Bitcoin

Crypto Inflows Soar to Record $3.13 Billion

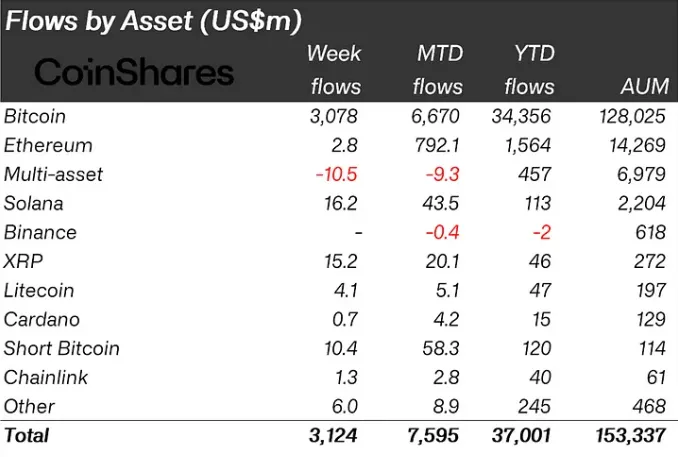

Crypto investment inflows registered a record-breaking weekly inflow of $3.12 billion last week. This surge brings the year-to-date inflows to an unprecedented $37 billion, highlighting Bitcoin’s growing dominance and renewed interest in digital asset investment products.

It comes as Bitcoin (BTC) continues to show potential for new record highs, with the peak price now standing at $99,588 on Binance.

Bitcoin Dominates Amid Crypto Inflows’ Record Highs

Bitcoin led the pack with $3.078 billion in inflows last week, marking its strongest performance to date. Despite reaching all-time price highs, the surge in interest extended to short-Bitcoin investment products, which recorded $10 million in weekly inflows. Notably, these short-Bitcoin inflows reached $58 million for the month — the highest since August 2022.

The recent $3.12 billion inflow is a sharp increase from previous weeks, continuing a strong upward trend. For context, the week prior saw $2.2 billion in inflows, buoyed by Republican electoral momentum and Federal Reserve dovishness.

The week before that brought $1.98 billion in post-election momentum. These successive inflows highlight the market’s resilience and growing confidence among investors despite broader economic uncertainties.

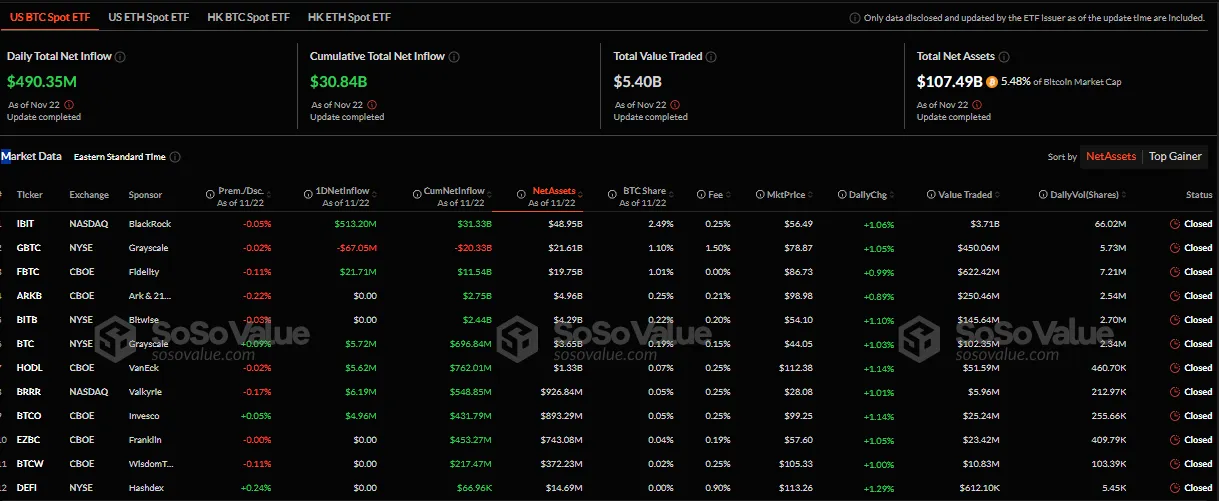

However, the growing adoption of Bitcoin ETFs (exchange-traded funds), which are attracting significant institutional interest, is driving Bitcoin’s rise. According to data on SoSoValue, the cumulative total net inflow for Bitcoin ETFs reached $30.84 billion as of November 22, when markets closed on Friday.

While all eyes were on MSTR, ETFs quietly ingested more than 10x the amount of BTC mined last week. Pac-Man mode activated,” quipped Eric Balchunas, an ETF analyst with Bloomberg Intelligence.

Amid the growing optimism, Balchunas recently noted that US spot ETFs are 98% to passing Satoshi as the world’s biggest BTC holder. Similarly, analysts predict Bitcoin’s upward trajectory could extend to $115,000 this holiday season. Whale activity and long-term holders capitalizing on the current rally bolster the enthusiasm.

MicroStrategy’s Michael Saylor, a vocal Bitcoin advocate, hinted at expanding the company’s Bitcoin holdings, further solidifying institutional confidence in the asset.

Solana (SOL) emerged as a strong contender among altcoins, recording $16 million in inflows last week. This significantly outpaced Ethereum’s $2.8 million. However, on a year-to-date basis, Solana still trails Ethereum, which remains the dominant altcoin with substantially higher total inflows.

Solana’s recent success can be attributed to increasing optimism surrounding Solana-based ETFs. With multiple filings from VanEck, 21Shares, and Bitwise, among others, investor confidence in Solana’s ecosystem has surged.

These ETFs are expected to broaden access to Solana’s technology for retail and institutional investors alike, pending SEC (Securities and Exchange Commission) approvals.

As Bitcoin and broader crypto markets continue their ascent, optimism remains tempered with caution. Market watchers like CryptoQuant caution against over-exuberance, warning of a possible price correction after Bitcoin’s recent climb. Other skeptics, including Justin Bons of Cyber Capital, raised concerns over the cryptocurrency’s vulnerability to liquidity risks.

On the one hand, analysts predict sustained growth driven by ETFs, institutional adoption, and strong market sentiment. On the other hand, warnings of over-leveraged positions and liquidity risks suggest that a pullback could follow this bullish phase. How long this momentum will persist depends on regulatory developments, market sentiment, and macroeconomic factors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Arthur Hayes Sees Tariff War Pushing Bitcoin Toward $1 Million

Arthur Hayes, co-founder of BitMEX and CIO at Maelstrom, believes the global financial system is undergoing a major shift that could propel Bitcoin toward the $1 million mark.

According to Hayes, rising trade tensions between the US and China are accelerating the breakdown of long-standing economic norms, opening the door for neutral assets like Bitcoin to take center stage.

How US-China Standoff Could Drive Bitcoin Demand in Shifting Financial Order

In an April 5 X post, Hayes speculated that the exchange rate between the US dollar and Chinese Yuan (USDCNY) could climb to 10.00.

He attributed this to Chinese President Xi Jinping’s likely refusal to alter the country’s economic direction to appease US demands, especially under President Donald Trump’s aggressive trade stance.

“USDCNY is going to 10.00 bc there is no way that Xi Jinping will agree to change China in the ways necessary to placate Trump. This is the super bazooka BTC needs to ascend rapidly towards $1 million,” Hayes wrote on Twitter.

Over the past week, the global financial markets have been on edge following the Trump administration’s decision to impose a 10% blanket tariff on all imports. China, facing even higher levies of up to 34%, responded with its own round of retaliatory tariffs set to begin on April 10.

However, Trump doubled down on the confrontation, dismissing China’s reaction as a mistake.

“CHINA PLAYED IT WRONG, THEY PANICKED – THE ONE THING THEY CANNOT AFFORD TO DO!” Trump wrote on Truth Social.

While that political posturing continues, Hayes sees deeper risks brewing beneath the surface. According to him, the ongoing tariff war could undermine the global role of US Treasuries and equities.

For decades, the US has exported dollars by running trade deficits, while foreign nations recycled those dollars into American financial assets. That system, according to Hayes, may no longer be sustainable.

If countries stop accumulating dollars, their demand for US bonds and stocks will shrink. Some may even start selling off reserves to protect their economies.

Hayes noted that even a Trump policy reversal wouldn’t restore confidence, as global leaders may no longer trust the stability of US trade policy.

“Even if Trump backtracks on the severity of the tariffs, no finance minister or world leader can risk Trump changing his mind again, and therefore things cannot return to the way they were. You must do what is best for your country,” Hayes wrote.

In this environment, Hayes sees a renewed role for assets that are not tied to any single government. According to him, gold, long regarded as a safe haven, would make a comeback.

“The dollar will still be the reserve currency, but nations will hold reserves in gold to settle global trade. Trump hinted at this because gold is tariff exempt! Gold must flow freely and cheaply in the new world monetary order,” Hayes stated.

However, Hayes says Bitcoin could be even more appealing in a world defined by decentralization, capital mobility, and reduced trust in traditional power structures.

“For those who want to adapt to a return to pre-1971 trade relationships, buy gold, gold miners and BTC,” he concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

5 Facts About Bitcoin’s Creator

April 5, 2025, marks what would be the 50th birthday of Satoshi Nakamoto—the pseudonymous creator of Bitcoin. This alleged birthday is based on the date listed in his P2P Foundation profile.

While Nakamoto’s true identity remains unconfirmed, his legacy continues to shape the digital financial landscape. Here are five facts about the elusive Bitcoin architect:

April 5 Wasn’t Random

Nakamoto listed April 5, 1975, as his birthday—exactly 42 years after the US government banned private gold ownership under Executive Order 6102 on April 5, 1933, to stabilize the dollar.

Bitcoin, by contrast, was designed to be a decentralized, deflationary alternative to fiat currency. Notably, BTC difficulty adjustment happens every 2016 block—2016 being 6102 in reverse.

Satoshi Nakamoto’s Bitcoin Fortune Remains Untouched

Satoshi’s wallet, believed to hold 1.096 million BTC, has remained untouched since early 2010. Over the past decade, its value has risen more than 333-fold, now exceeding $91 billion.

Despite the wallet’s inactivity, CoinJoin transactions are regularly sent to its address. Some view this as an act of homage or a method of obfuscation.

Still No Definitive Identity

In March 2024, a UK court ruled that Australian computer scientist Craig Wright is not Satoshi, calling his claims “deliberately false.”

An October 2024 HBO documentary controversially pointed to Canadian developer Peter Todd, who strongly denied any connection.

More recently, internet theories have speculated on Jack Dorsey’s possible ties, though no evidence supports the claim. Nakamoto’s identity remains the internet’s most persistent mystery.

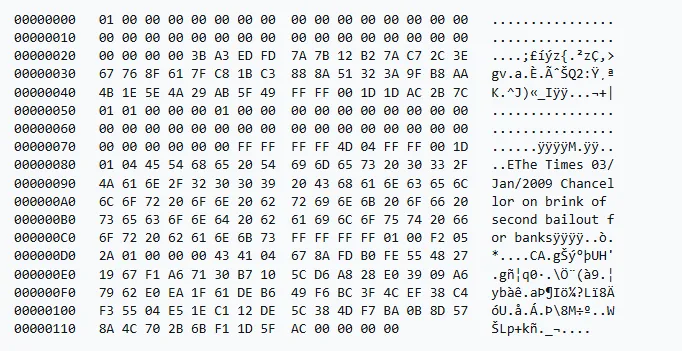

The Genesis Block’s Silent Message

Embedded in Bitcoin’s first block is the headline: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” The line is from a UK newspaper.

It is seen as a critique of centralized monetary policy and remains one of Nakamoto’s only public statements beyond technical documentation.

Bitcoin’s Design Still Holds

Fifteen years after its launch, Bitcoin remains secure and deflationary by design. Nakamoto’s codebase, while modified and improved by the open-source community, still forms the foundation of the network, securing over $1.6 trillion in value.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

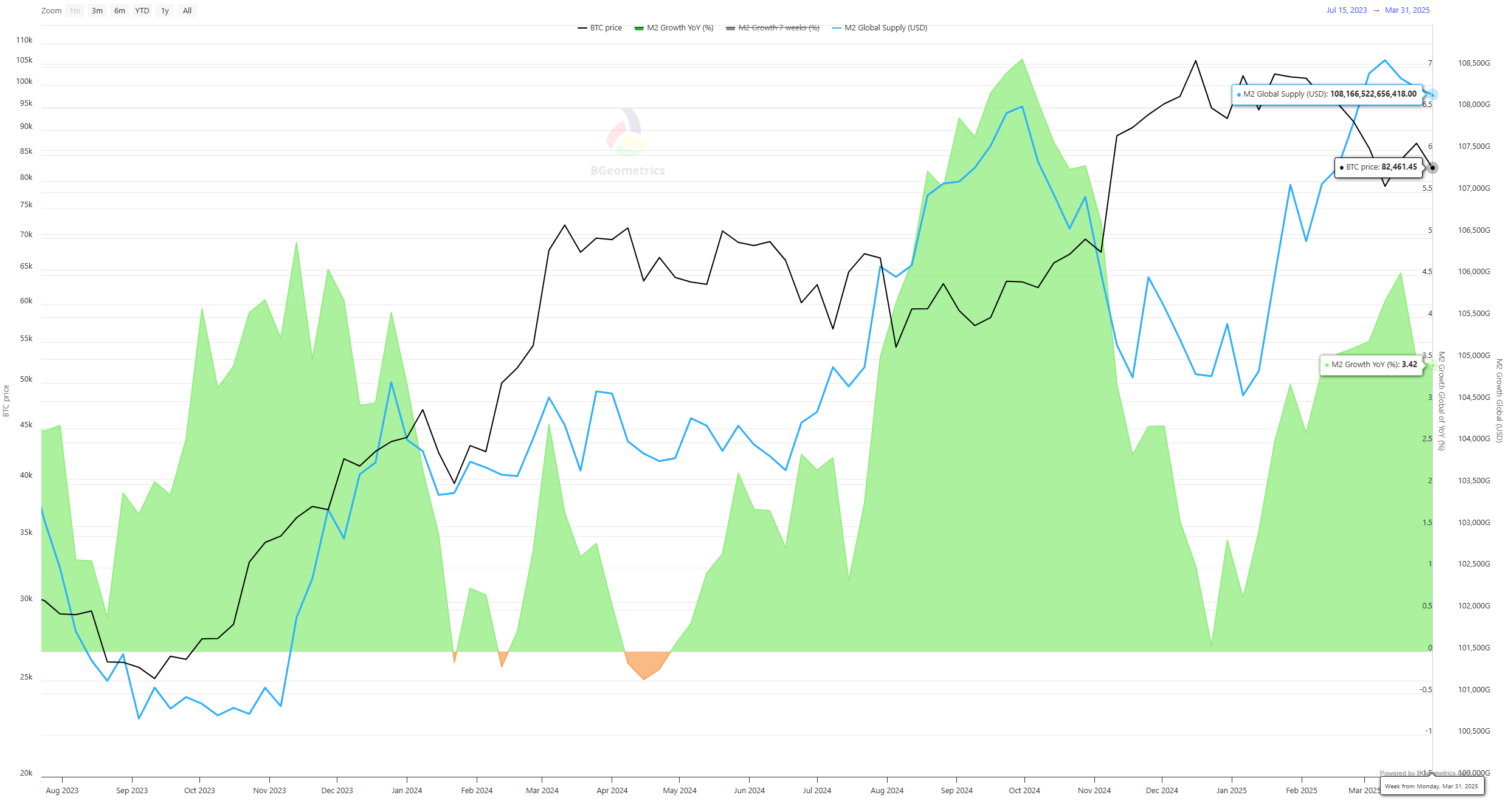

Bitcoin Eyes Breakout as Global M2 Hits Record $108 Trillion

The global M2 money supply has surged to an all-time high of $108.4 trillion, raising fresh questions about Bitcoin’s next move.

The milestone comes amid escalating economic uncertainty following former President Donald Trump’s new “Liberation Day” tariffs and China’s swift retaliatory measures, which together have roiled global markets.

What is M2 and Why Does It Matter for Bitcoin?

Despite the extreme volatility over the past two weeks, Bitcoin’s average value has remained almost unchanged.

Analysts claim that Bitcoin’s latest volatility reflects macroeconomic fears and fluctuating long/short ratios – but the largest cryptocurrency is nowhere near a bear market.

This is largely due to the historical correlation between rising M2 levels and significant Bitcoin rallies.

M2 is a broad measure of a country or region’s money supply. It includes physical cash, checking and savings deposits, and other liquid assets that can be quickly converted to cash.

When M2 increases, it typically signals greater liquidity in the financial system. It simply means more money that often seeks returns in riskier assets such as equities, real estate, or cryptocurrencies like Bitcoin.

Past surges in the M2 money supply have preceded major Bitcoin rallies. Following the COVID-era stimulus programs in 2020-2021, the US M2 supply jumped by over 25%.

This correlated with Bitcoin’s rise from under $10,000 in mid-2020 to an all-time high of over $69,000 by November 2021. Analysts point to a similar pattern today, albeit with a lag.

“Market proponents say that Trump’s tariffs are primarily a negotiation strategy, and their effect on businesses and consumers will remain manageable. Adding to the uncertainty are the inflationary pressures that could challenge the US Federal Reserve’s rate-cutting outlook. Also, resolving the debt ceiling remains a pressing issue, as the Treasury currently relies upon ‘extraordinary measures’ to meet US financial obligations. The exact timeline for when these measures will be exhausted is unclear, but analysts anticipate they may run out after the first quarter,” said Maksym Sakharov, Co-Founder of WeFi Deobank.

Also, Bitcoin’s price often trails global M2 growth by roughly two months.

With M2 accelerating since late February and the current spike taking it to its highest level ever, market watchers suggest that Bitcoin could see a delayed but strong upside if liquidity continues to expand.

However, macroeconomic headwinds could temper near-term gains. Trump’s tariff shock and China’s tit-for-tat response have already triggered the steepest Wall Street losses in five years.

Investors may delay allocating capital to high-volatility assets until trade tensions stabilize.

Still, with M2 surging and Bitcoin supply capped, the setup for a renewed bullish move remains in place. That is if historical patterns hold and markets regain confidence.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

-

Market22 hours ago

Market22 hours agoPEPE Price Breaks Ascending Triangle To Target Another 20% Crash

-

Altcoin22 hours ago

Altcoin22 hours agoPi Network Under Fire As PiDaoSwap Launches NFTs On Binance Chain

-

Regulation22 hours ago

Regulation22 hours agoRipple Whales Move $429 Million, What Is Going On?

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Predicts XRP Price To Reach Double Digits By July 21 Cycle Peak

-

Altcoin18 hours ago

Altcoin18 hours agoPayPal Adds Chainlink And Solana To Its US Cryptocurrency Service

-

Market21 hours ago

Market21 hours agoWhy Analysts Believe Q2 is a Great Opportunity to Buy Altcoins

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin Eyes Breakout as Global M2 Hits Record $108 Trillion

-

Market19 hours ago

Market19 hours agoNFT Market Falls 12% in March as Ethereum Sales Drop 59%