Market

WLFI Token Sale, and More

This week, several major cryptocurrency events are expected to drive volatility across key tokens. Among the highlights are large token unlocks, Donald Trump’s WLFI token sale, and the long-anticipated token generation event (TGE) for DeBridge.

These developments, along with updates from the decentralized finance (DeFi) and blockchain sectors, are likely to influence investor behavior and shape market performance in the coming days.

World Liberty Financial Token Sale

Donald Trump’s DeFi venture, World Liberty Financial, is set to launch its WLFI token on Tuesday, October 15. The project promises to democratize and depoliticize finance, offering an alternative to traditional financial institutions.

“World Liberty Financial Token Sale goes live on Tuesday morning, October 15th! This is YOUR chance to help shape the future of finance. Be there on Monday, October 14th at 8 AM EST for an Exclusive Spaces to learn more. Join the whitelist today and be ready for Tuesday,” an announcement read.

As markets anticipate the debut of the WLFI token, uncertainty surrounds the project’s overall dynamics. BeInCrypto reported at the project’s official launch that crypto investors have expressed a dented first impression of World Liberty Financial. Concerns about its viability, business model, and ability to deliver on its promises continue to be topics of discussion.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

Despite these uncertainties, WLFI is reportedly targeting $300 million in its upcoming token sale. WLFI will function as a governance token, granting holders the right to participate in the ecosystem’s development and decision-making. Notably, the sale will only be accessible to select individuals.

Binance to Delist ORN for LUMIA

Binance is also on the top crypto news this week, with a planned delisting of Orion (ORN) token. This is part of a rebranding process, with ORN transitioning to Lumia (LUMIA). Notably, the transition from ORN to LUMIA will occur at a 1:1 ratio, mirroring the recent MATIC to POL migration.

“We are pleased to inform you that Binance will support the Orion (ORN) mainnet swap and rebranding to Lumia (LUMIA). Binance will handle all technical requirements for users involved in this event. Please note that all ORN tokens will be swapped to LUMIA at a ratio of 1 ORN = 1 LUMIA,” Binance announced.

This means that after October 15, traders would not be able to trade ORN on Binance, but LUMIA instead. The supply of LUMIA tokens will more than double that of ORN, from 92,631,255 million to 238,888,888 million.

Lumia, which is a pioneer hyper-liquid restaking rollup Layer-2 (L2) for Real-World Assets, asked ORN token holders on other exchanges to wait for confirmation about swaps to LUMIA from those trading platforms about the transition.

First Avalanche Summit in LATAM

Traders and investors will also be watching AVAX price in the days leading to, and after, Wednesday, October 16, when the Avalanche Summit LATAM will take place at the Ciudad Cultural Konex in Buenos Aires, Argentina.

“We are thrilled to bring the Avalanche Summit to Latin America for the first time. We chose Buenos Aires for its exceptional talent pool and its rapid evolution as a key player in the world of Web3 and blockchain,” said Emin Gün Sirer, CEO of Ava Labs.

The last Avalanche Summit took place on May 3 in Spain, remembered to be bullish on blockchain, gaming, and Web3. The two-day event, between Wednesday and Friday, will offer a unique opportunity for developers, entrepreneurs, and blockchain technology enthusiasts to connect and learn about the latest innovations in the Avalanche ecosystem.

Noteworthy, the residents of Latin America have free entry benefits, as the event commits to be a milestone in the history of blockchain in the region. It will set the stage for the Avalanche-based game Off The Grid, potentially setting the tone for it to become a top gameplay on Epic Games.

Network participants also anticipate the launch of Avalanche 9000, an update that promises to change the way of applications development and launches on the blockchain.

deBridge TGE and DBR Airdrop

deBridge Finance will hold its token generation event (TGE) on Thursday, positioning itself as “the bridge that DeFi deserves.” The project has three primary stakeholders: the team, strategic partners, and the community. DBR, an SPL token on Solana, serves as the governance token for the deBridge ecosystem.

As the TGE approaches, deBridge will launch with an initial circulating supply of 1.8 billion tokens, or 18% of the total supply, aligning with other Solana TGEs like Pyth (15%) and Wormhole (18%). Jupiter (JUP) community members will also benefit from the event, as it includes an airdrop.

“When Jupiter had an airdrop, deBridge users received 4.6 million JUP because Jupiter’s API was integrated into deBridge’s API. Similarly, Jupiter users are now among the largest DBR airdrop recipients because the deBridge widget and API are integrated into the JUP ecosystem,” deBridge Finance co-founder Alex Smirnov said.

WCT Airdrop Registration Deadline

The WalletConnect (WCT) airdrop registration closes on Friday, October 18, with interested participants urged to act before the four-day window elapses. Further, users should use the WalletConnect option instead of connecting their wallet directly.

The registration started on September 24, and as the window closes on Friday, the token checker and claim will be in November 2024. According to an official blog announcement, 18.5% of the total supply, or 185 million WCT tokens, are allocated to the community.

Read more: Best Upcoming Airdrops in 2024

5% of the total DBR supply will be distributed in the first airdrop, with an additional 13.5% slated for subsequent airdrops in 2025. Additionally, users who mint the Wallet Connect badge will automatically rank among the top 1% of WCT airdrop farmers, granting them priority in future distributions.

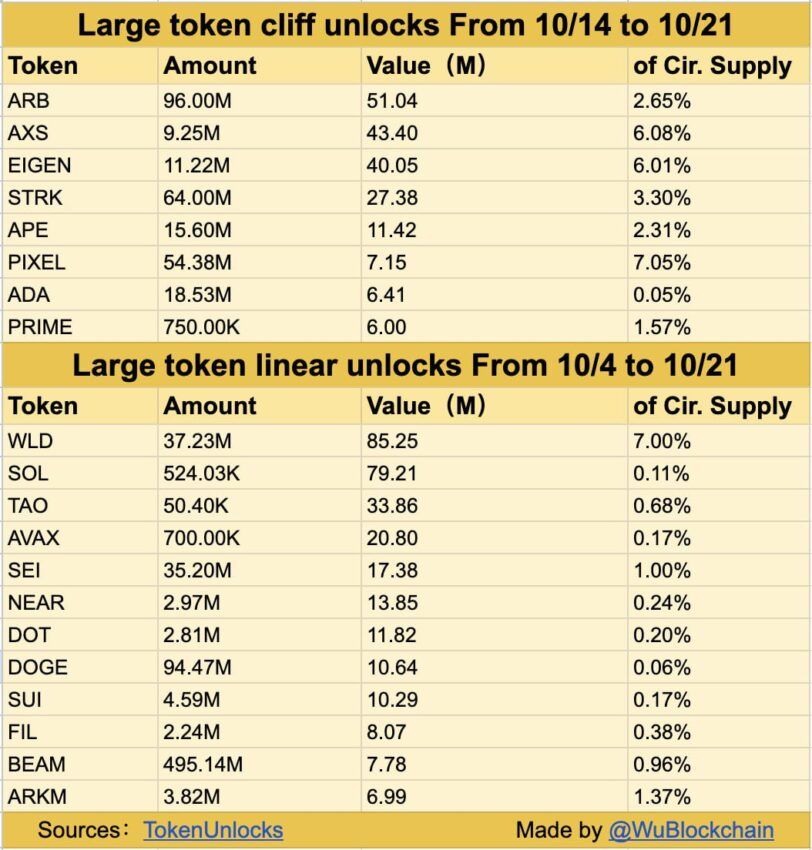

Over $173 Million Worth Cliff Unlocks

As BeInCrypto reported, there are several token unlock events this week. The most significant ones will concern Axie Infinity (AXS), Starknet (STRK), EigenLayer (EIGEN), Arbitrum (ARB), and ApeCoin (APE). Collectively, these unlocks will release over $173.29 million across the respective ecosystems.

Token unlocks often increase market liquidity and cause volatility. As these tokens enter circulation, their prices may experience flactuations, making it essential for traders to monitor the events closely.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Tries to Resume Lawsuit Against the FDIC

Coinbase asked a DC District Court if it could resume its old lawsuit against the FDIC. Coinbase sued this regulator over Operation Choke Point 2.0 and claimed that it’s still refusing to release relevant information.

Based on the information available so far, it’s difficult to draw definitive conclusions. The FDIC maintains that it responded to its opponents’ questions truthfully, though it has shown delays in the past.

Coinbase vs the FDIC

Coinbase, one of the world’s largest crypto exchanges, has been in a few fights with the FDIC. The firm has been pursuing the FDIC over Operation Choke Point 2.0 for months now, and has achieved impressive results. Despite this, however, Coinbase is asking the DC District Court to resume its litigation against the regulator:

“We’re asking the Court to resume our lawsuit because the FDIC has unfortunately stopped sharing information. While we would have loved to resolve this outside of the legal system – and we do appreciate the increased cooperation we’ve seen from the new FDIC leadership – we still have a ways to go,” claimed Paul Grewal, Coinbase’s Chief Legal Officer.

The FDIC has an important role in US financial regulation, primarily dealing with banks. This gave it a starring role in Operation Choke Point 2.0, hampering banks’ ability to deal with crypto businesses. However, it recently started a pro-crypto turn, releasing tranches of incriminating documents and revoking several of its anti-crypto statutes.

Grewal said that he “appreciated the increased cooperation” from the FDIC but that the cooperation stopped weeks ago. According to Coinbase’s filing, the FDIC hasn’t sent any new information since late February and claimed in early March that the exchange’s subsequent requests were “unreasonable and beyond the scope of discovery.”

On one hand, the FDIC has previously been slow to make relevant disclosures in the Coinbase lawsuit. On the other hand, Operation Choke Point 2.0 sparked significant tension within the industry, and a determined group is now aiming to significantly weaken the regulatory bodies involved.

Until the legal battle continues, it’ll be difficult to make any definitive statements. The FDIC will likely have two weeks to respond to Coinbase’s request.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

Larry Fink, CEO of BlackRock, claimed in a recent letter that Bitcoin and crypto could damage the dollar’s international standing. If investors treat Bitcoin as an inflation hedge to the dollar, it could precipitate serious trouble.

However, he was also adamant that the industry offers a lot of advantages, particularly through tokenization.

Larry Fink Sees Opportunity in Crypto

BlackRock is the leading Bitcoin ETF issuer in the US, and its CEO Larry Fink has long been bullish on Bitcoin. However, as Fink described in his most recent Annual Chairman’s Letter to investors, crypto’s best interest doesn’t always align with TradFi or the dollar.

“The US has benefited from the dollar serving as the world’s reserve currency for decades. But that’s not guaranteed to last forever. By 2030, mandatory government spending and debt service will consume all federal revenue, creating a permanent deficit. If the US doesn’t get its debt under control… America risks losing that position to digital assets like Bitcoin,” he said.

To be clear, Fink insisted that he supports crypto and listed some practical problems that he believes it can solve. He expressed a particular interest in asset tokenization, claiming that a digital-native infrastructure would improve and democratize the TradFi ecosystem.

Despite these advantages, Fink recognizes the danger that crypto can present to the US economy if not properly managed. He addressed the longstanding practice of using crypto to hedge against inflation, a wise practice for many assets.

However, if a wide swath of investors think Bitcoin is more stable than the dollar, it would threaten USD’s status as the world reserve currency. A scenario like that would be very dangerous to all of TradFi, and Fink has a particular interest in protecting BlackRock. Such an event would doubtlessly impact crypto as well.

“Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America’s economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar,” Fink added.

He didn’t offer too many specific solutions to this growing problem, but Fink isn’t the only person concerned with the issue. President Trump recently suggested that stablecoins could promote dollar dominance worldwide. Even if the dollar is seen as unstable, its adoption within a rapidly growing global industry like stablecoins could help reinforce its strength and relevance.

Of course, there are also drawbacks to Trump’s plan. Larry Fink acknowledged a possible threat from crypto, but continues to espouse its utility. Its benefits are too good to ignore.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Bears Lead, But Bulls Protect Key Price Zone

XRP has experienced a significant downturn in recent price action, with its value dropping nearly 15% over the past seven days as bears maintain control of the market. The coin’s technical indicators are showing mixed signals, with the RSI rebounding from oversold territory while Ichimoku Cloud patterns continue to paint a predominantly bearish picture.

Despite yesterday’s test of the critical $2.06 support level resulting in a temporary bounce, the momentum remains negative, with short-term EMAs positioned below long-term averages. The move from extreme oversold conditions suggests XRP might be entering a consolidation phase before its next significant price movement.

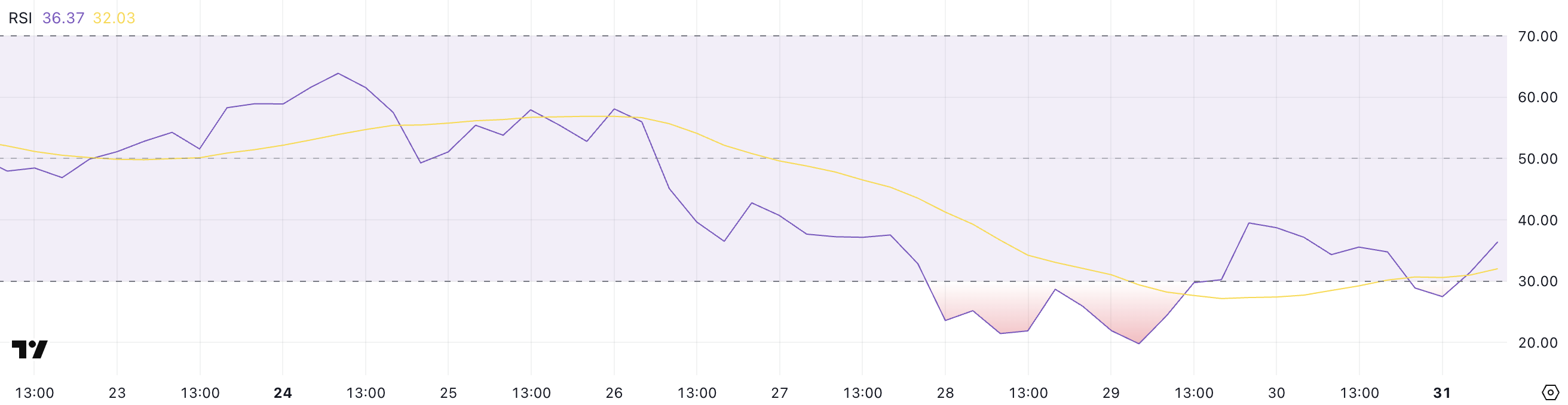

XRP RSI Is Up From Oversold Levels

XRP’s Relative Strength Index (RSI) is currently at 36.37, showing a notable rebound from a low of 27.49 just a few hours ago. This upward shift indicates a shift in momentum, as buying interest has started to pick up after a period of heavy selling pressure.

Although still in the lower range, this recovery suggests that traders may be stepping back in. That could mean they are potentially viewing the recent dip as an opportunity.

RSI is a widely used momentum indicator that measures the speed and change of price movements on a scale from 0 to 100. Readings below 30 typically indicate that an asset is oversold and may be undervalued, while readings above 70 suggest it is overbought and could be due for a correction.

XRP’s bounce from 27.49 to 36.37 signals that it may have just exited oversold conditions. This could mean that the recent selling phase is easing. If the buying momentum continues to build, XRP might be entering the early stages of a potential recovery.

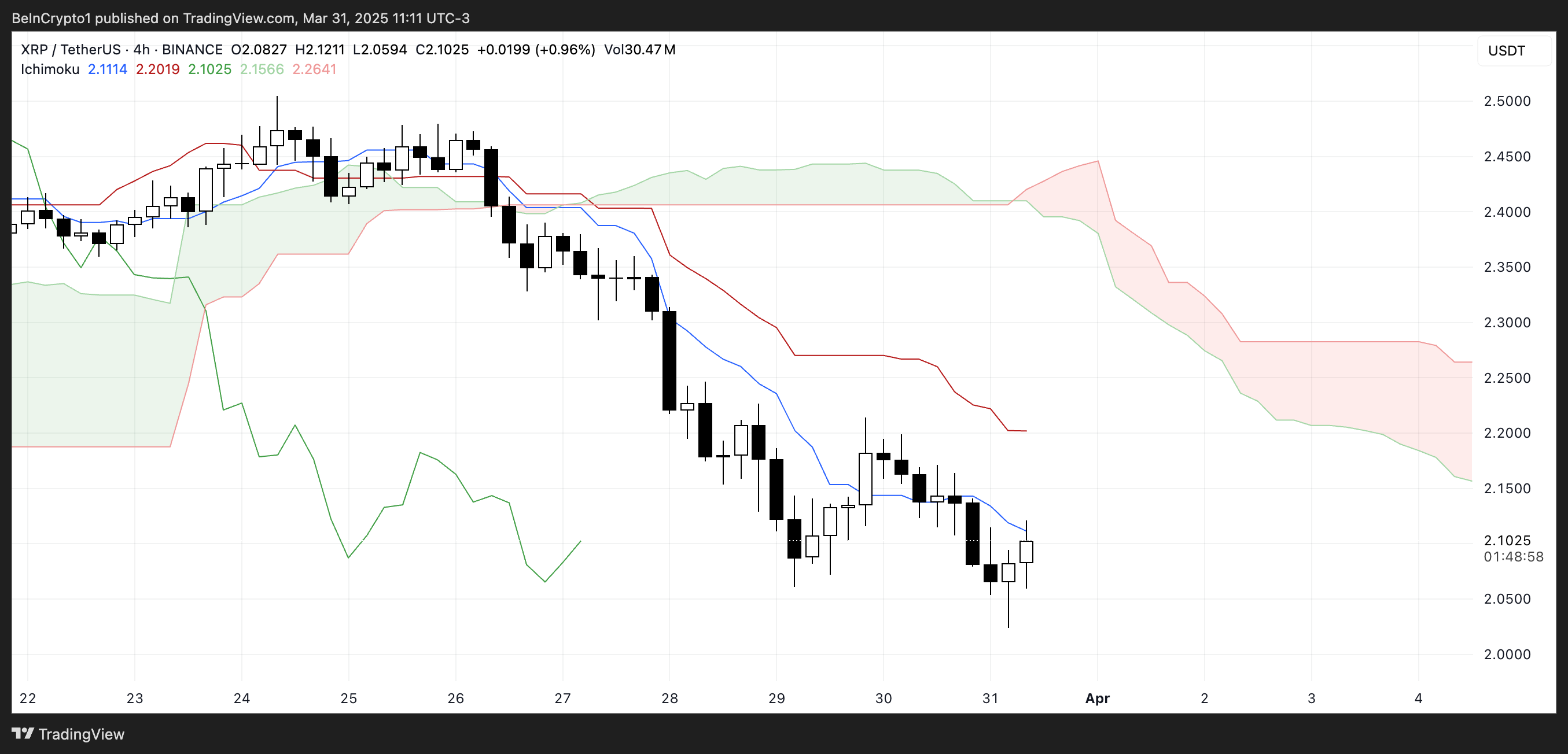

XRP Ichimoku Cloud Shows A Bearish Scenario

XRP’s Ichimoku Cloud chart shows that the price action remains below both the red baseline (Kijun-sen) and the blue conversion line (Tenkan-sen). That indicates the prevailing momentum is still bearish.

The candles are also forming well beneath the cloud, which reflects a broader downtrend.

When the price is under all major Ichimoku components like this, it typically signals continued downward pressure unless a strong reversal breaks those resistance levels.

Additionally, the cloud ahead is red and spans horizontally with a downward slope, reinforcing the bearish outlook in the near term. The thickness of the cloud suggests moderate resistance if the price attempts to move upward.

However, some consolidation is evident in the recent candles, showing that sellers may be losing some control.

For any potential trend reversal, XRP would need to break above the Tenkan-sen and Kijun-sen, and eventually challenge the cloud itself — a move that would require a clear uptick in momentum.

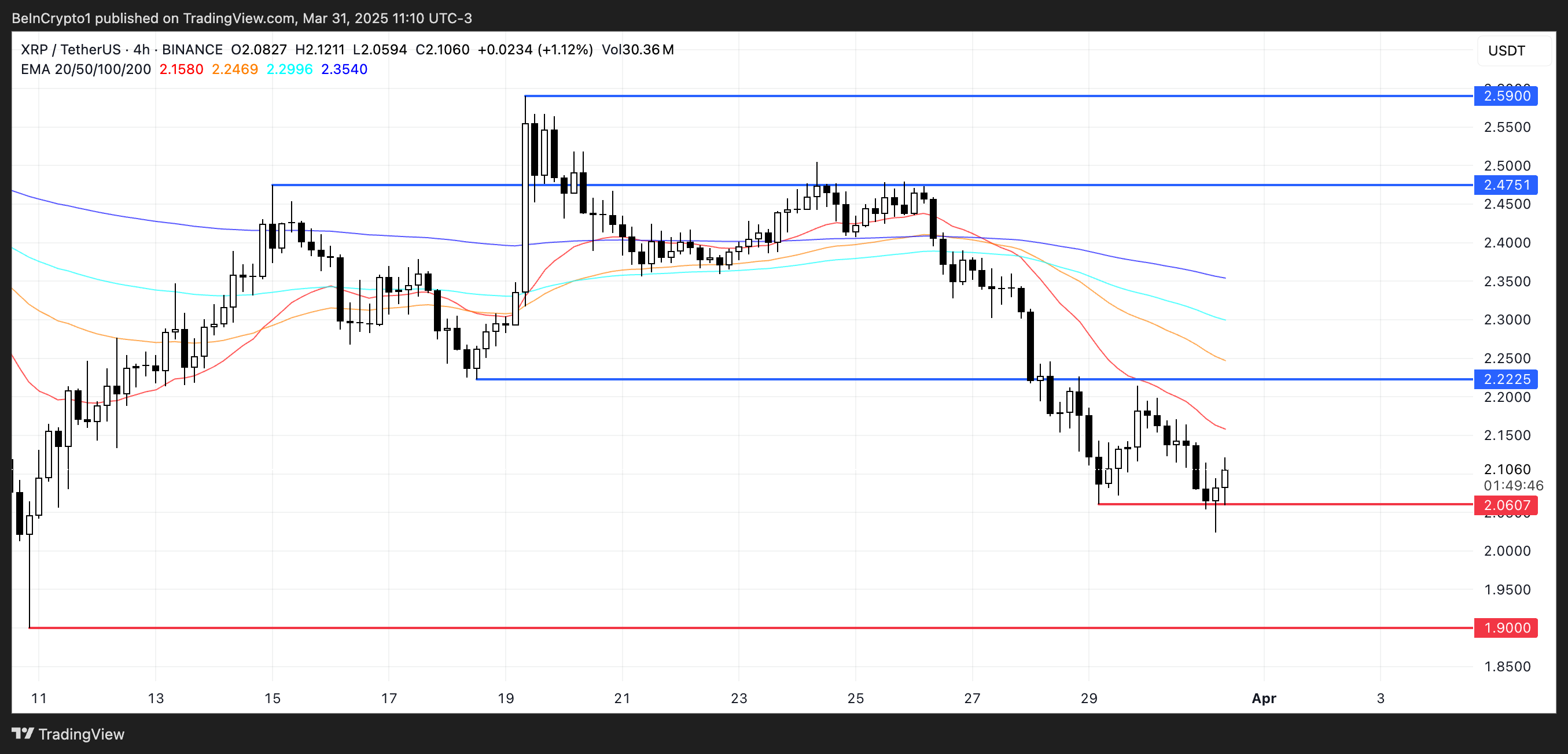

XRP Could Rise After Testing An Important Support Yesterday

XRP’s EMA lines are clearly aligned in a bearish formation, with the short-term averages sitting well below the long-term ones and a noticeable gap between them—highlighting strong downward momentum.

Yesterday, XRP price tested the support level at $2.06 and rebounded, showing that buyers are still active at that zone. However, this support remains critical. If it is tested again and fails to hold, XRP could fall further. Its next major support sitting around $1.90.

If the trend begins to shift and XRP breaks above the short-term EMAs, the first key resistance to watch is at $2.22. A successful move above this level could trigger a stronger recovery, potentially pushing the price toward $2.47.

If bullish momentum continues, the next upside target would be $2.59. For now, though, the EMA structure still leans bearish. XRP would need sustained buying pressure to flip the trend and aim for those higher resistance levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoCardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

-

Market19 hours ago

Market19 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market18 hours ago

Market18 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Market14 hours ago

Market14 hours agoThis Is How Dogecoin Price Reacted To Elon Musk’s Comment

-

Regulation7 hours ago

Regulation7 hours agoUSDC Issuer Circle Set To File IPO In April, Here’s All

-

Bitcoin13 hours ago

Bitcoin13 hours agoUS Macroeconomic Indicators This Week: NFP, JOLTS, & More

-

Market6 hours ago

Market6 hours agoPi Network Struggles, On Track for New All-Time Low

-

Market13 hours ago

Market13 hours agoDon’t Fall for These Common Crypto Scams