, senior cryptocurrency analyst at Steno Research, noted:

Interest rates are the most critical factor influencing the appeal of DeFi, as they determine whether investors are more inclined to seek out higher-risk opportunities in decentralized financial markets.

The report adds that the DeFi summer of 2020 was also buoyed by the Federal Reserve’s interest-rate cuts in response to the COVID pandemic. As a result, the subspace witnessed an all-time high TVL locked into its protocols in 2021, peaking at over $175 billion.

An example of the high-risk-seeking behavior of investors in 2020 is the popularity of passive investment strategies like yield farming.

For the uninitiated, yield farming allows investors to “farm” yield on their tokens by providing liquidity to liquidity pools of decentralized exchanges (DEX), lending platforms, or other applications.

However, Vitalik Buterin has expressed concerns about the sustainability of such short-term, high-risk reward strategies. 2024 is a lot different.

While no global pandemic is at work, interest rates have remained high to tackle high inflation, discourage consumer spending, and influence currency value. However, with cracks starting to appear in the US jobs market, the Federal Reserve is expected to initiate a series of interest-rate cuts from September onwards.

Another factor that could trigger the return of DeFi summer is the expanding stablecoin supply. Recent on-chain data indicates that stablecoin growth has flipped into positive territory, making a bullish case for the crypto industry.

Further, demand for real-world assets (RWAs) in the broader ecosystem has grown substantially in the broader ecosystem, indicating a healthy appetite for on-chain financial products. Examples of such RWAs include tokenized stocks, bonds, and commodities.

While the prospect of another DeFi summer sounds appealing, investors should be wary of the risks associated with the safety of their digital assets.

Featured image from Unsplash, Chart from TradingView.com

Ethereum

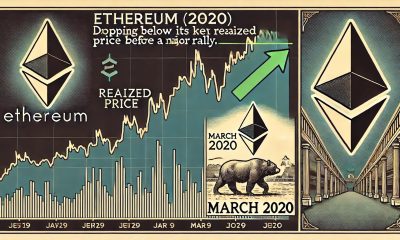

Ethereum Drops Below Key Realized Price: Last Time Was March 2020 Before A Rally

Ethereum has suffered yet another blow this week, sliding to a fresh low of around $1,380 — a level not seen since March 2023. The ongoing downtrend has left investors increasingly concerned, with many now questioning whether ETH’s long-term bullish structure is still intact. Market conditions remain harsh, driven by persistent macroeconomic tensions, rising global instability, and uncertainty stemming from U.S. trade and fiscal policies.

Sentiment across the crypto space continues to deteriorate, and Ethereum’s price action reflects that unease. After months of struggling to hold key support levels, the breakdown below $1,500 has added to fears that a deeper correction may be unfolding.

However, amidst the gloom, there may be a silver lining. According to CryptoRank data, Ethereum is now trading below its realized price — a rare occurrence historically associated with market bottoms and strong recovery phases.

While the near-term outlook remains uncertain, such rare on-chain signals could indicate that Ethereum is entering a key accumulation zone. The coming days and weeks will be critical in determining whether this is just another leg down — or the beginning of a long-term reversal.

Ethereum Sinks Below Realized Price As Fear Takes Over The Market

Ethereum has now lost over 33% of its value since late March, triggering deep concern among investors and analysts alike. The price plunge has brought ETH down to levels not seen in over two years, sparking panic and despair among holders who once expected 2025 to be a breakout year for altcoins. Instead, Ethereum has become a symbol of market fragility as the broader macroeconomic landscape continues to worsen.

Trade war fears, inflationary pressure, and a potential global recession are shaking financial markets to their core. In this climate, high-risk assets like Ethereum are among the first to suffer. As capital exits speculative assets in favor of safer havens, ETH’s selloff has only accelerated — and investor confidence has taken a serious hit.

However, there may be a glimmer of hope in the data. Top crypto analyst Carl Runefelt recently pointed out on X that Ethereum is now trading below its realized price of $2,000 — a rare occurrence that has historically signaled major turning points in ETH’s price trajectory.

