Bitcoin

US Trade Tariffs Trigger $240 Million Crypto Outflows Last Week

Crypto ETPs (exchange-traded products) saw a significant setback last week, as outflows reached $240 million.

The turnout follows escalating trade tensions in the US, sparking investor caution amidst President Donald Trump’s sweeping new import tariffs.

Crypto Outflows Hit $240 Million Last Week

According to the latest CoinShares report, crypto outflows totaled $240 million last week, primarily driven by fears that trade disruptions could stall global growth.

“Digital asset investment products saw outflows totaling $240m last week, likely in response to recent US trade tariff news that poses a threat to economic growth,” CoinShares’ James Butterfill noted.

Bitcoin alone accounted for $207 million of the outflows, significantly denting its year-to-date (YTD) inflow volume, which now stands at $1.3 billion.

Ethereum products also suffered, posting $37.7 million in outflows. Solana and Sui followed with $1.8 million and $4.7 million, respectively.

This marks a sharp reversal from the previous week’s report, which had seen $18 million in altcoin inflows, ending a four-week losing streak.

The shift in sentiment reflects deepening investor uncertainty across all asset classes. While the sell-off was widespread, the US led the outflows with $210 million. This supports the argument that President Trump’s tariffs contributed to the growing market uncertainty.

BeInCrypto reported that Trump plans reciprocal tariffs. The plan, announced as part of the president’s “America First” trade agenda, includes two key components. The first was a baseline 10% tariff on all imports into the US starting April 5, affecting nearly all trading partners.

Second, higher “reciprocal” tariffs, ranging from 11% to 50%, will target specific countries with significant trade surpluses with the US or high barriers to American goods. These escalated rates, affecting around 57 to 90 countries, will start on April 9.

In this regard, China faces a 34% reciprocal tariff on top of an existing 20% tariff, totaling 54%. Meanwhile, the European Union faces 20%, Japan 24%, and Vietnam up to 46%.

Against this backdrop, local media reported that China called out the US for economic bullying.

“China accuses the US of unilateralism, protectionism, and economic bullying with tariffs,” analyst Jackson Hinkle remarked.

US Bitcoin ETFs See $172 Million in Outflows.

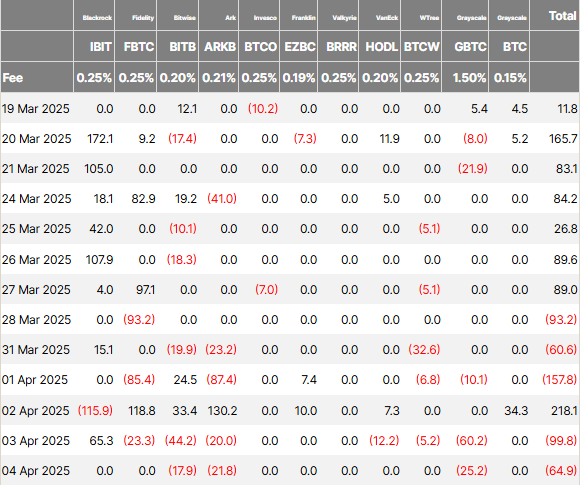

Meanwhile, institutional retreat was most evident in the US spot Bitcoin ETF (exchange-traded fund) market. These financial instruments posted $172.89 million in net outflows last week, ending a two-week inflow streak that had added nearly $941 million.

According to data from SoSoValue, most redemptions occurred across four of the five trading days, reflecting the scale of investor unease.

Data on Farside Investors corroborates the outlook, showing Grayscale’s GBTC led the pack with $95.5 million in outflows, followed by WisdomTree’s BTCW at $44.6 million.

Other ETFs, including BlackRock’s IBIT, Bitwise’s BITB, ARK 21Shares’ ARKB, and VanEck’s HODL, reported redemptions ranging from $4.9 million to $35.5 million.

Despite a strong mid-week inflow of $220.76 million on April 3, it was not enough to counter the heavy losses sustained on other days. Monday through Friday saw consistent outflows, with Tuesday alone recording $157.64 million in redemptions.

Ethereum ETFs were also not spared, marking six consecutive weeks of outflows totaling nearly $800 million since February. Last week alone, Ethereum funds saw $49.93 million in redemptions, reinforcing the narrative of widespread risk aversion.

Still, some bright spots emerged. Franklin Templeton’s EZBC, Fidelity’s FBTC, and Grayscale’s newer spot, Bitcoin Trust, collectively saw $61.8 million in inflows. This suggests selective institutional interest remains.

CryptoQuant CEO Ki Young Ju addressed the broader panic, emphasizing that institutional flows still rely heavily on on-chain settlements.

“Dismissing on-chain data due to paper Bitcoin is misguided; it’s essential for understanding market supply and demand dynamics,” he said on X (Twitter).

As the second week of Q2 begins, investors monitor whether the pullback represents a temporary correction. According to Standard Chartered Bank, Bitcoin could rebound as early as Friday. Meanwhile, sentiment suggests it could start a deeper structural shift in crypto’s institutional narrative.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

CryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

Ki Young Ju, the CEO of blockchain analytics platform CryptoQuant, has declared that the Bitcoin bull cycle is over. Notably, the premier cryptocurrency has struggled to establish a sustained uptrend since hitting a new all-time high of around $109,000 in January, causing doubts about the viability of the current bull run.

Bitcoin’s Unresponsive Price Points To Bear Market Onset

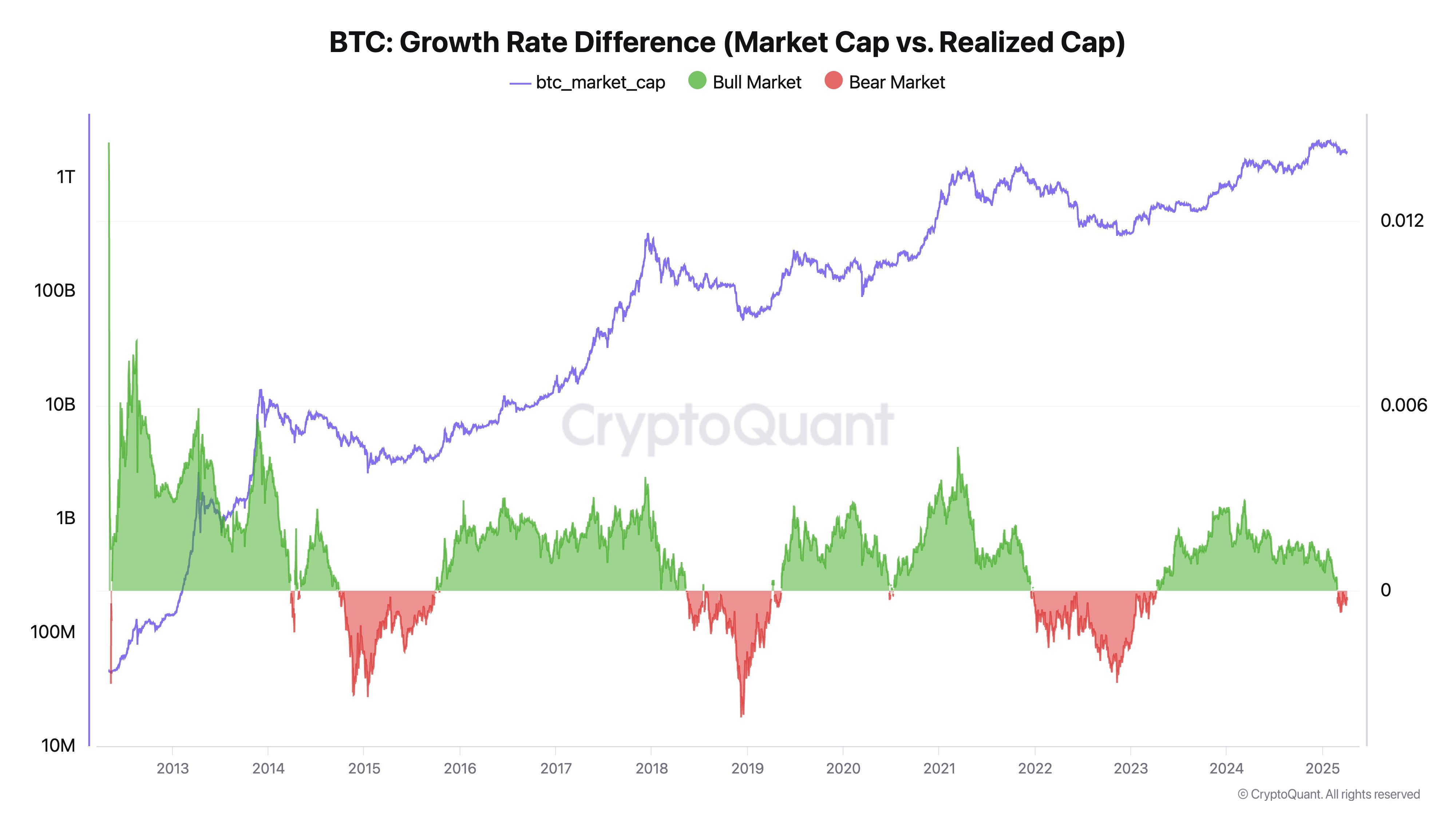

In an X post on April 5, Ki Young Ju shared an interesting theory on why Bitcoin may have concluded its current bull run. The prominent crypto figure has based this postulation on on-chain data concepts around the Realized Cap and the Market Cap.

Young Ju describes the Realized Cap as the total capital that flows into the BTC market as revealed by actual on-chain activity. The Realized cap reveals a more accurate measurement of the BTC network by summing the price at which each coin last moved.

On the other hand, the Market Cap provides a BTC network valuation based on the latest exchange trading prices. The CryptoQuant CEO explains that market cap/prices do not increase or decrease in proportion to transaction sizes based on common misconceptions but in response to the balance between buying and selling pressure.

Young Ju states that amidst low sell pressure, a small buy can cause a rise in price and market cap. On the other hand, large Bitcoin purchases during high sell pressure can fail to effect a positive price reaction as the market consists of a high number of sellers.

Looking at both concepts, it is understood that Realized Cap measures the capital inflows into the BTC market while Market Cap indicates price reaction to these inflows. Therefore, the CryptoQuant boss explains that a rise in Realized Cap, while Market Cap declines or remains unchanged, presents a classic bearish signal as prices are failing to respond positively despite new investments.

Alternatively, a stagnant Realized Cap accompanied by an increased Market Cap is a bullish signal that reflects the low level of sellers; thus any small amount of new capital can induce substantial price gains.

Ki Young Ju states the former situation is currently playing out in the Bitcoin market with prices failing to rise inflow as indicated by on-chain data in exchange transactions, ETF markets, and custodial wallets activity. This development suggests the presence of a bear market. While Young Ju states that the current sell pressure could wane at any time, historical data supports a reversal period of at least six months.

Bitcoin Price Overview

At press time, Bitcoin was trading at $83,700 reflecting a decline of 0.94% in the past day.

Featured image from TheStreet, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Satoshi Nakamoto Turns 50 — Still No Idea Who He Is

Today is the 50th birthday of Bitcoin’s enigmatic inventor, Satoshi Nakamoto. After all these years, nobody has a clue who he actually is. But his creation, Bitcoin, has revolutionized the world of finance in a huge way.

Since its introduction in 2009, Bitcoin has evolved from a tech test to one of the most popular digital currencies around. Its decentralized nature has raised serious discussions about the future of money and if traditional banking might one day become obsolete.

Satoshi Nakamoto Birthday: Why April 5 Matters

According to his old P2P Foundation profile, Satoshi Nakamoto’s birthday is listed as April 5, 1975—a date that might hold more symbolic weight than actual truth. What makes April 5 stand out? It’s the same day in 1933 when President Franklin D. Roosevelt signed Executive Order 6102, compelling Americans to surrender their gold to the government.

That moment marked a major transfer of financial power from individuals to the state—a stark contrast to Bitcoin’s core philosophy. Many believe Nakamoto chose this date on purpose, as a subtle nod to decentralization and a quiet rebellion against monetary control.

Bitcoin appears to be in contrast to that level of control. It’s decentralized, and its own supply is limited to 21 million coins. Many feel that Satoshi chose April 5 as a gesture of a departure from government-controlled money and towards financial freedom.

Big Names Are Now Backing Bitcoin

Bitcoin is no longer only for tech enthusiasts. Large corporations and institutions are now joining the bandwagon. Strategy (formerly MicroStrategy), for instance, owns more than 500,000 Bitcoin, valued in billions. Michael Saylor, Strategy’s executive chairman and co-founder, has been a strong supporter, frequently referring to Bitcoin as a “safer and more powerful store of value” than the US dollar.

Source: Gemini Imagen

Even BlackRock, the biggest asset manager globally, is interested. CEO Larry Fink just stated that Bitcoin could rival the dollar. He cited the increased US debt and inflation as reasons more individuals may flock to Bitcoin.

A Hedge In Uncertain Times

As inflation concerns grow, increasing numbers of individuals are turning to Bitcoin as a means of safeguarding their funds. In contrast to traditional currencies, which can be printed by governments without limit, Bitcoin is capped. This has prompted some to liken it to gold.

Would Bitcoin Replace The Dollar?

As Bitcoin continues to appreciate in value and popularity — an as the mystery surrounding Satoshi Nakamoto deepens – there is increasingly much being said about its place in the future world economy.

Some even believe it might dethrone the US dollar as the world’s currency of choice. That’s still a huge “maybe,” though. Supporters of Bitcoin, however, claim its decentralized nature and inherent scarcity make it a serious contender to be a long-term player in the financial world.

Featured image from Gemini Imagen, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Scottish School Lomond Pioneers Bitcoin Tuition Payment In The UK

The Lomond School in Scotland has become the first academic institution in the United Kingdom to accept tuition payments in Bitcoin (BTC) representing a major step in crypto mainstream adoption.

Bitcoin Represents Independence And Innovation, Lomond Says

In a recent blog post, Lomond School announced the inclusion of BTC as a payment option for tuition fees. The management of the British school explains that this decision was driven by multiple factors including Bitcoin’s alignment with independent thinking and innovation which are part of the school’s core ethos.

Lomond describes Bitcoin as a decentralized asset with no central authority and is easily accessible and transferable, thus reflecting important principles such as democracy and inclusion.

A statement by the school reads:

… Bitcoin is available to anyone willing to learn—making it more democratic and inclusive, particularly for people in developing nations who lack access to traditional banking. Lomond sees Bitcoin as a perfect real-world case study in economics, computing, ethics, and innovation.

The Scottish school further states that the adoption of BTC as a payment alternative is also driven by significant demand from local parents and international agents, showcasing the rising global acceptance of cryptocurrencies as viable financial assets.

However, Lomond has stated the school will only deal with Bitcoin at the moment which has distinguished itself from other cryptocurrencies in terms of “security, scarcity, transparency and resilience.”

Lomond: Bitcoin Treasury Is Feasible

To assuage customer fears about blockchain security, Lomond has stated that these BTC payments will be received by regulated and KYC-compliant partners — Musket and CoinCorner, on behalf of the school. However, despite this crypto-friendly approach, Lomond has stated that all Bitcoin received will be immediately converted to the Great Britain Pounds (GBP) to avoid dealing with the crypto market volatility.

Nevertheless, there is the possibility of establishing a BTC Treasury in the advent of significant support from the school community.

Lomond says:

The (Bitcoin) treasury is a phased goal, not an immediate change, and it depends entirely on community support and the school’s ability to responsibly “stack sats” over time.

While Lomond may be the first British school to dabble into Bitcoin payments, academic institutions in other countries have long explored the use of the premier cryptocurrency. Some of these schools include Wharton College in the University of Pennsylvania, King’s College in New York, and major universities in El Salvador among others. Meanwhile, other academic institutions such as the University of Wyoming have developed ample resources to conduct peer-reviewed research on the “digital gold.”

At the time of writing, BTC continues to trade at $83,230 after a 3.65% price gain in the last 24 hours.

Featured image from Pexels, chart from tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin24 hours ago

Altcoin24 hours agoBankless Cofounder David Hoffman Reveals Strategy To Improve Ethereum Price Performance

-

Market24 hours ago

Market24 hours agoSolana Bulls Lead 17% Recovery, Targeting $138

-

Market21 hours ago

Market21 hours agoXRP Price To Hit $45? Here’s What Happens If It Mimics 2017 And 2021 Rallies

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum (ETH) Consolidates Within Tight Range As Key Support Level Forms

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin Price Volatility Far Lower Than During COVID-19 Crash — What This Means

-

Bitcoin14 hours ago

Bitcoin14 hours agoBitcoin Set For Challenge With Two Major Resistance Zones

-

Ethereum10 hours ago

Ethereum10 hours agoEthereum Inverse Head And Shoulders – The Pattern That Could Spark A Reversal

-

Bitcoin7 hours ago

Bitcoin7 hours agoScottish School Lomond Pioneers Bitcoin Tuition Payment In The UK