Altcoin

XRP Eyes 570% Surge As Price & RSI Break To The Upside

Crypto analyst Javon Marks has provided a bullish outlook for XRP, suggesting that the altcoin could witness another 570% surge as its price and RSI break to the upside. Meanwhile, crypto analyst Dark Defender predicted that the altcoin could rally to as high as $8 soon.

XRP Could Surge 570% Again As Price & RSI Break To The Upside

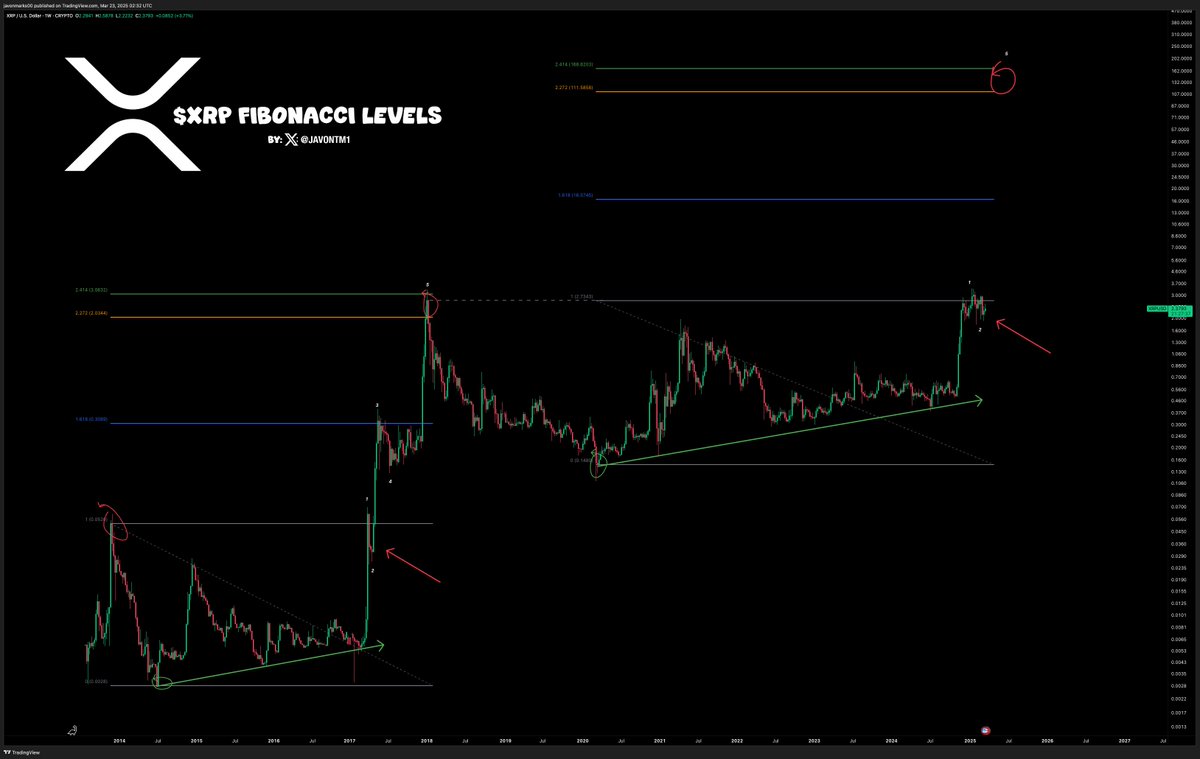

In an X post, Javon Marks revealed that XRP’s price and Relative Strength Index (RSI) have broken out to the upside. He revealed that the last breakout resulted in a price increase of about 570% and remarked that the altcoin can be ready for another substantial surge.

Based on history, the altcoin could record another 570% surge again, which would send its price to around $16 from its current level. In another X post, Marks indicated that the crypto was ready to witness a massive rally to the upside.

He stated that XRP’s next bullish wave looks to be nearing, and based on past performance, it can result in a push to the 1.618 Fib level at approximately $16.50. He added that a full similar performance to the last bull cycle could result in a rally to $100 or even higher.

Javon Marks’ prediction of $16 for the altcoin aligns with Egrag Crypto’s conservative target of $15 for XRP. Egrag Crypto also offered a more ambitious target, predicting that the altcoin could rally to as high as $44 in this cycle.

Crypto analyst Dark Defender also recently predicted that the altcoin could rally to as high as $23.20. He noted that the 3-month monthly close is approaching, and XRP boasts a clear bullish momentum on the higher timeframes. He added that there are ups and downs in smaller time frames, but the higher frames supersede smaller ones.

The crypto analyst also remarked that the 3rd wave is targeting between $5.85 and $8.076. Meanwhile, he claimed that the 5th wave is expected to finish the move between $18.22 and $23.20.

Final Countdown To A Breakout Is Here

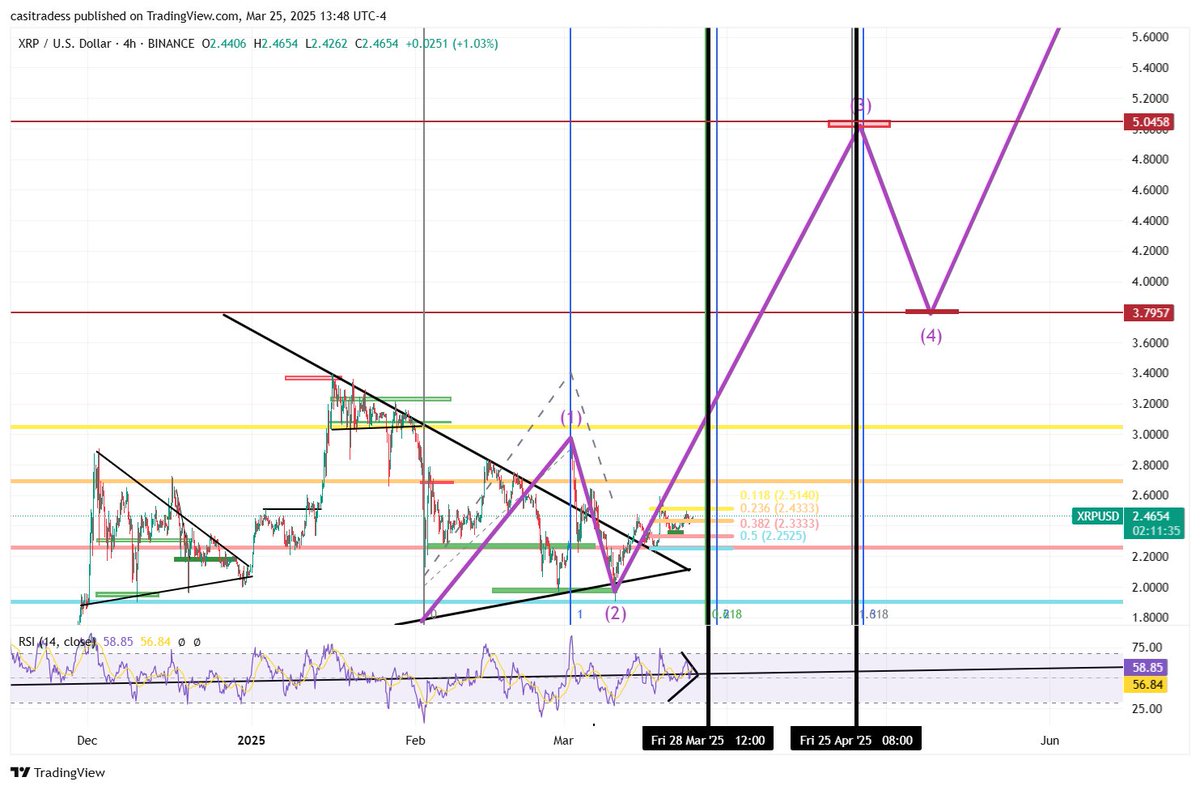

Crypto analyst CasiTrades stated that this is the final countdown to a breakout. She noted that XRP has been consolidating in a tightening structure ever since its breakout to $3.40 and that this pattern is quickly running out of time.

The crypto analyst asserted that what is even more exciting is that this price structure aligns perfectly with Fibonacci time analysis. She revealed that XRP is closing in on Time Zone 2 and the .618 Fibonacci time extension, both landing around March 30.

CasiTrades stated that it could take a week for this phase to resolve. Based on the current wave count and Fib confluence, she expects this to form a massive breakout near that time Fib towards the key price resistances at $2.70, $3.08, $3.80, and beyond.

The analyst also highlighted April 8, 25, and June 20 as key dates to watch. According to her, April 8 lines up with a major time pivot, which could lead to an attempt at $3.80, the current all-time high (ATH).

April 25 is the 1.0 Fib time extension and Time Zone 3, a strong indicator for a macro wave 3 top in this wave cycle. Meanwhile, June 20 is the Time Zone 5, which she claimed is likely the ultimate top in this market cycle for Wave 5 resistance.

CasiTrades stated that XRP is sitting right at the apex of this month-long consolidation. She added that the market is out of time, and it needs to make a decision.

With all the technicals aligning, the analyst believes the decision would be explosive. From a fundamentals standpoint, the altcoin’s outlook is also bullish, especially with Ripple dropping the cross-appeal against the US SEC and agreeing with the Commission to proceed with its XRP institutional sales, boosting the altcoin’s adoption.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Binance Update Sparks 50% Decline For Solana Meme Coin ACT: Details

A recent Binance update has triggered massive liquidations while sending Solana memecoin ACT into a steep correction. At first, pundits blamed market maker Wintermute for the jarring declines but Binance’s update to leverage and margin tiers appears to be the culprit.

Several Altcoins on Binance Suffer Massive Corrections

According to an X post, several altcoins listed on Binance took a major hit, dropping by double-digit percentages. The hardest hit of the lot was Solana memecoin ACT, experiencing a sudden drop of over 50% in 30 minutes.

Other altcoins including DEXE and DF equally recorded steep declines of 23% and 16% respectively in the same window. The price slump left traders scratching their heads but a consensus formed that sizable sell orders were behind the declines.

“The sudden dips were triggered by large sell orders executed in a short time frame, leading to a significant surge in spot trading volume,” said one pundit.

Others turned to market maker Wintermute as the trigger for the selloff. However, Wintermute CEO Evgeny Gaevoy denied responsibility while noting that the market maker reacted “post move.”

The decline comes amid a broader market recovery with several cryptocurrencies including Compound (COMP) gaining 70%.

What Triggered The 50% Decline For Solana Meme Coin

A Binance update on leverage and margin tiers on specific tokens like ACT triggered the massive declines. According to an April 1 announcement, the top exchange has updated the margin tiers of several perpetual contracts, noting that existing positions will be affected.

Following the move, one ACT whale got liquidated for $3.79 million at $0.1877, triggering a broad selloff. Former FTX community manager Benson Sun noted that traders had less than 3 hours to respond to the change, criticizing Binance for the move.

“Before changing the rules, Binance should have evaluated how many positions would be closed,” said Sun. “If there are market makers with large positions, they should have notified them in advance.”

Within hours of MUBARAK’s listing, the memecoin tumbled by 40% with Binance CEO Changpeng Zhao downplaying the impact of a listing on prices. Binance has drawn criticism in recent days following its exclusion of Pi Network from its Vote To List initiative.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

BTC, ETH, XRP, DOGE Fall Following Weak PMI, JOLTS Data

A crypto market crash looks imminent, with Bitcoin, Ethereum, XRP, and Dogecoin witnessing notable declines. This price crash happened following the release of weak manufacturing PMI and JOLTS data, which provides a bearish outlook for the market.

Crypto Market Crash: BTC, ETH, XRP, & DOGE Decline

CoinMarketCap data shows that a crypto market crash could be on the horizon, with the Bitcoin price sharply dropping below $83,000 from a daily high of around $84,400. Altcoins such as Ethereum, XRP, and DOGE also witnessed sharp declines.

This market crash occurred following the release of weak ISM manufacturing PMI and JOLTS data. The March PMI data dropped to 49, below expectations of 49.5 and lower than the 50 recorded in February.

The US JOLTS job openings for February came in at 7.568 million, below the expected 7.690 million and lower than the 7.762 million recorded in January. These data add to several macro fundamentals that paint a bearish outlook for the market.

This crypto market crash could persist, with China, Japan, and South Korea agreeing to respond to Donald Trump’s proposed tariffs. Trump is set to announce a number of reciprocal tariffs tomorrow, which could significantly harm the market as it sets off a trade war between the US and other nations.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Will XRP, SOL, ADA Make the List?

The US government’s strategic crypto reserve has been a hot topic of discussion, sparking expert opinions and debates. While President Donald Trump has already signed an executive order for a Bitcoin reserve, the fate of XRP, SOL, and ADA hangs in balance. However, the Trump administration’s upcoming disclosure of its crypto holdings is expected to bring clarity to the inclusion of altcoins in the US reserve.

Notably, the US Department of the Treasury and other government agencies are expected to expose their Bitcoin and other crypto holdings this week. Let’s unveil this crucial move’s potential implications on the US crypto and financial landscapes.

US Government To Disclose BTC and Crypto Holdings

In a recent X post, Bitcoin Magazine CEO David Bailey unveiled a crucial event on April 5, 2025, which is poised to revolutionize the US financial economy. According to Bailey’s post, the US government is set to complete a comprehensive audit of the country’s Bitcoin holdings this Saturday. Bailey said, “Depending on what we learn, might answer many of the open questions about the recent price action.”

The upcoming audit will provide a detailed inventory of the government’s Bitcoin portfolio, held across federal agencies. It will also provide insights into the collection of other cryptocurrencies like XRP, SOL, and ADA. Thus, this audit could also provide clarity into the possibility of including these altcoins in the US crypto reserve.

How Will the Audit Impact the US Crypto Reserve?

For context, President Donald Trump proposed a strategic crypto reserve to include XRP, ADA, and SOL in the US reserve. This development came amid growing speculations of the adoption of Bitcoin as a reserve asset.

Significantly, Trump’s move invoked criticism, with Bitcoin maximalists questioning the legitimacy of other cryptocurrencies to be a national reserve.

Though Trump signed an executive order for establishing a BTC reserve, there is still uncertainty surrounding the altcoin reserve. However, the US government’s decision to reveal its crypto holdings could bring transparency and clarity to the nation’s digital assets. The audit may also shed light on the potential developments within the government and its decision on altcoin reserves.

US Government’s BTC Holdings: A Closer Look

According to Arkham Intelligence data, the US government currently boasts a total of 198,012 BTC worth around $16 billion. As per crypto czar David Sacks’ statement, the US government has seized approximately 400,000 Bitcoin through civil and criminal asset forfeitures over the past decade.

Though the US government’s Bitcoin holdings are well-documented, its altcoin portfolio is still shrouded in uncertainty. Nonetheless, experts believe that the audit has the potential to clarify the government’s altcoin holdings and reserve management strategies.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum’s Price Dips, But Investors Seize The Opportunity To Stack Up More ETH

-

Market23 hours ago

Market23 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Altcoin22 hours ago

Altcoin22 hours agoElon Musk Rules Out The Use Of Dogecoin By The US Government

-

Market20 hours ago

Market20 hours agoBlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

-

Altcoin19 hours ago

Altcoin19 hours agoCharles Hoskinson Reveals How Cardano Will Boost Bitcoin’s Adoption

-

Market18 hours ago

Market18 hours agoHedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

-

Market17 hours ago

Market17 hours agoThis is Why PumpSwap Brings Pump.fun To the Next Level

-

Market16 hours ago

Market16 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

✓ Share: