Bitcoin

Crypto Inflows Return with $644 Million Boost, Bitcoin Leads

The market is experiencing renewed optimism as crypto inflows reached $644 million last week.

It is a significant reversal after five consecutive weeks of outflows, suggesting a notable change in investor sentiment.

Crypto Inflows Reach $644 Million, Market Sentiment Recovers

The rebound follows a challenging period in which investor sentiment remained cautious, leading to substantial withdrawals from the market. With total assets under management (AUM) rising by 6.3% since March 10, the latest data suggests a decisive shift in market confidence.

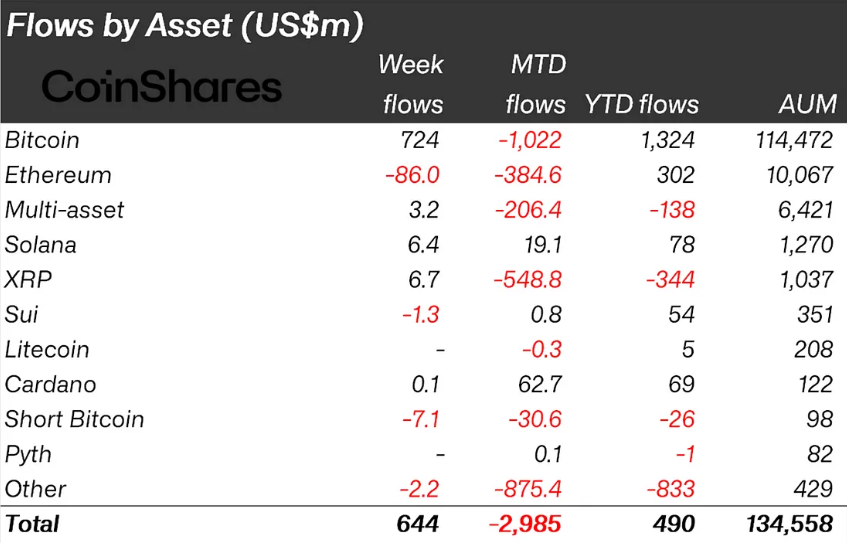

According to the latest CoinShares report, Bitcoin emerged as the primary driver of the market recovery. The pioneer crypto attracted $724 million in inflows, effectively ending a five-week outflow streak totaling $5.4 billion.

The surge in inflows reflects growing investor confidence in Bitcoin, which had previously seen sustained withdrawals amid broader market uncertainty. While Bitcoin saw a strong recovery, the altcoin market experienced a mixed performance.

Ethereum faced the heaviest outflows, with $86 million exiting the asset. On the other hand, Solana recorded $6.4 million in inflows.

The divergence in altcoin sentiment highlights that investors remain selective about where they allocate capital. Specifically, they focus on projects with perceived strong fundamentals. While the data points to continued investor caution regarding Ethereum (ETH), it also indicates investors see strong potential for Solana (SOL).

Meanwhile, most of last week’s infWeek’ssiginated from the US, which saw $632 million enter digital asset investment products.

March Reverses February’s Negative Trend

The return to inflows follows a difficult February and early March, during which crypto outflows surged. A week prior, crypto outflows totaled $1.7 billion, with Bitcoin withstanding the worst withdrawals.

Before that, outflows hit $876 million, led by US investors offloading digital assets amid a bearish trend. Therefore, the latest influx of capital suggests that sentiment may be turning, possibly driven by renewed institutional interest and a more stable macroeconomic outlook.

Further reinforcing the market’s rebound, Bitcoin ETFs (exchange-traded funds) also saw a strong influx of capital. After five consecutive weeks of outflows, Bitcoin ETFs recorded $744 million in inflows last week. This signals increased institutional participation.

The recovery aligns with Bitcoin’s broader market resurgence and suggests that investors are regaining confidence in crypto-based financial products.

“I bet BTC hits $110,000 before it retests $76,500. Why? The Fed is going from QT to QE for treasuries. And tariffs don’t matter cause transitory inflation,” wrote BitMex founder Arthur Hayes.

Meanwhile, BeInCrypto data shows BTC was trading for $87,720 as of this writing. This represents a surge of almost 4% in the last 24 hours, with the pioneer crypto steadily edging toward the $90,000 psychological level.

“Bitcoin rose above $87,000 on Monday, its highest since March 7, after dipping to $76,000 earlier this month. The rally comes as reports suggest upcoming Trump tariffs, set for April 2, will be more targeted and less disruptive than feared,” finance expert Walter Bloomberg observed.

The upcoming Trump tariffs, set for April 2 and dubbed “Liberation Day,” are expected to be less disruptive than anticipated. This could boost investor confidence in riskier assets like Bitcoin. The White House’s plan for reciprocal tariffs aims to equalize trade barriers, with Trump emphasizing no exceptions but offering unspecified “flexibility” for certain nations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

8,000 Dormant Bitcoin Suddenly Move: What’s Next For The Market?

Popular CryptoQuant analyst Maartunn reports that 8,000 Bitcoin (BTC) which have been dormant for five to seven years have been moved suddenly, adding to current bearish concerns in the crypto. This development comes after a rather adventurous week as BTC prices struggled to break above $89,000, following an initial steady bullish climb, before succumbing to heavy selling pressures driven by US President Donald Trump’s hawkish tariff policy.

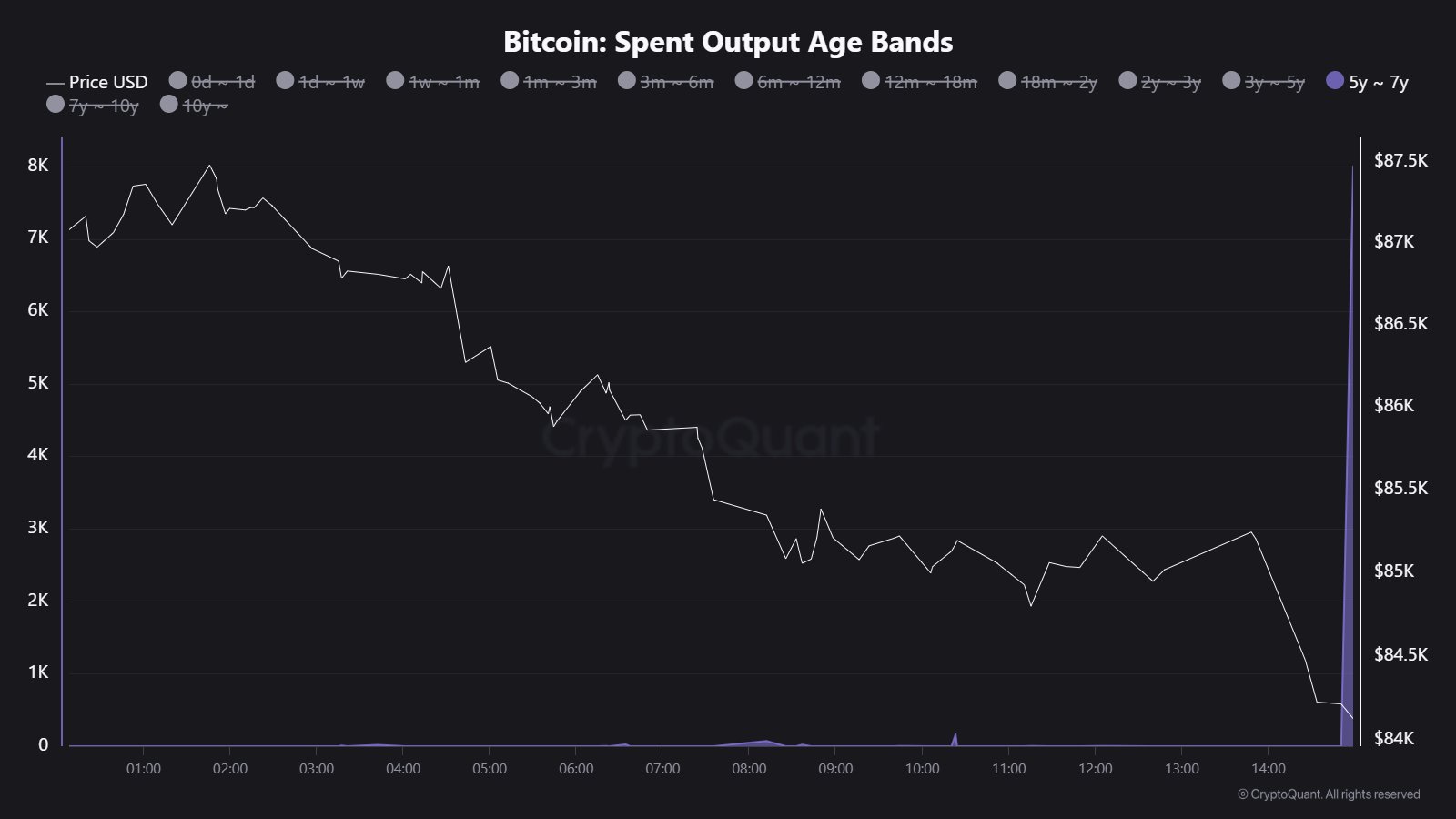

$674 Million In Old BTC Transfers In Single Block – Cause For Alarm?

The Spent Output Age Bands is a crucial metric to measure how long Bitcoin tokens remain inactive before moving. According to Maartuun in an X post, this metric has recently revealed that 8,000 BTC worth $674 million that was last transferred between 2018 and 2020 have been moved recently in a single block drawing significant market attention.

This transfer follows a string of recent activations of dormant Bitcoin stashes. On March 24, a 14-year inactive Bitcoin wallet suddenly moved 100 Bitcoin valued at $8.5 million. Meanwhile, in early March, six ancient Bitcoin wallets also transferred nearly 250 BTC worth $22 million.

Notably, the most recent transaction reported by Maartuun is of far larger size with potentially strong implications for an uncertain Bitcoin market. Generally, a movement of such a large amount of BTC from long-term dormancy is usually interpreted as a signal for incoming selling pressure leading to major price corrections.

However, there are other potential non-bearish motives behind such transactions such as internal wallet shuffling by institutional investors or large holders as well as a cold storage reorganization. Currently, the owners of the new wallets receiving the 8000 is unknown thus reducing the potential of a bearish reaction from BTC holders.

Bitcoin Price Overview

In the last day, Bitcoin prices declined by 4.00% after the US Government announced intentions to impose a 25% tariff on auto imports and goods from China, Mexico, and Canada starting from April 3. This marks the latest negative reaction of the crypto market to President Trump’s international trade policies following similar incidents in early February and mid-March.

These measures by the Donald Trump administration are flaming fears of a potential economic slowdown which could further push high-risk assets such as BTC out of investors’ portfolios leading to a further downside.

At press time, Bitcoin currently trades at $83,693 reflecting a decline of 0.72% and 2.53% in the last seven and 30 days respectively. Meanwhile, the asset’s daily trading volume is up by 19.38% and is valued at $31.58 billion. The BTC market cap now stands at $1.66 trillion and still represents a dominant 61.1% of the total crypto market.

BTC trading at $83,727 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Bitcoin

Bitcoin Price Could Surge To $95,000 — But Analyst Sounds ‘Bull Trap’ Alarm

The Bitcoin price seemed to be breaking out of its consolidation range early on in the week, rising to as high as $88,500 on Monday, March 24. However, the flagship cryptocurrency appears to be back to ground zero, retracing to around $84,000 on Friday, March 28.

This recent price correction came following the release of inflation data in the United States. With the latest inflation data suggesting delayed rate cuts by the US Federal Reserve, risk assets — including cryptocurrencies — experienced significant downward pressure to close the week.

Here’s How BTC Price Could Fall To $62,000

The story gets a little grim for the world’s largest cryptocurrency after popular crypto analyst Crypto Capo put forward a bearish projection for the Bitcoin price in their latest post on the X platform. According to the crypto trader, the price of BTC could be on its way to a new low in this cycle.

Crypto Capo highlighted in their analysis of the BTC 12-hour chart that the $84,000 – $85,000 is pivotal for the premier cryptocurrency’s future trajectory. The online pundit noted that the Bitcoin price action could go one of two ways over the next few weeks.

In the first scenario, Crypto Capo expects the price of Bitcoin to enjoy a short-lived bullish burst to within the $95,000 – $100,000 range. This initial price run-up would be a bull trap for investors, according to the analyst. For context, a bull trap is a pattern that lures long traders (bulls) into the market by an initial upward surge followed by a quick reversal.

Fittingly, Crypto Capo predicts that Bitcoin will experience a capitulation event that will see its value plummet to the next main support. As seen in the chart below, this next major support lies within the $62,000 – $69,000 bracket, containing the April and November all-time high prices.

Source: @CryptoCapo_ on X

In the alternate scenario, Crypto Capo highlighted how the first bull trap idea could be invalidated. According to the trader, if the Bitcoin price successfully closes beneath the $84,000 – $85,000 range, it could fall to the $62,000 – $69,000 bracket.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin is moving around the $83,300 level, reflecting a 3% decline in the past 24 hours. This single correction event has wiped out the premier coin’s early-week profit, with CoinGecko data showing no significant gain or loss in the last seven days.

The price of BTC slides beneath $84,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image created by DALL-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

El Salvador’s Nayib Bukele Open to White House Visit

El Salvador’s President Nayib Bukele has hinted at an upcoming visit to US President Donald Trump at the White House. The move has fueled speculation about closer cooperation between the two pro-Bitcoin leaders.

Although no official agenda has been released, if confirmed, the meeting would mark Bukele as the first Western Hemisphere leader to visit Trump at the White House during his current term.

Can Bitcoin Improve Diplomatic Relationship Between US and El Salvador?

On March 28, Bukele reacted to a report claiming that Trump plans to invite him to Washington.

Responding on social media, Bukele confirmed his willingness to visit and jokingly noted that he would bring “several cans of Diet Coke” — a nod to Trump’s well-known beverage of choice.

The two leaders have enjoyed a friendly relationship since Trump’s return to office. They reportedly spoke after the inauguration, and Trump later thanked Bukele publicly, commending his “understanding of this horrible situation” regarding US border issues.

Meanwhile, the possible visit follows El Salvador’s acceptance of deported Venezuelan gang members from the US.

These individuals were held at the country’s high-security Terrorism Confinement Center. The facility was recently visited by US Homeland Secretary Kristi Noem.

President Bukele’s administration has earned international praise — and criticism — for its tough stance on crime. His crackdown on gangs has transformed El Salvador from one of the most violent nations in the world to one of the safest in Latin America.

Meanwhile, speculation is growing within the crypto community that Bitcoin may emerge as a significant topic during the leaders’ discussions. Both Bukele and Trump have openly supported Bitcoin, though their approaches differ slightly.

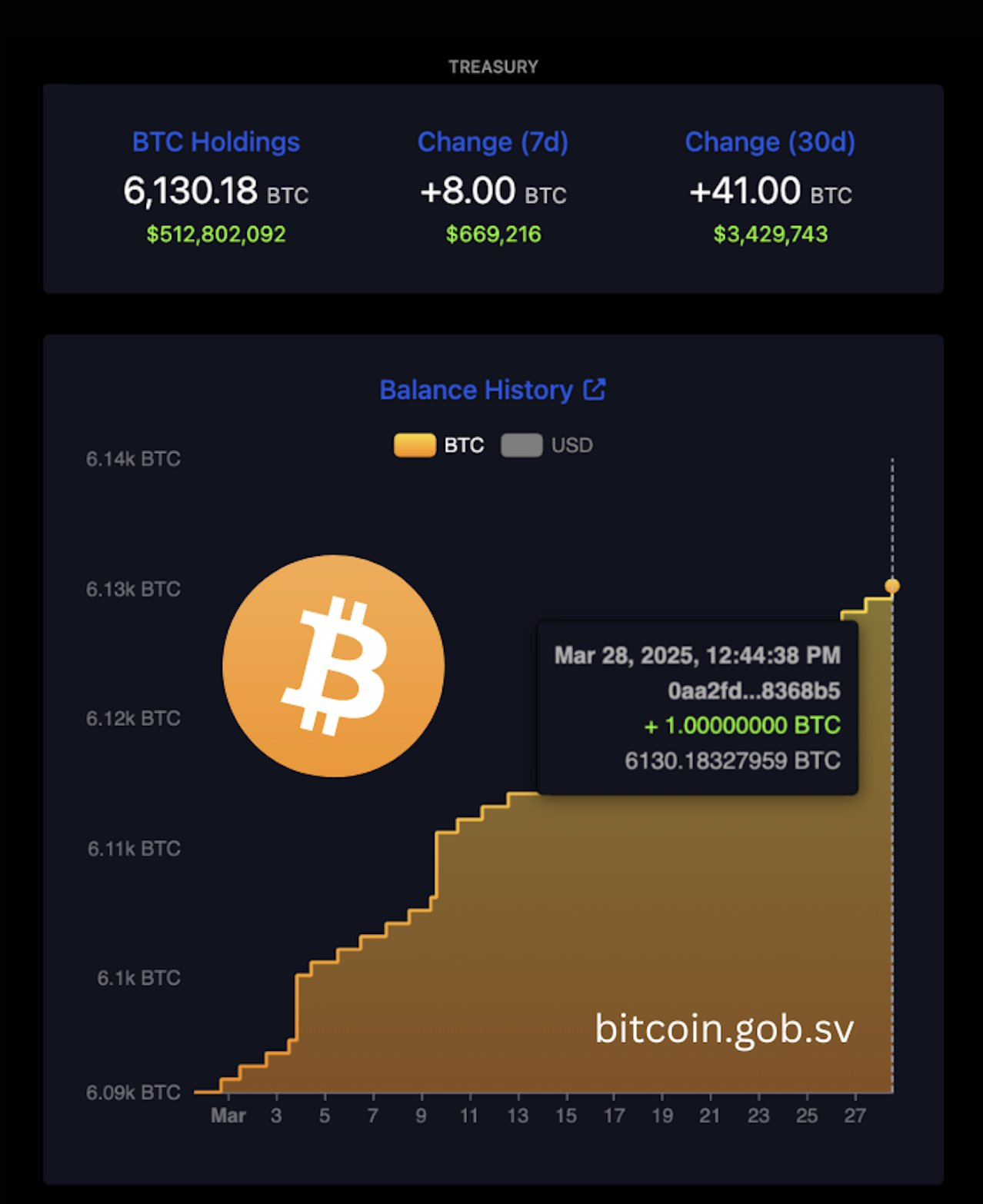

Bukele’s stance on Bitcoin is notably proactive. In 2021, he spearheaded the creation of the world’s first national Bitcoin reserve, which has since grown to 6,130.18 BTC—worth over $512 million.

Moreover, his pro-Bitcoin initiatives have attracted substantial foreign investments, including partnerships with prominent crypto companies like Tether.

President Trump also recently became more supportive of the top crypto asset, reversing previous skepticism.

Earlier this month, Trump authorized the establishment of a US National Bitcoin Reserve, with the federal government holding initial holdings of around 200,000 BTC.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin14 hours ago

Altcoin14 hours agoExpert Predicts Listing Date For WLFI’s USD1 Stablecoin, Here’s When

-

Market14 hours ago

Market14 hours agoGRASS Jumps 30% in a Week, More Gains Ahead?

-

Bitcoin19 hours ago

Bitcoin19 hours agoEl Salvador’s Nayib Bukele Open to White House Visit

-

Altcoin18 hours ago

Altcoin18 hours agoDid XRP Price Just Hit $21K? Live TV Display Error Goes Viral

-

Altcoin12 hours ago

Altcoin12 hours agoPepe Coin Whale Sells 150 Billion Tokens, Price Fall Ahead?

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Breakdown, Analyst Eyes $1,130–$1,200 Price Target

-

Bitcoin18 hours ago

Bitcoin18 hours agoBitcoin Price Could Surge To $95,000 — But Analyst Sounds ‘Bull Trap’ Alarm

-

Market18 hours ago

Market18 hours agoDark Web Criminals Are Selling Binance and Gemini User Data