Bitcoin

Here’s Where The Bitcoin Price Is Headed After Reclaiming $63,0000

The Bitcoin price saw a notable recovery trend over the weekend that put it back above $60,000, and by the early hours of Monday, the price had recovered above $63,000. Given this recovery trend, crypto analyst Bluntz Capital, has used the Elliot Wave Theory to map out where the BTC price could be headed from here after kickstarting this recovery trend.

Why Bitcoin Price Clearing $60,000 Is Important

In a Sunday analysis, crypto analyst Bluntz Capital revealed where the Bitcoin price could be headed next from here. The analysis, which was made while the Bitcoin price was still under $60,000, maps out a very bullish path for the cryptocurrency’s price is bulls stayed in control.

At the time of the analysis, the crypto analyst explained that the Bitcoin price action looked like accumulation had been going on. Why this is important is the fact that rallies often come after accumulation since a large percentage of the available supply is being taken out of circulation.

Bluntz’s analysis focused on the ability of Bitcoin being able to reclaim $60,000, a level which he believes will determine if the price was headed to a new all-time high. He explained that if BTC was able to clear $60,000, then it’s “off to the races and a new impulse up may have begun.”

Well, at the time of this writing, the Bitcoin price has already successfully cleared $60,00, with support established above $62,000. This trajectory puts the crypto analyst’s prediction in motion, suggesting that the Bitcoin price may be headed for a new all-time high.

BTC Price Headed For New All-Time High?

As mentioned above, the Bitcoin price has already cleared the important level presented by the analyst, giving credence to where the price might be headed next. With this new impulse, the analyst believes the Bitcoin price could rise above $80,000.

The very top of this impulse would mean that the BTC price would be hitting a brand-new all-time high, and given the timeline on the chart, this surge to the $80,000 level could happen sometime this year. This would mean an almost 20% increase from its current all-time high price of $73,000.

At the time of writing, the Bitcoin price is still maintaining price above $62,7000 after suffering a slight decline from $63,000. Nevertheless, the bulls remain in control of the price as it continues to hold the $60,5000 support.

If the crypto analyst is right, then the current sideways movement could last for only a short while before a bullish impulse sends it higher.

Featured image created with Dall.E, chart from Tradingview.com

Bitcoin

Bullish Signal for Bitcoin in 2025?

On April 10, 2025, the Chinese yuan (CNY) hit its lowest level in 18 years against the US dollar (USD) amid escalating tensions in the ongoing trade war between the two global economic giants.

This significant milestone in China’s monetary policy has sparked renewed discussions about its implications for the cryptocurrency market—particularly Bitcoin (BTC).

CNY Devaluation Amid US-China Trade War

One must first consider the broader economic context to understand the CNY devaluation. China is under heavy pressure from a trade war with the United States, especially after the US imposed a sweeping 104% tariff on Chinese goods.

In retaliation, China introduced an 84% tariff on imports from the US. These measures have intensified economic friction between the two nations and placed the Chinese currency in a downward spiral.

According to data from TradingView, the USD/CNY reference rate currently sits at 7.3412. Historical data shows that the yuan has fallen to its lowest point since 2007. This suggests that China may intentionally loosen monetary controls to support its export-driven economy as it grapples with slowing growth.

A Bullish Signal for Bitcoin and the Crypto Market

Arthur Hayes, co-founder of BitMEX, highlighted the potential link between the CNY devaluation and Bitcoin’s rise in a recent post on X (formerly Twitter). Hayes noted similar patterns in 2013 and 2015 when Chinese investors turned to Bitcoin as a haven. He predicts a repeat in 2025 as investors seek to shield their wealth from the falling yuan.

“CNY deval = narrative that Chinese capital flight will flow into $BTC,” Hayes remarked.

In 2013, during stringent financial controls in China, Bitcoin emerged as an attractive alternative asset.

“I think the Chinese really look to bitcoin as an excellent digital store of value, sort of like the new electronic version of gold.” said Bobby Lee, CEO of BTC China.

This tendency became even more pronounced due to China’s strict capital control measures. These measures limit individuals from transferring just $50,000 abroad annually. As the yuan depreciates, Chinese citizens see their domestic purchasing power decline, prompting them to seek alternative stores of value.

With its decentralized nature and independence from government control, Bitcoin has become an appealing option.

In 2017, when China tightened capital controls and banned domestic cryptocurrency exchanges, Forbes reported that Chinese investors flocked to Bitcoin to bypass these restrictions. This surge in demand pushed trading volume on platforms like Huobi (HTX) and OKX to record highs.

At one point, these Chinese exchanges accounted for more than 90% of global Bitcoin trading volume. However, as the CNY strengthened, Bitcoin prices fell.

In 2020, the weakening of the yuan again drew analysts’ attention. Chris Burniske, a well-known voice in the crypto space, predicted that a weaker yuan could drive Bitcoin prices higher—mirroring patterns observed in 2015 and 2016. He emphasized that if the CNY continues to fall against the USD, Bitcoin could enter another strong growth phase.

The yuan’s plunge to an 18-year low in 2025 could signal another bullish cycle for Bitcoin. First, strict capital controls remain, limiting Chinese investors’ ability to move wealth overseas. This restriction makes Bitcoin a viable option for capital preservation.

Second, historical patterns reinforce the view that a weakening CNY often coincides with Bitcoin’s upward momentum.

Finally, global market sentiment could shift as investors anticipate capital outflows from China entering Bitcoin, further fueling price gains. As the world watches China’s monetary decisions closely, Bitcoin stands poised to benefit as a hedge against devaluation and a global store of value in uncertain times.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

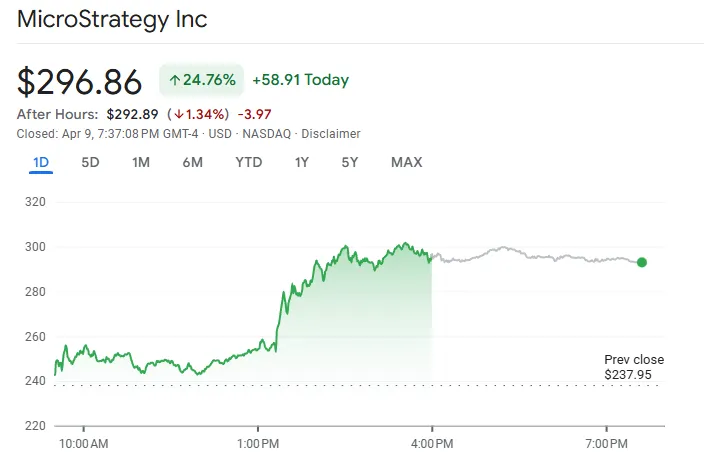

MicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

Rumors have been circulating that Strategy will be forced to liquidate its Bitcoin reserves if the price keeps dropping. The specific fears have been overstated, but the fundamental idea might be essentially true.

In any event, both Bitcoin and the firm’s stock price rose substantially after Trump announced a tariff pause. The immediate danger of a selloff has seemingly passed, but these factors may come into play in the future.

Will Strategy Need to Sell Its Bitcoin?

Since Strategy (formerly MicroStrategy) started buying Bitcoin, it’s become one of the world’s largest holders and a major pillar of market confidence.

While this has financially strengthened the company, it also presents certain challenges. Being one of the largest holders, if Michael Saylor’s firm chooses to sell a portion of its holdings, it could impact BTC’s market performance.

Rumors have been circulating that such an event might be inevitable, based on a recent filing. In the SEC filings, the firm writes a disclaimer that without access to favorable equity or debt financing, it could be required to liquidate BTC at a loss.

While the statement exists, it’s not new or extraordinary; it’s a routine inclusion found in MicroStrategy’s previous 10-Q reports from Q1 2024 and prior years.

BeInCrypto reported on Strategy’s Form 8-K when it came out earlier this week, analyzing its implications. The form claimed that Strategy did not buy any Bitcoin last week and has over $5.91 billion in unrealized losses.

“We may be required to take actions to pay expenses, such as selling bitcoin or using proceeds from equity or debt financings, some of which could cause significant variation in operating results in any quarter,” Strategy’s SEC filing claimed.

During the recent market chaos, these unrealized losses caused a lot of distress in the crypto community. However, that doesn’t mean that Strategy will have to dump its Bitcoin soon. In any event, its stock rallied today because of Trump’s tariff pause.

A Few Credible Selloff Scenarios

Although these concerns lack nuance, that doesn’t mean they’re totally unfounded. Michael Saylor claimed that Strategy can pay off its debts even if Bitcoin crashes, but some community members think these claims are either incorrect or deliberate lies.

His stated plan would involve massively diluting stock when he has already sold huge volumes.

In fact, several scenarios could force Strategy to sell its Bitcoin. If its price were to fall significantly and stay low, Strategy’s ability to meet debt obligations without tapping its BTC treasury could become strained.

The firm’s low revenue from its non-BTC business ventures would further exacerbate this problem.

Additionally, Strategy has used Bitcoin as collateral for loans on several occasions. If BTC drops below collateral thresholds, margin calls could force partial liquidation. However, such scenarios would be outlined in specific loan agreements, not general filings.

Above all else, the appearance of forced selling can seriously impact market sentiment, which is why these rumors are so serious.

Strategy’s stock price and Bitcoin are both riding high right now, and selloff fears seem less imminent. Yet, the fundamental macroeconomic situation remains unchanged. If Bitcoin falls again, MSTR’s debt position in the market will likely be impacted.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Will the Corporate Bitcoin Accumulation Trend Continue in 2025?

Bitcoin additions to corporate treasuries have risen during the first quarter of 2025, with industry giants like Tether and Metaplanet reaching record allocations compared to the previous quarter.

However, recent trade policy announcements in the US have cast a shadow over further Bitcoin accumulation. BeInCrypto interviewed Max Shannon, an analyst at CoinShares, to explore the sustainability of this trend throughout the year and the likelihood of further corporate adoption.

Which Companies Are Leading the Bitcoin Treasury Charge?

As Bitcoin’s path to mainstream adoption gains momentum, more companies are either expanding their BTC holdings or allocating the asset to their corporate treasuries for the first time in 2025.

The first quarter of 2025 stood out, with several major industry players making their largest Bitcoin allocations. Tether, the world’s largest stablecoin issuer, gradually acquired 8,888 BTC since January, bringing its total BTC balance to over 100,000. In the previous quarter, the issuer had only added 1,035 to its reserve.

Metaplanet also increased its allocation efforts. The Japanese publicly traded company first started purchasing Bitcoin in May 2024. By December, Metaplanet had accumulated 1,762 BTC, which grew to 4,046 by March 2025.

While other high-profile companies did not break their previous allocation records, they significantly expanded their Bitcoin supply.

Expanding the Ranks: From MicroStrategy to GameStop

Strategy, formerly known as MicroStrategy, has maintained its consistency with its aggressive accumulation style. So far this year, the company has bought a whopping 53,396 BTC.

Meanwhile, Fold Holdings, a financial services company, publicly announced that it had bought 475 BTC in early March, bringing its total accumulation to 1,485.

Corporations outside Web3 are also now joining the trend of acquiring Bitcoin.

Two weeks ago, video game and electronics retailer GameStop announced an update to its investment policy, revealing the addition of Bitcoin as a treasury reserve asset. Although the company made no immediate commitment to purchase BTC, speculation is high that it will allocate a portion of its $4.8 billion cash balance to the cryptocurrency.

Factors Driving Corporate Bitcoin Adoption

Bitcoin has become increasingly appealing to investors looking for an asset to hedge against inflation. Given BTC’s self-limiting supply, it is not subject to the type of depreciation that can impact fiat currencies.

“Companies understand that monetary inflation is the core reason behind the decline of their balance sheet’s purchasing power parity,” Shannon told BeInCrypto.

According to him, this may have led Metaplanet to accumulate record amounts of Bitcoin during the first three months of 2025. Metaplanet has already announced plans to amass 10,000 BTC by the end of the year.

“For Japanese firms facing persistent yen depreciation, Bitcoin serves as a hard-asset hedge. Moreover, in markets with negative real yields, BTC offers superior long-term risk-adjusted returns. Although It has no yield it offers long-term upside and inflation resistance when the inflation rates (either prices paid or monetary inflation) are higher than the nominal interest rate,” he said.

Given heightened concerns over spikes in inflation in the United States, Bitcoin has also become more appealing among American investors. Changes in accounting for digital currencies have also made them a more attractive addition to investment portfolios.

The Appeal of New Accounting Standards

In addition to its perceived value as an inflation hedge, Bitcoin’s attractiveness as a corporate investment has been further amplified by recent modifications to accounting standards in the United States.

In January, the Financial Accounting Standards Board (FASB) issued a new rule that enabled companies with BTC in their treasuries to report the profits on unrealized gains from their digital assets. Instead of waiting until they have sold their assets, companies can now report that increase in value as income in their financial statements.

“Selling a depreciating fiat currency in return for a digital hard asset such as Bitcoin that is also liquid and a ‘cash equivalent’ that can benefit from the new FASB accounting treatment (which can also improve the income statement) makes Bitcoin an attractive treasury asset,” Shannon added.

Despite its potential for inflation stability, Bitcoin’s inherent volatility can also attract investors with a greater risk appetite and companies aiming to diversify their holdings.

Can Bitcoin’s Volatility Be a Strategic Advantage?

Beta measures a stock’s volatility relative to the overall market. The higher the beta, the more volatile the stock is.

According to Shannon, adding a volatile asset like Bitcoin to the balance sheet increases the beta of the equity. If the price of Bitcoin goes up, the overall investor portfolio can score big.

“This can enhance returns for investors and has proven to do so. The volatility of the equity also tends to increase which improves the interest rate on convertible debt, therefore, impacting the capital structure and cost of capital for the company. The volatility also gives way for option and derivative traders which can increase the volumes of the stock and make it a more liquid asset,” Shannon told BeInCrypto.

However, investors can face higher potential losses during a Bitcoin bear market. Because of this, BTC as a treasury asset may be more appealing to companies looking to diversify or firms large enough to weather the storm.

Bitcoin for Specific Business Cases

The volatility and heightened trading activity accompanying Bitcoin adoption might offer a strategic advantage to particular companies, notably those with performance issues or in highly competitive sectors.

“Underperforming or mature businesses in competitive markets would benefit from an asset that increases the volatilty and volumes, as well as the beta of the equity,” Shannon told BeInCrypto.

GameStop is a good example of the former. The retailer’s Q4 2024 earnings report showed a significant decline in its sales volume.

Despite the worrying financial report, GameStop’s stock value rose by 12% after signaling that it would add BTC as a treasury reserve asset. Limited crypto exposure is expected to strengthen the company’s financial position in 2025.

In turn, Tether’s perceived robustness could make it more capable of withstanding Bitcoin’s significant price volatility.

Leveraging Profits for Bitcoin: Tether’s Financial Strategy

As the issuer of the largest stablecoin, Tether generates substantial revenue from transaction fees and managing its vast reserves. This financial strength could provide a buffer to absorb potential losses from Bitcoin price drops.

Demonstrating this financial capacity, Tether allocates 15% of its quarterly net profits to Bitcoin.

“This is similar to Dollar Cost Averaging by allocating 15% of its net realized operating profits for Bitcoin. This is a relatively conservative approach because it is post-tax so the excess cash (retained earnings) that accrues to equity can be used for a higher growth asset. In this instance, there are not huge drawbacks because the company is well capitalised with $7 billion in net equity, so its prudent risk management. However, there are still black swans where cash would be better needed than Bitcoin,” Shannon explained.

Despite its inherent unpredictability, Bitcoin’s observed long-term decline in volatility over recent years has supported the rationale for including it –even in small amounts– within a well-diversified portfolio.

“Bitcoin has improved the risk-adjusted returns of the 60/40 portfolio since 2017. [It] still has volatility risk which companies may not be willing to absorb, however, the volatility has historically trended down and could continue this into the future,” Shannon added.

While acknowledging Bitcoin’s advantages, Shannon finds it increasingly challenging to foresee if corporate asset accumulation will maintain the same rapid pace in Q2 as it did at the beginning of the year.

Market Disruptions: Will Corporate Appetite Wane?

Though only in its second week, April has proven to be a hard month for financial markets. The cryptocurrency sector experienced the most pronounced impact.

Trump’s recent Liberation Day celebration sent stocks on a downward spiral as investors braced themselves for incoming uncertainty. During the two days that followed Trump’s tariff announcements, over $1 billion in long and short positions were wiped out by the weekend volatility.

Amid this new wave of anxiety, Shannon anticipates that companies will prioritize more pressing concerns over further Bitcoin accumulation.

“The longer-term trend points to further balance sheet accumulation, however, its hard to call quarter over quarter. Based on the current volality of the markets, and tariff implications on margins, I suspect operational issues will be front of mind rather than Bitcoin accumulation,” he said.

Even after this initial wave of uncertainty subsides, macroeconomic conditions will significantly determine future corporate Bitcoin acquisitions. Bitcoin will also need to remain competitive to incentivize these purchases.

“A higher Bitcoin price should lead to FOMO and outperformance of Bitcoin-backed companies. For this to occur, trade policy certainty is needed (or in fact a reversal via deals with trading partners) as well as a lower 10 year yield and either a consolidation or recovery of the equity markets,” Shannon added.

For now, external headwinds may outweigh Bitcoin accumulation strategies.

An Uncertain Future

Corporate Bitcoin accumulation has reached new heights during the first quarter of 2025, but recent political and economic developments may stump future advancements.

Until the future of US trade policy and international reactions becomes more certain, the cryptocurrency market will likely experience heightened volatility. These circumstances might lead traditional investors and companies to favor a conservative strategy, directing their resources toward other priorities.

Only the passage of time will determine the outcome.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin16 hours ago

Bitcoin16 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Altcoin20 hours ago

Altcoin20 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Altcoin19 hours ago

Altcoin19 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Market16 hours ago

Market16 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin21 hours ago

Altcoin21 hours agoEthereum Price Signals Strong Recovery After Forming Historical Pattern From 2020

-

Regulation16 hours ago

Regulation16 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Market20 hours ago

Market20 hours agoFARTCOIN Jumps 160% in 30 Days but Momentum Fades

-

Market15 hours ago

Market15 hours agoPaul Atkins Confirmed as SEC Chair, Crypto Rules to Ease