Market

X (Twitter) Banned in Brazil and More

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup notes that Brazil’s government has banned X (formerly Twitter) due to its non-compliance with local regulations. Meanwhile, Chile has initiated a legal battle against Worldcoin due to concerns over biometric data, among other updates.

Bitcoin Adoption in El Salvador: Progress or Setback?

El Salvador’s President Nayib Bukele has acknowledged that Bitcoin adoption in his country has not advanced as quickly as expected. This comment is particularly interesting, given that the country declared BTC as legal tender in 2021.

In an interview with TIME Magazine, Bukele described the results as “positive,” although he admitted that the anticipated benefits were not achieved. Although large businesses in El Salvador, such as supermarkets and restaurant chains, accept Bitcoin as a means of payment, mass adoption has not materialized.

Read more: Who Owns the Most Bitcoin in 2024?

To date, Bukele’s government has promoted the use of cryptocurrency in daily transactions and also put forward ambitious proposals such as the creation of Bitcoin City. This initiative intends to build a city powered by geothermal energy from volcanoes that would serve as a global hub for cryptocurrencies. In addition, the president has launched a citizenship program for people who invest at least $1 million in Bitcoin or Tether, with the aim of attracting international investors.

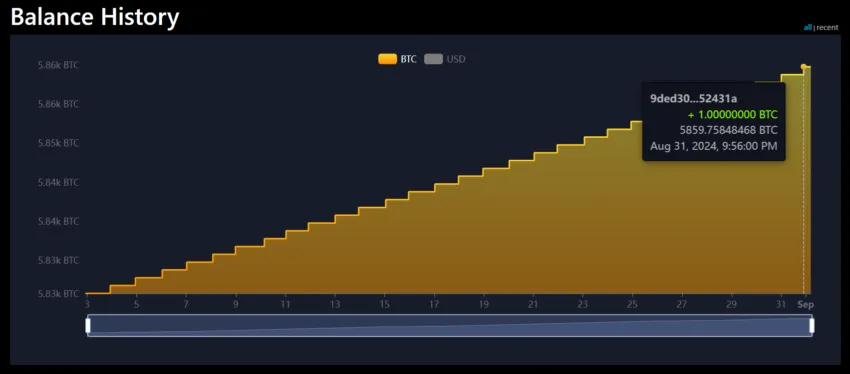

However, despite these efforts, Bukele’s administration remains strongly supportive of Bitcoin. Since the president implemented the Dollar Cost Averaging (DCA) strategy to buy one Bitcoin daily, the country has consistently purchased BTC regardless of market conditions.

At the time of writing, El Salvador’s mempool shows that the government holds 5,859 BTC. With the current market price of Bitcoin, this amount is equivalent to approximately $346.35 million.

Brazil has suspended the social media platform X following its failure to comply with local regulations. Minister Alexandre de Moraes ordered the ban after Elon Musk’s company neglected to appoint a legal representative in the country. The platform is expected to become inaccessible within 24 hours.

In addition to the ban, Brazil has imposed a fine of R$50,000 (approximately $10,000 USD) per day on individuals or companies using VPNs to access the app. Apple and Google have also been given a five-day deadline to remove the app from their stores.

This situation arose after X removed its legal representatives from Brazil in response to what Musk described as “untenable demands” from the Brazilian court, including censorship and privacy concerns.

Considering Brazil’s sixth-place global ranking for the number of X users, a ban could have significant consequences. Furthermore, this decision could impact the country’s crypto community.

X is a crucial platform for real-time market updates and crypto discussions. A potential ban would significantly challenge investors who rely on the platform for information and market insights.

According to a recent survey by CoinGecko, 34.4% of crypto traders and investors rely on X for their information needs. Specifically, 66.7% of the 1,065 survey participants identified X as their primary source of crypto information.

Worldcoin Sued in Chile Over Biometric Data Concerns

Chile’s National Consumer Service (SERNAC) has filed a lawsuit against the Optimistic SpA Group, the company that operates Worldcoin in the country. The lawsuit, submitted to the 2nd Local Police Court of Las Condes, cited irregularities in collecting biometric data from Chilean citizens.

SERNAC’s investigation uncovered multiple violations of the Consumer Law, particularly concerning the lack of transparency and inadequate protection of personal data.

The Chilean agency seeks to impose substantial fines, potentially reaching $20 million, on Worldcoin for its alleged misconduct. Additionally, it demands the immediate halt of Worldcoin’s operations in the country until the legal issues are resolved.

US Bill Reaffirms Sanctions on Venezuela, Targeting Cryptocurrencies

Amid ongoing political tensions, US Congress members are preparing to introduce a bill that will reinforce sanctions against Venezuela, with a specific focus on cryptocurrencies. The proposed “Law for the Promotion of Freedoms, Opportunities and Rights in Venezuela” (VALOR) seeks to maintain pressure on the Venezuelan government by blocking the assets of key financial institutions, including the Central Bank of Venezuela and the state-owned cryptocurrency, Petro.

This legislation, spearheaded by Congresswoman María Elvira Salazar, aims to tighten existing measures and expand the reach of US sanctions to ensure Venezuela remains under international scrutiny.

“The VALOR Act will do just that by seeking international cooperation for a peaceful transition to democracy in Venezuela and maintaining sanctions until there is substantial and measurable progress,” Salazar said.

In 2018, the Trump administration also implemented measures against Petro, a cryptocurrency the Maduro government launched to sidestep US sanctions. Trump labeled Petro as a corruption tool and a desperate bid to sustain the government.

Stellar Invests in Colombia’s Puntored to Boost Cross-Border Payments

The Stellar Development Foundation (SDF) announced investing $2 million in the Colombian FinTech company Puntored. They facilitated this investment through the Stellar Enterprise Fund as part of an effort to use blockchain technology to enhance remittance services and financial inclusion in Latin America.

Colombia has seen a significant increase in remittance inflow. The country’s Ministry of Finance reported a 17.3% rise between January and July 2024 compared to the previous year.

Read more: How To Accept Crypto Payments: A Brief Guide

Stellar’s collaboration with Puntored currently serves over 18 million users across Colombia, Mexico, and Puerto Rico. Therefore, this partnership is expected to transform the digital payments sector in the region.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

Vitalik Buterin Proposes to Replace EVM with RISC-V

Ethereum (ETH) co-founder Vitalik Buterin has proposed overhauling the blockchain’s smart contract infrastructure by replacing the Ethereum Virtual Machine (EVM) with RISC-V, a widely adopted open-source instruction set architecture.

This shift aims to address one of Ethereum’s key scaling bottlenecks by dramatically improving the efficiency and simplicity of smart contract execution.

Buterin Proposes Ditching EVM for RISC-V

The proposal was detailed in a post on the Ethereum Magicians forum. In it, Buterin suggested that smart contracts could eventually be compiled to RISC-V rather than EVM bytecode.

According to Buterin, this shift addresses long-term scalability challenges. This particularly includes keeping block production competitive and improving zero-knowledge (ZK) EVM-proof efficiency.

“It aims to greatly improve the efficiency of the Ethereum execution layer, resolving one of the primary scaling bottlenecks, and can also greatly improve the execution layer’s simplicity – in fact, it is perhaps the only way to do so,” he wrote.

Current ZK-EVM implementations spend around half of their proving cycles on EVM execution. By switching to a native RISC-V VM, Ethereum could potentially achieve up to 100x efficiency gains.

Importantly, many fundamental aspects of Ethereum’s architecture would remain unchanged, preserving continuity for developers and users. Core abstractions such as accounts, smart contract storage, ETH balances, and cross-contract calls would function exactly as they do today.

Developers would still write contracts in familiar languages like Solidity or Vyper. These would simply be compiled to RISC-V rather than EVM bytecode. Tooling and workflows would remain largely intact, ensuring a smooth transition.

Crucially, the proposal ensures backward compatibility. Existing EVM contracts will remain fully operational and interoperable with new RISC-V contracts.

Buterin outlines several potential implementation paths forward. The first would support both EVM and RISC-V smart contracts natively. The second suggests wrapping EVM contracts to run via an interpreter written in RISC-V. Thus, it would enable a full transition without breaking compatibility.

The third, more modular approach, builds on the second by formally enshrining interpreters as part of the Ethereum protocol. This would allow the EVM and the future virtual machines to be supported in a standardized way.

Buterin stated that the idea is “equally as ambitious as the beam chain effort.”

“The beam chain effort holds great promise for greatly simplifying the consensus layer of Ethereum. But for the execution layer to see similar gains, this kind of radical change may be the only viable path,” Buterin added.

For context, the Ethereum Beam Chain is a redesign of Ethereum’s consensus layer (Beacon Chain). It focuses on faster block times, faster finality, chain snarkification, and quantum resistance. The development will likely begin in 2026.

This proposal fits into Ethereum’s broader vision of modularity, simplicity, and long-term scalability. Previously, BeInCrypto reported on Buterin’s privacy-centric plans for the blockchain.

The proposal focused on integrating privacy-preserving technologies. Moreover, the Pectra upgrade is also nearing, with the launch expected on May 7.

Meanwhile, ETH continues to face market headwinds, trading at March 2023 lows. This year has been quite hard for the altcoin, as it saw a decline of 50.8%. In fact, Ethereum dominance hit a 5-year low last week.

Nonetheless, BeInCrypto data showed a slight recovery over the last 14 days. ETH rose by 6.1%. Over the past day alone, it saw modest gains of 1.7%. At the time of writing, ETH was trading at $1,639.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

Solana started a fresh increase from the $120 support zone. SOL price is now consolidating and might climb further above the $142 resistance zone.

- SOL price started a fresh increase above the $125 and $132 levels against the US Dollar.

- The price is now trading above $130 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if it clears the $142 resistance zone.

Solana Price Gains Over 5%

Solana price formed a base above the $120 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $125 and $132 resistance levels.

The pair even spiked toward the $145 resistance zone. A high was formed at $143.06 and the price is now retreating lower. There was a move below the 23.6% Fib retracement level of the upward move from the $135 swing low to the $143 high.

Solana is now trading above $130 and the 100-hourly simple moving average. There is also a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair. The trend line is close to the 76.4% Fib retracement level of the upward move from the $135 swing low to the $143 high.

On the upside, the price is facing resistance near the $142 level. The next major resistance is near the $145 level. The main resistance could be $150. A successful close above the $150 resistance zone could set the pace for another steady increase. The next key resistance is $155. Any more gains might send the price toward the $165 level.

Pullback in SOL?

If SOL fails to rise above the $142 resistance, it could start another decline. Initial support on the downside is near the $138.50 zone. The first major support is near the $137 level and the trend line.

A break below the $137 level might send the price toward the $132 zone. If there is a close below the $132 support, the price could decline toward the $125 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $137 and $132.

Major Resistance Levels – $142 and $145.

Market

Bitcoin Price Breakout In Progress—Momentum Builds Above Resistance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price is slowly moving higher above the $86,500 zone. BTC is gaining pace and might continue higher in the near term.

- Bitcoin found support at $84,200 and started a recovery wave.

- The price is trading above $85,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $88,000 zone.

Bitcoin Price Eyes Steady Increase

Bitcoin price remained stable above the $83,200 level and started a fresh increase. BTC was able to climb above the $84,200 and $85,000 resistance levels.

There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair. The bulls were able to pump the price above the $86,500 resistance. It even spiked above $87,000. A high is formed near $87,562 and the price might continue to rise unless there is a move below the 23.6% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high.

Bitcoin price is now trading above $86,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $87,500 level. The first key resistance is near the $88,000 level.

The next key resistance could be $88,800. A close above the $88,800 resistance might send the price further higher. In the stated case, the price could rise and test the $89,500 resistance level. Any more gains might send the price toward the $90,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $88,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $87,000 level. The first major support is near the $86,750 level.

The next support is now near the $86,000 zone. Any more losses might send the price toward the $85,750 support or the 50% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high in the near term. The main support sits at $84,850.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $86,750, followed by $86,000.

Major Resistance Levels – $87,500 and $88,000.

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market15 hours ago

Market15 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market21 hours ago

Market21 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market19 hours ago

Market19 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Altcoin24 hours ago

Altcoin24 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market20 hours ago

Market20 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Enters Historic Buy Zone As Price Dips Below Key Level – Insights