Bitcoin

Investors Buy $4.2 Billion in Bitcoin Before US Inflation Data

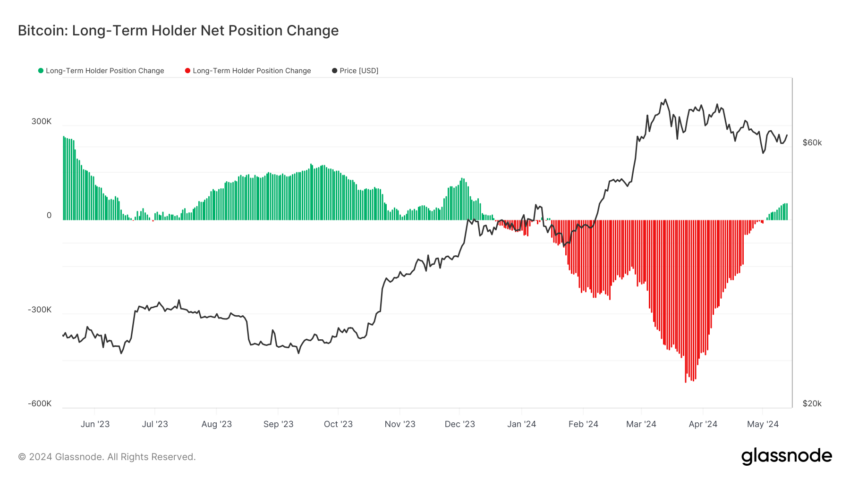

In anticipation of the upcoming US inflation report, savvy investors have purchased 70,000 Bitcoin (BTC), signaling a strategic pivot towards cryptocurrency as a hedge against potential economic volatility.

This massive acquisition follows a significant 1 million BTC sell-off at the close of 2023, underscoring renewed confidence among long-term holders in BTC’s value.

Investors Return to Buy 70,000 BTC Ahead of CPI Report

Recent worries about inflation and the decreasing worth of fiat currencies have sparked renewed interest in alternative stores of value.

Indeed, on-chain data from Glassnode reveals investors are strategically accumulating more Bitcoin. Their actions suggest a belief in BTC’s enduring value, particularly as it stabilizes above $60,000.

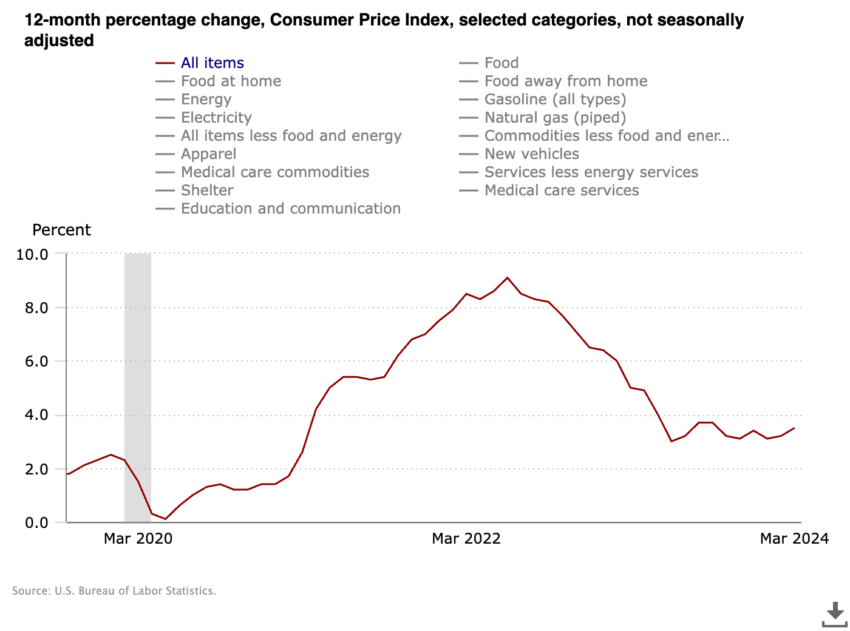

The US Consumer Price Index (CPI) rose 0.4% in March and reached 3.5% over the past year. This number remains historically high and has significantly changed the value of a dollar compared to a decade ago when the inflation rate was just 0.8%.

The upcoming US inflation report on May 15 also has investors on edge as the Federal Reserve remains unlikely to cut rates this year. For this reason, Neil Bergquist, CEO of Coinme, emphasizes Bitcoin’s appeal as a store of value.

He points out that, unlike bank-held dollars, Bitcoin’s capped supply of 21 million BTC presents an inflation-resistant alternative.

“There’ll never be more than 21 million bitcoin ever. It has a fixed supply, unlike fiat currencies, and no one can change that. No one can come in with a new policy, no one can get elected with a new idea and change that. It’s hard-coded into the bitcoin blockchain,” Bergquist explained.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

Core inflation, which excludes the more volatile costs of food and gas, will likely remain persistently high due to increased costs of shelter and core services such as insurance and medical care. According to Bank of America, higher energy prices, driven by increased gas prices, are expected to contribute to a “relatively firmer headline CPI print.”

As a result, Bitcoin may be able to establish itself as a decentralized resource, solidifying its standing as a hedge to traditional financial systems.

“If you hold dollars in your bank account over a period of rising inflation, then your balance has less purchasing power than if you were to store your value in Bitcoin,” Bergquist concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Whale Activity Peaks Amid Market Uncertainty

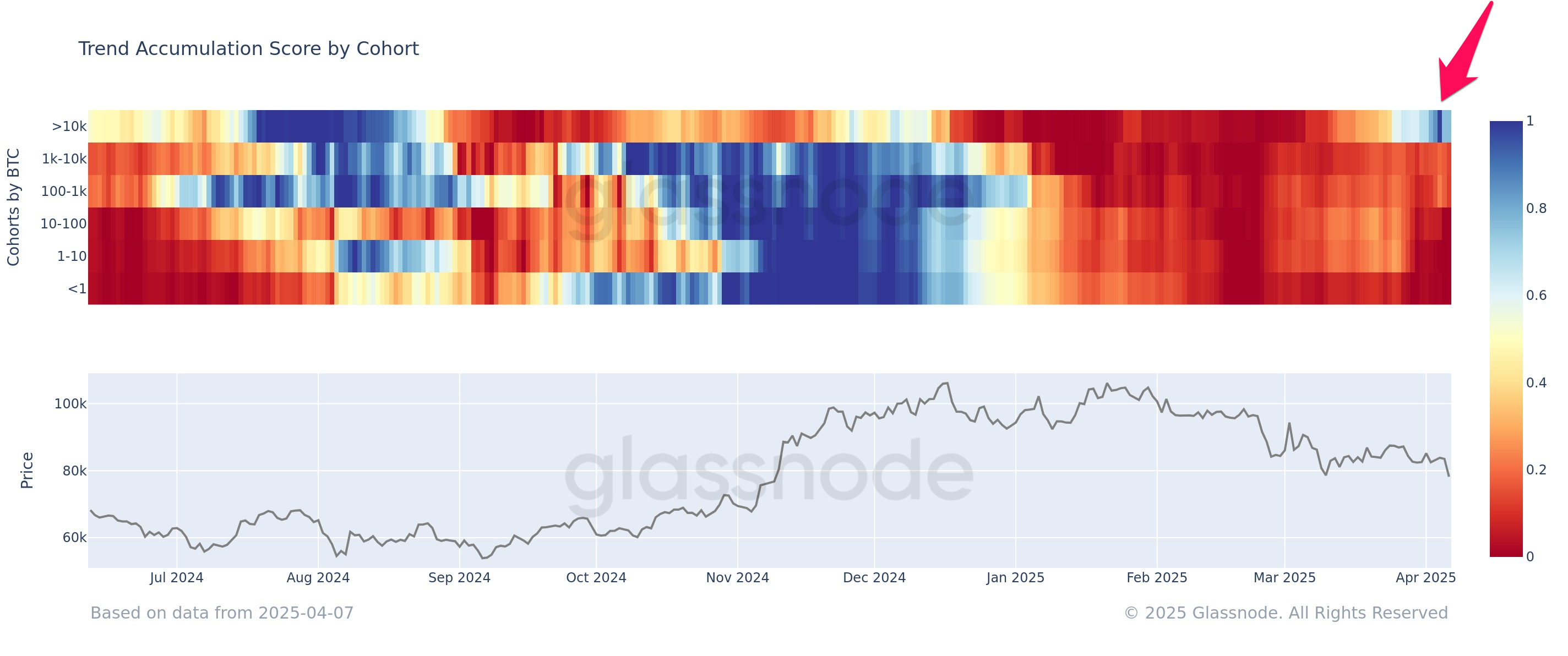

According to Glassnode, Bitcoin whales—entities holding over 10,000 BTC—achieved an accumulation score of approximately 1.0 earlier this month, reflecting intense buying activity.

This score marks a significant deviation from the behavior of smaller holders, who are leaning toward distribution.

Why Bitcoin Whales Are Buying While Smaller Holders Sell

Glassnode highlighted the shift in the latest X (formerly Twitter) post.

“Whales holding >10,000 BTC briefly hit a perfect accumulation score (~1.0) at the turn of the month,” Glassnote posted.

This score reflected a 15-day period of intense purchasing activity. However, after this spike, the score slightly eased to around 0.65. While this suggested a more moderate pace of buying, it still pointed to steady accumulation by large holders.

Meanwhile, smaller Bitcoin holders, categorized as those with holdings between <1 BTC and 100 BTC, shifted their focus to distribution. On-chain data revealed that these cohorts have significantly increased their selling activity, with accumulation scores trending down to between 0.1 and 0.2.

“This divergence shows the bigger players are still accumulating, while smaller holders are selling. Market sentiment remains split,” a user noted on X.

The growing gap between the actions of large and small holders is indicative of differing market sentiments. Whales appear to be betting on Bitcoin’s long-term growth. At the same time, smaller holders may be more cautious or reactive, choosing to liquidate their positions as a hedge against potential market downturns.

The contrasting strategies come amid heightened geopolitical tensions and trade war concerns, which some analysts believe will drive Bitcoin’s appeal as a hedge. Industry expert Will Clemente recently weighed in on the broader implications.

“Zooming out, seeds are being sown for global accumulation of BTC for not only hedging against money supply but de-globalization and geopolitical tensions. These allocations won’t come overnight, but this is what Bitcoin was made for,” Clemente remarked.

Despite the long-term optimism, the macroeconomic conditions have weighed heavily on BTC, causing it to drop below $80,000. Nonetheless, BeInCrypto data showed that Bitcoin saw modest gains of 5.0% over the past day. At the time of writing, it traded at $79,454.

Notably, the price dip has led to significant unrealized losses for public companies holding Bitcoin reserves, with many now seeing their holdings valued below their acquisition costs. In fact, Strategy even paused its Bitcoin purchases, reflecting caution in the face of market uncertainty.

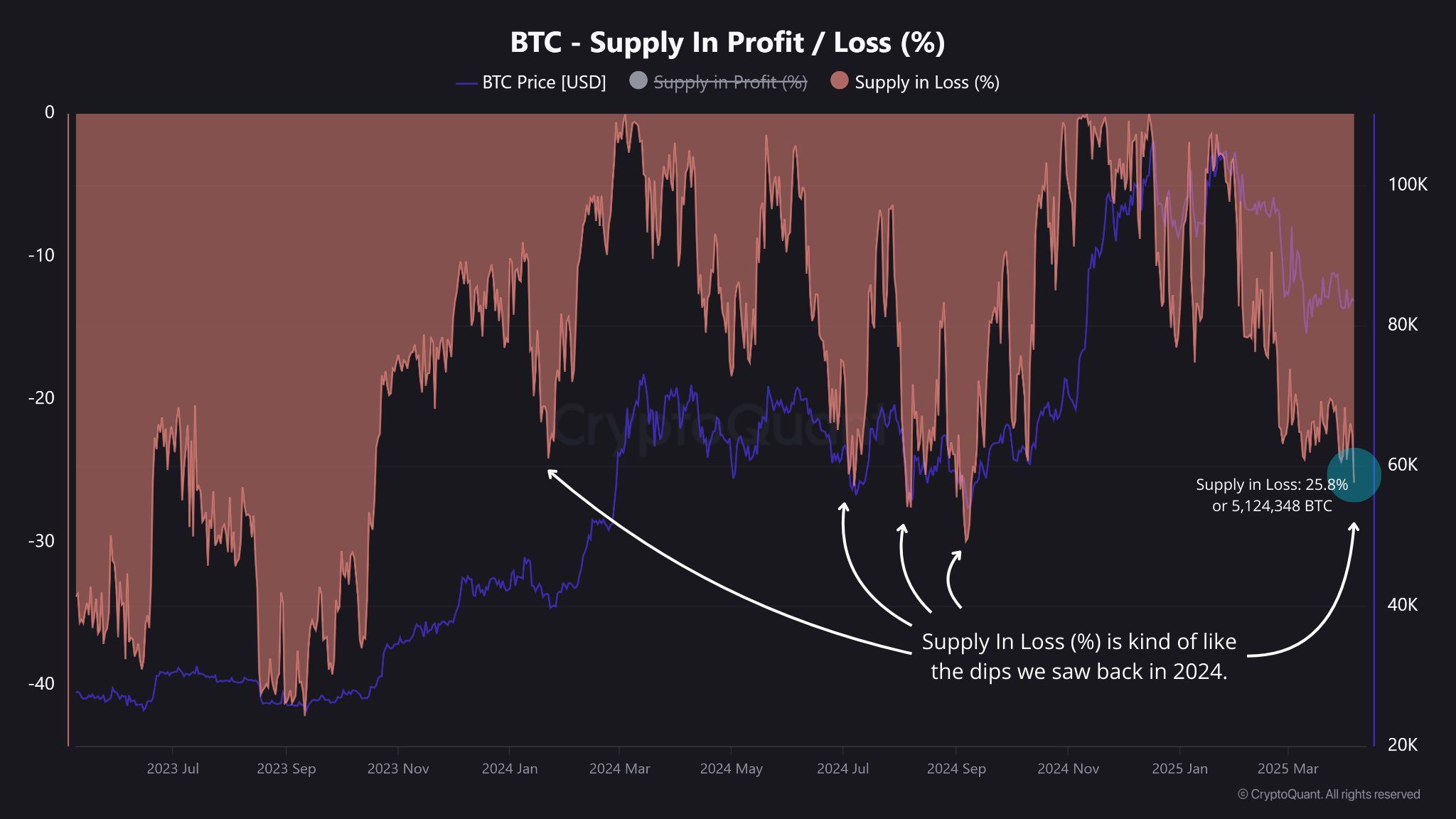

Moreover, data from CryptoQuant disclosed that 25.8% of the total Bitcoin supply is in loss.

“While it might seem alarming, it’s not unprecedented,” the post noted.

CryptoQuant added that similar scenarios have occurred throughout 2024, where a substantial portion of Bitcoin was also held at a loss. For instance, in January 2024, 24.1% of the circulating Bitcoin was underwater. In September, that figure rose to 29.9%.

Thus, these fluctuations show that periods of Bitcoin being held at a loss are not unusual and are part of the market’s cyclical nature, where price corrections affect a significant share of the supply.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Will the Fed Return to Quantitative Easing?

Crypto and financial markets, in general, are reeling from renewed volatility and mounting geopolitical pressure. As a result, speculation is intensifying around whether the Federal Reserve (Fed) will pivot back toward Quantitative Easing (QE).

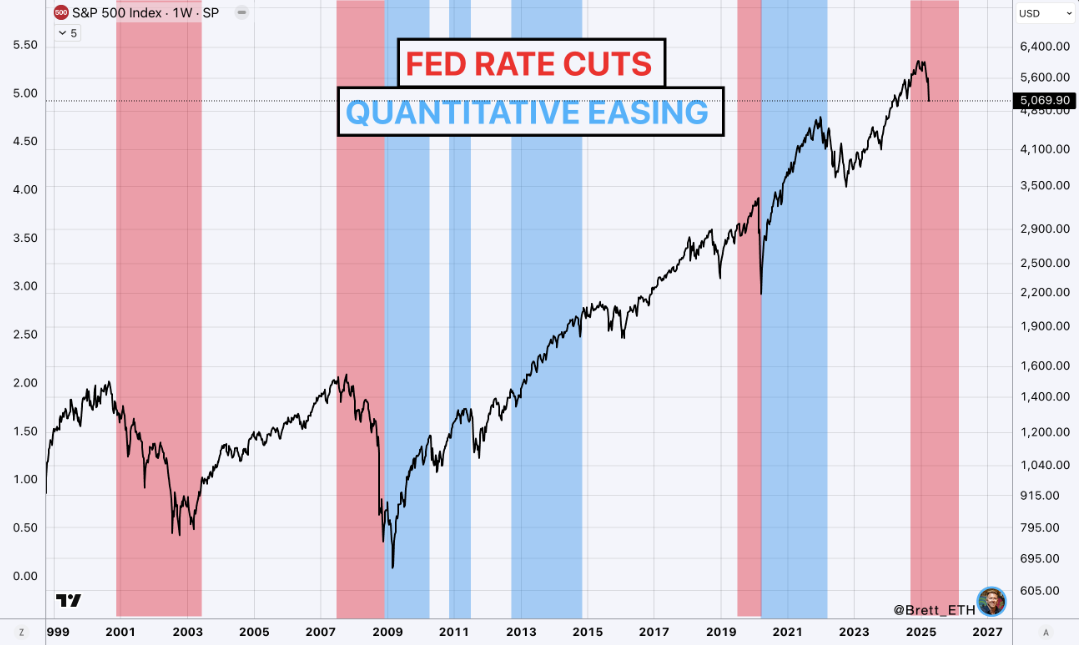

A potential QE would be reminiscent of the aggressive monetary interventions of 2008 and 2020. For crypto, the implications could be enormous, with many traders bracing for a potential V-shaped recovery and a historic rally if QE is revived.

Analysts Share Signals Why the FED Could Act

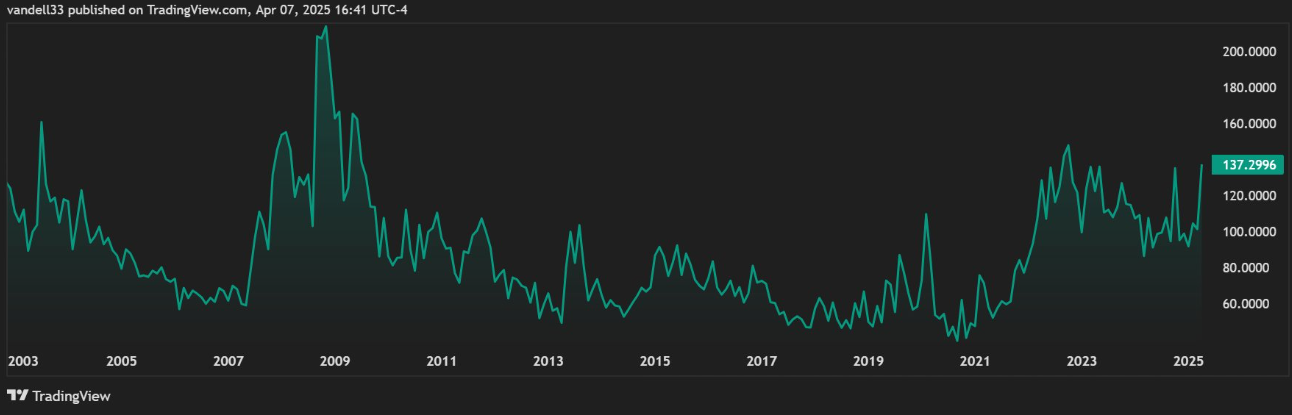

Analysts have shared reasons that could prompt the Fed to intervene, with one citing the MOVE Index. This is Wall Street’s “fear gauge” for the bond market. At 137.30, the index is currently within the 130–160 range where the Fed has historically acted during crises.

“Now it’s at 137.30, in the 130–160 range where the Fed might step in, depending on the economy. If they don’t, they’ll still cut rates soon because they have to refinance the debt to keep the Ponzi going,” wrote Vandell, co-founder of Black Swan Capitalist.

This signal aligns with other warning signs of financial instability, including global market sell-offs that set the tone for the crypto black Monday narrative. This prompted the Fed to schedule a closed-door board meeting on April 3.

According to analysts, this timing was not random, with mounting pressure likely to see the Fed cave and President Trump having his way.

“With the Fed hinting at QE, everything changes Risk: Reward is now in favor of the bulls. Watch for choppy price action, but do not miss the recovery rally. And remember… it’s easier to trade this market than to hold through it,” said Aaron Dishner, a crypto trader and analyst.

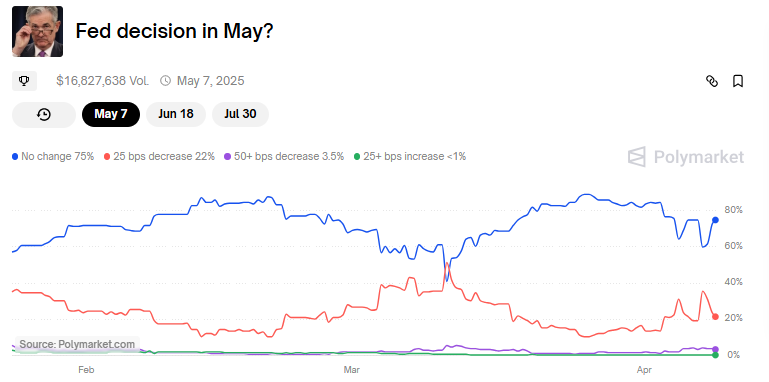

This suggests that investors are reading between the lines, particularly with the Fed’s next scheduled policy decision not until May 6–7. JPMorgan recently became the first Wall Street bank to forecast a US recession amid Donald Trump’s proposed tariffs, adding urgency to the conversation.

The bank suggests the Fed may be forced to act sooner, possibly with rate cuts or even QE, before the scheduled FOMC meeting. Against this backdrop, crypto investor Eliz shared a provocative take.

“I honestly think Trump is doing all this to speed up the Fed’s process to lower rates and QE,” they noted.

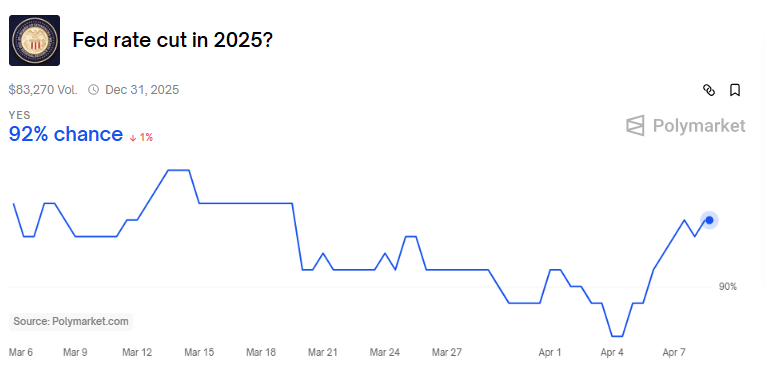

That may not be far-fetched given that the Fed must also manage over $34 trillion in federal debt. Noteworthy, this becomes harder to service at higher interest rates. According to Polymarket, there is now a 92% chance the Fed will cut rates at some point in 2025.

Why Crypto Could Benefit From QE

Should QE materialize, history suggests crypto could be one of the biggest beneficiaries. BitMEX founder and former CEO Arthur Hayes predicted that QE could inject up to $3.24 trillion into the system, nearly 80% of the amount added during the pandemic.

“Bitcoin rose 24x from its COVID-19 low thanks to $4 trillion in stimulus. If we see $3.24 trillion now, BTC could hit $1 million,” he said.

This aligns with his recent prediction that Bitcoin could reach $250,000 by year-end if the Fed shifts to QE to support markets.

Analyst Brett offered a more measured view, noting that QE typically follows rate cuts rather than precedes them.

“We’re likely going to see rate cuts through mid-2026…like in 2008 and 2020, Powell has said QE doesn’t come until rate cuts are complete,” Brett explained.

Based on this, the analyst committed to buying selectively but did not expect a V-shaped bounce unless something drastic changed.

That “something” could be Trump reversing his tariffs or the Fed front running a recession with emergency easing measures. If either happens, the crypto market could rally hard and fast.

Altseason on the Horizon?

Meanwhile, Our Crypto Talk says a Quantitative Easing in May could lay the groundwork for a possible altcoin season.

Their forecast echoes previous cycles where QE triggered explosive moves in risk assets. When QE kicked off in March 2020, altcoins surged over 100X by the time it ended in 2022.

Traders are now eyeing May as a potential kickoff for the next liquidity wave, with bettors wagering a 75% chance the Fed will hold rates steady. If those odds shift, traders expect the money printer to follow.

While some anticipate more price “chop” in the short term, most agree that the long-term setup is increasingly favorable.

“If QE really kicks off in May, this chop is just the calm before the giga pump,” wrote MrBrondorDeFi on X.

Even if quantitative easing does not occur immediately, confidence remains strong that it will happen this year.

“Maybe not May, then later. It will happen this year, which is good for another rally and new highs,” Our Crypto Talk added.

Therefore, the buck stops with the Fed. Whether it is rate cuts, QE, or both, the implications for crypto are enormous.

If history repeats and the Fed opens the liquidity floodgates again, Bitcoin and altcoins could be poised for a historic breakout. This could eclipse the gains seen during the 2020-2021 bull run.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Why Did MicroStrategy Pause Its Bitcoin Acquisitions Last Week?

Strategy (formerly MicroStrategy) did not buy any Bitcoin or sell any common stock this week, breaking a long-running streak. The firm officially disclosed that it has $5.91 billion in unrealized losses due to downturns in the crypto market.

Two likely scenarios explain this pause: Strategy is either waiting for more favorable market conditions or is forced into caution by these losses. Either way, the uncertainty may signal further apprehension among institutional investors.

MicroStrategy’s Bitcoin Purchase Pause: Cautious Signal or Liquidity Move?

Since Michael Saylor directed Strategy (formerly MicroStrategy) to start acquiring Bitcoin, it has become one of the world’s largest BTC holders. So far, it’s been a major purchaser in 2025, acquiring around $2 billion in Bitcoin on two occasions.

However, according to its most recent Form 8-K, Strategy bought zero BTC last week and didn’t sell any stock, either.

This isn’t the first interruption in Strategy’s Bitcoin purchases this year; it also paused acquisitions in February. Unlike that incident, this time feels substantially different due to fears of a US recession.

The pause in Bitcoin buying may suggest that Strategy’s management is taking a wait-and-see approach amid ongoing market volatility, possibly indicating that they believe Bitcoin could bottom out further before resuming purchases.

Billions have been liquidated from crypto and TradFi alike, and corporate Bitcoin holders have suffered serious losses.

The firm may also be trying to break its historic streak of consecutive purchases to avoid further downside risk until clearer market trends emerge.

However, a few prominent voices are taking a much more critical approach. The same Form 8-K shows that Strategy currently has $5.91 billion in unrealized losses in its Bitcoin holdings. There were already concerns about the firm’s liquidity, tax obligations, and over-leveraged debts.

Some community members are wondering how Saylor can avoid a crisis:

“Michael Saylor’s average BTC cost basis is ~$67,500. A 15% drop puts MicroStrategy deep in the red. That’s the thin line between ‘visionary CEO’ and ‘leveraged lunatic with a God complex,’” claimed Edward Farina via social media.

What’s Next for Strategy?

Essentially, Strategy serves as a major pillar of confidence in Bitcoin. If the firm sells, the market will notice. The crypto ecosystem carefully documents minor discrepancies in the firm’s BTC purchasing strategy, and a sale would be highly bearish.

Meanwhile, firms are already inventing novel ETF tools to short the company, praying for its collapse. What’s the best path to move forward?

So far, Saylor has been quiet about these market turns. MicroStrategy may be biding its time, planning to pull out another huge Bitcoin purchase whenever the market bottoms out.

It may also be paralyzed, unable to act due to its debt crisis and unrealized losses. For now, the uncertainty may signal broader apprehension among institutional investors.

This cautious stance may signal broader apprehension among institutional investors regarding current crypto market conditions, hinting at a potential pause before a renewed accumulation phase if market fundamentals improve.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoXRP Targets Rebound After Hitting Oversold Territory

-

Market24 hours ago

Market24 hours agoCan the Fed Rescue Crypto Markets With Interest Rate Cuts?

-

Market22 hours ago

Market22 hours ago3 Altcoins to Watch in the Second Week of April 2025

-

Altcoin19 hours ago

Altcoin19 hours agoProgrammer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

-

Market21 hours ago

Market21 hours agoWEEX Lists AB (AB) under the RWA and Blockchain Infrastructure Category

-

Altcoin21 hours ago

Altcoin21 hours agoRipple Whale Moves $355 Million To Binance, XRP Price To Dip Further?

-

Market20 hours ago

Market20 hours agoCrypto Pundit Reveals What Will Happen If XRP Price Does Not Break $2.3

-

Altcoin18 hours ago

Altcoin18 hours agoSolana’s Fartcoin Jumps 20% Despite Market Selloff