Bitcoin

OKX Chief Marketing Officer Highlights Economic Dangers of a US Strategic Bitcoin Reserve

Bitcoin enthusiasts have long touted the creation of a strategic Bitcoin reserve as a hedge against inflation that can reduce the national debt and reinforce the United States’ position as a global financial leader.

Its implementation could also unleash several damaging effects on the US economy, with consequences rippling across the globe. BeInCrypto spoke with Haider Radique, the Chief Marketing Officer at OKX Exchange, to break down the risks of creating a strategic Bitcoin reserve.

Strategic Bitcoin Reserves Grow in Popularity

The concept of a strategic Bitcoin reserve has gained notable popularity over the years, both in the United States and worldwide.

A strategic reserve is a stock of crucial resources acquired by the federal government that can be used to address significant supply disruptions. Many crypto enthusiasts have been campaigning for governments to adopt Bitcoin as a strategic reserve.

In the United States, 15 states have already introduced or passed bills to do just this. Republican Wyoming Senator Cynthia Lummis was one of the first politicians to introduce this type of legislation at a federal level.

Lummis calls for the US Treasury to acquire one million Bitcoin over five years in her proposed BITCOIN Act. The Bitcoin reserve would be kept intact for at least 20 years.

Countries like Germany, Switzerland, Russia, Brazil, and Poland have also taken steps in the same direction. However, several major players in the finance industry fear intense economic instability and pervasive market volatility if a strategic Bitcoin reserve is created.

This fear is particularly relevant if the United States were to establish such a reserve, given its role as the custodian of global trade and issuer of the world’s reserve currency.

“On its face, the idea of a Bitcoin National Reserve seems like a good one – it would serve as an endorsement of Bitcoin by the United States, and it would certainly have the potential to ignite markets in the short term. But if you look under the hood, there may be a number of downsides that should cause the industry to pause and reflect on potential negative long-term consequences,” Radique told BeInCrypto.

Understanding how a reserve works is vital to comprehend the associated risks.

Bitcoin Stockpiles vs. Strategic Bitcoin Reserve

With Donald Trump as the new US president, Bitcoin enthusiasts are bracing themselves for a real shot at creating the long-awaited reserve.

Two weeks ago, Trump signed an executive order to establish a national digital stockpile. The order called for the creation of a working group to explore this possibility. The group has until July to submit a report on the criteria for such a stockpile.

Some participants in the crypto community were disheartened by this move, given that the nature of the order was particularly distinct from a Bitcoin reserve. While the concept of a stockpile derives from seized assets mainly produced from illicit activity, a reserve implies purchasing additional Bitcoin.

The United States already has the biggest Bitcoin stockpile in the world. The federal government holds at least 198,800 BTC acquired through government seizures, currently valued at approximately $19 billion. Countries that trail behind it are China, the United Kingdom, El Salvador, and Ukraine.

A Bitcoin reserve, by contrast, would require the purchase of more Bitcoin. Lummis proposes this approach in her BITCOIN Act. According to her plan, Bitcoin would be directly linked to the US dollar in order to bolster the currency. Essentially, this vision entails a monetary system where Bitcoin takes on an active role.

The pressing need to introduce such a drastic change to the United States’ current monetary system remains unclear.

Debate Over Bitcoin’s Role as a Reserve Asset

Returning to the definition of a strategic reserve, the federal government purchases these commodities in times of economic need. Most economists refer to the Strategic Petroleum Reserve as a key example of the concept.

In 1975, President Gerald Ford created the reserve when Arab members of the Organization of Petroleum Exporting Countries (OPEC) imposed an oil embargo against the United States that sent shockwaves throughout the American economy.

The legislation mandated the storage of up to one billion barrels of petroleum, recognizing its critical role in the economy. Without petroleum, economic activity would cease.

These reserves continue to serve a critical purpose. In response to the Russian invasion of Ukraine, President Biden recently tapped into these reserves to ease the strain on energy prices.

On the other hand, Bitcoin does not serve a critical purpose that warrants this sort of urgent stashing, nor is its use crucial to the functioning of the US economy. Its role as a strategic asset remains largely unclear.

Furthermore, acquiring large amounts of Bitcoin would likely lead to significant market volatility rather than economic stability. If the United States were to purchase large quantities, it would quickly reduce the supply available on the market.

“If the US government decided to acquire large swathes of Bitcoin, the short term liquidity in markets would be constrained, which could entail massive volatility in both directions. We should remember that the vast majority of Bitcoin addresses –nearly 72% according to CoinMarketCap– are long-term holders of more than one year. A mass acquisition of Bitcoin could therefore constrain liquidity further in the short term,” Radique explained.

These sharp movements in Bitcoin supply would also worry investors.

Impact on Dollar Confidence

If the United States were to create a strategic Bitcoin reserve, investors could interpret this as the federal government deciding to back the US dollar with the digital asset rather than gold. In other words, the US would send signals of a loss of confidence in the current dollar-based system.

In a recent opinion article, Nic Carter used this argument to advocate against creating a Bitcoin reserve.

“The US considering a near term abandonment of the current, relatively stable monetary system and replacing it with a monetary standard not based on gold, but a highly volatile, emerging asset, would cause utter panic among its creditors. In my view, if we even got close to a Lummis-style reserve, markets would anticipatorily start to go berserk, and Trump would be forced to withdraw the policy,” he stated.

The same effect would occur if the United States chose to sell part of its Bitcoin reserves.

Liquidation Risks

If the United States were to purchase additional Bitcoin, it would also choose when to sell it.

“Despite the emergence of bipartisan support for crypto in the US political system recently, government policy can change quickly. Therefore, as circumstances change over time, the concentration of large amounts of Bitcoin on a country’s balance sheet could represent a liquidation risk,” Radique told BeInCrypto.

Previous instances where governments sold portions of their Bitcoin stockpile holdings have shown how such actions can significantly impact the market.

“We only need to look to last year, when the German government sold around 50,000 BTC, to see what such a move could do to markets. This is often cited as a key downside of a strategic Bitcoin reserve by critics,” Radique added.

Germany sold all of its Bitcoin holdings last July to comply with a federal law that mandates the liquidation of seized digital assets. The large Bitcoin sell-off in a short period caused the price of Bitcoin to drop.

In November, a similar situation occurred in the United States when the government transferred over $2 billion in Bitcoin to third-party wallets. This move sparked price drops and raised concerns among investors about potential future auctions.

Questions would also arise over the implications of the federal government’s ownership over such large amounts of Bitcoin.

Concerns Over Centralization

For many, the idea of a strategic Bitcoin reserve could appear to conflict with one of Bitcoin’s core principles: decentralization.

This philosophy, which lies at the heart of Bitcoin, ensures that no single entity can control the entire network. However, if the US government were to start acquiring Bitcoin in large volumes, it could spark concerns about centralization.

If the US Treasury were to control a significant portion of the Bitcoin supply, it could influence the market. Such control might allow the government to impact Bitcoin prices, which goes against its decentralized nature.

Overregulation risks also arise as institutional adoption of digital assets expands across public and private sectors.

“It is our collective responsibility as Bitcoiners to advocate for this technology to be as accessible as possible while preserving its original philosophy and peer-to-peer utility,” said Radique.

As the debate over the adoption of a strategic Bitcoin reserve continues, a measured approach will benefit its implementation.

The Case for Patience

One reassuring aspect of this ongoing debate is the understanding that expediting the process might be unnecessary. Since Bitcoin is not an essential commodity for the proper functioning of the US economy, establishing a strategic reserve is not an immediate priority.

Bitcoin has existed for less than two decades. Allowing the market more time to mature also reduces the asset’s volatility in the long run.

“Bitcoin has gone from a little-known cypherpunk invention to a global cultural phenomenon and accessible, institutionalized asset in a remarkably short time,” Radique explained.

By taking a wait-and-see approach, Bitcoin could evolve into a more reliable and liquid asset, making it a viable option for the US government to include in its portfolios in the future.

The post OKX Chief Marketing Officer Highlights Economic Dangers of a US Strategic Bitcoin Reserve appeared first on BeInCrypto.

Bitcoin

Analyst Says Bitcoin Price Might Be Gearing Up For Next Big Move — What To Know

The Bitcoin price seems stuck in a consolidation range, ricocheting off the $83,000 and $86,000 levels over the past week. With no clear direction for the premier cryptocurrency, investors are left wondering what phase the market cycle is in—bullish or bearish.

According to a popular crypto analyst on the social media platform X, the Bitcoin price could be preparing for its next big move in either direction over the next few weeks. In any case, here are the important levels to watch out for in the next few days.

Crucial Levels To Watch For BTC’s Next Move

In an April 19 post on the X platform, crypto analyst Ali Martinez shared an interesting analysis of the Bitcoin price while highlighting the current layout of the world’s largest cryptocurrency by market cap. The online pundit noted that BTC bears and bulls are locked in a battle, leading to a choppy market condition.

Notably, the premier cryptocurrency appears to have entered the $83,000 – $86,000 range on Saturday, April 12. Hence, Martinez’s analysis basically revolves around the price of BTC bouncing off the support and resistance levels on its one-hour timeframe.

Source: @ali_charts on X

As shown in the chart above, the Bitcoin price attempted multiple times to breach the resistance zone around the $86,000 region over the past week. However, the bulls’ optimism was met with the staunch resilience of the Bitcoin bears, as the price of BTC almost always found its way back toward the $83,000 mark.

Most recently, the flagship cryptocurrency made its way toward the $86,000 level on Wednesday, April 16, but failed to break the significant resistance zone after the US Federal Reserve (Fed) chair Jerome Powell suggested that interest rate cuts might not be coming as early as anticipated by crypto traders.

Martinez noted in his post that the next significant move for the Bitcoin price depends primarily on the $83,000 and $86,000 levels. According to the crypto pundit, a breakout above the $86,000 mark could spell the start of a bullish run for Bitcoin, while a break below $83,000 could mean further correction for the market leader.

Bitcoin Price Overview

After reaching its all-time high of $108,786 in January 2025, the price of BTC has been on a steady decline in the past few months. According to data from CoinGecko, the flagship cryptocurrency has losst more than 22% of its value since hitting its record-high price.

As of this writing, the price of Bitcoin stands at around $84,530, reflecting a 0.3% decline in the past 24 hours. Meanwhile, the Bitcoin price is up by more than 1% on the weekly timeframe.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Swiss Supermarket Chain Welcomes Crypto Payments

One of Zug, Switzerland’s Spar supermarkets has begun accepting Bitcoin as a form of payment, following an increasing number of enterprises welcoming cryptocurrency for day-to-day purchases. The move is a big development for the global grocery chain with almost 14,000 stores spread around the globe and catering to nearly 15 million customers every day.

Swiss Outlet Breaks Ground With Bitcoin Payment Option

This supermarket outlet in Zug has recently been added to the BTC Map, a community-powered platform that monitors businesses across the globe that accept Bitcoin payments, as reported by DFX.swiss, a Switzerland-based cryptocurrency startup. The system supports payment through Bitcoin Lightning Network technology, and customers can make payments by merely scanning a QR code.

Rahim Taghizadegan, a bitcoin economist who is the leader of the Bitcoin Association Switzerland, was a guest at the shop and verified the system functions correctly. In a video posted on LinkedIn, he explained how clients can pay using the cryptocurrency.

Spar on BTC Map.

Technical Solution Makes Transactions Quick

The payment system operates on the OpenCryptoPay protocol, created by DFX.swiss to support real-life crypto transactions. The system harnesses the peer-to-peer features of the Bitcoin Lightning Network, which accelerates transactions and makes them more feasible for use in retail outlets.

Switzerland has emerged as a hotbed of cryptocurrency acceptance, with more than 1,000 businesses accepting Bitcoin payments. The Swiss city of Lugano went as far as legalizing BTC and USDT as legal tender back in 2022, and lately, added a statue dedicated to the anonymous founder of Bitcoin, Satoshi Nakamoto.

Global Adoption Gaining Momentum

Although the Bitcoin payment option is now only offered at one Spar store, any rollout to the chain’s international network could have a massive impact on cryptocurrency usage in day-to-day shopping. Spar has an international presence in 48 countries, which means it has potential to bring millions of customers into contact with cryptocurrency payment.

Bitcoin at the checkout? It’s happening.

SPAR supermarket in Zug, Switzerland is now accepting Bitcoin via Lightning Network.

✅ Scan QR

✅ Pay in seconds

✅ No card, no cashIf this clicks, 13,900+ SPAR stores in 48 countries could follow.

Retail just got a crypto upgrade.— efiletax (@efile_tax) April 18, 2025

This move continues an increasing pattern of Bitcoin uptake among retail businesses across the globe. Pick n Pay, which operates as one of South Africa’s largest food grocery chains, accepted digital currency as of 2022. Sports car maker Ferrari is also on board with taking cryptocurrency payments, exhibiting adoption through numerous market sectors.

Education Sector Also Embracing Cryptocurrency

According to last week’s reports, the trend is extending beyond retail and high-end merchandise. Lomond School in the United Kingdom revealed that it would accept tuition fees in BTC from autumn 2025, introducing cryptocurrency payments into education.

As institutions and more businesses incorporate cryptocurrency payments, customers could find crypto used as a standard choice to make payments instead of the traditional way. The Spar rollout in Switzerland might be a pilot for other markets within the grocery chain’s wide network.

The move by Spar to bring this payment mechanism to Switzerland reaffirms the welcoming attitude of this nation toward innovations in cryptocurrency. With the endorsement of a reputable global retailer like Spar, Bitcoin continues its transition from being fundamentally an investment currency to a practical currency for everyday shopping.”

Featured image from Inc. Magazine, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

What Does This Mean for Altcoins?

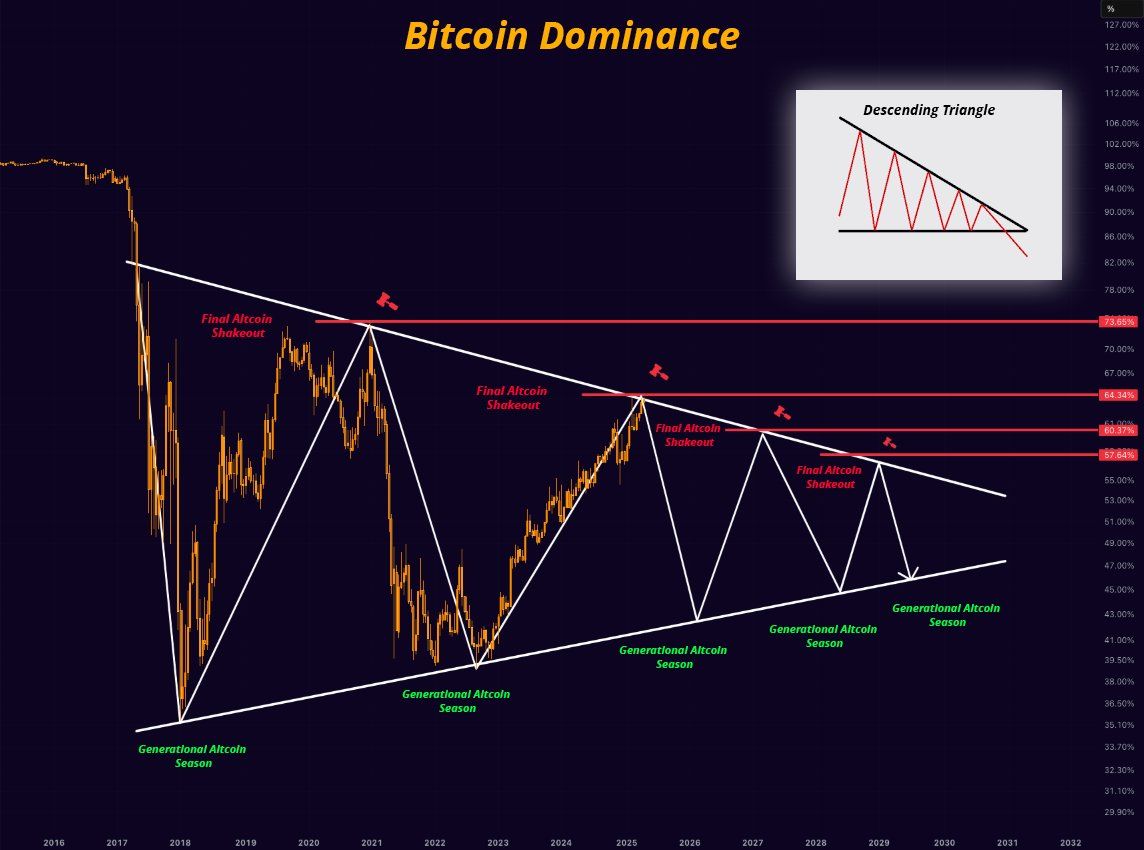

Bitcoin’s (BTC) market dominance has surged to 64%, reaching its highest level in over four years.

However, experts remain divided on what this means for the future. Some predict an impending altcoin season, and others caution that Bitcoin’s dominance could continue to suppress altcoins.

What Does Bitcoin’s Rising Dominance Mean?

For context, Bitcoin dominance (BTC.D) refers to the percentage of the total cryptocurrency market capitalization that BTC holds. It is a key indicator of Bitcoin’s market strength relative to other cryptocurrencies. A rising dominance suggests that Bitcoin is outperforming altcoins, while a decrease may signal growing interest or investment in other digital assets.

The metric has been steadily increasing since late 2022. As of the latest data, it surged to 64%, marking highs last seen in early 2021.

Notably, Benjamin Cowen, founder of Into The Cryptoverse, highlighted that the number is much higher when excluding stablecoins.

“Excluding stable coins, Bitcoin dominance is now at 69%,” Cowen revealed.

The rise in Bitcoin dominance has sparked debate among analysts about its implications for altcoins. Cowen believes there will be a correction or downward movement in altcoins before any substantial gains can be expected in the market. This implies that the altcoin season may not be imminent yet.

“I think ALT/ BTC pairs need to go down before they can go up,” he stated.

Nordin, founder of Nour Group, also expressed caution. He stressed that Bitcoin dominance is nearing the levels seen during the peak of the 2020 bear market.

“This isn’t just a BTC move. Its capital rotating out of alts,” he noted.

Moreover, Nordin warned that a break above 66% could intensify selling pressure on altcoins. This, in turn, could delay the altcoin season.

“Bitcoin dominance back to 64%. No Alt seasons in 2024 or 2025,” analyst, Alessandro Ottaviani, predicted.

On the other hand, analyst Mister Crypto predicts that Bitcoin’s dominance may follow a long-term descending triangle pattern. A descending triangle typically suggests bearish momentum, where the price or dominance gradually decreases as lower highs are formed.

However, this could prolong its market control before a broader correction allows altcoins to gain traction.

Another analyst mentioned that Bitcoin dominance is currently testing the resistance zone between 64% and 64.3%. Therefore, a possible retracement may be on the horizon. Should this retracement occur, altcoins could begin to gain traction, with some potentially emerging as top performers in the market as capital shifts away from Bitcoin.

“However, a breakout from this zone could mean further declines for alts,” the analyst remarked.

Finally, Junaid Dar, CEO of Bitwardinvest, offered a more optimistic view. According to Dar’s analysis, if Bitcoin’s dominance drops below 63.45%, it could trigger a strong upward movement in altcoins. This, he believes, would create an ideal opportunity to profit from altcoin positions.

“For now, alts are stuck. Just a matter of time,” Dar added.

Tether Dominance Signals Potential Altcoin Season

Meanwhile, many analysts believe that the trends in Tether dominance (USDT.D) signal a potential altcoin season. From a technical analysis standpoint, USDT.D has reached a resistance zone and may be due for a correction, suggesting the possibility of capital flowing from USDT into altcoins.

“The USDTD is in a rejection zone, as long as it does not close above 6.75% it will be favorable for the market,” a technical analyst wrote.

Another analyst also stressed that the USDT.D and USD Coin dominance (USDC.D) have reached resistance, forecasting an incoming altcoin season. Doğu Tekinoğlu drew similar conclusions by observing the combined chart of BTC.D, USDT.D, and USDC.D.

As Bitcoin’s dominance climbs, investors are closely monitoring these technical and on-chain signals. The interplay between Bitcoin’s strength and stablecoin dynamics could dictate whether altcoins stage a comeback this summer or face further consolidation. For now, Bitcoin’s grip on the market remains firm.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoCardano (ADA) Moves Sideways, But Bullish Shift May Be Brewing

-

Altcoin15 hours ago

Altcoin15 hours agoAnalyst Reveals Dogecoin Price Can Reach New ATH In 55 Days If This Happens

-

Market22 hours ago

Market22 hours agoXRP Consolidation About To Reach A Bottom, Wave 5 Says $5.85 Is Coming

-

Altcoin18 hours ago

Altcoin18 hours agoPi Coin Price Soars As Pi Network Reveals Massive Community Reward Plans.

-

Altcoin24 hours ago

Altcoin24 hours agoChainlink Price To Hit $26 If LINK Breaks Past This Crucial Level

-

Market21 hours ago

Market21 hours agoCanary Capital Aims to Launch TRON-Focused ETF

-

Altcoin10 hours ago

Altcoin10 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Market15 hours ago

Market15 hours agoBinance Mandates KYC Re-Verification For India Users