Ethereum

13 Mega Whales Holding Over 10,000 Ethereum Join The Network In 24 Hours – Major Accumulation Signal?

Ethereum (ETH) has had a turbulent week, with the price dipping to tag the critical $3,000 support level before recovering to current levels around $3,200. This sharp drop sparked fear among investors, as doubts about Ethereum’s performance for this cycle intensified. Many began questioning whether ETH could regain its momentum amid the broader market’s volatility.

However, key on-chain metrics suggest that not all investors share this skepticism. Data reveals that major players are still accumulating ETH despite recent price action. In the past 24 hours alone, 13 new mega whales—wallets holding over 10,000 ETH each—have joined the network. This signals strong confidence among high-net-worth investors and institutional players, who appear to see the current price levels as an opportunity.

This significant accumulation activity suggests that big players are positioning themselves for a potential breakout. While smaller retail investors may be hesitant, the moves of these whales could indicate optimism for Ethereum’s long-term prospects. As ETH stabilizes around the $3,200 level, the market will be closely watching whether this accumulation trend leads to renewed bullish momentum and a stronger recovery in the weeks ahead. The coming days could be pivotal for Ethereum’s trajectory in this market cycle.

Ethereum Enters A Recovery Phase

Ethereum has faced significant selling pressure since late December, shedding over 25% in value during this period. The prolonged downturn has tested investor confidence, yet recent price action suggests that the bearish phase may be nearing its conclusion. Analysts are now optimistic about a reversal and potential recovery, with Ethereum showing signs of regaining its footing.

Top crypto analyst Ali Martinez has highlighted compelling data supporting this bullish outlook. According to his analysis shared on X, 13 mega whales—wallets holding over 10,000 ETH each—have joined the Ethereum network in the last 24 hours.

This surge in large-scale accumulation suggests that big players are taking advantage of current price levels, positioning themselves for an anticipated recovery. Significant whale activity often serves as a strong indicator of confidence among institutional and high-net-worth investors, who typically operate with a long-term perspective.

At its current levels, Ethereum appears to be building a strong base of support. This accumulation by mega whales aligns with the broader market sentiment that ETH is poised for a bullish phase once the selling pressure subsides. If ETH can hold its ground and reclaim key resistance levels, the next upward move could mark the beginning of a strong recovery and sustained bullish momentum in the months ahead.

ETH Testing Crucial Liquidity

Ethereum is trading at $3,190 after finding strong support at the $3,000 mark, which aligns with the 200-day moving average. This key level has acted as a critical long-term indicator of strength, and ETH’s ability to hold above it suggests the potential for a trend reversal. After weeks of downward pressure, the current price action indicates that ETH might finally be ready to shift from its bearish trajectory.

For a complete confirmation of a bullish reversal, Ethereum must break above and hold the $3,500 level, a significant resistance zone that has capped its upward movement in recent weeks. Reclaiming this level would likely restore investor confidence and signal the start of a new uptrend. However, market conditions remain volatile, driven by speculation and broader macroeconomic uncertainties, which may delay ETH’s breakout.

Despite the challenges, Ethereum’s recovery above the 200-day moving average is a positive sign for the long-term outlook. Investors are cautiously optimistic as ETH stabilizes at current levels. Patience may be required, but the recent price action suggests ETH is setting the stage for a potential rally once it overcomes key resistance and the broader market finds direction.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Price Eyes $2,700 As Wyckoff Accumulation Nears Completion

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Incognito has predicted that the Ethereum price could soon rally to as high as $2,700. This bullish prediction comes despite ETH’s underperformance so far, with the altcoin’s market share already dropping to new lows.

Ethereum Price Could Rally To $2,700 As Wyckoff Accumulation Nears

In a TradingView post, Incognito predicted that the Ethereum price could witness a big move to $2,700 with the Wyckoff accumulation almost over. He remarked that if support holds, the ETH should see a breakout of the falling wedge. The analyst’s accompanying chart showed that $2,499 is the target for the falling wedge, while $2,700 is the second target that Ethereum could reach on this breakout.

Related Reading

However, Incognito warned that this could be a huge trap to shake out sellers, so he advised market participants to be looking to take profits. In the meantime, the Ethereum price could indeed break out to the upside, especially with the Bitcoin price attempting to reclaim the $90,000 level.

The Ethereum price is likely to reach new local highs if Bitcoin can sustain this bullish momentum, given their positive correlation. In an X post, crypto analyst Ali Martinez remarked that this week would be big for ETH as the TD Sequential just flashed a buy signal, hinting at a potential shift in momentum.

Martinez also raised the possibility of the Ethereum price recording a new bull rally. For that to happen, he mentioned that ETH needs to break the supply wall at $2,330. The leading altcoin could face significant selling pressure at that range, as 12.62 million addresses bought 68.63 million ETH around that range.

ETH May Have Already Bottomed

In an X post, crypto analyst Titan of Crypto suggested that the Ethereum price has already bottomed or may be bottoming out. He revealed that the leading altcoin is progressing within a giant ascending channel on the macro chart. His accompanying chart showed that ETH could rally to as high as $4,200 following this bullish reversal.

Related Reading

Crypto analyst Hardy also echoed a similar sentiment, suggesting that the Ethereum price has already reached its bottom. He noted that ETH’s weekly candle close was bullish and a good indicator of a potential reversal at the key support level around its current price. His accompanying chart showed that Ethereum could rally to as high as $4,300 on this bullish reversal.

Ethereum price reclaiming the $4,000 level could pave the way for a rally to a new all-time high (ATH). Crypto analyst Crypto Patel predicted that ETH could reach between $6,000 and $8,000 by the end of the year.

At the time of writing, the Ethereum price is trading at around $1,639, up almost 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Analyst Sets $3,000 Target As Price Action Signals Momentum – Details

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum and the broader crypto market experienced a small but notable pump yesterday, reigniting hopes of a potential trend reversal after weeks of sustained selling pressure. As market uncertainty intensifies, driven largely by global economic tensions and geopolitical strain between the US and China, investors are closely watching for signs of a breakout.

Related Reading

Despite the headwinds, analysts are starting to shift their tone. Some believe that the worst may be behind for Ethereum and that a strong move to the upside could be brewing. One of the most vocal among them is top analyst Carl Runefelt, who shared a bold outlook, suggesting that Ethereum “might go absolutely parabolic starting from here.” His analysis suggests that ETH is poised to break out from a daily descending trendline, which could serve as a key technical signal indicating va shift in momentum in favor of the bulls.

As Ethereum holds above critical support levels and inches closer to a potential trend reversal, traders and investors are now watching closely for follow-through confirmation. If volume and sentiment continue to build, this could be the beginning of a significant rally — one that may reset expectations for the rest of the cycle.

Ethereum Eyes Recovery Amid Rising Global Tensions

Global tensions and macroeconomic uncertainty continue to weigh heavily on investor sentiment, with the ongoing trade war between the US and China sending shockwaves through equities and high-risk assets. In the midst of this fragile backdrop, Ethereum has managed to find a solid support level around $1,500 and is now attempting to reclaim higher ground. After weeks of selling pressure that erased bullish expectations for the year, ETH is showing early signs of recovery.

Ethereum’s current price structure has become a focal point for market participants. The recent bounce from $1,500 marks a potential higher low, a technical setup often associated with trend reversals. If ETH can successfully push above the $1,700 mark and break the descending trendline, it could spark renewed momentum for bulls.

Runefelt shared an optimistic view, stating that Ethereum could go up really fast from here. According to his analysis, the next key price target sits at $3,000, assuming a confirmed breakout above short-term resistance levels.

Despite continued global risks, the Ethereum network remains fundamentally strong, with growing adoption in DeFi and real-world assets. If the breakout materializes and broader market sentiment stabilizes, ETH could lead the next leg of the crypto recovery.

Related Reading

Price Faces Key Resistance As Bulls Struggle for Momentum

Ethereum is currently trading at $1,630 after another failed attempt to break above the $1,700–$1,800 resistance zone. This price range has acted as a major barrier over the past several weeks, limiting bullish momentum and keeping ETH locked in a broader downtrend. Bulls must reclaim the local high at $1,691, set last week, to signal a potential shift in structure and confirm the start of a recovery rally.

A decisive move above $1,700 could open the door to a test of the $2,000 level, which would mark a significant psychological and technical milestone. However, the lack of follow-through on recent upside attempts reflects ongoing uncertainty across crypto markets, largely driven by macroeconomic tensions and risk-off sentiment.

Related Reading

If Ethereum fails to gain strength above current levels, a retracement toward $1,500 is likely, with the possibility of further downside if selling pressure intensifies. This level has served as a critical support zone in recent weeks. Without a convincing breakout, ETH remains vulnerable to renewed weakness and deeper corrections. All eyes are now on whether bulls can build enough momentum to flip resistance into support and avoid another leg down.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Enters Historic Buy Zone As Price Dips Below Key Level – Insights

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is currently trading at a critical resistance level as bulls attempt to regain momentum and push for a fresh high. The broader market remains under pressure as global uncertainty escalates, largely fueled by ongoing trade tensions between the United States and China. Last week, US President Donald Trump announced a 90-day tariff pause on all countries except China, intensifying concerns about an extended trade conflict that could destabilize global financial markets.

Related Reading

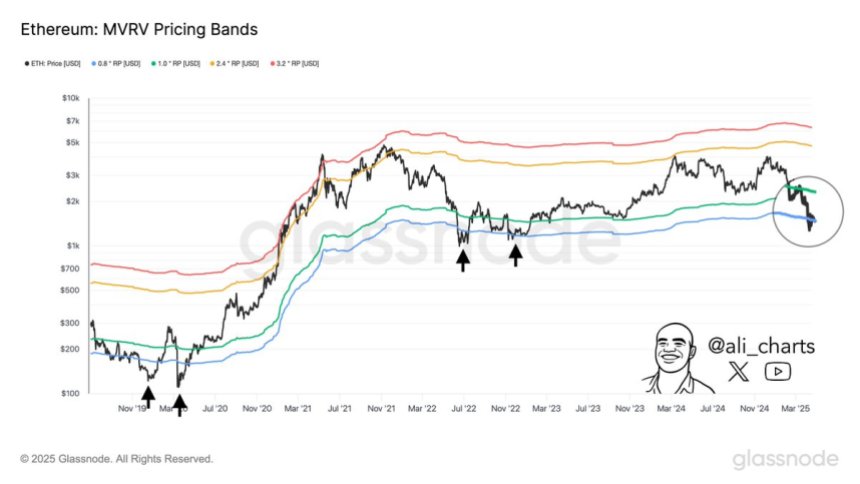

In this high-stakes environment, Ethereum’s price action is drawing close attention from investors and analysts. Top crypto analyst Ali Martinez shared that historically, the best Ethereum buying opportunities have emerged when the price drops below the lower MVRV (Market Value to Realized Value) Price Band—a level that signals potential undervaluation. Notably, ETH is now trading precisely in that zone.

This alignment between technical conditions and macroeconomic instability suggests that Ethereum could be entering a phase of accumulation, with long-term investors looking to capitalize on discounted prices. However, sustained upward momentum will depend on whether bulls can overcome immediate resistance and whether macro conditions improve. The coming days could prove pivotal for ETH as it tests both technical and psychological thresholds.

Ethereum Dips Into Historical Opportunity Zone

Ethereum is currently trading below key resistance levels after enduring several weeks of selling pressure and weak market performance. Since losing the crucial $2,000 support level, ETH has fallen roughly 21%, a clear indication that bulls have yet to regain control. Broader macroeconomic pressures, especially rising global tensions and uncertain trade conditions between the US and China, have further dampened market sentiment. These conditions have driven many investors to exit riskier assets like cryptocurrencies, leading to elevated volatility and reduced market participation.

Despite this downtrend, some analysts believe Ethereum could be nearing a pivotal turnaround zone. According to Martinez, one of the best historical signals for Ethereum accumulation has been price action dipping below the lower bound of the MVRV Price Band—a metric that compares market value to realized value to assess whether an asset is over- or undervalued. Currently, Ethereum is trading beneath that lower band.

Martinez emphasizes that this positioning has typically preceded strong upside reversals, especially during periods of extreme market pessimism. While short-term volatility may persist, ETH’s entry into this zone could present a rare opportunity for long-term investors to accumulate at historically discounted levels—if market conditions stabilize and sentiment shifts.

Related Reading

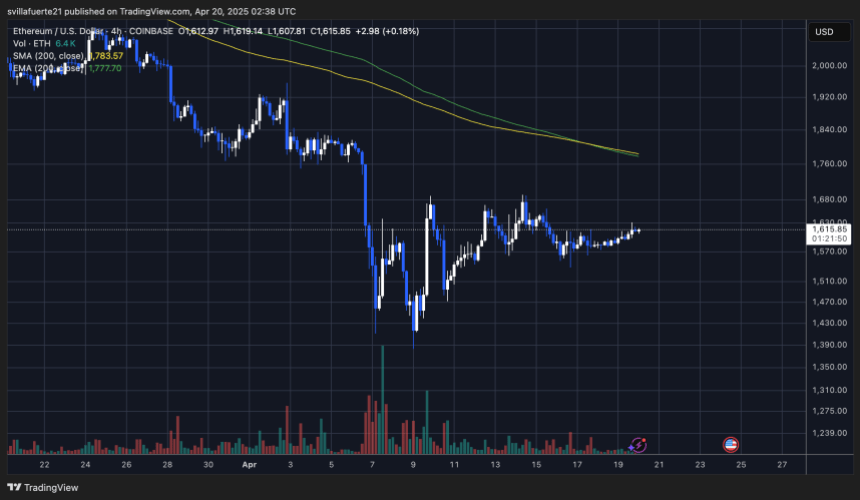

ETH Stalls In Tight Range

Ethereum is currently trading at $1,610 after nearly a week of low volatility and sideways action. Since last Tuesday, ETH has remained locked in a tight range between $1,550 and $1,630, reflecting the market’s uncertainty and hesitation to take a clear directional stance. This narrow trading zone highlights a period of price compression, often a precursor to a larger move in either direction.

For bulls to regain momentum and shift sentiment, Ethereum must reclaim the $1,700 level and push decisively above the $2,000 mark. These levels not only serve as key psychological barriers but also represent critical zones of previous support that have now turned into resistance. A breakout above $2,000 would likely trigger renewed buying interest and set the stage for a potential recovery rally.

Related Reading

However, if bearish pressure builds and the $1,550 floor is breached, Ethereum could quickly test the $1,500 support zone. A breakdown below that level would confirm further downside risk, potentially accelerating sell-offs and deepening the current correction. Until a breakout or breakdown occurs, traders should prepare for more consolidation and volatility as the market awaits a macro or technical catalyst.

Featured image from Dall-E, chart from TradingView

-

Bitcoin16 hours ago

Bitcoin16 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Bitcoin22 hours ago

Bitcoin22 hours agoHere Are The Bitcoin Levels To Watch For The Short Term

-

Market19 hours ago

Market19 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance

-

Market17 hours ago

Market17 hours agoSolana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

-

Altcoin14 hours ago

Altcoin14 hours agoExpert Reveals Why BlackRock Hasn’t Pushed for an XRP ETF

-

Altcoin19 hours ago

Altcoin19 hours agoExpert Says Solana Price To $2,000 Is Within Reach, Here’s How

-

Market16 hours ago

Market16 hours agoVitalik Buterin Proposes to Replace EVM with RISC-V

-

Altcoin9 hours ago

Altcoin9 hours agoWill Cardano Price Break Out Soon? Triangle Pattern Hints at 27% ADA Surge