Ethereum

Did MicroStrategy Mess Up By Choosing Bitcoin Over Ethereum? Analyst Weighs In

Earlier today, the United States Securities and Exchange Commission (SEC) approved 19b-4 fillings for eight spot Ethereum exchange-traded funds (ETFs), paving the way for the highly anticipated institutional adoption of the second most valuable coin.

The decision comes after months of uncertainty and less than six months after the regulator approved spot Bitcoin ETFs. For all that the crypto community can remember this week, the regulator uncharacteristically “scrambled” and hastily communicated to spot ETF issuers to make amends to their applications.

Related Reading

Did MicroStrategy Make A Mistake Choosing Bitcoin Over Ethereum?

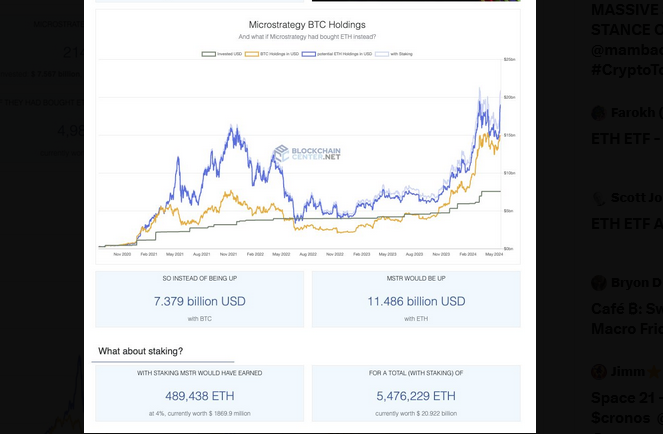

With spot Ethereum ETFs likely to be issued in the next few weeks, one analyst on X now thinks Michael Saylor, the former CEO of MicroStrategy, missed big rewards by choosing Bitcoin over Ethereum. As of May 24, MicroStrategy, a business intelligence firm and now one of the biggest public companies in the United States, has been increasing its BTC holdings over the years.

According to Bitcoin Treasuries, MicroStrategy is the largest public company holding BTC, controlling 214,400 BTC worth over $14 billion at press time.

However, with the United States SEC setting the ball rolling for spot Ethereum ETFs, the analyst is now pointing out a hypothetical scenario. If MicroStrategy had chosen ETH over BTC, their holding would have been worth over $19 billion at spot rates.

This level means MicroStrategy would be up over $4 billion. Assuming the business intelligence firm had chosen to buy and not hold but stake, their total holdings would be worth over $20.9 billion as of late May 2024.

ETH Trading At A Huge Discount: Will It Replicate BTC’s Success?

Looking at the aftermath of the approval and trading of spot Bitcoin ETFs, it becomes apparent that Ethereum prices might be significantly undervalued at spot rates. After a brief dip in mid-January, BTC prices surged, propelling Ethereum to a high of $4,100. In contrast, the world’s most valuable coin soared to breach $70,000 and set all-time highs at around $74,000.

With 19b-4 forms from eight ETF issuers, including BlackRock and Fidelity, approved, the only hurdle is the approval of S-1 registration statements. There might be delays in this round. However, the United States SEC green lights, spot Ethereum ETF shares will begin trading.

Related Reading

Still, it is important to note that spot Ethereum ETF issuers will hold ETH via a regulated custodian and not stake.

Feature image from DALLE, chart from TradingView