Runefelt emphasized that the last time ETH dipped below its realized price was in March 2020, when it crashed from $283 to $109 — only to recover strongly in the following months. While the current environment is full of uncertainty, such on-chain metrics hint at the possibility that ETH is entering an accumulation phase once again.

Still, confidence remains fragile, and price action must stabilize before any real bullish narrative can return. Ethereum’s next moves will be critical in determining whether this level marks a true bottom — or just another stop on the way down.

ETH Struggles Below $1,500 With No Clear Support in Sight

Ethereum is currently trading below the $1,500 level after suffering a brutal 50% decline since late February. The aggressive selloff has erased months of gains and left investors in a state of uncertainty, as ETH shows no signs of recovery. Market sentiment remains overwhelmingly bearish, and there is little indication that a bottom has been reached.

At this stage, Ethereum lacks a clearly defined support zone. Bulls have lost control, and price action continues to drift lower with weak demand and increasing fear. For a meaningful reversal to begin, ETH must first reclaim the $1,850 level — a zone that previously served as a key support and now stands as major resistance.

Until that happens, any upside attempt is likely to be met with strong selling pressure. The situation becomes even more precarious if Ethereum loses the $1,380 level, which has so far acted as a psychological threshold. Falling below this area could open the door to a deeper correction toward the $1,100–$1,200 range.

With macroeconomic tensions still high and volatility expected to persist, traders and investors will be watching closely to see whether Ethereum can stabilize — or continue its sharp decline.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Traders Pulling Back? ETH’s Open Interest On Binance Sees Continued Decline

After a slight rebound on Tuesday to the $1,600 threshold, Ethereum‘s price was faced with notable resistance, which led to a sudden breakdown to $1,450. ETH’s persistent weak performance this year has impacted investor conviction in the market, triggering significant selling pressure in the past few weeks.

Bearish Sentiment Toward Ethereum Grows On Binance

The bearish sentiment toward Ethereum has increased in crypto exchanges, especially on Binance, the world’s largest cryptocurrency exchange. Verified author and on-chain expert for CryptoQuant, Darkfost, revealed that ETH’s Open Interest (OI) on Binance continues to see a steady decline.

The persistent drop in open interest on the crypto exchange indicates that ETH‘s derivatives market is cooling down. It also reflects rising caution among investors and traders as the altcoin battles to sustain its bullish momentum.

Darkfost highlighted that the open interest on Binance continues to drop without stopping and is now changing under its 365 Simple Moving Average (SMA). This movement implies that speculative activity is pulling back as investors might be waiting for more certain signals before making a forceful comeback to the market.

After hitting an all-time high of $7.78 billion in December, the open interest on Binance has decreased by almost 50% between December and April, wiping out nearly $4 billion within the period. The chart shows that ETH’s open interest on Binance is now valued at $3.1 billion, suggesting a massive shift in investor sentiment on the platform.

According to the on-chain expert, Ethereum’s price has been significantly impacted by this sharp drop, and there are no indications that the ongoing downward trend will be stopping anytime soon. Furthermore, it reflects the magnitude of recent liquidations as well as a heightened aversion to risk among investors.

In the event that the trend continues, Darkfost noted that “Ethereum’s price is still far from entering a period of stability.” Thus, Darkfost has urged traders to monitor investors’ behavior on Binance, which remains a valuable indicator since the largest trade volumes across the market are regularly captured by the crypto platform.

ETH Is Poised For A Massive Upswing To New All-Time Highs

With ETH’s open interest decreasing on the largest crypto exchange and the market extremely volatile, this raises concerns about its price stability. Nonetheless, many crypto analysts are confident that a rebound could be on the horizon, which is likely to push the altcoin toward new highs.

Market expert and trader Milkybull Crypto shared a post on the X platform, outlining Ethereum’s potential to surge significantly in the upcoming weeks. At the time of the post, ETH was trading at $1,585, and the expert stated that the altcoin typically marks a macro bottom at this level. Should this level hold, Milkybull anticipates a huge rally, putting his next target at the $10,000 milestone.

Featured image from Unsplash, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Major Ethereum Whale Dumps 10,000 ETH After 2 Years, Is It Time To Get Out?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

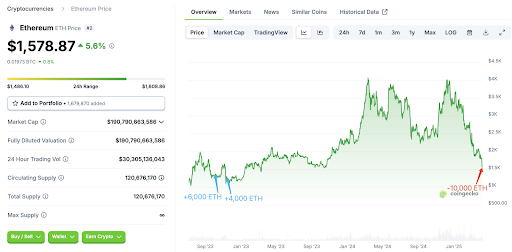

An Ethereum whale has dumped its ETH holdings after holding them for over two years, even through a bull market. This capitulation from the ETH whale suggests it might be a good time to offload the leading altcoin, with a further crash in the coming weeks a possibility.

Ethereum Whale Dumps 10,000 ETH After 900 Days

In an X post, on-chain analytics platform Lookonchain revealed that an Ethereum whale finally capitulated after holding for over 900 days, selling all their 10,000 ETH for $15.71 million. This whale had originally bought 10,000 ETH for $12.95 million at an average price of $1,295 on October 4 and November 14, 2022.

Related Reading

The Ethereum whale didn’t sell any of their ETH holdings, even when the leading altcoin broke through $4,000 twice in 2024. However, the whale has now capitulated with the Ethereum price below $1,500, nearing their average entry price of $1,295. The investor sold the coins for a $2.75 million profit, while their unrealized profit was $27.6 million at its peak.

This Ethereum whale isn’t the only one who is capitulating. As Bitcoinist reported, ETH whales have dumped over 500,000 coins in the space of 48 hours. This development is thanks to Ethereum’s massive crash, with the leading altcoin at risk of dropping lower. This decline is part of a broader crypto market crash, which has occurred due to Donald Trump’s tariffs.

Trump’s tariffs have led to a major trade war with China, which has promised not to back down, further sparking concerns among investors. As such, the Ethereum price looks more likely to suffer a further crash in the meantime, which explains why these Ethereum whales are capitulating to cut their losses.

Donald Trump’s World Liberty Financial Also Capitulating?

Donald Trump’s World Liberty Financial (WLFI), an Ethereum whale, looks to be feeling the heat and might have already started capitulating. Citing Arkham Intelligence’s data, Lookonchain revealed that a wallet possibly linked to WLFI sold 5,471 ETH for $8.01 million at the price of $1,465, representing a loss for the whale in question.

Related Reading

World Liberty Financial had previously bought 67,498 ETH for $210 million at an average price of $3,259. The crypto firm is now sitting on an unrealized loss of $125 million, seeing as the Ethereum price has declined by over 50% since their purchases.

Crypto analyst Ali Martinez predicts that the Ethereum price will crash further in the short term, indicating that Ethereum whales like WLFI could witness more unrealized loss on their ETH holdings. Martinez stated that $1,200 could be where the leading altcoin finds its footing.

At the time of writing, the Ethereum price is trading at around $1,400, down over 8% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

-

Altcoin17 hours ago

Altcoin17 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Altcoin16 hours ago

Altcoin16 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Bitcoin13 hours ago

Bitcoin13 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market13 hours ago

Market13 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Market17 hours ago

Market17 hours agoFARTCOIN Jumps 160% in 30 Days but Momentum Fades

-

Ethereum24 hours ago

Ethereum24 hours agoUncertainty Rocks Market As ETH/BTC Drops To 6-Year Low, Where Is Bitcoin Headed Next?

-

Market16 hours ago

Market16 hours agoWeb3 Projects Adjust to Market Chaos

-

Bitcoin23 hours ago

Bitcoin23 hours agoWill the Corporate Bitcoin Accumulation Trend Continue in 2025?