Ethereum

Ethereum Bullish Or Bearish? What Futures Market Data Says

Here’s what the data related to the Ethereum futures market suggests regarding whether the sentiment around ETH is looking bearish or bullish.

Ethereum Taker Buy Sell Ratio Has Observed A Strong Surge Recently

In a new CryptoQuant Quicktake post, an analyst has talked about the outlook of Ethereum based on futures market data. The focus indicator here is the “Taker Buy Sell Ratio,” which keeps track of the ETH taker buy and taker sell volumes on the derivatives platforms.

When the value of this metric is greater than 1, it means the taker’s buy or long volume outweighs the taker’s sell or short volume and thus, a majority bullish sentiment is present in the market.

On the other hand, the indicator being under the mark implies the dominance of a bearish mentality among future users as more sellers are willing to sell at a lower price.

Now, here is a chart that shows the trend in the 14-day simple moving average (SMA) Ethereum Taker Buy Sell Ratio over the last few months:

The 14-day SMA value of the metric appears to have been sharply going up in recent days | Source: CryptoQuant

As is visible in the above graph, the 14-day SMA Ethereum Taker Buy Sell Ratio has observed a rapid increase recently, implying that the balance in the market has been shifting.

Alongside this spike in the indicator, the asset’s price has also seen a surge. The chart shows that a similar trend in the metric was also observed in the lead-up to the price rally in the first quarter of the year.

Based on the recent trend, the quant comments:

This surge indicates strong buying interest in the perpetual market, suggesting a notable bullish sentiment. If this upward trend in the Taker Buy/Sell Ratio continues, it confirms a potential mid-term bullish trend in the market, with the price likely rallying toward higher values.

It remains to be seen if the 14-day SMA Taker Buy Sell Ratio will continue its surge in the coming days, thus confirming this possible bullish setup for the cryptocurrency.

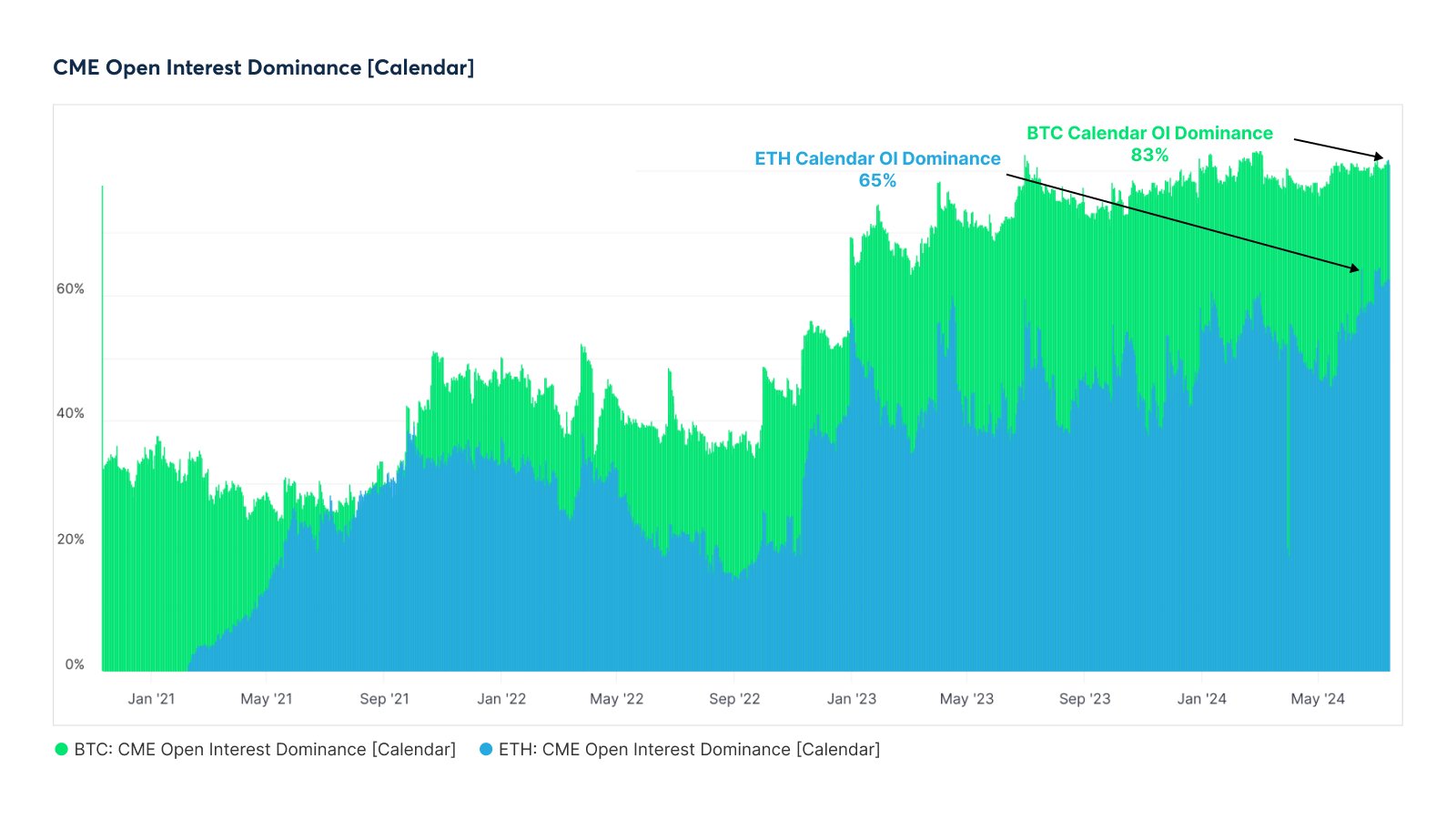

Speaking of the futures market, the CME Group has recently seen its dominance grow in the calendar futures market for Ethereum and Bitcoin, as the analytics firm Glassnode pointed out in an X post.

The trend in the Open Interest dominance of the CME group in the BTC and ETH calendar futures market | Source: Glassnode on X

The above chart displays the data for the Open Interest dominance of the CME Group. The Open Interest refers to the number of contracts currently open on the calendar futures market.

It would appear that the CME Group now occupies 83% and 65% of the Bitcoin and Ethereum calendar Open Interests, respectively.

ETH Price

Ethereum’s recovery has stalled during the last few days as the asset’s price still trades around the $3,400 mark.

Looks like the price of the coin has been moving sideways since its surge | Source: ETHUSD on TradingView

Featured image from Dall-E, CryptoQuant.com Glassnode.com, chart from TradingView.com

Ethereum

Ethereum Price Suffers 77% Crash Against Bitcoin, On-Chain Deep Dive Reveals Reasons Why

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Despite rolling out a large number of upgrades and innovations, the Ethereum price continues to lag behind Bitcoin (BTC) by a wide margin. Reports reveal that ETH has suffered a staggering 77% price crash against BTC — a decline likely fueled by a mix of technical, macro, and sentiment-driven factors. Notably, On-chain analytics platform, Santiment has now pinpointed and broken down the key reasons behind these price struggles.

Ethereum Price Nosedives Against Bitcoin

On April 11, Santiment released a detailed report on Ethereum, highlighting its almost four-year underperformance and the reasons behind it. Ethereum, once revered as the cryptocurrency most likely to dethrone Bitcoin, has recently suffered a brutal price decline when measured directly against BTC.

Related Reading

According to Santiment’s on-chain data, Ethereum has crashed by approximately 77% against Bitcoin since December 2021. While the dollar value of ETH hasn’t completely collapsed, especially compared to other altcoins, the long-term BTC/ETH ratio still paints a gruesome picture for Ethereum holders.

Notably, Ethereum has also failed to recover anywhere near its November 2021 all-time high of $4,760. In contrast, Bitcoin has surged ahead, reclaiming much of its market dominance and outpacing ETH across almost every timeframe.

This disparity has led many traders and former maximalists to compare ETH to a “shitcoin.” Even worse, various mid to low-cap altcoins have already outperformed Ethereum over the short, mid, and long-term timeframes, causing further embarrassment for the world’s second-largest cryptocurrency by market capitalization. Based on Santiment’s report, the ETH/BTC price ratio chart alone is enough to trigger doubt and uncertainty among long-term holders.

Behind The Scenes Of Ethereum Price Struggles

Beyond price action and market volatility, Santiment reveals that there are fundamental reasons for Ethereum’s sluggish performance over the years. Some of the major criticisms that analysts and traders have pinpointed include technical, sentimental, and regulatory issues.

Related Reading

Ironically, Ethereum’s Layer 2 solutions are one of the key drivers of its underperformance. L2 solutions like Arbitrum, Optimism, and zkSync are reportedly cannibalizing activity on the mainnet, taking investments from ETH while spreading investor attention thin.

Secondly, Ethereum seems to struggle with complex roadmaps and communication, which has led to investor confusion. Major updates like The Merge and Shanghai have been difficult for investors to comprehend, making ETH feel less accessible than BTC.

Thirdly, users remain frustrated by Ethereum’s relatively high gas fees and the slow rollout of key upgrades. This has pushed them toward more affordable and faster alternatives, significantly reducing adoption.

Another primary reason for Ethereum’s crash against Bitcoin is ongoing regulatory concerns. Unlike Bitcoin, which has a more established legal precedent, Ethereum faces constant uncertainty about whether it could be labeled a security.

Other points include ETH’s lack of investment appeal. While Bitcoin maintains the title as a stable digital gold, Ethereum appears to be caught in between, having no clear or attractive investment narrative. Moreover, newer blockchains like Solana and Cardano are also attracting a significant number of users with cheaper and faster solutions, ultimately pulling investments away from ETH.

The final reason Santiment has identified for Ethereum’s long-term price descent is rising selling pressure. Post-upgrade withdrawals of stakes ETHs have created steady sell-side pressure, limiting growth and momentum compared to Bitcoin.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Slips Below ‘Mayer Multiple’ Level That Preceded Last Rally To $4,000

The Ethereum token has been under significant bearish pressure over the past few months, losing almost half of its value in the first quarter of 2025. Along with the rest of the altcoin market, ETH bled severely following the announcement of new trade tariffs by United States President Donald Trump.

Interestingly, the suspension of these trade tariffs didn’t have as much of a bullish effect on the “king of the altcoins,” which failed to hold above the $1,600 level in the past day. This inability of the Ethereum price to mount a convincing recovery emphasizes the token’s struggles in recent months.

Is The Price Bottom In For ETH?

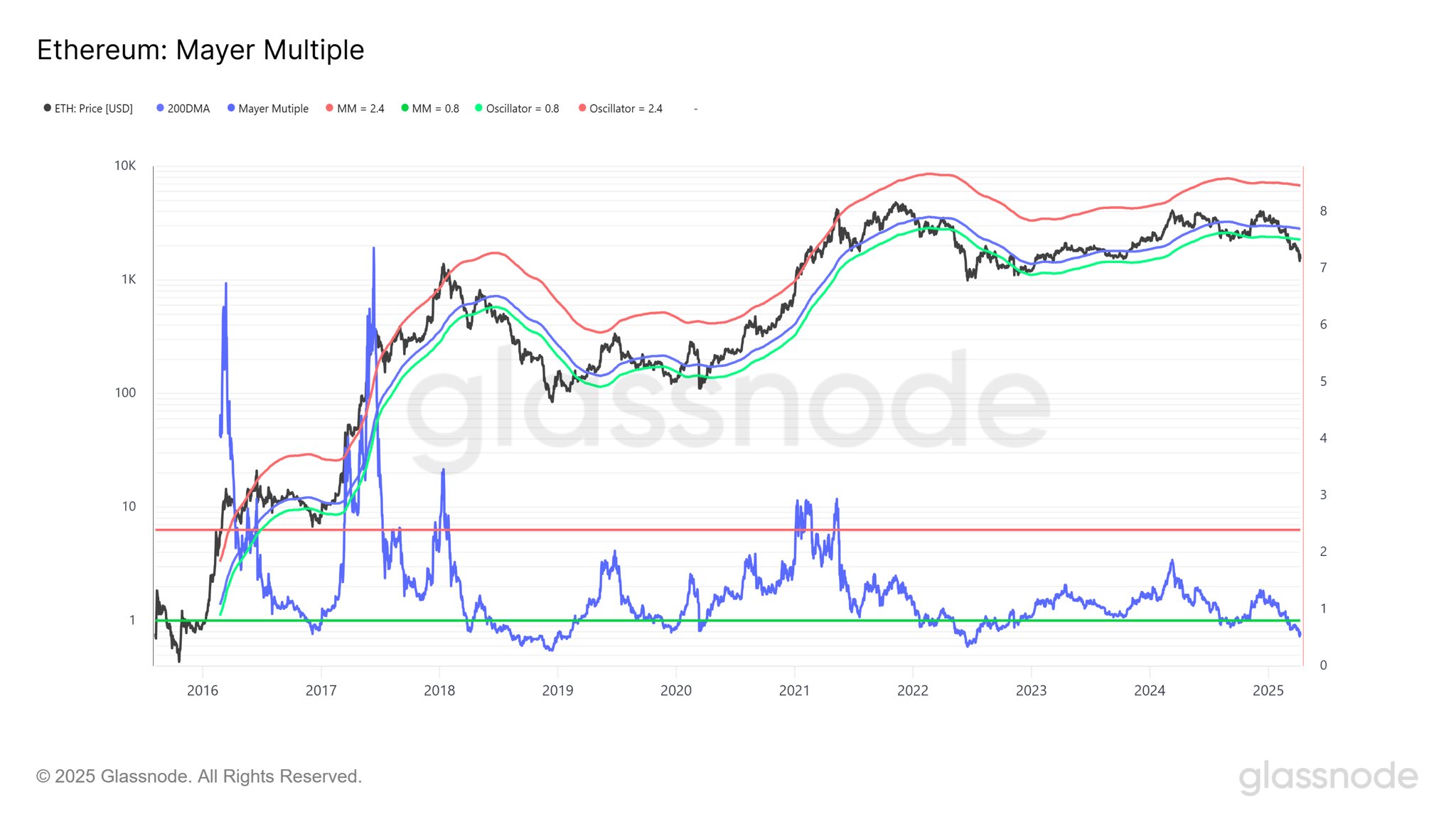

Crypto analyst with the pseudonym Cryptollica shared fresh on-chain insight in a post on the X platform, suggesting that the price of Ethereum could be at a pivotal point of bullish reversal. This projection is based on the Mayer Multiple indicator, which measures the ratio between an asset price and its 200-day moving average (MA).

The 200-day MA represents the long-term average price of an asset; and the Mayer Multiple estimates the distance of the asset’s actual price from this average value to determine overbought and oversold conditions. The metric indicates an overheating market condition and a potential price top when its value is above the 2.4 mark.

On the flip side, a Mayer Multiple value below 0.8 signals an oversold condition and that the asset’s price might have hit a bottom. Ultimately, the metric is used to determine macro bull or bear his when analyzing cyclical price changes.

Source: @cryptollica on X

According to the Glassnode chart shared by Cryptollica, the Ethereum Mayer Multiple recently slipped beneath the 0.8 mark. This suggests that the price of ETH might be bottoming out, with a potential bullish reversal on the horizon.

Moreover, the last time the Mayer Multiple indicator fell to this low in 2022, the price of Ethereum rebounded to above the $4,000 mark — the price high in the current cycle. If history repeats itself, the second-largest cryptocurrency could embark on another journey to $4,000 — an over 150% rally from the current price point — over the coming months.

Ethereum Price At A Glance

As of this writing, the price of ETH stands at around $1,550, reflecting a mere 1% jump in the past 24 hours. Despite the slightly improving market sentiment, the altcoin’s performance on the weekly timeframe has remained almost the same. According to CoinGecko data, the Ethereum price is down by nearly 15% in the past seven days.

The price of ETH on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum (ETH) Consolidates Within Tight Range As Key Support Level Forms

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency.

Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems.

In two years of active crypto writing, Semilore has covered multiple aspects of the digital asset space including blockchains, decentralized finance (DeFi), staking, non-fungible tokens (NFT), regulations and network upgrades among others.

In his early years, Semilore honed his skills as a content writer, curating educational articles that catered to a wide audience. His pieces were particularly valuable for individuals new to the crypto space, offering insightful explanations that demystified the world of digital currencies.

Semilore also curated pieces for veteran crypto users ensuring they were up to date with the latest blockchains, decentralized applications and network updates. This foundation in educational writing has continued to inform his work, ensuring that his current work remains accessible, accurate and informative.

Currently at NewsBTC, Semilore is dedicated to reporting the latest news on cryptocurrency price action, on-chain developments and whale activity. He also covers the latest token analysis and price predictions by top market experts thus providing readers with potentially insightful and actionable information.

Through his meticulous research and engaging writing style, Semilore strives to establish himself as a trusted source in the crypto journalism field to inform and educate his audience on the latest trends and developments in the rapidly evolving world of digital assets.

Outside his work, Semilore possesses other passions like all individuals. He is a big music fan with an interest in almost every genre. He can be described as a “music nomad” always ready to listen to new artists and explore new trends.

Semilore Faleti is also a strong advocate for social justice, preaching fairness, inclusivity, and equity. He actively promotes the engagement of issues centred around systemic inequalities and all forms of discrimination.

He also promotes political participation by all persons at all levels. He believes active contribution to governmental systems and policies is the fastest and most effective way to bring about permanent positive change in any society.

In conclusion, Semilore Faleti exemplifies the convergence of expertise, passion, and advocacy in the world of crypto journalism. He is a rare individual whose work in documenting the evolution of cryptocurrency will remain relevant for years to come.

His dedication to demystifying digital assets and advocating for their adoption, combined with his commitment to social justice and political engagement, positions him as a dynamic and influential voice in the industry.

Whether through his meticulous reporting at NewsBTC or his fervent promotion of fairness and equity, Semilore continues to inform, educate, and inspire his audience, striving for a more transparent and inclusive financial future.

-

Market16 hours ago

Market16 hours agoArthur Hayes Expects Bitcoin Surge if Fed Injects Liquidity

-

Altcoin15 hours ago

Altcoin15 hours agoBinance Issues Important Update On 10 Crypto, Here’s All

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum’s True Value? Lower Than You Think

-

Altcoin14 hours ago

Altcoin14 hours agoSolana Meme Coin Fartcoin Price Could Hit $1.29 If It Holds This Key Level

-

Market13 hours ago

Market13 hours agoCrypto Whales Position for Gains with DOGE, WLD and ONDO

-

Bitcoin10 hours ago

Bitcoin10 hours agoBitcoin’s Impact Alarming, Says NY Atty. General—Congress Needs To Act

-

Altcoin17 hours ago

Altcoin17 hours agoShiba Inu Burn Rate Explodes 1000%, Can SHIB Price Hit $0.000015?

-

Market10 hours ago

Market10 hours agoRipple May Settle SEC’s $50 Million Fine Using XRP