Bitcoin

Bitcoin Surpasses Meta, Now World’s 9th Largest Asset

Bitcoin has reached a milestone, surpassing Meta to secure the 9th position in global market capitalization rankings.

The rally, driven by investor optimism following Donald Trump’s win in the 2024 US presidential election, has propelled Bitcoin to a market cap of $1.48 trillion, once again edging out Meta’s $1.44 trillion.

Bitcoin is Now the 9th Largest Asset Worldwide

With each Bitcoin now valued at approximately $74,900, the cryptocurrency has surpassed Meta’s market cap with notable resilience.

This marks the second time Bitcoin has overtaken Meta, following a rally in March when it briefly surged above $73,000. The milestone highlights Bitcoin’s increasing relevance and competitive positioning alongside other major tech giants.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

The list is topped by gold, which has a market cap of $17.95 trillion. Chip maker NVIDIA is next at $3.57 trillion, followed by Apple at $3.36 trillion.

Other companies in this ranking include Microsoft, Amazon, and Alphabet (Google). Bitcoin’s latest valuation places it just behind silver in 9th place. This development demonstrates Bitcoin’s evolution from a niche digital asset to a globally significant store of value.

Can Bitcoin Overtake Silver?

As Bitcoin climbs the global market cap rankings, many are now wondering if it could soon surpass silver. Silver currently holds a market cap of approximately $1.75 trillion, placing it just above Bitcoin’s $1.48 trillion.

In March 2024, Bitcoin briefly overtook silver as Bitcoin became the 8th-ranking global asset.

“I could potentially see Bitcoin to become the 21st century digital gold. Let’s not forget that gold was also volatile historically. But it is important to keep in mind that Bitcoin is risky: it is too volatile to be a reliable store of value today. And I expect it to remain ultra-volatile in the foreseeable future,” said Marion Laboure, analyst at Deutsche Bank Research.

At that time, its valuation surged to $1.42 trillion, surpassing silver at $1.387 trillion, with a 4% increase to an all-time high beyond $72,000. With Bitcoin’s recent momentum and continued interest from institutional investors, this event is likely to repeat.

Surpassing silver would further solidify Bitcoin’s position as a digital gold and strengthen its reputation as a valuable asset in the broader financial arena. If Bitcoin continues on this trajectory, overtaking silver could be the next milestone in its journey.

Mainstream Bitcoin Adoption

Bitcoin’s ascent into the world’s top assets is accompanied by growing interest, as shown by investment flows into various exchange-traded funds (ETFs).

For instance on November 6, the majority of Bitcoin products showed positive inflows. Fidelity’s FBTC led with a substantial $308.8 million inflow, suggesting strong investor interest. Bitwise’s BITB and Ark’s ARKB also gained, receiving $100.9 million and $127 million, respectively.

Grayscale’s GBTC, despite previous outflows, managed a modest change of $30.9 million. This day’s inflows highlight a general uptick in interest across various ETFs, contrasting with recent periods of volatility and outflows in other funds. Total inflows reached $621.9 million, reflecting a demand for Bitcoin products.

Read more: What Is a Bitcoin ETF?

As Bitcoin continues to solidify its position among the world’s largest assets, these investment patterns suggest that mainstream adoption is on the horizon. With institutional support growing and infrastructure maturing to facilitate broader access, Bitcoin is positioned as a viable asset in traditional finance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Tokenized Gold Market Cap Tops $1.2 Billion as Gold Prices Surge

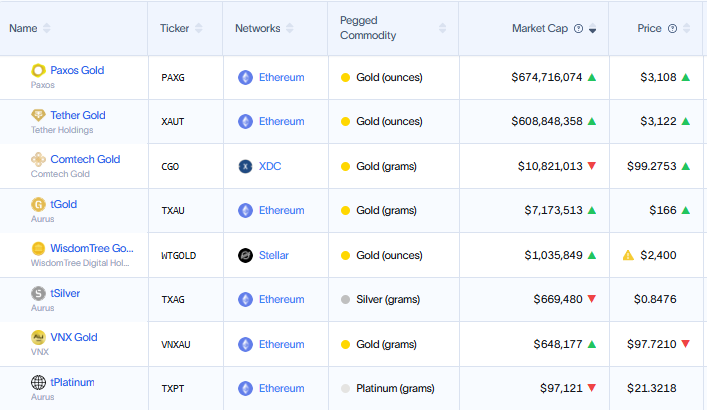

The market cap of tokenized gold has surpassed $1.2 billion, driven by soaring gold prices and a growing appetite for blockchain-based assets.

Rising interest in tokenized gold is part of a broader movement to modernize storage, trading, and utilization in financial markets.

Gold Meets Blockchain Amid Tokenization Revolution

Gold price has reached historic highs above $3,000 per ounce. With this surge, digital representations of precious metals, such as Tether Gold (XAUT) and Paxos Gold (PAXG), capture investor interest.

Don Tapscott, co-founder of Blockchain Research Institute, argues that tokenized gold could transform the $13 trillion gold market by bringing transparency, liquidity, and new financial models.

Based on this assumption, he questioned why gold is still stored in vaults as it was in the 1800s. Meanwhile, assets like Bitcoin (BTC) and stablecoins have gone digital. He believes blockchain technology can revolutionize gold’s role in finance.

“The US government could even tokenize its gold reserves, track them immutably, and use them in innovative ways,” Tapscott explained.

He stated that such an outcome would enable fractional ownership, on-chain verification, and increased accessibility to investors worldwide.

Meanwhile, companies such as Paxos and Tether lead the charge in tokenized gold offerings. Paxos holds a 51.74% market share, while Tether’s holdings follow closely behind at 46.69%.

Publicly listed Matador Technologies is taking a unique approach by tokenizing gold on the Bitcoin blockchain. This offers investors a digital claim on both physical gold and limited-edition digital art.

“We believe that the next generation of financial powerhouses will likely emerge from the tokenization revolution. It’s still early, and the playing field is wide open. Matador and others have the bull by the horns,” Tapscott noted in a recent article.

Gold Tokenization in the US: A Bold Policy Shift?

The momentum behind tokenized gold has also reached the US government. Following President Trump’s March 5 executive order to establish a Strategic Bitcoin Reserve (SBR), policymakers are exploring ways to modernize gold holdings.

Treasury Secretary Scott Bessent has indicated that the US will move to “monetize its assets,” leading some to speculate that Fort Knox gold could be tokenized.

“US Treasury Secretary Scott Bessent says, all the GOLD is there, as he has no plans to visit Fort Knox or to revalue GOLD reserves in a sovereign wealth fund. He speaks on “Bloomberg Surveillance,” Erik Yeung noted.

Senator Cynthia Lummis has also proposed swapping some of the US government’s gold reserves for Bitcoin. US gold reserves are held at a book value of $42 per ounce—unchanged since 1973—despite the market price exceeding $3,000 per ounce.

While the US explores tokenization, geopolitical rivals China and Russia may take an even bolder step—launching a gold-backed stablecoin. Bitcoin maximalist Max Keiser recently highlighted BRICS’ plans to introduce a gold-backed stablecoin.

“The BRICS, principally Russia, China & India, will counter any attempt by the US to introduce a hegemonic, USD-backed stablecoin — with a Gold-backed stablecoin. The majority of the global market will favor a Gold-backed coin since it’s inflation-proof (unlike the USD) and doesn’t boost unwelcome US hegemony. India already runs on a defacto Gold standard and Sharia law in Muslim countries would dictate Gold over a USD riba-coin as well. To be clear, a BTC-backed stablecoin is not fit for purpose due to volatility,” Keiser stated.

Further, Keiser suggested that a stablecoin backed by gold would outcompete USD-backed stablecoins in global markets. He argues that gold is more trusted than the US dollar, tracks inflation effectively, and remains minimally volatile compared to Bitcoin’s price swings.

Russia’s recent rejection of Bitcoin for its National Wealth Fund in favor of gold and the Chinese yuan adds weight to this theory.

With an estimated 50,000 tonnes of combined gold reserves, China and Russia could leverage blockchain technology to introduce a new gold-backed digital asset. Such an action would challenge the US dollar’s dominance in global trade.

Gold vs. Bitcoin: The Safe Haven Debate Intensifies

Gold’s record-breaking rally has reignited debates over its role as a safe-haven asset compared to Bitcoin. Some analysts speculate that Bitcoin could soon follow gold’s trajectory, setting new all-time highs.

However, in economic uncertainty and President Trump’s 2025 tariff policies, gold remains the preferred safe-haven asset. Historically, gold has been the go-to store of value during trade wars and inflationary periods. Meanwhile, Bitcoin’s volatility raises concerns for risk-averse investors.

Despite these differences, the rise of tokenized gold highlights a convergence between traditional and digital finance. As financial markets advance and investors rebalance their portfolios, gold and Bitcoin will likely coexist in a contemporary monetary system.

Whether through tokenization, gold-backed stablecoins, or government-led blockchain initiatives, the financial playing field is shifting.

As traditional institutions increasingly adopt blockchain, the stage is set for transforming how the world perceives, trades, and stores gold relative to Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Institutional Risk Aversion Drives $218 Million Bitcoin ETF Outflows

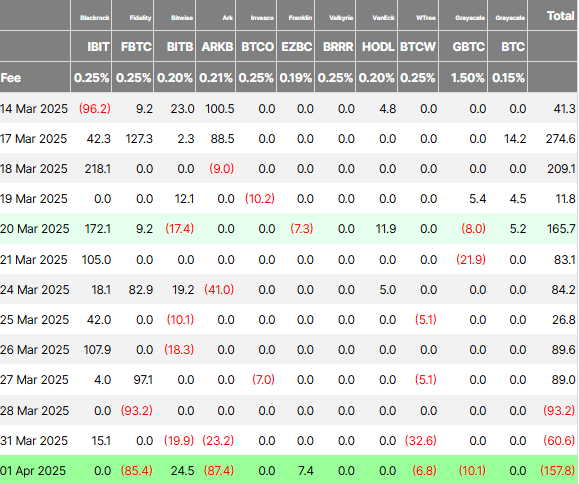

Bitcoin ETFs (exchange-traded funds) continue to record negative flows this week as President Trump’s Liberation Day countdown continues.

Sentiment is cautious across crypto markets, with traders and investors adopting a wait-and-see approach.

Bitcoin ETF See Outflows Amid Investor Caution

Data on Farside Investors shows two consecutive days of net outflows for Bitcoin ETFs since Monday. Financial instruments from Bitwise (BITB), Ark Invest (ARKB), and WisdomTree (BTCW) were in the frontline for Monday’s $60.6 million outflows, with only BlackRock’s IBIT seeing positive flows.

Meanwhile, Tuesday saw even more outflows, approaching $158 million, with Bitwise and Ark Invest leading the charge. Then, on April 1, BlackRock’s IBIT recorded zero flows. Meanwhile, Ethereum ETFs recorded net outflows of $3.6 million, data on Farside shows. This suggests a cautious sentiment among institutional investors.

“The Spot Bitcoin ETFs saw $157.8 million outflow yesterday. The Spot Ethereum ETFs saw a $3.6 million outflow. Institutions are reducing risk ahead of today’s tariff announcement,” analyst Crypto Rover noted.

Indeed, sentiment suggests traders are exercising caution, choosing to remain in “wait-and-see” mode. The caution comes ahead of Trump’s Liberation Day announcement, which is due later in the day on April 2.

With POTUS poised to unveil sweeping new tariffs, traders and investors across financial playing fields wait to see the scope of an onslaught that could spark a global trade war. Specifically, there is generally very little information about the tariffs’ specifics, which creates uncertainty regarding their impact on the broader economy and the crypto market.

“The White House has not reached a firm decision on their tariff plan,” Bloomberg reported, citing people close to the matter.

Despite the lack of clarity, it is understandable why investors would be cautious considering the impact of previous tariff announcements on Bitcoin price. Meanwhile, analysts predict extreme market volatility, with potential stock and crypto crashes reaching 10-15% if Trump enforces broad tariffs.

“April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen,” economic analyst Alex Krüger predicted.

While sentiment is cautious in the crypto market, some investors are channeling toward gold as a safe haven. A Bank of America survey showed that 58% of fund managers prefer gold as a trade war safe haven, while only 3% back Bitcoin.

These findings came as institutional investors cite Bitcoin’s volatility and limited crisis-time liquidity as key barriers to its safe-haven adoption. Trade tensions have historically driven capital into safe-haven assets.

With Trump’s Liberation Day announcement looming, investors preemptively position themselves again, favoring gold over Bitcoin.

Nevertheless, despite Bitcoin’s struggle to capture institutional safe-haven flows, its long-term narrative remains intact. This is seen with Bitcoin supply on exchanges dropping to just 7.53%, the lowest since February 2018.

When an asset’s supply on exchanges reduces, investors are unwilling to sell, suggesting strong long-term holder confidence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Could Serve as Inflation Hedge or Tech Stock, Say Experts

Bitcoin may be a useful hedge against inflation in the near future as market uncertainty is growing. In the long run, it may also be useful to envision Bitcoin differently, treating it as a barometer for the tech industry.

Standard Chartered’s Head of Digital Assets Research and WeFi’s Head of Growth both shared exclusive comments with BeInCrypto regarding this topic.

Bitcoin: Inflation Hedge or Magnificent 7 Candidate?

Since the early days of the crypto space, investors have been using it as a hedge against inflation. However, it’s only recently that institutional investors are beginning to treat it the same way. According to Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, the trend of Bitcoin as an inflation hedge is increasing.

Still, this view may be too narrow in a few ways. Since the Bitcoin ETFs were first approved, BTC has been increasingly well-integrated with traditional finance. Kendrick noted this, saying that it is highly correlated with the NASDAQ in the short term. He claimed that Bitcoin might represent more than an inflation hedge, instead serving as an ersatz tech stock:

“BTC may be better viewed as a tech stock than as a hedge against TradFi issues. If we create a hypothetical index where we add BTC to the ‘Magnificent 7’ tech stocks, and remove Tesla, We find that our index, ‘Mag 7B’, has both higher returns and lower volatility than Mag 7,” Kendrick said in an exclusive interview with BeInCrypto.

This comparison is particularly apt for a few reasons. Tesla’s stock price is heavily entangled with Bitcoin, but it’s also been dropping due to political controversies. If Bitcoin were to replace Tesla’s position in the Magnificent 7, it may be a welcome addition. Of course, there is currently no mechanism to cleanly treat Bitcoin as a similar type of product. That could change.

However, Bitcoin’s role as an inflation hedge might be more immediately relevant. As Trump’s Liberation Day approaches, the crypto markets are becoming increasingly nervous about new US tariffs. As Agne Linge, Head of Growth at WeFi, said in an exclusive interview, these fears are impacting all risk-on assets, Bitcoin included.

“Crypto markets are closely tracking investor sentiment ahead of Trump’s…tariff announcement, with growing concerns over the potential economic impact. Bitcoin’s increasing correlation with traditional markets has amplified its exposure to broader macroeconomic trends, making it more sensitive to the risk-off sentiment that has affected equity markets,” Linge claimed.

She went on to state that US economic uncertainty was at record levels, surpassing both the 2008 financial crisis and the pandemic in April 2020. In these circumstances, recent inflation indicators are showing expected rates above expectations.

In such an environment, the crypto market is sure to take a hit, but traditional finance and the dollar is also in great jeopardy. All that is to say, Bitcoin is likely to be a solid inflation hedge in the near future. Even if it falls dramatically, it has worldwide appeal and the ability to rebound.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin22 hours ago

Bitcoin22 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Altcoin20 hours ago

Altcoin20 hours agoWill XRP, SOL, ADA Make the List?

-

Bitcoin23 hours ago

Bitcoin23 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market22 hours ago

Market22 hours agoCoinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

-

Altcoin19 hours ago

Altcoin19 hours agoBTC, ETH, XRP, DOGE Fall Following Weak PMI, JOLTS Data

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Update Sparks 50% Decline For Solana Meme Coin ACT: Details

-

Market24 hours ago

Market24 hours agoXRP Price Struggles as Whale Selling Rises To $2.3 Billion

-

Market23 hours ago

Market23 hours agoFake Gemini Bankruptcy Emails Target Users