Bitcoin

Bitcoin Traders’ Realized Losses Reach FTX Crash Levels — What’s Happening?

The price of Bitcoin has had an interesting performance so far in 2025, starting the year with a run to a new all-time high. However, the flagship cryptocurrency finished the year’s first quarter with over 15% of its value shaved off in those three months.

While the BTC price appears to be steadying within a consolidation range, the prognosis doesn’t look all positive for the world’s largest cryptocurrency. This explains why several short-term investors are getting frustrated and, as a result, exiting the market.

Is Bitcoin About To Go Up?

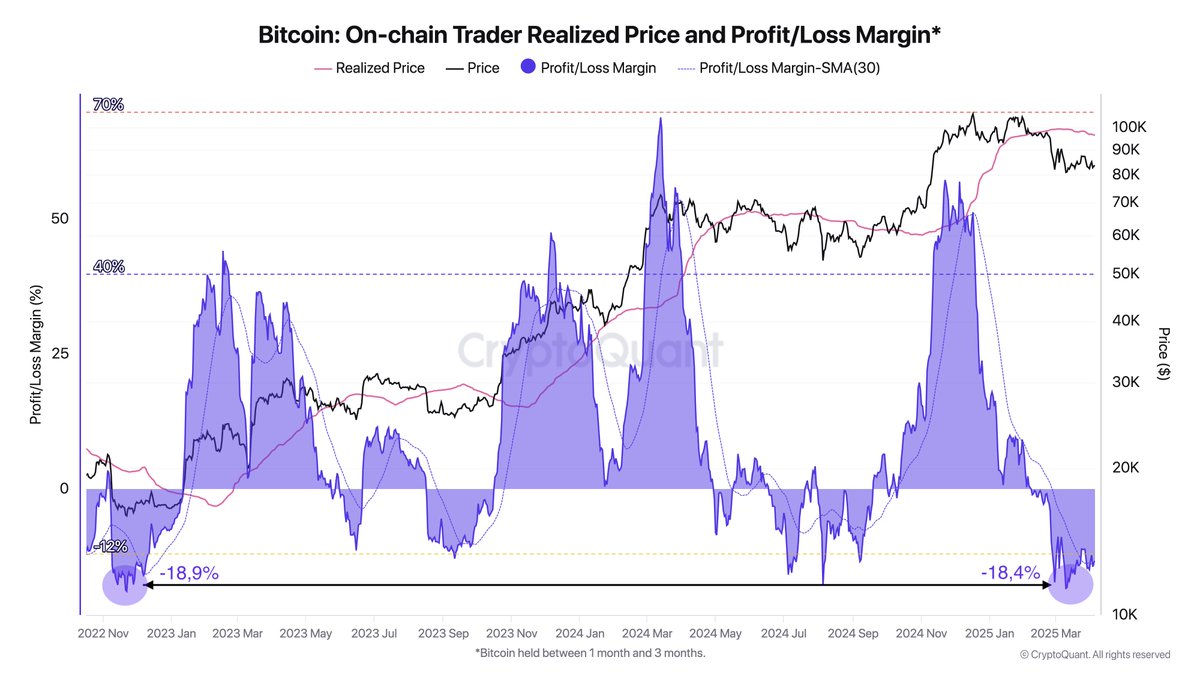

In a new post on the X platform, an on-chain analyst with the pseudonym Darkfost revealed that a certain class of Bitcoin holders have been selling their assets at a loss. According to the crypto pundit, the sell-offs are occurring at a rate not seen since the FTX collapse.

This on-chain observation is based on a significant drop in the Profit/Loss Margin, which tracks the profitability of investors by comparing their purchase price to the current price of a cryptocurrency. This metric offers insight into whether the market is in a state of unrealized profit or loss.

Specifically, Darkfost’s analysis focuses on Bitcoin investors who have been holding BTC for between one to three months (otherwise known as short-term holders). These traders are considered the most reactive class of holders, a trait highlighted by their recent activity.

Source: @Darkfost_Coc on X

According to Darkfost, BTC short-term holders have been offloading their coins at a loss since early February. These realized losses have now reached levels last seen in the FTX crash and are even higher than the losses recorded during the 2024 price pullback.

Historically, significant loss realization by the Bitcoin short-term holders has preceded substantial upward price movements, especially when long-term holders continue to accumulate. Hence, the persistence of this trend means that long-term investors will take the coins off the weak hands before the next bullish jump.

BTC Price At A Glance

As of this writing, the price of BTC stands at around $83,700, reflecting no significant change in the past 24 hours. According to data from CoinGecko, the market leader is up by 1% in the last seven days.

The price of Bitcoin is thickening around the $84,000 level on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Gary Gensler Explains Why Bitcoin Will Outlast Altcoins

Former US Securities and Exchange Commission (SEC) Chair Gary Gensler has stated that Bitcoin (BTC) could continue to exist and thrive for a long time.

However, Gensler emphasized that this may not be the case for most altcoins, as they lack solid fundamentals.

Why Gary Gensler Believes in Bitcoin

In a recent interview with CNBC, Gensler mentioned that Bitcoin’s enduring presence could be attributed to its strong global interest.

“Something like Bitcoin may persist for a long time because there’s 7 billion people around the globe, a real keen interest in it,” he stated.

Gensler, who served as SEC Chair from 2021 to 2025, made these remarks in response to questions about the crypto industry’s reaction to the dismissal of lawsuits and investigations initiated during his tenure.

While at the SEC, Gensler took a hard stance on cryptocurrency regulation. He launched multiple enforcement actions targeting several exchanges, token issuers, and other crypto entities.

While he refrained from commenting directly on the dismissal of these cases, he shifted focus to broader trends within the cryptocurrency market.

“I’m going to step back a little bit from any individual cases and just say this again to your viewing public. This is a very small part of the financial markets, but if you were interested in this, think about every financial asset sort of trades on a bit of fundamentals and sentiment. But this field is almost 99, or maybe one might say 100% sentiment and very little on fundamentals,” said Gensler.

The former SEC chair advocated for careful asset risk assessment. He noted that the primary focus should be the project’s fundamentals. Moreover, he warned that many assets are driven predominantly by sentiment. As a result, he suggested that such tokens are generally unsustainable and likely to lose value over time.

When pressed on whether Bitcoin should be grouped with other cryptocurrencies, Gensler drew an analogy to precious metals. He implied that Bitcoin holds a unique position in the cryptocurrency world.

“There’s only two or three precious metals. We humans have a certain fascination with two or three precious metals like gold,” he remarked.

Gensler believes that the vast majority of cryptocurrencies, especially those driven by trends, memes, or social sentiment, will not attract lasting interest. He stressed that only a few, like Bitcoin, will stand the test of time.

These comments align with Gensler’s previous statements on the crypto market. In a January 2025 interview with CNBC, he acknowledged BTC’s volatility yet showed faith in its long-term prospects.

“With 7 billion people around the globe, 7 billion people want to trade it just like we do have gold for 10,000 years. We have Bitcoin. It might be something else in the future as well,” Gensler noted.

Despite the optimistic outlook, Gensler disclosed that he did not own any Bitcoin or other crypto assets.

Gensler’s remarks reflect ongoing debates about the legitimacy and sustainability of cryptocurrencies. While Bitcoin has gained traction as a store of value, many altcoins struggle to demonstrate the same level of acceptance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

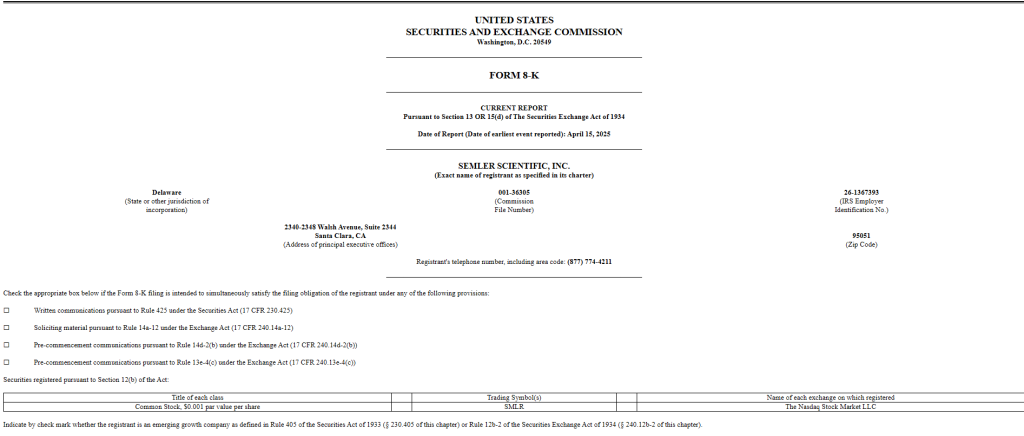

Semler Scientific Files To Buy $500-M In Bitcoin

Semler Scientific is looking to raise $500 million in new securities after settling a large case with the Department of Justice, according to company filings. The health care technology company will use some of the money to expand its crypto holdings, which are already in excess of 3,000 coins.

Company Enters $30 Million Settlement With Justice Department

As per recent Securities and Exchange Commission (SEC) filings, Semler Scientific has reached a $29.75 million settlement with the Department of Justice regarding marketing practices for its QuantaFlo product. The probe, which started in 2017, centered on potential violations of federal anti-fraud laws regarding the manner in which the company marketed its flagship product.

The settlement negotiations progressed in recent months following years of cooperation with several subpoenas. The deal is not complete yet, according to the company’s Tuesday SEC filing, but Semler has already obtained a way to finance the payment.

Semler Scientific's filing with the SEC. Source: US SEC.

Coinbase Loan To Fund Settlement Without Selling Bitcoin

Instead of liquidating its cryptocurrency holdings, Semler intends to use a loan from Coinbase to settle the DOJ case. The loan will be secured by the company’s large Bitcoin reserves, which stand at 3,190 BTC valued at about $267 million at current market prices.

This funding strategy enables Semler to satisfy its legal requirements without liquidating its cryptocurrency holding. With Bitcoin as collateral, the company can preserve its balance sheet strength while fulfilling the settlement needs.

Half-Billion Dollar Securities Filing Points To Bigger Crypto Plans

Apart from the settlement expenses, Semler has submitted an S-3 registration to the SEC to sell $500 million worth of securities. The filing indicates the company is not merely raising cash to pay the DOJ settlement but wants to increase its Bitcoin holding substantially.

Image: Threads

The action is made at a time when other businesses continue to accumulate Bitcoin into their coffers. According to reports in the filing, Michael Saylor’s firm recently bought 3,450 bitcoins worth $286 million, increasing its holdings to 531,640 bitcoins. Another company, Metaplanet, acquired $26 million worth of Bitcoin over the same time.

Image: Brookings Institution

Market Analysts Remain Bullish Despite Price Swings

The timing of Semler’s intended Bitcoin buys is during market volatility yet also forecasts of extreme price appreciation. An analyst, who goes by the handle “Titan of Crypto” forecasted Bitcoin to hit $137,000, although no timeframe was given for that price level.

The healthcare technology firm has not indicated precisely when it will finish its securities offering or make further Bitcoin buys. Nevertheless, the SEC filing clearly indicates that adding to cryptocurrency holdings is still a priority in addition to paying for the DOJ settlement.

Featured image from Pexels, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

ETF Issuers Bring Stability to Bitcoin Despite Tariff Chaos

BlackRock’s Bitcoin ETF is in the top 1% of performers in this category despite tariff chaos. Analysts theorize that the issuers are stabilizing Bitcoin’s volatility, and the ETF market will make BTC more secure in the future.

The issuers act as major whales, buying up any token dumps from retail investors. However, this new stability is entirely contingent on these powerful firms, which are exposed to broader macroeconomic concerns.

Are the ETFs Stabilizing Bitcoin?

The threat of Trump’s tariffs has brought chaos and uncertainty into global markets, but the price of Bitcoin has been relatively fine. Although it has fallen from its all-time high in January, its price shelf is still well above its performance before the November election.

According to one analyst, the ETFs may be providing Bitcoin with this extra stability:

“Bitcoin ETFs have eked out positive inflows past month and YTD and IBIT is +2.4 billion YTD (Top 1%). Impressivem and in my opinion, helps explain why BTC’s price has been relatively stable: its owners are more stable. ETF investors are much stronger hands than most think. This should increase stability and lower volatility and correlation long term,” claimed Eric Balchunas.

Since the Bitcoin ETFs first hit the market, they’ve totally transformed the crypto industry, but it’s been difficult to quantify that transformation.

However, this impending economic crisis has given analysts a useful chance to collect hard data from a stress test. Balchunas emphasized that ETF issuers had a powerful demand for BTC, which has powered some changes.

Over the last few months, US ETF issuers have been buying tremendous amounts of Bitcoin. Collectively, they surpassed Satoshi’s holdings in December and bought 20x as much BTC as the global mining output in January. Who met this apparent crisis in supply? Retail investors.

Bitcoin is more integrated than ever into traditional finance, and that presents a few opportunities. For any number of reasons, retailers have been compelled to dump their tokens.

Normally, these actions could spook the markets, but ETF issuers (and Michael Saylor’s Strategy) have been willing to buy as much Bitcoin as possible.

In other words, these whales have done a lot to hold up confidence in the entire market. Ideally, ETF issuers will have a mostly positive impact on the sector, potentially curing Bitcoin’s infamous chronic volatility.

Unfortunately, this substantial change comes with serious practical drawbacks, even discounting fears of de-decentralization. Since the ETFs transformed the market like this, Bitcoin has been more entangled than ever with broader macroeconomic trends.

These trends, however, could force these big whales to sell. Can we afford to tie Bitcoin’s fate to these actors?

The ETF issuers have a high confidence in Bitcoin, which has kept its price steady throughout the tariff chaos. If they lose that confidence for any reason, it could cause a powerful demand crisis.

This investment trend has been a tremendous benefit to the crypto industry, but it’s important to keep an eye on the potential risks involved.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoPEPE Price To Bounce 796% To New All-Time Highs In 2025? Here’s What The Chart Says

-

Ethereum19 hours ago

Ethereum19 hours ago77K Ethereum Moved to Derivatives—Is Another Price Crash Looming?

-

Market18 hours ago

Market18 hours agoBitcoin and Global M2 Money Supply: A Misleading Connection?

-

Market21 hours ago

Market21 hours agoNo Rate Cut Soon, Crypto Banking Rules to Ease

-

Market20 hours ago

Market20 hours agoEthereum Price Struggles to Rebound—Key Hurdles In The Way

-

Bitcoin19 hours ago

Bitcoin19 hours agoSemler Scientific Files To Buy $500-M In Bitcoin

-

Market12 hours ago

Market12 hours agoExpanding Blockspace and Enhancing Privacy

-

Altcoin17 hours ago

Altcoin17 hours agoCrypto Whales Bag $20M In AAVE & UNI, Are DeFi Tokens Eyeing Price Rally?