Market

Why Notcoin’s Price is Falling Despite Surging Active Addresses

Notcoin has witnessed a noticeable surge in demand over the past week. However, its value has plunged by double digits during the same period.

Key indicators assessed on a one-day chart hint at the likelihood of a continued price decline.

Notcoin: Rise in Demand Does Not Equal Price Rise

Since the arrest of Telegram’s CEO Pavel Durov on August 24, the values of Telegram-linked assets like NOT have plunged. Trading at $0.0076 as of this writing, NOT’s price has since declined by 23%.

At its current price, NOT is trading at a low last seen in May, creating a buying opportunity for those looking to trade against the market. This dip has driven a surge in demand for NOT over the past week.

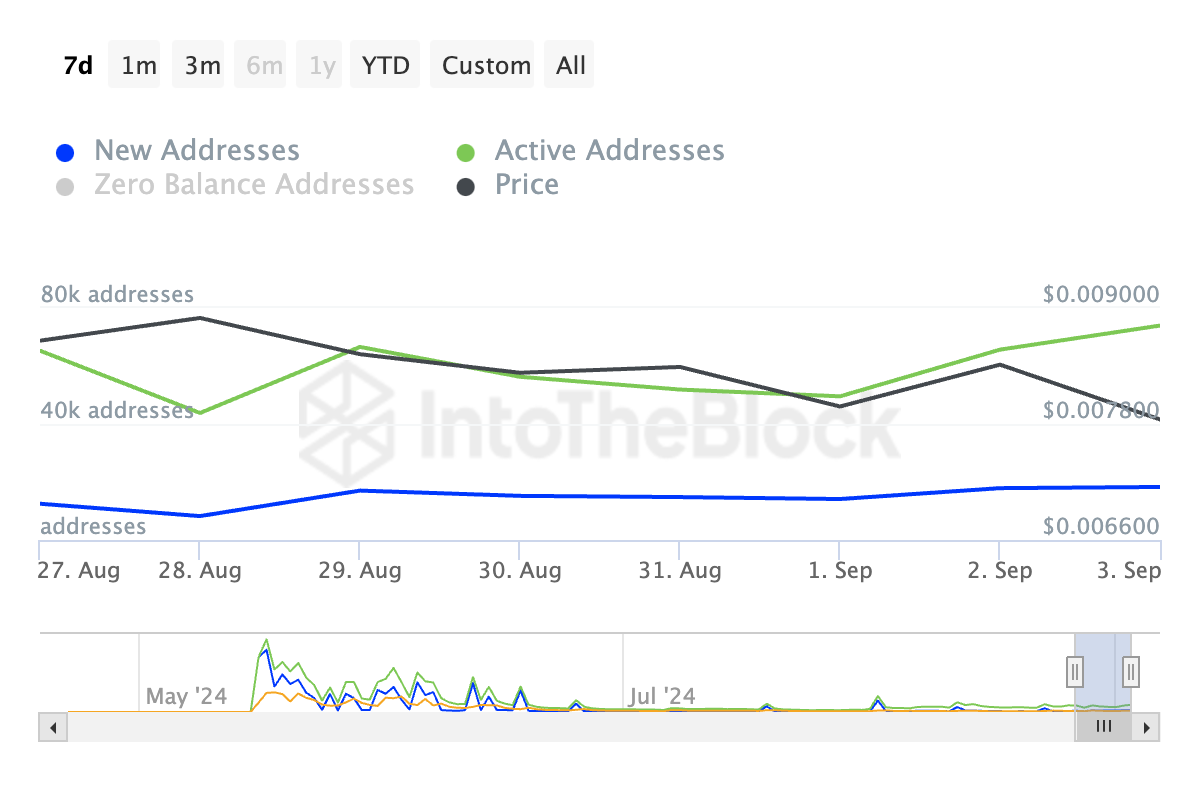

According to IntoTheBlock, the altcoin has experienced a 13% increase in daily active addresses in the last seven days. Additionally, new demand for NOT has surged, with a 46% rise in the daily count of new addresses trading the token during this period.

Read more: 5 Top Notcoin Wallets in 2024

However, apart from traders buying NOT’s dip, there is another explanation for the uptick in its active addresses while its price drops.

NOT’s existing holders might be distributing their tokens to new users to prevent further losses to their investments. This would ordinarily increase the number of active and new addresses. As these early adopters or whales cash out, the token’s price will continue to drop.

The declining large holders’ netflow for the token indicates that its whales have been steadily reducing balances since Durov’s arrest. Over the past week, this netflow has dropped by more than 90%, confirming the gradual exit of major holders. This is a bearish signal that may also prompt retail investors to sell their tokens.

NOT Price Prediction: Is a Rebound On the Horizon?

At press time, NOT’s Relative Strength Index (RSI) stands at 32, indicating it is approaching the oversold zone of 30, where a price rebound is often expected. If sellers’ exhaustion sets in, the token could reverse course and start an uptrend, potentially rallying toward $0.013.

However, this depends on new liquidity entering the market. The token’s Chaikin Money Flow (CMF) currently shows increased liquidity outflow, with a value of -0.20, signaling a risk of further devaluation.

Read more: Where To Buy Notcoin: Top 5 Platforms In 2024

If NOT traders continue to remove capital from the market, the token may revisit its all-time low of $0.00004.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Futures Traders Increase Bets on Upside

Over the past week, XRP’s price has remained range-bound amid the broader market’s recovery attempt.

However, with a growing bullish bias toward the altcoin, XRP may be on the brink of breaking free from this range and trending upward. This analysis explains why.

XRP Futures Traders Bet on Upside as Long Positions

The momentum shift towards the bulls has become evident, particularly within the futures market, where long bets on XRP are now surpassing short positions. This is reflected by the token’s XRP’s long/short ratio, which is currently at 1.07.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in the market.

When its value is below one, it indicates that the number of short positions outweighs long positions in the market, suggesting bearish sentiment or a lack of confidence in the token’s future price performance.

As with XRP, when an asset’s long/short ratio is above one, it means there are more long positions than short ones. It indicates that traders are predominantly bullish on XRP and hints at a higher likelihood of an upward breach of its narrow range.

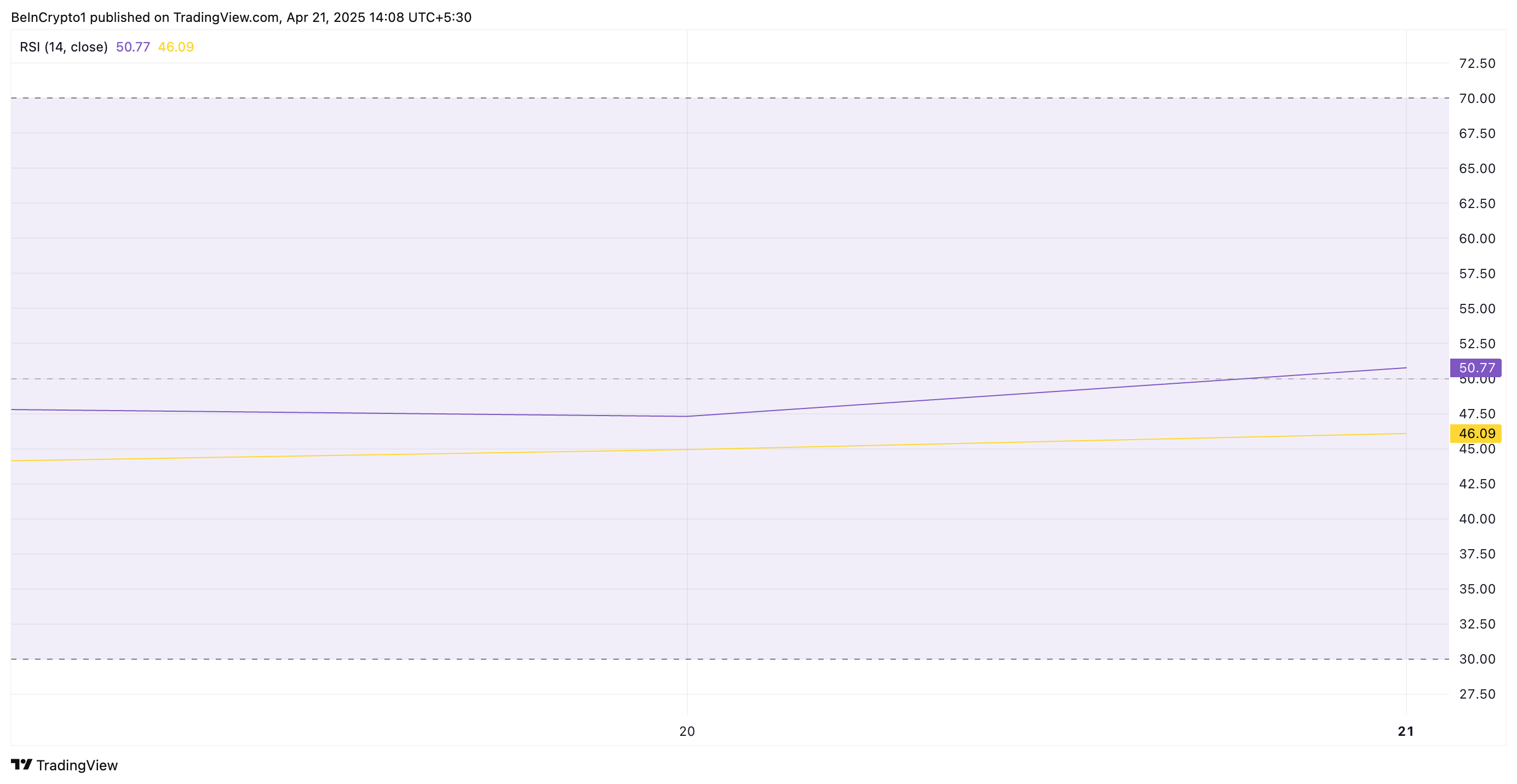

In addition, XRP’s relative strength index (RSI) has climbed steadily, indicating a gradual rise in demand for the token. The key momentum indicator, at 50.77, currently rests above the neutral line and is in an uptrend.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 50.77, XRP’s RSI signals a shift toward bullish momentum. It indicates that buying pressure is starting to outweigh selling pressure, and the asset may be poised for further price increases.

XRP Eyes $2.18 Resistance as Bulls Look to Push for $2.29

XRP currently trades at $2.13, just 3% away from its next significant resistance level, $2.18. If buying pressure intensifies and the altcoin successfully flips this price point into a support floor, it could trigger further price growth. In this scenario, XRP could potentially climb to $2.29.

However, if demand weakens and the bears regain control, XRP may remain range-bound. It could even break below the $2.03 support and fall to $1.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Optimism, Aztec, and Huma Finance

The crypto market is attempting a recovery, with Bitcoin (BTC) nearing the $90,000 milestone. Amidst improving sentiment, several startups are launching enticing airdrops, providing crypto enthusiasts with opportunities to engage with budding platforms without initial financial input.

This week, we discuss airdrop participation opportunities from three projects with financial backing from renowned investors.

Optimism

Layer-2 blockchain Optimism is one of the top three crypto airdrops this week. The Optimism crypto airdrop comes after the network raised $267.50 million from key investors such as Andreessen Horowitz, Coinbase Ventures, Paradigm, and IDEO CoLab Ventures, among others.

The airdrop concerns a SuperStacks Campaign, which opened on April 16 and will remain until June 30.

“With many chains building as one, a new network structure is emerging to solve fragmentation in Ethereum. This network is modular, interoperable, and composable by default. We call it the Superchain: and it changes everything,” Optimism explained.

Rewards are in the form of points, awarded for interacting with the projects. Airdrop farmers also get rewarded for providing liquidity to superchains, scalable blockchains combined into a single ecosystem to solve Ethereum fragmentation.

Actual tasks bring 10 EXP (experience points) per $1 of daily liquidity. In the past, Optimism held five airdrops, giving away over 265 million tokens.

“You may be eligible for the 6th airdrop without realizing it. In the system, we collect badges as you perform operations on Optimism. However, since it counts your previous operations when you log in, you may have opened many badges.,” one airdrop farmer explained.

This means even minimal effort could yield rewards. However, participating in the Optimism airdrop does not guarantee future rewards. Instead, it only provides an opportunity to earn points.

Aztec

Another top crypto airdrop to watch this week is Aztec, bringing forth a privacy-focused Layer-2 zero-knowledge (ZK) rollup on Ethereum.

Aztec is backed by $119.1 million in funding from investors such as Andreessen Horowitz (a16z), Paradigm, Consensys, and Coinbase Ventures.

The project has garnered significant attention, following talks of a native AZTEC token and a confirmed retroactive airdrop for early users.

On April 17, the network announced the Aztec Sequencer Form, front-running a public testnet. Interested participants were asked to fill out the form to gain early access to the testnet.

Historically, blockchain projects reward testnet participants with tokens. Based on this, Aztec’s funding and investor backing increase the probability of an airdrop.

Huma Finance

This week, the watchlist also includes Huma Finance, the first PayFi (Payment Finance) network built on Solana. The project focuses on transforming global payment settlements using blockchain technology.

Huma Finance launched the second version of point farming, which is available only on the Solana network. Participants can deposit USDC tokens and earn Feathers (points). Notably, no KYC is needed in this version, and more pools are available.

Recently, the project announced social and deposit quests on Galxe, allowing users to complete these quests and try to win a share of $2,000. Notably, participants should have at least lvl 2 of Web3 Passport.

“Huma 2.0 is The Next Wave! Now anyone can earn real yield and stack rewards, exclusively on Solana. New quest is LIVE on Galxe Quest. Join the PayFi movement for a chance to grab a share of $2000 USDC,” the network shared.

The project also launched a point farming program, in which participants can deposit USDC tokens into one of the pools. For this activity, users must pass KYC.

Meanwhile, Huma Finance boasts up to $46.3 million in funds raised from backers such as HashKey Capital, Circle, ParaFi Capital, and Distributed Global.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Staking Cap Surpasses Ethereum, But Is This Sustainable?

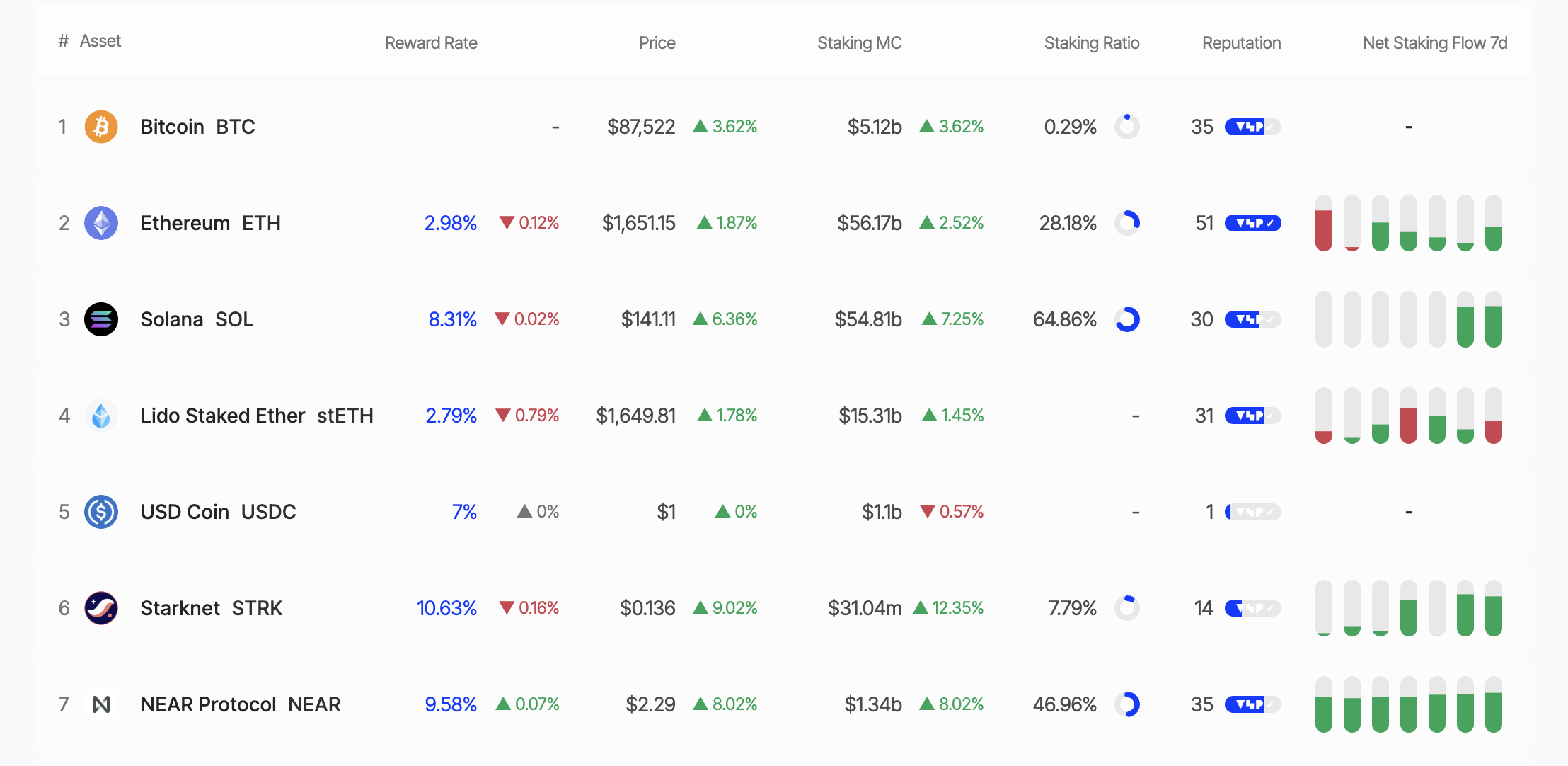

According to data from StakingRewards, Solana (SOL) has overtaken Ethereum (ETH) in staking market capitalization, reaching $53.15 billion compared to Ethereum’s $53.72 billion.

This milestone has sparked heated discussions across the social media platform X, raising the question: Is this a turning point for Solana, or merely a short-lived surge?

Solana Outpaces Ethereum As High Staking Yields Prove Appealing

Recent data reveals that 64.86% of Solana‘s total supply is currently staked, delivering an impressive annual percentage yield (APY) of 8.31%. In contrast, Ethereum has only 28.18% of its supply staked, with an APY of 2.98%.

This disparity highlights Solana’s growing appeal for investors seeking passive income through staking. Staking market capitalization is calculated by multiplying the total number of staked tokens by their current price. With SOL priced at $138.91 as of this writing, Solana has officially surpassed Ethereum in this metric.

However, Solana’s high staking ratio has sparked some controversy. Critics, such as Dankrad Feist on X, argue that Solana’s lack of a slashing mechanism (or penalties for validator violations) undermines the economic security of its staking model. With its slashing mechanism, Ethereum offers greater security, despite its lower staking ratio.

“It’s very ironic to call it ‘staking’ when there is no slashing. What’s at stake? Solana has close to zero economic security at the moment,” Dankrad Feist shared.

Increased Whale Activity Signals Caution

Meanwhile, recent moves by “whales” (large investors) have further fueled interest in Solana. On April 20, 2025, a whale unstaked 37,803 SOL (worth $5.26 million). Similarly, Galaxy Digital withdrew 606,000 SOL from exchanges over four days (April 15–19, 2025), concluding with 462,000 SOL.

Additionally, on April 17, 2025, a newly created wallet withdrew approximately $5.15 million worth of SOL from the Binance exchange. In the same tone, Binance whales withdrew over 370,000 SOL tokens valued at $52.78 million.

While some whales withdrew their SOL holdings, other large holders accumulated. Janover, a US-listed company, increased its Solana holdings to 163,651.7 SOL (worth $21.2 million) and partnered with Kraken exchange for staking on April 16, 2025.

These actions signal diverging plays from institutional investors and whales, as the Solana price fluctuates around key levels.

SOL Price Analysis: Opportunities and Challenges

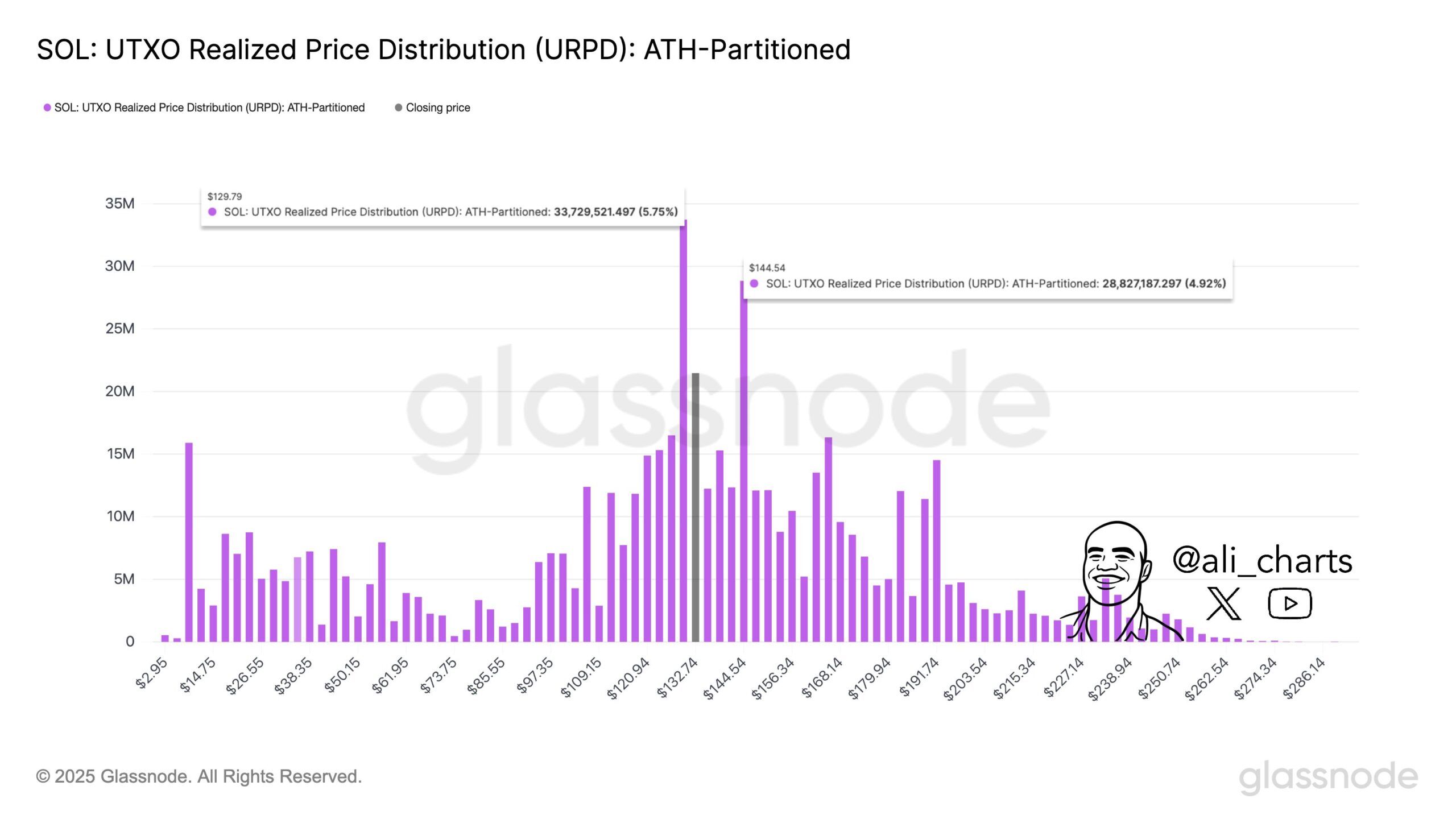

As of this writing, SOL was trading at $140.49, up 3.53% in the past 24 hours. Analysts highlight $129 as crucial support for the Solana price, with $144 presenting the key roadblock to overcome before Solana’s upside potential can be realized. Breaking above the aforementioned roadblock could propel SOL toward new highs.

Conversely, dropping below the $129 support level could trigger increased selling pressure. Nevertheless, SOL has shown a remarkable recovery, with a 14.34% increase over the past week.

Another factor to consider is the ongoing development of the Solana ecosystem. Key innovations include the QUIC data transfer protocol, the combination of Proof-of-History (PoH) and Proof-of-Stake (PoS), and the diversification of validator clients.

With these, Solana continues to enhance its performance and decentralization. Additionally, the launch of the Solang compiler, compatible with Ethereum’s Solidity, has attracted developers from the Ethereum ecosystem.

BeInCrypto also reported on Solana’s upcoming community conference, otherwise termed Solana Breakpoint. Key announcements from this event could provide further tailwinds for the SOL price.

Nevertheless, despite surpassing Ethereum in staking market capitalization, Solana faces significant challenges. Ethereum benefits from a more mature DeFi ecosystem, greater institutional trust, and enhanced security through its slashing mechanism.

To some, Ethereum’s lower staking ratio (28%) may be a deliberate strategy to reduce network pressure and ensure liquidity for DeFi applications.

In contrast, Solana’s high staking ratio (65%) could limit liquidity within its DeFi ecosystem. This raises the question of whether Solana can strike a balance between staking and the growth of its decentralized applications.

As Solana continues challenging Ethereum’s dominance, the crypto community remains divided. Is Solana’s rise a sustainable breakthrough, or just another wave of hype?

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market22 hours ago

Market22 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Market20 hours ago

Market20 hours agoTokens Big Players Are Buying

-

Market19 hours ago

Market19 hours agoDogecoin Defies Bullish Bets During Dogeday Celebration

-

Market17 hours ago

Market17 hours agoWill XRP Break Support and Drop Below $2?

-

Market23 hours ago

Market23 hours agoHow Token Launch Frenzy Is Delaying 2025 Altcoin Season

-

Altcoin23 hours ago

Altcoin23 hours agoBinance Traders Go Big On Dogecoin—Majority Holding Long Positions

-

Altcoin19 hours ago

Altcoin19 hours agoExpert Predicts Pi Network To Reach $5 As Whales Move 41M Pi Coins Off Exchanges