Market

Why TAO Price May Struggle to Sustain Gains After 111% Surge

In September, Bittensor’s (TAO) price surged 111%, rising from $264 to $587. However, as October begins, several indicators suggest that TAO’s price may encounter resistance, potentially limiting further gains.

Popularly called “Uptober,” due to its historically bullish performance, the broader market expected many cryptos to end the month with positive returns. While TAO could do the same, this analysis explains why the altcoin may struggle in the first few days.

Bittensor May Soon Be Overbought

TAO’s impressive performance in September is closely tied to several developments in Artificial Intelligence (AI) sector. This surge in interest has caused significant price swings, as evidenced by the widening of the Bollinger Bands (BB) on the daily chart.

Bollinger Bands typically expand during periods of high volatility, and TAO’s case is no exception. Furthermore, the indicator also shows if an asset is overbought or oversold. When the upper band of BB touches the price, it is overbought, and when the lower band does, it is oversold.

The chart below shows that TAO’s price at $585.50 is close to tapping the upper band. Considering the momentum around the altcoin, the price might increase to $660. Once it does, it will be overbought, and a pullback could be on the cards.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

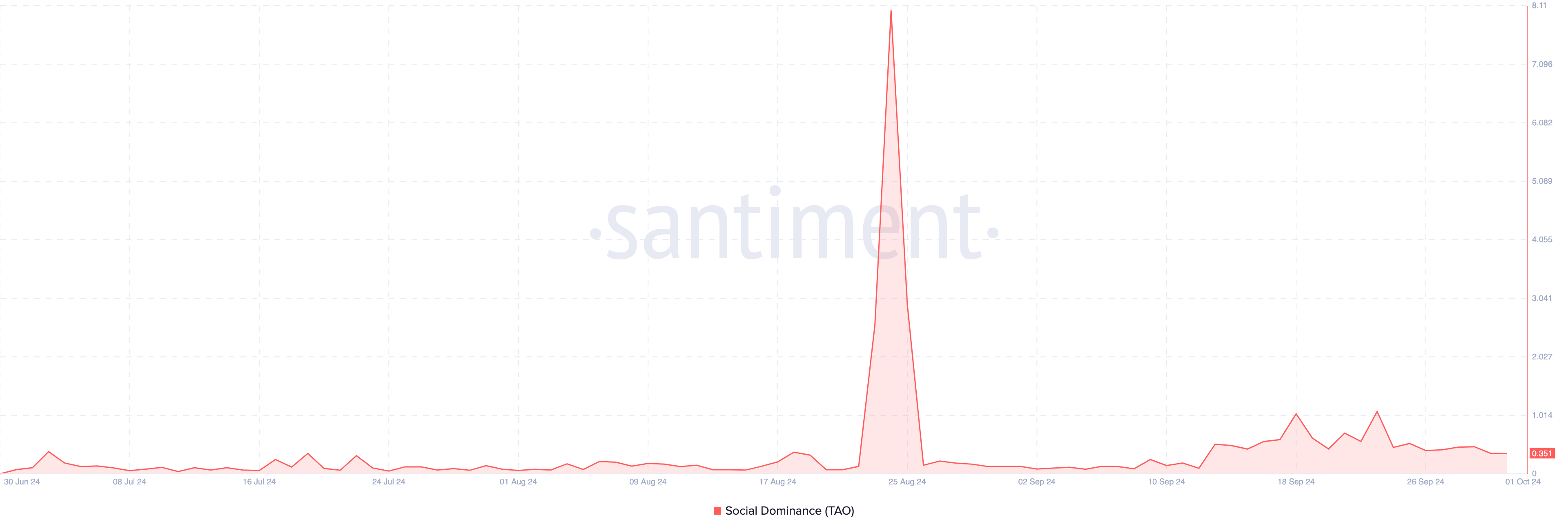

From an on-chain perspective, Bittensor’s social dominance is one metric supporting the prediction. Social dominance compares the rate of discussions around a cryptocurrency to other assets in the top 100.

