Altcoin

Decide AI (DCD) Price Prediction: Internet Computer and Decide AI Investors Enter New A.I Casino Presale

The cryptocurrency market continues to witness dynamic developments, with Internet Computer (ICP) and Decide AI (DCD) standing out as two major players gaining momentum. Investors are increasingly looking toward these tokens as the market shifts towards decentralized AI solutions. However, as volatility continues to plague these tokens, many traders are now hedging their positions with Mpeppe (MPEPE), a rapidly rising meme coin with growing popularity in the crypto community.

Why Traders Are Flocking to Mpeppe (MPEPE)

With the volatile nature of Internet Computer (ICP) and the challenges facing Decide AI (DCD), investors are increasingly diversifying into alternative assets like Mpeppe (MPEPE). This meme coin has shown incredible growth potential, with traders reporting gains of up to 100x in a short span. Its rapid rise is driven primarily by community engagement and viral appeal, making it a highly attractive option for traders seeking quick returns in a volatile market.

Unlike ICP and Decide AI (DCD), which are rooted in technological innovation, Mpeppe (MPEPE) thrives on its simplicity and the power of its community. The coin’s integration with online platforms, particularly in the gaming and entertainment sectors, has further cemented its status as a high-growth asset.

For ICP and Decide AI (DCD) investors, Mpeppe (MPEPE) represents a unique opportunity to hedge their positions while still remaining involved in the crypto market. With its potential for rapid growth and the ongoing buzz surrounding the meme coin, Mpeppe has become a go-to option for traders looking to offset the risks associated with more technical tokens.

ICP and Decide AI: On-Chain AI Innovation Drives Growth

The Internet Computer (ICP) has been steadily growing in significance, particularly with its innovative partnerships. Decide AI (DCD), a decentralized AI company, recently deployed OpenAI’s GPT-2 model on the ICP blockchain. This marks a monumental achievement, as it is the first time a full AI model has been hosted on a blockchain.

This breakthrough allows for the integration of decentralized AI into sectors such as healthcare, finance, and education. It offers enhanced data security, privacy, and transparency, which are critical in industries where trust is paramount. Decide AI (DCD)’s deployment of GPT-2 not only demonstrates the feasibility of on-chain AI models but also opens doors for broader AI applications on blockchain technologies.

Investors in ICP have seen a 124.2% growth in value over the past year, making it one of the most promising tokens in the decentralized AI space. However, despite this growth, Internet Computer (ICP) remains volatile, and traders are seeking alternatives to hedge their investments.

Challenges Facing ICP and Decide AI (DCD)

Despite its recent advancements, Internet Computer (ICP) faces significant competition from major players like Ethereum and Solana. This rivalry has stifled some of the growth that Internet Computer (ICP) anticipated post-launch. ICP has also struggled with price volatility, which continues to concern long-term holders.

Currently, ICP trades at around $7.58, but it has seen short-term corrections, leading to a cautious outlook from some investors. Similarly, Decide AI (DCD) has gained traction, but its success hinges on broader adoption of decentralized AI applications. As the market for decentralized finance (DeFi) and AI expands, Decide AI (DCD)’s role could be pivotal, but it needs to overcome existing challenges related to market penetration and scalability.

Future Outlook for ICP, Decide AI, and Mpeppe

The future for Internet Computer (ICP) and Decide AI (DCD) looks promising, particularly with the integration of advanced AI models on the blockchain. The potential for decentralized AI applications in industries like healthcare and finance is enormous, and both tokens could see long-term gains as these sectors adopt decentralized technologies.

However, their immediate outlook remains uncertain due to volatility and competition from other major players. This is where Mpeppe (MPEPE) comes into play. The meme coin’s viral nature and the rapid growth of its community have made it a compelling hedge for traders. If Mpeppe continues its current trajectory, it could offer traders a unique blend of stability and high returns.

Conclusion: Diversifying for Success

While Internet Computer (ICP) and Decide AI (DCD) are poised to revolutionize decentralized AI, their volatile nature has led many traders to seek alternative investments. Mpeppe (MPEPE), with its rapid growth and strong community backing, offers an attractive hedge for those looking to stay invested in the crypto market while mitigating risk.

As the market continues to evolve, savvy investors are diversifying their portfolios, ensuring that they are well-positioned to capitalize on the unique opportunities presented by both cutting-edge technology and community-driven assets. Whether the future belongs to Internet Computer (ICP) decentralized AI or Mpeppe (MPEPE)’s viral appeal, traders are preparing for all outcomes by betting on both.

For more information on the Mpeppe (MPEPPE) Presale:

Visit Mpeppe (MPEPPE)

Join and become a community member:

Altcoin

Bankless Cofounder David Hoffman Reveals Strategy To Improve Ethereum Price Performance

Ethereum’s torrid patch is extending into Q2 of 2025, forcing industry players to wade into proffer advice for the largest altcoin. Bankless confounder David Hoffman says a change in network culture will have the biggest impact on the Ethereum price performance.

David Hoffman Wants Ethereum Community To Stop Policing Behaviour

Bankless cofounder David Hoffman has revealed suggestions to improve Ethereum price performance, pointing to a culture and leadership shift in the network. According to an X post, Hoffman says mainstream Ethereum critics are sidestepping the real reason for ETH’s lackluster price performance in recent months.

Hoffman notes that Ethereum’s leadership and its culture of alienating users and builders is to blame for its underwhelming performance. The cryptocurrency executive cited the public exorcism of ETH staking platform Lido Finance and criticism against degenerate traders.

At the time, Lido Finance came under fire from the Ethereum community for regulatory, centralization, and security concerns while degens took flak for spiking gas fees and lack of long-term projects.

He argues that the broad hostility against a class of users plays a big role in the Ethereum price decline. Hoffman notes that the network’s attempt to police behavior on a permissionless chain is the straw that broke the camel’s back. Ethereum price is hanging onto the $1,500 mark after sinking to lows of $1,415 over the last week.

To remedy the situation, David Hoffman is advocating for the Ethereum Foundation (EF) to attract users and builders to the network, demonstrating the spirit of true decentralization.

“If we want ETH to group, the EF and broader community need to start attracting users and builders, not pushing them away with a holier-than-thou culture,” said Hoffman.

Ethereum Price Is Staging A Strong Recovery

Hoffman’s comments come amid a fresh market resurgence for Ethereum price with ETH grabbing a 6% spike over the last day. While ETH price has declined to a 5-year low against Bitcoin, momentum is rising for prices to reclaim $2,000.

One side, backed by community members like Leo Glisic sees a potential upside for Ethereum, driven by a simple investment narrative.

“The play is infrastructure for the future global financial system,” said Glisic. “Ethereum will serve as the settlement and interoperability layer, which is a winner-take-all market.”

However, CryptoCurb is comparing Ethereum to Nokia’s downfall, noting that Solana will displace ETH like Apple to become the largest altcoin. Critics like CryptoCurb and Peter Schiff say the rally is unsustainable and an ETH decline below $1,000 is a possibility.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Solana Meme Coin Fartcoin Price Could Hit $1.29 If It Holds This Key Level

Solana-based meme coin Fartcoin price is eyeing the next potential rally as per the latest analysis.

Despite currently trading well below its all-time high of $2.48 reached on January 19, 2025, Fartcoin has been forming a bullish pattern that could set the stage for upward movement.

