Altcoin

Is Litecoin Price Finally Ready for A Bull Run?

Litecoin price has been in a period of consolidation, with futures market open interest remaining subdued despite a rise in activity from large holders, often referred to as whales.

The coin is currently trading around $61, a level it has hovered at for the past two weeks. This price represents a 27% recovery from its August low, though it remains 44% below its highest point of the year.

Litecoin: Whales Accumulate Amidst Declining Active Users

As of writing, LTC price was up only 1% to $60,73, with its trading volume soaring 4.81% from yesterday. In addition, a recent Litecoin price prediction shows that the crypto could hit $70,97 by the end of the year. The movement in the price has mirrored that of Bitcoin, which surged to an all-time high of $73,800 in March before dropping to $49,000 in August. Bitcoin is now trading around $54,000.

Data from Santiment shows a notable uptick in whale purchases of this famous altcoin over recent weeks, suggesting that large investors are taking advantage of the lower prices. Additionally, the platform has reported a surge in social media mentions for Litecoin, indicating growing interest in the asset.

Additional data from Santiment indicates a significant decrease in daily active addresses for this altcoin in recent months. On Friday, September 6, LTC recorded over 327,000 active addresses, a sharp decline from the 801,000 active addresses observed in June.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Shiba Inu Price on The Verge of Breaking $0.00002

The memecoin ecosystem has joined the latest revival in the broader market, with the Shiba Inu price now in the spotlight. The memecoin has reset its bearish outlook and will break crucial price milestones in the coming days.

For Shiba Inu, the death cross formation was confirmed on April 6 when the price dropped from $0.00001232 to a low of $0.00001030.

Shiba Inu Price Golden Cross Confirmed

Market data shows that the SHIB price is gradually disappearing from its earlier consolidation trend. At the time of writing, the coin’s price was changing hands for $0.00001249, up by 2.14% in 24 hours.

SHIB recovered after trading at a low price of $0.00001205 to a daily high of $0.00001265 before settling at the current level. This price boost comes as the SHIB burn rate jumped 1000% in early trading, setting the memecoin on a possible revival path.

The SHIB/USDT 4h chart confirms a golden cross pattern for the memecoin. This pattern is formed when the short-term Moving Average switches above the longer-term moving average.

Although this pattern is fully formed on the 4-hour chart, it is yet to form on the daily chart. However, with the current momentum, a confirmed breakout is possible. Already, the token has displaced Hedera and now ranks as the 17th largest cryptocurrency.

Shibarium Catalyst for Price Rebound

Different ecosystem factors can boost the price of Shiba Inu in the long term. One of these factors is closely tied to the outlook of Shibarium and its associated Layer-2 scaling solution.

As reported earlier by CoinGape, the Shibarium 200 million addresses milestone is near. If the network attains this landmark, it will show a clear sign of growing adoption, a move that might boost its token valuation.

Already, Shibarium has broken the 1 billion total transaction milestone. Should the Shiba Inu network continue to record organic growth, its chances of outranking Dogecoin is higher.

Amid the ongoing boost, the question remains how high the memecoin could soar. Drawing on this, a potential SHIB retest of its ATH of $0.00008844 is possible moving forward. While it will require as much as a 710% growth from current levels, SHIB can print this uptick, drawing on its historical trend.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Bankless Cofounder David Hoffman Reveals Strategy To Improve Ethereum Price Performance

Ethereum’s torrid patch is extending into Q2 of 2025, forcing industry players to wade into proffer advice for the largest altcoin. Bankless confounder David Hoffman says a change in network culture will have the biggest impact on the Ethereum price performance.

David Hoffman Wants Ethereum Community To Stop Policing Behaviour

Bankless cofounder David Hoffman has revealed suggestions to improve Ethereum price performance, pointing to a culture and leadership shift in the network. According to an X post, Hoffman says mainstream Ethereum critics are sidestepping the real reason for ETH’s lackluster price performance in recent months.

Hoffman notes that Ethereum’s leadership and its culture of alienating users and builders is to blame for its underwhelming performance. The cryptocurrency executive cited the public exorcism of ETH staking platform Lido Finance and criticism against degenerate traders.

At the time, Lido Finance came under fire from the Ethereum community for regulatory, centralization, and security concerns while degens took flak for spiking gas fees and lack of long-term projects.

He argues that the broad hostility against a class of users plays a big role in the Ethereum price decline. Hoffman notes that the network’s attempt to police behavior on a permissionless chain is the straw that broke the camel’s back. Ethereum price is hanging onto the $1,500 mark after sinking to lows of $1,415 over the last week.

To remedy the situation, David Hoffman is advocating for the Ethereum Foundation (EF) to attract users and builders to the network, demonstrating the spirit of true decentralization.

“If we want ETH to group, the EF and broader community need to start attracting users and builders, not pushing them away with a holier-than-thou culture,” said Hoffman.

Ethereum Price Is Staging A Strong Recovery

Hoffman’s comments come amid a fresh market resurgence for Ethereum price with ETH grabbing a 6% spike over the last day. While ETH price has declined to a 5-year low against Bitcoin, momentum is rising for prices to reclaim $2,000.

One side, backed by community members like Leo Glisic sees a potential upside for Ethereum, driven by a simple investment narrative.

“The play is infrastructure for the future global financial system,” said Glisic. “Ethereum will serve as the settlement and interoperability layer, which is a winner-take-all market.”

However, CryptoCurb is comparing Ethereum to Nokia’s downfall, noting that Solana will displace ETH like Apple to become the largest altcoin. Critics like CryptoCurb and Peter Schiff say the rally is unsustainable and an ETH decline below $1,000 is a possibility.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Solana Meme Coin Fartcoin Price Could Hit $1.29 If It Holds This Key Level

Solana-based meme coin Fartcoin price is eyeing the next potential rally as per the latest analysis.

Despite currently trading well below its all-time high of $2.48 reached on January 19, 2025, Fartcoin has been forming a bullish pattern that could set the stage for upward movement.

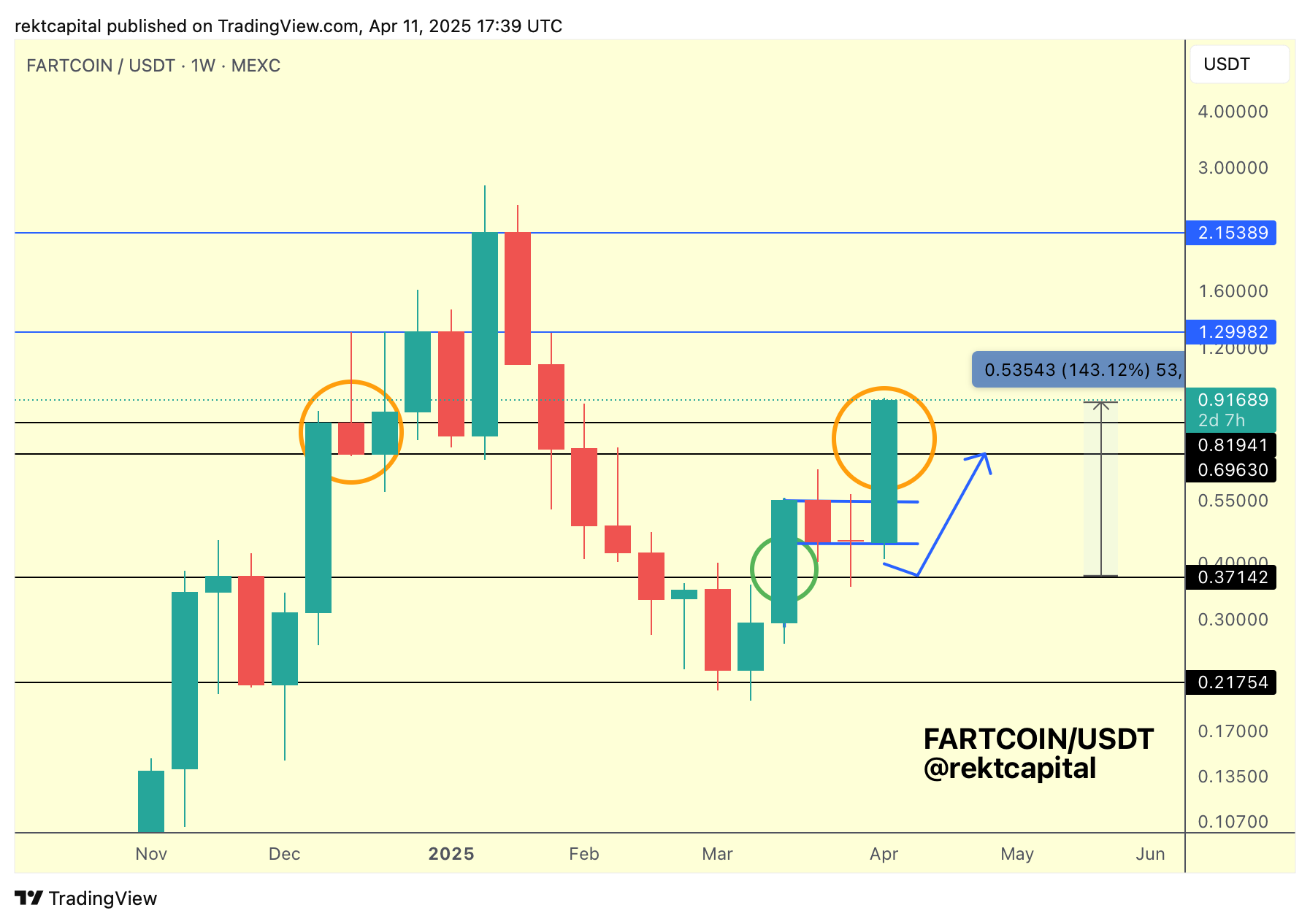

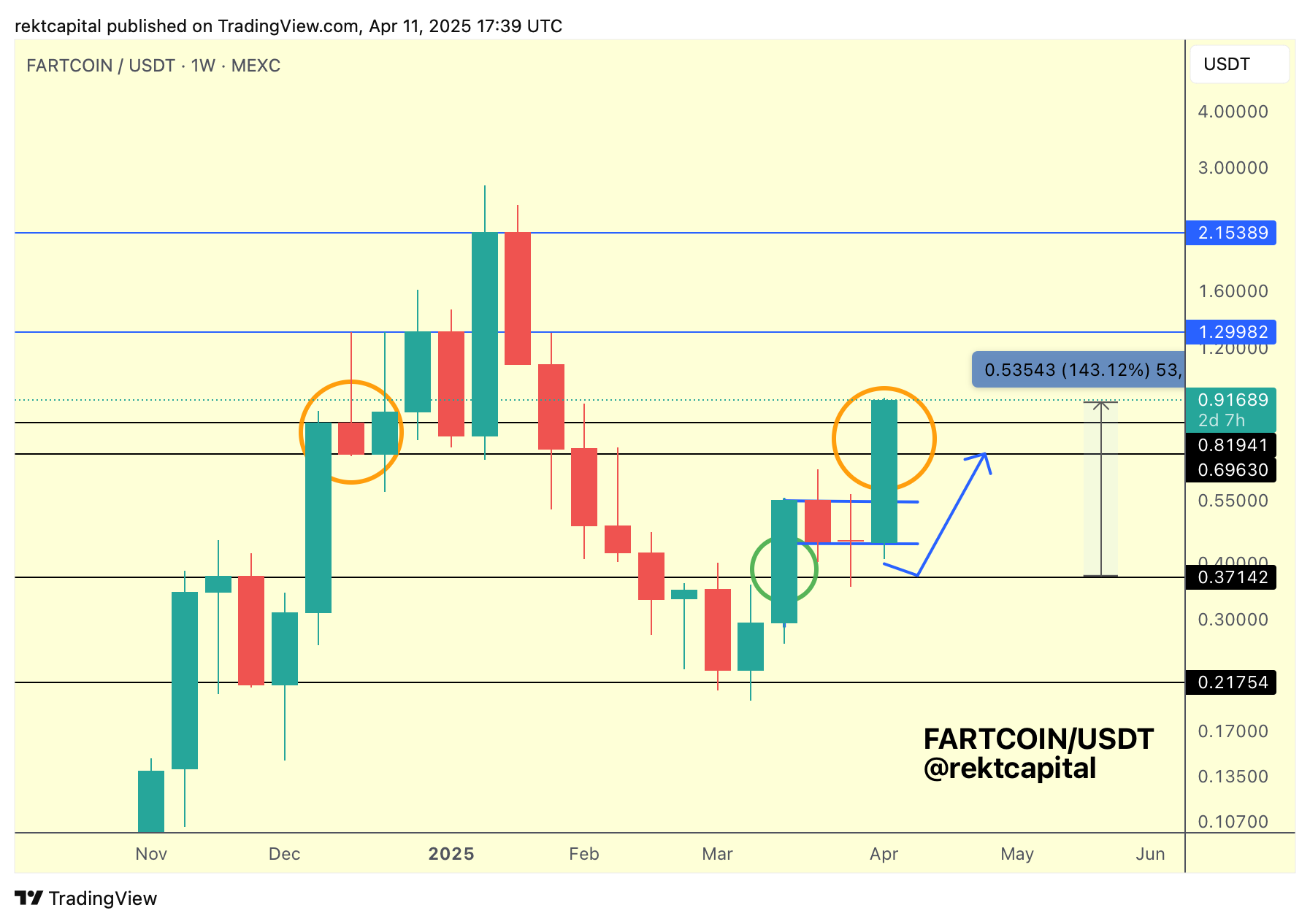

Fartcoin Price Analysis Shows Potential Path To $1.29 Resistance

According to Rekt Capital’s analysis, Fartcoin has been following a predictable technical pattern that could lead to higher prices if key levels hold. The analyst notes that after identifying a potential path in mid-March, “FARTCOIN has progressively followed through on that path.”

The technical formation described includes the development of a “Bull Flag” pattern, with the price pulling back to the origin point of what the analyst calls “the blue path” for a successful retest via a downside wick. Following this retest, Fartcoin rallied over 140%.

The key resistance level to watch is $1.29, marked as “blue highs” in the analysis. However, reaching this target depends on Fartcoin’s ability to break and hold above the “black Range High” of approximately $0.82. The analyst notes that a “past Weekly Close above the ~$0.82 level has enabled upside in the past.” This analysis comes after Fartcoin slumped amid macroeconomic uncertainties.

Major Fartcoin support points to search for upward growth

Rekt Capital sees important price points Fartcoin needs to hold onto to remain strong. The report says if FARTCOIN is able to get a “Weekly Close within the black-black range, inside the orange circle, then it could allow for more buying within the range.”

More significantly, a “Weekly Close above the black Range High of ~$0.82” might unlock further upside potential. Here, the analyst indicates that price might do a “post-breakout retest” of this level. This action might turn it new support and validate a trajectory towards the $1.29 resistance level.

The $0.37 is the uppermost of the current range and is the first barrier for Fartcoin to breach in order to achieve even greater prices. Breaking through this resistance would be the first sign of further positive action.

In short, the analyst states that “FARTCOIN just has to remain above either of the black levels if it does pull back, and satisfying this requirement would leave the price in position to return to $1.29 (blue highs) later.”

Solana Meme Coins’ Performance Mirrors Sustained High Market Interest

Fartcoin price performed amazingly well on various time frames. Statistics indicate the token rising by 75.7% over the past 7 days and a whopping 205.9% over the past 30 days. The Solana meme coin also jumped 20% on April 11 amidst the market crash.

Despite all this, Fartcoin is still 64.7% off its all-time high of $2.48. This means there could be a possibility of recovery if the market is still strong and technical support is upheld. While Fartcoin hasn’t shown any major spikes in 24 hours, Solana’s price is up over 5%.

Following what Rekt Capital calls a “successful retest,” the token has bounced over 140% from its recent low. This validates the technical pattern pointed out by the analyst. This sudden turnaround has piqued interest in the token’s potential to return to its previous highs.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin16 hours ago

Altcoin16 hours agoBinance Issues Important Update On 10 Crypto, Here’s All

-

Market17 hours ago

Market17 hours agoArthur Hayes Expects Bitcoin Surge if Fed Injects Liquidity

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum’s True Value? Lower Than You Think

-

Altcoin15 hours ago

Altcoin15 hours agoSolana Meme Coin Fartcoin Price Could Hit $1.29 If It Holds This Key Level

-

Market14 hours ago

Market14 hours agoCrypto Whales Position for Gains with DOGE, WLD and ONDO

-

Bitcoin11 hours ago

Bitcoin11 hours agoBitcoin’s Impact Alarming, Says NY Atty. General—Congress Needs To Act

-

Altcoin18 hours ago

Altcoin18 hours agoShiba Inu Burn Rate Explodes 1000%, Can SHIB Price Hit $0.000015?

-

Market11 hours ago

Market11 hours agoRipple May Settle SEC’s $50 Million Fine Using XRP

✓ Share: