Altcoin

These Altcoins Are Seeing Fresh Address Activity, Firm Says

Data from Santiment suggests that three altcoins have recently seen particularly notable bullish action in their address activity.

Render, Aave, & Maker Are Altcoins Seeing High Active Addresses Currently

In a new post on X, the on-chain analytics firm Santiment discussed the altcoins currently witnessing a significant surge in network activity.

The relevant on-chain metric here is the “Daily Active Addresses,” which keeps track of the total number of addresses of a given asset that participates in some transaction activity daily. This indicator naturally takes into account both senders and receivers.

When the metric’s value is high, it means many addresses or users are making moves on the network right now. Such a trend implies that interest in cryptocurrency is currently high.

On the other hand, the low indicator suggests that investors may not pay much attention to the asset as the blockchain doesn’t see too much activity.

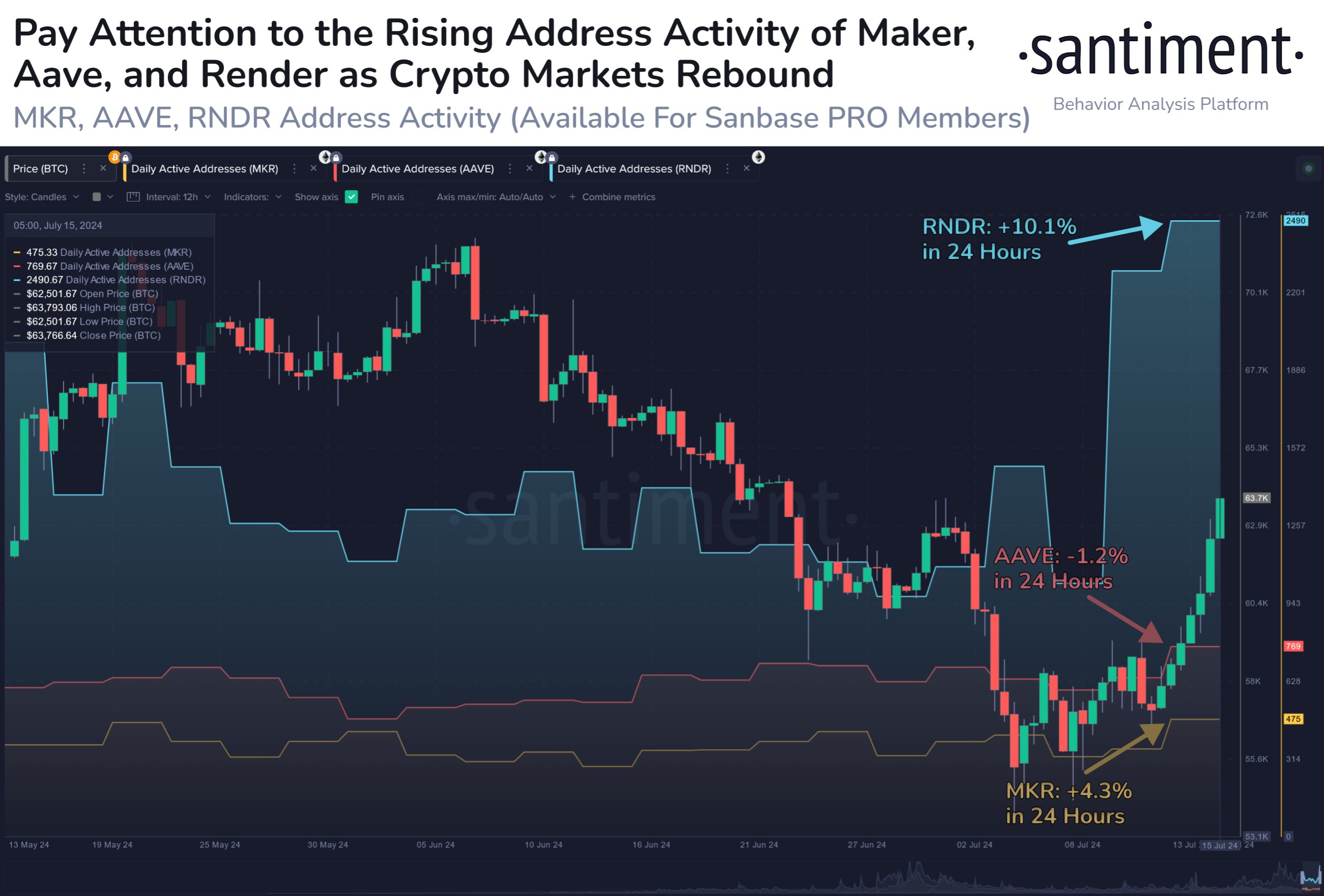

Now, here is a chart that shows the trend in the Daily Active Addresses for three different altcoins, Render (RNDR), Aave (AAVE), and Maker (MKR), over the past couple of months:

Looks like the value of the metric has been rising for all three of these coins | Source: Santiment on X

As is visible in the above graph, the Daily Active Addresses has seen a surge for all three of these altcoins recently. This increase in user activity has come for these assets as the market has been recovering.

Address activity going up alongside an increase in the price isn’t unusual for any cryptocurrency, as investors tend to find such price action exciting. Hence, they are more likely to make some moves.

A rise in the Daily Active Addresses could even be considered a prerequisite for any rally to be sustainable, as the increasing number of users provides the fuel a surge needs.

Historically, price moves that have failed to amass enough attention have run out of steam before too long. As such, Maker, Aave, and Render could be set up to see bullish action in the future, as they have seen the metric register an increase recently.

From the chart, it’s apparent that the jumps haven’t been too big in the case of MKR and Aave, but RNDR has stood out as it has enjoyed sharp growth in the metric. Therefore, it would appear that attention has been particularly strong for the altcoin.

It now remains to be seen if the rise in the Daily Active Addresses will end up benefiting the prices of these altcoins or not.

MKR Price

At the time of writing, Maker is trading around $2,950, up more than 30% over the past week.

The price of the coin seems to have been sharply going up in recent days | Source: MKRUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Altcoin

Binance Announces KERNEL As 4th Megadrop Project; Here’s The Listing Date

Cryptocurrency exchange giant Binance has once again garnered substantial investor attention with its latest announcement on the restaking protocol KernelDAO. On Tuesday, April 8, the CEX revealed its 4th Megadrop project, KERNEL, whilst also revealing plans to list the token soon. Mentioned below are some of the vital listing details that traders and investors should know as they look to capitalize on such emerging opportunities.

Binance Reveals 4th Megadrop Project KERNEL, Here’s All To Know

In an official press release on Tuesday, Binance Megadrop declared plans to support KernelDAO by adding it as the 4th project on the platform. The platform’s massive user base can participate in this event starting April 9 at 00:00 UTC.

Notably, the crypto exchange clarified that it will be the first platform to list this token. As per the platform’s announcement, any other claims offering sales before the allotted timeline are false.

Here’s The Listing Date

Binance revealed in its announcement that it will list the following trading pairs for KERNEL shortly ahead:

- KERNEL/USDT

- KERNEL/BNB

- KERNEL/USDC

- KERNEL/FDUSD

- KERNEL/TRY

The platform’s users can partake in trading the abovementioned crypto pairs starting April 14 at 12:00 UTC. Further, a seed tag is to be applied next to this asset, signaling high risk and volatility.

More Details On The Megadrop

The Megadrop event on the top crypto exchange will be live from April 00:00 UTC to April 13 at 23:59 UTC. The token, KERNEL, boasts a total token supply of 1 billion coins.

At the time of the crypto’s listing on Binance, the initial circulating supply will be 162,317,496 coins, worth 16.23% of the total token supply. The ‘Hard Cap’ per user is set at 320,000 tokens, per the announcement. Users can move on to the official site for further details regarding the Megadrop participation process.

Notably, KernelDAO is a shared restaking security protocol on BNB Chain. Users can restake BNB, BTC, and other yield-bearing tokens to amass rewards.

Binance Cements Top Ranking With New Offerings

Meanwhile, it’s worth considering that the CEX has continued to secure its top ranking by revealing such opportunities for market participants globally. Intriguingly, the crypto exchange revealed plans to support the Bitcoin staking protocol Babylon earlier this month.

Therefore, the exchange continues to witness growing popularity across the crypto landscape. Meanwhile, some other upcoming listings on the same exchange include Hyperliquid, Mantle, and Kaspa, among other crypto assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Solana’s Fartcoin Jumps 20% Despite Market Selloff

The rout in the broader digital currency ecosystem did not impact some assets like Fartcoin, the memecoin linked to the Solana blockchain. As against the more than 8% drawdown in the combined market cap at the peak of the selloff on April 7, Fartcoin price maintained a more than 20% uptick.

Per the token’s performance, the speculation of a memecoin-driven market recovery is gaining momentum.

Fartcoin Price and Decoupling Trends

Despite the strong correlation that most digital currencies maintain with Bitcoin, the Fartcoin price displayed rare decoupling today. At the time of writing, the memecoin was changing hands for $0.5482, up by more than 20% in the past 24 hours per CoinMarketCap data.

Beyond the Solana memecoin’s price, other important metrics are also green. For instance, the coin saw its trading volume jump by more than 159% to over $370 million. This proof of engagement has helped the memecoin maintain a steady price above $0.5 amid volatility.

An earlier Fartcoin price analysis explored the prospect of the token soaring to $1.4. Historically, the token has always outperformed the broader market. The currently staged uptick might trigger its sustained rebound in the coming weeks in its bid to hit new heights.

Solana Memecoin Revival: Fartcoin To Lead?

Finding one token to serve as an outlier within a functioning blockchain ecosystem is not uncommon. While top tokens like BONK and Dogwifhat are underperforming, Fartcoin may be geared to lead the broader Solana revival.

The pivot to memecoins is already gaining traction with the rebranding of PumpFun. As reported earlier by CoinGape, the meme launchpad recently launched PumpSwap as a decentralized exchange to power its supported tokens. Shortly after, PumpFun launched PumpFi, a liquidity boost protocol for its users.

PumpFun helped push Solana’s price to a high of $294 before community backlash forced it to take the backstage. However, if the rebrand efforts and the relaunch of the PumpFun livestream turbocharge interest, Solana, Fartcoin, and associated assets may skyrocket further in due course.

Market Outlook to Watch

The headwind suppressing the price of most risk-on assets is the Donald Trump-fueled tariff war. While this is temporary, many digital currencies are poised to regain their lost valuations.

With the stock market correlation with digital currencies, protocols like Solana may pick on other bullish attractions within their ecosystems to stage a rebound. The growing push for a SOL ETF from Fidelity Investments and other asset managers creates a tailwind for the underlying asset.

If all the bullish factors around Solana play out, tokens like Fartcoin may see a retest of $2 in the long term.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Programmer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

While the PiCoreTeam (PCT) has endured a barrage of criticisms, Pi Network node runner John Lang has expressed optimism over the future of Pi Network. He hinges his belief on several initiatives by the PCT while urging investors not to sell their Pi Coins in the face of extended bearish sentiments.

Lang Says Pi Network Is Building Behind The Scenes

After enduring a torrid week that saw Pi Network price tumble to $0.58, John Lang is kindling bullish sentiments for Pi Coin holders. According to a post on X, the Pi Network node runner revealed that the price correction is only a small blip in the grand scheme of things for Pi.

His optimism stems from a series of behind-the-scenes activities by the PiCoreTeam which he says will usher a range of positives for the network. Per Lang, Pi community members should be patient with the PCT in view of the mountain of work before the development team.

“Guys, be patient with the PiCoreTeam. They keep working, building meticulously behind the scenes,” said Lang. “Their task is not easy and there are so much things to do.”

His comments come on the heels of scathing criticism against the PCT revolving around delays for KYB approvals for community projects. Things reached a head after PiDaoSwap launched NFTs on BSC as a temporary fix to the lengthy delays by the PCT.

Furthermore, Lang wants investors not to capitulate despite the pervading bearish conditions. Pi price has slipped 13% and is in free fall toward $0.3 with all eyes on the PCT for a short-term fix.

“Just trust the process and whatever the market condition is, never sell your Pi cheap,” said Lang.

PiCoreTeam Releases Technical Conditions For Ecosystem Developers

In a recent update, the PCT has released technical conditions for developers keen on building applications on the Pi Network. The conditions focus on a mobile-first strategy spelling out development language and framework while rolling out a software development kit.

Per the announcement, developers must pass KYC certification, and apps on the network must indicate a way of value exchange. The PCT’s pragmatic suggestions include apps for virtual goods, service decentralized applications (DApps), and mini-game platforms.

The PCT has released an update on Pi domain auctions, noting that bids have surpassed the 200,000 mark confirming rising on-chain metrics. Despite the rising PCT activity, market analyst Dr Altcoin has urged the PCT to burn billions of Pi Coins in its foundation wallets.

The pseudonymous Satoshi Nakamoto has urged community members to help stabilize the Pi price via a decentralized strategy. Nakamoto proposes a community-driven liquidity pool (CDLP) powered by investors committing to purchase a fixed amount of Pi each month.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market22 hours ago

Market22 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?

-

Bitcoin23 hours ago

Bitcoin23 hours ago$1 Billion in Liquidations Over the Weekend

-

Altcoin17 hours ago

Altcoin17 hours agoDogecoin Whale Dumps 300M Coins Amid Market Crash, Can DOGE Price Dip Below $0.1?

-

Market23 hours ago

Market23 hours agoSolana (SOL) Price Falls Below $100, Crashes To 14-Month Low

-

Regulation17 hours ago

Regulation17 hours agoPakistan’s Crypto Council Appoints Binance Founder Changpeng Zhao As Strategic Advisor

-

Bitcoin21 hours ago

Bitcoin21 hours agoWill 2025’s Crypto Market Mirror 2020’s Rebound? Analysts Predict

-

Market20 hours ago

Market20 hours agoBitcoin Price Crashes Hard—Is The Selloff Just Getting Started?

-

Market15 hours ago

Market15 hours agoIs $0.415 the Key to Further Gains?

✓ Share: