Altcoin

Ripple Moves 900M XRP From Escrow, Is $25 Target Possible?

In a riveting turn of events, American blockchain payments company Ripple stole the spotlight on Friday, unlocking nearly 900 million coins from escrow. The massive unlock emerged in tandem with noteworthy lawsuit developments, sparking market discussions over future price action. XRP price traded at the $0.52 level today, with the broader market speculations gauging in on a potential $25 target ahead amid recent developments.

Ripple Unlocks 900M Coins From Escrow Sparking Discussions

As per data by Whale Alert on November 1, the American blockchain payments company Ripple unlocked 900 million XRP from escrow in two massive transactions. The first transaction indicated that 500 million coins, worth $254.70 million, were unlocked and transferred to the address rDqGA2Gfve. Further, the second transaction indicated that 400 million coins, worth $203 million, were unlocked and moved to the address rw2hzLZgiQ.

These escrow transactions, boosting the token’s market supply, have raised investor concerns amid the token’s current volatile run. Further, a recent CoinGape Media report spotlighted massive XRP whale dumps to exchanges, solidifying an apprehensive market state for the digital asset.

Simultaneously, recent legal maneuvers in the Ripple Labs vs. the U.S. SEC lawsuit have garnered additional attention toward the massive on-chain transactions surrounding the coin. Notably, the U.S. Court of Appeals for the Second Circuit set January 15 as the deadline for the US SEC to file its opening brief regarding appeals in the ongoing lawsuit.

Will XRP Rally To $25?

At press time, XRP is trading at $0.51, showcasing a highly volatile trading session over the past day. Further, the coin’s intraday low and high were recorded as $0.5039 and $0.5234, respectively.

Notably, Ripple coin’s intraday trading volume soared 42% to $1.25 billion, sparking contrasting market sentiments about the asset’s future. Besides, Coinglass data showed that the crypto’s futures OI slipped 1% to $734 million. This data has added to mixed investor sentiments surrounding the asset’s price ahead.

Also, it’s worth mentioning that an XRP price analysis by CoinGape Media suggests that the coin could rally as high as $25 soon. As the U.S. elections near, crypto market analysts anticipate a phenomenal shift in price trajectories. Primarily, with Donald Trump’s pro-crypto stance and substantially high winning bets, market watchers anticipate that a $25 price target is possible, given the Republican wins.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Binance Lists BABY As Bitcoin Protocol Babylon Goes Live

Cryptocurrency exchange Binance has revealed the listing of BABY, the native token of the Babylon Genesis blockchain. The listing comes as the Babylon Foundation finished its airdrop of 600 million BABY tokens to early adopters and contributors to the ecosystem.

Babylon Genesis Launches As First Bitcoin-Secured L1 Blockchain

The Babylon Genesis blockchain has officially gone live. The project has described itself as the launch of “the world’s first L1 blockchain secured by Bitcoin.” According to an X post by the Babylon team, this launch establishes the Babylon Bitcoin staking protocol as a “foundational infrastructure layer for Bitcoin.”

Babylon Genesis is Live: Secured by Bitcoin to Unite the Decentralized World

Babylon Genesis, the world’s first L1 blockchain secured by Bitcoin, officially launches today.

This launch cements the Babylon Bitcoin staking protocol as the foundational infrastructure layer for… pic.twitter.com/tPXa8npbWH

— Babylon (@babylonlabs_io) April 10, 2025

The project brings with it a fresh paradigm to securing blockchains as it employs Bitcoin as the Layer-1 blockchain’s security mechanism. In the system, the holders of Bitcoin are able to stake their BTC in order to secure the Babylon network and, as a reward, receive BABY tokens.

Babylon’s mission is to realize the maximum utility of Bitcoin by reconditioning “idle Bitcoin to be the foundation of the decentralized economy.” Such an approach helps fix Bitcoin’s lack of programmability without violating its security paradigm by using the staking protocol.

BABY Token Airdrop Successfully Launched

Babylon Foundation reported the completion of its airdrop of BABY tokens to early entrants in its ecosystem. According to official information, the airdrop distributed 600 million BABY tokens. This accounts for 6% of the total supply of 10 billion tokens.

In their announcement tweet, the foundation stated: “Dear Babylonian, the Babylon Foundation is happy to announce that the airdrop has just been successfully executed! You should be able to see your BABY in your wallet very soon.”

Dear Babylonian, the Babylon Foundation is happy to announce that the airdrop has just been successfully executed! You should be able to see your BABY in your wallet very soon. There is no transfer restrictions on your BABY. You could also stake your BABY to secure Babylon…

— Babylon Foundation (@bbn_foundation) April 10, 2025

The foundation confirmed that there are no transfer restrictions on the airdropped tokens. This gives recipients immediate freedom to trade or use their BABY holdings. Recipients also have the option to stake their BABY tokens to secure the Babylon Genesis network and earn additional tokens as staking rewards.

The airdrop acts as a reward mechanism for early adopters and as a way to distribute governance rights.

Binance Listing Details And Token Information

Binance’s listing of the BABY token provides immediate liquidity for airdrop recipients and other BABY holders. According to the exchange’s announcement, trading for BABY began on April 10, 2025, at 10:00 UTC. The tokens are available to trade against five different currencies: USDT, USDC, BNB, FDUSD, and TRY.

The leading crypto exchange has applied the “seed tag” to BABY. This generally indicates to traders that the token is in early stages and may carry additional investment risks. Deposits for the token will be enabled six hours after Binance’s announcement. This allows users time to prepare for trading. The exchange’s announcement comes after it unveiled its decision to delist 7 crypto pairs.

The total supply of BABY tokens is set at 10 billion, with the recent airdrop distributing 600 million tokens or 6% of this total supply. This distribution approach aims to establish a broad base of token holders who can participate in the network’s governance from its early stages. According to CoinMarketCap data, Babylon is trading at $0.1032 with a market cap of $234 million.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals How XRP Price Can Hit $22 If BTC Rallies To This Level

XRP price has surged nearly 10% today, indicating a renewed market interest in Ripple’s native asset. Notably, the robust surge comes amid a broader crypto market recovery and several other positive developments like the successful ETF launch in the US. Amid this, a top expert has highlighted the XRP/BTC performance and said that Ripple’s native asset is likely to hit $22 if Bitcoin hits a new ATH ahead.

XRP/BTC Bullish Cross Signals Massive Surge Ahead

Crypto analyst EGRAG CRYPTO recently highlighted a major bullish signal on the XRP/BTC chart. He pointed out a rare crossover of two key indicators, i.e. the 55-week Exponential Moving Average (EMA) and the 155-week Moving Average (MA). According to him, this “Bullish Cross” could be a game-changer for XRP holders.

EGRAG explained that the last time this crossover occurred was back in May 2017. XRP price rallied 958% shortly after that event. A similar cross took place again on February 17, 2025, and could repeat the explosive pattern if market conditions align.

Meanwhile, he added that if XRP/BTC retests the 55 EMA level of 0.00001850, Ripple’s coin could reach around $1.48, assuming Bitcoin trades at $80,000. However, if the historical pattern plays out and XRP/BTC gains another 958%, XRP price could skyrocket much higher. Besides, it also comes amid a surge of nearly 6% in BTC price today.

XRP Price Likely To Follow Bitcoin Move

EGRAG CRYPTO’s prediction hinges heavily on Bitcoin’s next major move. If Bitcoin price revisits its 2025 ATH near $109,000 and retraces to $97,000, XRP could hit $16.5. But if BTC breaks into higher territory, the numbers look even more bullish.

For context, he calculated that if Bitcoin touches $130K, XRP could trade at $22. Furthermore, if BTC rallies to $150K, XRP might surge to $25. A push toward $170K could propel XRP to $29, he added.

Why Does This Technical Signal Matters?

The analyst believes most traders overlook the significance of the 55 EMA and 155 MA combination. He noted that many still doubt XRP’s ability to reach double digits, especially after the recent crypto market crash.

However, the analyst remains firm in his belief that the chart tells a different story. He believes that as long as the XRP/BTC pair holds above the 55 EMA, the bullish projection for the XRP price stays valid.

XRP Price Soars 10%

XRP price today was up nearly 10% and exchanged hands at $2, while its one-day volume rose 3% to $8 billion. Simultaneously, the XRP Futures Open Interest also soared past the $3 billion mark with over 4% surge, CoinGlass data showed.

Notably, this recent surge comes as the Ripple network has seen a massive surge in active addresses recently. Besides, the recent XRP ETF launch in the US has also bolstered market confidence. The first-day volume of the Teucrium 2X Long Daily XRP ETF has outshined Solana’s 2X ETF (SOLT) first-day volume.

Considering all these fundamental developments, it appears that the crypto is gearing up for a major rally ahead. Besides, the analyst’s forecast, if holds true, could send the crypto to over $20 in the coming days.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Will Q2 2025 Mark the Return of Altcoin Season?

The cryptocurrency market is showing potential signs of an impending altcoin season. Market watchers cite a confluence of technical, sentiment, and macroeconomic factors that could lead to a significant rally in altcoins.

The outlook follows a notable downturn in the altcoin market, which has dropped about 37.6% since its high in early December 2024. As of the latest data, the market cap stands at $1.1 trillion.

Is Altcoin Season Coming?

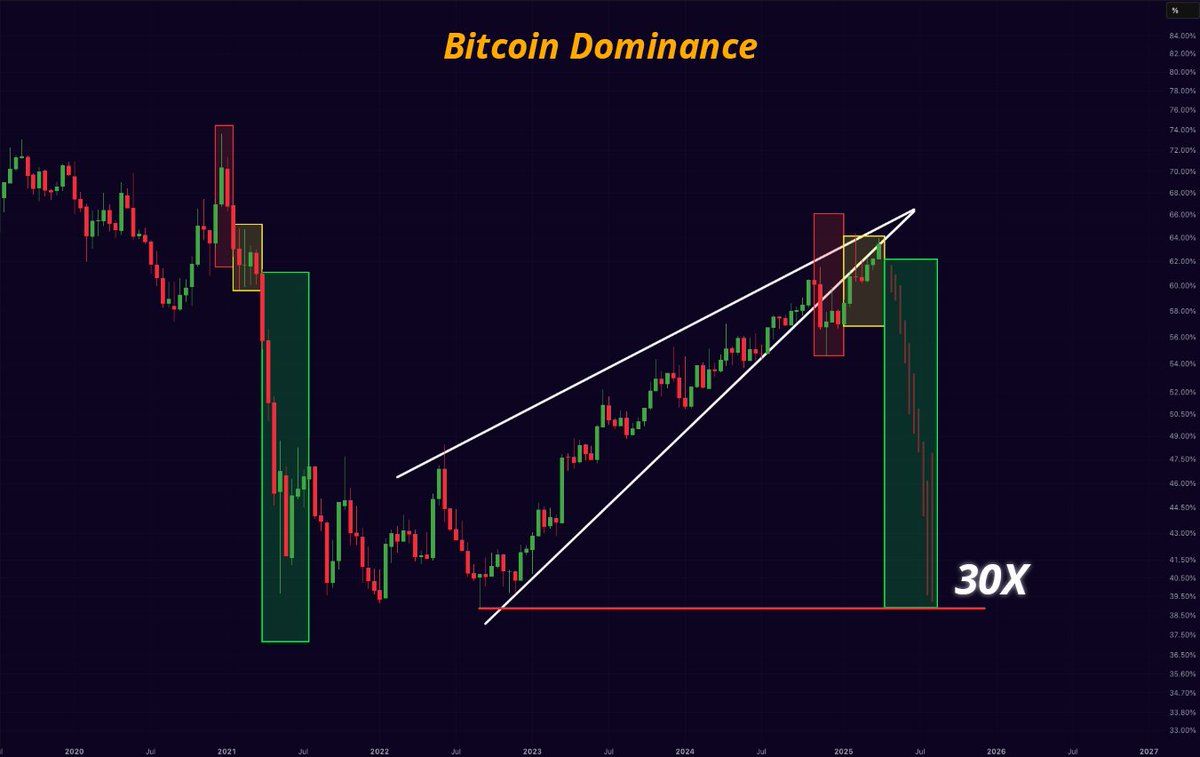

From a technical perspective, Bitcoin (BTC) Dominance, which measures Bitcoin’s market share relative to the total cryptocurrency market, seems to be at a key turning point.

A recent chart shared by crypto analyst Mister Crypto on X highlighted that Bitcoin Dominance has reached a resistance following a rising wedge pattern. This pattern is generally seen as a bearish signal, often leading to sharp pullbacks.

“Bitcoin Dominance will collapse. Altseason will come. We will all get rich this year!” he wrote.

In addition, another analyst corroborated these findings, noting that Bitcoin Dominance has reached a peak. Thus, he forecasted a subsequent downturn.

However, the Altcoin Season Index has dropped to a low of 16. The index, which analyzes the performance of the top 50 altcoins against Bitcoin, indicated that altcoins are currently underperforming.

Notably, this level mirrors the bottom for altcoins observed around August 2024. This period preceded a significant altcoin rally, and the index peaked at 88 by December 2024.

Lastly, from a macroeconomic perspective, the 90-day delay in President Donald Trump’s tariff implementation has renewed market confidence. This delay is perceived as a positive signal, potentially encouraging capital inflows into altcoins.

“90 days tariff pause = 90 days of altseason,” an analyst claimed.

Moreover, analyst Crypto Rover pointed to quantitative easing (QE) as a catalyst for an altseason. According to him, when the central bank starts pumping money into the economy (through QE), altcoins could experience a significant price surge, benefiting from the increased liquidity and investor optimism.

“Once QE starts. Altcoin season will make a massive comeback!” he stated.

However, in the latest report, Kaiko Research stressed that a traditional altcoin season may no longer be feasible. Instead, any potential rally could be selective, with only a few altcoins experiencing significant upside. The focus will likely be on assets with real-world use cases, strong liquidity, and revenue-generating potential.

“Altseasons may become a thing of the past, necessitating a more nuanced categorization beyond just ‘altcoins,’ as correlations in returns, growth factors, and liquidity among crypto assets are diverging significantly over time,” the report read.

Kaiko Research noted that the growing concentration of liquidity in a few altcoins and Bitcoin may disrupt the typical capital flow into altcoins during market upswings. Furthermore, as Bitcoin becomes more widely adopted as a reserve asset by institutions and governments, its position in the market strengthens further.

Ultimately, while the signs point to a potential altcoin rally, it’s clear that the future of altcoins could involve more nuanced market dynamics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin18 hours ago

Altcoin18 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Bitcoin15 hours ago

Bitcoin15 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Altcoin19 hours ago

Altcoin19 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Market15 hours ago

Market15 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Market24 hours ago

Market24 hours agoPaul Atkins SEC Confirmation Vote

-

Market17 hours ago

Market17 hours agoFBI Ran Dark Web Money Laundering to Track Crypto Criminals

-

Market11 hours ago

Market11 hours agoBitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

-

Altcoin17 hours ago

Altcoin17 hours ago21Shares Files For Spot Dogecoin ETF With US SEC

✓ Share: