Market

DOT Experiences 25% Price Drop in June Amid Bearish Pressure

Polkadot faces bearish pressure as it struggles to maintain critical support levels, signaling potential further declines in its price action.

The goal of the analysis is to assess Polkadot’s bearish selling pressure, using Key Support and Resistance Levels, Market Sentiment, and Future Price Movements.

Polkadot Faces Bearish Pressure: Key Levels and Market Sentiment Analysis

Polkadot (DOT) has been experiencing a bearish trend, evident from the recent price action where it fell below critical support levels. The rejection from the Ichimoku Cloud and testing of lower support levels further emphasize this downtrend.

Following Bitcoin’s price drop to $64,700 yesterday, the price of DOT reached the important support level of $5.46. Subsequently, the price of DOT bounced upward, stabilizing around $5.80, as observed in the 4-hour chart.

DOT’s price has dropped 25% from its local high recorded on June 7

Read More: 5 Best Polkadot (DOT) Wallets To Consider In 2024

Currently, Polkadot faces several key support and resistance levels. Following our insights shared on BeInCrypto analysis, the DOT price managed to break below the $6.23 price level yesterday. This prompted the price to drop 12% in 2 days, underscoring and highlighting the importance of monitoring this price level. This price level should now act as a resistance level for DOT.

The Ichimoku Cloud analysis shows that the price action is clearly rejected from the cloud, indicating bearish sentiment. On the daily chart, the price is currently below the Ichimoku Cloud, suggesting strong bearish momentum. The baseline and conversion lines are trending downwards, which confirms the bearish outlook.

Similarly, on the 4-hour chart, the price is below the cloud, reinforcing the short-term bearish sentiment.

A breakdown below the current support at $5.46 could lead to further declines towards the next major support at $4.88. On the upside, the first major resistance to watch is $6.81. Reclaiming this level could indicate a potential reversal of the current downtrend.

To confirm a bullish reversal, higher resistance levels at $7.12 and $7.41 will also need to be broken through.

The moving averages also support the bearish outlook. The price is trading well below the 200 EMA, indicating a long-term bearish trend, and the 100 EMA is also above the current price, acting as a resistance level.

The Relative Strength Index (RSI) is trending towards the oversold territory, currently hovering around 30. This indicates increasing selling pressure. If the RSI drops below 30, it could signal potential further declines. Conversely, if it bounces off this level, it could indicate a short-term relief rally.

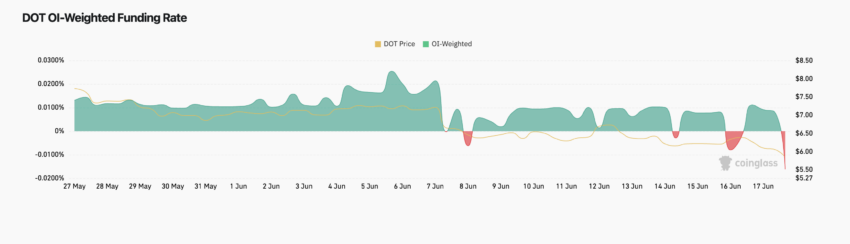

OI-Weighted Funding Rate Reflects Cautious Market Sentiment

Open Interest (OI) is the total number of outstanding derivative contracts, such as futures or options, yet to be settled. Higher OI indicates increased market participation and speculative activity, while lower OI suggests reduced trader engagement.

The funding rate is the periodic payment between traders holding long and short positions in perpetual futures contracts. Positive rates mean long positions pay shorts, indicating bullish sentiment, while negative rates mean shorts pay longs, indicating bearish sentiment.

The OI-weighted funding rate combines the funding rate with open interest, offering a detailed view of market sentiment. It shows whether sentiment is driven by many participants or just a few, helping to gauge the strength of market trends.

During June, the funding rate remained relatively stable and positive, indicating a bullish sentiment among traders. This period coincided with DOT’s price stability around the $7 mark. However, the market sentiment shifted around June 8 when the funding rate briefly turned negative, suggesting increased short positions or a reduction in long positions.

From June 9 to June 15, the funding rate returned to positive territory, though with some fluctuations, reflecting a mixed but generally bullish sentiment. Notably, during this time, DOT’s price faced resistance around $7, experiencing multiple rejections. This suggests that while traders were willing to maintain long positions, the price struggled to break through this key resistance level, indicating potential exhaustion among buyers.

Read More: Polkadot (DOT) Price Prediction 2024/2025/2030

The most significant change occurred between June 16 and June 17, when both the funding rate and DOT’s price experienced sharp declines. The funding rate turning negative again reflects a bearish pressure, aligning with Polkadot dropping from around $6.50 to approximately $5.4. This period of heightened volatility and increased trading volume suggests panic selling or intensified shorting, reinforcing the bearish outlook.

Overall, the analysis of the OI-weighted funding rate indicates that traders are becoming more cautious, anticipating further declines. The reduced speculative activity, as evidenced by the decreasing funding rate, points to a market sentiment that is hesitant to take long positions at current levels.

Monitoring this indicator alongside key support and resistance levels can provide crucial insights for future price movements and market sentiment.

Strategic Recommendations

If Polkadot’s price continues to fall below the $5.45 level, it could trigger a significant cascade of liquidations and bearish selling pressure, potentially driving the price down to $4.88. The fact that Bitcoin remains above the $65,000 level suggests it is experiencing only a minor correction.

However, if Bitcoin’s price continues to decline and reaches $60,000, this could be very bearish for Polkadot and incentivize further price drops below $4.88.

A reversion back to $67,000 for Bitcoin could positively impact Polkadot, potentially driving its price back up to $6.23. If this level is broken, it could signal a possible reversal, allowing for further upward movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

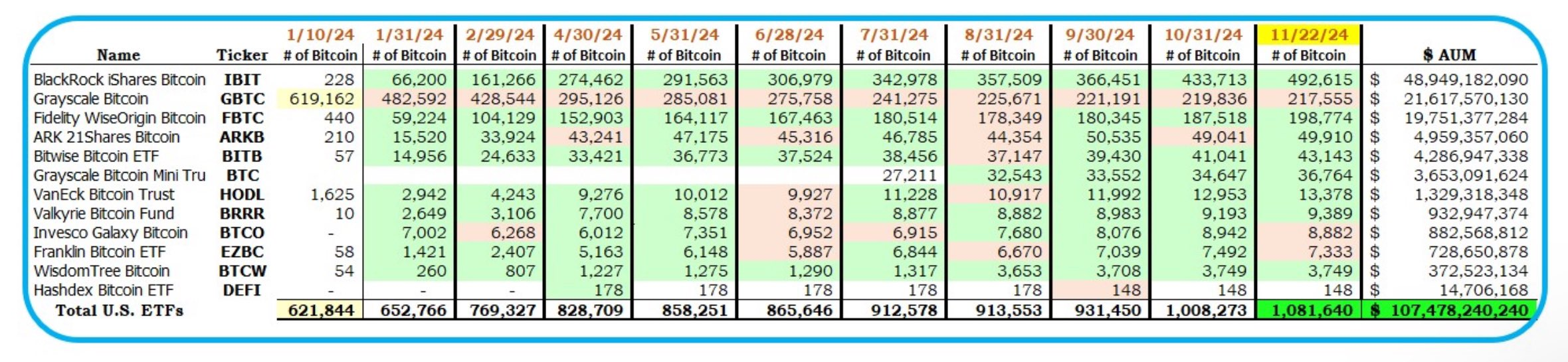

Bitcoin ETFs Could Overtake Gold ETFs by End of The Year

Spot Bitcoin exchange-traded funds (ETFs) in the US are nearing a major milestone. They are set to become the biggest BTC holders in the world, even surpassing the amount held by Bitcoin’s creator, Satoshi Nakamoto.

Additionally, they are catching up to gold ETFs in total net assets.

Bitcoin ETFs on The Verge of Surpassing Satoshi Nakamoto’s BTC Stash

Since their launch in January, US spot Bitcoin ETFs have grown significantly. According to crypto analyst HODL15Capital, these funds now hold about 1.081 million Bitcoin, just below Nakamoto’s estimated 1.1 million.

Satoshi Nakamoto, the anonymous creator of Bitcoin, is believed to own approximately 5.68% of the total Bitcoin supply. These holdings, valued at over $100 billion, place Nakamoto among the world’s wealthiest individuals — if they are alive and a single person.

However, Bloomberg’s Senior ETF Analyst, Eric Balchunas, pointed out that ETFs are now 98% of the way to overtaking Nakamoto. He predicted that if the current pace of inflows continues, this could happen by Thanksgiving.

“US spot ETFs now 98% of way there to passing Satoshi as world’s biggest holder. My over/under date of Thanksgiving looking good. If next 3 days are like the past 3 days flow-wise it’s a done deal,” Balchunas stated.

SoSoValue data shows inflows into these ETFs grew by around 97% week-on-week to $3.3 billion over the last five trading days, with BlackRock’s iShares Bitcoin Trust (IBIT) contributing $2 billion. This surge coincides with the introduction of options trading for these products, which many believe is attracting more institutional investors.

Meanwhile, Bitcoin ETFs are also narrowing the gap with gold ETFs, which currently hold $120 billion in assets under management (AUM). According to Balchunas, Bitcoin ETFs manage $107 billion and could overtake gold ETFs by Christmas.

These bullish predictions reflect Bitcoin’s exceptional performance in 2024. The top cryptocurrency has surged nearly 160% since January, trading near the $100,000 landmark. In addition, its $1.91 trillion market capitalization now exceeds that of silver and major corporations like the state-owned oil company Saudi Aramco.

However, BTC still lags behind gold, which remains the world’s largest asset with a market capitalization of more than $18 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Ethereum Price May Fall Under $3,000

Ethereum (ETH) is currently facing significant downward pressure, with its price declining by 3% over the past 24 hours. This bearish trend could push ETH’s price below the critical $3,000 price level.

This analysis examines the factors contributing to this likelihood.

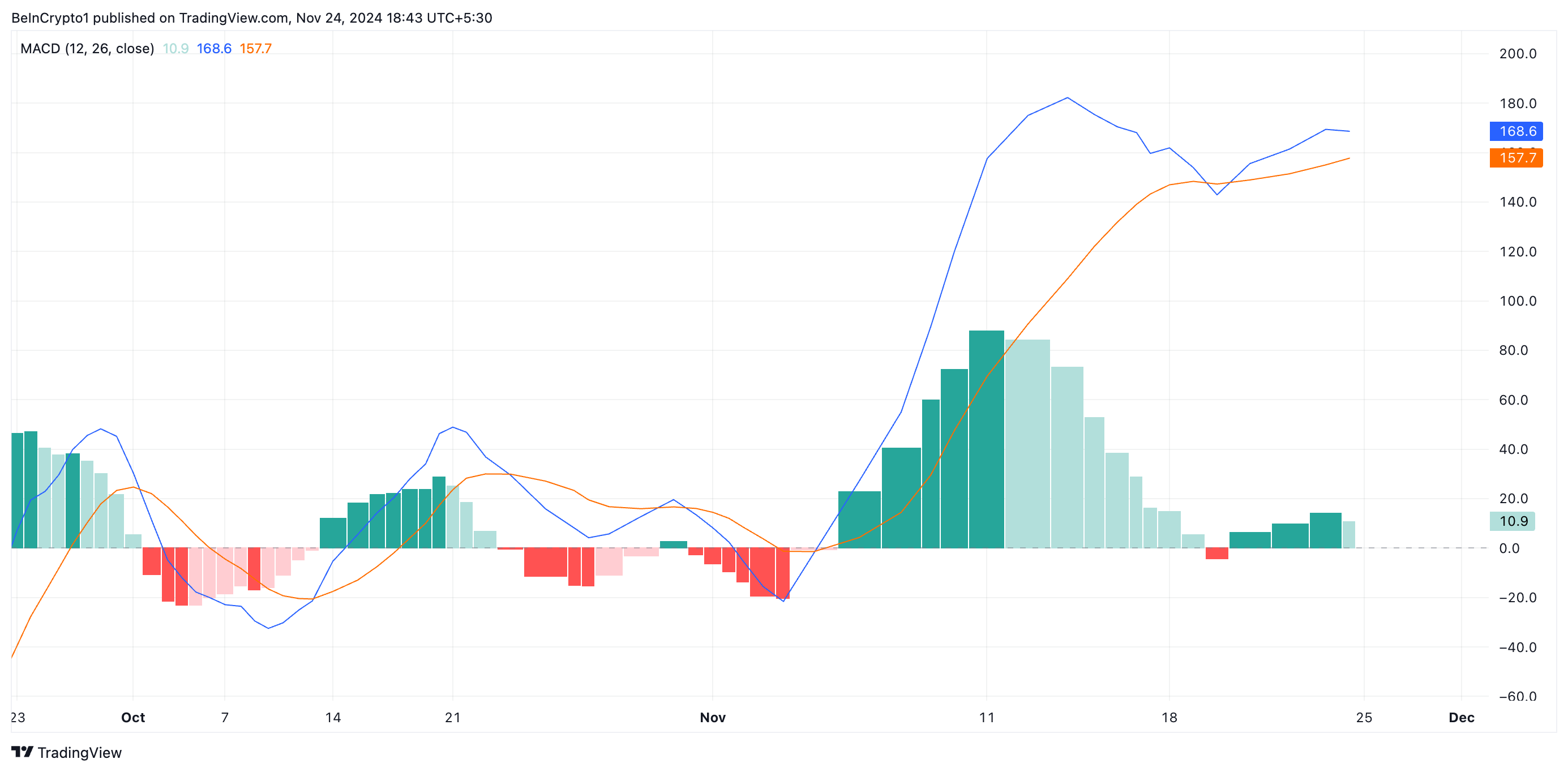

Ethereum Sellers Re-Emerge

An assessment of the ETH/USD one-day chart has revealed that the coin’s moving average convergence divergence (MACD) indicator is forming a potential death cross. As of this writing, the coin’s MACD line (blue) is attempting to fall below its signal line (orange).

This indicator measures an asset’s price trends and momentum and identifies its potential buy or sell signals. A MACD death cross occurs when the MACD line (the shorter-term moving average) crosses below the signal line (the longer-term moving average), indicating a bearish trend or momentum reversal. This signal suggests that selling pressure is increasing, and the asset’s price could decline further.

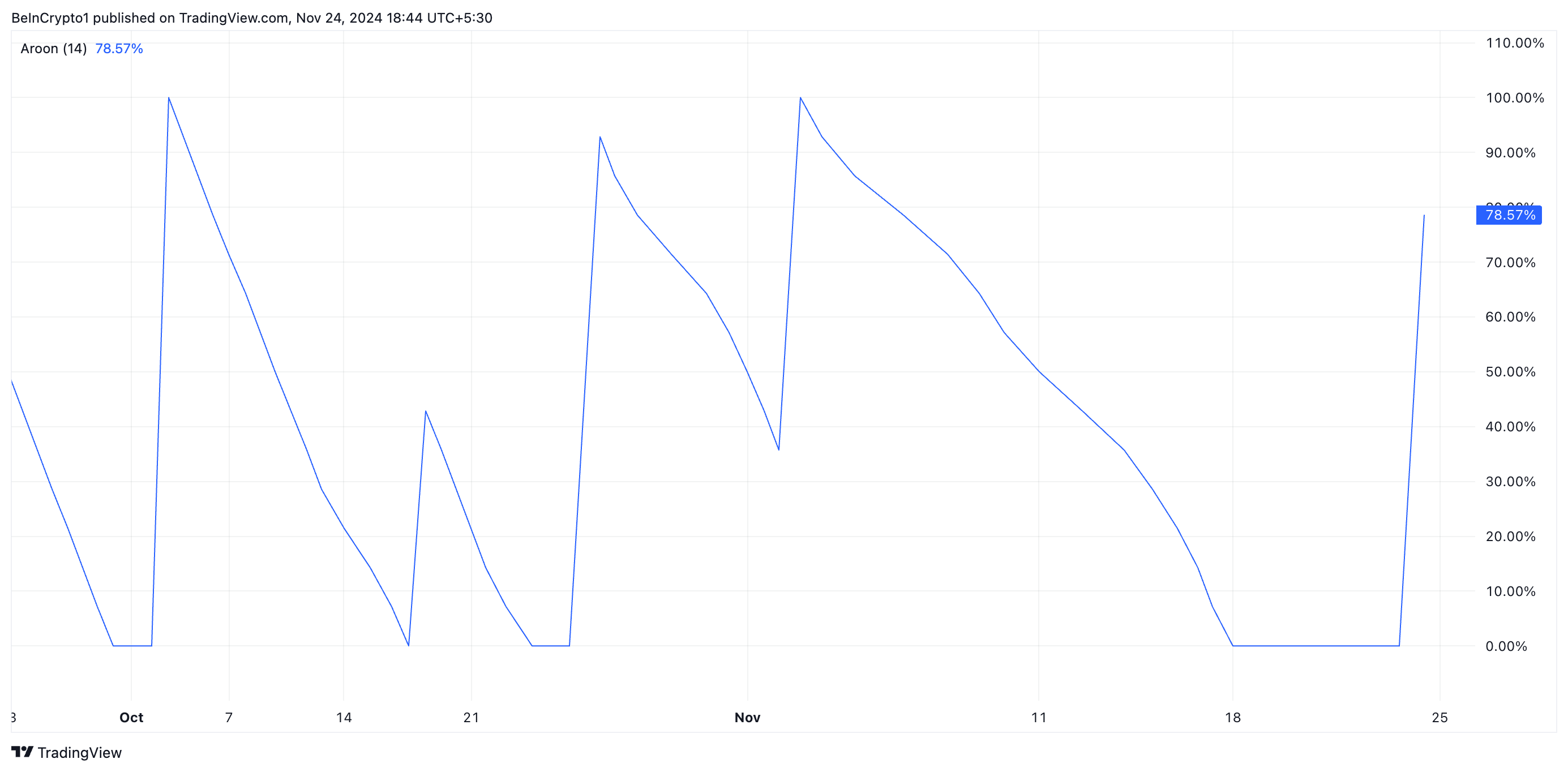

ETH’s rising Aroon Down Line confirms this strengthening bearish pressure. It currently sits at 78.57%, confirming that the decline in ETH’s price is gaining momentum.

The Aroon Indicator evaluates the strength of an asset’s price trend through two components: the Aroon Up line, which reflects the strength of an uptrend, and the Aroon Down line, which reflects the strength of a downtrend. A rising Aroon Down line indicates that recent lows are occurring more frequently, signaling growing bearish momentum or the start of a downtrend.

ETH Price Prediction: Key Support Level To Watch

ETH currently trades at $3,333, resting above the support formed at $3,203. This level is crucial because a decline below it will cause ETH to exchange hands under $3000. According to readings from the coin’s Fibonacci Retracement tool, the Ethereum price will drop to $2,970 if this happens.

However, a resurgence in the demand for the leading altcoin will invalidate this bearish thesis. If this occurs, Ethereum will rally toward $3,500.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

Cantor Fitzgerald, a prominent US financial services firm, is expanding its alliance with Tether, a key player in the digital asset industry and the issuer of the world’s largest stablecoin.

According to reports, the firm has agreed to acquire a 5% stake in Tether as part of a broader collaboration that includes Bitcoin-backed lending initiatives.

Tether Mints $13 Billion USDT as Cantor Fitzgerald Deepens Tie

The acquisition talks, reportedly finalized in 2023, valued the 5% stake at approximately $600 million. This partnership positions Tether to gain strategic advantages, particularly as Cantor Fitzgerald’s CEO, Howard Lutnick, takes on his new role as Secretary of Commerce under President-elect Donald Trump.

Market observers suggest that the nomination raises the possibility of enhanced regulatory support for Tether, which has faced scrutiny over potential violations of sanctions and anti-money laundering regulations—a claim the company has denied. However, Lutnick has promised to step down from his positions at Cantor Senate confirmation.

Beyond the ownership stake, Tether is expected to support Cantor Fitzgerald’s Bitcoin lending program, a multi-billion-dollar initiative. The program aims to offer loans backed by Bitcoin, initially funded with $2 billion, with plans for significant future expansion.

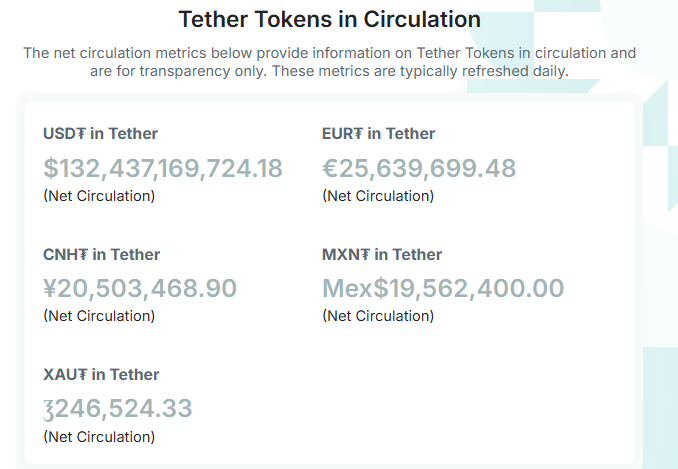

Meanwhile, Cantor Fitzgerald is already a critical partner for Tether, reportedly holding a significant portion of the stablecoin issuer’s $134 billion reserves in US Treasury bills.

As Cantor Fitzgerald deepens its involvement with Tether, the firm has continued its aggressive token minting. On November 24, blockchain analytics platform Lookonchain reported that stablecoin company minted an additional $3 billion USDT, bringing the total minted since November 8 to $13 billion. This expansion has pushed the total supply of USDT to approximately $132 billion.

The increased USDT supply may reflect the growing demand for stablecoins, often used to hedge market positions or facilitate crypto transactions without converting to fiat. This liquidity influx could reduce volatility and enhance price stability across the digital asset market.

This surge in USDT supply coincides with a broader market rally led by Bitcoin and other assets such as Dogecoin and Solana, signaling renewed investor confidence in the crypto ecosystem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin18 hours ago

Altcoin18 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Market15 hours ago

Market15 hours agoWhy a New Solana All-Time High May Be Near

-

Market9 hours ago

Market9 hours agoToken Unlocks to Watch Next Week: AVAX, ADA and More

-

Bitcoin12 hours ago

Bitcoin12 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market12 hours ago

Market12 hours agoWinklevoss Urges Scrutiny of FTX and SBF Political Donations

-

Bitcoin11 hours ago

Bitcoin11 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin10 hours ago

Bitcoin10 hours agoAI Company Invests $10 Million In BTC Treasury

-

Bitcoin24 hours ago

Bitcoin24 hours agoBitcoin Price To $100,000? Here’s What To Expect If BTC Makes History