Altcoin

ICP Price Prediction: Internet Computer A.I Developments and Product Releases

As 2024 continues to be a transformative year for the cryptocurrency market, Internet Computer (ICP) has been making significant strides, particularly in the realm of artificial intelligence (A.I.) and innovative product releases. With these advancements, many investors are keenly watching ICP for potential growth opportunities. However, alongside this tech-driven evolution, another token is catching the attention of savvy investors—Mpeppe (MPEPE).

The Evolution of Internet Computer (ICP)

Internet Computer (ICP), launched by the DFINITY Foundation, is a revolutionary blockchain protocol aimed at decentralizing the internet. ICP enables developers to build websites, enterprise IT systems, and internet services directly on the blockchain, without the need for traditional cloud services. This has positioned ICP as a powerful player in the Web 3.0 landscape, driving significant interest from developers and investors alike.

In 2024, ICP has not only maintained its relevance but also expanded its influence through groundbreaking A.I. developments. The integration of A.I. capabilities into the ICP ecosystem allows for more intelligent, automated systems that can process complex tasks more efficiently. These advancements are paving the way for a new era of decentralized applications that are smarter, faster, and more secure.

A.I. Developments and Product Releases

One of the most notable aspects of ICP’s recent evolution is its focus on A.I. and machine learning. The development team behind Internet Computer (ICP) has been working on integrating A.I. into its core infrastructure, enabling decentralized applications (dApps) to utilize artificial intelligence for a variety of use cases. This includes everything from automated trading algorithms to sophisticated data analysis tools that can operate without centralized control.

Additionally, ICP has announced several product releases that are set to enhance its ecosystem further. These include new developer tools that make it easier to build and deploy A.I.-powered dApps on the Internet Computer blockchain, as well as enhancements to its network’s scalability and security. These developments are not only attracting more developers to the platform but are also increasing investor confidence in ICP’s long-term potential.

Mpeppe (MPEPE) Emerges as a Key Player

While ICP’s advancements in A.I. are noteworthy, another token that has been gaining significant traction is Mpeppe (MPEPE). Mpeppe has carved out a niche for itself in the decentralized finance (DeFi) and gambling sectors, offering a unique blend of utility and profitability that has caught the attention of investors.

Mpeppe (MPEPE)’s integration of decentralized gambling into its ecosystem provides users with a platform where they can engage in gaming and betting activities using the MPEPE token. This utility, combined with the token’s potential for high returns, has made Mpeppe an attractive investment opportunity, particularly for those who are looking to diversify their portfolios with projects that offer both innovation and profitability.

The Synergy Between ICP and Mpeppe

The developments in both Internet Computer (ICP) and Mpeppe (MPEPE) highlight a growing trend in the cryptocurrency market— the convergence of blockchain technology with real-world applications. ICP’s focus on A.I. and decentralized computing complements Mpeppe’s innovative approach to decentralized gambling, creating potential synergies between the two projects.

As more developers build A.I.-powered dApps on the Internet Computer (ICP) platform, there could be opportunities for Mpeppe to integrate these advancements into its own ecosystem. For example, A.I. could be used to enhance the gaming experience on Mpeppe’s platform by creating more sophisticated algorithms for betting strategies or by offering personalized gaming experiences based on user data.

ICP Price Prediction and Market Outlook

Given the ongoing developments in A.I. and the upcoming product releases, ICP is well-positioned for potential growth in 2024. Analysts are optimistic about ICP’s ability to attract more developers and users to its platform, which could drive demand for the Internet Computer (ICP) token and increase its market value.

However, as with any investment, there are risks to consider. The success of ICP’s A.I. integration and product releases will depend on the broader adoption of these technologies by developers and users. If ICP can successfully capitalize on its A.I. advancements, it could see significant price appreciation in the coming months.

Conclusion: A New Era for Crypto Investments

As we look ahead to the rest of 2024, both ICP and Mpeppe (MPEPE) stand out as promising projects in the cryptocurrency space. ICP’s advancements in A.I. and decentralized computing, combined with Mpeppe’s unique approach to decentralized gambling, offer investors a diverse range of opportunities for growth.

