Altcoin

Ethereum ETF Applicants To Meet US SEC, ETH Price To Rebound?

As speculations swirl around the approval of Spot Ethereum ETFs, Fox journalist Eleanor Terrett revealed that there are upcoming meetings scheduled between ETF applicants and staff members of the U.S. Securities and Exchange Commission (SEC). This disclosure follows a series of mixed sentiments from industry insiders regarding the likelihood of approval.

Ethereum ETF Applicants To Meet SEC Staff

The discourse began with Nate Geraci, co-founder of The ETF Institute, sharing insights from a conversation with a prospective Spot Ethereum ETF issuer. The issuer expressed “extreme pessimism” about the approval prospects. Earlier, Matthew Sigel, head of digital asset research at VanEck, one of the applicants for a Spot Ethereum ETF, echoed a similar sentiment.

Moreover, Sigel’s remarks during a podcast indicated a lack of optimism from VanEck’s perspective, adding to the prevailing uncertainty. However, the revelation by Terrett suggests a potential shift from the previous “radio silence” from the SEC. While these scheduled meetings do not guarantee approval, they signify a departure from the perceived lack of engagement by the regulatory body.

This newfound communication could offer Ethereum ETF applicants an opportunity to address any concerns or provide additional information to the SEC. Moreover, it could even potentially influence the decision-making process. The significance of these scheduled meetings lies in the potential for increased transparency and dialogue between ETF applicants and regulatory authorities.

Such engagement can help clarify regulatory expectations and requirements, facilitating a more informed evaluation of the Ethereum ETF proposals. Additionally, it reflects a proactive approach by both parties to navigate the complexities of introducing Ethereum-based financial products into the market.

Also Read: Spot Ethereum ETF: ARK 21Shares Updates Application, No Staking

Impact On ETH Price

Moreover, the outcome of these meetings could have broader implications for the crypto and financial markets. Approval of Spot Ethereum ETFs could open the door for broader institutional participation in Ethereum, potentially driving increased liquidity and market stability. Hence a Ethereum price rebound or even a parabolic surge can be expected.

Conversely, a denial or prolonged delay could dampen investor sentiment and could even affect the ETH price negatively. Michaël van de Poppe, a renowned crypto analyst on X, noted that a potential denial of Spot Ethereum ETFs could push the ETH price down to a low of $2,700 while it currently trades at $2,900.

Meanwhile, Ark Invest and 21Shares have dropped the staking feature from their combined Ether ETF application. Earlier, Grayscale withdrew its Ethereum futures ETF. Netizens speculate that Ark 21Shares’ could prove to be beneficial for the applications as the SEC had earlier cast down on the staking feature.

Moreover, Grayscale’s withdrawal of ETH futures ETF also is seen as a positive development. The community believes that the asset manager wouldn’t drop the application if it wasn’t sure of an imminent approval of the Spot Ethereum ETF. The narrative stems from Grayscale’s relentless battle in the Spot Bitcoin ETF arena, which led to the approval of these investment products.

Also Read: Bloomberg Reveals Reasons Behind Bitcoin, ETH, SOL, XRP, SHIB Prices Crash

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Programmer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

While the PiCoreTeam (PCT) has endured a barrage of criticisms, Pi Network node runner John Lang has expressed optimism over the future of Pi Network. He hinges his belief on several initiatives by the PCT while urging investors not to sell their Pi Coins in the face of extended bearish sentiments.

Lang Says Pi Network Is Building Behind The Scenes

After enduring a torrid week that saw Pi Network price tumble to $0.58, John Lang is kindling bullish sentiments for Pi Coin holders. According to a post on X, the Pi Network node runner revealed that the price correction is only a small blip in the grand scheme of things for Pi.

His optimism stems from a series of behind-the-scenes activities by the PiCoreTeam which he says will usher a range of positives for the network. Per Lang, Pi community members should be patient with the PCT in view of the mountain of work before the development team.

“Guys, be patient with the PiCoreTeam. They keep working, building meticulously behind the scenes,” said Lang. “Their task is not easy and there are so much things to do.”

His comments come on the heels of scathing criticism against the PCT revolving around delays for KYB approvals for community projects. Things reached a head after PiDaoSwap launched NFTs on BSC as a temporary fix to the lengthy delays by the PCT.

Furthermore, Lang wants investors not to capitulate despite the pervading bearish conditions. Pi price has slipped 13% and is in free fall toward $0.3 with all eyes on the PCT for a short-term fix.

“Just trust the process and whatever the market condition is, never sell your Pi cheap,” said Lang.

PiCoreTeam Releases Technical Conditions For Ecosystem Developers

In a recent update, the PCT has released technical conditions for developers keen on building applications on the Pi Network. The conditions focus on a mobile-first strategy spelling out development language and framework while rolling out a software development kit.

Per the announcement, developers must pass KYC certification, and apps on the network must indicate a way of value exchange. The PCT’s pragmatic suggestions include apps for virtual goods, service decentralized applications (DApps), and mini-game platforms.

The PCT has released an update on Pi domain auctions, noting that bids have surpassed the 200,000 mark confirming rising on-chain metrics. Despite the rising PCT activity, market analyst Dr Altcoin has urged the PCT to burn billions of Pi Coins in its foundation wallets.

The pseudonymous Satoshi Nakamoto has urged community members to help stabilize the Pi price via a decentralized strategy. Nakamoto proposes a community-driven liquidity pool (CDLP) powered by investors committing to purchase a fixed amount of Pi each month.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Ripple Whale Moves $355 Million To Binance, XRP Price To Dip Further?

A large Ripple whale transaction has drawn attention across the crypto market. Early reports confirm that 200,000,000 XRP, worth approximately $355.6 million, was transferred from an unknown wallet to Binance. This movement has triggered concerns about possible price volatility in the near term.

The XRP price as a result of the Ripple whale dropped to around $1.61, sparking fears of a further dip.

Ripple Whale Major Transaction Sparks Worry

According to Whale Alert, a Ripple whale has moved 200 million XRP to Binance. The total value of this transfer stands at $355,576,574 based on the current XRP price. Such large movements often signal upcoming trading activity that could affect price behavior. Moreover, some optimism is building up brought by the NYSE Arca approval of listing and registration of Teucrium’s 2X Long Daily XRP ETF.

Post the Ripple whale action, analysts on social media have shared differing views on this development. Dark Defender commented, “There is no change in our XRP Monthly Frame. $1.8815 is holding firm.”

While the origin of the Ripple whale remains unknown, historical data shows that similar movements have preceded corrections or temporary price drops. Meanwhile, crypto analyst Ali Charts has predicted that XRP price is breaking out of a head-and-shoulders pattern, setting the stage for a potential move to $1.30. This interpretation adds a short-term XRP bearish perspective if the pattern confirms lower levels before a potential rebound.

Will XRP Price Rally To $8 in April?

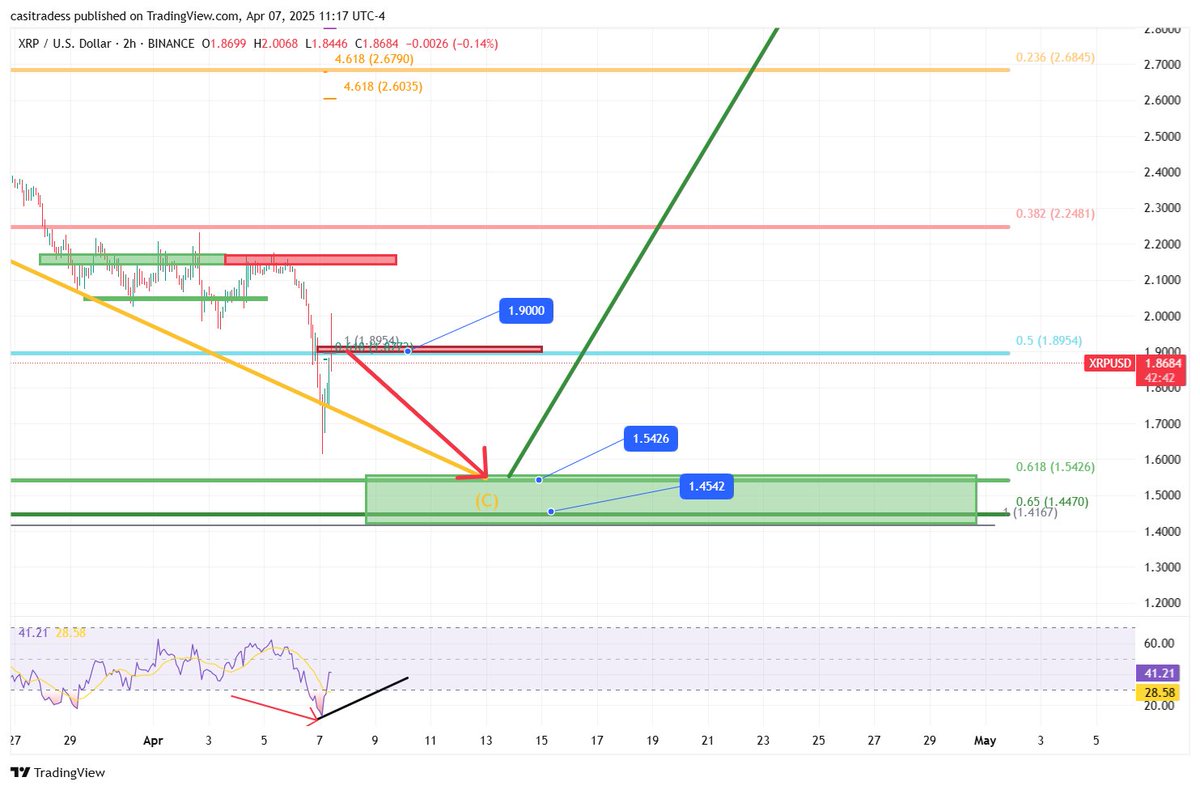

Concurrent with the Ripple whale, Casi Trades, reported that the $1.90 support level has broken down, turning it into a resistance point for XRP price. “This low made new extremes on the RSI,” they stated, referring to the market-wide price dip that took XRP to $1.61.

Casi also noted the next support at $1.55, which aligns with the .618 Fibonacci retracement level. This is a crucial area where many traders are setting alerts. According to the trader, “If we do bottom near $1.55, it actually strengthens the bullish case for those big April targets—$8 to $13 still stands.”

CredibleCrypto echoed similar thoughts, noting that XRP finally moved below a range low that had held for over a month. They pointed to a key demand zone between $1.61 and $1.79, suggesting it offers a possible setup for a rebound. However, they also noted that “Ideally we bracket/range here for a bit to form a base before a full-on reversal.”

As of now, despite the Ripple whale move the XRP price is consolidating just above this zone.

Analyst Outlines Key Resistance To Breach To Resume Bull Rally

Technical analysts have continued to monitor the Elliott Wave structure, suggesting that XRP price may be completing Wave 2 of a larger trend. This theory proposes that a strong Wave 3 could begin soon, which typically represents a strong upward movement.

The local resistance levels to watch include $1.97 and $2.17. A breakout above these points could lead to a move toward higher targets like $2.72 and possibly the previous all-time high of $3.70. However, a failure to hold above $1.61 could shift the focus to a deeper correction.

According to Egrag, a potential double-bottom or inverse head-and-shoulders pattern forming, which could support a bullish reversal if confirmed. This pattern is forming within the demand zone, which is being viewed by some traders as an ideal long setup for XRP price.

Historical Market Cycles and Long-Term View

Egrag Crypto shared a long-term view, drawing from past market cycles. They compared the current XRP price movement with patterns from 2017 and 2021. According to Egrag, during both cycles, XRP price touched or dropped below the 200 MA (moving average) before making large gains.

“In 2017, XRP dropped 73% then pumped 2700%. In 2021, it dropped 78% then pumped 1000%,” Egrag stated. He emphasized that as long as the 50 MA hasn’t crossed below the 200 MA, the bullish trend remains valid.

Egrag pointed out that short-term price declines are part of larger patterns. “You buy the blood, even if it’s your own,” he wrote, referring to buying during market fear.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Peter Schiff Predicts Ethereum Price To Drop Below $1,000, Compares It To Bitcoin And Gold

Bitcoin critic Peter Schiff has revealed grim predictions for the Ethereum price, tipping the second-largest cryptocurrency to see new lows. Schiff says the broader selloff affecting Ethereum will worsen in the coming days and can push prices below $1,000

Peter Schiff Sees Ethereum Price Tumbling Below $1,000

As the market reels from the bloodbath over the weekend, Bitcoin critic Peter Schiff says darker days are coming for Ethereum. In a post on X, Schiff predicts that the Ethereum price will continue the steep correction that will see it fall under $1,000.

The Bitcoin critic is hinging his prediction on the recent jarring price drops faced by the largest altcoin in recent days. The latest correction sees ETH hold onto $1,500 after falling by 20% over the last day.

Ethereum price reached a daily low of $1,400 before gingerly picking its way above the $1,500 mark. Given the grim price action, Peter Schiff says it is only a matter of time till the Ethereum price falls under $1,000 with technicals and fundamentals painting a grim picture.

“Ether crashed below $1,500 for the first time in over two years,” said Schiff. “So far, the intraday low was just above $1,400, a 20% drop overnight. I don’t think it will be long before it breaks below $1,000.”

ETH remains stuck under $2,000 since it slipped below the psychological level back with on-chain indicators showing no signs of a resurgence.

Comparisons With Bitcoin And Gold Reveal Ethereum’s Dire Condition

While optimists may disagree with Schiff’s prediction, historical patterns point to a deeper decline in the Ethereum price. Peter Schiff argues that during the last market crash in mid-2022, Ethereum slipped below $1,000, noting that there is little evidence that the cryptocurrency will trade above the psychological level in the market downturn.

He adds that while the Ethereum price is weak in dollar terms, the asset is faring worse on ETH/BTC charts. A steady downtrend on the ETH/BTC chart confirms massive selling pressure for the Ethereum price, with gold being its “worst-looking chart.”

“It barely held $1,000 in June 2022,” said Schiff. “The chart is horrible, even worse priced in Bitcoin than dollars. Of course, its worst-looking chart is priced in gold.”

Despite the dour predictions, investors say Ethereum price can rally as high as $4,000 but will have to contend with whale selloffs and market risk-on sentiment.

Peter Schiff’s grim predictions extend to the top cryptocurrency with the economist tipping Bitcoin price to $10K. He went on to criticize claims of Bitcoin as digital gold, pointing to steep declines in the face of macroeconomic woes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Bitcoin17 hours ago

Bitcoin17 hours ago$1 Billion in Liquidations Over the Weekend

-

Market16 hours ago

Market16 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?

-

Market14 hours ago

Market14 hours agoBitcoin Price Crashes Hard—Is The Selloff Just Getting Started?

-

Market20 hours ago

Market20 hours agoSolana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?

-

Altcoin11 hours ago

Altcoin11 hours agoDogecoin Whale Dumps 300M Coins Amid Market Crash, Can DOGE Price Dip Below $0.1?

-

Market17 hours ago

Market17 hours agoSolana (SOL) Price Falls Below $100, Crashes To 14-Month Low

-

Bitcoin15 hours ago

Bitcoin15 hours agoWill 2025’s Crypto Market Mirror 2020’s Rebound? Analysts Predict

-

Market11 hours ago

Market11 hours agoBinance Founder CZ Joins Pakistan Crypto Council as Advisor

✓ Share: