Bitcoin

Here’s How Much Bitcoin Would Flood The Market If All Governments Decide To Sell

The German government undoubtedly left a sour taste on the crypto market following the sale of nearly 50,000 BTC, which it seized from the pirated movie website movie2k. This has led to further research into how much Bitcoin other governments hold, given the impact their sales could have on the market if they also decided to sell.

How Much Bitcoin Will Flood The Market If All Governments Sell

According to data from Bitcoin Treasuries, almost 517,414 BTC ($32.9 billion) will flood the market if all the nine governments currently holding the flagship crypto decide to offload all their BTC reserves. These governments include the United States, China, the United Kingdom, Ukraine, El Salvador, Bhutan, Venezuela, Finland, and Georgia.

The United States government currently holds the most BTC among these governments, with a reserve of 213,246 BTC. These bitcoins form part of the seizures from the dark web marketplace Silk Road. The US government is known to have already offloaded some of its Bitcoin holdings, with its last sale coming on April 2 when the government sold 1,754 BTC.

China is second on the list, with a BTC reserve of 190,000 BTC. Like the US, China’s Bitcoin holdings are believed to have come about through seizures from the Plus Token scam, a Ponzi scheme that promised investors high yields. The United Kingdom holds 61,000 BTC, which were seized from an ex-takeaway worker who was found guilty of money laundering.

Ukraine is next on the list, with a reserve of 46,351 BTC. El Salvador follows Ukraine, as the government holds 5,800 BTC. The El Salvador government has become famous for its pro-BTC stance. It has been actively accumulating BTC since the country adopted the flagship crypto as a legal tender in September 2021.

Bhutan, Venezuela, Finland, and Georgia are behind El Salvador with BTC holdings of 621, 240, 90, and 66 BTC, respectively.

Fund Managers Hold More BTC

As expected, asset managers like BlackRock hold more BTC, given how they have been accumulating the flagship crypto through their respective Bitcoin exchange-traded funds (ETFs). According to data from Bitcoin Treasuries, these fund managers hold a cumulative total of over 1 million BTC.

BlackRock is the largest BTC holder among these fund managers, with a reserve of 316,276 BTC for its IBIT Spot Bitcoin ETF. Grayscale is next on the list, with a reserve of 272,661 BTC for its GBTC Spot Bitcoin ETF. Fidelity, Ark Invest, and Bitwise complete the top 5 list with holdings of 176,995, 47,764, and 39,661 BTC, respectively.

At the time of writing, Bitcoin is trading at around $63,800, up over 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Bitcoin

Bitcoin Price Volatility Far Lower Than During COVID-19 Crash — What This Means

Over the past few weeks, the cryptocurrency market has been overwhelmed by a high degree of uncertainty and volatility triggered by the constantly shifting global macroeconomics. This unsettled market condition saw the Bitcoin price dance between $74,000 and $83,000 in the space of a few days.

The price of BTC sank toward $74,000 at the start of the past week as crypto investors panicked after United States President Donald Trump announced new trade tariffs. On Thursday, April 10, the premier cryptocurrency reclaimed the $83,000 level after President Trump paused trade tariffs on all countries except China.

Is Bitcoin Now A ‘Mature Asset’?

The Bitcoin price has been quite reactive to virtually every piece of news in the global trade, demonstrating the highly volatile state of the cryptocurrency market. However, an on-chain analytics expert has explained that the volatility of the current Bitcoin market pales in comparison to past episodes.

In a new post on the social media platform X, CryptoQuant’s head of research, Julio Moreno, revealed that the Bitcoin price volatility in the ongoing global trade drama has been “so far lower” than that from other past events, such as the COVID-19 crash, Terra-Luna collapse, FTX downfall, and the Silicon Valley Bank (SVB) bank run.

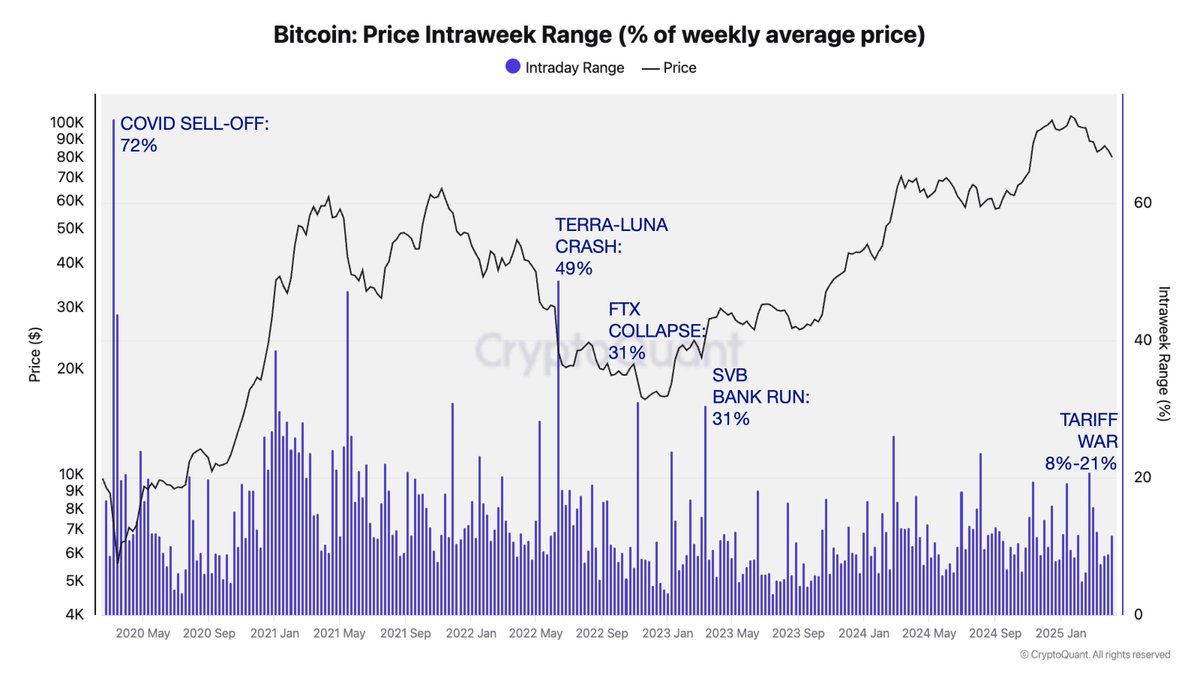

The relevant indicator here is the Price Intraweek Range metric, which estimates the percentage change in the average weekly price of Bitcoin. According to data from CryptoQuant, the Bitcoin Price Intraweek Range climbed to an all-time high of 72% during the COVID-19 market downturn in April 2020.

Source: @jjcmoreno on X

The chart above shows that the BTC Intraweek Range metric surged to 49% after the crash of the Terra Luna ecosystem in May 2022. Meanwhile, the indicator reached 31% following the collapse of the Sam-Bankman-Fried-led FTX exchange in late 2022 and the SVB bank run in early 2023.

With the escalating trade tensions between the United States and China, the Bitcoin Price Intraweek Range metric stands between 8% – 21%. This reduced volatility suggests that the premier cryptocurrency has matured as an asset, with deeper liquidity and a better market structure.

The relatively stable price action can be connected to the growing base of long-term holders and steady corporate adoption, as institutional players are beginning to view the world’s largest cryptocurrency less as a high-risk asset and more as a hedge against macroeconomic uncertainties.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $83,700, reflecting a 5% increase in the past 24 hours.

The price of BTC returns to above $83,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin’s Impact Alarming, Says NY Atty. General—Congress Needs To Act

New York Attorney General Letitia James issued a warning to US congressional leaders regarding regulation of cryptocurrency, particularly how Bitcoin and other virtual currencies could erode the US dollar’s position around the world. She urged stronger federal regulations to protect investors from fraud and criminal use in the cryptocurrency market.

NY’s Top Lawyer Demands Stricter Crypto Restrictions

James emphasized the importance of a federal regulatory system for digital currencies in her Congressional letter. She identified that lacking regulation, these type of currencies expose users to fraud and monetary volatility.

Bitcoin currently presents an actual threat to the dominance of the dollar, particularly since more businesses and individuals opt for digital currencies when sending money overseas, James indicated.

Her concerns echo those of BlackRock CEO Larry Fink, who suggested that Bitcoin could serve as a hedge against the dollar amid US fiscal challenges and rising inflation.

“Millions of New Yorkers actively buy, sell or hold cryptocurrency and other digital assets, and they deserve further protection,” James wrote in her message.

NEW: This morning @NewYorkStateAG Letitia James sent a letter to congressional leaders @LeaderJohnThune, @SenSchumer, @SpeakerJohnson and @RepJeffries urging them to pass a federal regulatory framework for digital assets to mitigate fraud, criminal activity, and financial… pic.twitter.com/yJjDgBqdBt

— Eleanor Terrett (@EleanorTerrett) April 10, 2025

Stablecoin Safeguards And Investor Protection Measures

The Attorney General placed particular emphasis on stablecoins, which are cryptocurrencies pegged to stable assets such as the US dollar. She called on lawmakers to establish regulations mandating that stablecoin issuers have a US presence and support their tokens with US dollars or treasuries.

James described how stablecoins facilitate the exchange of value among various cryptocurrencies but, in the absence of regulation, can be manipulated and create fraud.

She also demanded greater protections from crypto scams that have resulted in tremendous financial losses. “Thousands of New Yorkers and investors nationwide have lost millions of dollars to cryptocurrency scams and fraud that can be avoided with more robust federal regulations,” James said.

Keep Crypto Out Of Retirement Funds

James actually cautioned against having digital assets in retirement accounts like IRAs. She contended that cryptocurrencies are too volatile and risky for retirement savings plans, citing the extreme price fluctuations of Bitcoin as proof of instability capable of injuring the financial well-being of individuals, especially retirees relying on savings. This is because financial institutions like Fidelity began offering crypto IRA options to clients.

In addition to investor protection, James also contended that thorough crypto regulations would enhance national security. She explained that cryptocurrency purchases are usually anonymous and used for criminal activities, thus necessitating the government to implement stringent rules mandating crypto firms to register with regulators and adhere to anti-money laundering protocols.

Featured image from Dado Ruvic/REUTERS, chart from TradingView

Bitcoin

Is Bitcoin Ready for Another Surge?

The US Dollar Index (DXY), which measures the dollar’s value against a basket of foreign currencies, has dropped to a three-year low. The decline contrasts with gold’s performance, which hit an all-time high of $3,220 amid rising trade war tensions.

Yet, DXY’s dip has sparked optimism among cryptocurrency investors. Many see the weakening dollar as a bullish signal for Bitcoin (BTC), which has recently shown signs of modest recovery.

Will Bitcoin Rally Following the DXY Index’s Fall?

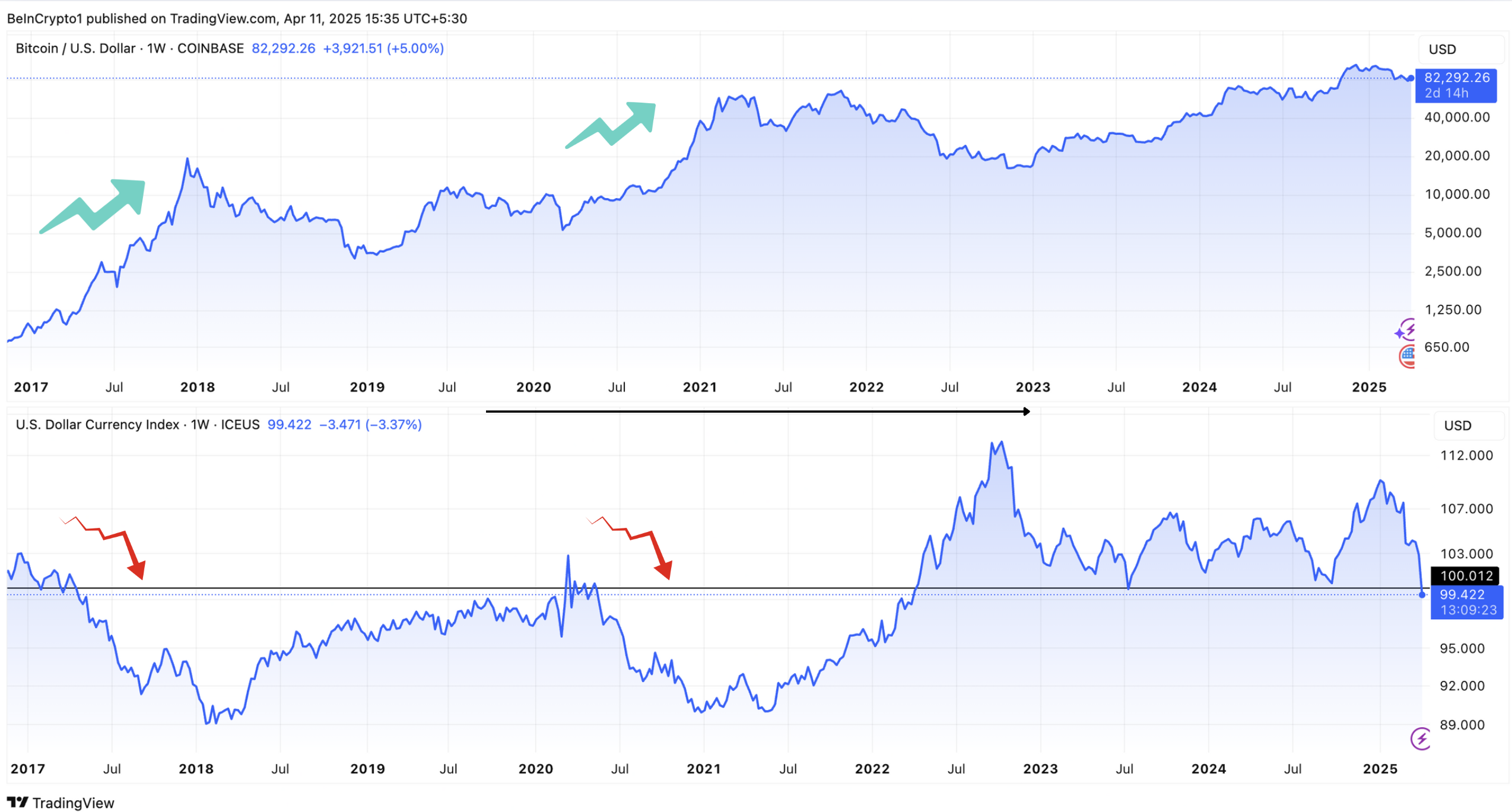

Data shows that the DXY index dropped by 1.5% in the last 24 hours. As of press time, it stood at 99.4, marking its lowest level since April 2022. The decline is part of a broader trend in 2025, with the DXY down 8.3% since January.

“The US dollar index dropped to its lowest level in nearly three years amid capital outflows from American assets. Escalating trade tensions and growing concerns over broader economic fallout, particularly for the US, have weighed heavily on market sentiment,” CryptoQuant’s Alex Adler told BeInCrypto.

Notably, the index’s fall below 100 marks a critical threshold. Historical data highlights a strong correlation between a declining DXY and substantial Bitcoin price surges.

The last two times the DXY fell below the 100 mark—in April 2017 and May 2020—Bitcoin experienced significant, months-long rallies. These substantial increases have led to speculation that history could repeat itself. If it does, Bitcoin could potentially be poised for another major surge.

Interestingly, Bitcoin has already shown signs of recovery after the 90-day tariff pause. The largest cryptocurrency reclaimed the $80,000 level, signaling renewed investor confidence. According to BeInCrypto data, Bitcoin appreciated by 0.8% over the past 24 hours. This reflected minor but positive gains that suggest momentum could be building.

In fact, the market watchers on X (formerly Twitter) share a similar outlook.

“Weak dollar is going to be a surprising tailwind for emerging markets this year that wasn’t on anyone’s bingo card,” a user wrote.

Meanwhile, an analyst observed that the US dollar’s decline has occurred despite the Federal Reserve’s failure to reduce interest rates or implement quantitative easing (QE).

“Traditionally, DXY going down is very bullish for BTC,” he said.

The analyst also highlighted a notable bearish divergence on the charts. Thus, he predicted that the dollar could potentially drop to 90, signaling a further decline in its value.

Similarly, another analyst described DXY’s decline as “one of the best anticipated macro moves ahead.”

“Each time this has happened in the past, it resulted in a massive bull market for Bitcoin, Crypto, and stocks,” Jackis remarked.

He also acknowledged that the markets have been slow to react, attributing this delay to a lag of more than three months. Additionally, he noted that the ongoing bond situation between China and the US, driven by escalating trade tensions, is contributing to this slow reaction.

Yet, he believes this situation will either be resolved through a deal between the two countries or the Federal Reserve will intervene by buying long-term bonds to stabilize the market. Now, the coming weeks will be crucial to determine whether Bitcoin will actually enter another bull run or falter under geopolitical tensions and broader market shifts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin15 hours ago

Altcoin15 hours agoBinance Issues Important Update On 10 Crypto, Here’s All

-

Market16 hours ago

Market16 hours agoArthur Hayes Expects Bitcoin Surge if Fed Injects Liquidity

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum’s True Value? Lower Than You Think

-

Altcoin14 hours ago

Altcoin14 hours agoSolana Meme Coin Fartcoin Price Could Hit $1.29 If It Holds This Key Level

-

Market13 hours ago

Market13 hours agoCrypto Whales Position for Gains with DOGE, WLD and ONDO

-

Market24 hours ago

Market24 hours agoPump.fun Reopens Livestreams with Strict Moderation

-

Market15 hours ago

Market15 hours agoDogecoin and D.O.G.E – Elon Musk’s Billionaire Crypto Experiment

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Leads Market-Wide Drawdown As Altcoin Correlation Spikes – Details