Bitcoin

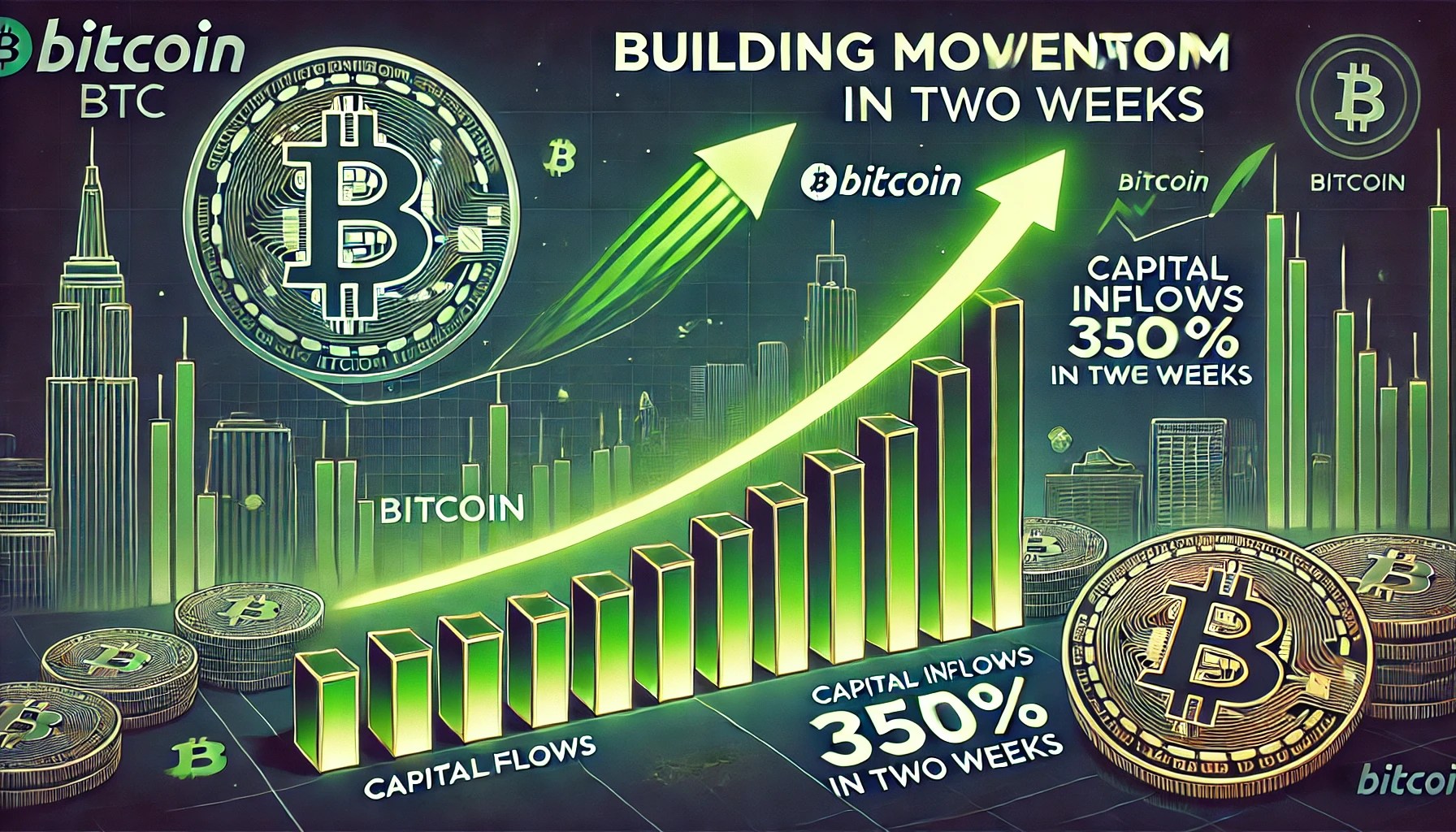

Bitcoin Indicator Signals Momentum Building – Capital Inflows Surge 350% In 2 Weeks

Bitcoin is facing critical selling pressure as bulls struggle to reclaim the $90,000 level, while bears continue to test — but fail to break — the $81,000 support zone. The market remains stuck in a tight range, caught between resistance and support, with macroeconomic uncertainty and rising geopolitical tensions adding to the volatility. United States President Donald Trump’s latest tariff moves and unpredictable policy direction have only amplified investor caution, particularly toward risk-on assets like Bitcoin.

Despite the ongoing pressure, some key data suggests the worst may be behind. According to Glassnode, capital inflows into the crypto market have surged by an impressive 350% over the past two weeks. This sharp increase in fresh capital signals renewed investor interest, particularly from institutions, and could be a leading indicator of improving market sentiment.

While Bitcoin still faces resistance and uncertainty, the strength of these inflows hints at growing confidence beneath the surface. If the trend continues, it could help BTC reclaim higher levels and shift the market’s direction. For now, bulls must hold key support and watch for momentum above $90K to confirm the start of a meaningful recovery.

Bitcoin Market Reacts To Trump Tariffs And Surging Capital Inflows

Bitcoin is trading at critical levels as financial markets absorb the shock from Trump’s sweeping tariff announcement during Liberation Day. The unexpected move has triggered massive selling pressure across global markets, fueling a rise in volatility and uncertainty. Crypto has not been spared. Bitcoin, down 22% from its all-time high, continues to struggle as the broader correction phase that began in January shows no signs of reversing yet.

Trade war fears, compounded by ongoing macroeconomic instability, have shaken investor confidence. Traditional markets are seeing increased risk-off behavior, with capital shifting away from equities and high-volatility assets — Bitcoin included. As a result, panic selling and cautious sentiment have driven BTC lower, putting the $81,000 support level in the spotlight.

However, not all signals point to weakness. Top crypto analyst Ali Martinez shared insights showing that capital inflows into the crypto market have surged by 350% in just two weeks. According to on-chain data, crypto capital moved from $1.82 billion to $8.20 billion — a sign of renewed interest from investors and institutions despite bearish price action.

These inflows may signal that the market is preparing for a rebound once current macro pressures ease. While Bitcoin remains in a fragile state, capital inflow strength could provide a base for recovery in the weeks ahead.

BTC Price Action: Bulls Struggle To Reclaim Key Levels

Bitcoin is trading at $83,400 following several days of intense selling pressure and heightened volatility. The recent market shakeup has pushed BTC well below critical resistance zones, with bulls now fighting to reclaim lost ground. One of the most important levels in the short term is $85,500 — a zone that previously acted as strong support and now aligns closely with the 4-hour 200 moving average (MA) and exponential moving average (EMA).

Reclaiming this level is essential for any potential recovery. It would signal a shift in momentum and provide bulls with the technical foundation needed to make another attempt at the $88K to $90K range. However, BTC has so far failed to retest or break back above this zone, and continued rejection could lead to further downside.

If Bitcoin cannot reclaim the $85,500 level in the coming sessions, the probability of a deeper retrace grows significantly. A drop below the $81,000 mark — the current support floor — would likely open the door to even lower targets and confirm that the correction phase remains in full effect. With macro uncertainty still looming, BTC’s next move will be critical in shaping short-term market sentiment.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Gary Gensler Explains Why Bitcoin Will Outlast Altcoins

Former US Securities and Exchange Commission (SEC) Chair Gary Gensler has stated that Bitcoin (BTC) could continue to exist and thrive for a long time.

However, Gensler emphasized that this may not be the case for most altcoins, as they lack solid fundamentals.

Why Gary Gensler Believes in Bitcoin

In a recent interview with CNBC, Gensler mentioned that Bitcoin’s enduring presence could be attributed to its strong global interest.

“Something like Bitcoin may persist for a long time because there’s 7 billion people around the globe, a real keen interest in it,” he stated.

Gensler, who served as SEC Chair from 2021 to 2025, made these remarks in response to questions about the crypto industry’s reaction to the dismissal of lawsuits and investigations initiated during his tenure.

While at the SEC, Gensler took a hard stance on cryptocurrency regulation. He launched multiple enforcement actions targeting several exchanges, token issuers, and other crypto entities.

While he refrained from commenting directly on the dismissal of these cases, he shifted focus to broader trends within the cryptocurrency market.

“I’m going to step back a little bit from any individual cases and just say this again to your viewing public. This is a very small part of the financial markets, but if you were interested in this, think about every financial asset sort of trades on a bit of fundamentals and sentiment. But this field is almost 99, or maybe one might say 100% sentiment and very little on fundamentals,” said Gensler.

The former SEC chair advocated for careful asset risk assessment. He noted that the primary focus should be the project’s fundamentals. Moreover, he warned that many assets are driven predominantly by sentiment. As a result, he suggested that such tokens are generally unsustainable and likely to lose value over time.

When pressed on whether Bitcoin should be grouped with other cryptocurrencies, Gensler drew an analogy to precious metals. He implied that Bitcoin holds a unique position in the cryptocurrency world.

“There’s only two or three precious metals. We humans have a certain fascination with two or three precious metals like gold,” he remarked.

Gensler believes that the vast majority of cryptocurrencies, especially those driven by trends, memes, or social sentiment, will not attract lasting interest. He stressed that only a few, like Bitcoin, will stand the test of time.

These comments align with Gensler’s previous statements on the crypto market. In a January 2025 interview with CNBC, he acknowledged BTC’s volatility yet showed faith in its long-term prospects.

“With 7 billion people around the globe, 7 billion people want to trade it just like we do have gold for 10,000 years. We have Bitcoin. It might be something else in the future as well,” Gensler noted.

Despite the optimistic outlook, Gensler disclosed that he did not own any Bitcoin or other crypto assets.

Gensler’s remarks reflect ongoing debates about the legitimacy and sustainability of cryptocurrencies. While Bitcoin has gained traction as a store of value, many altcoins struggle to demonstrate the same level of acceptance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Semler Scientific Files To Buy $500-M In Bitcoin

Semler Scientific is looking to raise $500 million in new securities after settling a large case with the Department of Justice, according to company filings. The health care technology company will use some of the money to expand its crypto holdings, which are already in excess of 3,000 coins.

Company Enters $30 Million Settlement With Justice Department

As per recent Securities and Exchange Commission (SEC) filings, Semler Scientific has reached a $29.75 million settlement with the Department of Justice regarding marketing practices for its QuantaFlo product. The probe, which started in 2017, centered on potential violations of federal anti-fraud laws regarding the manner in which the company marketed its flagship product.

The settlement negotiations progressed in recent months following years of cooperation with several subpoenas. The deal is not complete yet, according to the company’s Tuesday SEC filing, but Semler has already obtained a way to finance the payment.

Semler Scientific's filing with the SEC. Source: US SEC.

Coinbase Loan To Fund Settlement Without Selling Bitcoin

Instead of liquidating its cryptocurrency holdings, Semler intends to use a loan from Coinbase to settle the DOJ case. The loan will be secured by the company’s large Bitcoin reserves, which stand at 3,190 BTC valued at about $267 million at current market prices.

This funding strategy enables Semler to satisfy its legal requirements without liquidating its cryptocurrency holding. With Bitcoin as collateral, the company can preserve its balance sheet strength while fulfilling the settlement needs.

Half-Billion Dollar Securities Filing Points To Bigger Crypto Plans

Apart from the settlement expenses, Semler has submitted an S-3 registration to the SEC to sell $500 million worth of securities. The filing indicates the company is not merely raising cash to pay the DOJ settlement but wants to increase its Bitcoin holding substantially.

Image: Threads

The action is made at a time when other businesses continue to accumulate Bitcoin into their coffers. According to reports in the filing, Michael Saylor’s firm recently bought 3,450 bitcoins worth $286 million, increasing its holdings to 531,640 bitcoins. Another company, Metaplanet, acquired $26 million worth of Bitcoin over the same time.

Image: Brookings Institution

Market Analysts Remain Bullish Despite Price Swings

The timing of Semler’s intended Bitcoin buys is during market volatility yet also forecasts of extreme price appreciation. An analyst, who goes by the handle “Titan of Crypto” forecasted Bitcoin to hit $137,000, although no timeframe was given for that price level.

The healthcare technology firm has not indicated precisely when it will finish its securities offering or make further Bitcoin buys. Nevertheless, the SEC filing clearly indicates that adding to cryptocurrency holdings is still a priority in addition to paying for the DOJ settlement.

Featured image from Pexels, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

ETF Issuers Bring Stability to Bitcoin Despite Tariff Chaos

BlackRock’s Bitcoin ETF is in the top 1% of performers in this category despite tariff chaos. Analysts theorize that the issuers are stabilizing Bitcoin’s volatility, and the ETF market will make BTC more secure in the future.

The issuers act as major whales, buying up any token dumps from retail investors. However, this new stability is entirely contingent on these powerful firms, which are exposed to broader macroeconomic concerns.

Are the ETFs Stabilizing Bitcoin?

The threat of Trump’s tariffs has brought chaos and uncertainty into global markets, but the price of Bitcoin has been relatively fine. Although it has fallen from its all-time high in January, its price shelf is still well above its performance before the November election.

According to one analyst, the ETFs may be providing Bitcoin with this extra stability:

“Bitcoin ETFs have eked out positive inflows past month and YTD and IBIT is +2.4 billion YTD (Top 1%). Impressivem and in my opinion, helps explain why BTC’s price has been relatively stable: its owners are more stable. ETF investors are much stronger hands than most think. This should increase stability and lower volatility and correlation long term,” claimed Eric Balchunas.

Since the Bitcoin ETFs first hit the market, they’ve totally transformed the crypto industry, but it’s been difficult to quantify that transformation.

However, this impending economic crisis has given analysts a useful chance to collect hard data from a stress test. Balchunas emphasized that ETF issuers had a powerful demand for BTC, which has powered some changes.

Over the last few months, US ETF issuers have been buying tremendous amounts of Bitcoin. Collectively, they surpassed Satoshi’s holdings in December and bought 20x as much BTC as the global mining output in January. Who met this apparent crisis in supply? Retail investors.

Bitcoin is more integrated than ever into traditional finance, and that presents a few opportunities. For any number of reasons, retailers have been compelled to dump their tokens.

Normally, these actions could spook the markets, but ETF issuers (and Michael Saylor’s Strategy) have been willing to buy as much Bitcoin as possible.

In other words, these whales have done a lot to hold up confidence in the entire market. Ideally, ETF issuers will have a mostly positive impact on the sector, potentially curing Bitcoin’s infamous chronic volatility.

Unfortunately, this substantial change comes with serious practical drawbacks, even discounting fears of de-decentralization. Since the ETFs transformed the market like this, Bitcoin has been more entangled than ever with broader macroeconomic trends.

These trends, however, could force these big whales to sell. Can we afford to tie Bitcoin’s fate to these actors?

The ETF issuers have a high confidence in Bitcoin, which has kept its price steady throughout the tariff chaos. If they lose that confidence for any reason, it could cause a powerful demand crisis.

This investment trend has been a tremendous benefit to the crypto industry, but it’s important to keep an eye on the potential risks involved.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Breakout Imminent? Analyst Expects ETH Price Surge To $2,000

-

Market22 hours ago

Market22 hours agoBNB Burn Reduces Circulating Supply by $916 Million

-

Market17 hours ago

Market17 hours agoHow It’s Impacting the Network

-

Altcoin17 hours ago

Altcoin17 hours agoAnalyst Reveals Why The Solana Price Can Still Drop To $65

-

Altcoin15 hours ago

Altcoin15 hours agoDOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

-

Market20 hours ago

Market20 hours agoThis Crypto Security Flaw Could Expose Seed Phrases

-

Market19 hours ago

Market19 hours agoAre TRUMP Meme Coin Investors Selling Before Friday’s Unlock?