When it increases, it means that the market is paying more attention to the asset, which could help increase demand. A decrease, on the other hand, indicates that most investors are overlooking the assets, which could lead to consolidation or, in a worst-case scenario, drag TAO’s price down.

As of this writing, TAO’s social dominance has fallen, indicating that investors are starting to look in another direction. Should this linger for some days, the altcoin’s price might decrease.

TAO Price Prediction: Token Could Drop to $520

On the daily chart, the Relative Strength Index (RSI), an indicator that measures momentum, shows that TAO is overbought. As seen below, the RSI on the daily chart is above 70.00. This position aligns with the earlier notion that TAO’s price might decrease in the short term.

Using the Fibonacci retracement indicator, BeInCrypto observes that TAO might initially decline to $520.65 (the 78.6% Fibonacci level). If the token fails to hold this level, it could drop further, with the next support region around $445.63.

Read more: Which Are the Best Altcoins To Invest in October 2024?

However, TAO could defy this bias and run toward $700 if demand for the token significantly increases. In that case, the potential drawdown might not last, and October’s performance could get close to a 100% hike.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

US Senators Question Trump’s Involvement in USD1 Stablecoin

A coalition of US Senators is raising serious concerns about a potential conflict of interest involving President Donald Trump and an upcoming stablecoin project called USD1.

The digital asset, backed by World Liberty Financial (WLF), has drawn scrutiny due to Trump’s reported ties to the company behind it.

Warren-Led Group Flags Risks of Presidential Involvement in USD1 Approval

On March 28, a group of lawmakers led by Senator Elizabeth Warren sent a letter to the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

They asked both agencies to clarify how they plan to uphold regulatory integrity regarding the impending USD1 stablecoin.

The request comes as Congress considers the GENIUS Act, a bill that would grant the Fed and OCC broad authority over stablecoin regulation.

“The President of the United States could sign legislation that would facilitate his own product launch and then retain authority to regulate his own financial company,” they noted.

The Senators warned that allowing a sitting president to profit from a digital currency regulated by federal agencies under his influence poses a major threat to financial stability. They argue that such a situation is without precedent and could erode public trust in the regulatory process.

“The launch of a stablecoin directly tied to a sitting President who stands to benefit financially from the stablecoin’s success presents unprecedented risks to our financial system,” They argued.

The letter outlines scenarios where Trump could directly or indirectly influence decisions involving USD1.

For instance, the President could interfere with the OCC’s evaluation of the stablecoin’s application or discourage enforcement actions against WLF.

They also suggested that Trump could pressure the Federal Reserve to provide emergency financial support for USD1 during market volatility—support that may not extend to competing stablecoins.

“[Trump] could also attempt to direct the Fed to establish a master account at the central bank for WLF. He could intervene to deny such assistance to USD1’s competitors,” the lawmakers stressed.

In addition, the Senators noted that the GENIUS Act contains no conflict-of-interest provisions that would prevent Trump from using his office to benefit financially from the stablecoin’s success.

This absence of guardrails, they say, opens the door to regulatory favoritism and economic manipulation.

Considering this, the lawmakers demanded clarification on how the Fed and OCC would handle key issues. These include the approval process for USD1, the potential creation of liquidity support during crises, and WLF’s oversight of potentially unsafe business practices.

The agencies must submit their responses by April 11, 2025. The letter was signed by Senators Elizabeth Warren, Ron Wyden, Chris Van Hollen, Jack Reed, and Cory Booker.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Drops As Two Whales Face $235 Million Liquidation Risk

Ethereum (ETH) is under pressure once again, dropping around 3% in the last 24 hours and falling below the $1,800 level. This decline is putting several large leveraged positions at risk, including two massive whale vaults on Maker that collectively hold over $235 million worth of ETH.

With on-chain indicators flashing warning signs and technical levels being tested, the stakes are rising for both bulls and bears. As ETH hovers near critical support, the coming days could prove pivotal for its short-term price trajectory.

Ethereum Whales Could Get Liquidated

Ethereum has dropped around 3% in the past 24 hours, slipping below the $1,900 mark once again. This decline is putting pressure on large leveraged positions within the DeFi ecosystem.

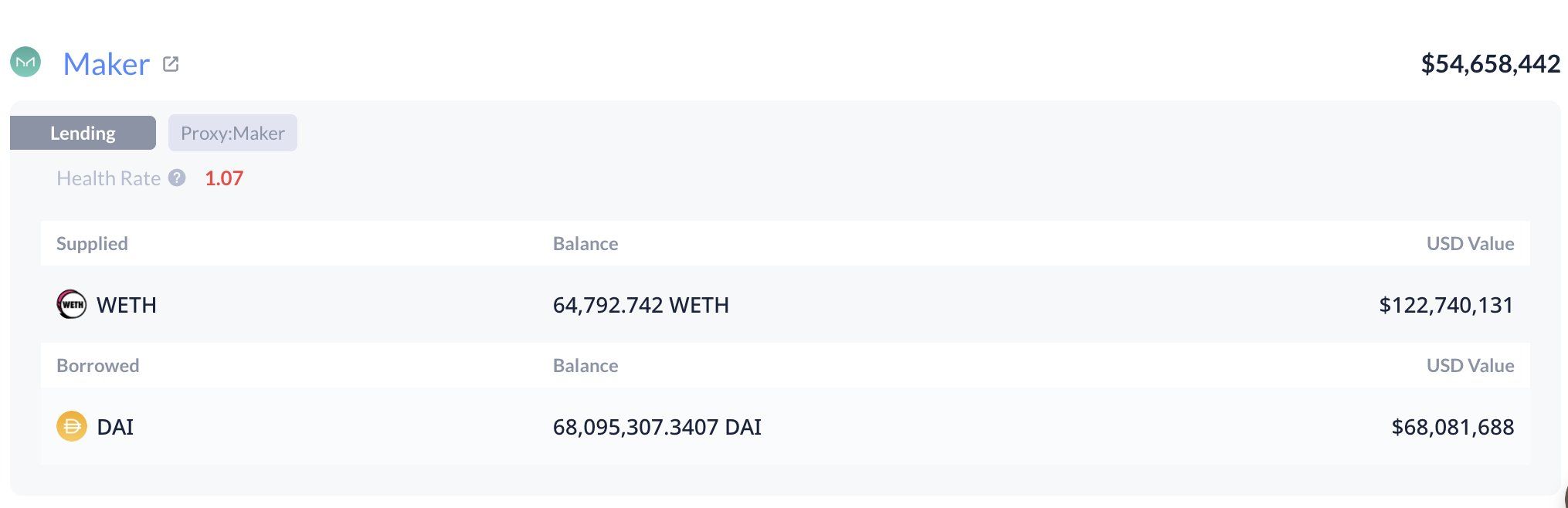

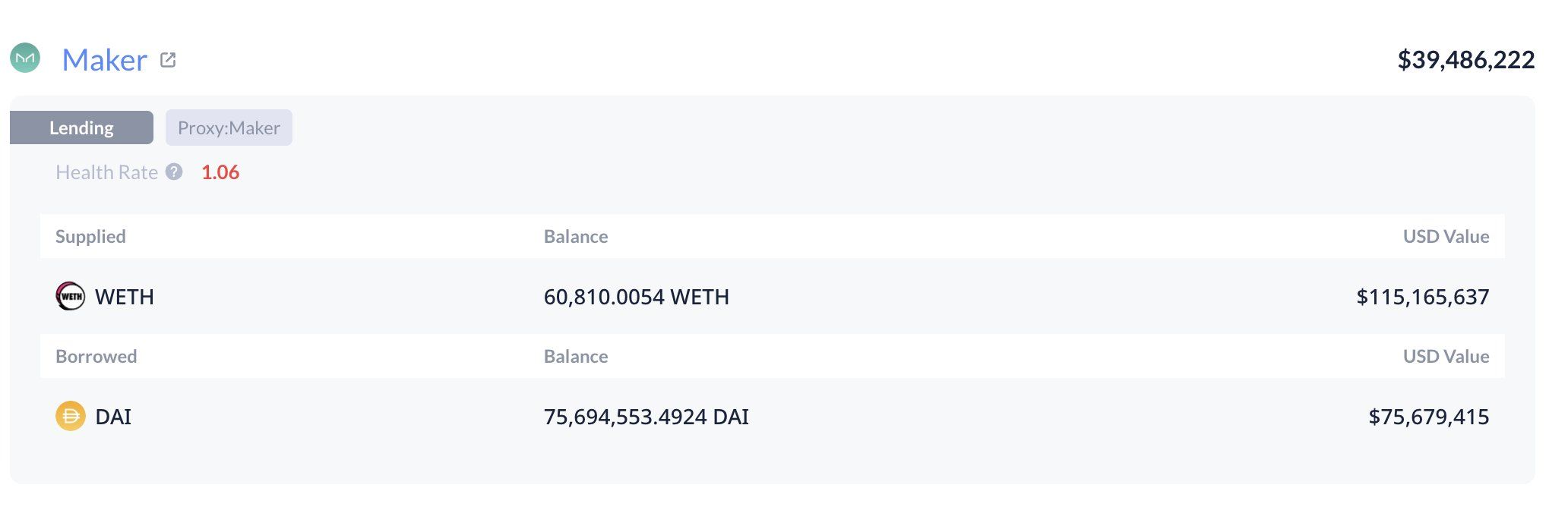

According to on-chain data from Lookonchain, two major whale vaults on Maker—one of the leading decentralized lending protocols—are now approaching critical levels.

Together, these vaults hold 125,603 ETH, valued at approximately $235 million. With ETH’s price nearing their liquidation thresholds, both vaults are at risk of being forcibly closed if the downward trend continues.

In Maker’s system, users can deposit ETH into vaults as collateral to borrow the DAI stablecoin. To avoid liquidation, the collateral must stay above a certain health ratio—essentially a safety buffer.

When that buffer gets too low, the protocol automatically sells off the collateral to cover the debt. In this case, the health ratio of the whale positions has fallen to just 1.07, dangerously close to the minimum threshold.

One vault faces liquidation at an ETH price of $1,805, and the other at $1,787. If ETH continues to dip, these vaults could trigger significant sell pressure, potentially accelerating the downward move.

Indicators Suggest The Downtrend Could Continue

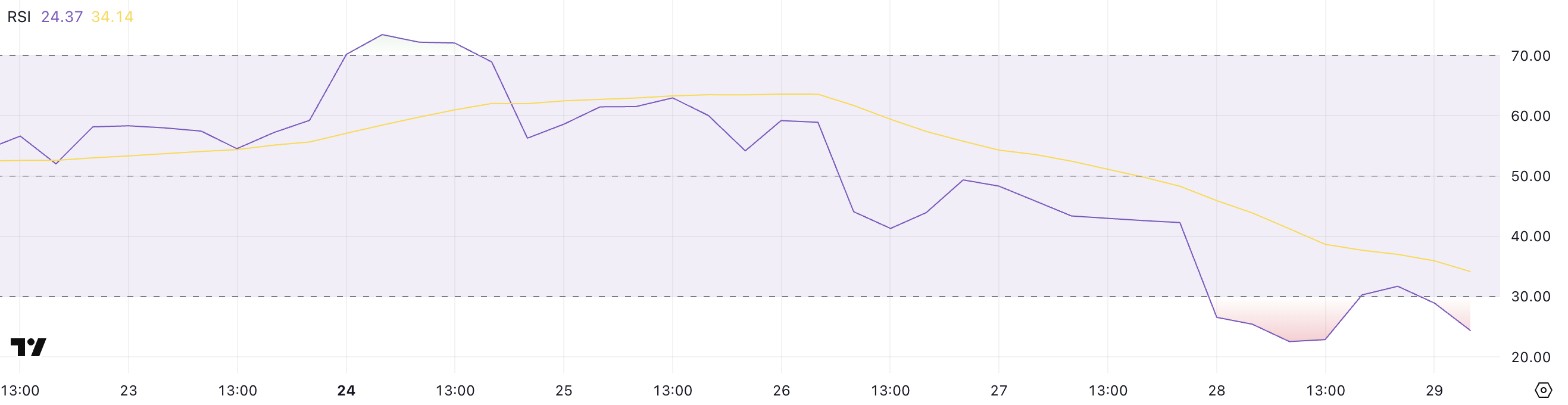

Ethereum’s recent price drop has pushed its Relative Strength Index (RSI) back into oversold territory, currently sitting at 24.37. Just three days ago, the RSI was at 58.92, indicating how quickly sentiment has shifted.

The RSI is a momentum indicator that measures the speed and change of price movements, with readings below 30 typically signaling that an asset is oversold.

While this suggests that Ethereum may be due for a short-term bounce or relief rally, historical data shows that RSI can remain oversold for extended periods—or even drop further—if bearish momentum stays strong.

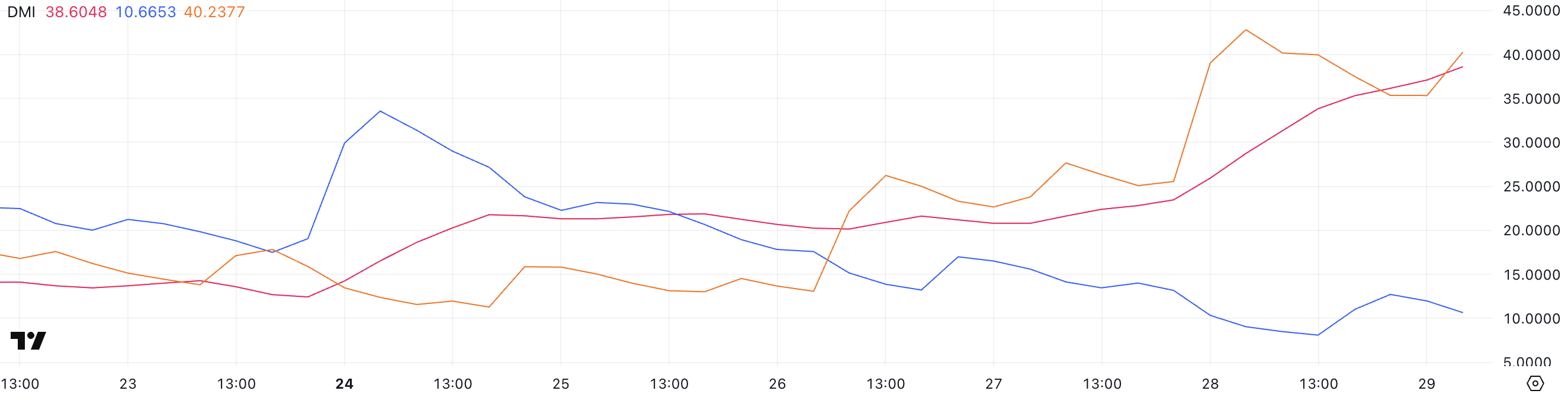

Ethereum’s Directional Movement Index (DMI), which signals a strong downtrend, adds to the bearish outlook. The Average Directional Index (ADX), which measures the strength of a trend, surged to 38.6 from 23.47 just a day ago, indicating growing momentum behind the current move.

Meanwhile, the +DI (positive directional indicator) has fallen to 10.6, while the -DI (negative directional indicator) has spiked to 40.23, showing that sellers are firmly in control.

This combination—rising ADX, high -DI, and falling +DI—typically suggests an intensifying bearish trend, meaning Ethereum’s price could remain under pressure in the near term despite already being technically oversold.

Will Ethereum Fall Below $1,800 Soon?

If Ethereum’s downtrend continues, the next key level to watch is the support at $1,823. A break below this level could quickly push the price down toward $1,759—a move that would trigger the liquidation of two major whale vaults on Maker, which are already hovering near their thresholds.

These potential liquidations could amplify sell pressure, making it even harder for Ethereum price to stabilize in the short term. Given the current bearish momentum and weak technical indicators, this scenario remains a real risk if bulls fail to step in.

However, if sentiment shifts and the trend reverses, Ethereum could regain ground and test the resistance level at $1,938.

Breaking above that could open the path toward $2,104, a level that has previously acted as both resistance and support. Should buying momentum strengthen further, ETH might continue climbing toward $2,320 and potentially even $2,546.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dark Web Criminals Are Selling Binance and Gemini User Data

More than 100,000 users of popular crypto exchanges Binance and Gemini may be at risk after a trove of sensitive information appeared for sale on the dark web.

The leaked data reportedly includes full names, email addresses, phone numbers, and location details—raising alarms over growing cyber threats in the crypto sector.

Dark Web Actors Are Targeting Crypto Users

On March 27, a dark web user operating under the alias AKM69 listed a large database allegedly tied to Gemini, one of the largest crypto trading platforms in the US.

According to Dark Web Informer, the dataset mainly includes information about users from the United States, with a few entries from Singapore and the United Kingdom. The attacker claims the data could be used for marketing, fraud, or crypto recovery scams.

“The database for sale reportedly includes 100,000 records, each containing full names, emails, phone numbers, and location data of individuals from the United States and a few entries from Singapore and the UK,” the report stated.

It is unclear whether the leak resulted from a direct breach of Gemini’s systems or from other vulnerabilities, such as compromised user accounts or phishing campaigns.

Meanwhile, this incident followed another alarming listing on March 26.

According to the report, a separate dark web actor, kiki88888, allegedly offered a trove of Binance user data for sale. The database is said to hold over 132,000 entries, including the exchange users’ login information.

The Dark Web Informer suggests phishing attacks likely caused the breach rather than a compromise of the exchange’s systems.

“Some of you really need to stop clicking random stuff,” the Informer stated.

Binance and Gemini have yet to publicly comment on these incidents. However, phishing remains one of the most effective methods cybercriminals use to exploit crypto holders.

Scammers often impersonate official accounts or place misleading ads that redirect users to fake websites. Coinbase users are also being extensively targeted through phishing campaigns.

As BeInCrypto reported earlier, in March, Coinbase users lost over $46 million to social engineering scams.

Blockchain security firm Scam Sniffer revealed that phishing-related losses exceeded $15 million in the first two months of the year. This figure highlights the growing scale of the threat.

Given the rising threats, crypto users should stay vigilant and avoid unfamiliar links. They should also protect their accounts with two-factor authentication and hardware wallets whenever possible.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation22 hours ago

Regulation22 hours agoFDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

-

Regulation21 hours ago

Regulation21 hours agoSonic Labs To Abandon Plans For Algorithmic USD Stablecoin, Here’s Why

-

Market20 hours ago

Market20 hours agoCoinbase Users Lost $46 Million to Crypto Scams in March

-

Altcoin20 hours ago

Altcoin20 hours agoPiDaoSwap, Trump Media, & Grayscale

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

-

Market24 hours ago

Market24 hours agoA Threat to Crypto’s Decentralized Future?

-

Altcoin24 hours ago

Altcoin24 hours agoTRUMP Crypto Whale Incurs Massive $15M Loss Amid Price Slump, Here’s How

-

Market23 hours ago

Market23 hours agoPopular Analyst Peter Brandt Identifies XRP Head & Shoulder Pattern, Reveals Path To Take