Bitcoin

Will The Top Crypto Defy Historical Downtrends?

Bitcoin historically tends to have a tough time during the month of September, as quite often it delivers negative returns to traders. Despite the gloomy trend, the current forecast of BTC price is surprisingly rosy, anticipating it to rise 30% by October 1, 2024. But will this bullish forecast last, or is Bitcoin in for yet another raw deal in the weeks ahead?

BTC prices have not been able to stay above $60,000. The coin was most recently rejected at the psychological level on August 27. It then went through a quick 10% correction over the next two days. That drop helped wipe out $140 million in leveraged BTC longs. Speculators now join the chorus of many wondering: why can’t Bitcoin break through $60,000?

Mixed Bag Of Metrics

Despite this, on-chain evidence suggests otherwise. Santiment reported $4.2 billion in August 2024 crypto trading profits. Despite substantial profit-taking, whale transactions—large transfers worth $100,000 or more—have dropped to their lowest levels in almost four years, suggesting that big players are holding onto their crypto in anticipation of rising prices.

The supply of Bitcoin on exchanges has also fallen to its lowest in as many months. Normally, when the supply on exchanges begins to fall, this is a sign of bullishness. Less Bitcoin on the exchanges means less people looking to sell it. Theoretically, this can drive up the price of it.

But here is the catch: Spot Bitcoin ETFs that were supposedly going to herald unprecedented institutional inflows have seen underwhelming outflows. Some analysts make sure to note that ETF outflows are always a lagging indicator, as bearish mood after major news events usually reflects later on. Yet, such outflows only add more ambiguity to that, and traders simply remain in doubt whether this promise of institutional demand ever comes or just fizzles out.

ETF Outflows And Traditional Markets

Further, contributing to Bitcoin’s current quagmire is traditional finance. Concerns from conventional finance players caused the crypto asset’s $61,000 rejection. High dependence on tech firms, especially AI-driven ones, worries them. This has increased pessimism, matching market expectations for a 100% interest rate decrease in September.

Recent fluctuations in the price of Bitcoin have moved in lockstep with the S&P 500 index, underlining the increasingly correlated nature of cryptocurrency and traditional markets. That may mean the future of Bitcoin is pegged to general economic fortunes – for better or worse.

Bitcoin: Time To Buy?

At the time of writing, BTC was trading at $57,515, down 1.5% and 10.3% in the 24-hour and weekly timeframe, data from Coingecko shows.

Although on-chain statistics show promise, the prevailing mood is far from optimistic. By October, CoinCodex’s most recent Bitcoin price estimate predicts the price 40%. That is rather significant. Their technical indicators, however, show a bearish attitude, and the Fear & Greed Index comes out as Fearful, at 26.

Featured image from CNBC, chart from TradingView

Bitcoin

Why Did MicroStrategy Pause Its Bitcoin Acquisitions Last Week?

Strategy (formerly MicroStrategy) did not buy any Bitcoin or sell any common stock this week, breaking a long-running streak. The firm officially disclosed that it has $5.91 billion in unrealized losses due to downturns in the crypto market.

Two likely scenarios explain this pause: Strategy is either waiting for more favorable market conditions or is forced into caution by these losses. Either way, the uncertainty may signal further apprehension among institutional investors.

MicroStrategy’s Bitcoin Purchase Pause: Cautious Signal or Liquidity Move?

Since Michael Saylor directed Strategy (formerly MicroStrategy) to start acquiring Bitcoin, it has become one of the world’s largest BTC holders. So far, it’s been a major purchaser in 2025, acquiring around $2 billion in Bitcoin on two occasions.

However, according to its most recent Form 8-K, Strategy bought zero BTC last week and didn’t sell any stock, either.

This isn’t the first interruption in Strategy’s Bitcoin purchases this year; it also paused acquisitions in February. Unlike that incident, this time feels substantially different due to fears of a US recession.

The pause in Bitcoin buying may suggest that Strategy’s management is taking a wait-and-see approach amid ongoing market volatility, possibly indicating that they believe Bitcoin could bottom out further before resuming purchases.

Billions have been liquidated from crypto and TradFi alike, and corporate Bitcoin holders have suffered serious losses.

The firm may also be trying to break its historic streak of consecutive purchases to avoid further downside risk until clearer market trends emerge.

However, a few prominent voices are taking a much more critical approach. The same Form 8-K shows that Strategy currently has $5.91 billion in unrealized losses in its Bitcoin holdings. There were already concerns about the firm’s liquidity, tax obligations, and over-leveraged debts.

Some community members are wondering how Saylor can avoid a crisis:

“Michael Saylor’s average BTC cost basis is ~$67,500. A 15% drop puts MicroStrategy deep in the red. That’s the thin line between ‘visionary CEO’ and ‘leveraged lunatic with a God complex,’” claimed Edward Farina via social media.

What’s Next for Strategy?

Essentially, Strategy serves as a major pillar of confidence in Bitcoin. If the firm sells, the market will notice. The crypto ecosystem carefully documents minor discrepancies in the firm’s BTC purchasing strategy, and a sale would be highly bearish.

Meanwhile, firms are already inventing novel ETF tools to short the company, praying for its collapse. What’s the best path to move forward?

So far, Saylor has been quiet about these market turns. MicroStrategy may be biding its time, planning to pull out another huge Bitcoin purchase whenever the market bottoms out.

It may also be paralyzed, unable to act due to its debt crisis and unrealized losses. For now, the uncertainty may signal broader apprehension among institutional investors.

This cautious stance may signal broader apprehension among institutional investors regarding current crypto market conditions, hinting at a potential pause before a renewed accumulation phase if market fundamentals improve.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

US Trade Tariffs Trigger $240 Million Crypto Outflows Last Week

Crypto ETPs (exchange-traded products) saw a significant setback last week, as outflows reached $240 million.

The turnout follows escalating trade tensions in the US, sparking investor caution amidst President Donald Trump’s sweeping new import tariffs.

Crypto Outflows Hit $240 Million Last Week

According to the latest CoinShares report, crypto outflows totaled $240 million last week, primarily driven by fears that trade disruptions could stall global growth.

“Digital asset investment products saw outflows totaling $240m last week, likely in response to recent US trade tariff news that poses a threat to economic growth,” CoinShares’ James Butterfill noted.

Bitcoin alone accounted for $207 million of the outflows, significantly denting its year-to-date (YTD) inflow volume, which now stands at $1.3 billion.

Ethereum products also suffered, posting $37.7 million in outflows. Solana and Sui followed with $1.8 million and $4.7 million, respectively.

This marks a sharp reversal from the previous week’s report, which had seen $18 million in altcoin inflows, ending a four-week losing streak.

The shift in sentiment reflects deepening investor uncertainty across all asset classes. While the sell-off was widespread, the US led the outflows with $210 million. This supports the argument that President Trump’s tariffs contributed to the growing market uncertainty.

BeInCrypto reported that Trump plans reciprocal tariffs. The plan, announced as part of the president’s “America First” trade agenda, includes two key components. The first was a baseline 10% tariff on all imports into the US starting April 5, affecting nearly all trading partners.

Second, higher “reciprocal” tariffs, ranging from 11% to 50%, will target specific countries with significant trade surpluses with the US or high barriers to American goods. These escalated rates, affecting around 57 to 90 countries, will start on April 9.

In this regard, China faces a 34% reciprocal tariff on top of an existing 20% tariff, totaling 54%. Meanwhile, the European Union faces 20%, Japan 24%, and Vietnam up to 46%.

Against this backdrop, local media reported that China called out the US for economic bullying.

“China accuses the US of unilateralism, protectionism, and economic bullying with tariffs,” analyst Jackson Hinkle remarked.

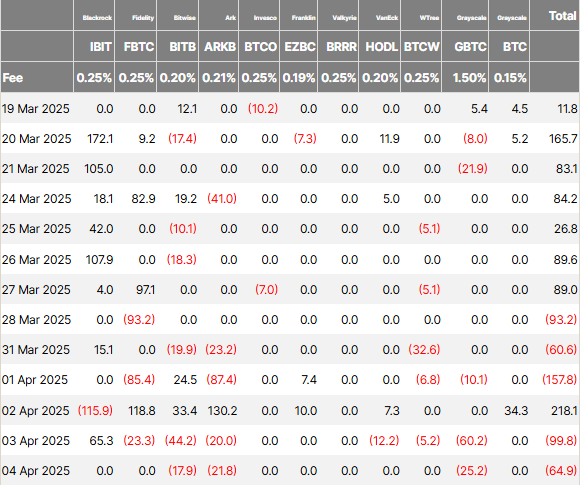

US Bitcoin ETFs See $172 Million in Outflows.

Meanwhile, institutional retreat was most evident in the US spot Bitcoin ETF (exchange-traded fund) market. These financial instruments posted $172.89 million in net outflows last week, ending a two-week inflow streak that had added nearly $941 million.

According to data from SoSoValue, most redemptions occurred across four of the five trading days, reflecting the scale of investor unease.

Data on Farside Investors corroborates the outlook, showing Grayscale’s GBTC led the pack with $95.5 million in outflows, followed by WisdomTree’s BTCW at $44.6 million.

Other ETFs, including BlackRock’s IBIT, Bitwise’s BITB, ARK 21Shares’ ARKB, and VanEck’s HODL, reported redemptions ranging from $4.9 million to $35.5 million.

Despite a strong mid-week inflow of $220.76 million on April 3, it was not enough to counter the heavy losses sustained on other days. Monday through Friday saw consistent outflows, with Tuesday alone recording $157.64 million in redemptions.

Ethereum ETFs were also not spared, marking six consecutive weeks of outflows totaling nearly $800 million since February. Last week alone, Ethereum funds saw $49.93 million in redemptions, reinforcing the narrative of widespread risk aversion.

Still, some bright spots emerged. Franklin Templeton’s EZBC, Fidelity’s FBTC, and Grayscale’s newer spot, Bitcoin Trust, collectively saw $61.8 million in inflows. This suggests selective institutional interest remains.

CryptoQuant CEO Ki Young Ju addressed the broader panic, emphasizing that institutional flows still rely heavily on on-chain settlements.

“Dismissing on-chain data due to paper Bitcoin is misguided; it’s essential for understanding market supply and demand dynamics,” he said on X (Twitter).

As the second week of Q2 begins, investors monitor whether the pullback represents a temporary correction. According to Standard Chartered Bank, Bitcoin could rebound as early as Friday. Meanwhile, sentiment suggests it could start a deeper structural shift in crypto’s institutional narrative.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Drop Hits Companies Holding Digital Assets Hard

Public companies are grappling with mounting losses from their Bitcoin (BTC) reserve strategies as the cryptocurrency’s value plunges.

This comes as BTC dropped below $80,000, sparking renewed debate over the risks of corporate investments in digital currencies.

Are Bitcoin Reserve Strategies Backfiring for Companies?

The week opened on a grim note for the cryptocurrency market, with many referring to it as a “Black Monday.” According to BeInCrypto data, Bitcoin saw a sharp decline of 9.6% in the past 24 hours, falling to $75,089 at the time of writing.

The liquidation figures have been equally staggering. According to Coinglass, Bitcoin experienced the highest liquidations in the same timeframe, totaling $474 million. Of that, $405.7 million came from long liquidations, while $68.2 million was from short liquidations.

Importantly, companies holding Bitcoin reserves have not been spared from the recent market bloodbath. Many now face significant unrealized losses amid Bitcoin’s sharp downturn.

According to data from Bitcoin Treasuries, the NGU ratio, which measures the difference between the current Bitcoin value and the cost basis of a company’s holdings, has turned red for many firms.

This indicated that the current market price of Bitcoin is now below the acquisition cost for many institutional investors. For example, Metaplanet (3350.T) is experiencing a 12.4% unrealized loss on its Bitcoin holdings. The company currently holds 4,206 Bitcoins, valued at approximately $314.7 million, with an average cost per Bitcoin of $85,483.

Similarly, The Blockchain Group’s (ALTBG.PA) portfolio is down 14.4%. Holding 620 Bitcoins valued at $46.39 million, the company’s average cost per Bitcoin is $87,424.

Semler Scientific (SMLR) has also felt the impact, with a 14.7% loss on its portfolio. The company holds 3,192 Bitcoins valued at $238.9 million, with an average cost of $87,850 per Bitcoin.

Even Strategy (MSTR), an early player in corporate Bitcoin adoption, is facing challenges. Since beginning its Bitcoin acquisition in August 2020, the company has accumulated 528,185 Bitcoins, valued at $39.5 billion, with an average cost of $67,485 per Bitcoin, resulting in an overall profit of 10.9%.

However, data from SaylorTracker reveals that all Bitcoin purchased by the firm since November 2024 is currently at a loss. These acquisitions were made at prices ranging from $83,000 to as high as $106,000 per Bitcoin.

Meanwhile, the decline in Bitcoin’s value has had a significant ripple effect on the firms’ stocks. 3350.T saw a sharp 20.2% drop in its stock price, while ALTBG.PA experienced a 15.8% decline.

SMLR experienced a smaller 0.6% dip but still reflected the broader market trend. Lastly, MSTR dropped 11.2% in pre-market trading despite some initial resilience.

Amid this market crash, Peter Schiff, economist and long-time Bitcoin skeptic, took aim at Strategy.

“Attention Saylor, now that Bitcoin is below $80,000, if you want to prevent it from crashing below your average cost of $68,000, you had better back up the truck with borrowed money today and go all in,” he posted on X.

The economist further predicted that the company’s Bitcoin strategy could lead to its downfall.

“It will end with the bankruptcy of MSTR,” Schiff stated.

He also questioned Bitcoin’s value as a safe haven asset. Schiff stressed that the coin’s substantial decline compared to other assets makes it an unreliable store of value, especially during market selloffs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?

-

Bitcoin20 hours ago

Bitcoin20 hours ago$1 Billion in Liquidations Over the Weekend

-

Market23 hours ago

Market23 hours agoSolana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?

-

Market20 hours ago

Market20 hours agoSolana (SOL) Price Falls Below $100, Crashes To 14-Month Low

-

Bitcoin18 hours ago

Bitcoin18 hours agoWill 2025’s Crypto Market Mirror 2020’s Rebound? Analysts Predict

-

Market17 hours ago

Market17 hours agoBitcoin Price Crashes Hard—Is The Selloff Just Getting Started?

-

Market13 hours ago

Market13 hours agoBinance Founder CZ Joins Pakistan Crypto Council as Advisor

-

Altcoin13 hours ago

Altcoin13 hours agoDogecoin Whale Dumps 300M Coins Amid Market Crash, Can DOGE Price Dip Below $0.1?