Bitcoin

Bitcoin (BTC) To Take Off In June, Analyst Pins Market Target At $175,000

Since hitting a new all-time high in January, Bitcoin (BTC) has struggled to establish a bullish form resulting in a downtrend that has lasted over the last two months. According to prominent market analyst Egrag Crypto, the premier cryptocurrency could likely remain in correction for the next few months before launching a price rally.

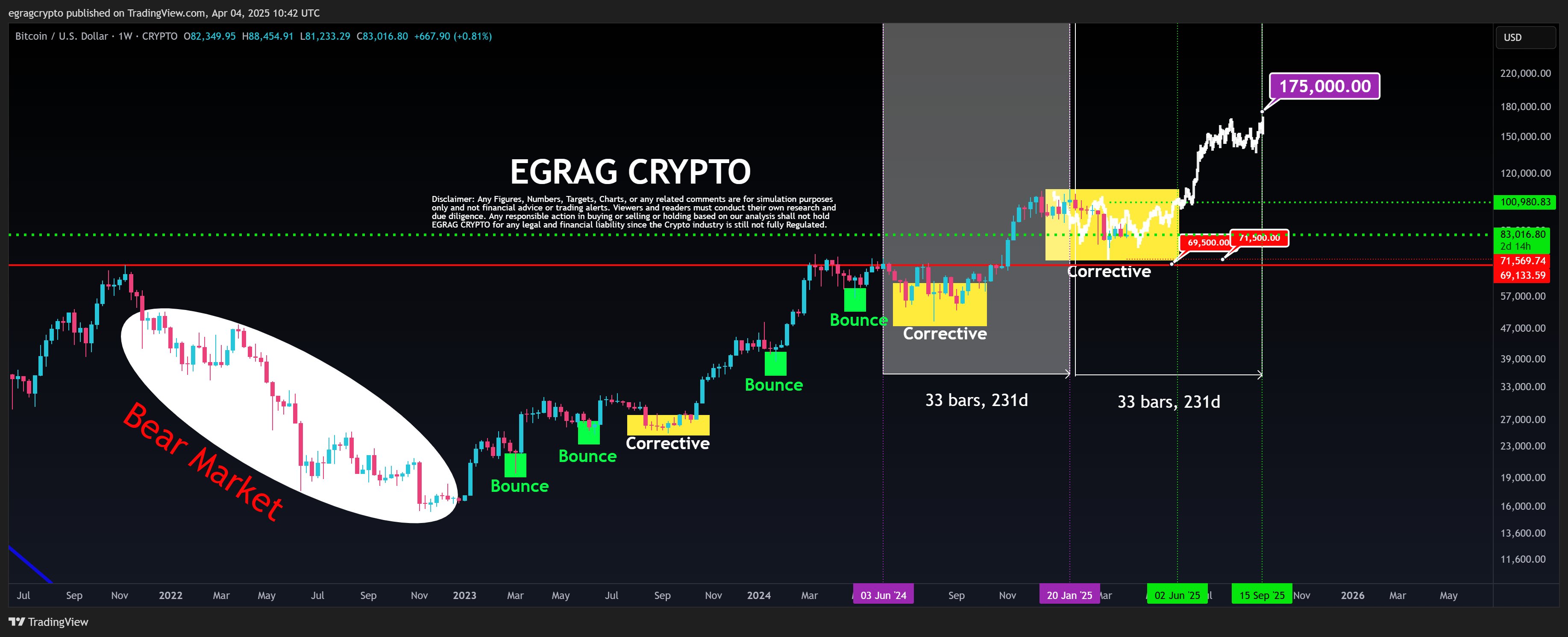

Bitcoin’s 231-Day Cycle Hints At $175,000 Target By September

Following an initial price decline in February, Egrag Crypto had postulated Bitcoin could experience a price correction due to a CME gap before experiencing a price bounce. However, the lack of strong bullish convictions over the past weeks has forced a conclusion that the premier cryptocurrency is stuck in a potentially long corrective phase.

According to Egrag in a recent post, Bitcoin’s ongoing correction aligns with a fractal pattern i.e. a repeating price structure that has appeared across multiple timeframes. This pattern is based on a 33-bar (231-day) cycle during which BTC transits from a corrective phase to an explosive price rally.

In comparing previous cycles to the current developing one, Egrag has predicted Bitcoin could potentially break out of its recalibration by June. In this case, the analyst expects the crypto market leader to hit a market top of $175,000 by September, hinting at a potential 107.83% gain on current market prices.

However, in igniting this price rally, market bulls must ensure a breakout above the stiff price barrier at $100,000. On the other hand, any potential fall below the $69,500-$71,500 support price level could invalidate this current bullish setup and possibly signal the end of the current bull run.

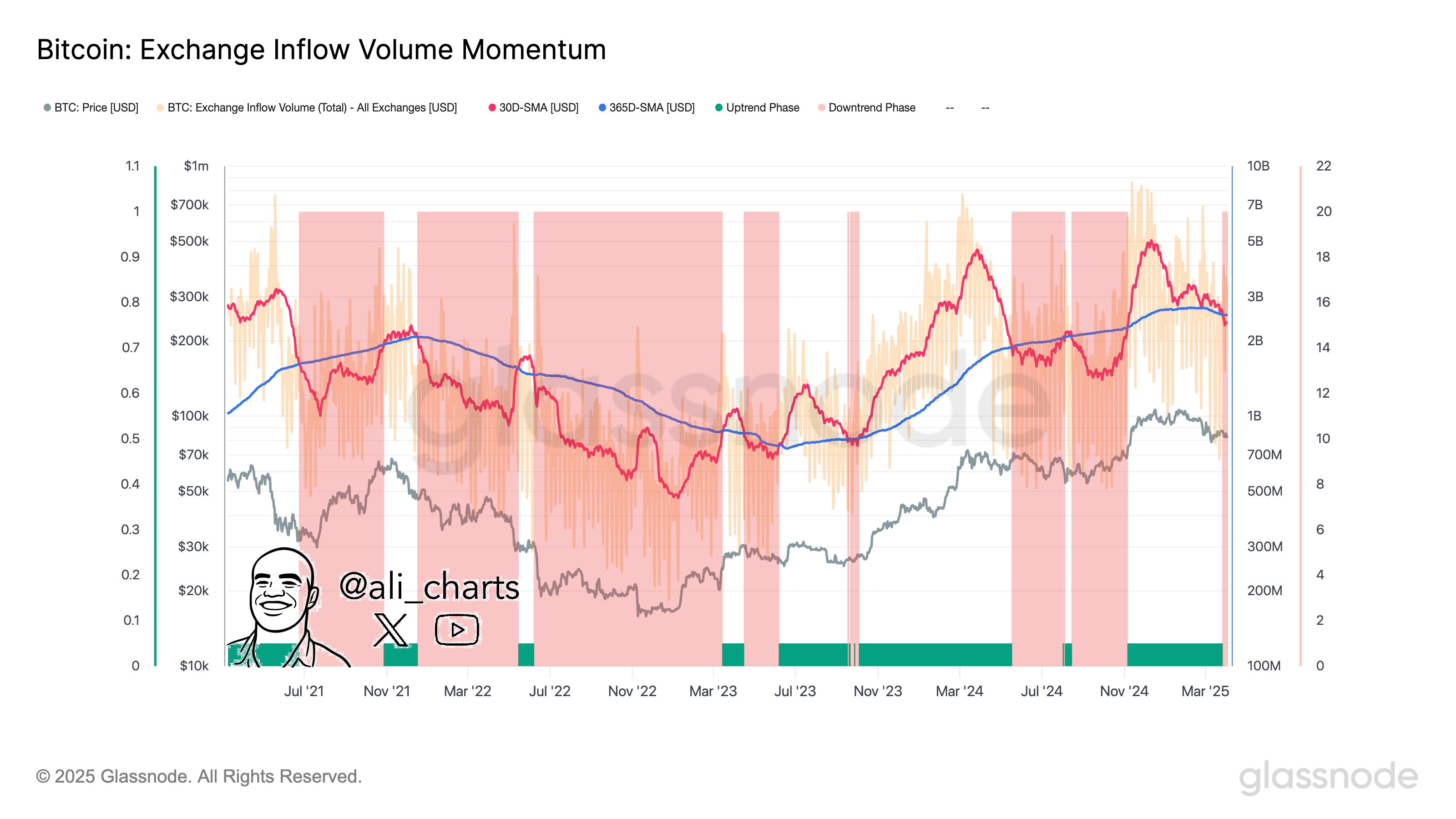

BTC Investors Wait As Exchange Activity Slows Down

In other news, popular crypto expert Ali Martinez has reported a decline in Bitcoin exchange-related activity indicating reduced investors’ interest and network utilization. Notably, this development suggests that investors are hesitating to deposit or withdraw Bitcoin on exchanges perhaps due to market uncertainty on the asset’s immediate future trajectory.

According to Martinez, Bitcoin is now likely to undergo a trend shift as investors wait for the next market catalyst. Notably, Bitcoin has shown commendable resilience despite the new tariffs imposed by the US government on April 2. According to data from Santiment, BTC’s price dipped only 4% in the hours following the announcement—a milder reaction compared to previous tariff-related market moves.

Since then, BTC has made some price gains and currently trades at $83,805 as investors flock to the crypto market which has recorded a $5.16 billion inflow over the past day. Meanwhile, BTC’s trading volume is up by 26.52% and is valued at $43.48 billion.

Featured image from UF News, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Semler Scientific Files To Buy $500-M In Bitcoin

Semler Scientific is looking to raise $500 million in new securities after settling a large case with the Department of Justice, according to company filings. The health care technology company will use some of the money to expand its crypto holdings, which are already in excess of 3,000 coins.

Company Enters $30 Million Settlement With Justice Department

As per recent Securities and Exchange Commission (SEC) filings, Semler Scientific has reached a $29.75 million settlement with the Department of Justice regarding marketing practices for its QuantaFlo product. The probe, which started in 2017, centered on potential violations of federal anti-fraud laws regarding the manner in which the company marketed its flagship product.

The settlement negotiations progressed in recent months following years of cooperation with several subpoenas. The deal is not complete yet, according to the company’s Tuesday SEC filing, but Semler has already obtained a way to finance the payment.

Semler Scientific's filing with the SEC. Source: US SEC.

Coinbase Loan To Fund Settlement Without Selling Bitcoin

Instead of liquidating its cryptocurrency holdings, Semler intends to use a loan from Coinbase to settle the DOJ case. The loan will be secured by the company’s large Bitcoin reserves, which stand at 3,190 BTC valued at about $267 million at current market prices.

This funding strategy enables Semler to satisfy its legal requirements without liquidating its cryptocurrency holding. With Bitcoin as collateral, the company can preserve its balance sheet strength while fulfilling the settlement needs.

Half-Billion Dollar Securities Filing Points To Bigger Crypto Plans

Apart from the settlement expenses, Semler has submitted an S-3 registration to the SEC to sell $500 million worth of securities. The filing indicates the company is not merely raising cash to pay the DOJ settlement but wants to increase its Bitcoin holding substantially.

Image: Threads

The action is made at a time when other businesses continue to accumulate Bitcoin into their coffers. According to reports in the filing, Michael Saylor’s firm recently bought 3,450 bitcoins worth $286 million, increasing its holdings to 531,640 bitcoins. Another company, Metaplanet, acquired $26 million worth of Bitcoin over the same time.

Image: Brookings Institution

Market Analysts Remain Bullish Despite Price Swings

The timing of Semler’s intended Bitcoin buys is during market volatility yet also forecasts of extreme price appreciation. An analyst, who goes by the handle “Titan of Crypto” forecasted Bitcoin to hit $137,000, although no timeframe was given for that price level.

The healthcare technology firm has not indicated precisely when it will finish its securities offering or make further Bitcoin buys. Nevertheless, the SEC filing clearly indicates that adding to cryptocurrency holdings is still a priority in addition to paying for the DOJ settlement.

Featured image from Pexels, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

ETF Issuers Bring Stability to Bitcoin Despite Tariff Chaos

BlackRock’s Bitcoin ETF is in the top 1% of performers in this category despite tariff chaos. Analysts theorize that the issuers are stabilizing Bitcoin’s volatility, and the ETF market will make BTC more secure in the future.

The issuers act as major whales, buying up any token dumps from retail investors. However, this new stability is entirely contingent on these powerful firms, which are exposed to broader macroeconomic concerns.

Are the ETFs Stabilizing Bitcoin?

The threat of Trump’s tariffs has brought chaos and uncertainty into global markets, but the price of Bitcoin has been relatively fine. Although it has fallen from its all-time high in January, its price shelf is still well above its performance before the November election.

According to one analyst, the ETFs may be providing Bitcoin with this extra stability:

“Bitcoin ETFs have eked out positive inflows past month and YTD and IBIT is +2.4 billion YTD (Top 1%). Impressivem and in my opinion, helps explain why BTC’s price has been relatively stable: its owners are more stable. ETF investors are much stronger hands than most think. This should increase stability and lower volatility and correlation long term,” claimed Eric Balchunas.

Since the Bitcoin ETFs first hit the market, they’ve totally transformed the crypto industry, but it’s been difficult to quantify that transformation.

However, this impending economic crisis has given analysts a useful chance to collect hard data from a stress test. Balchunas emphasized that ETF issuers had a powerful demand for BTC, which has powered some changes.

Over the last few months, US ETF issuers have been buying tremendous amounts of Bitcoin. Collectively, they surpassed Satoshi’s holdings in December and bought 20x as much BTC as the global mining output in January. Who met this apparent crisis in supply? Retail investors.

Bitcoin is more integrated than ever into traditional finance, and that presents a few opportunities. For any number of reasons, retailers have been compelled to dump their tokens.

Normally, these actions could spook the markets, but ETF issuers (and Michael Saylor’s Strategy) have been willing to buy as much Bitcoin as possible.

In other words, these whales have done a lot to hold up confidence in the entire market. Ideally, ETF issuers will have a mostly positive impact on the sector, potentially curing Bitcoin’s infamous chronic volatility.

Unfortunately, this substantial change comes with serious practical drawbacks, even discounting fears of de-decentralization. Since the ETFs transformed the market like this, Bitcoin has been more entangled than ever with broader macroeconomic trends.

These trends, however, could force these big whales to sell. Can we afford to tie Bitcoin’s fate to these actors?

The ETF issuers have a high confidence in Bitcoin, which has kept its price steady throughout the tariff chaos. If they lose that confidence for any reason, it could cause a powerful demand crisis.

This investment trend has been a tremendous benefit to the crypto industry, but it’s important to keep an eye on the potential risks involved.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

China Liquidates Seized Crypto to Boost Struggling Treasury

Amid mounting economic challenges and a growing pile of confiscated cryptocurrencies, local governments in China are increasingly liquidating seized digital assets to bolster strained public finances.

The practice raises legal and regulatory questions, especially concerning China’s blanket ban on crypto trading.

China Selling Seized Crypto To Bolster Treasury

China reportedly held around 15,000 Bitcoin (BTC) worth $1.4 billion by the end of 2024. According to River, a Bitcoin investment firm, this places the country among the top 15 global holders of the asset.

However, reports suggest China’s local governments are offloading digital currencies through private firms despite the national crypto ban.

Cas Abbe, a Web3 growth manager, and Binance exchange affiliate, noted on X that the dump in crypto prices may partly stem from these offloading activities.

“Local governments in China are selling seized crypto to top up their treasury. Despite the crypto trading ban in China, local governments are using private companies to offload their holdings. This explains pretty much the dump even before tariff news hit the market,” Abbe noted.

The surge in liquidations comes as authorities grapple with inconsistent policies for handling crypto seized from criminal investigations, which spiked sharply in 2023.

Over $59 billion was tied to crypto-related crimes in China that year. Blockchain security firm SAFEIS reported that more than 3,000 people were prosecuted for offenses ranging from internet fraud to illegal gambling.

Despite Beijing’s ban, local governments have reportedly turned to private firms to offload confiscated tokens. Specifically, they are converting them into cash to fund their treasuries.

Jiafenxiang, a Shenzhen-based technology firm, has sold more than 3 billion yuan ($414 million) worth of digital assets in offshore markets since 2018. Documents reviewed by Reuters link the company to liquidation deals with local authorities in Xuzhou, Hua’an, and Taizhou.

Though practical for cash-strapped regions, the process is legal gray territory. Such practices risk undermining the country’s crypto enforcement regime without clear regulatory frameworks.

“This raises so many questions about transparency. How are they even doing this legally?” noted one analyst in a post.

Experts are now calling for urgent regulatory reforms. These include judicial recognition of crypto as assets and the creation of standardized disposal mechanisms.

Some are even floating the idea of building a centralized national crypto reserve. This mirrors Trump’s administration’s proposals to manage seized assets more strategically.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Breakout Imminent? Analyst Expects ETH Price Surge To $2,000

-

Market23 hours ago

Market23 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?

-

Market21 hours ago

Market21 hours agoBNB Burn Reduces Circulating Supply by $916 Million

-

Market16 hours ago

Market16 hours agoHow It’s Impacting the Network

-

Ethereum24 hours ago

Ethereum24 hours agoDid Ethereum Survive The Storm? Analyst Eyes Breakout Next

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Reveals Why The Solana Price Can Still Drop To $65

-

Market19 hours ago

Market19 hours agoThis Crypto Security Flaw Could Expose Seed Phrases