Altcoin

Total Volume on PancakeSwap Exceeds $1.1 Trillion in Early 2025

PancakeSwap, a leading decentralized exchange (DEX) operating on nine blockchain networks, set a new record for trading activity in January and February 2025. It has achieved the highest monthly trading volume since 2021.

This record was driven by the recovery of the BNB Chain and the meme movement on the chain. However, the March market is showing signs that could challenge the DEX’s ability to maintain this volume.

Total Cumulative Volume on PancakeSwap Exceeds $1.1 Trillion

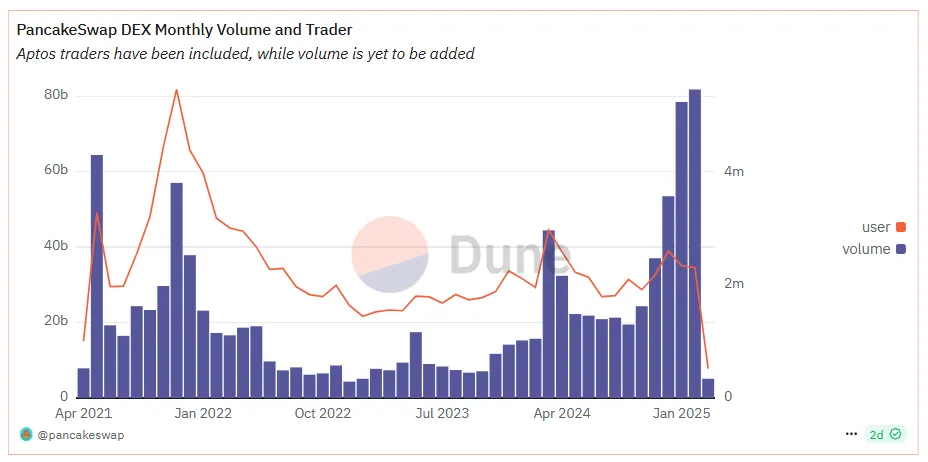

Data from Dune indicates that PancakeSwap’s trading volume started to rise sharply in December last year. By January, the DEX reached $78.4 billion in trading volume, and in February, it surpassed $81 billion. This marks the highest monthly trading volume since 2021.

This record helped push PancakeSwap’s total cumulative volume beyond $1.1 trillion.

The surge in trading volume was mainly due to the revival of the BNB Chain ecosystem.

“As a key player in the BNB Chain ecosystem, PancakeSwap continues to benefit from BNB Chain’s increasing resurgence,” read an excerpt in a press release shared with BeInCrypto.

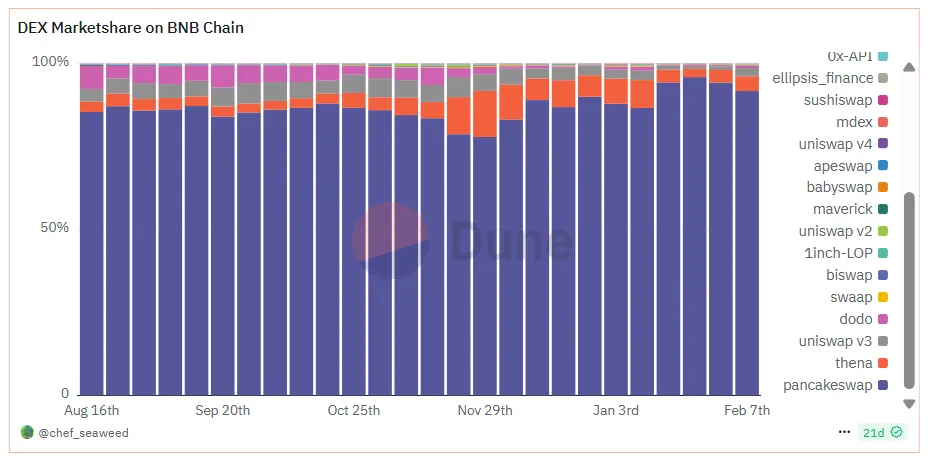

Additionally, Dune data shows that PancakeSwap holds over 90% of the DEX market share on the BNB Chain. This highlights the close relationship between BNB Chain and PancakeSwap.

Since early February, CZ—the former CEO of Binance—has promoted Four.meme by launching the Test (TST) token. Four.meme acts as a “gateway” for introducing new tokens to PancakeSwap. The surge in activity on Four.meme may have contributed to PancakeSwap’s increased trading volume, as new tokens attracted users and traders.

Despite PancakeSwap’s strong trading volume in early 2025, its monthly active users remained around 2 million. This represents a 63% drop from the peak in 2021 and a 30% decline from the highest level in 2024. The exchange has yet to attract a significant number of new traders.

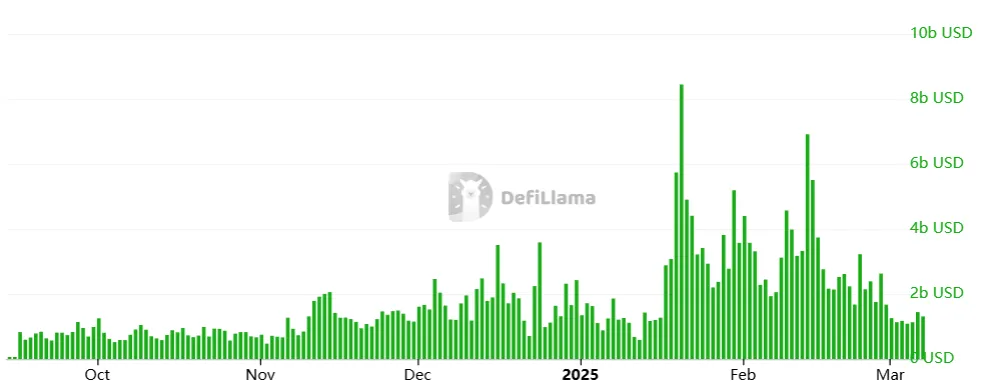

Additionally, data from DefiLlama shows that daily DEX trading volume on BNB Chain has been gradually declining since mid-February, dropping from over $6 billion per day to just $1.5 billion per day.

Moreover, the market capitalization of meme coins in March dropped nearly 60% from the December peak, falling from $137 billion to $55 billion. The meme coin trading frenzy on DEXs is also weakening. This could pose a challenge for PancakeSwap in the coming months.

According to BeInCrypto data, PancakeSwap (CAKE) is trading around $1.74 at the time of writing, down 60% from its recent high of $4.5 in December last year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Solana’s Fartcoin Jumps 20% Despite Market Selloff

The rout in the broader digital currency ecosystem did not impact some assets like Fartcoin, the memecoin linked to the Solana blockchain. As against the more than 8% drawdown in the combined market cap at the peak of the selloff on April 7, Fartcoin price maintained a more than 20% uptick.

Per the token’s performance, the speculation of a memecoin-driven market recovery is gaining momentum.

Fartcoin Price and Decoupling Trends

Despite the strong correlation that most digital currencies maintain with Bitcoin, the Fartcoin price displayed rare decoupling today. At the time of writing, the memecoin was changing hands for $0.5482, up by more than 20% in the past 24 hours per CoinMarketCap data.

Beyond the Solana memecoin’s price, other important metrics are also green. For instance, the coin saw its trading volume jump by more than 159% to over $370 million. This proof of engagement has helped the memecoin maintain a steady price above $0.5 amid volatility.

An earlier Fartcoin price analysis explored the prospect of the token soaring to $1.4. Historically, the token has always outperformed the broader market. The currently staged uptick might trigger its sustained rebound in the coming weeks in its bid to hit new heights.

Solana Memecoin Revival: Fartcoin To Lead?

Finding one token to serve as an outlier within a functioning blockchain ecosystem is not uncommon. While top tokens like BONK and Dogwifhat are underperforming, Fartcoin may be geared to lead the broader Solana revival.

The pivot to memecoins is already gaining traction with the rebranding of PumpFun. As reported earlier by CoinGape, the meme launchpad recently launched PumpSwap as a decentralized exchange to power its supported tokens. Shortly after, PumpFun launched PumpFi, a liquidity boost protocol for its users.

PumpFun helped push Solana’s price to a high of $294 before community backlash forced it to take the backstage. However, if the rebrand efforts and the relaunch of the PumpFun livestream turbocharge interest, Solana, Fartcoin, and associated assets may skyrocket further in due course.

Market Outlook to Watch

The headwind suppressing the price of most risk-on assets is the Donald Trump-fueled tariff war. While this is temporary, many digital currencies are poised to regain their lost valuations.

With the stock market correlation with digital currencies, protocols like Solana may pick on other bullish attractions within their ecosystems to stage a rebound. The growing push for a SOL ETF from Fidelity Investments and other asset managers creates a tailwind for the underlying asset.

If all the bullish factors around Solana play out, tokens like Fartcoin may see a retest of $2 in the long term.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Programmer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

While the PiCoreTeam (PCT) has endured a barrage of criticisms, Pi Network node runner John Lang has expressed optimism over the future of Pi Network. He hinges his belief on several initiatives by the PCT while urging investors not to sell their Pi Coins in the face of extended bearish sentiments.

Lang Says Pi Network Is Building Behind The Scenes

After enduring a torrid week that saw Pi Network price tumble to $0.58, John Lang is kindling bullish sentiments for Pi Coin holders. According to a post on X, the Pi Network node runner revealed that the price correction is only a small blip in the grand scheme of things for Pi.

His optimism stems from a series of behind-the-scenes activities by the PiCoreTeam which he says will usher a range of positives for the network. Per Lang, Pi community members should be patient with the PCT in view of the mountain of work before the development team.

“Guys, be patient with the PiCoreTeam. They keep working, building meticulously behind the scenes,” said Lang. “Their task is not easy and there are so much things to do.”

His comments come on the heels of scathing criticism against the PCT revolving around delays for KYB approvals for community projects. Things reached a head after PiDaoSwap launched NFTs on BSC as a temporary fix to the lengthy delays by the PCT.

Furthermore, Lang wants investors not to capitulate despite the pervading bearish conditions. Pi price has slipped 13% and is in free fall toward $0.3 with all eyes on the PCT for a short-term fix.

“Just trust the process and whatever the market condition is, never sell your Pi cheap,” said Lang.

PiCoreTeam Releases Technical Conditions For Ecosystem Developers

In a recent update, the PCT has released technical conditions for developers keen on building applications on the Pi Network. The conditions focus on a mobile-first strategy spelling out development language and framework while rolling out a software development kit.

Per the announcement, developers must pass KYC certification, and apps on the network must indicate a way of value exchange. The PCT’s pragmatic suggestions include apps for virtual goods, service decentralized applications (DApps), and mini-game platforms.

The PCT has released an update on Pi domain auctions, noting that bids have surpassed the 200,000 mark confirming rising on-chain metrics. Despite the rising PCT activity, market analyst Dr Altcoin has urged the PCT to burn billions of Pi Coins in its foundation wallets.

The pseudonymous Satoshi Nakamoto has urged community members to help stabilize the Pi price via a decentralized strategy. Nakamoto proposes a community-driven liquidity pool (CDLP) powered by investors committing to purchase a fixed amount of Pi each month.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Ripple Whale Moves $355 Million To Binance, XRP Price To Dip Further?

A large Ripple whale transaction has drawn attention across the crypto market. Early reports confirm that 200,000,000 XRP, worth approximately $355.6 million, was transferred from an unknown wallet to Binance. This movement has triggered concerns about possible price volatility in the near term.

The XRP price as a result of the Ripple whale dropped to around $1.61, sparking fears of a further dip.

Ripple Whale Major Transaction Sparks Worry

According to Whale Alert, a Ripple whale has moved 200 million XRP to Binance. The total value of this transfer stands at $355,576,574 based on the current XRP price. Such large movements often signal upcoming trading activity that could affect price behavior. Moreover, some optimism is building up brought by the NYSE Arca approval of listing and registration of Teucrium’s 2X Long Daily XRP ETF.

Post the Ripple whale action, analysts on social media have shared differing views on this development. Dark Defender commented, “There is no change in our XRP Monthly Frame. $1.8815 is holding firm.”

While the origin of the Ripple whale remains unknown, historical data shows that similar movements have preceded corrections or temporary price drops. Meanwhile, crypto analyst Ali Charts has predicted that XRP price is breaking out of a head-and-shoulders pattern, setting the stage for a potential move to $1.30. This interpretation adds a short-term XRP bearish perspective if the pattern confirms lower levels before a potential rebound.

Will XRP Price Rally To $8 in April?

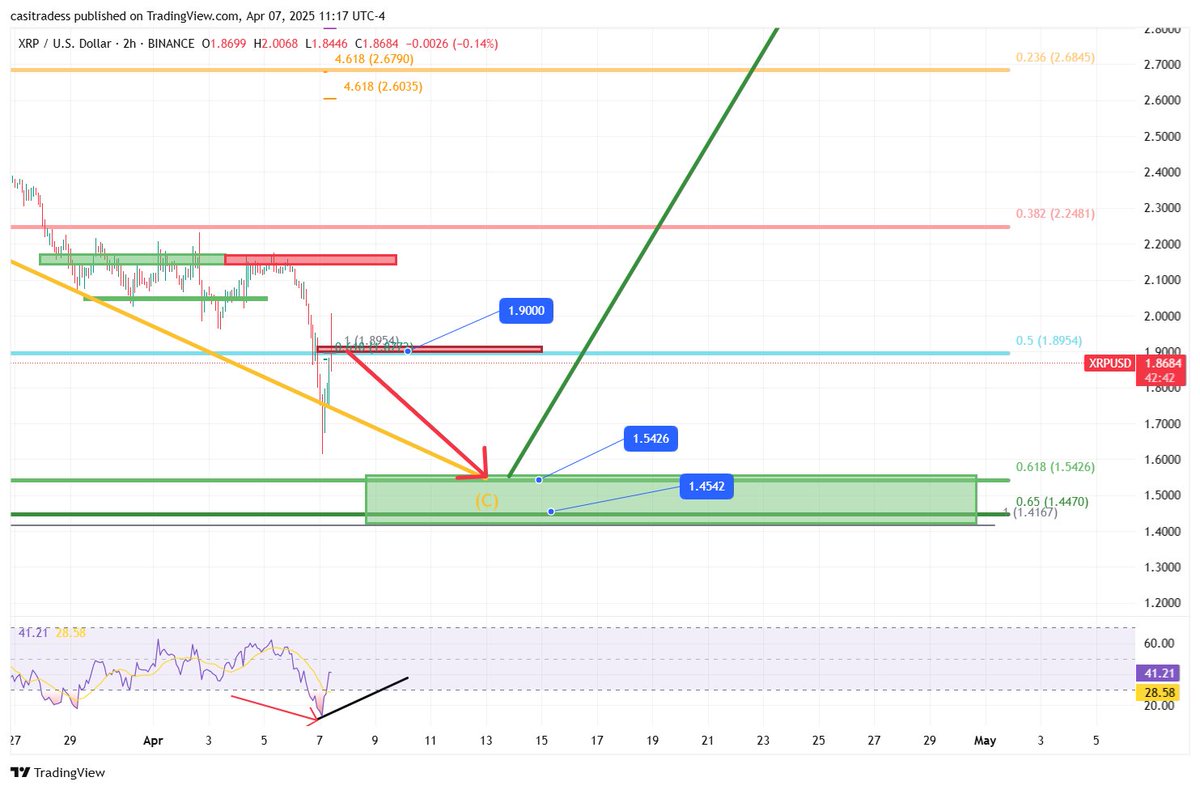

Concurrent with the Ripple whale, Casi Trades, reported that the $1.90 support level has broken down, turning it into a resistance point for XRP price. “This low made new extremes on the RSI,” they stated, referring to the market-wide price dip that took XRP to $1.61.

Casi also noted the next support at $1.55, which aligns with the .618 Fibonacci retracement level. This is a crucial area where many traders are setting alerts. According to the trader, “If we do bottom near $1.55, it actually strengthens the bullish case for those big April targets—$8 to $13 still stands.”

CredibleCrypto echoed similar thoughts, noting that XRP finally moved below a range low that had held for over a month. They pointed to a key demand zone between $1.61 and $1.79, suggesting it offers a possible setup for a rebound. However, they also noted that “Ideally we bracket/range here for a bit to form a base before a full-on reversal.”

As of now, despite the Ripple whale move the XRP price is consolidating just above this zone.

Analyst Outlines Key Resistance To Breach To Resume Bull Rally

Technical analysts have continued to monitor the Elliott Wave structure, suggesting that XRP price may be completing Wave 2 of a larger trend. This theory proposes that a strong Wave 3 could begin soon, which typically represents a strong upward movement.

The local resistance levels to watch include $1.97 and $2.17. A breakout above these points could lead to a move toward higher targets like $2.72 and possibly the previous all-time high of $3.70. However, a failure to hold above $1.61 could shift the focus to a deeper correction.

According to Egrag, a potential double-bottom or inverse head-and-shoulders pattern forming, which could support a bullish reversal if confirmed. This pattern is forming within the demand zone, which is being viewed by some traders as an ideal long setup for XRP price.

Historical Market Cycles and Long-Term View

Egrag Crypto shared a long-term view, drawing from past market cycles. They compared the current XRP price movement with patterns from 2017 and 2021. According to Egrag, during both cycles, XRP price touched or dropped below the 200 MA (moving average) before making large gains.

“In 2017, XRP dropped 73% then pumped 2700%. In 2021, it dropped 78% then pumped 1000%,” Egrag stated. He emphasized that as long as the 50 MA hasn’t crossed below the 200 MA, the bullish trend remains valid.

Egrag pointed out that short-term price declines are part of larger patterns. “You buy the blood, even if it’s your own,” he wrote, referring to buying during market fear.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market20 hours ago

Market20 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?

-

Market24 hours ago

Market24 hours agoSolana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?

-

Bitcoin21 hours ago

Bitcoin21 hours ago$1 Billion in Liquidations Over the Weekend

-

Market21 hours ago

Market21 hours agoSolana (SOL) Price Falls Below $100, Crashes To 14-Month Low

-

Bitcoin19 hours ago

Bitcoin19 hours agoWill 2025’s Crypto Market Mirror 2020’s Rebound? Analysts Predict

-

Market17 hours ago

Market17 hours agoBitcoin Price Crashes Hard—Is The Selloff Just Getting Started?

-

Market14 hours ago

Market14 hours agoBinance Founder CZ Joins Pakistan Crypto Council as Advisor

-

Altcoin14 hours ago

Altcoin14 hours agoDogecoin Whale Dumps 300M Coins Amid Market Crash, Can DOGE Price Dip Below $0.1?

✓ Share: