Altcoin

Tether Invests $18.75M In XREX Group Boosting Cross-Border Payments

In a strategic move aimed at enhancing the efficiency of cross-border transactions, Tether has announced a significant investment of $18.75 million in XREX Group. This infusion of capital shows Tether’s commitment to fostering innovation within the global payment ecosystem. By partnering with XREX, a company known for its cutting-edge financial technology solutions, Tether aims to streamline and bolster the infrastructure for international payments. This investment offers increased reliability and speed in the transfer of funds across borders.

Driving Innovation in the Digital Asset Industry

Tether, the largest company in the digital asset industry, has announced a strategic investment of $18.75 million in XREX Group, a fully regulated, blockchain-enabled financial institution. This collaboration aims to drive innovation in the digital asset industry, particularly in facilitating USDT-based cross-border payments in emerging markets and advancing regulatory technology. With Tether’s funding, XREX will facilitate compliant, USDT-based cross-border B2B payments in emerging markets, revolutionizing financial transactions by offering businesses greater ease, efficiency, and potentially lower costs. Additionally, XREX will work with the Unitas Foundation to launch XAU1, a USD-pegged unitized stablecoin over-reserved with Tether Gold (XAUt), providing customers with a stable alternative and a hedge against inflation.

This collaboration will drive innovation in Regulatory Technology (RegTech), enhancing solutions to detect and prevent the illicit use of stablecoins. Tether’s commitment to responsible financial stewardship aligns with XREX’s dedication to fostering a safe, accessible, and trusted environment for all crypto users in emerging markets. “Tether’s strategic investment in XREX Group signifies our unwavering commitment to fostering financial inclusion in emerging markets,” said Paolo Ardoino, CEO of Tether. “Our collaboration with XREX will spearhead several groundbreaking initiatives, including the launch of a unique new unitized stablecoin by the Unitas Foundation and the facilitation of USDT-based cross-border payments, setting a new standard for financial accessibility and efficiency in the region.”

Also Read: US Lawmakers Pressure Biden To Secure Binance Exec’s Return From Nigeria

Expanding Financial Inclusion and Compliance

Tether and XREX have a history of successful collaboration in assisting law enforcement agencies to identify, arrest, and sentence criminals. With Tether’s strong support and investment, XREX is expanding this success into a RegTech product line, further refining XREX Group as a responsible financial institution. “We thank Tether and all existing investors for supporting this up round, which involved an issuance of new team (common) shares to fuel our top talent recruiting.

XREX boasts an impressive investor lineup, including the Taiwanese Government National Development Fund, CDIB Capital Group, SBI Holdings, E.Sun Financial Holding, ThreeD Capital, AppWorks, BlackMarble, and New Economy Ventures. XREX Singapore recently acquired the Monetary Authority of Singapore’s Major Payment Institution license, while XREX has been operating under the Taiwan Financial Supervisory Commission’s Registered VASP status.

Also Read: Bitcoin At $72K Sets $1.5B Liquidation Cascade, Willy Woo Predicts What’s Next

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Solana Meme Coin Fartcoin Price Could Hit $1.29 If It Holds This Key Level

Solana-based meme coin Fartcoin price is eyeing the next potential rally as per the latest analysis.

Despite currently trading well below its all-time high of $2.48 reached on January 19, 2025, Fartcoin has been forming a bullish pattern that could set the stage for upward movement.

Fartcoin Price Analysis Shows Potential Path To $1.29 Resistance

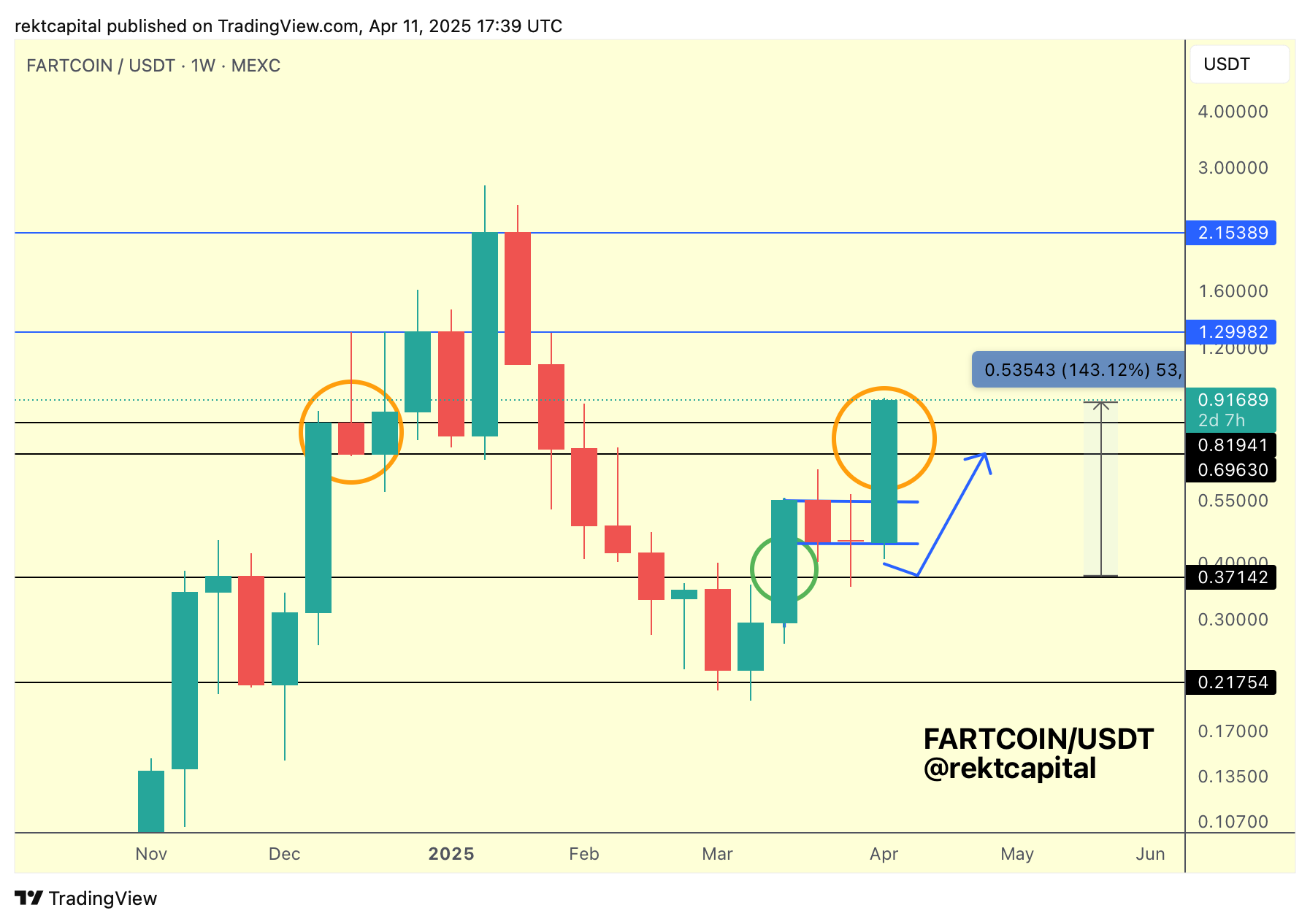

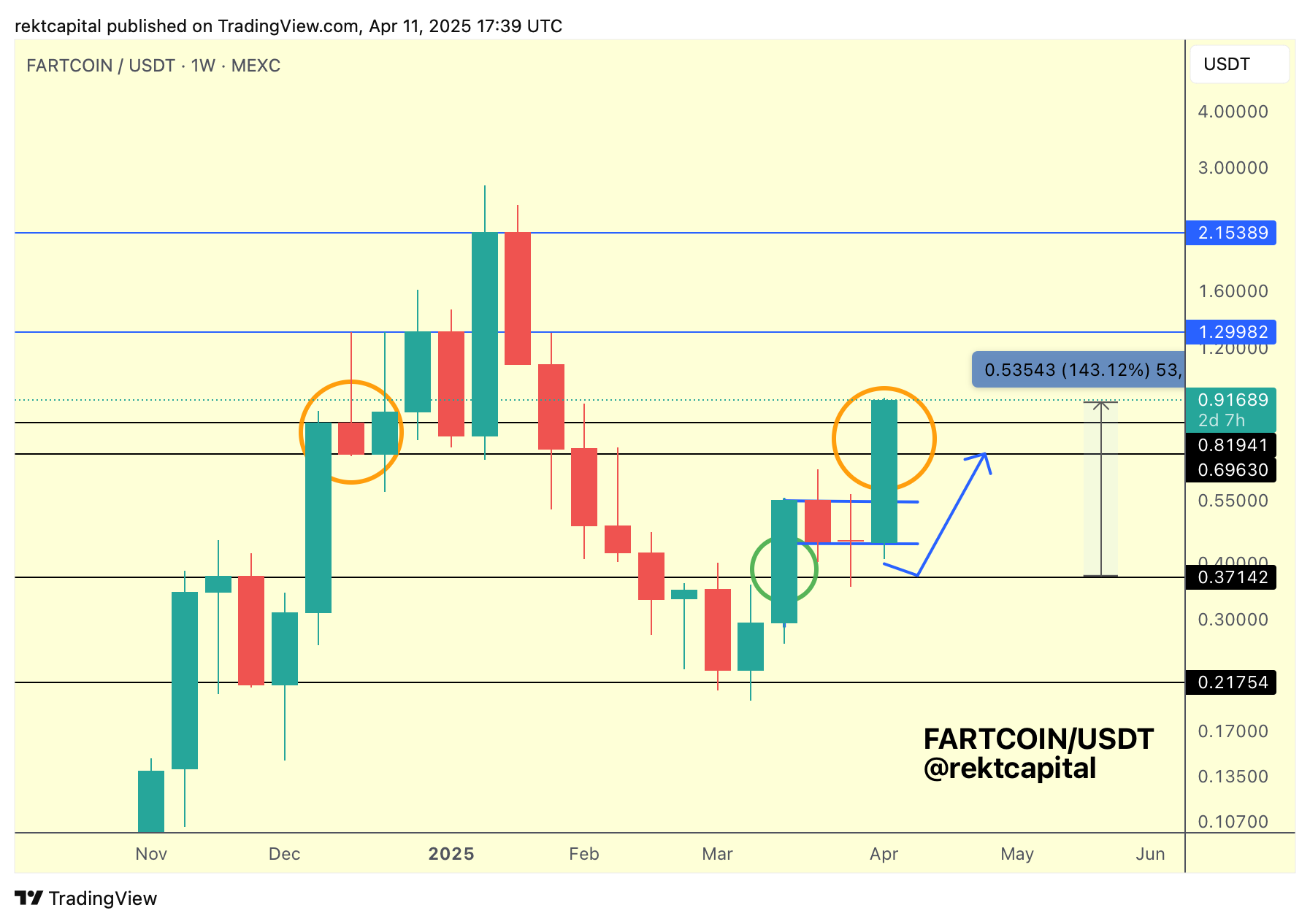

According to Rekt Capital’s analysis, Fartcoin has been following a predictable technical pattern that could lead to higher prices if key levels hold. The analyst notes that after identifying a potential path in mid-March, “FARTCOIN has progressively followed through on that path.”

The technical formation described includes the development of a “Bull Flag” pattern, with the price pulling back to the origin point of what the analyst calls “the blue path” for a successful retest via a downside wick. Following this retest, Fartcoin rallied over 140%.

The key resistance level to watch is $1.29, marked as “blue highs” in the analysis. However, reaching this target depends on Fartcoin’s ability to break and hold above the “black Range High” of approximately $0.82. The analyst notes that a “past Weekly Close above the ~$0.82 level has enabled upside in the past.” This analysis comes after Fartcoin slumped amid macroeconomic uncertainties.

Major Fartcoin support points to search for upward growth

Rekt Capital sees important price points Fartcoin needs to hold onto to remain strong. The report says if FARTCOIN is able to get a “Weekly Close within the black-black range, inside the orange circle, then it could allow for more buying within the range.”

More significantly, a “Weekly Close above the black Range High of ~$0.82” might unlock further upside potential. Here, the analyst indicates that price might do a “post-breakout retest” of this level. This action might turn it new support and validate a trajectory towards the $1.29 resistance level.

The $0.37 is the uppermost of the current range and is the first barrier for Fartcoin to breach in order to achieve even greater prices. Breaking through this resistance would be the first sign of further positive action.

In short, the analyst states that “FARTCOIN just has to remain above either of the black levels if it does pull back, and satisfying this requirement would leave the price in position to return to $1.29 (blue highs) later.”

Solana Meme Coins’ Performance Mirrors Sustained High Market Interest

Fartcoin price performed amazingly well on various time frames. Statistics indicate the token rising by 75.7% over the past 7 days and a whopping 205.9% over the past 30 days. The Solana meme coin also jumped 20% on April 11 amidst the market crash.

Despite all this, Fartcoin is still 64.7% off its all-time high of $2.48. This means there could be a possibility of recovery if the market is still strong and technical support is upheld. While Fartcoin hasn’t shown any major spikes in 24 hours, Solana’s price is up over 5%.

Following what Rekt Capital calls a “successful retest,” the token has bounced over 140% from its recent low. This validates the technical pattern pointed out by the analyst. This sudden turnaround has piqued interest in the token’s potential to return to its previous highs.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Binance Issues Important Update On 10 Crypto, Here’s All

The latest update from crypto exchange titan Binance has left traders speculating over a potential price impact on 10 crypto assets. An official press release by the exchange on Saturday, April 12, revealed that the collateral ratio of 10 tokens under portfolio margin is being updated. These tokens include DENT, ENJ, NOT, DASH, CHZ, AXS, ENS, SAND, THETA, and QNT.

Binance Updates Collateral Ratio For 10 Crypto Under Portfolio Margin

According to a recent Binance announcement, collateral ratios for the abovementioned crypto tokens will primarily be reduced shortly ahead. The exchange revealed that the new ratios will be visible on the platform starting April 18 at 06:00 UTC. This phenomenon raises market concerns as lower collateral ratios mean reduced borrowing power.

Market participants can use less of these assets’ value as collateral. This also shrinks their margin buying power, limiting their ability to open or maintain trade positions. Broadly speaking, the impact could be forced portfolio adjustments as market participants look to mitigate potential losses.

Here Are The New Collateral Ratios

Binance added that the update will also affect the Unified Maintenance Margin Ratio (uniMMR). “Users should monitor uniMMR closely to avoid any potential liquidation or losses that may result from the change of collateral ratio,” the leading crypto exchange notified.

How Are The Crypto Performing?

As mentioned above, the new update ignited cautious investor sentiments about the assets’ prices due to the downsized market and trade offerings. Nevertheless, most of the mentioned crypto tokens have traded in the green against the backdrop of the broader crypto market trend.

DENT price was up by 3% and traded at $0.0006567. ENJ price also jumped over 2% and exchanged hands at $0.06690. NOT price witnessed a slight 1% increase in value, closing in at $0.001882. DASH price was also up nearly 2% to $20.69.

ENS price soared nearly 3% and exchanged hands at $14.37. SAND price likewise gained nearly 0.5% to reach $0.2609. Also, QNT price surged roughly 2.5% and is currently sitting at $65.77. On the other hand, tokens like CHZ, AXS, and THETA traded in red territory. Market watchers continue to thoroughly eye the tokens for price action shifts ahead.

It’s also worth mentioning that Binance has revealed plans to list ONDO, VIRTUAL, and BIGTIME tokens recently, further revolutionizing its trade offerings.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Shiba Inu Burn Rate Explodes 1000%, Can SHIB Price Hit $0.000015?

Shiba Inu burn rate continues to deal a massive blow to the meme coin’s circulating supply, surging nearly 1000% this Saturday. Recent statistics from the token’s official burn tracker revealed that almost 17 million coins were removed from the circulating supply in just a day.

As a result, crypto traders and investors anticipate a highly bullish price trajectory for the token ahead, abiding by economic principles. Simultaneously, SHIB Knight, a renowned community member, has further asserted that a $0.000015 price target for the token looms right over the horizon.

Shiba Inu Burn Rate Bursts 1000%, What’s Fueling The Surge?

According to the latest data from Shibburn on X, the Shiba Inu burn rate has surged 984.58% in the past 24 hours. As per the data, 16.94 million coins have been removed from the total supply over the past day.

Following the abovementioned burn chronicle, the total number of coins burnt to date was evaluated as 410.74 trillion tokens. Further, the total circulating supply shredded down to 584.37 trillion SHIB tokens at the time of reporting.

Notably, two separate wallet addresses were collectivelyggested that the responsible for boosting the Shiba Inu burn rate today. Shibburn’s data suwallet addresses “0xa9d1e08c7” and “0xa20833” burnt 10 million and 4.3 million SHIB tokens, respectively.

Traders and investors view this saga as bullish news, given that supply reduction could prompt a price upswing even if the demand for the asset remains the same.

SHIB Price Eyes $0.000015?

At the time of reporting, SHIB coin’s price jumped over 3% and exchanged hands at $0.00001220. The meme coin pumped from a low of $0.00001183 over the past day. This price upswing mirrors a bullish impact fueled via the recent SHIB burn rate surge.

Besides, the price upswing also falls in line with today’s broader market trend, signaling that a recovery-like trend is cooking. Bitcoin price regained a hold above $83K after slipping as low as $74K this week. Altcoins and meme coins have mainly mimicked this uptrend, with Shiba Inu recovering from a weekly low at the $0.000010 level.

In response, broader market sentiments orbiting the meme coin are already optimistic. Moreover, community member SHIB Knight has posted on X amid this upswing, revealing that $0.00001570 is the short-term price target. Market participants remain highly optimistic as the meme coin has shown the potential to achieve such a feat ahead.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market22 hours ago

Market22 hours ago3 Altcoins to Watch for Binance Listing This April

-

Regulation23 hours ago

Regulation23 hours agoUS Senators Reintroduce PROOF Act To Set Reserve Standards for Crypto Firms

-

Market20 hours ago

Market20 hours agoLawmakers Propose the PROOF Act to Avoid Another FTX Incident

-

Market19 hours ago

Market19 hours agoThis is Why The Federal Reserve Might Not Cutting Interest Rates

-

Market18 hours ago

Market18 hours agoXRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

-

Market17 hours ago

Market17 hours agoCrypto Whales Are Buying These Altcoins Post Tariffs Pause

-

Market16 hours ago

Market16 hours agoBinance and the SEC File for Pause in Lawsuit

-

Altcoin6 hours ago

Altcoin6 hours agoBinance Issues Important Update On 10 Crypto, Here’s All

✓ Share: