Altcoin

Is Pi Network Heading for Price Pegging? What Happens to Pi Coin Next?

The latest reports in the market suggest that Pi Network is heading for a price pegging mechanism on the blockchain. Reportedly, the community has recently come across a smart contract code associated with Chainlink, while making direct references to the native cryptocurrency Pi Coin. The Pi price has shot up by 8% today, moving to $1.50 as investors continue to stay bullish for a rally to $5 and beyond.

Pi Network To Implement Dynamic Pegging Mechanism?

The Pi Network community has recently come across a smart contract code, featuring Chainlink, while putting up a direct reference to Pi Coin. This code hints at implementing a dynamic pegging mechanism, thereby potentially signaling plans to stabilize Pi’s value via an automated minting and burning system.

If verified, the discovery suggests that Pi Network could be implementing a price-pegging mechanism to manage volatility. This approach is commonly used in stablecoins like USDT and USDC, which tie their value to assets such as USD or gold. The mechanism further enables price stability, providing a predictable and less volatile trading environment.

Some market analysts believe that a pegged Pi Coin could attract more users and investors by offering a more reliable valuation method. They also believe that as an algorithmic stablecoin, the altcoin could see greater acceptability in everyday transactions and decentralized finance (DeFi) ecosystems. However, the PiCoreTeam still needs to confirm the authenticity around this pegging mechanism.

What Will Be Pi Coin Price After Pegging?

Recent details about Pi Network’s pegging mechanism highlight a unique approach to stabilizing its value through dynamic algorithmic pegging. The smart contract, reportedly tied to Chainlink, will automatically manage the supply of Pi Coins based on price fluctuations. It will do this in two ways:

- Minting additional Pi Coins when the price drops below the target.

- Burning existing Pi Coins when the price exceeds the target.

As shown in the image below, the name of the pegged token is Pi Coin with a target price of $314,159 USD (represented as 314,159 × 10¹⁸ Wei, the smallest Ethereum unit). The mint mechanism will be activated when the price falls below the target and the burn mechanism will be activated when the price moves above the target.

Binance Listing an Immediate Price Target

The latest reports in the town suggest that the Pi Network cryptocurrency could be heading for an immediate listing on crypto exchange Binance. This could provide it a major liquidity boost, driving the price higher. With a binance listing, Pi Coin could register its spot among the top ten cryptocurrencies by market cap.

Pi Coin’s price has demonstrated resilience, holding firmly at the $1.30 support level despite recent market volatility. Analysts point to this as a bullish signal, suggesting that Pi cryptocurrency may be gearing up for a significant upward move. Market sentiment is turning optimistic, with growing calls for a potential rally pushing PI towards the $5 mark.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

PI Network Price Breaks Key Resistance, Is $20 Imminent?

PI Network Coin has gained strong momentum, breaking past key resistance levels as the broader market sustains its bullish consolidation. Notably, with the March 14 Know Your Customer and Mainnet migration deadline approaching, many investors are watching to see if PI Network can keep this momentum.

The PI Network Price Breakout

PI Network has crossed the $1.7 price level, which is designated as a critical resistance point. This breakout has drawn attention from traders and investors who see it as a signal for a potential rally.

According to CoinMarketCap, Pi Coin’s price is $1.719, up 20.67% in the last 24 hours. Additionally, the PI Coin trading volume increased by over 120%, reaching $842.34 million. This comes as it traded from a low of $1.403 to a high of $1.738.

Per social chatter, many traders attribute this recent surge to growing confidence in the cryptocurrency as its migration deadline nears.

Over the past week, PI Network has posted more than a 53% price gain, making it one of the best-performing digital assets in the market. The increased activity comes as many users rush to complete their Know Your Customer verification to secure their holdings before the final migration phase.

Market analysts believe breaking the $1.7 resistance level could set the stage for upward movement. PI Coin could soon test the $2 resistance mark if buying pressure continues. Historical data shows it has not reclaimed this level over the past 14 days.

A successful move past this point could lead to a rally toward $5 in the coming weeks. If achieved, analysts place long-term projections at $20, depending on key developments.

Why is PI Network Soaring As KYC Deadline Draws Close

A major reason for PI Coin’s price surge is the upcoming March 14 KYC and Mainnet migration deadline. PI Network has reminded users that unverified balances will be lost after this date, driving more engagement within the community.

Many users who previously ignored the process are now rushing to complete their verification, increasing PI Coin’s demand.

In addition, speculation about a potential coin listing on the Binance exchange has contributed to the rally. Last month, Binance posted an announcement to its community regarding a possible listing of PI Network on the platform.

While the Binance PI vote indicated that 87.1% of participants favored listing the coin on the exchange, it has yet to make an official announcement.

What Next for PI Coin?

With PI Coin holding above $1.7, many investors believe the price could soon challenge $2. If momentum continues, the next targets could be $5 and $10 before the migration deadline.

However, the key factors that could push PI Coin toward $20 include successful KYC completion, increased adoption, and a major exchange listing. However, analysts advice tempered expectations considering the volatile PI ecosystem.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveal How Ethereum Price $8,000 Move Could Be In Play

Ethereum price is poised for further recovery as analysts have identified hidden bullish divergence that could enhance the previous rally. The pattern which indicates momentum shifts has it that, contrary to the present slump in the price, ETH could be on course to rise above its previous record high of $4,850.

If this pattern holds, Ethereum could be positioned for a climb to $8,000, a move that would likely trigger an altcoin rally.

Hidden Bullish Divergence Signals Ethereum Price Rally to $8,000

Analyst Javon Marks shared on the X platform that Ethereum price has confirmed a Hidden Bullish Divergence, which often signals a continuation of an existing uptrend. The pattern indicates that despite a recent pullback, the underlying momentum remains strong, suggesting a recovery in ETH price.

This technical formation typically appears when an asset’s price makes a higher low while its relative strength index (RSI) forms a lower low. Such a setup often leads to a continuation of the previous uptrend. With Ethereum price already displaying this pattern, analysts believe the next major resistance level to watch is $4,850. A successful breakout above $4,850 could clear the way for Ethereum price to reach $8,000.

Ethereum Drops Below Realized Price

Additionally, Ethereum recently fell below its realized price of $2,054 for the first time since February 2023. The realized price represents the average price at which ETH tokens last moved on-chain, providing insights into the overall market sentiment and profitability of holders.

On-chain data from Glassnode revealed that Ethereum’s market value to realized value (MVRV) ratio dropped to 0.93, indicating an average unrealized loss of 7% for ETH holders. Historically, dips below the realized price have often preceded market recoveries as long-term investors accumulate during these periods.

However, a recent CoinGape price analysis revealed that Ethereum price might see further downside if selling pressure continues to rise. Whale transactions to exchanges have intensified, raising concerns about a potential ETH drop below the $1,500 mark. However, a bullish diamond pattern suggests that ETH could rebound if it breaks key resistance levels.

Momentum Could Trigger Altcoin Rally

Notably, a rally above $4,850 may take Ethereum price to $8,000 and possibly trigger an altseason. Majority of the altcoins replicate the movement of ETH especially when the price is rising sharply.

Moreover, such a rally will bring institutional and retail investors into the market, therefore, a multiplier effect may be observed across other cryptos. This would be good for altcoins as many of them are yet to recover from the effects of recent pullbacks.

Analysts have identified the $1,600 to $1,900 range as a potential support zone for Ethereum price. Recent data from Glassnode shows that around 600,000 to 700,000 ETH were accumulated near the $1,900 level.

If the top altcoin maintains this support and gains momentum, the resistance at $2,200 could be the next hurdle. A successful breakout from will set the stage for an altcoin rally to $4,850, confirming the path to $8,000.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals When The XRP Price Will Hit Double & Triple Digits

Crypto analyst Egrag Crypto has revealed when the XRP price will hit double and triple digits. This provides a bullish outlook for XRP especially amid the recent market crash and its brief drop below the psychological $2 price level.

When The XRP Price Will Hit Double & Triple Digits

In an X post, Egrag Crypto stated that the XRP price will hit double digits in this cycle and triple digits in the next cycle. for triple digits, his accompanying chart showed that XRP could reach as high as $110. Interestingly, crypto analyst Dark Defender also recently predicted that XRP could reach triple digits, although he provided a more bullish outlook for the crypto as he predicted that it could reach $333.

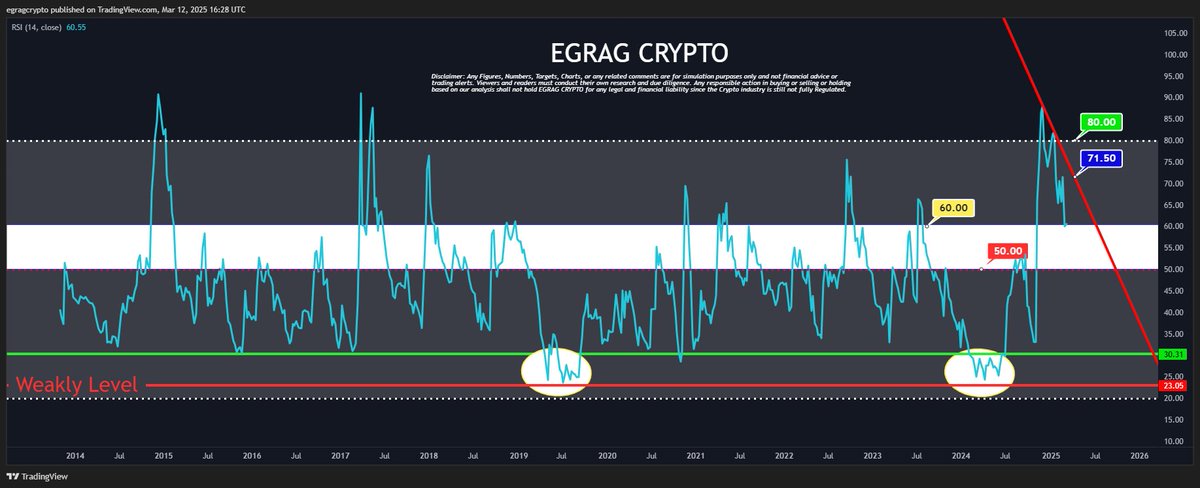

Meanwhile, in another X post, Egrag Crypto suggested that XRP’s recovery could be imminent. While analyzing the weekly Relative Strength Index (RSI), he stated that the crypto simply needs to cross 71.50 and then ‘kaboom,’ indicating a parabolic rally.

He noted that on the 60 level, XRP’s RSI is starting to kick upward. The analyst added that as the crypto builds strength from 60, it could easily climb back above 80. However, he remarked that it first needs to close above 71.50.

Crypto analyst Rose Premium also recently predicted that XRP could soon rally to as high as $3.35. The analyst stated that a bounce from the current support level of $2.12 could drive the crypto’s price towards key targets at $2.32, $2.61, $2.90 and then $3.35.

A Rally To $5 Is Also On The Cards In The Mid Term

Crypto analyst Dark Defender also indicated that an XRP price rally to 45 was also on the cards in the mid-term. This came as he highlighted this price level as one of the targets in his recent analysis.

He noted that XRP has finished the correction on the four-hour time frame. Analyzing the daily chart, he stated that XRP is expected to move towards $2.42 first considering the correction structures. He added that the real momentum will start after XRP stands above Ichimoku clouds.

The analyst highlighted $2.22 and $2.04 as the key support levels to watch out for. Meanwhile, he stated that the targets for XRP at the moment are $4.2932 and $5.8563.

It is worth mentioning that fundamentals such as the XRP ETFs and a potential Ripple SEC settlement provide a bullish outlook for the XRP price. Yesterday, asset manager Franklin Templeton filed the S-1 for its XRP ETF with the US SEC. Meanwhile, Journalist Eleanor Terrett recently reported that the SEC could soon close its case against Ripple.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market24 hours ago

Market24 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

-

Market19 hours ago

Market19 hours agoBitcoin Price Recovers Some Losses—Is a Full Rebound in Sight?

-

Market18 hours ago

Market18 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs

-

Ethereum17 hours ago

Ethereum17 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?

-

Market23 hours ago

Market23 hours agoXRP Bears Continue to Drive Price Down, Risks Further Losses

-

Market15 hours ago

Market15 hours agoPi Coin Centralization Raises Serious Questions About the Future

-

Market20 hours ago

Market20 hours agoSEC Delays XRP and Solana ETF Approvals

-

Bitcoin17 hours ago

Bitcoin17 hours agoCrypto Market Recovers After Liquidations: Here’s Why

✓ Share: