NFT

Types And How To Avoid Them

NFT scams have quickly become a major concern in the digital asset realm, overshadowing the growing Non-Fungible Token world. They range from NFT scams on Instagram to complex NFT art frauds like the Bored Ape Yacht Club and Logan Paul’s NFT game. The risks are varied and significant. This guide explores the murky world of NFT fraud, highlighting various forms such as fake NFTs, NFT Ponzi schemes, and common OpenSea scams.

Overview Of NFT Scams

The Non-Fungible Tokens (NFTs) realm has opened a new digital frontier, bringing with it a surge in NFT scams, troubling both investors and enthusiasts. These scams, leveraging the novelty and complexity of NFTs, often catch even experienced participants off guard.

NFT scams vary widely and continue to evolve, from simple phishing attempts to more complex Ponzi schemes. These fraudulent activities occur not only on lesser-known platforms but also on popular ones like OpenSea and in high-profile projects like the Bored Ape Yacht Club. The growth of social media further complicates matters, with platforms like Instagram becoming centers for NFT fraud.

Understanding the range and mechanics of these scams is essential for anyone involved in the NFT space. The risks are numerous, from fake NFTs posing as legitimate digital art to Ponzi schemes presented as attractive investments, and phishing scams targeting valuable digital assets.

True Or Not: NFTs Are A Scam?

The question of whether NFTs are a scam is complex and requires a nuanced understanding of the NFT ecosystem. At the outset, it’s important to clarify that not all NFTs are scams. NFTs, by their very nature, are a legitimate technological innovation, providing a unique way to authenticate and trade digital assets on the blockchain. They have been utilized in various fields, from digital art and entertainment to real estate and identity verification.

However, the burgeoning interest in NFTs has also attracted scammers looking to exploit the hype and the often limited understanding of the technology among the general public. This has led to a significant number of fraudulent schemes within the NFT space. Scams such as selling plagiarized digital art, creating fake NFT marketplaces, or promoting non-existent NFT projects are not uncommon. High-profile cases, like certain celebrity-endorsed NFT projects, have also raised suspicions and added to the skepticism.

The key takeaway is that while NFTs as a concept are not a scam, the ecosystem has been marred by fraudulent activities that prey on the uninformed. The presence of scams does not invalidate the entire NFT space but serves as a cautionary tale about the need for due diligence and skepticism, especially in a field that is relatively new and rapidly evolving. As the NFT market continues to mature, it is hoped that better regulation and informed participation will reduce the prevalence of these scams.

Types of NFT Scams

The world of NFTs, while offering vast opportunities for creators and collectors, is also rife with various types of scams. Here’s a list of the most common NFT scams:

Plagiarized NFTs / Fake NFTs

One of the most common types of NFT scams involves the sale of plagiarized or fake NFTs. In these scams, fraudsters create and sell NFTs that are unauthorized copies of existing digital artworks. They may also create entirely fake NFTs, passing them off as valuable or rare digital assets.

These scams exploit the NFT hype, especially in digital art, by taking advantage of buyers’ lack of knowledge in verifying NFT authenticity and originality. The decentralized, permissionless nature of blockchain, allowing anyone to mint NFTs, presents challenges in identifying these scams. It’s tough for buyers to distinguish between original and plagiarized NFTs without proper verification, leading to fraud and infringement on legitimate artists’ rights and profits.

To avoid such scams, thoroughly research the creator’s background and the NFT’s provenance. While platforms and marketplaces are increasingly vetting creators and artworks, buyers must still perform due diligence before purchasing.

NFT Ponzi Schemes

NFT Ponzi schemes are another alarming trend in the realm of digital assets. In these schemes, early investors are promised high returns based on the investments of new participants, rather than legitimate business activities or profit. The structure inevitably collapses once there are not enough new investors, leading to significant losses for later investors.

These schemes exploit the hype and speculative nature of the NFT market, often using aggressive marketing and false promises of guaranteed returns. They might be disguised as innovative NFT projects or exclusive investment opportunities in the digital art world.

To protect yourself from NFT Ponzi schemes, be wary of projects that promise high returns with little to no risk, and always research the project’s fundamentals and the credibility of its creators.

Rug Pull Scams

Rug pull scams are particularly nefarious in the NFT space. In these scams, the developers of an NFT project hype up their offering to increase demand and price. However, once they accumulate a substantial amount of funds, they abandon the project and disappear with the investors’ money. This leaves investors with worthless NFTs and no way to recoup their investment.

These scams are often associated with new projects that lack a track record or verifiable information about the team behind them. To avoid rug pulls, it’s essential to conduct thorough research on the NFT project, understand its utility, and verify the transparency and track record of the developers involved. Engaging with the community and looking for independent reviews can also provide valuable insights into the legitimacy of a project.

Bidding NFT Scams

Bidding NFT scams are a sophisticated form of fraud that occurs in the auction process of buying and selling NFTs. In these scams, fraudsters manipulate the bidding process to inflate the price of an NFT artificially. This is often done by using fake accounts to place high bids on the NFT, creating a false sense of demand and value.

Unsuspecting buyers, believing the NFT to be more valuable than it actually is, are then tricked into placing even higher bids. Once the NFT is sold at the inflated price, the scammers withdraw, leaving the buyer with an asset worth significantly less than what they paid.

To avoid falling victim to bidding scams, it’s crucial to research the bidding history of an NFT and be cautious of auctions where the price seems to escalate unusually quickly. It’s also advisable to verify the credibility of other bidders, if possible, and to understand the typical market value of similar NFTs.

NFT Pump And Dumps

NFT pump and dumps are similar in nature to their counterparts in the stock market. In these scams, a group of individuals or a single entity artificially inflates the value of an NFT or a series of NFTs through hype and misinformation. Scammers typically use social media to quickly spread rumors or exaggerated claims about an NFT’s potential value. After they pump up the price and attract other investors, they sell (or dump) their NFTs at a high price. This causes the value to plummet, leaving new investors with a devalued asset.

Phishing Scams

Phishing scams are a prevalent issue in the NFT world, where scammers use deceptive methods to steal sensitive information, such as private keys or login credentials. These scams often occur through emails, social media messages, or fake websites that mimic legitimate NFT platforms. The scammers lure victims with the promise of exclusive NFT deals or access to rare digital assets, and once the victims enter their information on these fraudulent platforms, their digital wallets and the assets within them are compromised.

To protect against phishing scams, always verify the authenticity of any communication or websites claiming to be from well-known NFT platforms. Be cautious of unsolicited offers and never share your private keys or sensitive account information.

NFT Airdrop Or Giveaway Scams

NFT airdrop or giveaway scams take advantage of users’ desire for free assets. Scammers promote fake airdrops or giveaways, claiming to distribute free NFTs or cryptocurrencies. To participate, users are often asked to perform certain tasks like sending a small amount of cryptocurrency, sharing private keys, or completing a form with personal information. Once the information is shared or the payment is made, the scammers disappear without delivering the promised NFTs.

To avoid these scams, be wary of any offer that seems too good to be true, especially if it requires an upfront payment or sensitive information. Legitimate airdrops and giveaways usually do not require such actions.

Website Scams

Website scams in the NFT space typically involve the creation of fraudulent websites that imitate legitimate NFT marketplaces or projects. These websites might offer the sale of fake NFTs or pretend to offer services related to NFT trading. Unsuspecting users who transact on these sites may end up losing their funds or digital assets. These scams are sophisticated, with websites often appearing highly credible and professional.

To avoid falling for website scams, always double-check the URL of the website you’re visiting and ensure it’s the official site. Look for signs of legitimacy, such as secure connections (https), reviews from trusted sources, and verified contact information. Be cautious of websites that appear from unsolicited emails or social media links, and consider using browser extensions that can help detect and block malicious websites.

Most Common NFT Ponzi Schemes

NFT Ponzi schemes are significant frauds in the digital asset space, disguising themselves as legitimate investment opportunities. They benefit early initiators at the expense of later participants, often promising high returns quickly, backed by convoluted or non-existent business models.

A common NFT Ponzi scheme form involves platforms claiming to offer exclusive access to rare or high-value NFTs, asserting rapid value appreciation. Investors are urged to buy and recruit others, with the promise of earning from higher future sales. However, returns typically come from new participants’ investments. When new investors dwindle, the scheme collapses, leaving most at a loss.

Another variant involves scammers creating NFT projects with elaborate backstories and promised future utility, attracting investors with high-quality artwork or supposed real-world asset tie-ins. The goal is to boost initial sales and trading volumes, after which the creators vanish, leaving investors with worthless tokens.

To avoid NFT Ponzi schemes, thoroughly research any project or platform, especially those promising high returns. Seek transparent, realistic business models, and be cautious of projects reliant on recruiting new investors for profit.

NFT Scams On Instagram

Phishing attempts are rampant as well, directing users to fake websites that mimic popular NFT marketplaces or wallets. These sites steal login credentials, leading to loss of funds or NFTs from the victims’ actual wallets.

Staying safe from NFT scams on Instagram requires a high degree of vigilance. Always verify the authenticity of any NFT sale or project promoted on the platform. Be skeptical of unsolicited offers received via direct messages and avoid clicking on suspicious links. Additionally, cross-reference NFT offerings with official websites or platforms, and never share personal or wallet information on unverified sites.

NFT Art Scams And NFT Fraud

OpenSea Scams

Bored Ape Scam

Scammers have also targeted the Bored Ape Yacht Club (BAYC) collection, known for its high-value and celebrity-endorsed NFTs. The high demand and significant media attention make it an attractive target. Scams related to Bored Ape Yacht Club (BAYC) typically involve selling fake Bored Ape NFTs, phishing to steal these valuable NFTs from owners, and using the BAYC brand in fraudulent investment schemes to deceive victims.

Logan Paul NFT Game Scam

Further accusations include that the game did not work or never existed, and that the defendants manipulated the digital currency market for Zoo Tokens to their advantage. After completing the sale of all their NFTs, the defendants allegedly transferred the money to wallets controlled by themselves.

Avoiding NFT Scams: Best Practices

Here are some essential tips to help you stay safe in the world of NFTs:

- Do Your Research: Ensure you conduct thorough research on the project, its creators, and the selling platform before investing in any NFT. Look for reviews, community feedback, and the track record of the creators.

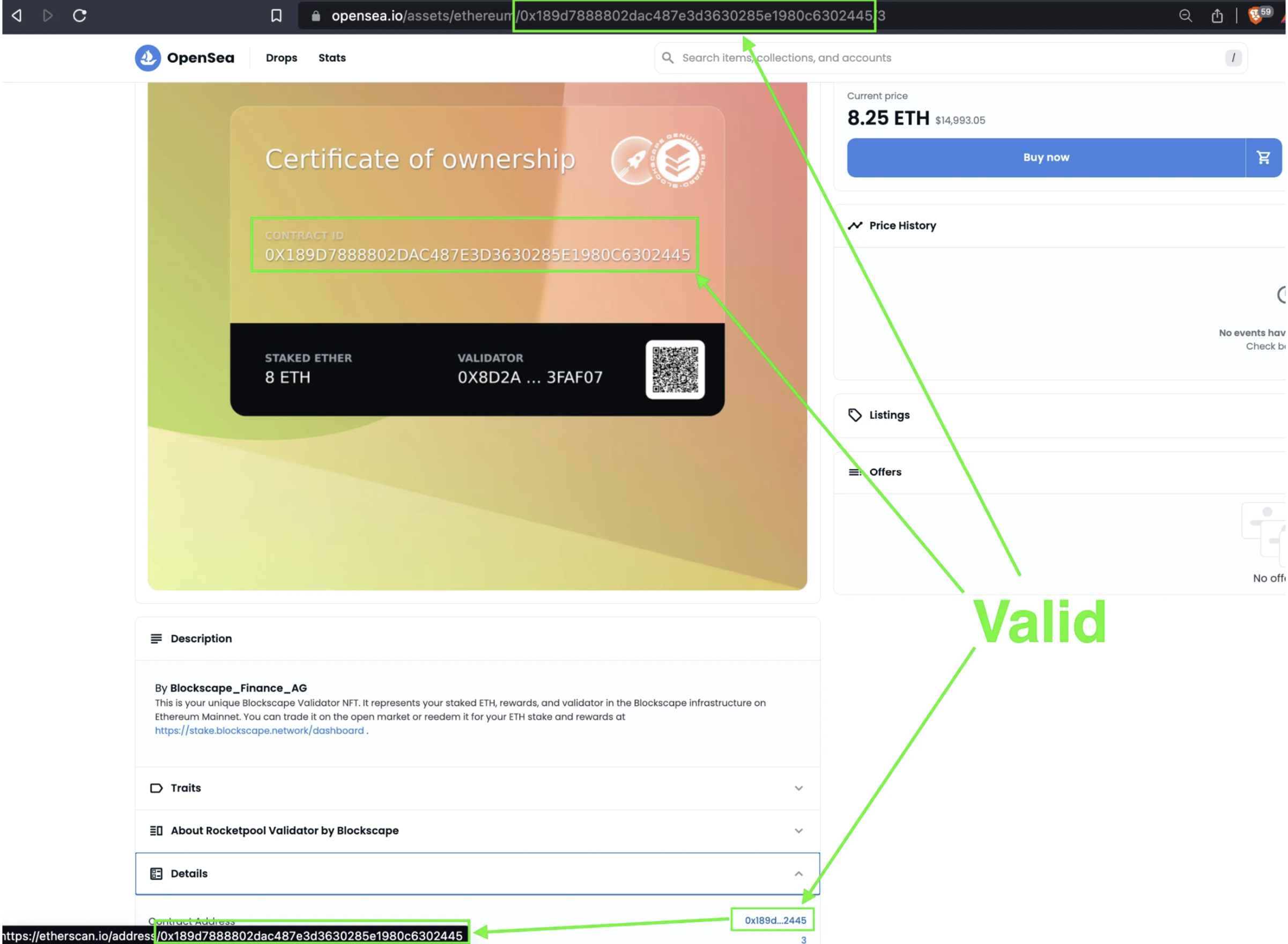

- Verify Authenticity And Provenance: Confirm the authenticity of the NFT you’re interested in to ensure it’s not a counterfeit. Check the item’s history and originality, which can be verified on the blockchain.

- Use Reputable Platforms: Stick to well-known and reputable NFT marketplaces that have measures in place to prevent scams. These platforms often have verification processes for sellers and their NFTs.

- Be Wary of Unsolicited Offers: Exercise caution with unsolicited offers that come through email, social media, or direct messages, particularly if they promise high returns or exclusive opportunities.

- Secure Your Digital Wallet: Use a secure and reputable digital wallet to store your NFTs. Protect your wallet’s private keys and make sure never to share them with anyone.

- Watch Out For Phishing Attempts: Be vigilant about phishing scams. Always check the URL of a website to ensure it’s legitimate and be cautious about clicking on links in emails or social media messages.

- Avoid Overhyped Projects: Approach NFT projects surrounded by excessive hype with skepticism, particularly those lacking substantial and verifiable information.

- Stay Informed About Scam Trends: Keep yourself updated on the latest scam trends in the NFT space. Knowledge about how scammers operate can be your best defense.

FAQ: NFT Scams

Fake NFTs, non-genuine digital assets, include plagiarized copies of legitimate NFTs or entirely fabricated items misrepresented as valuable or rare. Creators make them to deceive buyers into purchasing something with little to no actual value.

How To Avoid NFT OpenSea Scams?

To avoid OpenSea scams, always verify the authenticity of NFTs and sellers, use OpenSea’s official website, be cautious of phishing links, and ensure your digital wallet’s security. Research and due diligence are key in avoiding scams on OpenSea.

What Are Examples Of NFT Fraud?

Examples of NFT fraud include the Bored Ape Yacht Club scams, Logan Paul NFT game scam, Ponzi schemes disguised as NFT projects, and phishing attacks targeting NFT collectors and investors.

Are All NFTs Scam?

No, not all NFTs are scams. While there are fraudulent activities within the NFT space, many legitimate NFTs offer genuine value and opportunities for artists, collectors, and investors.

Are NFTs Ponzi Scheme?

Not all NFTs are Ponzi schemes, but the NFT market has seen its share of Ponzi schemes disguised as legitimate investment opportunities. It’s important to differentiate between genuine NFT projects and those structured like Ponzi schemes.

What Are The Most Common NFT Scams On Instagram?

On Instagram, the most common NFT scams involve fake NFT sales and phishing attacks posing as legitimate offers. Additionally, scams often use hacked accounts to promote fraudulent NFT projects.

NFTs Are A Scam?

NFTs themselves are not a scam. They are a legitimate form of digital asset. However, like any emerging market, the NFT space has attracted scammers exploiting the hype and lack of regulation.

Is The Logan Paul NFT Game A Scam?

The NFT game CryptoZoo, associated with Logan Paul, is currently facing a class action lawsuit alleging it to be a “rug pull” scam. The lawsuit claims the game was non-functional or nonexistent and accuses the developers of financial manipulation. The ongoing case, still awaiting a final judgment, actively raises serious concerns about the project’s legitimacy due to these allegations.

How To Spot Bored Ape Yacht Club Scams?

Featured images from Shutterstock

NFT

Pudgy Penguins Linked Abstract Chain Goes Live On Mainnet

In an astounding development, Abstract Chain, an Ethereum Layer-2 network launched by Pudgy Penguins’ parent company, Igloo Inc., has gone live on the mainnet. Reportedly, the Ethereum-based Layer 2 blockchain is designed to empower crypto communities and facilitate user-centric Web3 applications.

Despite Abstract Chain’s mainnet launch, Pudgy Penguins’ PENGU token has seen a massive decline. While the token’s descent aligns with the broader market trend, the community remains anxious about its further movements.

Igloo’s Abstract Chain Sees Mainnet Launch

Abstract Chain is now live on the mainnet, opening it up to the public for usage. According to a press release, Abstract Chain is now available for consumers, with the mission of driving mass crypto adoption. Developed by Igloo Inc., the parent company of the popular NFT collection, Pudgy Penguins, Abstract Chain focuses on providing a user-friendly experience.

On January 26, Pudgy Penguins CEO Luca Netz shared an X post announcing Abstract Chain’s mainnet launch. Netz proclaimed that the launch would take place on January 27, effective today.

MONDAY MAINNET ✳️🐧 https://t.co/Cp5naJdoB4

— Luca Netz 🐧✳️ (@LucaNetz) January 25, 2025

Commenting on the launch of Abstract, Netz stated,

The launch of Abstract is more than just a technical milestone—it’s a shift in how everyday users – and not just crypto natives – experience blockchain. We’ve built Abstract to strip away the complexities of crypto, offering an intuitive and enjoyable experience that empowers users to explore and create effortlessly.

Igloo Introduces the Consumer Blockchain Platform- The Portal

Meanwhile, the Abstract Blockchain unveiled The Portal, which the L2 network describes as the consumer blockchain platform. In a more intriguing description, the blockchain network calls The Portal a “Digital Theme Park of Fun” that revolutionizes the way billions interact with blockchain technology.

The Portal allows users to set up a wallet using just their email address, providing seamless access to a vast ecosystem featuring over 100 community-driven decentralized applications (dApps). The platform aligns with Abstract’s vision of merging the simplicity of Web2 with the transformative potential of Web3.

Abstract Chain’s Zero-Knowledge Rollups

Leveraging ZKsync’s ZK stack, Abstract Chain utilizes zero-knowledge rollups. Reportedly, it provides scalable and cost-effective on-chain solutions with reduced transaction fees.

In response to Abstract’s mainnet launch, ZKsync co-founder Alex Gluchowski cited,

For blockchain to reach the masses, we must abstract away the complexity. Users need to experience better apps, builders need to have more engaged users, and creators need to be rewarded for their efforts – while cutting out unnecessary middlemen. Abstract building for everyone, not just Web3 power-users, is the path to get the next billion onchain.

Pudgy Penguins’ PENGU Token Falls 11%

Echoing the broader market sentiment, Pudgy Penguins’ PENGU token dropped by more than 11% in a day despite Abstract Chain’s mainnet launch. Mainly triggered by China’s DeepSeek AI launch, the crypto market is bleeding today, with Bitcoin slipping below $99k.

As of press time, PENGU is exchanging hands at $0.2282, with a decrease of 4.5% over the last seven days. In a month, the token has seen a massive fall of 37%. However, PENGU’s 24-hour trading volume has seen a hike of 48%, currently at $376 million. PENGU token’s substantial decline follows its last month’s remarkable surge that earned a staggering 14,500x return for an investor. With an initial investment of just $6, the investor made a profit of $87K.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

NFT

CyberKongz Receives Wells Notice from SEC, Vows to Fight for NFT Clarity

The NFT collection CyberKongz said the Securities and Exchange Commission (SEC) will likely charge it.

In a post on X on Monday, the collection said it received a Wells Notice, a letter from the SEC staff that recommends an enforcement action. It commented that the SEC is trying to pull through its laws before Joe Biden’s administration is over.

CyberKongz: “We Will Not Be Silenced”

In a statement, the NFT collection said it was disappointed with the approach of the SEC and vowed to stand up for and fight for greater clarity in the NFT space.

It also mentioned that the SEC raised concerns about its business with Genesis Kongz in April 2021, describing it as a “contract migration.”

It said:

CyberKongz added it intends to fight for clearer crypto regulation, particularly regarding NFT projects.

Eyeing Trump’s Crypto-Friendly Stance

The NFT collection has been vocal about the current administration, which it claims is anti-crypto in its approach. Just recently, as the US Senate Banking Committee was preparing to vote on SEC Commissioner Caroline Crenshaw’s renomination, lawyer Bill Hughes raised concerns about her stance on cryptocurrency regulation. Hughes argued that her renomination one could see as politically hostile to the crypto industry. This stands in contrast to the increasing support for crypto-friendly policies under the incoming administration.

CyberKongz is optimistic that the new administration will provide a more level playing field with a more just regulatory framework. In the meantime, the team comited to support all NFT projects on every blockchain platform.

In the past year, the SEC has acted against several cases related to NFTs. This includes lawsuits against podcast studio Impact Theory and Stoner Cats 2 LLC over unregistered NFT offerings that raised millions. The commission also doled out a Wells Notice to NFT marketplace OpenSea, signaling potential enforcement action.

It is up to wait and see how this enforcement will unfold in the transition of the commission’s leadership. The current SEC Chairman Gary Gensler announced his departure on January 20, in concert with the inauguration of President-elect Donald Trump. Trump has named former SEC Commissioner Paul Atkins, considered friendlier to the crypto industry, as the head of the SEC.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

NFT

Unyted + Vesa

Unyted we (meta) stand

Many of the fancy metaverse projects take loooong to build and often require developers and budgets just to stay alive. In fact, one of my favorite ones had the whole company collapse around it in the build phase. I absolutely love what we’ve built with Superworld, for example, and what we’re about to release with Asvoria. Both of these require heavy machinery and rotation to come to life—and to be maintained.

Enter Unyted and my newest spatial Web3 space, which allows me to deliver fluent, up-to-date presentations on what’s happening now while also providing an overview of my entire career. I built it mostly by myself, with some guidance and glitch-fixing help from the team—special thanks to Tijana, Saskia, and Florian. I can update it in minutes to include a new project, presentation, or missing link. It’s freeing and necessary.

Unyted is at the forefront of spatial computing, offering innovative solutions that empower users to create, own, and monetize immersive 3D virtual environments. Their platform is designed to facilitate seamless transitions into the metaverse, providing tools for education, collaboration, and personalized digital experiences.

Link to join the metaverse

Link to join the X spaces.

Join us for a session with Ador, Bitcoin LIVE and others tomorrow 20.00 CET

Starting Thursday, we’ll kick things off with a joint presentation with Ador, and from there, we’ll host regular spaces that people can join visually. X is great for connecting with people, but for an artist, a lot is still missing from the full experience. Let’s see if we can bring these two innovations together in a sensible way.

Watch the Tijana introduction to Unyted as well as my keynote held some time ago regarding web3, metaverse and creativity.

Watch the Tijana introduction to Unyted as well as my keynote held some time ago regarding web3, metaverse and creativity.

Delivering the Metaverse

They’re just starting out, and sure, sure there are a few glitches, but I’ve already given a couple of presentations that feel like a real departure from the world of Zoom. Nothing is ever perfect and getting going and constantly working on it is what keeps the thing alive.

It’s a step closer to delivering something of real value in the metaverse. People showed up to my first keynote in the space done together, they asked questions and then some were left to wonder around the space to explore it on their own. Promises kept. Those matter, after the last run.

I’ve been friends with Florian Krueger since the early blockchain days in London back in 2018, and we’ve collaborated on several projects. He remains one of my favorite people in the crypto space—always looking out for his people and tirelessly fighting for the ethical side of it. I was happy to hear he was starting a new venture and that I could also be a part of.

If you prefer the (virtual) city life?

Key Features of Unyted:

- Modular Environments: Unyted enables users to design and customize digital spaces, such as virtual homes, offices, or campuses, reflecting their unique vision. These environments can be monetized, allowing creators to generate revenue through their virtual properties.

- EdTech Solutions: The platform offers immersive educational experiences with features like AI-driven personalized learning paths, customizable avatars, and virtual classrooms. These tools aim to enhance student engagement and retention, providing scalable and cost-effective solutions for educational institutions.

- Data Protection and Security: Operating under EU regulations and compliant with GDPR, Unyted ensures top-tier data protection. Users maintain complete control over their personal and institutional data, upholding responsible practices in the metaverse.

- Sustainability Commitment: Unyted is dedicated to sustainability, calculating energy consumption and offsetting carbon emissions for each project. Through Unyted.World, users can stake tokens specifically for carbon offsetting, promoting environmental responsibility within the digital landscape.

In many ways what is important about the metaverse is our ability to pre-visualise the world we would like to live in, and then walk toward that direction.

Founded in 2022 by Gaby K. Slezák and Florian Krueger, Unyted envisions a decentralized, independent metaverse where users have equal access to a secure three-dimensional internet. Their mission is to empower individuals to shape their digital futures, fostering a community where creativity and collaboration thrive.

For those seeking to explore the metaverse, Unyted offers consulting services to guide organizations through VR, AR, blockchain, Web3, and Web4 technologies. Their seasoned team provides strategy insights and design expertise to craft unique digital experiences aligned with organizational visions.

Unyted stands as a visionary force in the evolving digital landscape, pioneering innovation while prioritizing user ownership, open collaboration, data protection, and sustainability.

Ador aka BitSavage will join us for the Monday talk in which we also dwell deeper into DAF – the Department of Artistic Freedom

Asvoria coming up soon!

I’ll soon travel to Bulgaria to film some content in the Asvoria linked Hotel Satoshi Nakamoto, as well as guide the team on advances in our shiny updated metaverse space.

I’ll soon travel to Bulgaria to film some content in the Asvoria linked Hotel Satoshi Nakamoto, as well as guide the team on advances in our shiny updated metaverse space.

The art cars are also gearing up for their auction in Dubai in January, but more on that later.

See you Dec 5th 20.00 CET:

Link to join the metaverse

Link to join the X spaces.

Much to build,

VESA

Crypto Artist, Speaker, Consultant, Writer

All links to physical, NFTs, and more below

-

Altcoin24 hours ago

Altcoin24 hours agoArk Invest Gains First Exposure to Solana With 3iQ ETF Bet

-

Market24 hours ago

Market24 hours agoBitcoin ETFs Dominate Market Despite 72 Altcoin Proposals

-

Market23 hours ago

Market23 hours agoCardano (ADA) Jumps 4% as Bullish Signals Emerge

-

Altcoin23 hours ago

Altcoin23 hours agoPumpFun Moves $13M SOL To Kraken as Solana Price Consolidates, What Next?

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum to Emphasize Layer-1 Efficiency and UX in Upcoming Protocol Upgrades

-

Market22 hours ago

Market22 hours agoXRP Surpasses Ethereum In This Major Metric After Outperforming For 6 Months

-

Market21 hours ago

Market21 hours agoCrypto Firms Donated $85 million in Trump’s Inauguration

-

Market20 hours ago

Market20 hours agoSolana Leads Blockchain Metrics as SOL Momentum Builds

✓ Share: