Ethereum

Ethereum ETF Selloff Triggers $300 Million Crypto Long Flush

Data shows that a lot of long liquidations have piled up on exchanges after the Ethereum ETF approval, which was a sell-the-news event.

Ethereum Price Has Been Down Since Spot ETFs Gained Approval

Yesterday, the US Securities and Exchange Commission (SEC) finally gave the green light on all eight Ethereum spot exchange-traded funds (ETFs) that were awaiting approval.

Spot ETFs are basically investment vehicles that provide a way to gain indirect exposure to ETH’s price movements without actually owning any tokens.

ETFs are available through means that traditional investors would be familiar with, so those who don’t want to bother with cryptocurrency exchanges and wallets could decide to invest in the asset through them.

The market had been anticipating this event, just like the Bitcoin spot ETF approval back in January. In BTC’s case, the inflows through the ETFs eventually fueled a rally towards a new all-time high (ATH).

When the Bitcoin ETFs had just been approved, though, the investors initially showed a selling reaction, which resulted in the cryptocurrency registering a significant drawdown.

It would appear that the Ethereum spot ETF approval has also been met with some selling so far, as coins across the sector have been in the red over the past 24 hours. Ethereum itself is down more than 5% in the window.

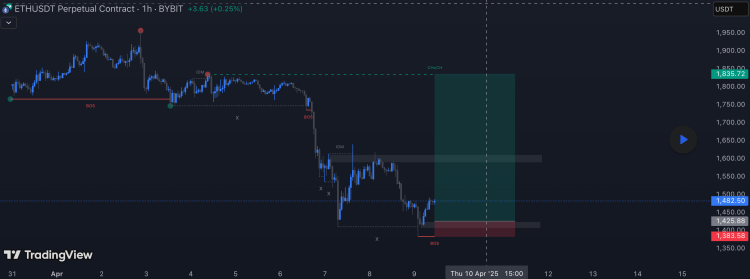

The price of the asset appears to have shot up over the last few days | Source: ETHUSD on TradingView

Despite the decline, Ethereum investors would still be holding notable profits, as the coin at its current price of $3,700 is still up over 23% in the past week.

It would appear that the approval and the subsequent selloff may have caught the market off-guard, as the derivatives side has registered some large liquidations in the last 24 hours.

$384 Million In Cryptocurrency Contracts Found Liquidation In Past Day

According to data from CoinGlass, the cryptocurrency derivatives market has observed a mass flush during the past day. The below table shows what the numbers have looked like.

The data for the cryptocurrency-related liquidations over the last 24 hours | Source: CoinGlass

As is visible, over $384 million in cryptocurrency contracts have seen forceful closure during this period. More than $297 million of these liquidations involved the long holders alone.

This means these investors betting on a bullish outcome made up 77% of the flush. This naturally lines up, as the overall price volatility in the past day has been towards the downside.

It’s also not surprising that Ethereum, which has been the focus of attention recently, contributed the largest share to this liquidation squeeze, as the heatmap below reveals.

Looks like ETH liquidations have been more than double that of BTC's | Source: CoinGlass

At more than $150 million liquidations, Ethereum has managed to significantly outdo Bitcoin, which has seen contracts worth $74 million flushed down.

Featured image from Kanchanara on Unsplash.com, CoinGlass.com, chart from TradingView.com

Ethereum

Breakout To $1,800 With These Two Supply Zones

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Even with the Ethereum price struggling amid the market downturn, there are still some who remain bullish on the second-largest cryptocurrency by market cap. One of those is pseudonymous crypto analyst NotWojak, who took to the TradingView website to share a rather bullish prediction for the Ethereum price that goes contrary to the current market sentiment.

Bearish Ethereum Price Downtrend Coming To An End

The Ethereum price is still stuck in an apparent downtrend. However, according to the crypto analyst, this could be ending anytime soon with two supply zones coming up. So far, there have been multiple liquidity sweeps across major levels, sending the Ethereum price towards lower lows. Nevertheless, this could turn bullish soon as they could suggest a reversal is coming for the cryptocurrency.

Related Reading

Currently, the two supply zones called out by the analyst are the $1,425 and $1,600 level. As they explain, the $1,425 level has already been mitigated during the latest retracement. So, this leaves only the $1,600 level unmitigated. As such, this could easily turn this level into resistance in the event of an uptrend.

Despite sellers still dominating currently with high volumes pouring into the market, the crypto analyst puts the bottom before $1,350. In this case, this level could be potential support and the breakout could begin from here.

The target for this major breakout has been placed 20% above the current level, with the analyst setting a high $1,835 target. This could lead to further upside, especially if resistances are easily cleared from here.

ETH On-Chain

Ethereum’s profitability has plummeted with the price decline as only 32% of all investors are seeing any profit on their positions. On the other side, 65% of all holders are in losses and only 2% are sitting at breakeven price, according to data from the on-chain data aggregation website, IntoTheBlock.

Related Reading

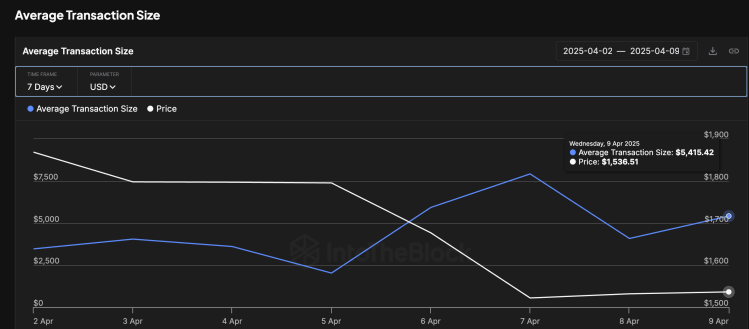

Ethereum whales have also been very active during this time and this could mean that large investors have been behind the selling that has crashed the ETH price. Large transactions rose from $4.8 billion to $6.48 billion by April 9 as the Ethernet price dropped back below $1,500.

Average transaction size also grew during the this time from $4,048 to $5,415. This suggests that investors are moving more coins at the time, which could explain the increased selling that has plagued the cryptocurrency. If this continues, then the ETH price could see further crashes from here.

At the time of writing, the Ethereum price was trending at $1,544, down 4.56% in the last day.

Featured image from Dall.E, chart from TradingView.com

Ethereum

Is Donald Trump’s World Liberty Finance Behind The Crash To $1,400?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Ethereum price crash to $1,400 has shaken the crypto market, amplifying already volatile conditions. This dramatic price drop comes after a major ETH sell-off by US President Donald Trump’s World Liberty Finance, suggesting that the recent dump may have been a primary catalyst behind ETH’s price collapse.

Blockchain analytics platform Lookonchain revealed on April 9 via X (formerly Twitter) that the wallet associated with World Liberty Finance, a decentralized finance protocol linked to Trump, recently dumped a significant amount of Ethereum. Interestingly, this sell-off came just before Ethereum’s price crash, raising the question of whether it contributed to the unexpected decline.

Donald Trump‘s World Liberty Finance Dumps ETH

Launched in 2024, World Liberty Finance is Trump’s controversial digital asset firm designed to rival centralized banking and facilitate the adoption of stablecoins. According to data from Lookonchain, Trump’s World Liberty Finance, which was previously accumulating Ethereum at a low price, is now selling off a large chunk of its holding at a steep loss.

Related Reading

Lookonchain flagged the transaction, noting that the wallet linked to World Liberty Finance had offloaded 5,471 ETH tokens worth roughly $8.01 million. The sell-off was executed at a price of $1,465 per ETH, a significant drop from its previous value of over $1,600.

Notably, World Liberty Finance’s ETH sell-off move has raised eyebrows across the crypto community. It appears to mark a shift in strategy for a player who was previously known for large-scale ETH accumulation.

According to Lookonchain, the wallet address linked to World Liberty Finance had accumulated a total of 67,498 ETH at an average price of $3,259. This means that the decentralized finance protocol spent a total of $210 million to amass such a large amount of ETH.

At its sell-off price, this leaves the entity sitting on a staggering unrealized loss of around $125 million. The recent sell-off also adds more fuel to the growing uncertainty surrounding Ethereum’s future outlook, as the cryptocurrency’s recent price crash has sparked even more bearish predictions of continued decline.

Although the reason behind World Liberty Finance’s unexpected ETH sell-off remains unclear, some believe that the dump was likely triggered by Ethereum’s ongoing price decline, while others suggest it could signal a market bottom.

Ethereum Price Crash To $1,400

Ethereum’s price decline to $1,400 came as a shock to the market, making it the first time the cryptocurrency had fallen so low in seven years. Notably, Ethereum was not the only leading cryptocurrency that was affected by the market turmoil, as big players like Bitcoin also suffered losses.

Related Reading

Currently, Ethereum seems to be recovering slightly from its previous low and is now trading at $1,591 after jumping 7.44%. Although this recovery brings hope of a rebound, the cryptocurrency’s value has still dropped by 16.63% over the past month. Moreover, technical indicators from CoinCodex highlight that sentiment surrounding the cryptocurrency is still deeply bearish, suggesting that further declines could be on the horizon.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Long-Term Holders Show Signs Of Capitulation – Prime Accumulation Zone?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum saw a dramatic turnaround this week, bouncing over 21% from its recent low of $1,380 in just hours. The sharp recovery came in response to an unexpected shift in macroeconomic policy: US President Donald Trump announced a 90-day pause on reciprocal tariffs for all countries—except China, which now faces a steep 125% tariff. The news sent a ripple through global markets, sparking a short-term rally in risk assets, including crypto.

Related Reading

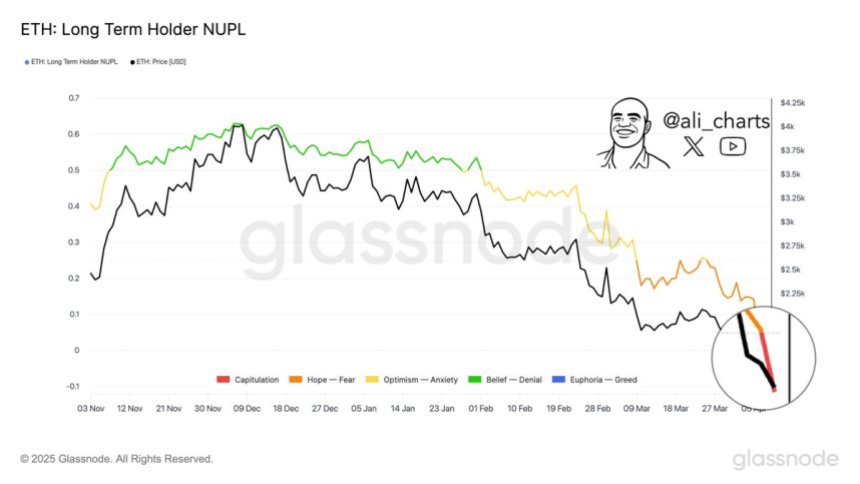

Ethereum, which had been under heavy selling pressure for weeks, appears to have found temporary relief. According to Glassnode data, long-term Ethereum holders are starting to fold, offloading positions at a loss after months of decline. Historically, these moments of long-term holder capitulation have often marked bottoming phases and preceded meaningful rebounds.

While short-term volatility remains elevated, some analysts view this setup as a potential opportunity zone, especially for contrarian investors looking to accumulate during peak fear. The market now watches to see if ETH can hold its gains or if broader uncertainty will drag prices back down. One thing is clear: the next few days could be pivotal for Ethereum’s trend heading into the second half of 2025.

Ethereum Finds Relief Amid Chaos, But Market Remains On Edge

Ethereum is now at a pivotal crossroads after enduring weeks of relentless selling pressure and uncertainty. The recent surge from sub-$1,400 levels has offered a glimmer of hope, as bulls begin to push back against the downtrend. This bounce follows aggressive volatility not just in crypto but across global equities, with price action rocked by continued geopolitical unrest and macroeconomic instability. US President Donald Trump’s unpredictable stance on tariffs remains a wildcard, keeping global markets on edge.

Since peaking in late December, Ethereum has shed over 60% of its value, triggering growing concern that a full-scale bear market may be unfolding. Many investors have already exited positions, while others remain sidelined waiting for clarity. Still, some see opportunity.

According to top analyst Ali Martinez, long-term Ethereum holders have now entered what’s commonly referred to as “capitulation” mode—a stage when even the most patient investors begin to fold under pressure. Martinez believes this could present a rare window for contrarian buyers. “For those watching risk-reward dynamics, this phase has historically marked prime accumulation zones,” he shared on X.

While Ethereum’s path forward is still uncertain, current sentiment suggests that a critical test is underway—one that could determine whether this recovery has legs, or if further pain lies ahead.

Related Reading

Bulls Look To Confirm Recovery With Key Breakout

Ethereum is showing signs of short-term strength as it forms an “Adam & Eve” bullish reversal pattern on the 4-hour chart. This classic technical formation, which starts with a sharp V-shaped low followed by a rounded bottom, often signals a potential breakout if price action holds and follows through. For Ethereum, reclaiming the $1,820 level is the first step to confirm this bullish structure.

If bulls can push ETH above this level with conviction, the next key challenge lies at the 4-hour 200 moving average (MA) and exponential moving average (EMA), both of which converge around the $1,900 mark. A decisive breakout through this zone would validate the recovery setup and could kickstart a more sustained move higher.

Related Reading

However, failure to reclaim the $1,800 level in the coming days may keep ETH stuck in a consolidation range. If rejected, price could remain rangebound between current levels and the lower support area near $1,300, where ETH recently bounced. For now, all eyes are on how price reacts to the resistance levels ahead, as bulls aim to regain control and shift the short-term momentum in their favor.

Featured image from Dall-E, chart from TradingView

-

Altcoin18 hours ago

Altcoin18 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market17 hours ago

Market17 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Market16 hours ago

Market16 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Market23 hours ago

Market23 hours agoControversy Follows Babylon’s BABY Token Launch and Airdrop

-

Market18 hours ago

Market18 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Altcoin16 hours ago

Altcoin16 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Bitcoin15 hours ago

Bitcoin15 hours agoOver $2.5 Billion in Bitcoin and Ethereum Options Expire Today

-

Market10 hours ago

Market10 hours agoChina Raises Tariffs on US to 125%, Crypto Markets Steady