For those looking to invest in the next wave of innovative crypto projects, keeping an eye on both ICP and Mpeppe could prove to be a smart move. As these projects continue to evolve and integrate new technologies, they are likely to play a significant role in shaping the future of the blockchain industry.

For more information on the Mpeppe (MPEPPE) Presale:

Visit Mpeppe (MPEPPE)

Join and become a community member:

Altcoin

Analyst Reveals XRP Price Can Hit $45 If It Follows This 2017 Pattern

Crypto analyst Egrag Crypto has predicted that the XRP price could rally to as high as $45 if it mirrors a bullish price movement from the 2017 bull run. The analyst also raised the possibility of the altcoin at least touching $19 if it replicates the 2021 price action.

XRP Price Could Rally To $45 If It Mirrors 2017 Bull Run

In an X post, Egrag Crypto predicted that the XRP price could rally to $45 if it mimics the 2017 cycle. He noted that in 2017, the price found heavy support at the 21 Exponential Moving Average (EMA) and experienced a last blow-off top.

This blow-off top led to a price surge of 2,700%, which the analyst believes could lead to XRP’s rally to $45 if the 2017 bull run repeats itself. Meanwhile, Egrag Crypto predicts the altcoin could at least touch $19 if a similar price movement like the 2021 bull run occurs.

He noted that in 2021, the price breached the 21 and 33 EMA and then pumped in a final leg that marked the cycle’s blow-off top. During this period, XRP surged by 1,050%, which the crypto analyst believes could lead to a rally to $19 if history repeats itself. The analyst added that his target has always been $27 and advised market participants to DCA if necessary.

In the short term, the XRP price looks to be eyeing a rally to $5. A CoinGape market analysis revealed that the Hidden Road acquisition may lead to $10 billion in volume to the XRP Ledger, which could push the altcoin to this target.

Meanwhile, XRP’s on-chain metrics also paint a bullish outlook for the altcoin, with the number of wallet addresses hitting a new all-time high (ATH) recently. This indicates that Ripple’s native crypto is enjoying wider adoption.

Ripple’s Native Crypto Has The Potential To Hit $1,000

Crypto analyst BarriC asserted that the XRP price could hit $1,000, although he admitted that it would “absolutely” take time. He claimed it will take a utility run and mass adoption to drive XRP to this price target.

The analyst added that it would also take a big shift in the financial space for the altcoin to reach this $1,000 level. Essentially, BarriC believes something massive has to happen for XRP to reach this target. However, once they do, he assured that there is no going back.

A CoinGape market analysis also once suggested that the XRP price could reach $1,000 if Michael Saylor swapped his $21 billion BTC for Ripple’s native crypto.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Solana Price Eyes Breakout to $200, SOL ETF Approval Timeline

The price of Solana (SOL) is again in the spotlight as the current bullish consolidation has flipped the coin to a new weekly high. The Solana community also anticipates the Exchange Traded Fund (ETF) tied to the asset, prompting the debate on the potential timeline for the offering’s approval. With the price of Bitcoin and altcoin showcasing a rebound, Solana’s performance has stood out from other altcoins.

Is The Solana Price Breakout to $200 Possible?

According to new insight on X from market analyst World of Charts, the price of Solana is currently testing a potential breakout trend. He said the coin is testing crucial resistances that can easily push it to the $200 level if it successfully breaks out.

The World of Charts thesis tips the SOL price to soar by over 86%, with the potential to add $105 in a bull case scenario. However, this does not negate a possible SOL price retest of $75 if crucial support levels fail to hold.

At the time of writing, the price of Solana was changing hands for $120, up by 8.06% in 24 hours.

Despite the Relative Strength Index (RSI) soaring from the low of 34 recorded on April 8 to the current 46.89, SOL is not completely out of the woods. The MA Cross indicator shows that the Death Cross inked on April 2 has yet to be invalidated.

Solana ETF: Potential Approval Timeline

With Solana showcasing a potential rebound trend, many community members are quizzing to determine what will happen to its growing ETF products. Responding to SOL ETF approval queries, Senior Bloomberg ETF Analyst James Seyffart broke the silence on what to expect.

He reiterated that the first ‘final’ deadline for SOL ETFs is October 10. He noted that there is a non-zero chance the new Atkins-led US SEC and Hester Peirce-led Crypto Task Force will move earlier than that.

Despite this definitive timeline, he reiterated that there is a strong expectation of approval by that deadline. In the meantime, the Crypto Task Force is pushing for clear regulations, which is positive for a potential approval.

A Solana ETF could usher in institutional money into the ecosystem, which is bullish for the SOL price, leading to a massive breakout.

More SOL Fundamentals to Watch

According to a recent ecosystem shift, the Proof-of-Stake (PoS) protocol is undergoing a subtle rebranding in the market. Besides introducing Confidential Balances to drive privacy, Solana Developers have also unveiled Open Source Relayers. In partnership with OpenZeppelin, these Relayers are in alpha mode and can power some functionalities within the ecosystem.

A defined attempt to revive the memecoin outlook in the SOL ecosystem through PumpFun also exists. With the return of the livestream, PumpFi, and PumpSwap, the protocol is gearing up for a new wave of meme explosion and price rebound.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Sonic Surges to $1 Billion TVL in 66 Days Amid DeFi Market Slump

The crypto market in 2025 is facing intense turbulence. The capitalization of once-hot trends like meme coins has plummeted. Capital has flowed out of decentralized finance (DeFi) protocols, driving DeFi’s total value locked (TVL) down from $120 billion to around $87 billion.

In this context, Sonic stands out. It has consistently hit new TVL highs, reaching $1 billion in April after growing nearly 40 times since the beginning of the year. So, what makes Sonic a bright spot amid a stormy market?

Investors Are Pouring Capital into Sonic

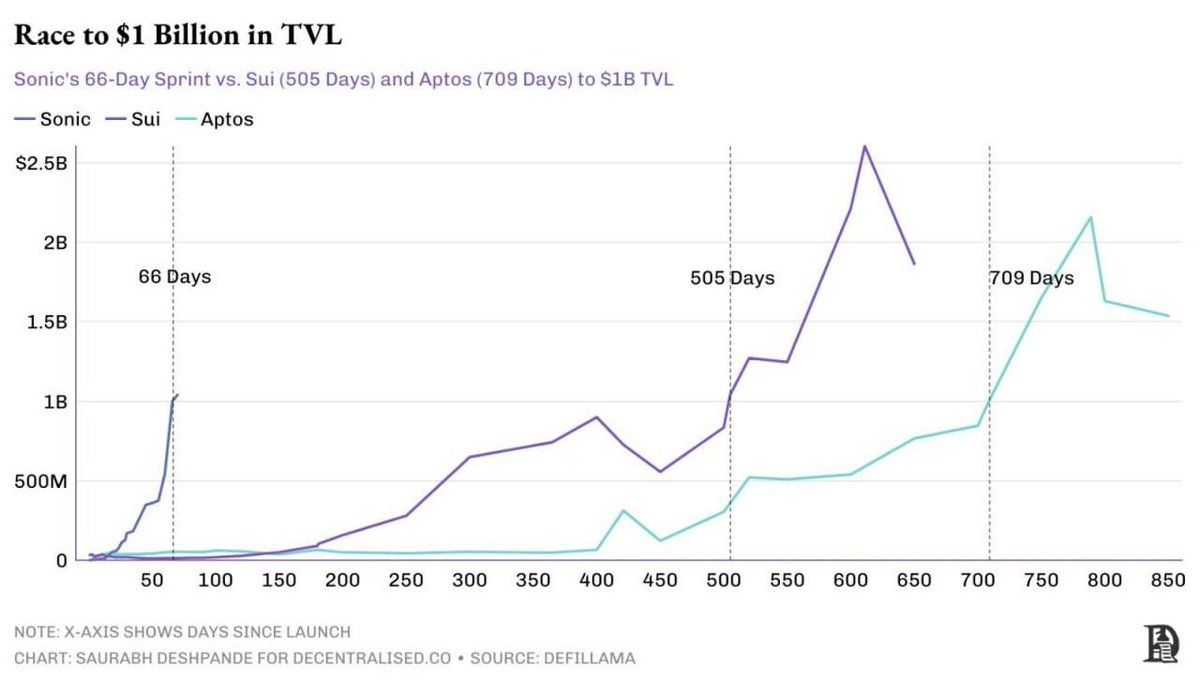

Sonic has made its mark with a rapid TVL growth rate, far outpacing better-known blockchains. According to DefiLlama, Sonic reached $1 billion in TVL within 66 days. In comparison, Sui took 505 days, and Aptos needed 709.

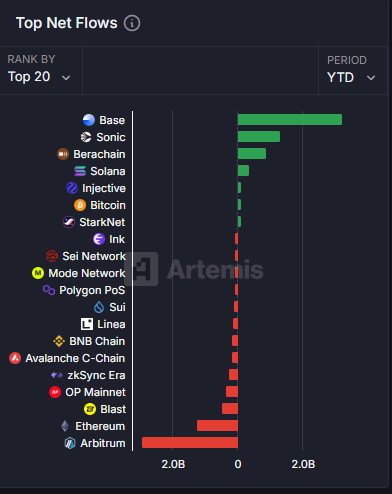

This achievement reflects strong capital inflows into the Sonic ecosystem despite the broader DeFi trend of capital withdrawal. Data from Artemis supports this, ranking Sonic as the second-highest netflow protocol this year—trailing only Base, a blockchain backed by Coinbase.

The growth goes beyond TVL numbers. Sonic’s ecosystem is attracting various projects, including derivatives exchanges like Aark Digital and Shadow Exchange and protocols such as Snake Finance, Equalizer0x, and Beets. These projects still have small TVLs, but they have the potential to draw new users and capital, fueling Sonic’s momentum.

However, the question remains: Can this capital inflow remain sustainable while the market fluctuates?

Andre Cronje on Sonic’s Potential and Strengths

Andre Cronje, the developer behind Sonic, shared his ambition in an interview to push this blockchain beyond its competitors.

“Sonic has sub-200 millisecond finality, faster than human responsiveness,” Andre Cronje said.

According to Cronje, Sonic isn’t just about speed. The platform also focuses on improving both user and developer experience. He explained that 90% of transaction fees go to dApp, not to validators, creating incentives for developers to build.

Unlike other blockchains, such as Ethereum, which are limited by long block times, Sonic leverages an enhanced virtual machine that theoretically processes up to 400,000 transactions per second. Cronje acknowledges, however, that current demand has yet to push the network to its full capacity. Still, these technical advantages make Sonic a compelling option for developers seeking more user-friendly dApps.

He also revealed new features on Sonic that have the potential to attract users.

“If your first touch point with a user is to download this wallet and then buy this token on an exchange, you’ve lost 99.9% of your users. They’ll use their Google off-email password, fingerprint, face, whatever it is, to access the dApp and interact with it, and they’ll never need to know about Sonic or token,” Andre Cronje revealed.

Risks and Challenges Ahead

Despite reaching impressive milestones, Sonic is not immune to risk. The price of its token, S, has declined significantly from its peak. According to BeInCrypto, it has dropped around 20% in the past month—from $0.60 down to $0.47—mirroring the broader market’s volatility.

Furthermore, Grayscale recently removed Sonic from its April asset consideration list. This decision reflects a shift in the fund’s expectations and raises concerns about Sonic’s ability to maintain its TVL should investor sentiment deteriorate.

Sonic also faces fierce competition from other high-performance chains like Solana and Base. Although Sonic holds a clear advantage in speed, long-term user adoption will depend on whether its ecosystem can deliver real value, not just high TVL figures.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market19 hours ago

Market19 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Market18 hours ago

Market18 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Market20 hours ago

Market20 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Altcoin18 hours ago

Altcoin18 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Bitcoin17 hours ago

Bitcoin17 hours agoOver $2.5 Billion in Bitcoin and Ethereum Options Expire Today

-

Market12 hours ago

Market12 hours agoChina Raises Tariffs on US to 125%, Crypto Markets Steady

-

Market17 hours ago

Market17 hours agoBTC ETF Outflows Continue Amid Institutional Caution,

✓ Share: