Market

XRP Price Consolidates—Breakout Incoming or More Choppy Moves?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Why XRP Could Beat Dogecoin, Solana In ETF Race And Trigger A Price Surge

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

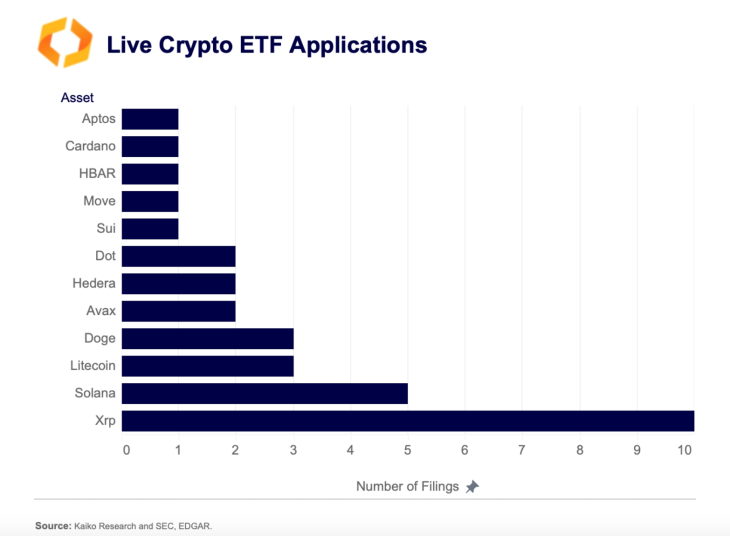

XRP remains one of the most popular coins in the market, with a cult-like community that has supported it for years. With the bullish sentiment surrounding it, the altcoin has performed quite well and continues to inspire support. The most recent developments for XRP have been the ETF filings that suggest it might be the next altcoin to get an SEC nod after Ethereum. The number of filings also puts it well ahead of investor favorites such as Solana and Dogecoin in the running for the next ETF approval.

XRP ETF Filings Climb To 10

XRP ETF filings have been coming out of the market over the past year, especially with the approvals of Ethereum Spot ETFs. These ETFs are expected to give institutional investors an official vehicle to get proper exposure to the market. As Bitcoin and Ethereum ETFs have been done and dusted, issuers have looked to other large cap altcoins to bring into the market.

Related Reading

The next favorites on the list have been XRP, in addition to heavy hitters such as Solana, Dogecoin, and Litecoin. However, in the race, XRP has clearly differentiated itself in terms of interest, boasting twice as many filings as any other altcoin.

According to data from Kaito Research, there are currently 10 XRP ETF filings pending approval or rejection from the SEC. In contrast, there are five Solana ETF filings, 3 Litecoin filing, and 3 Dogecoin filings. This shows clearly that interest in XRP as the next altcoin to gain ETF approval is the highest.

Additionally, the SEC has acknowledged the XRP ETF filings from industry leaders such as Grayscale. There are also filings from ProShares, Franklin Templeton, Bitwise, 21Shares, among others. However, BlackRock has not made a move to file for an XRP ETF despite leading the Bitcoin and Ethereum ETF campaigns.

Nevertheless, the filings for XRP ETFs remain a big deal for the altcoinm and their approval could trigger another wave of price hikes.

ETFs And The SEC Battle Conclusion

For many, the major hindrance to an SEC approval of an XRP ETF was the ongoing battle between the crypto firm and the regulator, which began in 2020. However, in March 2025, Ripple CEO Brad Garlinghouse announced that the case was officially over.

Related Reading

With this development, expectations that the regulator will look favorably upon an XRP ETF are high. If the ETFs are approved, even with a fraction of the Bitcoin ETF volumes, the XRP price is expected to explode in response, with some analysts predicting that the altcoin’s price could rise to the double-digits.

Featured image from Dall.E, chart from TradingView.com

Market

Expanding Blockspace and Enhancing Privacy

Ethereum Layer-2 (L2) network Base, incubated by Coinbase, has unveiled its product roadmap for the second quarter (Q2) 2025.

It indicates a bold slate of performance upgrades, enhanced privacy features, and broader support for developers.

Base Q2 Roadmap: Speed, Privacy, and Builder Adoption

In a detailed post on X (Twitter), Base’s development team outlined key objectives for the quarter. The roadmap reaffirms Base’s commitment to building in the open. It also lays the groundwork for scaling its role as a core pillar of the on-chain economy.

The plan to achieve 200ms effective block times on the mainnet is among the most eye-catching. The move could dramatically increase throughput and improve user experience.

Additionally, Base aims to scale blockspace from 30 to 50 Mgas/s and reach “Stage 1 decentralization.” Notably, they are key milestones in both performance and network security.

Privacy is also a central focus. Base is working to implement privacy-preserving on-chain account verification. This initiative reflects the growing importance of identity and privacy in a blockchain environment where transparency and pseudonymity often clash.

Beyond scaling and privacy, the roadmap details efforts to enhance its developer toolkit, notably expanding usage of the Base MCP (Modular Crypto Platform) tooling. This includes increasing weekly active apps built on OnchainKit and MiniKit and launching new Base Appchains on the mainnet.

The Base MCP tooling is part of a broader push to enable developers to go from “Idea to App, App to Business,” as described by the team. However, it is worth noting that MCP protocols have come under scrutiny recently due to a critical security flaw, raising concerns about their current implementations.

BeInCrypto recently reported on vulnerabilities that, if left unpatched, could expose user data or funds. This suggests that Base’s teams must prioritize security alongside growth.

“This risk comes from using a ‘poisoned’ MCP. Hackers could trick Base-MCP into sending your crypto to them instead of where you intended. If this happens, you might not notice,” Superoo7, head of Data and AI at Chromia, highlighted.

Base’s community-centric ethos is evident in its continued support for builder programs like Base Batches, Buildathons, and the Builder Rewards initiative. The team emphasized that these initiatives will support developers technically and economically, creating viable paths to earning a living by building on-chain.

Coinbase CEO Brian Armstrong also weighed in, endorsing the roadmap with a simple but affirming statement. This highlights Coinbase’s continued backing of the Layer-2 solution, which has become a standout in the ecosystem.

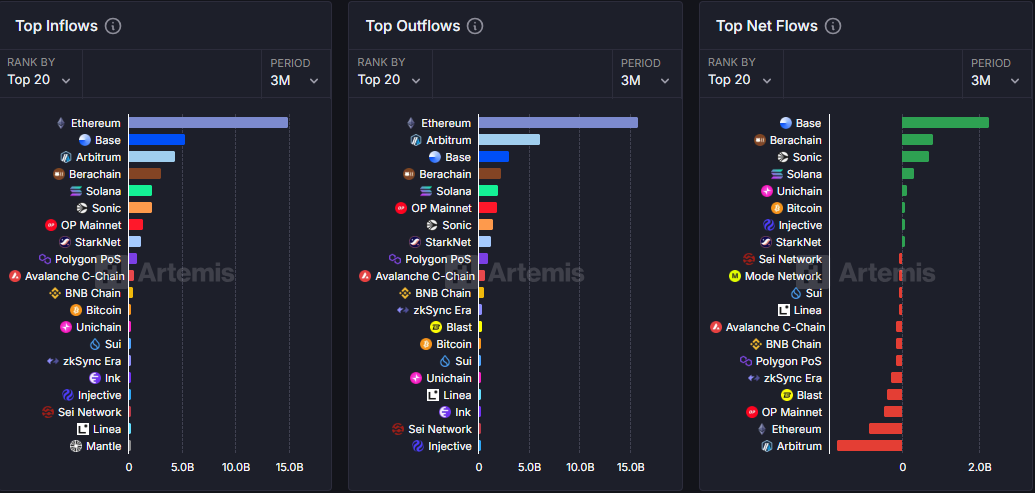

Base Blockchain Leads Net Flows Across DeFi Bridges

Base has emerged as a top performer in 2025, leading the market in net flow over the past three months. On total inflow metrics, data on Artemis Terminal shows it is second, after Ethereum (ETH). This traction reflects growing user confidence and adoption across DeFi, gaming, and NFT verticals.

Still, the network has not been immune to controversy. Only hours ago, Base faced backlash after a meme coin, allegedly promoted by insiders, triggered a trading frenzy and abrupt collapse. As BeInCrypto reported, this raised accusations of a pump-and-dump scheme.

While Base distanced itself from the coin in question, the incident raises concerns about transparency and ethical boundaries on the platform.

“This wasn’t a meme coin. This wasn’t a token launch. Base didn’t drop a coin to pump bags or flip the market. This was a content coin — and that distinction matters,” Base developer Charis posted on X.

As Base moves into Q2, it stands at a crossroads. On the one hand, it is armed with performance upgrades and developer momentum. On the other hand, it faces heightened scrutiny.

If successful, its roadmap could further cement Base’s place as a foundation of the next-generation internet. However, the pressure to balance innovation, security, and trust has never increased.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Range-Bound—But a Move Higher May Be Brewing?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

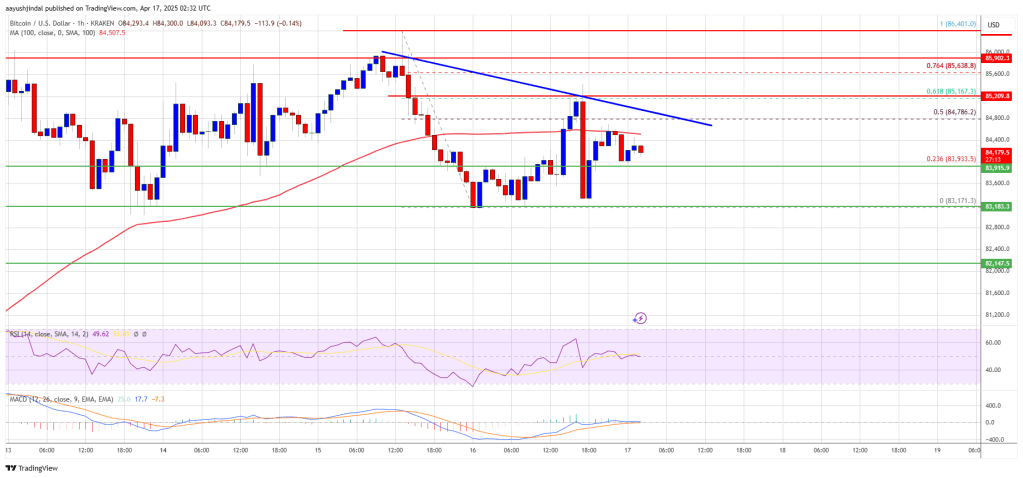

Bitcoin price started a fresh decline below the $85,500 zone. BTC is now consolidating and might attempt to clear the $85,200 resistance zone.

- Bitcoin started a fresh decline below the $85,500 zone.

- The price is trading below $85,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $84,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,000 zone.

Bitcoin Price Eyes Fresh Increase

Bitcoin price struggled near the $86,500 zone and started a fresh decline. BTC declined below the $85,500 and $85,000 levels to enter a short-term bearish zone.

The price tested the $83,200 support. A low was formed at $83,171 and the price recently corrected some losses. There was a move above the $83,800 level. The price surpassed the 50% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low.

Bitcoin price is now trading below $85,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $84,750 level. There is also a connecting bearish trend line forming with resistance at $84,800 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $85,150 level or the 61.8% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low. The next key resistance could be $85,500.

A close above the $85,500 resistance might send the price further higher. In the stated case, the price could rise and test the $85,800 resistance level. Any more gains might send the price toward the $86,400 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,000 resistance zone, it could start another decline. Immediate support on the downside is near the $83,900 level. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $83,200, followed by $82,200.

Major Resistance Levels – $84,750 and $85,150.

-

Altcoin24 hours ago

Altcoin24 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Altcoin19 hours ago

Altcoin19 hours agoDOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

-

Market21 hours ago

Market21 hours agoHow It’s Impacting the Network

-

Market17 hours ago

Market17 hours agoBitcoin and Ethereum Now Accepted by Panama City Government

-

Market24 hours ago

Market24 hours agoThis Crypto Security Flaw Could Expose Seed Phrases

-

Market14 hours ago

Market14 hours agoCrypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Reveals Why The Solana Price Can Still Drop To $65

-

Market20 hours ago

Market20 hours agoRaydium’s New Token Launchpad Competes with Pump.fun