Ethereum

Ethereum Trading At 40-Month Lows Versus Bitcoin: Is This An Endorsement Of BTC?

Ethereum is firm when writing but continues to underperform versus Bitcoin. Though ETH is floating above $2,400, and may even break above $3,000 in the coming years, the rapid strengthening of the world’s most valuable coin, on the other hand, might push the ETH/BTC ratio to multi-month lows.

ETH Struggling Versus Bitcoin, ETH/BTC Ratio Drops To A 40-Month Low

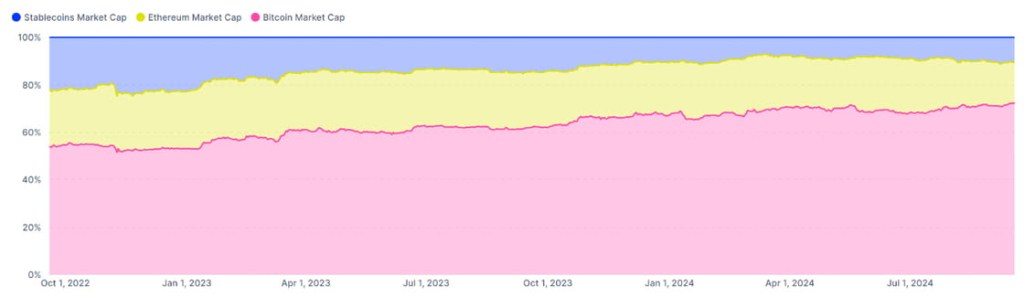

As of September 20, IntoTheBlock data reveals that ETH is trading at the lowest level versus Bitcoin in over 40 months. This trend clearly shows that the market, even with the engagement of institutions, is bullish on BTC.

Interestingly, ETH continues to underperform despite the approval of spot Ethereum ETFs for trading in July 2024. The approval of these complex derivatives allowed institutions to get exposure to the second most valuable coin within the law’s confines while not breaking the bank as they did.

Previously, institutions in the United States seeking to buy ETH could only do so by purchasing Grayscale ETHE shares. The problem is that fees were higher when the financial world didn’t know the regulatory status of ETH. Although nothing has changed, the approval of spot Ethereum ETFs, preventing issuers from staking coins bought by clients, was seen as a win.

The United States Securities and Exchange Commission (SEC) has yet to issue an official statement endorsing ETH as a commodity similar to Bitcoin. However, the Commodity Futures Trading Commission (SEC) has repeatedly stated that ETH is a commodity.

With ETH sliding versus BTC, IntoTheBlock analysts are convinced that institutional investors are confident of Bitcoin’s prospects. Specifically, they pointed to Bitcoin’s relative stability compared to Ethereum, an asset with a higher risk-reward profile.

Will Ethereum Find Support?

Even with this assessment, it should be noted that Bitcoin remains a transactional layer, riding on its first-mover advantage. On the other hand, Ethereum is the first smart contracts platform, and hosts various innovations ranging from DeFi, NFTs, and is now driving tokenization.

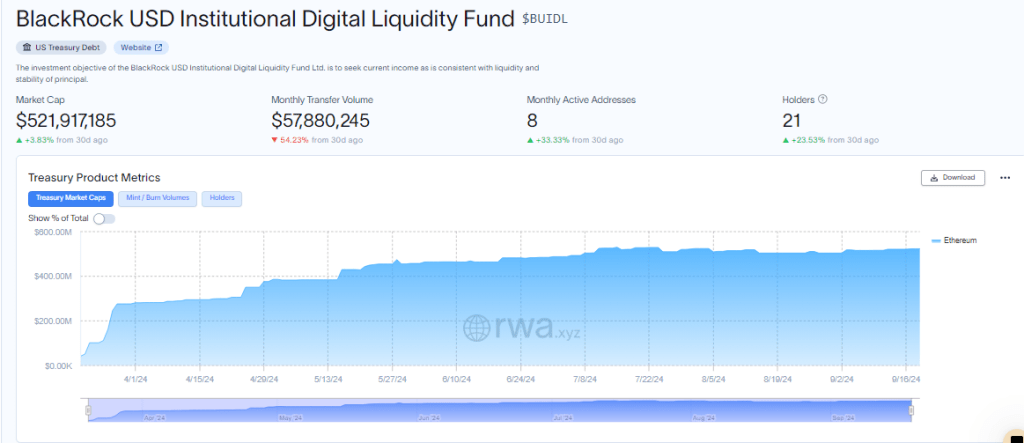

Earlier on, Larry Fink, the CEO of BlackRock, said real-world asset (RWA) tokenization, most of which is done on Ethereum, will rise to command a trillion in market cap. BlackRock has issued BUIDL, a product tokenizing United States Treasuries, on Ethereum.

It remains to be seen whether ETH will recover versus BTC. Looking at the daily chart, the trend appears to be shifting, at least in the immediate term. The double-bar bullish formation of September 18 and 19 has been confirmed today.

At the same time, ETH seems to be strengthening, turning the corner from the 61.8% Fibonacci retracement level of the 2020 to 2021 trade range.

Ethereum

Ethereum Capitulation May Be Nearing End – Will A Fed Pivot Spark A Recovery?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has extended its downtrend, setting fresh lows around $1,400 — a level not seen since early 2023. The continuation of selling pressure has shaken market sentiment, with many investors fearing that the worst is still ahead. Ethereum, down over 65% from its 2024 highs, has failed to find a solid support level amid broad market weakness and growing macroeconomic uncertainty.

Related Reading

Despite the bearish outlook, some analysts believe a turning point may be near. According to top analyst Ted Pillows, Ethereum is now deep in a capitulation phase. He suggests that while there may still be one final 5%–10% dump left in the tank — particularly given the recent weakness in equities — the broader market structure may be setting the stage for a rebound.

Pillows points to a potential Federal Reserve pivot as a key catalyst. With traditional markets under pressure and volatility rising, a shift in monetary policy could bring relief. Historically, changes in the Fed’s stance have provided a strong boost to risk assets. If support from policymakers emerges, Ethereum could stabilize and begin recovering from its recent lows — but not before weathering one last wave of fear and uncertainty.

Ethereum Capitulation Deepens, But Fed Pivot Could Spark Rebound

Ethereum is trading at $1,450 after suffering a sharp 20% decline in just hours, marking one of its steepest drops this year. The panic-driven selloff has shaken investor confidence, with fear now dominating the market. Ethereum, once expected to lead the altcoin rally in 2025, has failed to deliver on those expectations. Instead, it continues to disappoint as bearish momentum builds and selling pressure intensifies.

Wider market conditions are adding to the pain. Trade war tensions, policy uncertainty from the US President Donald Trump administration, and mounting fears of a global recession are dragging both equities and crypto lower. With the S&P 500 already down sharply, the fear of a broader financial contagion is rising.

Pillows’ analysis supports that Ethereum’s current plunge reflects a full-blown capitulation. However, he suggests that the market could be nearing a turning point. “Maybe there’s one last dump left, but after that, it’ll bounce,” Pillows said. The key reason? A likely pivot from the Federal Reserve.

Pillows points to a potential Federal Reserve pivot as the catalyst. With the S&P 500 down over 10% in just two days and volatility rising, any further drop could force an emergency Fed response. Historically, rate cuts and renewed quantitative easing (QE) have been bullish for risk assets like Ethereum. If a pivot arrives, Ethereum could quickly bounce from current levels — but only after one final shakeout.

Related Reading

Ethereum Slides To $1,410 As Bears Maintain Control

Ethereum has plunged to $1,410 after losing the crucial $1,800 support level, triggering a wave of aggressive selling and panic across the market. With no clear support zone immediately below current levels, bearish momentum appears firmly in control as ETH struggles to find footing. The breakdown below $1,800 marked a major technical failure, erasing confidence among traders and accelerating downside pressure.

For now, the path of least resistance remains to the downside. If sentiment doesn’t stabilize soon, Ethereum could continue sliding into lower demand zones, possibly retesting levels not seen since early 2022. The lack of a defined support structure beneath current prices leaves ETH exposed to more volatility in the near term.

Related Reading

However, hope remains for a recovery — but it hinges on a swift reclaim of the $1,800 level. A strong bounce back above this mark could signal that capitulation is complete and invite renewed buying interest from sidelined investors. Until then, Ethereum remains vulnerable, and any upside attempts will likely face resistance unless backed by broader market strength or a decisive macro shift. Bulls have a narrow window to flip the momentum before deeper losses set in.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Price Looks Set To Crash To $1,000-$1,500, But Can It Fill The CME Gaps Upwards To $3,933

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is facing renewed downward selling pressure, with the entire crypto market entering a fresh downtrend in the past 24 hours. This renewed selling pressure has seen the Ethereum price lose a strong support level at $1,800, causing it to fall by about 14.5% from its price 24 hours ago at the time of writing.

The trading trend shows that the Ethereum price is about to break below $1,500, with one analyst even suggesting a potential break to $1,000. Yet, despite the sharp decline, technical patterns suggest the possibility of Ethereum revisiting much higher price levels upwards to $3,933, specifically to fill multiple CME futures gaps that are still open above.

Ethereum Breaks Below Key Support, Larger Breakdown Ahead

The loss of the $1,800 support has strengthened the bear case for Ethereum, especially amid broader weakness in the altcoin market. One of the more blunt takes comes from crypto analyst Andrew Kang, who argued that the price of Ethereum is actually overvalued. He described Ethereum’s $215 billion market cap as “ridiculous” for what he calls a “negative growth/profitability asset.”

Related Reading

According to Kang, the momentum of speculative winds that used to ignite Ethereum’s price surge has run dry, and a revisit of the $1,000 to $1,500 zone is not only likely but overdue. What adds weight to Kang’s warning is how quickly the market appears to have validated his concerns.

Since his statement, Ethereum’s market cap has dropped significantly, sliding to $186.5 billion at the time of writing. Although the decline is due to other market factors, the pace and depth of this decline suggest that investor confidence in Ethereum may be lower than expected, with no immediate signs of reversal in sight. If bearish pressure continues, Ethereum could soon find itself trading at the lower end of Kang’s projected range at $1,000.

CME Gaps Above $2,500 Offer A Technical Outlook For Rebound

Even as price action trends lower, Ethereum’s CME futures chart tells a different story. Titan of Crypto pointed out that three distinct CME gaps are unfilled above the current market level. These include a gap between $2,550 and $2,625, another between $2,890 and $3,050, and a partially filled third gap between $3,917 and $3,933.

Related Reading

The CME gap theory is rooted in the observation that asset prices often return to fill these voids, even if the move takes weeks or months. In the case of Ethereum, the odds of a return to the CME gaps are very low in the short term.

However, considering Q2 2025 is only just starting, there is still enough time to witness the buying pressure needed to fill these levels before the end of the year. At the time of writing, Ethereum is trading at $1,540, down by 14.5% in the past 24 hours.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Supply On Exchanges Plummets – Is A Supply Squeeze Coming?

Ethereum is down 55% from its December high, reflecting the broader weakness that has hit the crypto market amid escalating global uncertainty. Much of the recent pressure comes from US President Donald Trump’s aggressive tariff policies and unpredictable economic stance, which have rattled investor confidence and driven a risk-off sentiment across financial markets. High-volatility assets like Ethereum have been particularly hard hit, with bulls struggling to hold critical support levels and sellers continuing to dominate short-term price action.

Despite the bearish outlook, on-chain data provides a glimmer of hope for Ethereum’s long-term prospects. According to CryptoQuant, Ethereum exchange reserves have been steadily declining since 2022 — a trend that suggests a continued reduction in available supply on centralized platforms. While this hasn’t translated into upward price action yet, it points to a potential supply squeeze once demand returns.

For now, ETH remains under pressure with no immediate signs of a reversal, but the shrinking exchange supply could set the stage for a strong rally if buying interest picks up. Until then, Ethereum continues to trade in a fragile state, with investors closely watching for signs of support or further breakdown in the coming weeks.

Ethereum Tests Critical Support As Exchange Supply Drops

Ethereum is testing critical demand levels as the market continues to lean bearish. After weeks of persistent selling pressure, ETH is now trading below the $1,800 level — a zone that many analysts view as a last line of defense before deeper losses. The broader macroeconomic backdrop remains challenging, with trade war fears and tightening financial conditions keeping risk assets under pressure.

Ethereum has been particularly weak since late February, when bulls lost control following the breakdown below $2,500. Since then, price action has steadily declined, and hopes for a bullish cycle have faded. Investor sentiment is fragile, and bulls have yet to show enough strength to reclaim broken support levels or initiate a meaningful recovery.

However, there are signs of long-term potential building beneath the surface. According to top analyst Quinten Francois, ETH supply on exchanges is plummeting. Shared via X, CryptoQuant data shows a significant downtrend in Ethereum held on centralized platforms — a signal that investors may be moving assets into cold storage, reducing sell-side pressure.

This ongoing decline in exchange supply historically precedes bullish breakouts. Once demand returns and price consolidates, the thin supply on exchanges could act as fuel for a sharp rally. While current conditions remain bearish, the structural reduction in available ETH offers a compelling setup for a future rebound.

For now, Ethereum must hold above the $1,750–$1,800 range to prevent a deeper slide, but long-term holders are watching closely for the moment when reduced supply meets renewed buying pressure.

ETH Trades Below Key Weekly Indicators

Ethereum is currently trading below both the weekly 200-day moving average (MA) around $2,500 and the exponential moving average (EMA) near $2,250 — key long-term indicators that now act as overhead resistance. This breakdown highlights the severity of the ongoing correction, with bulls under heavy pressure to prevent further losses. ETH is now flirting with its lowest weekly close since October 2023, adding to concerns that the downtrend could deepen if buyers fail to step in soon.

Momentum remains weak, and bullish attempts to recover have been short-lived, as macroeconomic instability and continued selling pressure weigh on the broader crypto market. For Ethereum to avoid further downside, it must hold the $1,800 level — a key demand zone and psychological threshold.

If bulls manage to defend this level and reclaim the $2,000 mark in the coming days, it could signal the beginning of a recovery rally. Reentering this range would shift sentiment and possibly trigger renewed buying interest. Until then, ETH remains vulnerable, and a close below $1,800 could open the door to a retest of lower support levels, potentially accelerating the decline if sentiment worsens further.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin23 hours ago

Altcoin23 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Market22 hours ago

Market22 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Supply On Exchanges Plummets – Is A Supply Squeeze Coming?

-

Market9 hours ago

Market9 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?

-

Market23 hours ago

Market23 hours agoAvalanche Price Holds Under $20, Low Selling Can’t Lift Price

-

Market24 hours ago

Market24 hours agoJustin Sun Claims First Digital Trust Fraud Exceeds Impact of FTX

-

Market13 hours ago

Market13 hours agoSolana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?

-

Bitcoin10 hours ago

Bitcoin10 hours ago$1 Billion in Liquidations Over the Weekend