Bitcoin

Bank of America Says Don’t Sell Before CPI Report: Crypto Impact

Bank of America has issued a timely warning to investors: resist the urge to sell in May, particularly ahead of the upcoming Consumer Price Index (CPI) report.

This advice comes as the CPI data for April 2024, set to be released by the US Bureau of Labor Statistics on May 15, looms large over financial and crypto markets.

Bank of America Says HODL

According to the Cleveland Federal Reserve, the anticipated CPI report is expected to reflect ongoing inflationary pressures, with predictions suggesting a 0.4% increase in headline inflation and a 0.3% rise in core inflation. Kalshi, an event forecasting site, predicts inflation will range between 3.3% and 3.5%.

These figures, if accurate, would signify that inflation remains well above the Federal Reserve’s target of 2%.

The Federal Reserve has maintained a stringent stance on inflation, raising interest rates to curb rising prices. Despite these efforts, inflation has proven stubborn, particularly in the shelter category, significantly impacting the CPI index.

The Federal Open Market Committee (FOMC) hopes that easing shelter costs will eventually help achieve their inflation target. However, thus far, there has been little evidence of such a trend.

As the market braces for the CPI report, Bank of America analysts recommend holding off on selling investments. Historical data indicates that the S&P 500 performs well in the summer months, especially in presidential election years.

“The S&P 500 (SPX) tends to have a summer rally, and presidential election years can see big summer rallies,” the bank stated.

From June to August, this period has historically been the second strongest three-month period, with an average return of 3.2%. In election years, the average return increases to 7.3%, with the S&P 500 rising 75% of the time. Meanwhile, Bitcoin’s average return during election years is 23.68%.

The upcoming elections, CPI reports, and subsequent Federal Reserve actions are closely watched in the crypto market.

Bitcoin, in particular, stands to be impacted by these economic indicators, with institutions starting to show their appetite for this new asset class. For instance, Susquehanna International reported owning $1.2 billion in Bitcoin across ten ETFs, while Hightower disclosed $68 million in Bitcoin holdings through six ETFs.

This institutional interest suggests confidence in Bitcoin’s potential as a hedge against inflation and economic uncertainty.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

As the market awaits the CPI report, investors are advised to remain cautious and avoid hasty selling. The interplay between inflation data, Federal Reserve policies, and market trends will be crucial in shaping the markets in the coming months.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

MicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

Rumors have been circulating that Strategy will be forced to liquidate its Bitcoin reserves if the price keeps dropping. The specific fears have been overstated, but the fundamental idea might be essentially true.

In any event, both Bitcoin and the firm’s stock price rose substantially after Trump announced a tariff pause. The immediate danger of a selloff has seemingly passed, but these factors may come into play in the future.

Will Strategy Need to Sell Its Bitcoin?

Since Strategy (formerly MicroStrategy) started buying Bitcoin, it’s become one of the world’s largest holders and a major pillar of market confidence.

While this has financially strengthened the company, it also presents certain challenges. Being one of the largest holders, if Michael Saylor’s firm chooses to sell a portion of its holdings, it could impact BTC’s market performance.

Rumors have been circulating that such an event might be inevitable, based on a recent filing. In the SEC filings, the firm writes a disclaimer that without access to favorable equity or debt financing, it could be required to liquidate BTC at a loss.

While the statement exists, it’s not new or extraordinary; it’s a routine inclusion found in MicroStrategy’s previous 10-Q reports from Q1 2024 and prior years.

BeInCrypto reported on Strategy’s Form 8-K when it came out earlier this week, analyzing its implications. The form claimed that Strategy did not buy any Bitcoin last week and has over $5.91 billion in unrealized losses.

“We may be required to take actions to pay expenses, such as selling bitcoin or using proceeds from equity or debt financings, some of which could cause significant variation in operating results in any quarter,” Strategy’s SEC filing claimed.

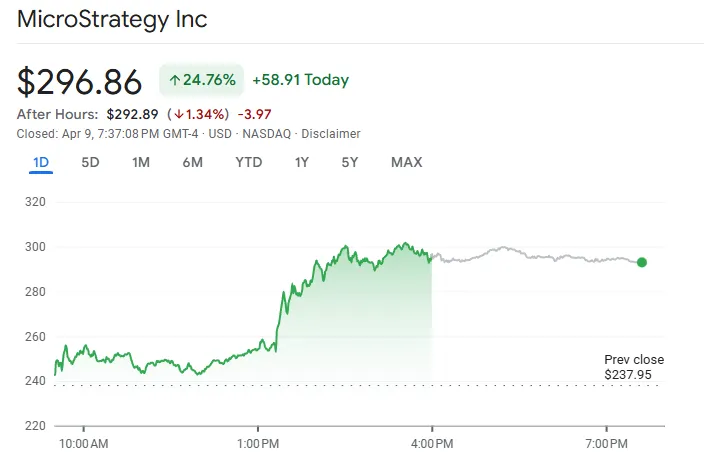

During the recent market chaos, these unrealized losses caused a lot of distress in the crypto community. However, that doesn’t mean that Strategy will have to dump its Bitcoin soon. In any event, its stock rallied today because of Trump’s tariff pause.

A Few Credible Selloff Scenarios

Although these concerns lack nuance, that doesn’t mean they’re totally unfounded. Michael Saylor claimed that Strategy can pay off its debts even if Bitcoin crashes, but some community members think these claims are either incorrect or deliberate lies.

His stated plan would involve massively diluting stock when he has already sold huge volumes.

In fact, several scenarios could force Strategy to sell its Bitcoin. If its price were to fall significantly and stay low, Strategy’s ability to meet debt obligations without tapping its BTC treasury could become strained.

The firm’s low revenue from its non-BTC business ventures would further exacerbate this problem.

Additionally, Strategy has used Bitcoin as collateral for loans on several occasions. If BTC drops below collateral thresholds, margin calls could force partial liquidation. However, such scenarios would be outlined in specific loan agreements, not general filings.

Above all else, the appearance of forced selling can seriously impact market sentiment, which is why these rumors are so serious.

Strategy’s stock price and Bitcoin are both riding high right now, and selloff fears seem less imminent. Yet, the fundamental macroeconomic situation remains unchanged. If Bitcoin falls again, MSTR’s debt position in the market will likely be impacted.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Will the Corporate Bitcoin Accumulation Trend Continue in 2025?

Bitcoin additions to corporate treasuries have risen during the first quarter of 2025, with industry giants like Tether and Metaplanet reaching record allocations compared to the previous quarter.

However, recent trade policy announcements in the US have cast a shadow over further Bitcoin accumulation. BeInCrypto interviewed Max Shannon, an analyst at CoinShares, to explore the sustainability of this trend throughout the year and the likelihood of further corporate adoption.

Which Companies Are Leading the Bitcoin Treasury Charge?

As Bitcoin’s path to mainstream adoption gains momentum, more companies are either expanding their BTC holdings or allocating the asset to their corporate treasuries for the first time in 2025.

The first quarter of 2025 stood out, with several major industry players making their largest Bitcoin allocations. Tether, the world’s largest stablecoin issuer, gradually acquired 8,888 BTC since January, bringing its total BTC balance to over 100,000. In the previous quarter, the issuer had only added 1,035 to its reserve.

Metaplanet also increased its allocation efforts. The Japanese publicly traded company first started purchasing Bitcoin in May 2024. By December, Metaplanet had accumulated 1,762 BTC, which grew to 4,046 by March 2025.

While other high-profile companies did not break their previous allocation records, they significantly expanded their Bitcoin supply.

Expanding the Ranks: From MicroStrategy to GameStop

Strategy, formerly known as MicroStrategy, has maintained its consistency with its aggressive accumulation style. So far this year, the company has bought a whopping 53,396 BTC.

Meanwhile, Fold Holdings, a financial services company, publicly announced that it had bought 475 BTC in early March, bringing its total accumulation to 1,485.

Corporations outside Web3 are also now joining the trend of acquiring Bitcoin.

Two weeks ago, video game and electronics retailer GameStop announced an update to its investment policy, revealing the addition of Bitcoin as a treasury reserve asset. Although the company made no immediate commitment to purchase BTC, speculation is high that it will allocate a portion of its $4.8 billion cash balance to the cryptocurrency.

Factors Driving Corporate Bitcoin Adoption

Bitcoin has become increasingly appealing to investors looking for an asset to hedge against inflation. Given BTC’s self-limiting supply, it is not subject to the type of depreciation that can impact fiat currencies.

“Companies understand that monetary inflation is the core reason behind the decline of their balance sheet’s purchasing power parity,” Shannon told BeInCrypto.

According to him, this may have led Metaplanet to accumulate record amounts of Bitcoin during the first three months of 2025. Metaplanet has already announced plans to amass 10,000 BTC by the end of the year.

“For Japanese firms facing persistent yen depreciation, Bitcoin serves as a hard-asset hedge. Moreover, in markets with negative real yields, BTC offers superior long-term risk-adjusted returns. Although It has no yield it offers long-term upside and inflation resistance when the inflation rates (either prices paid or monetary inflation) are higher than the nominal interest rate,” he said.

Given heightened concerns over spikes in inflation in the United States, Bitcoin has also become more appealing among American investors. Changes in accounting for digital currencies have also made them a more attractive addition to investment portfolios.

The Appeal of New Accounting Standards

In addition to its perceived value as an inflation hedge, Bitcoin’s attractiveness as a corporate investment has been further amplified by recent modifications to accounting standards in the United States.

In January, the Financial Accounting Standards Board (FASB) issued a new rule that enabled companies with BTC in their treasuries to report the profits on unrealized gains from their digital assets. Instead of waiting until they have sold their assets, companies can now report that increase in value as income in their financial statements.

“Selling a depreciating fiat currency in return for a digital hard asset such as Bitcoin that is also liquid and a ‘cash equivalent’ that can benefit from the new FASB accounting treatment (which can also improve the income statement) makes Bitcoin an attractive treasury asset,” Shannon added.

Despite its potential for inflation stability, Bitcoin’s inherent volatility can also attract investors with a greater risk appetite and companies aiming to diversify their holdings.

Can Bitcoin’s Volatility Be a Strategic Advantage?

Beta measures a stock’s volatility relative to the overall market. The higher the beta, the more volatile the stock is.

According to Shannon, adding a volatile asset like Bitcoin to the balance sheet increases the beta of the equity. If the price of Bitcoin goes up, the overall investor portfolio can score big.

“This can enhance returns for investors and has proven to do so. The volatility of the equity also tends to increase which improves the interest rate on convertible debt, therefore, impacting the capital structure and cost of capital for the company. The volatility also gives way for option and derivative traders which can increase the volumes of the stock and make it a more liquid asset,” Shannon told BeInCrypto.

However, investors can face higher potential losses during a Bitcoin bear market. Because of this, BTC as a treasury asset may be more appealing to companies looking to diversify or firms large enough to weather the storm.

Bitcoin for Specific Business Cases

The volatility and heightened trading activity accompanying Bitcoin adoption might offer a strategic advantage to particular companies, notably those with performance issues or in highly competitive sectors.

“Underperforming or mature businesses in competitive markets would benefit from an asset that increases the volatilty and volumes, as well as the beta of the equity,” Shannon told BeInCrypto.

GameStop is a good example of the former. The retailer’s Q4 2024 earnings report showed a significant decline in its sales volume.

Despite the worrying financial report, GameStop’s stock value rose by 12% after signaling that it would add BTC as a treasury reserve asset. Limited crypto exposure is expected to strengthen the company’s financial position in 2025.

In turn, Tether’s perceived robustness could make it more capable of withstanding Bitcoin’s significant price volatility.

Leveraging Profits for Bitcoin: Tether’s Financial Strategy

As the issuer of the largest stablecoin, Tether generates substantial revenue from transaction fees and managing its vast reserves. This financial strength could provide a buffer to absorb potential losses from Bitcoin price drops.

Demonstrating this financial capacity, Tether allocates 15% of its quarterly net profits to Bitcoin.

“This is similar to Dollar Cost Averaging by allocating 15% of its net realized operating profits for Bitcoin. This is a relatively conservative approach because it is post-tax so the excess cash (retained earnings) that accrues to equity can be used for a higher growth asset. In this instance, there are not huge drawbacks because the company is well capitalised with $7 billion in net equity, so its prudent risk management. However, there are still black swans where cash would be better needed than Bitcoin,” Shannon explained.

Despite its inherent unpredictability, Bitcoin’s observed long-term decline in volatility over recent years has supported the rationale for including it –even in small amounts– within a well-diversified portfolio.

“Bitcoin has improved the risk-adjusted returns of the 60/40 portfolio since 2017. [It] still has volatility risk which companies may not be willing to absorb, however, the volatility has historically trended down and could continue this into the future,” Shannon added.

While acknowledging Bitcoin’s advantages, Shannon finds it increasingly challenging to foresee if corporate asset accumulation will maintain the same rapid pace in Q2 as it did at the beginning of the year.

Market Disruptions: Will Corporate Appetite Wane?

Though only in its second week, April has proven to be a hard month for financial markets. The cryptocurrency sector experienced the most pronounced impact.

Trump’s recent Liberation Day celebration sent stocks on a downward spiral as investors braced themselves for incoming uncertainty. During the two days that followed Trump’s tariff announcements, over $1 billion in long and short positions were wiped out by the weekend volatility.

Amid this new wave of anxiety, Shannon anticipates that companies will prioritize more pressing concerns over further Bitcoin accumulation.

“The longer-term trend points to further balance sheet accumulation, however, its hard to call quarter over quarter. Based on the current volality of the markets, and tariff implications on margins, I suspect operational issues will be front of mind rather than Bitcoin accumulation,” he said.

Even after this initial wave of uncertainty subsides, macroeconomic conditions will significantly determine future corporate Bitcoin acquisitions. Bitcoin will also need to remain competitive to incentivize these purchases.

“A higher Bitcoin price should lead to FOMO and outperformance of Bitcoin-backed companies. For this to occur, trade policy certainty is needed (or in fact a reversal via deals with trading partners) as well as a lower 10 year yield and either a consolidation or recovery of the equity markets,” Shannon added.

For now, external headwinds may outweigh Bitcoin accumulation strategies.

An Uncertain Future

Corporate Bitcoin accumulation has reached new heights during the first quarter of 2025, but recent political and economic developments may stump future advancements.

Until the future of US trade policy and international reactions becomes more certain, the cryptocurrency market will likely experience heightened volatility. These circumstances might lead traditional investors and companies to favor a conservative strategy, directing their resources toward other priorities.

Only the passage of time will determine the outcome.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Goldman Sachs Raises US Recession Odds to 45%

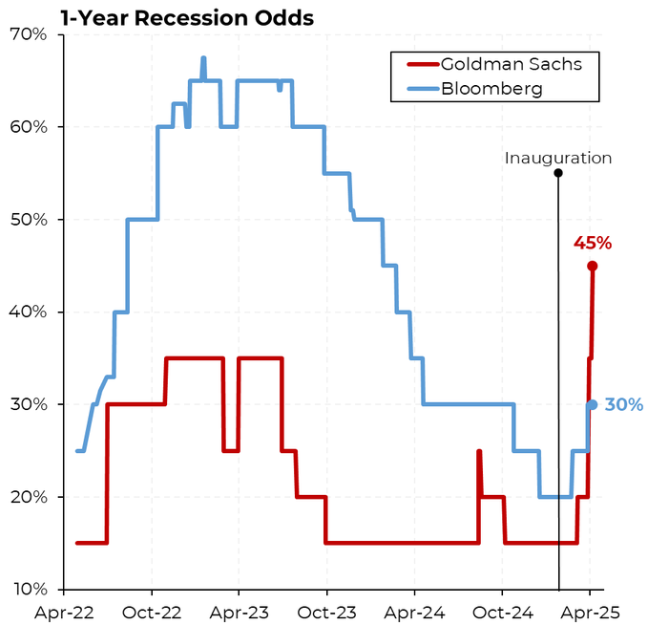

Goldman Sachs has raised its probability of a US recession within the next year to 45%. The prediction signals increased economic uncertainty amid escalating global tensions, tightening financial conditions, and looming tariff impacts.

This marks the highest probability of recession predicted by the investment bank since the post-pandemic inflation and interest rate hikes began.

Goldman Sachs Sees 45% Chances of US Recession

Goldman Sachs’ latest note, “Countdown to Recession,” outlines a sharp deterioration in economic conditions. These include the implications of tariffs expected to take effect on April 9.

Steven Rattner, former head of the Obama Auto Task Force and current Wall Street financier, shared the news on social media, emphasizing the gravity of Goldman’s new outlook.

“Goldman Sachs now predicts a 45% chance of a recession in the next year,” Rattner wrote.

According to Rattner, the recent surge in policy uncertainty and capital spending concerns compound financial market instability.

Meanwhile, Nick Timiraos, the chief economics correspondent for The Wall Street Journal, echoed the news, indicating the bank has adjusted its 2025 Q4 GDP growth forecast to a mere 0.5%.

“We are lowering our 2025 Q4/Q4 GDP growth forecast to 0.5% and raising our 12-month recession probability from 35% to 45% following a sharp tightening in financial conditions, foreign consumer boycotts, and a continued spike in policy uncertainty that is likely to depress capital spending by more than we had previously assumed,” Timiraos reported, citing Goldman Sachs.

While this reflects the anticipated fallout, the bank’s current forecast assumes that many new tariffs scheduled for April 9 will not materialize.

However, Goldman Sachs articulated that if Trump enacted these tariffs, the bank would adjust its prediction and formally forecast a recession. This could fuel already simmering inflation and drive further downward pressure on US economic growth.

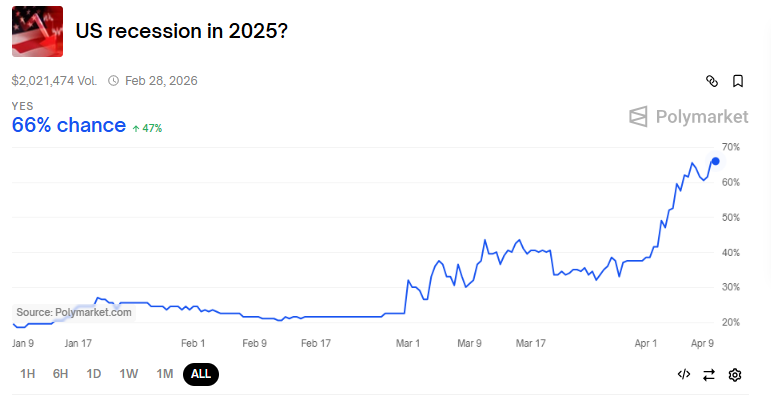

Amid escalating trade tensions, Polymarket bettors see almost 70% odds of US recession after Liberation Day tariffs.

Goldman Sachs Ups Bitcoin ETF Holdings

Despite the grim outlook for the economy, Goldman Sachs remains heavily invested in the crypto space, particularly Bitcoin (BTC). As of February 12, the bank held a substantial $1.5 billion in Bitcoin. This exposure comes through exposure to BlackRock and Fidelity’s Bitcoin ETFs (exchange-traded funds).

Moreover, recent filings reveal that Goldman Sachs has significantly increased its Bitcoin ETF holdings. Compared to previous filings, it boosted its position in the iShares Bitcoin Trust (IBIT) by 88% and the Franklin Bitcoin Trust (FBTC) by 105%.

This position reflects Goldman Sachs’ growing interest in digital assets as an alternative store of value amid traditional market instability.

This increase comes as Bitcoin has shown resilience in recent months, outpacing many other asset classes in performance. Recently, the bank’s CEO, David Solomon, highlighted the potential of blockchain technology to streamline traditional finance (TradFi). BeInCrypto reported Solomon saying Bitcoin was not a threat to the US dollar.

Besides Goldman Sachs, JPMorgan also predicted a recession in the US. BeInCrypto reported that it was the first major Wall Street bank to predict a US recession following former President Trump’s tariffs.

Their forecast warned of the broader economic consequences of trade wars, predicting that the Federal Reserve (Fed) might need to cut rates sooner than expected.

The possibility of a rate cut, which many see as a response to a weakening economy, adds to concerns about stagflation—a simultaneous rise in inflation and stagnation in economic growth.

This economic uncertainty also raises the odds of quantitative easing (QE) in the US financial system. Such an outcome could have far-reaching implications for the crypto market.

If the Fed opts for stealth QE, it could inject liquidity into the market and provide a short-term lifeline for risk assets like Bitcoin.

However, such actions could also intensify inflationary pressures, prompting a difficult balancing act for policymakers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoShiba Inu Burn Rate Shoots Up 1500%, Can SHIB Price Recover After Bloodbath?

-

Bitcoin24 hours ago

Bitcoin24 hours agoBitcoin Crashes Below $75,000 As Asian Stock Markets Bleed

-

Market24 hours ago

Market24 hours agoBerachain Drops 47% in a Month as Bearish Signals Grow

-

Bitcoin20 hours ago

Bitcoin20 hours agoHow Trump’s Tariffs Threaten Bitcoin Mining in the US

-

Market19 hours ago

Market19 hours agoDogecoin (DOGE) at Risk of More Losses as Market Volatility Spikes

-

Market17 hours ago

Market17 hours agoXRP Price Warning Signs Flash—Fresh Selloff May Be Around the Corner

-

Altcoin16 hours ago

Altcoin16 hours agoBinance To Delist These 7 Crypto Pairs Amid Market Turmoil, Are Prices At Risk?

-

Market23 hours ago

Market23 hours agoBitcoin Price Takes Another Tumble—Is The Floor About to Crack?