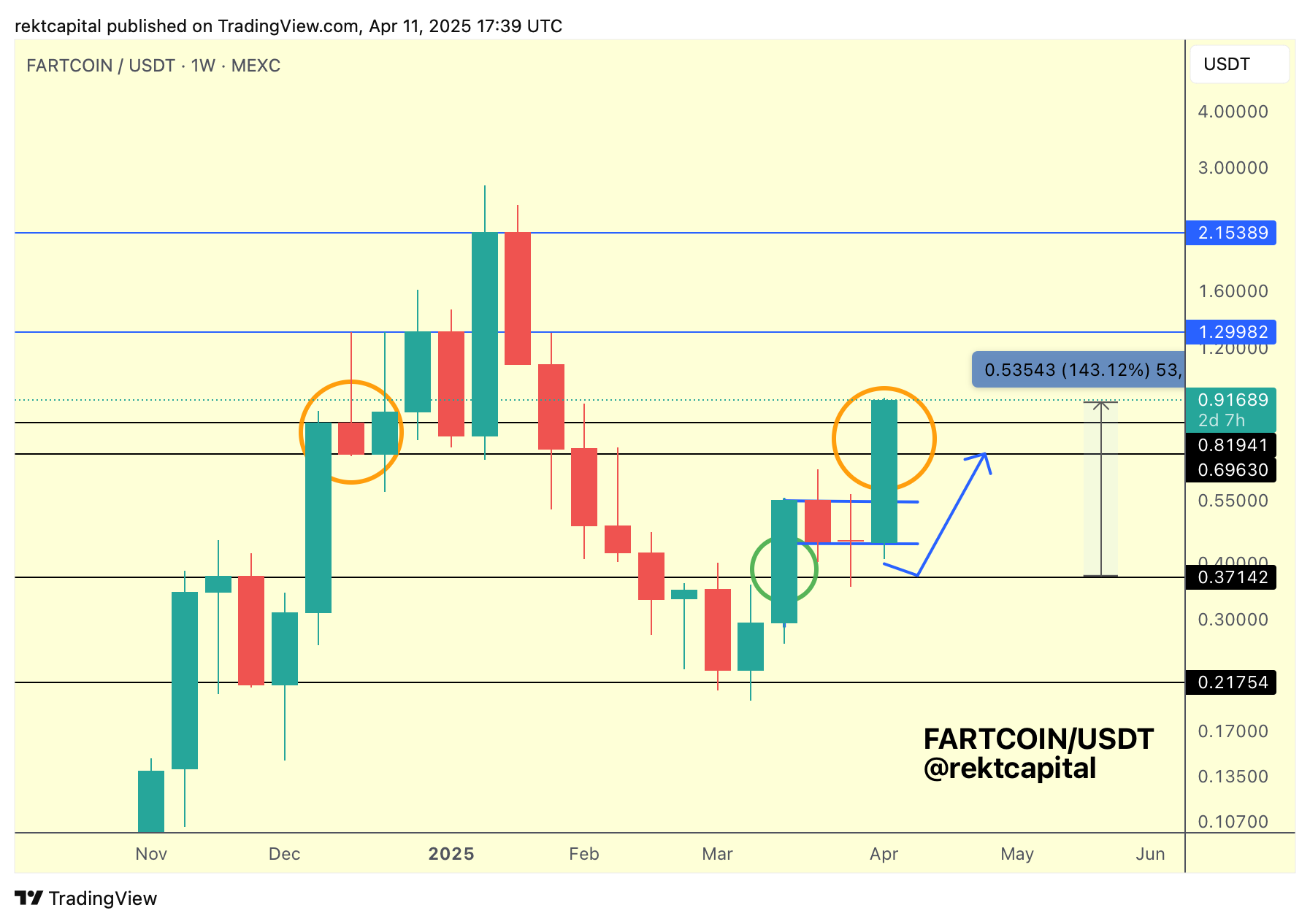

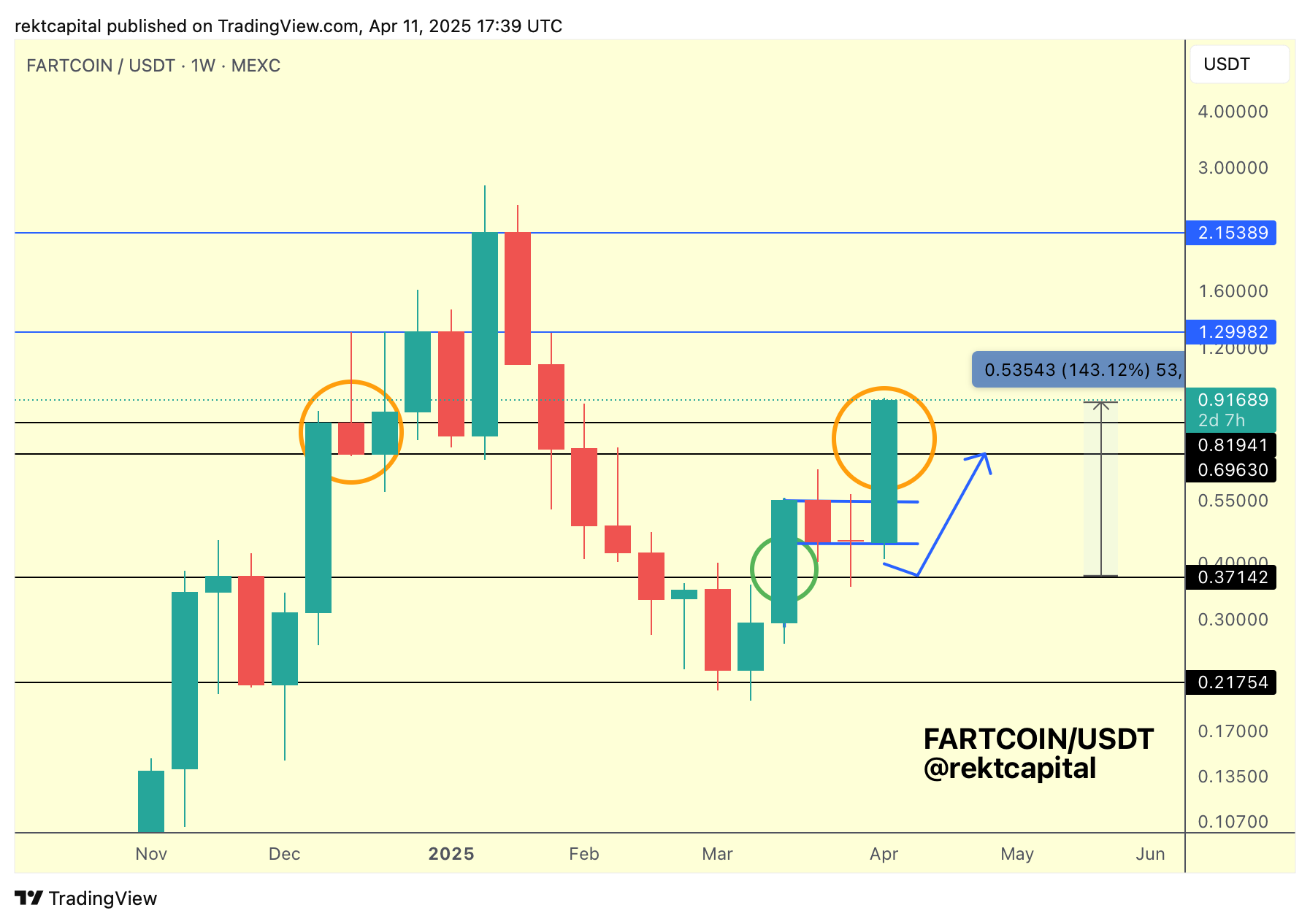

Fartcoin Price Analysis Shows Potential Path To $1.29 Resistance

According to Rekt Capital’s analysis, Fartcoin has been following a predictable technical pattern that could lead to higher prices if key levels hold. The analyst notes that after identifying a potential path in mid-March, “FARTCOIN has progressively followed through on that path.”

The technical formation described includes the development of a “Bull Flag” pattern, with the price pulling back to the origin point of what the analyst calls “the blue path” for a successful retest via a downside wick. Following this retest, Fartcoin rallied over 140%.

The key resistance level to watch is $1.29, marked as “blue highs” in the analysis. However, reaching this target depends on Fartcoin’s ability to break and hold above the “black Range High” of approximately $0.82. The analyst notes that a “past Weekly Close above the ~$0.82 level has enabled upside in the past.” This analysis comes after Fartcoin slumped amid macroeconomic uncertainties.

Major Fartcoin support points to search for upward growth

Rekt Capital sees important price points Fartcoin needs to hold onto to remain strong. The report says if FARTCOIN is able to get a “Weekly Close within the black-black range, inside the orange circle, then it could allow for more buying within the range.”

More significantly, a “Weekly Close above the black Range High of ~$0.82” might unlock further upside potential. Here, the analyst indicates that price might do a “post-breakout retest” of this level. This action might turn it new support and validate a trajectory towards the $1.29 resistance level.

The $0.37 is the uppermost of the current range and is the first barrier for Fartcoin to breach in order to achieve even greater prices. Breaking through this resistance would be the first sign of further positive action.

In short, the analyst states that “FARTCOIN just has to remain above either of the black levels if it does pull back, and satisfying this requirement would leave the price in position to return to $1.29 (blue highs) later.”

Solana Meme Coins’ Performance Mirrors Sustained High Market Interest

Fartcoin price performed amazingly well on various time frames. Statistics indicate the token rising by 75.7% over the past 7 days and a whopping 205.9% over the past 30 days. The Solana meme coin also jumped 20% on April 11 amidst the market crash.

Despite all this, Fartcoin is still 64.7% off its all-time high of $2.48. This means there could be a possibility of recovery if the market is still strong and technical support is upheld. While Fartcoin hasn’t shown any major spikes in 24 hours, Solana’s price is up over 5%.

Following what Rekt Capital calls a “successful retest,” the token has bounced over 140% from its recent low. This validates the technical pattern pointed out by the analyst. This sudden turnaround has piqued interest in the token’s potential to return to its previous highs.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Binance Issues Important Update On 10 Crypto, Here’s All

The latest update from crypto exchange titan Binance has left traders speculating over a potential price impact on 10 crypto assets. An official press release by the exchange on Saturday, April 12, revealed that the collateral ratio of 10 tokens under portfolio margin is being updated. These tokens include DENT, ENJ, NOT, DASH, CHZ, AXS, ENS, SAND, THETA, and QNT.

Binance Updates Collateral Ratio For 10 Crypto Under Portfolio Margin

According to a recent Binance announcement, collateral ratios for the abovementioned crypto tokens will primarily be reduced shortly ahead. The exchange revealed that the new ratios will be visible on the platform starting April 18 at 06:00 UTC. This phenomenon raises market concerns as lower collateral ratios mean reduced borrowing power.

Market participants can use less of these assets’ value as collateral. This also shrinks their margin buying power, limiting their ability to open or maintain trade positions. Broadly speaking, the impact could be forced portfolio adjustments as market participants look to mitigate potential losses.

Here Are The New Collateral Ratios

Binance added that the update will also affect the Unified Maintenance Margin Ratio (uniMMR). “Users should monitor uniMMR closely to avoid any potential liquidation or losses that may result from the change of collateral ratio,” the leading crypto exchange notified.

How Are The Crypto Performing?

As mentioned above, the new update ignited cautious investor sentiments about the assets’ prices due to the downsized market and trade offerings. Nevertheless, most of the mentioned crypto tokens have traded in the green against the backdrop of the broader crypto market trend.

DENT price was up by 3% and traded at $0.0006567. ENJ price also jumped over 2% and exchanged hands at $0.06690. NOT price witnessed a slight 1% increase in value, closing in at $0.001882. DASH price was also up nearly 2% to $20.69.

ENS price soared nearly 3% and exchanged hands at $14.37. SAND price likewise gained nearly 0.5% to reach $0.2609. Also, QNT price surged roughly 2.5% and is currently sitting at $65.77. On the other hand, tokens like CHZ, AXS, and THETA traded in red territory. Market watchers continue to thoroughly eye the tokens for price action shifts ahead.

It’s also worth mentioning that Binance has revealed plans to list ONDO, VIRTUAL, and BIGTIME tokens recently, further revolutionizing its trade offerings.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market24 hours ago

Market24 hours ago3 Altcoins to Watch for Binance Listing This April

-

Market22 hours ago

Market22 hours agoLawmakers Propose the PROOF Act to Avoid Another FTX Incident

-

Market21 hours ago

Market21 hours agoThis is Why The Federal Reserve Might Not Cutting Interest Rates

-

Market9 hours ago

Market9 hours agoArthur Hayes Expects Bitcoin Surge if Fed Injects Liquidity

-

Altcoin7 hours ago

Altcoin7 hours agoBinance Issues Important Update On 10 Crypto, Here’s All

-

Altcoin22 hours ago

Altcoin22 hours agoSolana Price Eyes Breakout to $200, SOL ETF Approval Timeline

-

Market20 hours ago

Market20 hours agoXRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

-

Market19 hours ago

Market19 hours agoCrypto Whales Are Buying These Altcoins Post Tariffs Pause

✓ Share: