Bitcoin

Ultra-Rich Get Exclusive Access To New ETF

Thailand has taken its first tentative steps into the world of Bitcoin with the launch of a unique exchange-traded fund (ETF) aimed at high net-worth individuals and institutions. This comes amidst a global surge in interest in cryptocurrencies, but with Thai regulators taking a cautious approach, prioritizing security and controlled access for beginners.

Limited Access For The Privileged Few

The Securities and Exchange Commission (SEC) has given its nod to the ONE Bitcoin ETF Fund of Funds Unhedged, offered by One Asset Management (ONEAM), Thailand-headquartered daily Bangkok Post disclosed, Tuesday. Unlike traditional ETFs accessible to the general public, this one comes with a hefty entry barrier.

Only accredited investors, a category encompassing institutions and wealthy individuals, can participate. This restricted access reflects a common theme in Asia, where regulators are taking a measured approach to Bitcoin. While China has cracked down heavily, others like South Korea and Japan have implemented stricter know-your-customer (KYC) regulations and listing requirements for crypto exchanges.

Security First: Bitcoin Wrapped In A Safety Net

The ONEAM ETF offers a twist on the typical investment model. Instead of directly holding the top crypto, the fund invests in a basket of 11 well-established global Bitcoin funds. This “fund-of-funds” structure aims to mitigate risks associated with individual trading platforms, which have faced issues like data breaches and stolen digital assets in the past.

BTCUSD trading at $68,940 on the 24-hour chart: TradingView.com

Furthermore, the ETF emphasizes secure storage practices, employing international standards and custodians used by institutional investors. These custodians store Bitcoin offline, significantly reducing the vulnerability to online attacks.

A Diversification Play

For accredited investors, the allure of Bitcoin lies in its potential to diversify their portfolios. The coin’s price movements tend to have a low correlation with traditional assets like stocks and bonds. This means that including a small allocation of BTC can help reduce overall portfolio volatility.

Despite its potential benefits, the SEC acknowledges the inherent risks of investing in crypto. Bitcoin’s history is marked by high volatility, with significant price swings. To manage this risk, ONEAM recommends a cautious approach, suggesting investors allocate only 5% of their portfolio to Bitcoin.

A Measured Step Forward For Thailand

Thailand’s foray into Bitcoin ETFs represents a calculated move by regulators. It acknowledges the growing interest in cryptocurrency but prioritizes protecting less sophisticated investors. The limited access and focus on secure storage reflect this cautious approach.

This stands in contrast to some other Asian markets, like Hong Kong, which recently approved ETFs that directly invest in both Bitcoin and Ethereum, potentially opening the doors to a wider range of investors.

Featured image from Pastel, chart from TradingView

Bitcoin

Goldman Sachs Raises US Recession Odds to 45%

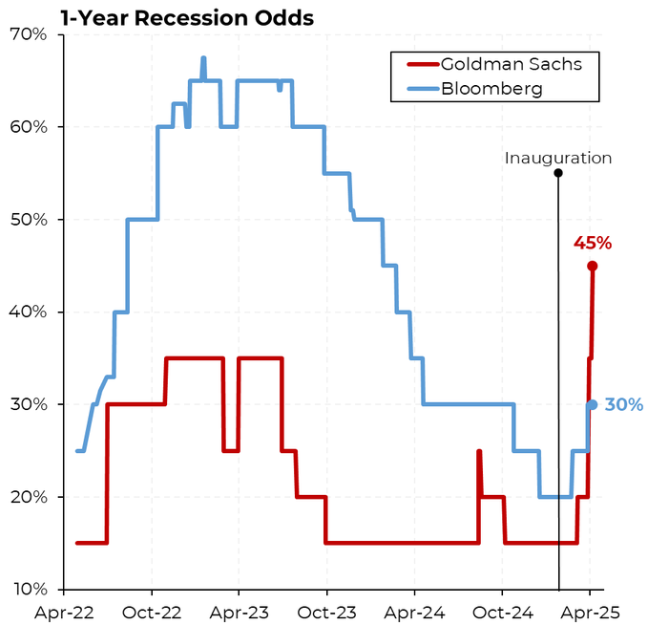

Goldman Sachs has raised its probability of a US recession within the next year to 45%. The prediction signals increased economic uncertainty amid escalating global tensions, tightening financial conditions, and looming tariff impacts.

This marks the highest probability of recession predicted by the investment bank since the post-pandemic inflation and interest rate hikes began.

Goldman Sachs Sees 45% Chances of US Recession

Goldman Sachs’ latest note, “Countdown to Recession,” outlines a sharp deterioration in economic conditions. These include the implications of tariffs expected to take effect on April 9.

Steven Rattner, former head of the Obama Auto Task Force and current Wall Street financier, shared the news on social media, emphasizing the gravity of Goldman’s new outlook.

“Goldman Sachs now predicts a 45% chance of a recession in the next year,” Rattner wrote.

According to Rattner, the recent surge in policy uncertainty and capital spending concerns compound financial market instability.

Meanwhile, Nick Timiraos, the chief economics correspondent for The Wall Street Journal, echoed the news, indicating the bank has adjusted its 2025 Q4 GDP growth forecast to a mere 0.5%.

“We are lowering our 2025 Q4/Q4 GDP growth forecast to 0.5% and raising our 12-month recession probability from 35% to 45% following a sharp tightening in financial conditions, foreign consumer boycotts, and a continued spike in policy uncertainty that is likely to depress capital spending by more than we had previously assumed,” Timiraos reported, citing Goldman Sachs.

While this reflects the anticipated fallout, the bank’s current forecast assumes that many new tariffs scheduled for April 9 will not materialize.

However, Goldman Sachs articulated that if Trump enacted these tariffs, the bank would adjust its prediction and formally forecast a recession. This could fuel already simmering inflation and drive further downward pressure on US economic growth.

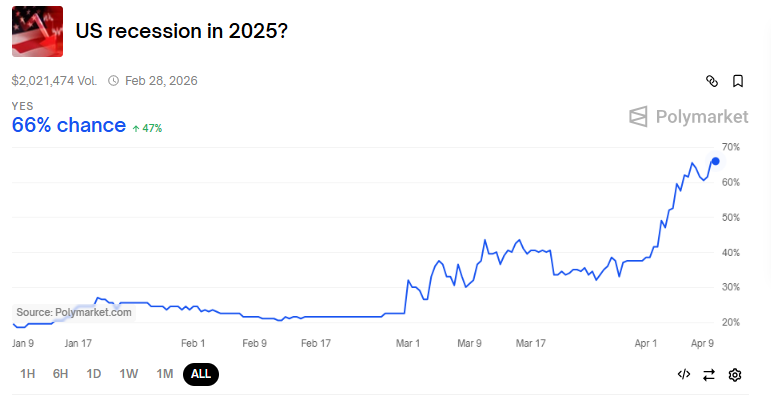

Amid escalating trade tensions, Polymarket bettors see almost 70% odds of US recession after Liberation Day tariffs.

Goldman Sachs Ups Bitcoin ETF Holdings

Despite the grim outlook for the economy, Goldman Sachs remains heavily invested in the crypto space, particularly Bitcoin (BTC). As of February 12, the bank held a substantial $1.5 billion in Bitcoin. This exposure comes through exposure to BlackRock and Fidelity’s Bitcoin ETFs (exchange-traded funds).

Moreover, recent filings reveal that Goldman Sachs has significantly increased its Bitcoin ETF holdings. Compared to previous filings, it boosted its position in the iShares Bitcoin Trust (IBIT) by 88% and the Franklin Bitcoin Trust (FBTC) by 105%.

This position reflects Goldman Sachs’ growing interest in digital assets as an alternative store of value amid traditional market instability.

This increase comes as Bitcoin has shown resilience in recent months, outpacing many other asset classes in performance. Recently, the bank’s CEO, David Solomon, highlighted the potential of blockchain technology to streamline traditional finance (TradFi). BeInCrypto reported Solomon saying Bitcoin was not a threat to the US dollar.

Besides Goldman Sachs, JPMorgan also predicted a recession in the US. BeInCrypto reported that it was the first major Wall Street bank to predict a US recession following former President Trump’s tariffs.

Their forecast warned of the broader economic consequences of trade wars, predicting that the Federal Reserve (Fed) might need to cut rates sooner than expected.

The possibility of a rate cut, which many see as a response to a weakening economy, adds to concerns about stagflation—a simultaneous rise in inflation and stagnation in economic growth.

This economic uncertainty also raises the odds of quantitative easing (QE) in the US financial system. Such an outcome could have far-reaching implications for the crypto market.

If the Fed opts for stealth QE, it could inject liquidity into the market and provide a short-term lifeline for risk assets like Bitcoin.

However, such actions could also intensify inflationary pressures, prompting a difficult balancing act for policymakers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Why Bitcoin’s Value Could Benefit from Trade War, Analyst Explains

Escalating trade war tensions have triggered widespread market volatility, prompting growing concerns among investors. Yet, one analyst suggests that these very uncertainties could act as a catalyst for Bitcoin’s (BTC) value growth.

The outlook emerges as Bitcoin struggles to gain momentum, with both traditional and cryptocurrency markets showing signs of widespread losses.

Could a Trade War Be Bitcoin’s Big Break? Five Key Factors Driving Value Growth

In a detailed analysis posted on the social media platform X (formerly Twitter), Ben Sigman, analyst, and CEO of Bitcoin Libre, outlined five distinct factors through which a tariff-driven conflict could trigger a rise in Bitcoin’s value.

His first point revolved around the US dollar’s potential trajectory. According to him, a trade war would strengthen the dollar. Yet, a subsequent collapse would reverse this.

“Tariffs spike the dollar. EMs crack under $12 Trillion in USD debt. Trust in fiat slips. Capital scrambles for fixed-supply safety,” he said.

Sigman suggested that in this case, capital may seek refuge in assets with a fixed supply, such as Bitcoin, positioning it as a safeguard against financial instability.

Next, he pointed to Bitcoin’s potential as a hedge against inflation. Tariffs often disrupt global supply chains, increasing the cost of goods and stifling economic growth. In response, central banks, including the Federal Reserve, may reduce interest rates, thereby devaluing national currencies.

Sigman argued that Bitcoin’s inherent scarcity and global accessibility render it a compelling hedge in such a scenario.

Third, Sigman highlighted the accelerating trend of de-dollarization. He explained that nations such as China, which now conducts 56% of its trade invoicing in yuan, are increasingly seeking alternatives to the US dollar.

According to him, the BRICS (Brazil, Russia, India, China, and South Africa) coalition will also develop alternative financial systems. However, this shift is not without risks, as it could lead to capital flight.

“Bitcoin thrives in a fragmented world as the neutral, global option,” he claimed.

Fourth, Sigman predicted market panic. He estimates that a single tariff cycle could erase $5 trillion in market value, flatten bond yields, and render traditional safe-haven assets, such as gold, less attractive.

In such an environment, Bitcoin’s volatility may attract investors seeking high-risk, high-reward opportunities, potentially driving substantial capital inflows.

Finally, Sigman contended that a trade war could expose systemic vulnerabilities in global institutions. Tariffs may precipitate debt defaults and erode trust in fiat-based systems, prompting investors to turn to Bitcoin.

“Bitcoin was built for this – permissionless, borderless, bankless,” he concluded.

Nevertheless, not all analysts share Sigman’s optimism. Another prominent commentator, Fred Krueger, recently outlined nine predictions regarding the potential imposition of tariffs exceeding 100% on China within the next year. He forecasted that this measure could lead to significant declines in Bitcoin and other cryptocurrencies like Solana (SOL).

“All goes down together. at some point this ends. When? Trump is unfortunately insane and badly advised,” Krueger wrote.

When asked whether Bitcoin will go to zero, he quipped, stating,

“I will take it all at $1.”

As trade tensions between the US and China intensify—driven by further tariffs on Chinese goods and broader geopolitical frictions—the role of Bitcoin in the global financial sector remains intensely scrutinized. How the largest cryptocurrency performs in the long term remains to be seen.

For now, the market appears quite bearish. BeInCrypto data showed that over the past day, BTC dipped 3.1%. At the time of writing, it was trading at $76,914.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

How Trump’s Tariffs Threaten Bitcoin Mining in the US

According to a recent report, President Trump’s new tariffs may fundamentally shift the dynamics of global Bitcoin (BTC) mining, making the US less competitive than other countries.

The tariffs, announced by the Trump administration on April 2, are set to escalate the cost of essential mining equipment, impacting imports and even the global hashrate.

Impact of Trump’s Tariffs on Bitcoin Mining

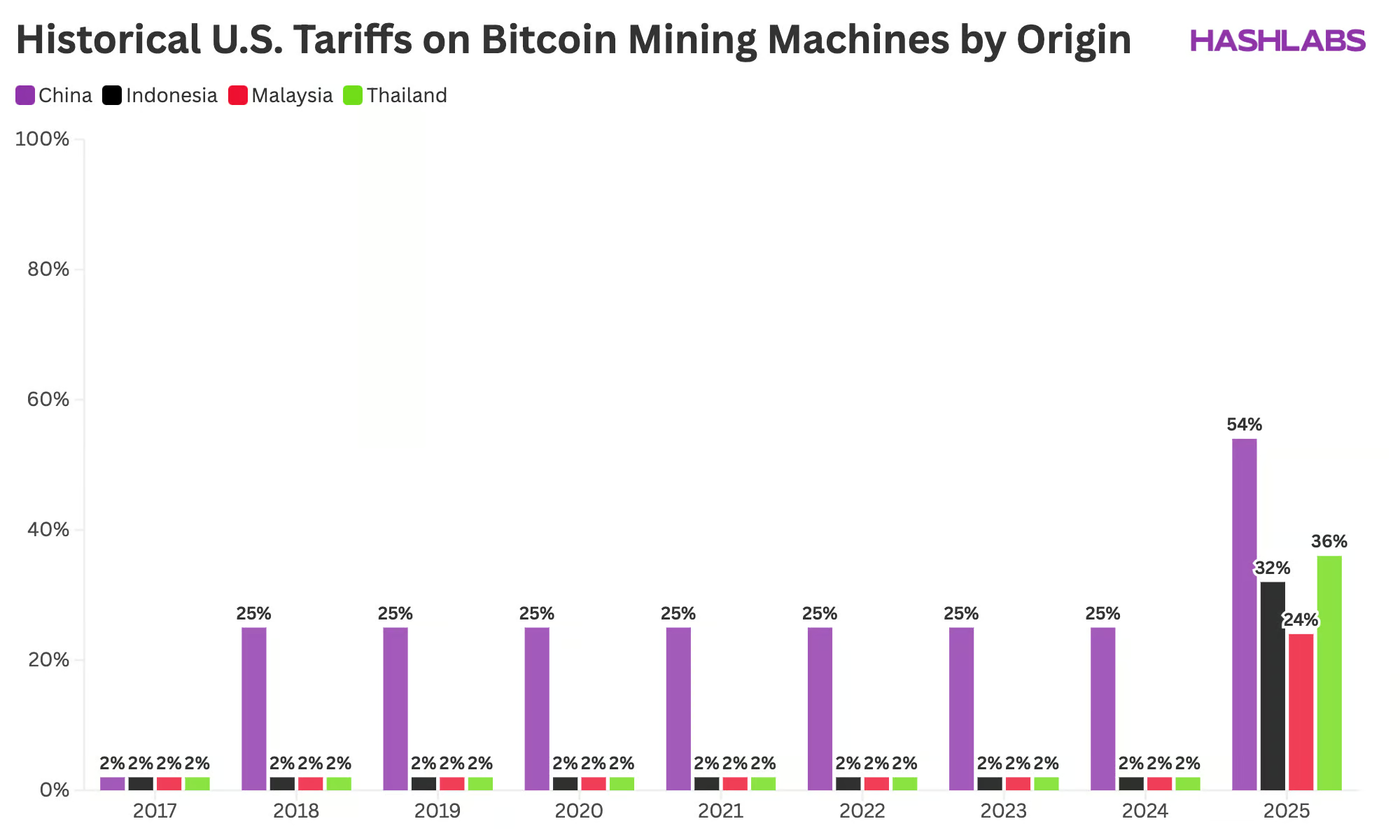

Jaran Mellerud, CEO of Hashlabs Mining, highlighted that new reciprocal tariffs would increase the cost of importing mining machines to the US by at least 24% compared to tariff-free countries like Finland.

Notably, the US is heavily reliant on Bitcoin mining hardware produced in Southeast Asia, especially by companies like Bitmain, MicroBT, and Canaan. He explained that while a 25% tariff on machines imported from China has been in effect for several years, manufacturers managed to sidestep it by relocating production to Southeast Asia.

“This strategy was effective until earlier this month when Trump raised tariffs on goods imported from Indonesia, Malaysia, and Thailand to 32%, 24%, and 36%, respectively,” Mellerud stated.

As a result, these manufacturers can no longer fully avoid these steep tariffs. Therefore, the demand would decrease, and in turn, manufacturers may find themselves with surplus equipment. To clear this excess inventory, they may be forced to lower prices to appeal to buyers in other regions.

“While it’s difficult to predict exactly how much machine prices will fall—since mining profitability also plays a role—we can confidently say that, based on basic economic principles, a decrease in demand for an asset typically leads to a drop in its price,” the report read.

Bitcoin Hashrate Redistribution Likely as US Mining Costs Rise

Meanwhile, the repercussions of Trump’s tariff hikes go beyond just rising Bitcoin mining equipment prices. The US, which currently accounts for approximately 36% of the global Bitcoin mining hashrate, is at risk of seeing its share of the market shrink.

Higher operational costs in the US will make it less attractive for miners to expand their operations. Nonetheless, miners in countries unaffected by the tariffs could gain a competitive edge.

“In the broader picture, this may lead to a more geographically diverse Bitcoin mining landscape than ever before. While the US will remain a major player, its dominance will fade, giving rise to a more globally distributed hashrate,” Mellerud remarked.

In addition, the absence of significant US expansion could reduce the global growth rate. In the short to medium term (the next 1-2 years), global hashrate growth could be slower than anticipated. However, the report emphasized that it’s unlikely that the US mining sector will stop growing completely.

“The assumption of a 36% reduction in global hashrate growth should be seen as an absolute upper limit— the actual impact will likely be somewhat lower,” Mellerud stated.

Moreover, in the longer term, if US mining growth slows, miners in other countries may increase their expansion to fill the gap.

Mellerud also pointed out that even if Trump reverses the tariffs, the damage to long-term investor confidence cannot be undone. The sudden implementation has made it harder for investors to commit to large-scale, long-term investments in the US mining industry. This unpredictability creates a challenging environment for attracting the capital needed for sustained growth.

“In an industry as capital-intensive as bitcoin mining, policy stability is crucial—and right now, that’s in short supply,” he said.

President Trump’s decision to impose reciprocal tariffs has triggered a broader stock and cryptocurrency market crash. According to BeInCrypto, the President’s move to implement a 104% tariff on imports from China led to a significant downturn in Bitcoin. The largest cryptocurrency fell briefly below $75,000.

Furthermore, the total global cryptocurrency market capitalization fell by 6.0% over the past day, highlighting the far-reaching consequences of this policy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoRipple Announces $1.25B Acquisition Of Hidden Road To Set Major Milestone

-

Altcoin22 hours ago

Altcoin22 hours agoDeveloper Advocates For Pi Network Community To Launch Liquidity Pool To Stablilize Pi Coin Price

-

Market19 hours ago

Market19 hours agoIs Ethereum Falling to $1,000 This April?

-

Market16 hours ago

Market16 hours agoUS DOJ Will No Longer Investigate Crypto Exchanges

-

Altcoin16 hours ago

Altcoin16 hours agoWhy Is XRP Price Falling After ETF Hype?

-

Market23 hours ago

Market23 hours agoXCN Price’s Month-Long Bearishness Meets Whale Conviction

-

Market14 hours ago

Market14 hours agoCrypto Stocks Suffer As Trump Confirms 104% Tariffs on China

-

Ethereum13 hours ago

Ethereum13 hours agoEthereum Network Performance Tumbles As Total Transaction Fees Drops To New Lows