Bitcoin

Malaysian Electricity Company Hit Hard By Illegal Bitcoin Mining

Bitcoin mining, a complex activity that requires adding data to the blockchain, has been the subject of complaints. While it’s arguably a lucrative trade for some, it impacts the local electricity grid.

Some estimates say you need up to 155,000 kilowatt hours (kWh) of electricity just to mine one coin, and each transaction requires around 851 kWh, equivalent to one month’s electricity supply for an average household in the US.

Bitcoin mining’s threat is global, with many national and local economies feeling the pinch. For example, Tenaga Nasional Berhad, Malaysia’s national electricity provider, has reported losses of more than 440 million Ringgit (about $101 million) due to mining-related electricity theft. This figure is on top of the reported confiscation of electrical items related to Bitcoin mining valued at $500,000.

Local Reports Say Theft Has Affected TNB For Years

A report from The Star says that Tenaga Nasional Berhad has been bleeding from Bitcoin mining-related thefts since 2020. According to Comm Datuk Seri Mohd Shuhaily Mohd Zain, the company suffered from increasing losses year-on-year.

The director added that in 2020 alone, the company lost RM5.9 million, which increased to RM140.4 million the following year. Then, in 2022, the losses hit RM124.9 million; in 2023, they grew to RM67.1. This year, the losses are at RM103 million and counting.

As of today, the market cap of cryptocurrencies stood at $2.4 trillion. Chart: TradingView.com

Bitcoin Mining Continues To Impact Local Supply

TNB and the local authorities claim that the losses go back to 2018 and have connection to illicit mining operations. TNB said in another separate paper that their losses between 2018 and 2023 totaled more than $755 million.

Although crypto mining only accounts for a small portion of Malaysia’s total consumption, it has a substantial financial impact. Aside from TNB’s losses, over $500,000 of electrical equipment linked to illicit mining operations have been confiscated.

The government’s seizure of these electrical items is part of Malaysia’s campaign on tax evasion involving different parties involved with cryptocurrencies. Malaysia’s Criminal Investigation Unit plans to investigate the thefts and factors contributing to the increasing loss trend.

How Does Bitcoin Mining Affect Electric Companies?

Bitcoin mining is a complex activity that involves adding new data to the blockchain but requires extensive power. In exchange for Bitcoin, an individual or a firm must solve a complex mathematical problem in order to “mine” or acquire bitcoin.

However, experts say that this process requires a large amount of computational power and energy. In many countries like Malaysia, the requirement of a substantial electrical supply often tempts people to skirt payments and commit crimes.

Featured image created using Dall.E, chart from TradingView

Bitcoin

Will 2025’s Crypto Market Mirror 2020’s Rebound? Analysts Predict

Over the weekend, the cryptocurrency market took a sharp dive, with major assets suffering significant losses. While the downturn has raised concerns, some crypto experts believe it could present an opportunity for potential future gains.

This outlook comes amid widespread fears about a potential global recession and escalating trade wars.

Will the Market Crash Lead to a New Class of Crypto Millionaires? Experts Weigh In

BeInCrypto reported a dramatic plunge in the cryptocurrency market today. The total market capitalization dropped by $216 billion within the past 24 hours. Bitcoin (BTC) also saw a significant decline, falling below the $75,000 mark.

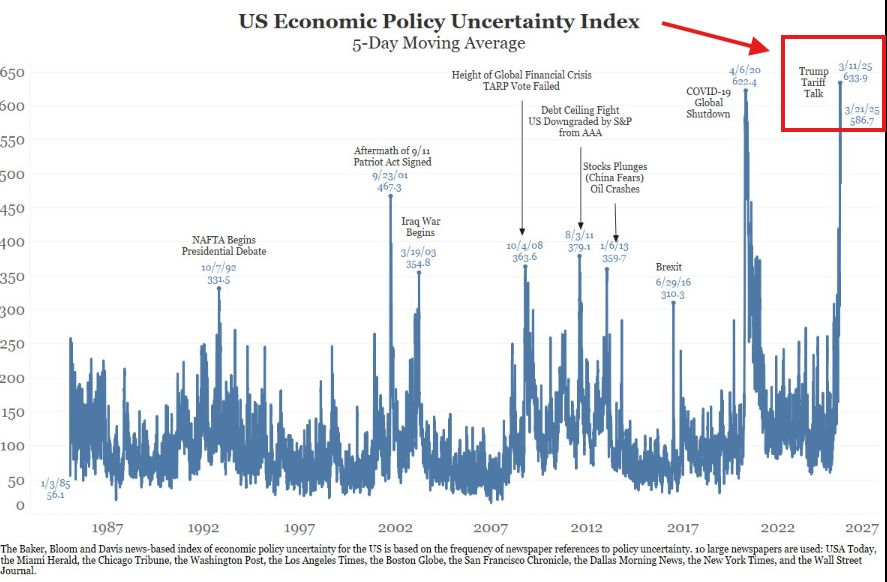

Amidst this, an analyst highlighted that the US Economic Policy Uncertainty Index has reached an unprecedented high. For context, this index measures the level of uncertainty in the US economy related to policy changes.

It combines newspaper mentions of economic uncertainty with data on tax policy and budget deficits. A higher index value indicates greater uncertainty, which can influence market volatility, investor behavior, and economic decision-making.

Notably, it has surpassed levels seen during the 2008 financial crisis and the 2020 COVID-19 market crash.

“The market has never been more uncertain than it is right now. It’s worse than both the great financial crisis & the covid crash,” he posted.

The analyst stated that trillions of dollars have been pulled from the stock market. However, he expressed optimism that much of this capital will find its way into Bitcoin, presenting a potential opportunity for the cryptocurrency.

Meanwhile, another analyst addressed concerns about a potential repeat of the 2008 financial crisis. He noted that such an event is highly unlikely in the current market. Instead, he forecasted a recovery akin to the rapid rebound following the 2020 crash.

“Current market crash is looking a lot like March 2020. Back then, it was a generational entry point for crypto, and the few who stayed patient walked away with millions,” he wrote.

Drawing parallels to the 2020 market downturn, he pointed out that the current market is likely halfway through its correction phase. The analyst also emphasized that after the 2020 crash, central banks responded by slashing interest rates and injecting massive liquidity into the economy.

This surge in liquidity played a crucial role in pushing stocks and risk assets to new record highs in the subsequent year.

“If we’re mirroring the 2020 price action, which I believe is likely, you’ll encounter generational opportunities in crypto. Be patient and start paying close attention, next weeks and months will be decisive. Buy fear, but don’t rush into it, chances are it’s still early,” the analyst explained.

Nonetheless, he stressed that several uncertainties remain, including the duration and impact of tariffs, other countries’ responses, and whether Bitcoin can decouple from the S&P 500 as a recession hedge.

This perspective aligns with another expert, who suggested that the present turmoil could pave the way for a new generation of crypto millionaires to emerge.

“Remember the COVID crash in 2020. BTC was $3,850, ETH was $100, XRP was at $0.11. And all these projects went on to create millionaires over the next few years!” he claimed.

As markets grapple with unprecedented uncertainty, the coming months will likely determine whether this period marks a turning point for a new wave of wealth creation or a deeper economic downturn.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

$1 Billion in Liquidations Over the Weekend

Industry players have labeled today, April 7, the crypto black Monday, a sentiment drawing from the bloodbath over the weekend.

Over the past two days, over $1 billion in long and short positions were wiped out by the weekend volatility.

Crypto Black Monday After Weekend Bloodbath

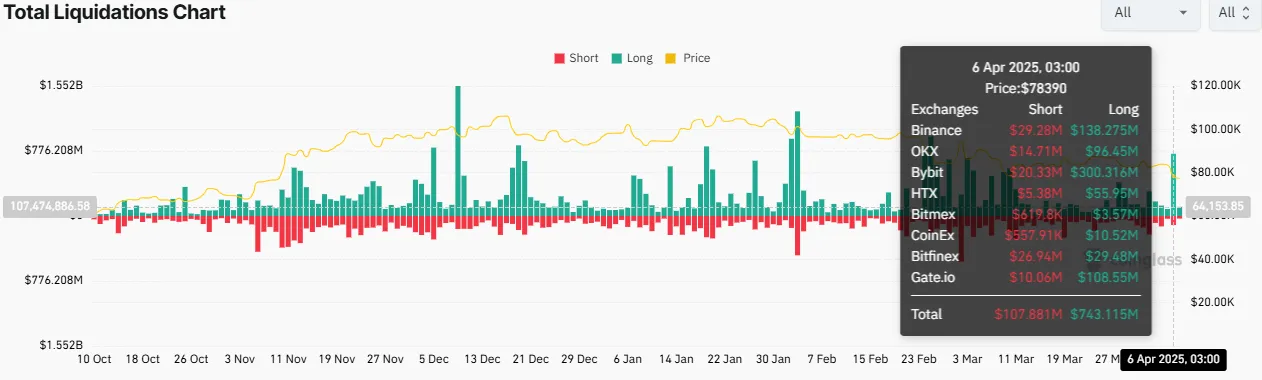

Data on Coinglass shows up to $116.59 million worth of positions were liquidated on Saturday, April 5. This comprised $33.02 million and $83.57 million in short and long positions, respectively.

The next day, the volume of traders and investors blown out of the water increased as crypto liquidations came in over $850 million. Like the day before, the lion’s share of these liquidations was long, at $743.115 million, against $107.881 million short positions.

“In the past 24 hours, 320,444 traders were liquidated, the total liquidations come in at $985.82 million,” Coinglass noted.

This volume of liquidations has fueled widespread pessimism across the crypto market. Data on CoinGecko shows the total crypto market cap is down by over 10% to $2.5 trillion.

Among the crypto top 10, XRP price is leading the crash, down by over 15.4% to trade for $1.7 as of this writing. Likewise, Ethereum’s price was down by 14.3%, selling for $1,480 at press time.

Analysts on X (Twitter) are buzzing about the potential for a historic crash reminiscent of “Black Monday.”

“Tomorrow [meaning April 7] is shaping up to be Black Monday 2.0,” analyst Maine remarked.

“Black Monday” refers to a significant and sudden stock market crash on October 19, 1987. That day, major stock indices worldwide plummeted, with the Dow Jones Industrial Average (DJIA) in the United States dropping by 22.6%. This marked its largest single-day percentage decline in history.

Against this backdrop, panic ensued as trading volumes overwhelmed markets. The lack of mechanisms to pause trading during extreme volatility allowed the free-fall to continue unchecked.

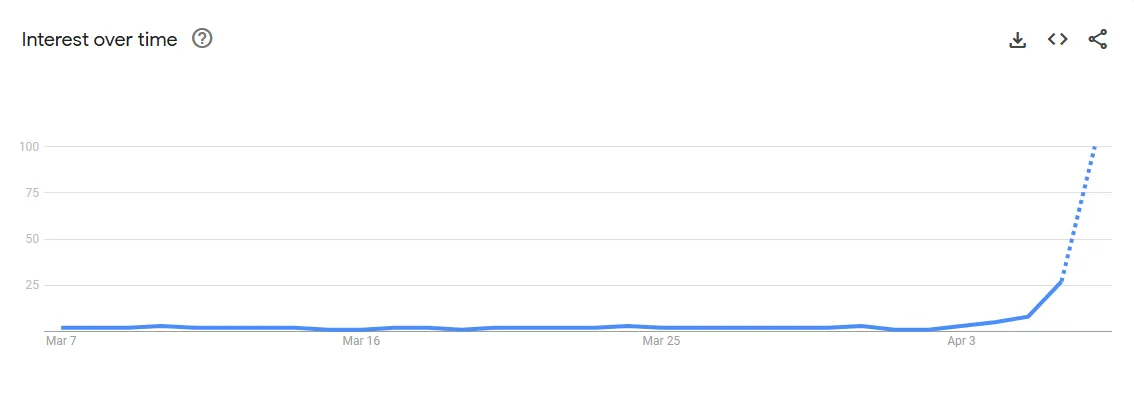

Following the massive liquidations, data on Google Trends shows global “black Monday” searches at peak levels.

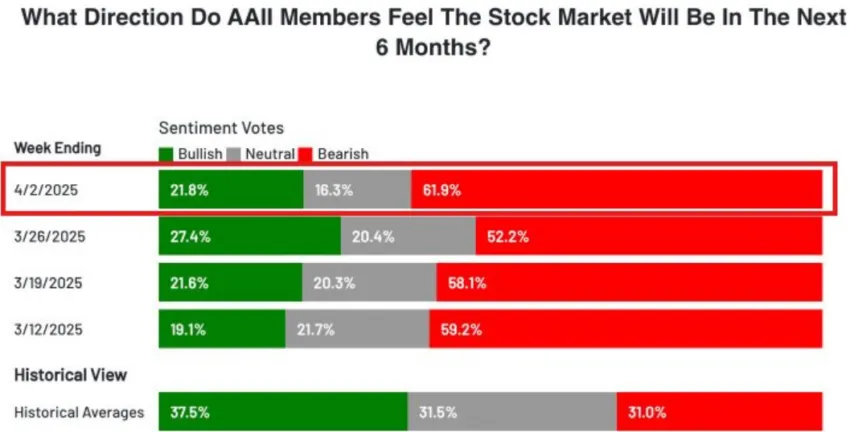

“Bearish sentiment is arguably near its highest levels in history,” The Kobeissi Letter remarked.

Panic Week: What’s Behind Crypto Black Monday?

The renowned market commentary attributed the gloom to uncertainty surrounding proposed tariffs, describing “Black Monday” as the consensus view. Based on this, analysts at The Kobeissi Letter predict “short-term capitulation” this week.

“Down then up,” analysts wrote, hinting at a volatile but potentially rebounding market.

This sentiment aligns with the AAII Sentiment Survey, which reported a striking 61.9% bearish outlook. Notably, this is double its historical average of 31.0%.

“Black Monday 2.0,” TheMaineWonk warned.

Analyst Duo Nine supports this supposition. He warns that Trump tariffs could dismantle global supply chains, reduce productivity, and lead to a prolonged bear market for crypto. However, he believes this could last 1-2 years if a recession hits.

“If the US does not make a U-turn soon, then the only conclusion is that this is intentional and the damage will only increase with time. Unfortunately, for crypto, this means the start of a prolonged bear market. It can last 1-2 years or more if a global recession starts,” Duo None explained.

While tariff fears dominate, contrarian investors might view the extreme pessimism as a buying signal. This perception is based on the assumption that when such dire predictions become mainstream, the market bottom may be near. Such a move would offer opportunities amid peak fear.

Not everyone agrees with the apocalyptic tone. Ryan Wollner, founder of Pearpop, urged caution against overblown narratives on X. He also dismissed comparisons to the 1987 crash.

“I think we might only be looking at a 2-3 week transition, and then we will see people buying back in once the tariffs are more understood, “Wollner said.

Wollner suggested savvy traders could profit by selling now and buying low soon. He emphasized that unlike past recessions driven by fraud, this downturn reflects a temporary shift, with funds likely flowing to US companies and tariff-favored nations.

BeInCrypto data shows Bitcoin is down by nearly 8% in the last 24 hours to trade for $77,030 as of publication time.

As markets brace for turbulence, opinions remain between impending doom and opportunistic rebounds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

US Macro Setup To Favour New Bitcoin ATH In The Long Run

In the last two months, Bitcoin price has plunged by over 23% in a prolonged market correction. Significant portions of this decline have been attributed to a series of new US tariffs announced in February, March, and most recently April.

Despite the short-term bearish effects of this macroeconomic development on the crypto market, popular crypto analyst Miles Deutscher theorizes that BTC could substantially benefit from the long-term effects of these policy decisions.

Short-Term Chaos, Long-Term Clarity: Bitcoin Tipped For New ATH

In a recent X post, Deutscher states that Bitcoin is on course for a new all-time high despite current market uncertainty. The analyst explains that while recent trade and economic policy changes by the administration of US President Donald Trump may be exerting a negative market effect, the ensuing sequence of events from these decisions can prove bullish.

Firstly, Deutscher states that recent economic decisions by the US government show intentions to induce short-term pain that could weaken the dollar and interest rates which should be beneficial for Bitcoin and other crypto assets.

However, the new import tariffs are likely going to discourage the purchase of US Treasury Bills forcing a reliance on domestic buyers which triggers liquidity tightening. As Bitcoin is sensitive to liquidity, the contraction of global liquidity will cause further price falls as investors move their funds to safer assets.

Eventually, the crypto market is expected to bottom out pricing in recession fears. By the time an official recession is announced, the market could be stable and anticipate an economic response by the Federal Reserve.

At this junction, the US Apex Bank is likely to announce a rate cut clearing the way for quantitative easing (QE). However, while this QE may not occur until 2026, Bitcoin will experience a dollar liquidity boost from other economic tools including repurchase agreements, Bank Term Funding Program, and Treasury bill purchases.

Following this development, Bitcoin is expected to embark on an upward trajectory. The “top quality” altcoins will potentially follow the market leader while other tokens with little to no utility shrink. Once Bitcoin nears or hits a peak price, the altseason will kick in.

Deutscher explains it is currently difficult to predict the crypto market and US policies in the short term i.e. 1-12 weeks. However, his forecast is likely to roll out in the coming months placing Bitcoin in a strong position for a new all-time high between Q3 2025 and Q1 2026.

BTC Market Overview

At the time of writing, Bitcoin was trading at $83,313 following a 0.90% gain in the past week. However, the asset’s daily trading volume is down by 68.68% and is valued at $14.25 billion.

Featured image from The Conversation, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market24 hours ago

Market24 hours agoHBAR Could Avoid $30 Million Liquidation Thanks to Death Cross

-

Altcoin17 hours ago

Altcoin17 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Market23 hours ago

Market23 hours agoConor McGregor’s Crypto Token REAL Tanks After Launch

-

Bitcoin19 hours ago

Bitcoin19 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Market19 hours ago

Market19 hours ago3 Token Unlocks for This Week: AXS, JTO, XAV

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Lags Behind Bitcoin In Q1 Performance Amid Market Downturn – Details

-

Market16 hours ago

Market16 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

-

Market22 hours ago

Market22 hours agoCelestia (TIA) Price’s 30% Crash Prolonging Could Bring Recovery