Regulation

President Joe Biden Renominates Anti-Crypto SEC Commissioner Caroline Crenshaw

On the one hand, the Biden administration has been reaching out to crypto communities for crypto donations, while on the other hand, it continues to appoint people who have been staunchly anti-crypto. In the latest development, President Joe Biden has renominated anti-crypto SEC Commissioner Caroline Crenshaw.

Joe Biden Appoints Anti-Crypto SEC Commissioner

Fox Business reporter Eleanor Terret recently stated that President Joe Biden has announced his intentions to renominate Democrat Caroline Crenshaw to serve as the Commissioner of the U.S. Securities and Exchange Commission for the second term.

During her time in the office, Crenshaw has consistently taken an anti-crypto stance and was staunchly against the approval of the spot Bitcoin ETFs earlier this year in January. some critics argue that she’s even greater advocate of strong crypto policies than her colleague and SEC Chair Gary Gensler. Interestingly, billionaire Mark Cuban recently warned that Gary Gensler and his anti-crypto camp could cost President Biden the next election.

Crenshaw has been typically anti-crypto, voting against the approval of the $BTC spot ETFs. Her critics say she’s even more progressive than @GaryGensler on climate policies. https://t.co/uksDB2I8TF

— Eleanor Terrett (@EleanorTerrett) June 13, 2024

After Donald Trump’s strong support for crypto during his recent campaigns, the Biden administration has been making a desperate move to reach out to the crypto community during recent weeks. After cracking down on a number of crypto firms, the Biden administration is now seeking donations from the crypto community.

Community Backlash Unleashes

The recent reach-out by President Joe Biden to the crypto community has met with community backlash. Moreover, the recent dual stands from the Biden administration make the crypto community question whether he’s actually pro-crypto or just pretending to be for the sake of the elections.

Ethereum contributor Anthony Sassal wrote: “Biden wants to accept crypto donations yet his SEC buddies are suing the biggest U.S based crypto companies (Coinbase, Kraken, Uniswap Labs)”.

Ryan Selkis, founder of Messari Crypto, has also expressed strong disapproval of any crypto donations to political campaigns before any concessions or policy reversals are made. Selkis stated: “I will never be able to look at anyone who donates to this campaign using crypto – before ANY concessions or policy reversals – without spitting venom. Would be an act of complete cowardice, betrayal, and show negative self-worth”.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

US SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

Hawk Tuah girl Hailey Welch, known for her association with the controversial $HAWK token, has been cleared of any wrongdoing after a lengthy investigation by the U.S. Securities and Exchange Commission (SEC). The SEC has decided not to press charges against Welch in connection with the rapid rise and subsequent collapse of the meme-based cryptocurrency.

US SEC Investigation Into Hawk Tuah Girl Concludes Without Charges

The SEC had launched an investigation into the $HAWK token after its dramatic price drop. The token, which was linked to Welch’s viral persona, initially saw a market cap surge to $490 million before crashing by over 90%. Investors who were impacted by the crash filed a lawsuit against those behind the project, alleging that the coin had been promoted and sold without proper registration.

Hawk Tuah girl Hailey Welch, who cooperated fully with the investigation, expressed relief after the SEC’s decision. “For the past few months, I’ve been cooperating with all the authorities and attorneys, and finally, that work is complete,” Welch told TMZ.

Her attorney, James Sallah, confirmed that the SEC had closed the case without any findings against her, adding that there would be no monetary sanctions or restrictions on Welch’s future involvement in cryptocurrency or securities.

This Is A Developing News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

Sonic Labs To Abandon Plans For Algorithmic USD Stablecoin, Here’s Why

Barely a week after hinting at launching an algorithmic USD stablecoin, Sonic Labs is shuttering its plans. Sonic Labs co-founder Andre Cronje revealed that incoming stablecoin regulation in the US contributes to the change of stance.

Sonic Labs Makes U-Turn Over Algorithmic USD Stablecoin

In mid-March, Sonic Labs disclosed plans for a yield-generating algorithmic stablecoin for its blockchain. However, new developments in the US regulatory landscape are forcing the company to ditch its algorithmic stablecoin ambitions.

Sonic Labs co-founder Andre Cronje confirmed the change in direction via an X post following the release of the full draft of the STABLE Act by Congress for clearer oversight. According to the text, lawmakers are pushing for a two-year moratorium on algorithmic stablecoin, souring Sonic Labs plans.

Unlike mainstream stablecoins backed by fiat or other commodities, algorithmic stablecoins rely on smart contracts to maintain their peg. The 2022 implosion of Terra’s ecosystem following the de-pegging of its TerraUSD (UST) algorithmic stablecoin stunned regulators.

“We will no longer be releasing a USD-based algorithmic stablecoin,” said Cronje.

In a light-hearted note, community members teased potential strategies for Sonic Labs to sidestep incoming stablecoin regulation. Apart from the loophole of launching the algorithmic stablecoin before the regulation goes live, Cronje teased an algorithmic dirham that will be denominated in USD.

Industry Players Are Bracing For New Stablecoin Regulations

Stablecoin issuers are steeling themselves for incoming stablecoin regulations in the US. While the GENIUS Act and STABLE Act continue to inch forward, there are common denominators in both bills.

For starters, there is the requirement for equivalent reserves at a 1:1 ratio with both bills steering clear of algorithmic stablecoins. The White House is favoring the GENIUS Act over the STABLE Act as lobbyists rally to stifle the possibility of a Conference Committee.

Authorities are targeting stablecoin regulation to reach Trump in two months as issuers jostle for position. Tether, Circle, and Ripple are staking their claims to lead the US government’s ambitions to rely on stablecoins to maintain the dollar’s dominance.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

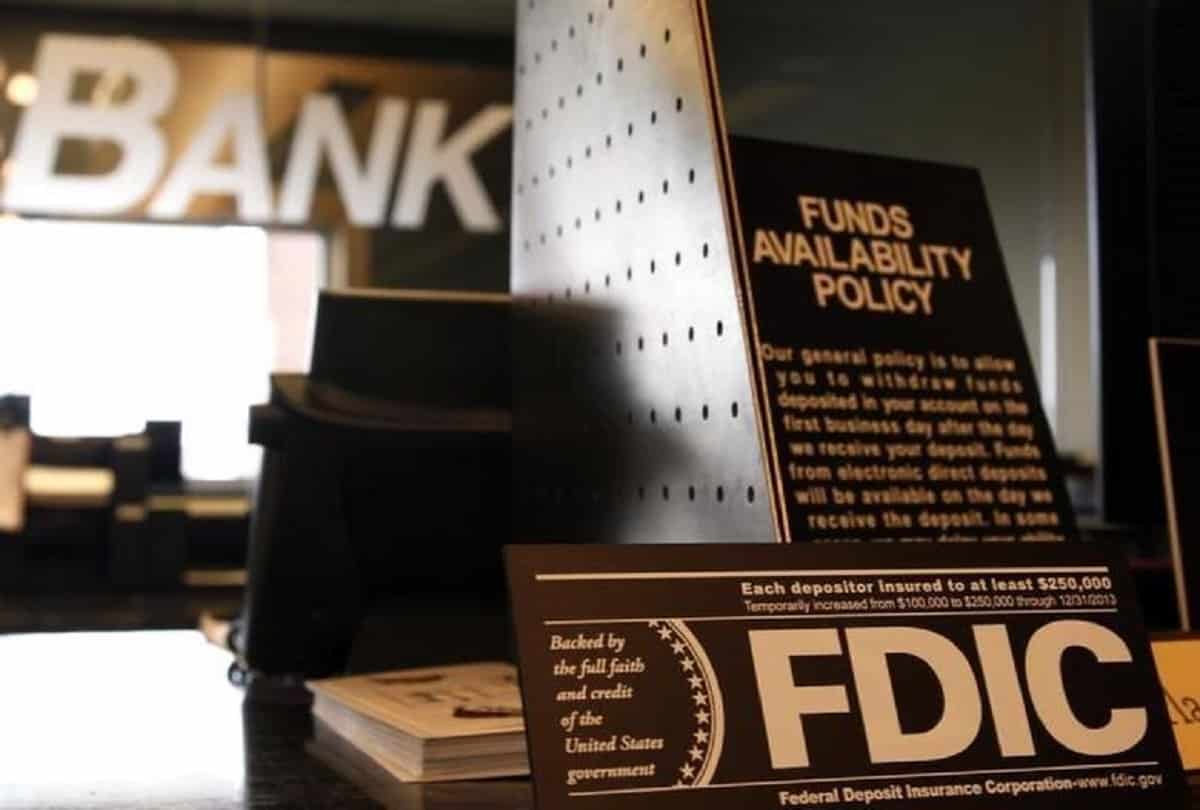

FDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

The Federal Deposit Insurance Corporation (FDIC) has updated its guidelines, enabling banks to engage in cryptocurrency-related activities without seeking prior approval. This new policy shift signals a change in the FDIC’s approach to the growing role of digital assets in the banking sector.

New FDIC Guidelines on Crypto-Related Activities

The FDIC has issued a new Financial Institution Letter (FIL-7-2025), which provides updated guidance for banks looking to engage in cryptocurrency activities. The new guidance rescinds the previous policy set out in FIL-16-2022, which required banks to notify the FDIC before engaging in such activities.

Under the new rules, banks can now participate in permissible crypto-related activities without waiting for FDIC approval, as long as they manage the risks appropriately.

This change is seen as a shift in the FDIC’s stance, following the agency’s earlier stance that required prior approval for crypto engagements. FDIC Acting Chairman Travis Hill expressed that this new approach aims to establish a more consistent framework for banks to explore and adopt emerging technologies like crypto-assets and blockchain.

“With today’s action, the FDIC is turning the page on the flawed approach of the past three years,” said Hill in a statement.

This Is A Developing News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Regulation22 hours ago

Regulation22 hours agoFDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

-

Regulation21 hours ago

Regulation21 hours agoSonic Labs To Abandon Plans For Algorithmic USD Stablecoin, Here’s Why

-

Market20 hours ago

Market20 hours agoCoinbase Users Lost $46 Million to Crypto Scams in March

-

Altcoin20 hours ago

Altcoin20 hours agoPiDaoSwap, Trump Media, & Grayscale

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

-

Market23 hours ago

Market23 hours agoPopular Analyst Peter Brandt Identifies XRP Head & Shoulder Pattern, Reveals Path To Take

-

Market22 hours ago

Market22 hours agoWhat to Expect from XRP Price in April 2025

-

Market17 hours ago

Market17 hours agoWhy Did MUBARAK Drop 40% Despite Binance Listing?

✓ Share: