Ethereum

Last Chance To Buy Ethereum? Analyst Expects $6,000 Once It Breaks 8-Month Accumulation

Ethereum (ETH) is gearing up for an explosive bullish phase after decisively breaking above the crucial $3,000 mark. This milestone has fueled optimism among traders and investors, signaling a potential surge to new all-time highs. ETH’s recent price action demonstrates strong momentum, suggesting that the second-largest cryptocurrency by market cap is ready to reclaim its place in the spotlight.

Renowned analyst and investor Carl Runefelt has bolstered this bullish outlook with a compelling technical analysis. Sharing his insights, Runefelt pointed out Ethereum’s impressive recovery and growing strength. He emphasized that if current momentum continues, the $6,000 milestone could be within reach sooner than many expect.

Related Reading

According to Runefelt, Ethereum’s upward trajectory is supported by increasing network activity, heightened institutional interest, and broader adoption of its smart contract capabilities.

The crypto market’s recent surge, led by Bitcoin’s new all-time highs, has created an environment ripe for Ethereum to follow suit. As traders focus on ETH’s potential to outperform other altcoins, all eyes are on whether it can sustain its breakout and push higher. The coming weeks will be crucial as Ethereum solidifies its position above $3,000, potentially paving the way for a rally that could redefine expectations for this cycle.

Ethereum Testing Supply

Ethereum is on the brink of a significant breakout as it approaches the last major supply levels before potentially embarking on a Bitcoin-like rally. After reclaiming its local highs with strong momentum, Ethereum has captured the attention of traders and investors looking for the next big move in the crypto market. Many believe the current consolidation phase is just the calm before a bullish storm.

Runefelt recently shared a detailed technical analysis on X, highlighting Ethereum’s readiness for a massive bull run. Runefelt emphasized that ETH is mirroring Bitcoin’s recent explosive breakout, suggesting that Ethereum could be next to surge.

According to his analysis, this may be the last opportunity to buy ETH at relatively low prices before the market takes off. Runefelt set an ambitious price target of $6,000, forecasting this level as attainable once Ethereum breaks through its final supply zones.

Related Reading

Ethereum’s potential rally is supported by a combination of technical strength and increasing demand for its smart contract platform. With Bitcoin setting new all-time highs, the market’s focus is gradually shifting toward altcoins, particularly Ethereum. If ETH breaks above its current resistance, it could ignite a wave of buying pressure that sends prices soaring to unprecedented levels.

ETH Testing Technical Levels

Ethereum is currently trading at $3,110, following a 12% retrace from its recent local highs. Despite the pullback, ETH continues to show resilience, holding firmly above the 200-day moving average (MA) at $2,955. This key demand level is a strong indicator of long-term market strength and suggests that Ethereum remains in bullish territory despite short-term volatility.

The 200-day MA serves as a critical support zone, and its defense could pave the way for a significant rally in the coming days. If ETH maintains its position above this level for an extended period, it would signal renewed bullish momentum and set the stage for a breakout to higher supply zones.

Related Reading

The next major resistance level for Ethereum is at $3,450. A successful breach and consolidation above this price point would confirm a breakout, positioning ETH to challenge its all-time high (ATH). Such a move could reignite bullish sentiment and attract new buying pressure from investors anticipating further gains.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Whale Activity Fades Since Late February – Details

Ethereum is trading below the $1,900 level after weeks of persistent selling pressure, and signs suggest that the downside momentum could continue. Bulls lost control back in late February when ETH failed to hold the $2,500 mark — a key level that many viewed as critical for sustaining a bullish outlook. Since then, Ethereum has continued to underperform, disappointing investors who had anticipated a strong 2025 rally fueled by growing institutional interest and market optimism.

Instead, macroeconomic uncertainty, global tensions, and weakening market sentiment have weighed heavily on high-risk assets like Ethereum. Price action has remained underwhelming, with failed attempts to reclaim key resistance levels adding to bearish sentiment.

Adding to these concerns, crypto analyst Ali Martinez shared insights showing a significant decline in on-chain activity. Since late February, the number of large Ethereum transactions — typically involving whales and institutional players — has dropped significantly. This decline suggests that major market participants may be stepping back, reducing their exposure as uncertainty lingers.

Ethereum Under Pressure As Macroeconomic Fears Grow

Ethereum continues to struggle under mounting pressure as macroeconomic uncertainty and global instability ripple through financial markets. Among the most affected are high-risk, volatile assets like Ethereum, which have seen significant outflows in recent weeks. The broader market sentiment remains fragile, largely driven by US President Donald Trump’s unpredictable policy decisions and tariff threats. His administration’s economic stance has injected fresh uncertainty into global markets, pushing investors toward safer assets and away from speculative plays like ETH.

Bulls are finding it increasingly difficult to defend key support levels. After failing to hold above $2,500 in late February, Ethereum has slipped steadily lower, now trading below $1,900 — a level that once served as a critical psychological threshold. With little sign of renewed buying pressure, the risk of a continued selloff looms large.

Ali Martinez shared alarming on-chain data showing that since February 25, the number of large Ethereum transactions has dropped by 63.8%. This decline in whale activity signals that major holders may be exiting or sitting on the sidelines, reducing overall market confidence and liquidity.

As long as macroeconomic pressures persist and whales remain inactive, Ethereum is likely to remain vulnerable. Bulls must step in to stabilize price action, or risk watching ETH fall further into lower support zones. For now, the outlook remains cautious, with continued weakness likely unless sentiment shifts or broader economic clarity emerges.

ETH Trades Below $1,900 As Bulls Defend Key Support

Ethereum is currently trading around $1,880, attempting to hold above a critical support zone near $1,750 — widely seen as the last line of defense for bulls. After weeks of sustained selling pressure, ETH remains in a vulnerable position, struggling to recover lost ground. The price is now well below the weekly 200-day moving average (MA) and exponential moving average (EMA), both sitting near the $2,500 level, which highlights the broader weakness in Ethereum’s market structure.

As long as ETH remains below these long-term trend indicators, the overall outlook stays bearish. Bulls must step in with conviction to prevent a deeper breakdown and shift momentum back in their favor. The most immediate priority is maintaining support above $1,800, which serves as a psychological and technical level of strength.

To confirm a recovery, Ethereum must also push back above the $2,000 mark in the near term. A break above this level would help restore investor confidence and could open the door for a move toward reclaiming the 200-week averages. Until then, Ethereum remains in a precarious position, and failure to defend current levels could trigger a deeper correction in the sessions ahead.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Is Ethereum Price Nearing A Bottom? This Bullish Divergence Suggests So

The cryptocurrency market was fairly stable despite the global macroeconomic headwind that rocked the traditional markets during the past week. The Ethereum price didn’t enjoy the same relief as other large-cap assets, beginning the month of April almost as it ended the first quarter of 2025.

The second-largest cryptocurrency is on the verge of losing the $1,800 level, having declined in value by almost 5% in the past week. However, the latest on-chain data suggests that the Ethereum price might be close to a bottom and might be readying for a rebound in the coming weeks.

Rising Metric Says Ethereum Price Might Be Ready For A Comeback

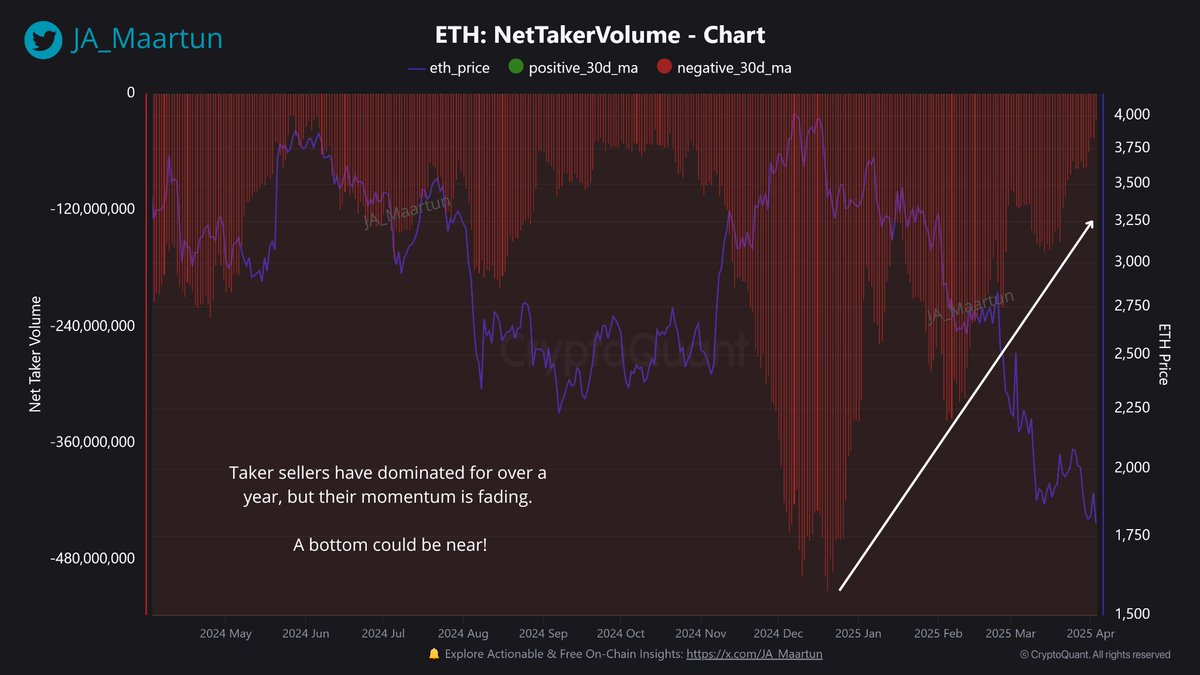

In a recent post on the X platform, on-chain analyst Maartunn shared a fresh insight into the activity of Ethereum investors on centralized exchanges. According to the crypto pundit, this latest on-chain shift suggests that a new bottom could be brewing for the Ethereum price.

The relevant indicator here is the Net Taker Volume metric, which tracks the difference between taker buy volume and taker sell volume in a particular asset market (Ethereum, in this case). This on-chain indicator can be used to gauge the strength of the selling or buying pressure in the market.

When the Net Taker Volume is positive, it indicates that aggressive buying activity (taker buys) is overwhelming selling activity (taker sells), suggesting a growing bullish sentiment. A negative metric implies that the taker sell volume is higher than the taker buy volume, which is typically a bearish signal.

Maartunn noted in his post that aggressive selling activity has been outweighing the buying activity in the Ethereum market for over a year. However, the on-chain analyst highlighted that the taker sell volume appears to be waning and losing some steam in the past few weeks.

Source: @JA_Maartun on X

As shown in the chart above, the Net Taker Volume is forming higher lows, even as the Ethereum price is making new lower lows. This classic bullish divergence suggests that the altcoin could be preparing to bottom out and experience a bullish reversal.

As of this writing, the ETH token is valued at around $1,806, reflecting a roughly 1% price jump in the past 24 hours.

ETH Whales Trimming Their Holdings

Interestingly, a conflicting piece of on-chain data has also emerged, showing that an important class of investors known as whales has been offloading their assets. This investor cohort is influential on the market dynamics due to their significant holdings and, as such, is typically monitored by other investors.

Source: @ali_charts on X

In a April 4 post on X, crypto analyst Ali Martinez revealed that whales (holding between 10,000 and 100,000 coins) have sold over 500,000 ETH tokens in the past 48 hours. Considering the size of this sell-off and the influence of the investors, this activity could be a bearish roadblock for a possible Ethereum price recovery.

The price of ETH on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Whales Dump 500,000 ETH In 48 Hours: On-Chain Data

Ethereum is trading below the $1,900 level as selling pressure continues to mount, raising concerns that the recent downtrend could extend further. After losing the critical $2,500 support in late February, bulls have struggled to regain control. What began as a minor pullback has turned into a broader correction, disappointing investors who had anticipated a bullish 2025 for ETH.

The failure to reclaim key levels has eroded market confidence, and price action remains weak across both short and mid-term timeframes. Ethereum’s inability to sustain even brief recoveries has only reinforced the bearish sentiment that has gripped the crypto space in recent weeks.

Adding to the negative outlook, new data from Santiment reveals that whales have sold approximately 500,000 ETH over the past 48 hours. This massive distribution by large holders highlights a clear lack of confidence among some of the most influential players in the market — a trend that could weigh heavily on Ethereum’s near-term performance.

As ETH hovers below $1,900, all eyes are on whether bulls can defend remaining support levels, or if continued selling from whales and broader market uncertainty will drive the price further down in the days ahead.

Ethereum Whale Selling Fuels Bearish Outlook

Ethereum is down 55% from its December high, with price action continuing to reflect the broader market’s weakness. The selloff has been sharp and consistent, fueled by growing macroeconomic uncertainty and global instability. The latest wave of volatility was triggered by US President Donald Trump’s renewed tariff threats and unpredictable policy direction, which have spooked financial markets and driven capital away from high-risk assets.

As a result, Ethereum — a key altcoin with deep ties to speculative sentiment — has become one of the hardest-hit major cryptocurrencies. Bulls are struggling to hold support near the $1,800 level, and every attempt to rally has been met with renewed selling pressure. Without a clear shift in trend, ETH remains vulnerable to further downside in the near term.

Adding to the bearish sentiment, top analyst Ali Martinez shared data showing that whales sold 500,000 ETH over the last 48 hours. This massive distribution from large wallets suggests that even experienced market participants are growing increasingly cautious. Such activity tends to precede deeper corrections, particularly when accompanied by weak technicals and broader risk-off sentiment.

Unless Ethereum can reclaim key resistance levels and show signs of accumulation, the current trend may continue to favor sellers. As markets digest macro developments, ETH holders are watching closely for any indication that the worst is over — but for now, the pressure remains firmly to the downside.

Ethereum Trades At $1,810 As Bulls Defend Crucial Support

Ethereum is trading at $1,810 after repeated failed attempts to reclaim the $1,900 level. The price continues to face strong resistance, and bullish momentum has significantly weakened in recent weeks. Bulls are now in a critical position, with $1,800 emerging as the most important support level in the current cycle. A decisive breakdown below this mark could trigger a deeper correction, potentially sending ETH as low as $1,550 — a zone not seen since mid-2023.

The broader crypto market remains under pressure, and Ethereum’s price action reflects that. Sentiment has been weighed down by macroeconomic headwinds and aggressive selling from whales, adding to the difficulty for bulls to regain control. Still, hope remains if ETH can stabilize and push higher in the coming sessions.

A breakout above the $2,000 level would mark a significant shift in momentum and could spark a strong recovery rally. That level remains the psychological and technical threshold for a potential trend reversal. Until then, Ethereum continues to walk a tightrope between consolidation and further downside, with bulls needing to hold $1,800 at all costs to avoid cascading losses. The next few days will be crucial in determining ETH’s short-term direction.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market20 hours ago

Market20 hours agoDogecoin Faces $200 Million Liquidation If It Slips To This Price

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Calls On Pi Network To Burn Tokens To Revive Pi Coin Price

-

Ethereum20 hours ago

Ethereum20 hours agoCrypto Analyst Who Called Ethereum Price Dump Says ETH Is Now Undervalued, Time To Buy?

-

Market18 hours ago

Market18 hours agoIMX Price Nears All-Time Low After 30 Million Token Sell-Off

-

Market21 hours ago

Market21 hours agoSEC’s Crypto War Fades as Ripple, Coinbase Lawsuits Drop

-

Bitcoin21 hours ago

Bitcoin21 hours agoArthur Hayes Sees Tariff War Pushing Bitcoin Toward $1 Million

-

Market19 hours ago

Market19 hours agoSEC’s Guidance Raises Questions About Tether’s USDT

-

Market17 hours ago

Market17 hours agoKey Levels To Watch For Potential Breakout