Bitcoin

Bitcoin Could Serve as Inflation Hedge or Tech Stock, Say Experts

Bitcoin may be a useful hedge against inflation in the near future as market uncertainty is growing. In the long run, it may also be useful to envision Bitcoin differently, treating it as a barometer for the tech industry.

Standard Chartered’s Head of Digital Assets Research and WeFi’s Head of Growth both shared exclusive comments with BeInCrypto regarding this topic.

Bitcoin: Inflation Hedge or Magnificent 7 Candidate?

Since the early days of the crypto space, investors have been using it as a hedge against inflation. However, it’s only recently that institutional investors are beginning to treat it the same way. According to Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, the trend of Bitcoin as an inflation hedge is increasing.

Still, this view may be too narrow in a few ways. Since the Bitcoin ETFs were first approved, BTC has been increasingly well-integrated with traditional finance. Kendrick noted this, saying that it is highly correlated with the NASDAQ in the short term. He claimed that Bitcoin might represent more than an inflation hedge, instead serving as an ersatz tech stock:

“BTC may be better viewed as a tech stock than as a hedge against TradFi issues. If we create a hypothetical index where we add BTC to the ‘Magnificent 7’ tech stocks, and remove Tesla, We find that our index, ‘Mag 7B’, has both higher returns and lower volatility than Mag 7,” Kendrick said in an exclusive interview with BeInCrypto.

This comparison is particularly apt for a few reasons. Tesla’s stock price is heavily entangled with Bitcoin, but it’s also been dropping due to political controversies. If Bitcoin were to replace Tesla’s position in the Magnificent 7, it may be a welcome addition. Of course, there is currently no mechanism to cleanly treat Bitcoin as a similar type of product. That could change.

However, Bitcoin’s role as an inflation hedge might be more immediately relevant. As Trump’s Liberation Day approaches, the crypto markets are becoming increasingly nervous about new US tariffs. As Agne Linge, Head of Growth at WeFi, said in an exclusive interview, these fears are impacting all risk-on assets, Bitcoin included.

“Crypto markets are closely tracking investor sentiment ahead of Trump’s…tariff announcement, with growing concerns over the potential economic impact. Bitcoin’s increasing correlation with traditional markets has amplified its exposure to broader macroeconomic trends, making it more sensitive to the risk-off sentiment that has affected equity markets,” Linge claimed.

She went on to state that US economic uncertainty was at record levels, surpassing both the 2008 financial crisis and the pandemic in April 2020. In these circumstances, recent inflation indicators are showing expected rates above expectations.

In such an environment, the crypto market is sure to take a hit, but traditional finance and the dollar is also in great jeopardy. All that is to say, Bitcoin is likely to be a solid inflation hedge in the near future. Even if it falls dramatically, it has worldwide appeal and the ability to rebound.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Traders’ Realized Losses Reach FTX Crash Levels — What’s Happening?

The price of Bitcoin has had an interesting performance so far in 2025, starting the year with a run to a new all-time high. However, the flagship cryptocurrency finished the year’s first quarter with over 15% of its value shaved off in those three months.

While the BTC price appears to be steadying within a consolidation range, the prognosis doesn’t look all positive for the world’s largest cryptocurrency. This explains why several short-term investors are getting frustrated and, as a result, exiting the market.

Is Bitcoin About To Go Up?

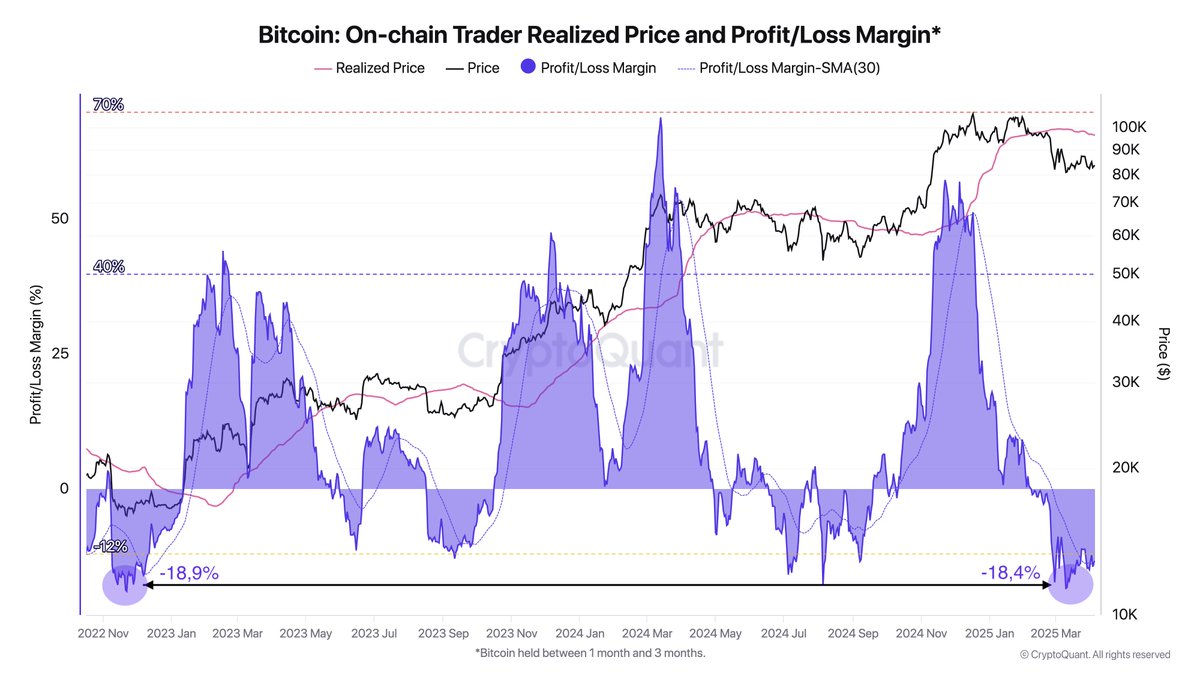

In a new post on the X platform, an on-chain analyst with the pseudonym Darkfost revealed that a certain class of Bitcoin holders have been selling their assets at a loss. According to the crypto pundit, the sell-offs are occurring at a rate not seen since the FTX collapse.

This on-chain observation is based on a significant drop in the Profit/Loss Margin, which tracks the profitability of investors by comparing their purchase price to the current price of a cryptocurrency. This metric offers insight into whether the market is in a state of unrealized profit or loss.

Specifically, Darkfost’s analysis focuses on Bitcoin investors who have been holding BTC for between one to three months (otherwise known as short-term holders). These traders are considered the most reactive class of holders, a trait highlighted by their recent activity.

Source: @Darkfost_Coc on X

According to Darkfost, BTC short-term holders have been offloading their coins at a loss since early February. These realized losses have now reached levels last seen in the FTX crash and are even higher than the losses recorded during the 2024 price pullback.

Historically, significant loss realization by the Bitcoin short-term holders has preceded substantial upward price movements, especially when long-term holders continue to accumulate. Hence, the persistence of this trend means that long-term investors will take the coins off the weak hands before the next bullish jump.

BTC Price At A Glance

As of this writing, the price of BTC stands at around $83,700, reflecting no significant change in the past 24 hours. According to data from CoinGecko, the market leader is up by 1% in the last seven days.

The price of Bitcoin is thickening around the $84,000 level on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin (BTC) To Take Off In June, Analyst Pins Market Target At $175,000

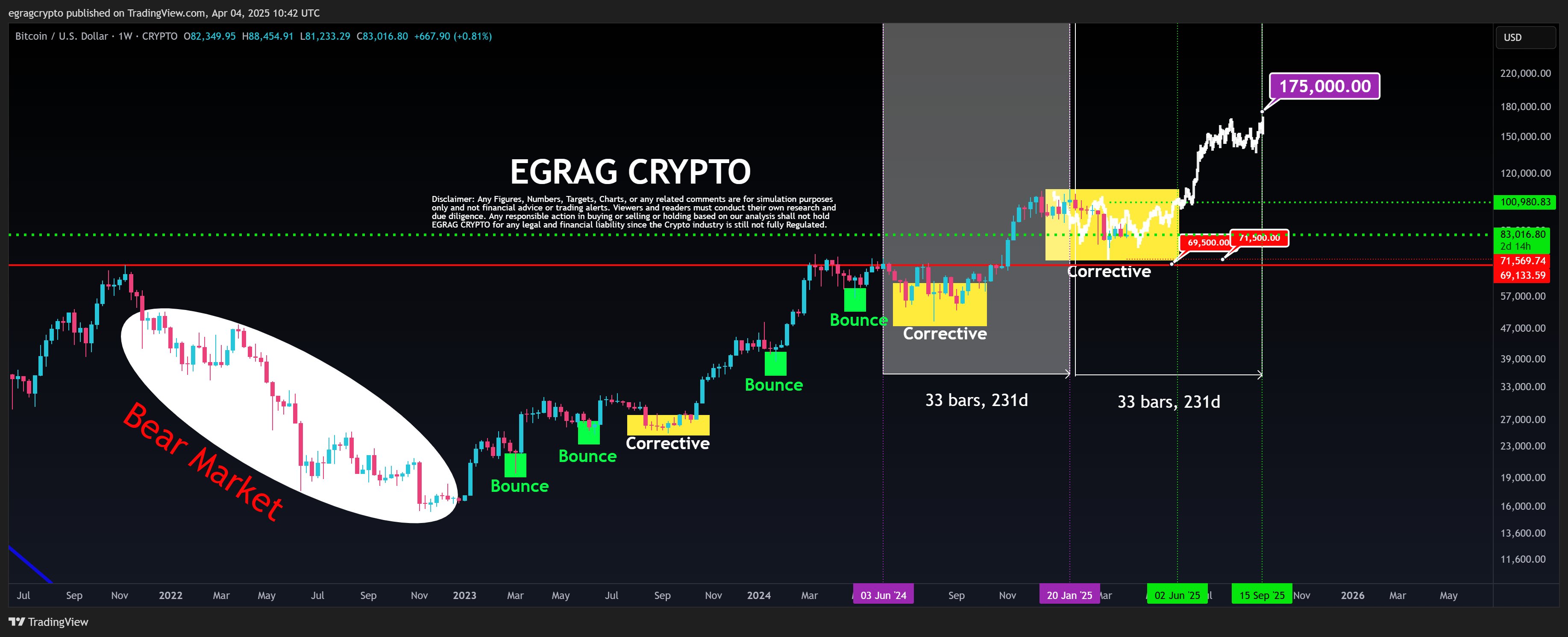

Since hitting a new all-time high in January, Bitcoin (BTC) has struggled to establish a bullish form resulting in a downtrend that has lasted over the last two months. According to prominent market analyst Egrag Crypto, the premier cryptocurrency could likely remain in correction for the next few months before launching a price rally.

Bitcoin’s 231-Day Cycle Hints At $175,000 Target By September

Following an initial price decline in February, Egrag Crypto had postulated Bitcoin could experience a price correction due to a CME gap before experiencing a price bounce. However, the lack of strong bullish convictions over the past weeks has forced a conclusion that the premier cryptocurrency is stuck in a potentially long corrective phase.

According to Egrag in a recent post, Bitcoin’s ongoing correction aligns with a fractal pattern i.e. a repeating price structure that has appeared across multiple timeframes. This pattern is based on a 33-bar (231-day) cycle during which BTC transits from a corrective phase to an explosive price rally.

In comparing previous cycles to the current developing one, Egrag has predicted Bitcoin could potentially break out of its recalibration by June. In this case, the analyst expects the crypto market leader to hit a market top of $175,000 by September, hinting at a potential 107.83% gain on current market prices.

However, in igniting this price rally, market bulls must ensure a breakout above the stiff price barrier at $100,000. On the other hand, any potential fall below the $69,500-$71,500 support price level could invalidate this current bullish setup and possibly signal the end of the current bull run.

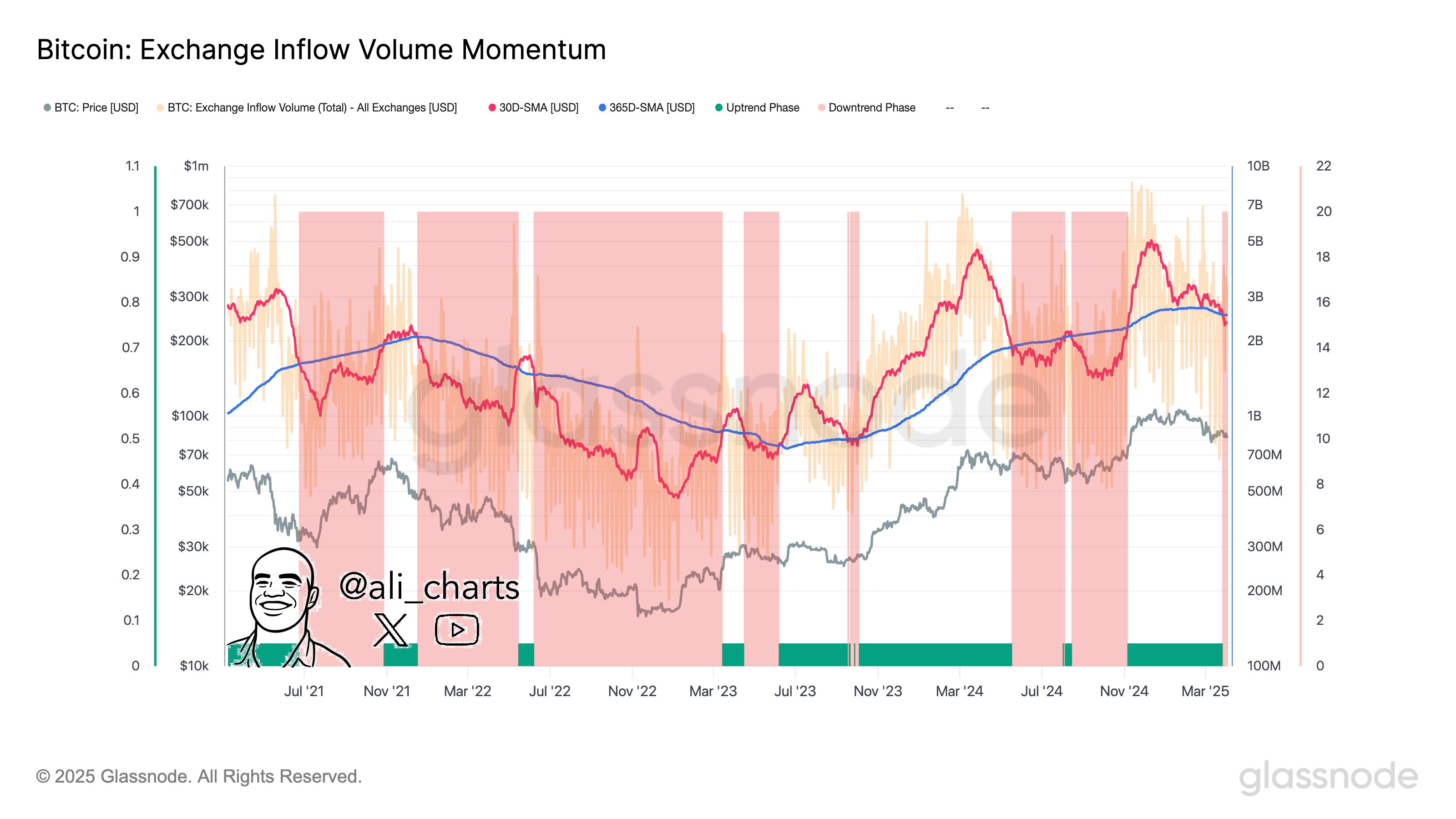

BTC Investors Wait As Exchange Activity Slows Down

In other news, popular crypto expert Ali Martinez has reported a decline in Bitcoin exchange-related activity indicating reduced investors’ interest and network utilization. Notably, this development suggests that investors are hesitating to deposit or withdraw Bitcoin on exchanges perhaps due to market uncertainty on the asset’s immediate future trajectory.

According to Martinez, Bitcoin is now likely to undergo a trend shift as investors wait for the next market catalyst. Notably, Bitcoin has shown commendable resilience despite the new tariffs imposed by the US government on April 2. According to data from Santiment, BTC’s price dipped only 4% in the hours following the announcement—a milder reaction compared to previous tariff-related market moves.

Since then, BTC has made some price gains and currently trades at $83,805 as investors flock to the crypto market which has recorded a $5.16 billion inflow over the past day. Meanwhile, BTC’s trading volume is up by 26.52% and is valued at $43.48 billion.

Featured image from UF News, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin Indicator Signals Momentum Building – Capital Inflows Surge 350% In 2 Weeks

Bitcoin is facing critical selling pressure as bulls struggle to reclaim the $90,000 level, while bears continue to test — but fail to break — the $81,000 support zone. The market remains stuck in a tight range, caught between resistance and support, with macroeconomic uncertainty and rising geopolitical tensions adding to the volatility. United States President Donald Trump’s latest tariff moves and unpredictable policy direction have only amplified investor caution, particularly toward risk-on assets like Bitcoin.

Despite the ongoing pressure, some key data suggests the worst may be behind. According to Glassnode, capital inflows into the crypto market have surged by an impressive 350% over the past two weeks. This sharp increase in fresh capital signals renewed investor interest, particularly from institutions, and could be a leading indicator of improving market sentiment.

While Bitcoin still faces resistance and uncertainty, the strength of these inflows hints at growing confidence beneath the surface. If the trend continues, it could help BTC reclaim higher levels and shift the market’s direction. For now, bulls must hold key support and watch for momentum above $90K to confirm the start of a meaningful recovery.

Bitcoin Market Reacts To Trump Tariffs And Surging Capital Inflows

Bitcoin is trading at critical levels as financial markets absorb the shock from Trump’s sweeping tariff announcement during Liberation Day. The unexpected move has triggered massive selling pressure across global markets, fueling a rise in volatility and uncertainty. Crypto has not been spared. Bitcoin, down 22% from its all-time high, continues to struggle as the broader correction phase that began in January shows no signs of reversing yet.

Trade war fears, compounded by ongoing macroeconomic instability, have shaken investor confidence. Traditional markets are seeing increased risk-off behavior, with capital shifting away from equities and high-volatility assets — Bitcoin included. As a result, panic selling and cautious sentiment have driven BTC lower, putting the $81,000 support level in the spotlight.

However, not all signals point to weakness. Top crypto analyst Ali Martinez shared insights showing that capital inflows into the crypto market have surged by 350% in just two weeks. According to on-chain data, crypto capital moved from $1.82 billion to $8.20 billion — a sign of renewed interest from investors and institutions despite bearish price action.

These inflows may signal that the market is preparing for a rebound once current macro pressures ease. While Bitcoin remains in a fragile state, capital inflow strength could provide a base for recovery in the weeks ahead.

BTC Price Action: Bulls Struggle To Reclaim Key Levels

Bitcoin is trading at $83,400 following several days of intense selling pressure and heightened volatility. The recent market shakeup has pushed BTC well below critical resistance zones, with bulls now fighting to reclaim lost ground. One of the most important levels in the short term is $85,500 — a zone that previously acted as strong support and now aligns closely with the 4-hour 200 moving average (MA) and exponential moving average (EMA).

Reclaiming this level is essential for any potential recovery. It would signal a shift in momentum and provide bulls with the technical foundation needed to make another attempt at the $88K to $90K range. However, BTC has so far failed to retest or break back above this zone, and continued rejection could lead to further downside.

If Bitcoin cannot reclaim the $85,500 level in the coming sessions, the probability of a deeper retrace grows significantly. A drop below the $81,000 mark — the current support floor — would likely open the door to even lower targets and confirm that the correction phase remains in full effect. With macro uncertainty still looming, BTC’s next move will be critical in shaping short-term market sentiment.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market23 hours ago

Market23 hours agoPi Network Hits New Low, Then Rallies 36%—What’s Next?

-

Market22 hours ago

Market22 hours agoEthereum Transaction Fees Hit Lowest Level Since 2020

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Risks 15% Drop If It Doesn’t Reclaim Key Resistance

-

Market18 hours ago

Market18 hours agoDogecoin Faces $200 Million Liquidation If It Slips To This Price

-

Market19 hours ago

Market19 hours agoSEC’s Crypto War Fades as Ripple, Coinbase Lawsuits Drop

-

Bitcoin18 hours ago

Bitcoin18 hours agoArthur Hayes Sees Tariff War Pushing Bitcoin Toward $1 Million

-

Altcoin18 hours ago

Altcoin18 hours agoExpert Calls On Pi Network To Burn Tokens To Revive Pi Coin Price

-

Ethereum18 hours ago

Ethereum18 hours agoCrypto Analyst Who Called Ethereum Price Dump Says ETH Is Now Undervalued, Time To Buy?