Bitcoin

Bitcoin Price Could Soar as Global M2 Money Supply Expands

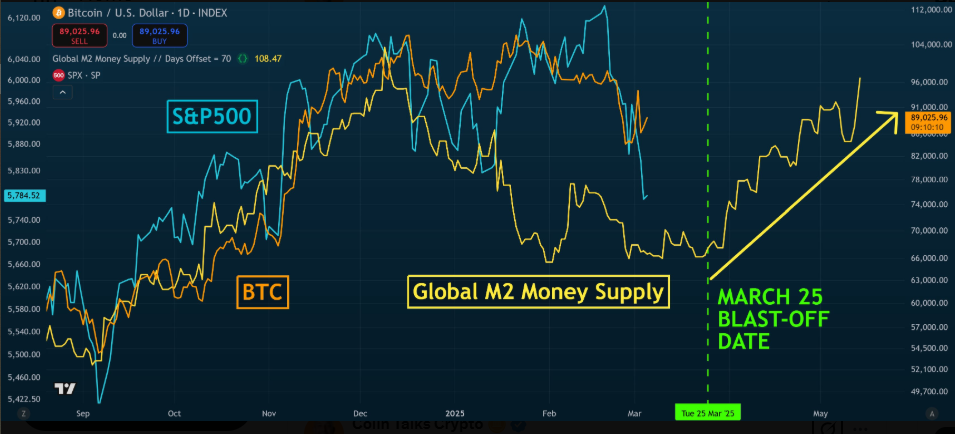

Recent analyses by crypto experts acknowledge that Bitcoin (BTC) price movements closely correlate with the global M2 money supply. Based on this, they predict potential bullish momentum for the crypto market in late March.

With global liquidity expanding, analysts predict that Bitcoin and other digital assets could experience a significant rally, starting around March 25, 2025, and potentially lasting until mid-May.

Global M2 and Its Influence on Bitcoin

The M2 money supply represents a broad measure of liquidity, including cash, checking deposits, and easily convertible near-money assets. Historically, Bitcoin has demonstrated a strong correlation with M2 fluctuations, as increased liquidity in financial markets often drives demand for alternative assets like cryptocurrencies.

Colin Talks Crypto, an analyst on X (Twitter), highlighted this correlation, pointing to a sharp increase in global M2. He described it as a “vertical line” on the chart, signaling an imminent surge in asset prices.

According to his prediction, the rally for stocks, Bitcoin, and the broader crypto market is expected to commence on March 25, 2025, and extend until May 14, 2025.

“The Global M2 Money Supply chart just printed another vertical line. The rally for stocks, Bitcoin, and crypto is going to be epic,” he suggested.

Vandell, co-founder of Black Swan Capitalist, supports that global M2 movements directly influence Bitcoin’s price. He notes that declines in global M2 are typically followed by Bitcoin and cryptocurrency market downturns about ten weeks later.

Despite the potential for short-term dips, Vandell believes this cycle sets the stage for a long-term uptrend.

“As seen recently, when global M2 declined, Bitcoin & crypto followed roughly 10 weeks later. While further downside is possible, this drawdown is a natural part of the cycle. This liquidity shift will likely continue throughout the year, setting the stage for the next leg up,” Vandell explained.

Similarly, another popular analyst, Michaël van de Poppe, sees M2 expansion as one of five key indicators for an early market recovery. He emphasizes that with inflation no longer the primary focus and expectations of US Federal Reserve rate cuts, financial conditions are becoming more favorable for Bitcoin.

“Bottom line is: Inflation isn’t the prime topic, likely to go down. FED rate cuts. The dollar to weaken massively. Yields to fall. M2 Supply to significantly expand. And as this process started, it’s just a matter of time until altcoins and crypto pick up. Bull,” he stated.

Historical Context and Projections

The correlation between Bitcoin’s price and global M2 growth is not new. Tomas, a macroeconomist, recently compared previous market cycles, particularly in 2017 and 2020. At the time, significant increases in global M2 coincided with Bitcoin’s strongest annual performances.

“Money supply is expanding globally. The last two major global M2 surges occurred in 2017 and 2020—both coincided with mini ‘everything bubbles’ and Bitcoin’s strongest years. Could we see a repeat in 2025? It depends on whether the U.S. dollar weakens significantly,” Tomas observed.

Tomas also highlighted the impact of central bank policies, pointing out that while major banks are cutting rates, the strength of the US dollar could be a limiting factor. If the dollar index (DXY) drops to around 100 or lower, it could create conditions similar to previous Bitcoin bull runs.

The Federal Reserve’s Role

Macro researcher Yimin Xu believes that the Federal Reserve might halt its Quantitative Tightening (QT) policies in the latter half of the year. Such a move, Yimin says, could potentially shift toward Quantitative Easing (QE) if economic conditions demand it. This shift could inject additional liquidity into the markets, fueling Bitcoin’s upward trajectory.

“I think reserves could get too thin for the Fed’s liking in the second half of the year. I predict they will terminate QT in late Q3 or Q4, with possible QE to come after,” Xu commented.

Tomas agreed, stating that the Federal Reserve’s current plan is to increase its balance sheet slowly, which is in line with GDP growth. He also articulates that a major financial event could trigger a full-scale return to QE.

These perspectives suggest that uncertainties remain, including the strength of the US dollar and potential economic shocks. Nevertheless, the broader consensus among analysts points toward an impending bullish phase for Bitcoin.

Investors must conduct their own research as they continue to watch macroeconomic indicators in the coming months, anticipating whether the predicted rally will materialize.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Public Companies are Buying Bitcoin Again After a Brief Pause

Bitcoin is rebounding after tariff chaos, and public companies like Metaplanet are conducting major acquisitions. The firm bought $28.2 million worth of the asset, nearly a $2 million increase from last week.

However, despite this new confidence, Metaplanet’s stock has continued to perform shakily. The crypto market is showing cautious optimism, but that won’t immediately translate into major gains.

Although a few corporate Bitcoin whales briefly paused their big purchases recently, the markets are heating back up again. Metaplanet began buying the dip last week, and Bitcoin has been making steady progress since then.

Today, its CEO, Simon Gerovich, announced a new purchase as BTC rebounds:

“Metaplanet has acquired 330 BTC for ~$28.2 million at ~$85,605 per bitcoin and has achieved BTC Yield of 119.3% YTD 2025. As of 4/21/2025, we hold 4855 $BTC acquired for ~$414.5 million at ~$85,386 per bitcoin,” he claimed.

Trump’s tariff threats caused massive uncertainty and crypto liquidations in the last few weeks. However, since he announced a pause, crypto and industry-related stocks have been rallying.

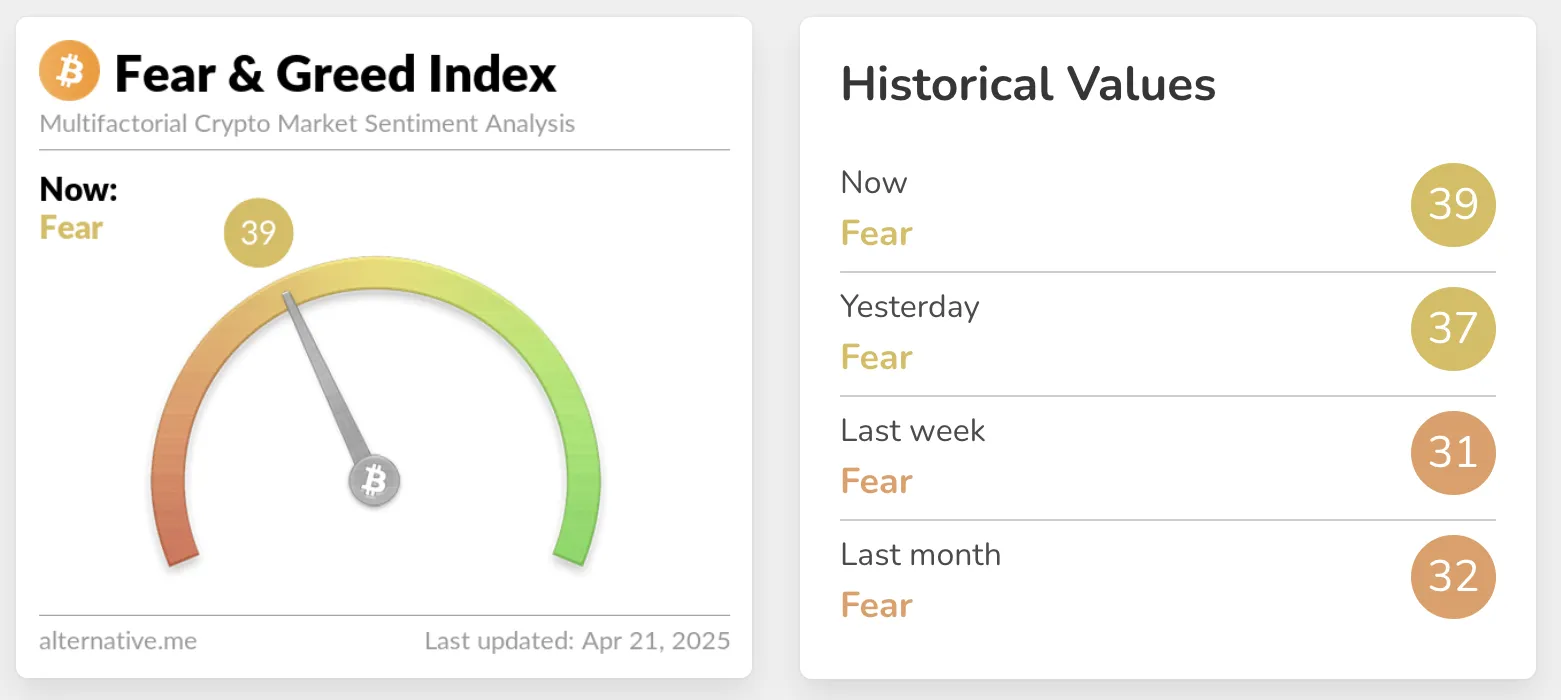

Whales like Metaplanet and MicroStrategy immediately began buying Bitcoin, and the whole market is rising. The Crypto Fear and Greed Index was recently in Extreme Fear but has since recovered greatly:

Still, markets are showing cautious optimism, not a full rally. A quick look at some major crypto-related stocks will paint a clearer picture.

MicroStrategy rose over 4% in the last five days and nearly 6% in the last month, but it’s a pillar of confidence in BTC. Metaplanet, a much smaller Bitcoin holder, only fell 1.89% in the last five days but over 20% in the last 30.

In other words, it can be difficult to cleanly connect Bitcoin’s recent successes with major holders like Metaplanet. Compare two prominent US-based crypto miners, Marathon and Riot.

The former recovered from its slump in early April, while the latter only continued to drop. Coinbase, too, has only made brief rallies on a trend of continual decline.

While Bitcoin’s adoption has surged dramatically over the past year, there’s still a lot of uncertainty about tariffs and recession. Metaplanet may be in shaky territory right now, but its confidence in Bitcoin can provide a long-term sense of stability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Dollar Dips While Bitcoin Hits New Heights

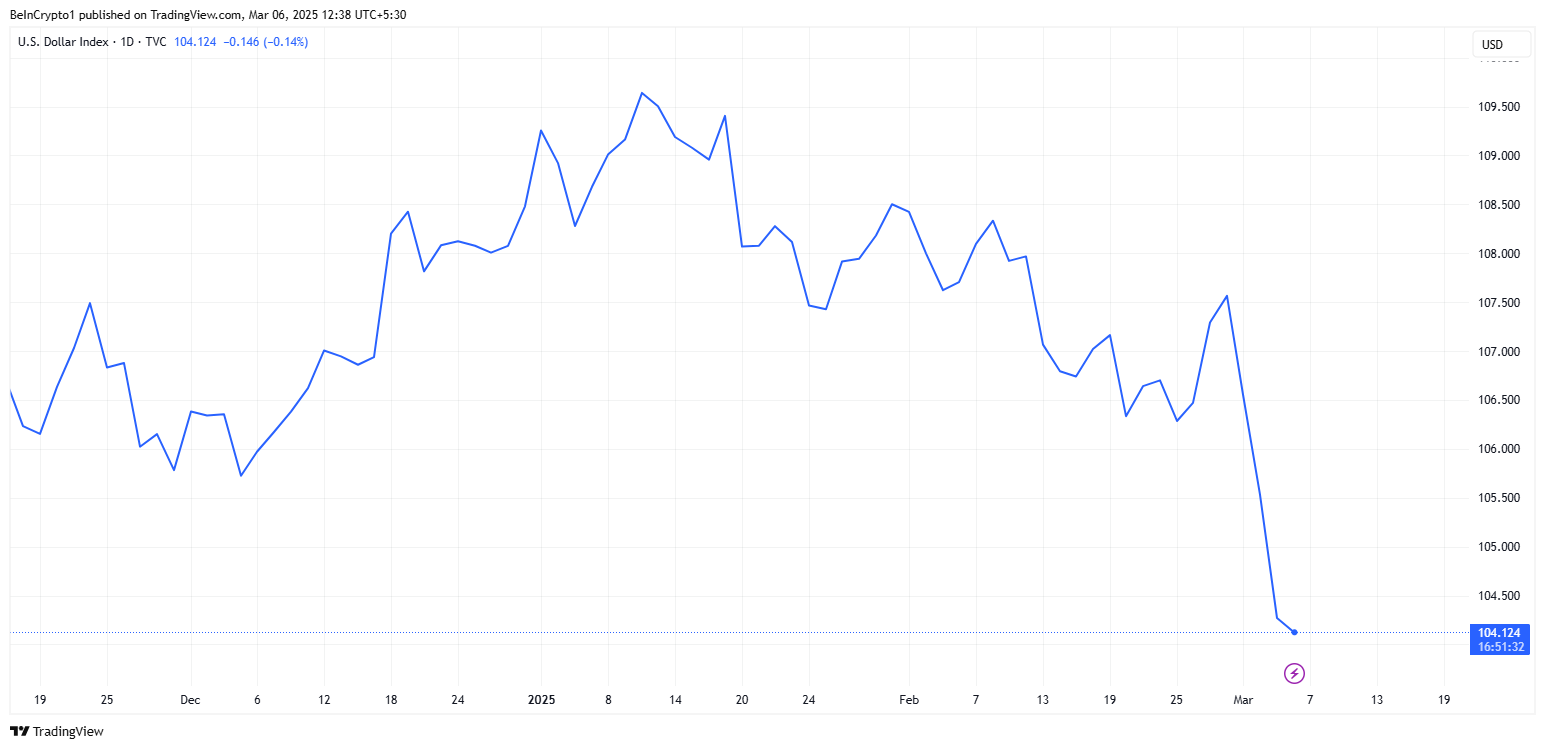

The US Dollar Index (DXY) has dropped to a three-year low amid reports that President Donald Trump is considering removing Federal Reserve Chairman Jerome Powell.

Meanwhile, the development positively affected Bitcoin’s (BTC) price, pushing it to its highest level since President Trump’s Liberation Day.

Trump’s Push Against Powell Adds Pressure on the Dollar

According to the latest data, DXY has plunged below 99. At press time, it stood at 98.2, representing the lowest value since March 2022.

Economist Peter Schiff highlighted the severity of the situation in the latest post on X (formerly Twitter).

“Gold is up over $50, hitting a record high of $3,380. The euro is above $1.15. The dollar has also fallen below 141 Japanese yen and .81 Swiss francs (a new 14-year low, just 3% above a record low). The dollar Index is below 98.5, a new three-year low. This is getting serious,” Schiff posted.

The dollar’s steep fall comes amid the latest comments made by National Economic Council Director Kevin Hassett on Friday, April 18. Hassett revealed that Trump and his team are actively exploring the possibility of ousting Powell.

His statement was in response to a reporter’s question about whether removing Powell was an option.

“The president and his team will continue to study that matter,” Hassett replied.

In addition, he called out the Federal Reserve for politically motivated actions under Powell’s leadership. Specifically, Hassett criticized the Fed for raising interest rates shortly after Trump’s election and cutting them ahead of the election, moves he claims favored the Democratic Party.

Notably, the growing contempt towards Powell is a response to the Fed’s stance on interest rates. BeInCrypto reported earlier that the Fed will likely not cut rates in May amid rising inflation and President Trump’s tariff pause.

Recently, Trump also blamed the Fed Chair for being slow to act on interest rate cuts. In a post on social media, Trump compared Powell’s actions unfavorably to the European Central Bank (ECB), which is set to implement its seventh interest rate cut.

Trump argued that Powell, whom he described as “always too late and wrong,” should have taken similar measures long ago to address economic conditions.

“Powell’s termination cannot come fast enough!” the President wrote.

The Fed Chair’s potential removal raises serious questions about the Federal Reserve’s independence and its implications for global markets. Powell, whose term as chair extends to May 2026, has previously stated that legal protections prevent his removal and that he intends to serve out his term.

Will Dollar Weakness Drive Bitcoin to New Heights?

Nonetheless, it’s worth noting that if Powell is removed and President Trump successfully persuades the Federal Reserve to cut interest rates, it could likely lead to a crypto market rally. Generally, when the Fed lowers interest rates, the US dollar tends to weaken.

Therefore, investors prefer cryptocurrencies, especially Bitcoin, which is often seen as a hedge against inflation and the weakening of fiat currencies. The inverse relation between the DXY and BTC further solidifies the case for a rally if the dollar depreciates.

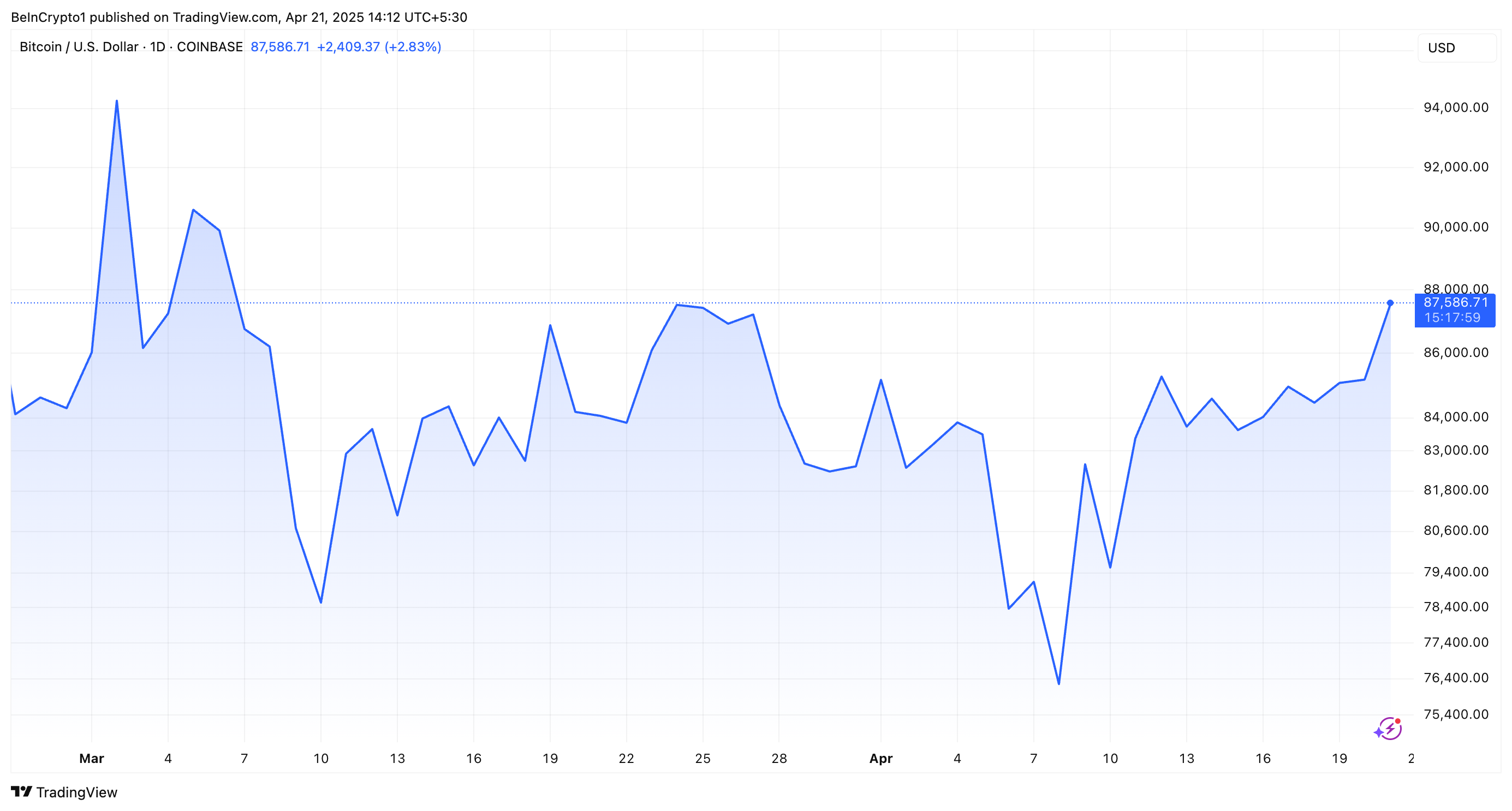

In fact, the latest decline in the dollar index has coincided with a notable increase in Bitcoin’s price. The largest cryptocurrency surged to over $87,000 for the first time since April 2.

“USD weakness is driving the rally in crypto,” Sean McNulty, Derivatives Trading Lead at FalconX, told Bloomberg.

At the time of writing, BTC was trading at $87,586. BeInCrypto data showed that this represented an appreciation of 3.5% over the past day. As markets celebrate these gains, the focus remains on Trump’s next moves and their broader economic consequences.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Solana, Bitcoin in Texas, and Initia

Several top crypto news stories are in the lineup this week in crypto, spanning various ecosystems with the potential to drive volatility.

This week, traders looking to capitalize on event-specific volatility should monitor the following developments.

This week, the Solana Community Conference, or Breakpoint, is among the top crypto news stories. It kicks off on April 25 and is Solana’s flagship gathering of developers, investors, and innovators.

Historically, Solana Breakpoint is a stage for major announcements, such as new project launches, partnerships, or technological advancements. In recent years, key announcements in similar gatherings have included the Solana Seeker phone or the Firedancer validator client.

According to Solscan data, Solana’s ecosystem boasts nearly 4 million active wallets. Meanwhile, DefiLlama data shows up to $7.37 billion in total value locked (TVL). With these numbers, the Solana community conference could drive positive sentiment for SOL, which was trading at $141.05 at press time.

Traders should brace for potential price volatility, as positive news could spark short-term spikes. In the same way, any underwhelming news or network concerns, like past outages, might temper enthusiasm.

Texas Bitcoin Reserve Hearing

Another top crypto news story this week concerns a strategic crypto reserve. On April 23, Texas will hold a strategic Bitcoin reserve hearing, marking a significant event given the state’s pro-crypto stance.

The bill, introduced four months ago, passed the committee with a 9-0 vote and received senate approval with 80% support. Similarly, Dan Patrick, Lieutenant Governor for the State of Texas, listed Bitcoin Reserve as a top priority for 2025.

“My statement announcing the first round of top 40 priority Bills for the 2025 legislative session,” he shared on X (Twitter) in January.

Against these backdrops, the Wednesday hearing could clarify Texas’s approach to institutional Bitcoin adoption. This could set a precedent for other states or federal policy.

A favorable outcome might bolster Bitcoin’s legitimacy, driving demand from institutional investors and positively influencing the BTC price.

Initia’s Mainnet and INIT Token Launch

Also in the headlines, this week in crypto, Initia’s mainnet launch and its token, INIT, debut on Thursday, April 24. This comes after the network revealed a 50 million token airdrop three weeks ago.

The Thursday event will mark a key milestone for the layer-1 blockchain, which is focused on interoperability and user experience. The launch could attract attention from decentralized finance (DeFi) and cross-chain enthusiasts, as Initia aims to simplify dApp interactions.

For traders, INIT’s initial price action will be critical, as new token launches often experience high volatility due to speculative trading.

“Initia INIT Binance Spot Listing Date Announced! Listing on: 24th April 2025. Mainnet will also officially launch on the same day. Airdrop claim date and exact time are yet to be announced,” the network stated recently.

Investors should evaluate Initia’s partnerships and developer adoption, as its success hinges on ecosystem growth.

Injective’s Lyora Mainnet Upgrade

Injective’s Lyora mainnet upgrade, scheduled for Tuesday, April 22, aims to enhance network performance and transaction speed. It would strengthen its position as a DeFi-focused layer-1 chain.

“The Injective Lyora Mainnet is nearly here! Vote today to dramatically enhance Injective infrastructure, performance, and transaction speeds. The official launch is on April 22,” Injective said.

This upgrade could improve user experience and attract developers to Injective’s ecosystem, particularly for derivatives and trading platforms.

Traders should watch INJ’s price for short-term momentum, as successful upgrades often drive positive sentiment.

At the same time, investors should consider Injective’s growing TVL (total value locked) and partnerships, like its collaboration with Sonic for AI agent platforms, as indicators of long-term potential.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.