Regulation

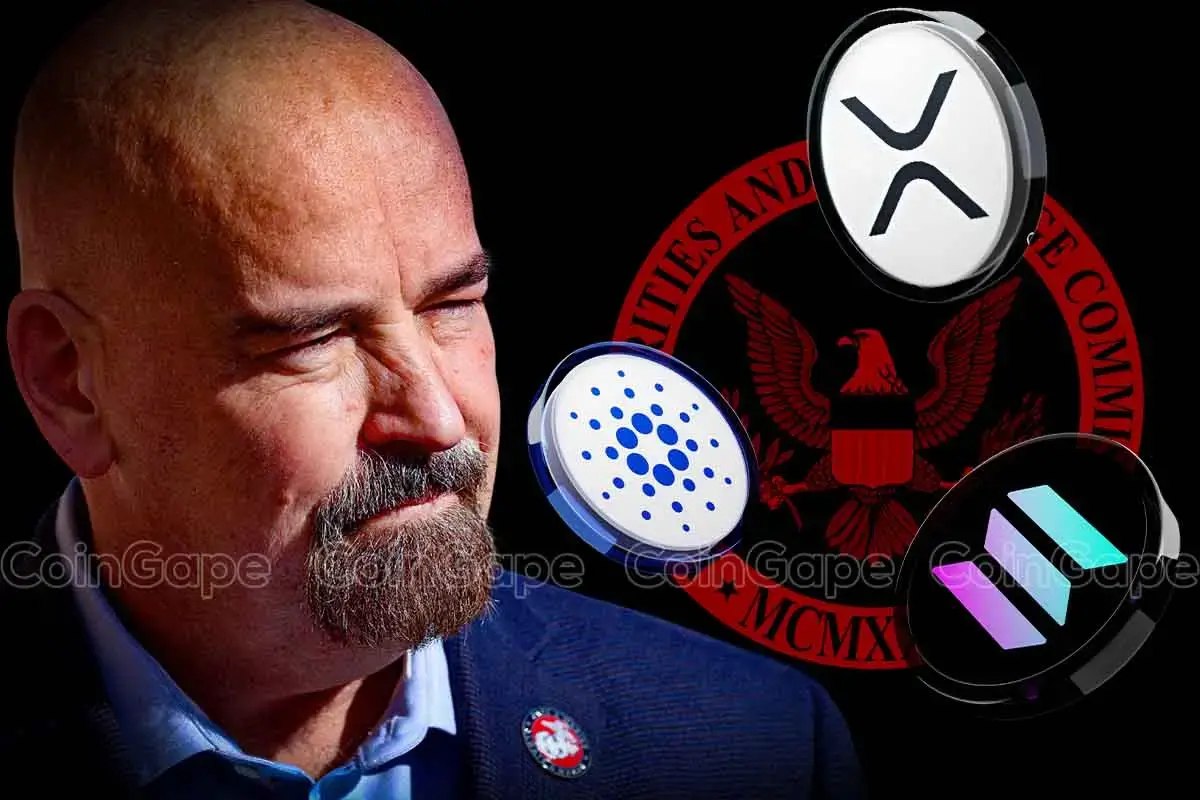

Pro Crypto Matt Gaetz Nominated As Donald Trump’s Attorney General

Pro-crypto Florida Congressman Matt Gaetz has been nominated by US President Donald Trump to serve as the Attorney General of the United States. Gaetz, a Republican representative known for his strong stance on justice reform and cryptocurrency advocacy, has garnered attention in recent years for his outspoken views on federal oversight and digital currency policies.

Donald Trump’s nomination of Matt Gaetz underscores his commitment to reshaping the Department of Justice (DOJ) and pushing back against what he calls “weaponized government.”

Matt Gaetz Nominated As Donald Trump’s Attorney General

In a statement, US President Donald Trump described Gaetz as a deeply gifted and tenacious attorney who has dedicated his efforts in Congress to the reform of the Department of Justice. Gaetz has been outspoken in his efforts to reduce what he perceives to be political motivations within the Justice Department and has accused the Biden administration of weaponizing the justice system.

If confirmed, Gaetz will focus on rebuilding the reputation of the DOJ and restoring its credibility by ensuring the department is more transparent and acts within the law.

President Trump noted that Florida Congressman, Gaetz has been focusing on justice issues while serving in the House Judiciary Committee and overseeing the DOJ. Trump called Gaetz a champion for the Constitution who will ensure the rule of law while working to introduce the changes that are needed.

Advocacy for Cryptocurrency and Blockchain in Government

In addition to his stance on DOJ reform, Matt Gaetz has recently emerged as an advocate for cryptocurrency, proposing legislation to allow federal income taxes to be paid with Bitcoin. His bill was submitted in June and seeks to modify the Internal Revenue Code to allow the U.S. Treasury to accept Bitcoin as a form of tax payment.

In Gaetz’s opinion, this could ‘lead to more innovation, better efficiencies, and provide more options for Americans.’

The bill would mandate the Treasury secretary to come up with rules for the processing of Bitcoin payments for specific federal taxes. The law outlines that any Bitcoin received would be converted into US dollar as soon as the payment is made.

His actions are in line with recent trends promoted by Trump to encourage the use of cryptocurrencies and reduce the level of restrictions on the activities of crypto companies.

Trump’s Pro-Crypto Agenda Gains Momentum

Florida Congressman Matt Gaetz nomination is part of a wider trend within Trump’s insider circle of supporting cryptocurrency within the United States. Trump has earlier vowed to put an end to Biden’s war on crypto and make cryptocurrencies an essential part of the US economy. To this end, Trump has proposed filling key posts in his administration with crypto supporters, as well as working on the creation of conditions under which the crypto business will be more comfortable.

More pro-crypto figures are said to be under consideration for positions in Trump’s transition team including Howard Lutnick, the CEO of Cantor Fitzgerald as a potential treasury secretary. Crypto advocates see these appointments as an opportunity to end regulatory crackdowns on the industry and establish the U.S. as a global leader in digital finance.

Concurrently, Donald Trump has created a new Department of Government Efficiency (DOGE), to be led by Tesla CEO Elon Musk and entrepreneur Vivek Ramaswamy.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

John Deaton Lays Out 5 To-Do List

John Deaton, a prominent crypto lawyer, has outlined a five-point plan for regulation by lawmakers in the United States. In his latest post on X, he calls for urgent action to establish clear rules that will support innovation, protect users, and bring stability to the crypto sector.

John Deaton on the Five Crypto Regulation Priorities

Deaton’s first recommendation is to pass a law on stablecoins. He believes this can increase demand for U.S. Treasuries and reduce the cost and delay in sending money across borders. This, he noted, will help the United States play a stronger role in global trade.

John Deaton wants the US. Congress should clearly define which tokens are securities and which are commodities. This will help decide whether the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC) should regulate them. Without such clarity, regulators may continue to clash over control, and projects may face confusion.

He also raised the need for crypto exchange regulation. Deaton wants strict rules to ensure customer funds are not mixed with company funds. He suggests that exchanges hold full reserves visible on the blockchain. This way, they can avoid high-risk activities like offering large amounts for lending or using customer funds elsewhere.

In addition, Deaton suggests easing the tax burden. He proposes removing the capital gains tax on small crypto payments and allowing people to pay federal taxes in cryptocurrency without facing more taxes.

Lastly, he urges Congress to revise or remove the Accredited Investor Rule. John Deaton believes the rule locks out too many people from early investment opportunities. He warns that lawmakers must act before the 2026 midterm elections to avoid delays caused by political changes.

Stablecoin Laws May Arrive Very Soon

It is important to add that Deaton’s views support ongoing developments in Congress. A bill known as the GENIUS Act is already being discussed.

It suggests that the Federal Reserve would manage large banks issuing stablecoins, while state bodies would handle smaller groups.

According to recent reports, the global market for stablecoins now exceeds $234 billion, raising hopes that new U.S. laws will soon follow.

As mentioned earlier by President Donald Trump, lawmakers are likely to fasttrack the stablecoin regulation. The current timeline is slated for Q2 this year.

SEC’s Shifting Position on Oversight

The SEC, which once took a hard line on crypto regulation, is now adjusting its stance

CoinGape noted earlier that the era of counterproductive oversight may be ending, as U.S. SEC and CFTC leaders have agreed to work together moving forward.

Historically, the SEC treated most tokens as securities, focusing on enforcement, while the CFTC took a softer approach to the markets. Recent laws like FIT21 aim to give the CFTC more control over decentralized assets.

With both regulatory oversight looking to create more cohesive plans to work, and the new leadership of Paul Atkins, the industry hopes to overcome challenges, reduce uncertainty, and foster greater clarity in crypto regulation.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

US SEC and Binance Agree To Pause Legal Proceedings for 60 More Days

The U.S. Securities and Exchange Commission (SEC) and Binance have requested a federal judge to extend the pause in their ongoing legal case for another 60 days.

This decision follows what both parties described as “productive discussions” and will provide more time for further deliberations.

US SEC and Binance Agree To Pause Legal Proceedings

The SEC initially sued Binance in 2023, accusing the exchange and its executives, including former CEO Changpeng Zhao, of violating federal securities laws, who is now the Strategic Advisor to Pakistan’s Crypto Council. The charges centred on Binance’s operation as an unlicensed clearing agency, broker, and exchange.

Additional allegations included the commingling of funds and manipulation of trading volume on Binance.US, its U.S. affiliate. These serious claims led to the ongoing litigation, which was paused multiple times to allow the parties to negotiate and clarify their positions.

Earlier this year, the SEC requested a 60-day pause in the case to allow for discussions around a new crypto task force to clarify how securities law might apply to digital assets. That pause was set to expire on April 14, 2025, but the SEC and Binance have now mutually agreed to extend it for an additional two months.

Reasons for the Continued Binance SEC Pause

The SEC, in its filing, explained that the discussions between both parties had focused on how the work of the newly formed crypto task force could impact the case. The task force, created to address regulatory issues in the cryptocurrency sector, may provide clearer guidance on how U.S. securities law applies to digital assets.

The SEC also pointed out that additional time was needed for authorization from the Commission before making any decisions or revisions in the scope of the case. Binance, for its part, agreed that an extension of the pause was in everyone’s best interest and would help to facilitate the ongoing discussions between the two sides.

“The continued pause is appropriate and in the interest of judicial economy,” the filing stated. Both the SEC and Binance have indicated that they aim to resolve the matter efficiently, without unnecessary delays or complications.

Crypto Task Force’s Role in the Case

The SEC’s newly established crypto task force may shape how digital asset transactions are treated under U.S. law. In a recent statement, Acting SEC Chair Mark Uyeda emphasized the importance of clear regulations for the cryptocurrency market and noted that the task force’s role is to create long-term solutions for regulating crypto trading.

Uyeda also suggested that a “time-limited, conditional exemptive relief framework” might be appropriate to allow innovation in blockchain technology while maintaining regulatory oversight. He encouraged market participants to contribute their views on where such exemptions might be necessary to foster industry growth.

The crypto task force’s efforts may influence how the SEC handles its case against Binance and its broader approach to regulating the digital asset space. The task force aims to ensure that U.S. law can adapt to the rapidly evolving technology behind cryptocurrencies while also protecting investors and ensuring market integrity.

Next Steps in the Legal Proceedings

With the case now paused for another 60 days, the SEC and Binance will continue their discussions and await further guidance from the crypto task force. The next update on the case’s status will come after the 60-day period.

As the pause continues, like the Ripple vs SEC case, stakeholders in the cryptocurrency industry will closely monitor the outcome of the discussions, as the case could set important precedents for future regulatory actions.

The SEC, as a result, has clarified that it is focused on ensuring compliance with securities laws, while Binance has stated its commitment to working within the framework of U.S. regulations.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

US Senators Reintroduce PROOF Act To Set Reserve Standards for Crypto Firms

As crypto regulation gains ground in the US under pro-crypto President Donald Trump, US Senators are taking further steps to strengthen oversight of digital asset firms. Senators Thom Tillis and John Hickenlooper reintroduced the Proving Reserves of Other Funds (PROOF) Act, which aims to create new standards for transparency and fund management in the cryptocurrency sector.

US Senators Reintroduce PROOF Act Bill

According to Eleanor Terrett, US Senators Tillis and Hickenlooper have renewed their push for the PROOF Act, which was first introduced in 2023. The bill responds to concerns raised by the collapse of FTX, where customer funds were reportedly mixed with the company’s own capital and redirected to affiliated firms.

The PROOF Act would prohibit the co-mingling of customer assets by digital asset custodians and exchanges. It sets requirements for monthly third-party reserve checks, which would ensure that firms hold enough reserves to back customer holdings.

Independent auditing firms would perform these checks, sending the results to the U.S. Department of the Treasury.

Mandatory Proof of Reserves Checks

Under the US Senator’s proposed law, all firms offering digital asset custody or exchange services must undergo monthly Proof of Reserves (PoR) inspections. These checks would verify that firms hold the assets they claim to possess on behalf of their clients.

PoR uses cryptographic tools like Merkle trees and zero-knowledge proofs to verify balances without revealing user data. To ensure transparency, the inspection reports would be made public through the Treasury Department. If a company fails to comply, it will face civil fines that increase with repeated violations.

Although some firms have previously voluntarily shared proof of reserves information, these practices have been inconsistent and often lacked third-party verification. The PROOF Act would create a standardized process across the industry.

Preventing Fund Mismanagement in the Crypto Industry Through The PROOF Act

The US Senators’ renewed effort to pass the PROOF Act follows the financial failure of several crypto companies, most notably FTX. Reports showed that FTX moved customer deposits to its sister firm, Alameda Research, without proper disclosure or reserves, contributing to a major loss of trust in the sector.

Lawmakers aim to reduce the risk of mismanaged or missing funds by introducing strict reserve reporting requirements. The bill, as a result, intends to give customers more confidence that their digital assets are safe and properly accounted for by crypto firms.

The legislation also encourages more responsible behaviour from digital asset institutions by requiring them to follow clearly defined standards. These standards subsequently support regulatory oversight and prevent future financial harm to customers.

SEC Leadership and Regulatory Developments

The reintroduction of the PROOF Act follows Paul Atkins’s appointment as the new Chair of the Securities and Exchange Commission (SEC) in the United States. The Senate endorsed Atkins with a 52 to 44 majority in acknowledging his position on precise crypto regulations.

As a result, the Division of Corporation Finance of the SEC published guidance for crypto issuers as a follow-up to Atkins’ confirmation. The guidance also involves disclosure concerning business models and financial statements and risks associated with digital assets that fall under the definition of securities.

Subsequently, Senator Cynthia Lummis, a pro-Bitcoin legislator, has corroborated the development while acknowledging optimism about the future under Atkins. She stated that from her conversation with Atkins, she became confident in his handling of digital asset regulation.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market19 hours ago

Market19 hours agoCardano (ADA) Moves Sideways, But Bullish Shift May Be Brewing

-

Altcoin15 hours ago

Altcoin15 hours agoAnalyst Reveals Dogecoin Price Can Reach New ATH In 55 Days If This Happens

-

Market22 hours ago

Market22 hours agoXRP Consolidation About To Reach A Bottom, Wave 5 Says $5.85 Is Coming

-

Altcoin24 hours ago

Altcoin24 hours agoChainlink Price To Hit $26 If LINK Breaks Past This Crucial Level

-

Market21 hours ago

Market21 hours agoCanary Capital Aims to Launch TRON-Focused ETF

-

Altcoin18 hours ago

Altcoin18 hours agoPi Coin Price Soars As Pi Network Reveals Massive Community Reward Plans.

-

Altcoin9 hours ago

Altcoin9 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Market15 hours ago

Market15 hours agoBinance Mandates KYC Re-Verification For India Users

✓ Share: